Bioplastics Packaging Market Report

Published Date: 01 February 2026 | Report Code: bioplastics-packaging

Bioplastics Packaging Market Size, Share, Industry Trends and Forecast to 2033

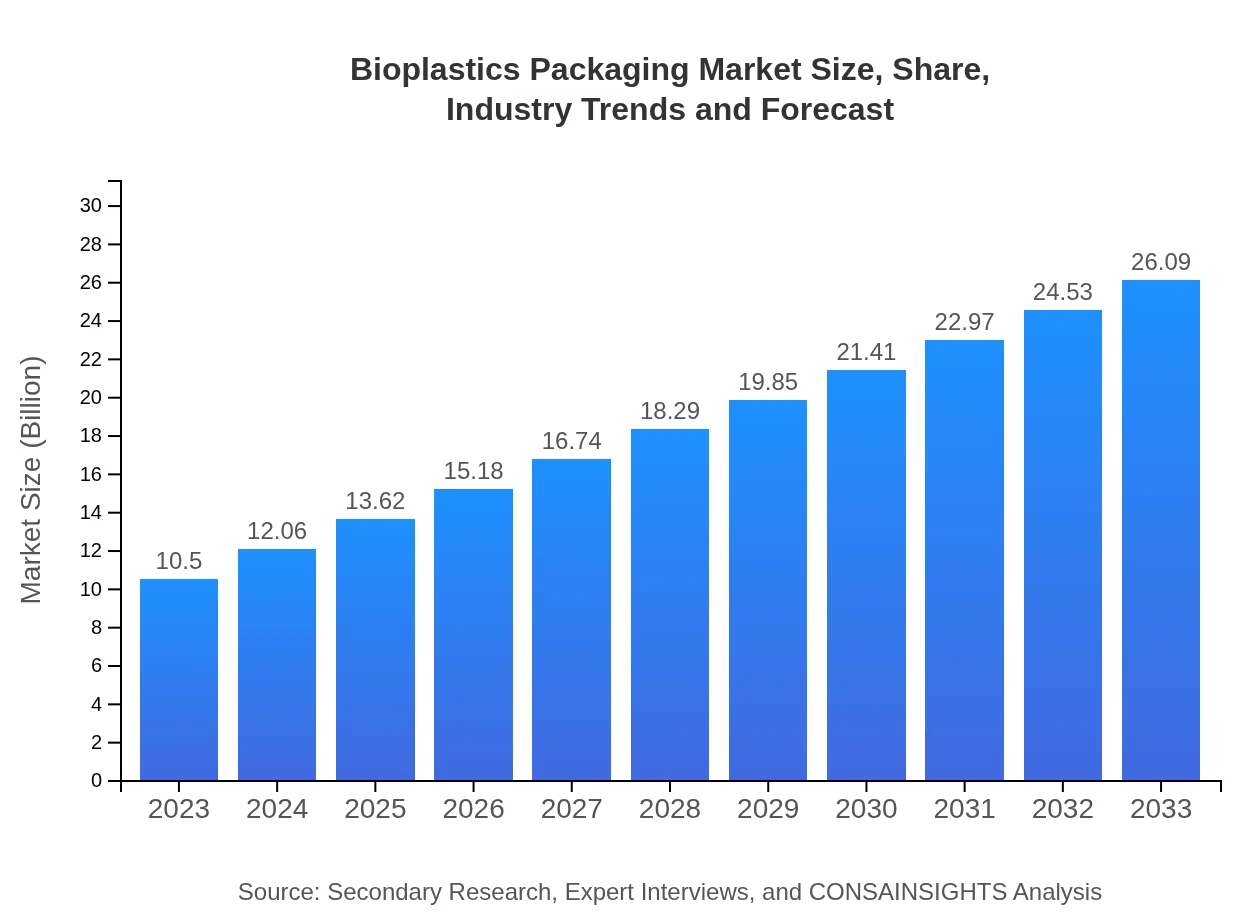

This report delves into the Bioplastics Packaging market, offering insights on current trends, segmentation, and forecasts from 2023 to 2033. Data on regional performance, market leaders, and growth projections are included to provide a comprehensive overview.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | NatureWorks LLC, BASF SE, Novamont S.p.A., Cardia Bioplastics |

| Last Modified Date | 01 February 2026 |

Bioplastics Packaging Market Overview

Customize Bioplastics Packaging Market Report market research report

- ✔ Get in-depth analysis of Bioplastics Packaging market size, growth, and forecasts.

- ✔ Understand Bioplastics Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioplastics Packaging

What is the Market Size & CAGR of Bioplastics Packaging market in 2023?

Bioplastics Packaging Industry Analysis

Bioplastics Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioplastics Packaging Market Analysis Report by Region

Europe Bioplastics Packaging Market Report:

Europe is a frontrunner in the Bioplastics Packaging market, with a size of USD 3.58 billion in 2023, expected to grow to USD 8.89 billion by 2033. Stringent environmental regulations, as well as initiatives aimed to reduce plastic waste, propel the adoption of bioplastic materials, especially in the packaging sector.Asia Pacific Bioplastics Packaging Market Report:

In the Asia Pacific region, the Bioplastics Packaging market valued at USD 1.99 billion in 2023 is expected to grow to USD 4.95 billion by 2033. This growth is spurred by increased industrialization and rising awareness of sustainable packaging solutions. Countries like Japan and India show substantial demand driven by both consumer and legislative pushes towards eco-friendly practices.North America Bioplastics Packaging Market Report:

North America's market is anticipated to expand from USD 3.54 billion in 2023 to USD 8.81 billion by 2033. The United States leads in this segment, influenced by consumer demand for sustainable products, coupled with supportive government policies that encourage bioplastics adoption.South America Bioplastics Packaging Market Report:

The South American Bioplastics Packaging market, valued at USD 0.21 billion in 2023, is projected to reach USD 0.53 billion by 2033. The Brazilian market drives this growth as local industries adapt to stricter regulations on plastics, increasing the demand for biodegradable packaging solutions.Middle East & Africa Bioplastics Packaging Market Report:

In the Middle East and Africa, the market size is projected to grow from USD 1.17 billion in 2023 to USD 2.91 billion by 2033. The region is witnessing increasing investments towards sustainability, particularly in UAE and South Africa, enhancing local bioplastics manufacturing capabilities.Tell us your focus area and get a customized research report.

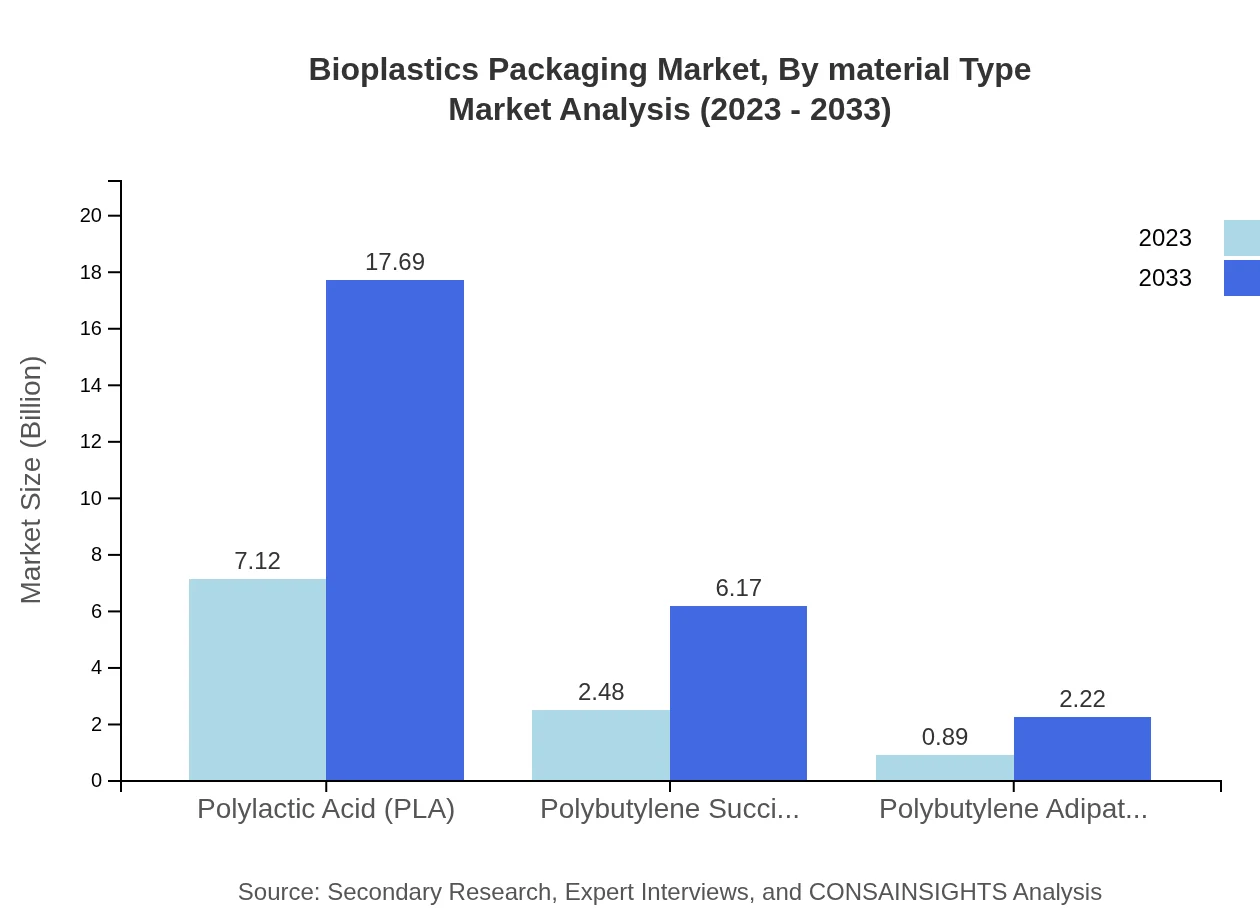

Bioplastics Packaging Market Analysis By Material Type

The Bioplastics Packaging market by material type is led by Polylactic Acid (PLA), with a market size of USD 7.12 billion in 2023, projected to grow to USD 17.69 billion by 2033, representing a market share of 67.82%. Polybutylene Succinate (PBS) follows with market growth from USD 2.48 billion to USD 6.17 billion by 2033, while Polybutylene Adipate Terephthalate (PBAT) anticipates growth from USD 0.89 billion to USD 2.22 billion during the same timeframe. These materials are favored for their biodegradability and applicability across various packaging formats.

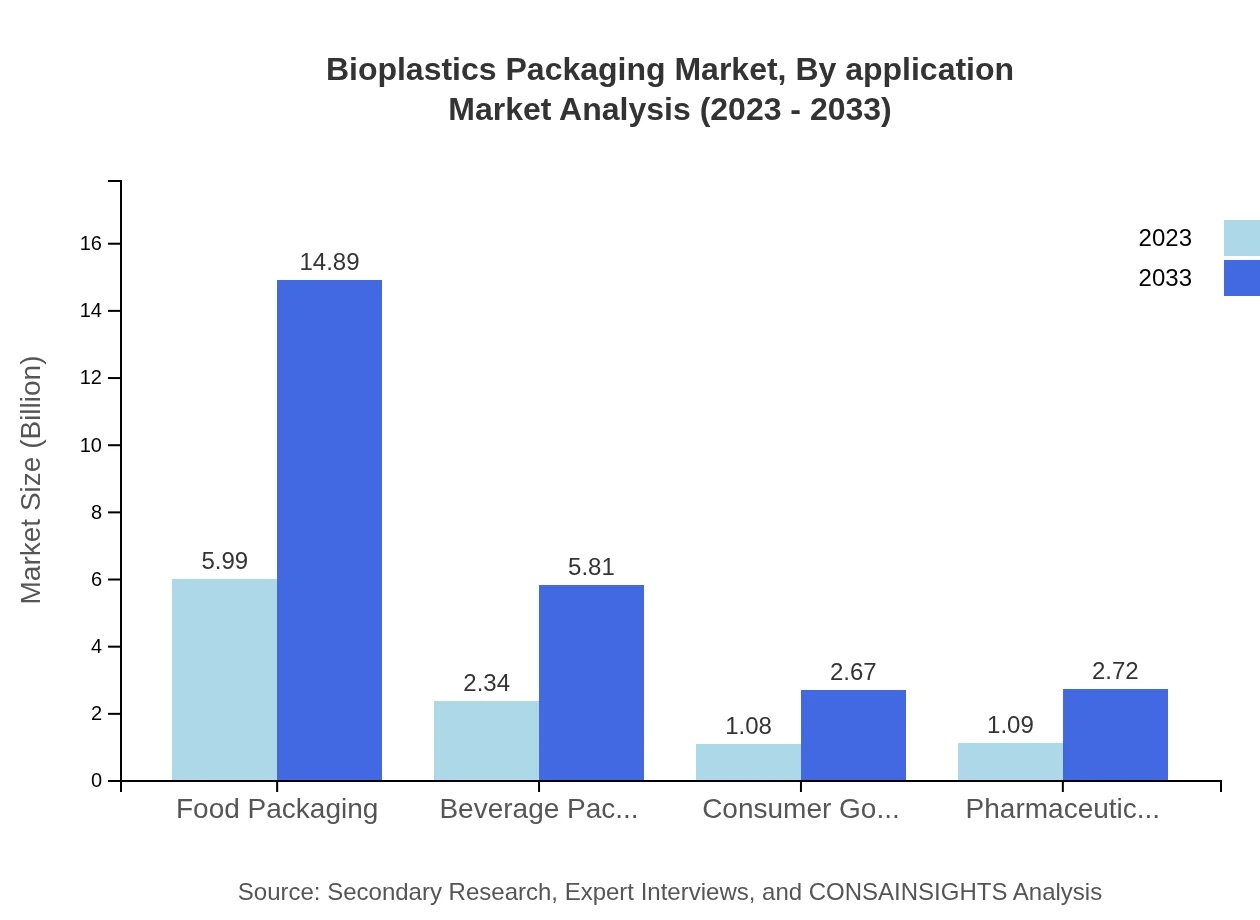

Bioplastics Packaging Market Analysis By Application

In terms of application, the Food Industry dominates with a market size of USD 5.99 billion in 2023, expected to escalate to USD 14.89 billion by 2033, maintaining a share of 57.06%. Beverage applications size increases from USD 2.34 billion to USD 5.81 billion with a stable share of 22.29%. Additionally, cosmetic and pharmaceutical applications are growing steadily, reflecting the broad adaptability of bioplastics across diverse sectors.

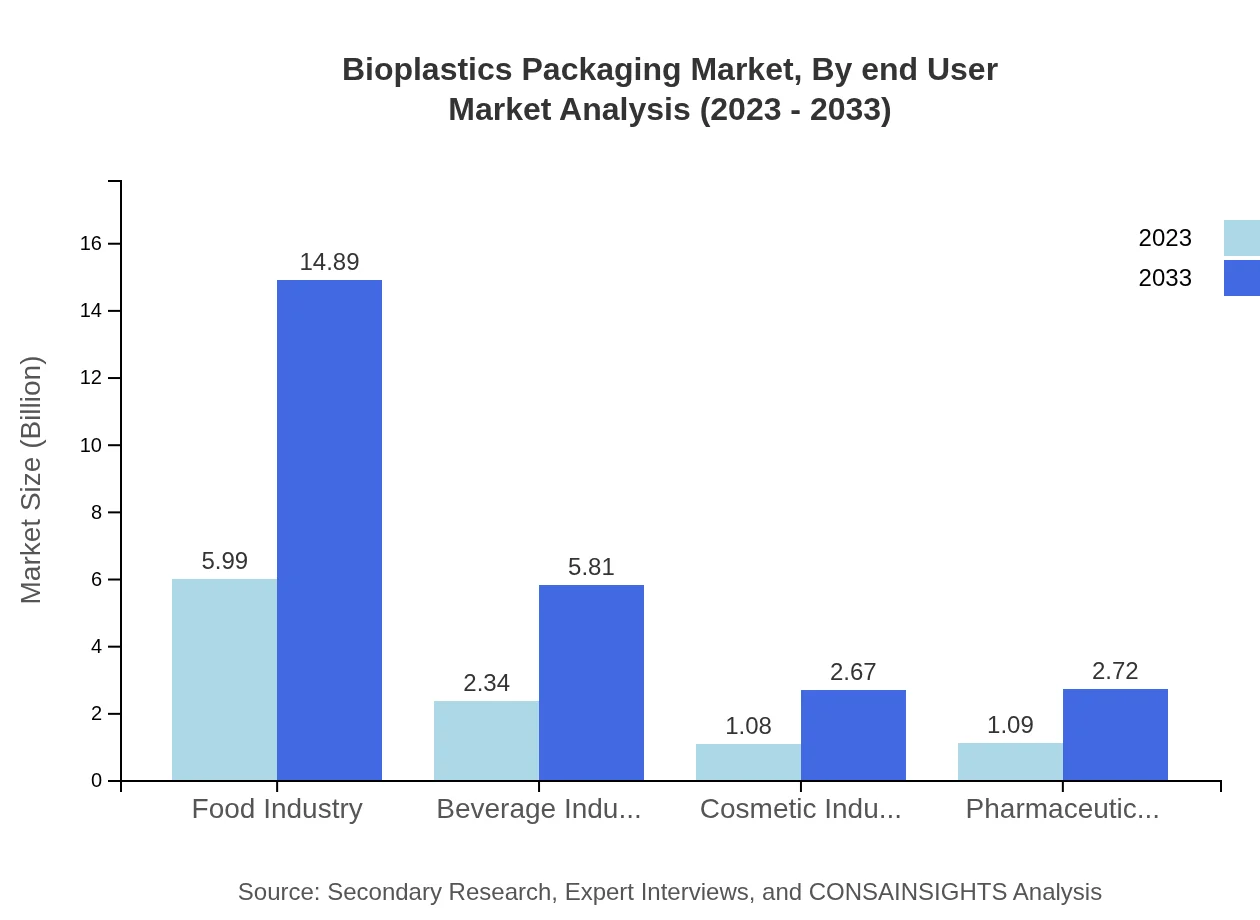

Bioplastics Packaging Market Analysis By End User

End-user segments show significant growth potential, particularly in the Food and Beverage sectors, wherein food packaging alone reflects a market share of 57.06% in 2023. Cosmetic packaging is valued at USD 1.08 billion, expanding to USD 2.67 billion by 2033, while pharmaceutical packaging showcases a similar growth pattern, indicating robust demand across industries as sustainable solutions become more critical.

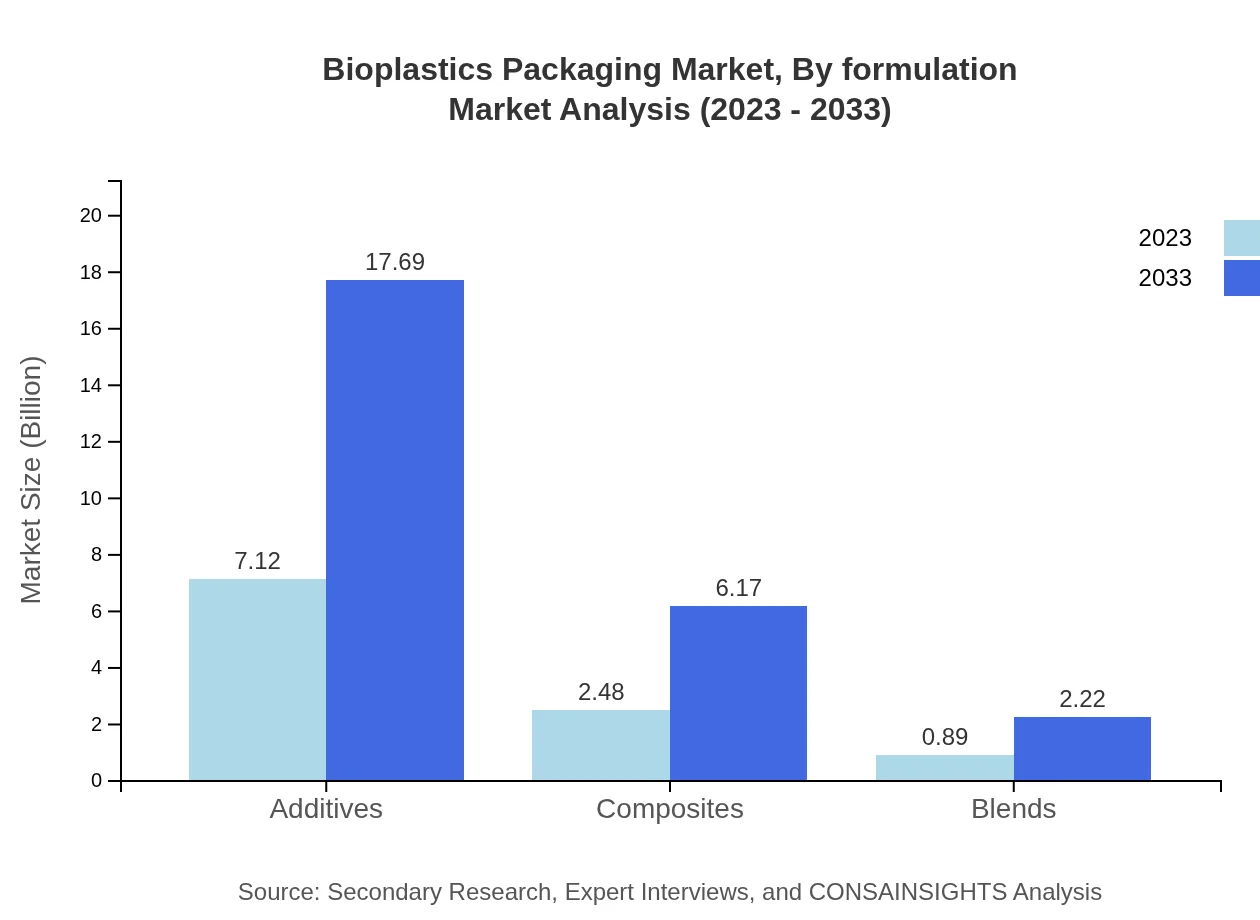

Bioplastics Packaging Market Analysis By Formulation

By formulation, the additives category leads with a size of USD 7.12 billion in 2023, projected to reach USD 17.69 billion by 2033, while composites and blends together represent a smaller yet significant sector. The additive market ensures enhanced properties of bioplastics, crucial for performance in packaging applications, thus affirming its emerging role in the market landscape.

Bioplastics Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioplastics Packaging Industry

NatureWorks LLC:

NatureWorks is a leading producer of PLA with strong technological capabilities and a vast product range catering to various packaging applications.BASF SE:

BASF is a global chemical company with a dedicated division for bioplastics, producing a variety of sustainable solutions that enhance biodegradable packaging.Novamont S.p.A.:

Novamont specializes in the development of biodegradable bioplastics and has been at the forefront of creating innovative products for the packaging sector.Cardia Bioplastics:

Cardia offers renewable resource-based bioplastics and plays an active role in promoting sustainable packaging solutions globally.We're grateful to work with incredible clients.

FAQs

What is the market size of bioplastics Packaging?

The bioplastics packaging market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 9.2%, reaching significant growth by 2033. This reflects an increasing demand for sustainable packaging solutions across various industries.

What are the key market players or companies in this bioplastics Packaging industry?

Key players in the bioplastics packaging industry include leading manufacturers that specialize in innovative, sustainable materials. Companies are increasingly investing in research and development to improve bioplastics technology and expand their market presence globally.

What are the primary factors driving the growth in the bioplastics Packaging industry?

Key drivers for the bioplastics packaging market include rising environmental concerns over plastic waste, regulatory support for sustainable materials, and increasing consumer demand for eco-friendly products. Sensitization to climate change propels innovation in bioplastics.

Which region is the fastest Growing in the bioplastics Packaging?

The fastest-growing region in the bioplastics packaging market is Europe, with market growth from $3.58 billion in 2023 to an estimated $8.89 billion by 2033, driven by sustainability initiatives and consumer demand for green packaging solutions.

Does ConsaInsights provide customized market report data for the bioplastics Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the bioplastics packaging industry. Clients can obtain in-depth insights and analytics relevant to their business strategy and emerging market trends.

What deliverables can I expect from this bioplastics Packaging market research project?

Deliverables from the bioplastics packaging market research project typically include comprehensive reports, market size assessments, competitive analysis, and insights into consumer trends, allowing businesses to make informed decisions.

What are the market trends of bioplastics Packaging?

Current trends in the bioplastics packaging market include an increasing shift towards renewable materials, advancements in biodegradable technologies, and enhanced consumer awareness regarding sustainable practices, indicating robust growth potential.