Biopolymer Packaging Market Report

Published Date: 01 February 2026 | Report Code: biopolymer-packaging

Biopolymer Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biopolymer Packaging market from 2023 to 2033, offering insights into market size, growth rates, trends, regional dynamics, industry segmentation, and competitive landscape.

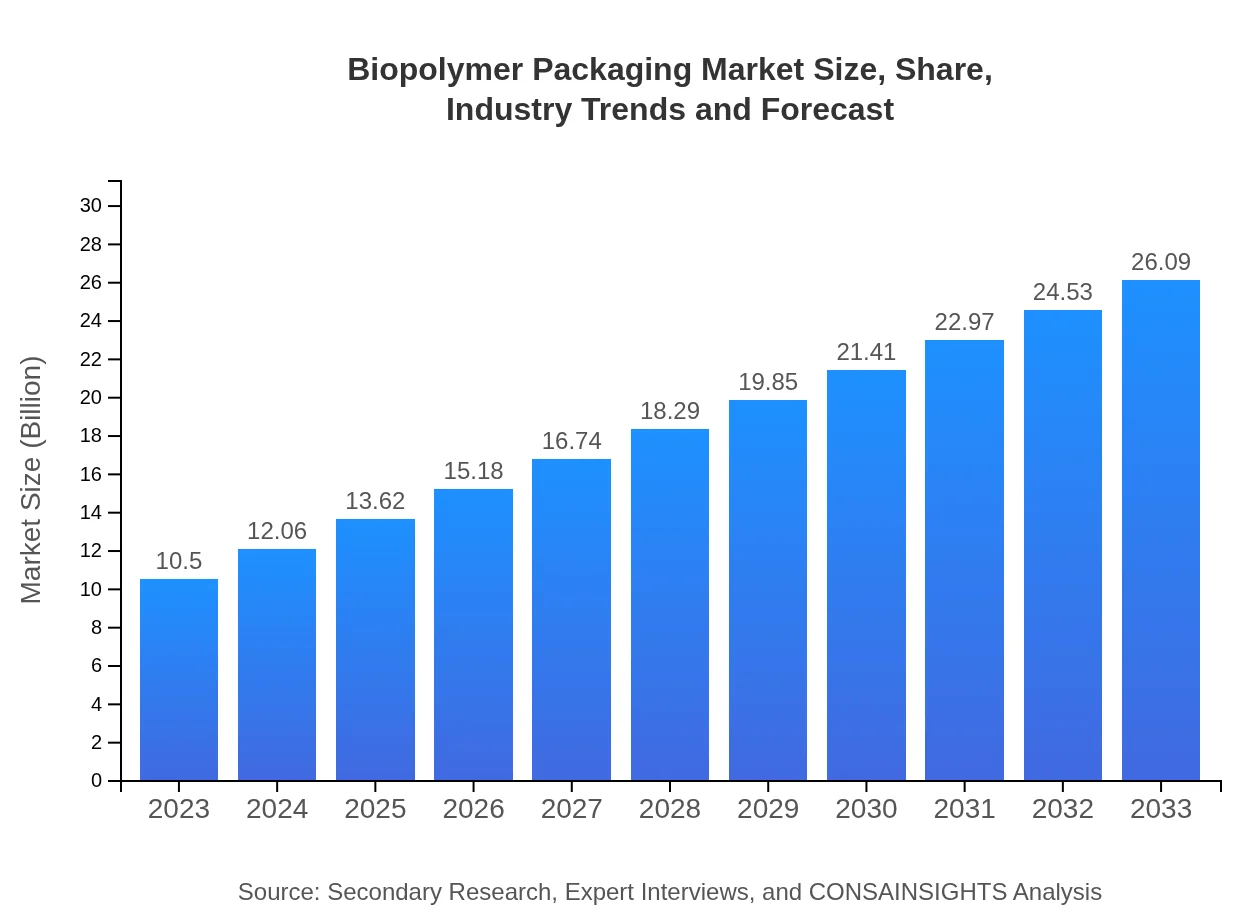

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $26.09 Billion |

| Top Companies | NatureWorks LLC, BASF SE, Novamont S.p.A., Bio-On S.p.A., Synlogic |

| Last Modified Date | 01 February 2026 |

Biopolymer Packaging Market Overview

Customize Biopolymer Packaging Market Report market research report

- ✔ Get in-depth analysis of Biopolymer Packaging market size, growth, and forecasts.

- ✔ Understand Biopolymer Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biopolymer Packaging

What is the Market Size & CAGR of Biopolymer Packaging market in 2023?

Biopolymer Packaging Industry Analysis

Biopolymer Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biopolymer Packaging Market Analysis Report by Region

Europe Biopolymer Packaging Market Report:

In Europe, the market is anticipated to surge from $2.83 billion in 2023 to $7.03 billion by 2033. European countries are at the forefront of adopting sustainable packaging solutions due to stringent environmental policies.Asia Pacific Biopolymer Packaging Market Report:

The Asia Pacific region is experiencing robust growth in the Biopolymer Packaging market, projected to grow from $2.10 billion in 2023 to $5.22 billion by 2033. This growth is fueled by increasing consumer awareness, evolving regulatory frameworks, and a burgeoning middle class seeking sustainable products.North America Biopolymer Packaging Market Report:

North America holds a significant share of the Biopolymer Packaging market, with expectations to grow from $3.90 billion in 2023 to $9.69 billion by 2033. The region is a leader in innovation and has established a solid regulatory framework promoting the use of biopolymers.South America Biopolymer Packaging Market Report:

In South America, the market is expected to expand from $1.02 billion in 2023 to $2.54 billion by 2033. As nations in the region adopt stricter environmental regulations, biopolymer packaging adoption is set to rise dramatically.Middle East & Africa Biopolymer Packaging Market Report:

The Middle East and Africa market is set to grow from $0.65 billion in 2023 to $1.60 billion by 2033. This growth is driven by increasing investment in green technologies and a growing awareness of the importance of sustainability.Tell us your focus area and get a customized research report.

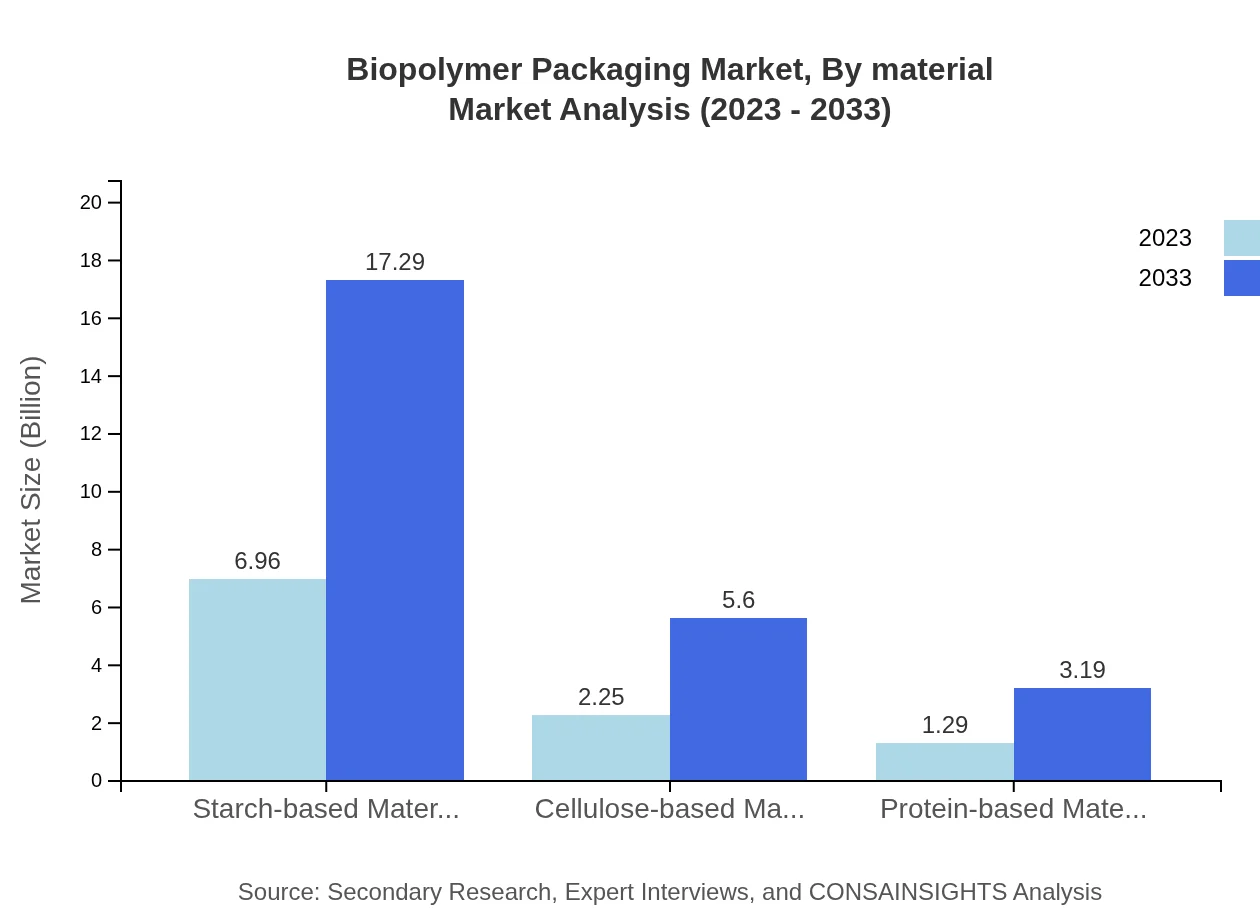

Biopolymer Packaging Market Analysis By Material

The Biopolymer Packaging market by material is dominated by starch-based materials, which generate $6.96 billion in 2023 and are expected to reach $17.29 billion by 2033. Cellulose-based materials are also gaining traction, projected to grow from $2.25 billion to $5.60 billion. Protein-based materials, while smaller in size, are crucial for niche applications, growing from $1.29 billion to $3.19 billion during the same period.

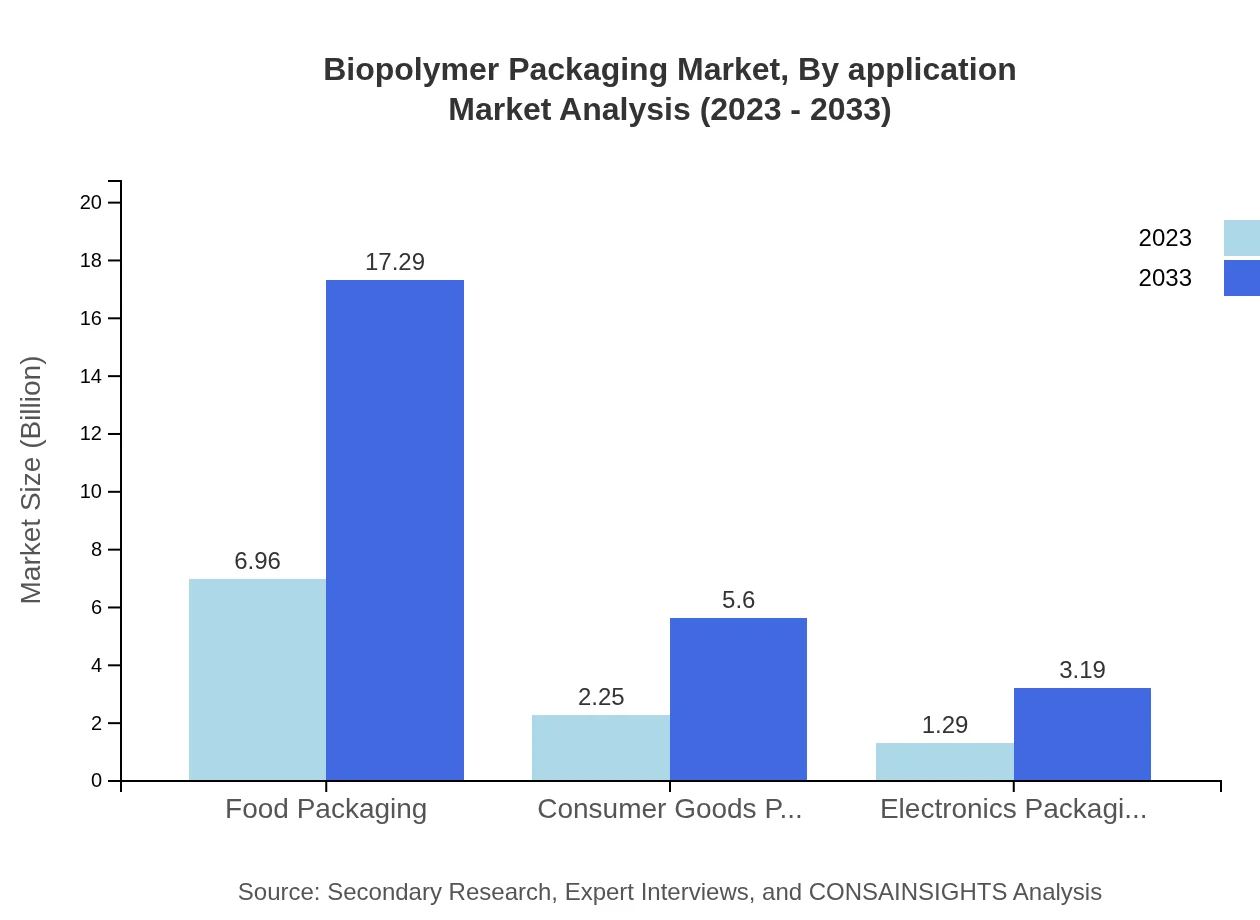

Biopolymer Packaging Market Analysis By Application

In terms of application, food packaging dominates the market, generating $6.96 billion in 2023 and expected to reach $17.29 billion by 2033. Other applications such as consumer goods packaging and pharmaceuticals also show promising growth, indicating a strong shift towards sustainable packaging solutions across various sectors.

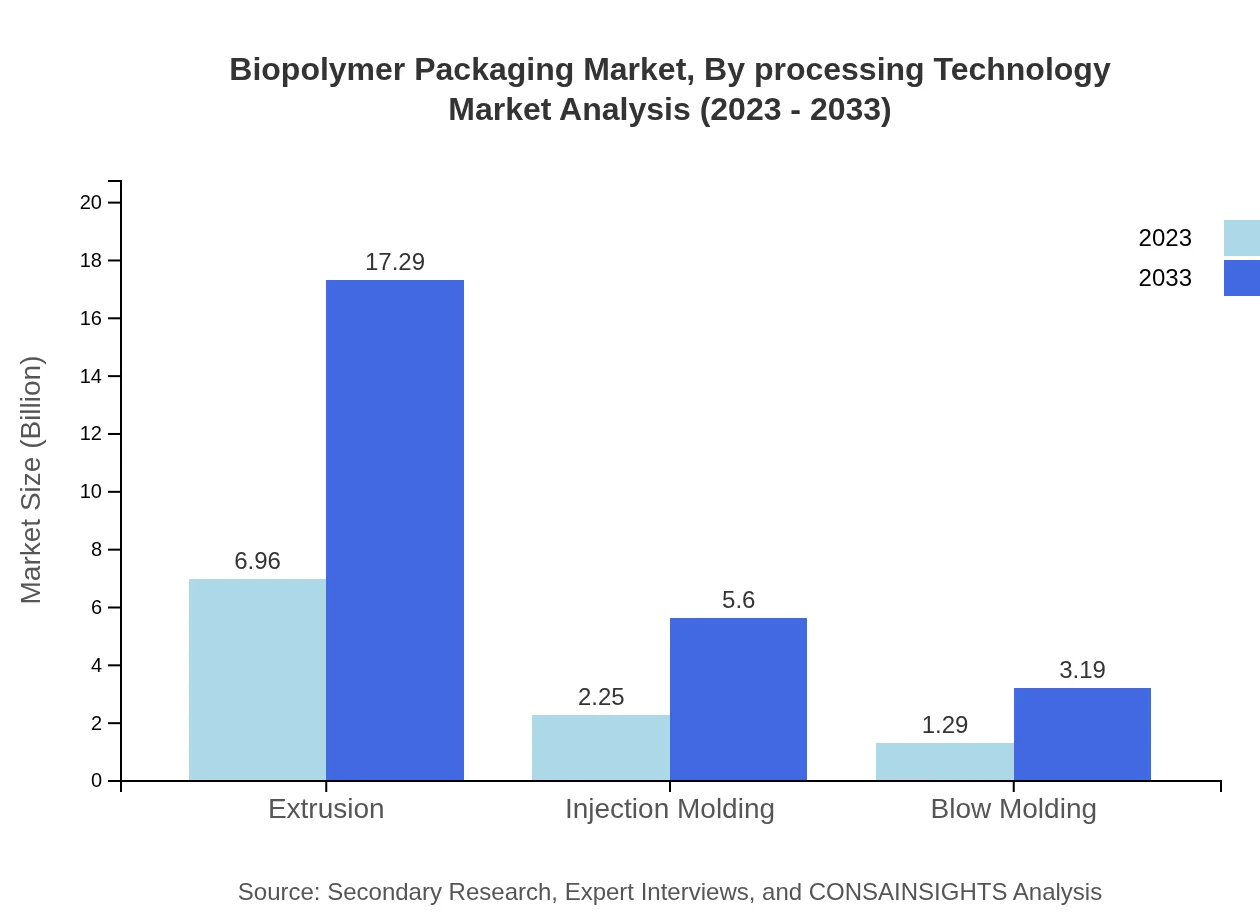

Biopolymer Packaging Market Analysis By Processing Technology

The processing technologies segment is crucial, with extrusion showing the largest market size of $6.96 billion in 2023, expected to grow to $17.29 billion by 2033. Injection molding and blow molding also contribute significantly to the market, with each showing steady growth as industries adopt more sustainable production methods.

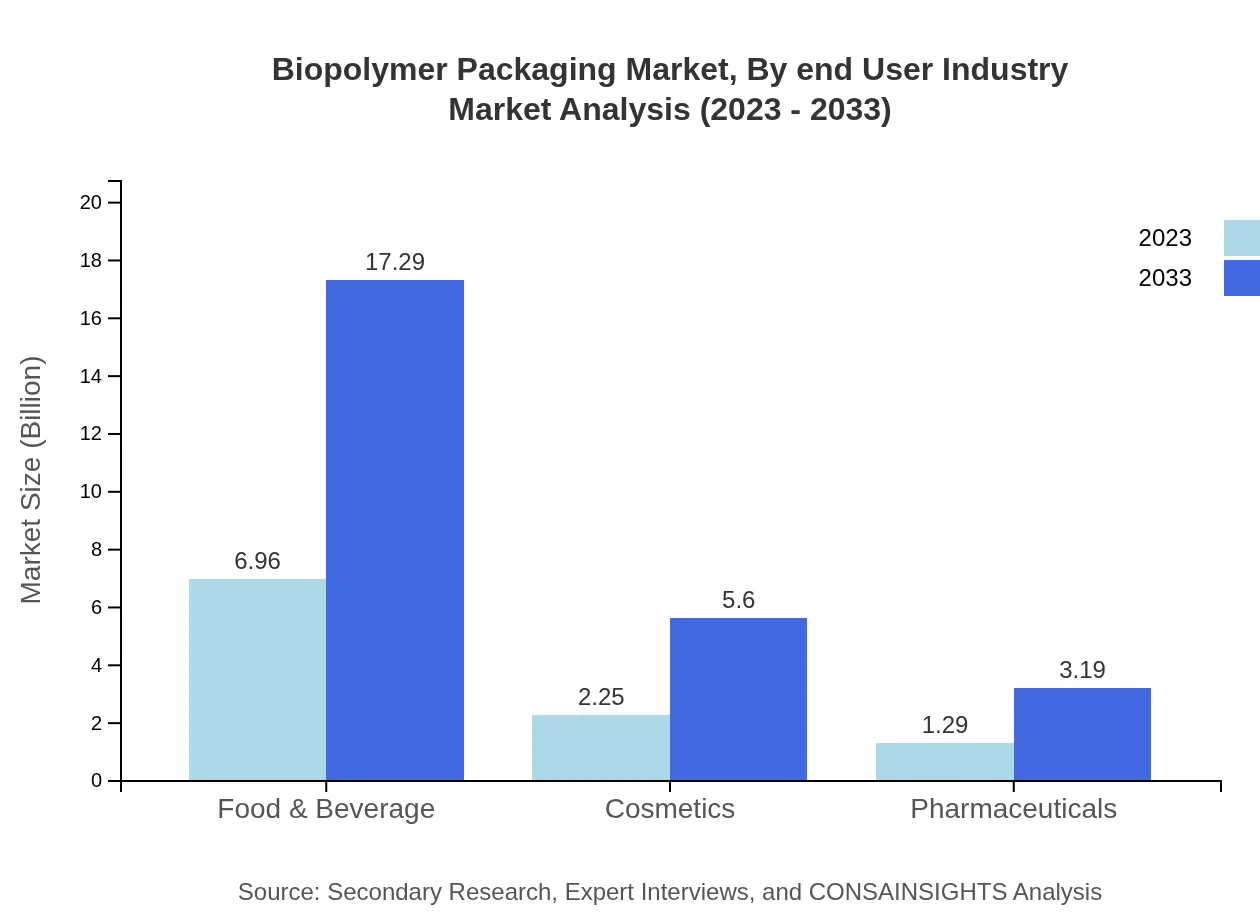

Biopolymer Packaging Market Analysis By End User Industry

The pharmaceutical industry is seeing increasing demand for Biopolymer Packaging solutions, contributing to a market size of $1.29 billion in 2023, projected to reach $3.19 billion by 2033. The food and beverage industry remains the largest end-use market, indicating the critical need for eco-friendly packaging in traditional sectors.

Biopolymer Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biopolymer Packaging Industry

NatureWorks LLC:

NatureWorks is a global leader in the production of Ingeo biopolymer, which is derived from renewable plant materials and used in various packaging applications.BASF SE:

BASF is renowned for its innovative biopolymer materials and solutions that enhance sustainability in packaging while maintaining performance.Novamont S.p.A.:

Novamont specializes in bioplastics and promotes sustainable development through its range of biodegradable and compostable packaging products.Bio-On S.p.A.:

Bio-On focuses on the biopolymer production deriving from agricultural waste, enhancing the sustainability aspect of packaging solutions.Synlogic:

Synlogic is a leading player in developing biodegradable materials focused on delivering high performance with lower environmental impact.We're grateful to work with incredible clients.

FAQs

What is the market size of biopolymer Packaging?

The biopolymer packaging market is valued at approximately $10.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 9.2%, indicating strong growth potential in the coming years.

What are the key market players or companies in the biopolymer Packaging industry?

Key players in the biopolymer packaging market include major companies such as BASF, NatureWorks, Braskem, and Novamont, which are known for their innovations in sustainable materials and environmentally friendly packaging solutions.

What are the primary factors driving the growth in the biopolymer packaging industry?

The growth in biopolymer packaging is driven by increasing environmental concerns, stringent regulations on plastic usage, rising consumer demand for sustainable packaging, and technological advancements in biopolymer material production.

Which region is the fastest Growing in the biopolymer packaging?

The Asia Pacific region is the fastest-growing market for biopolymer packaging, projected to increase from $2.1 billion in 2023 to $5.22 billion by 2033, reflecting significant market opportunities.

Does ConsaInsights provide customized market report data for the biopolymer packaging industry?

Yes, ConsaInsights offers customized market reports for the biopolymer packaging industry, tailoring insights based on specific client needs and market parameters for precise decision-making.

What deliverables can I expect from this biopolymer packaging market research project?

Typical deliverables from this market research project include comprehensive reports, detailed analytics, segmentation data, market forecasts, and strategic recommendations based on the latest industry trends.

What are the market trends of biopolymer packaging?

Current market trends in biopolymer packaging include an increase in the use of starch-based materials, growth in food packaging applications, and innovations in manufacturing processes such as extrusion and injection molding.