Bioprocess Containers Market Report

Published Date: 31 January 2026 | Report Code: bioprocess-containers

Bioprocess Containers Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bioprocess Containers market from 2023 to 2033, including market size forecasts, growth trends, regional insights, and major players shaping the industry landscape.

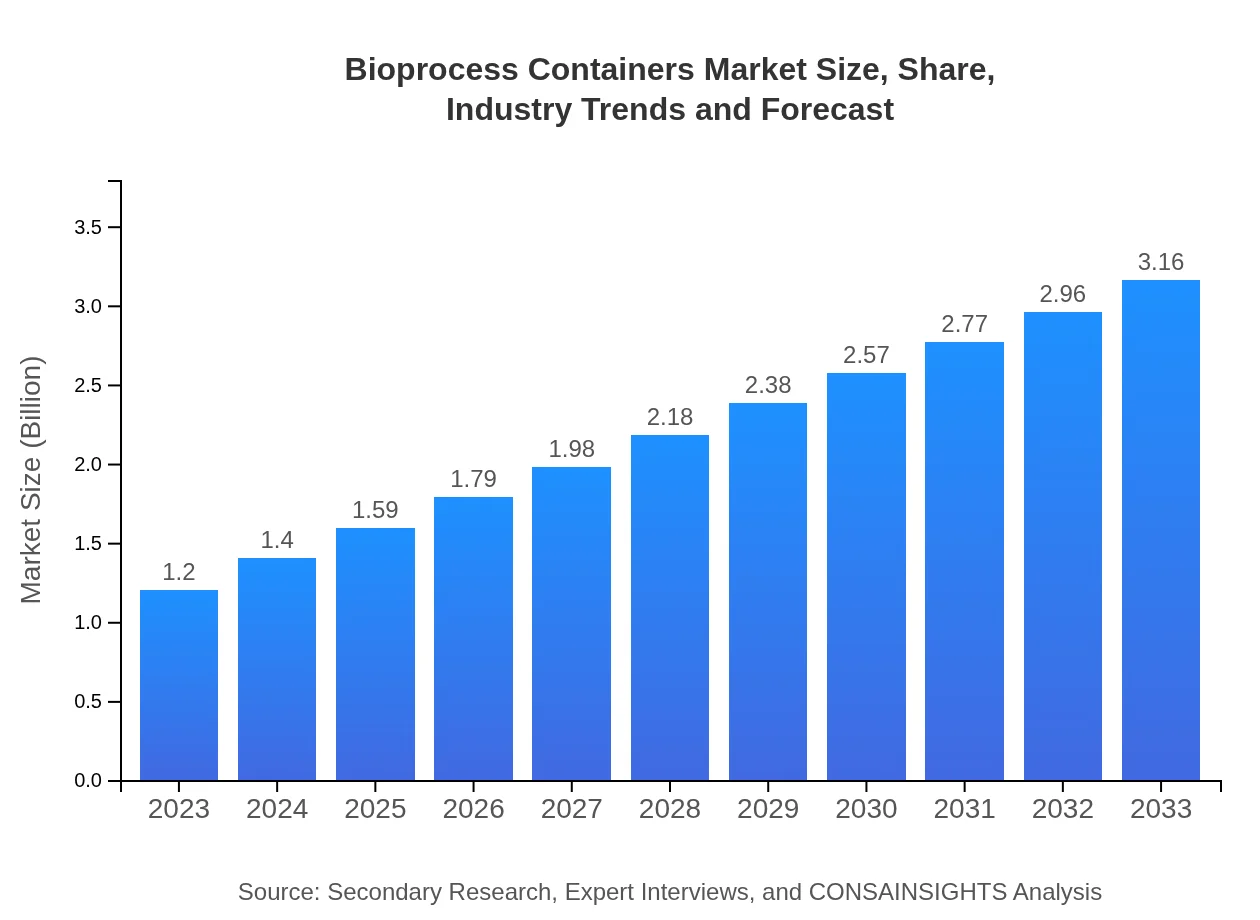

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $3.16 Billion |

| Top Companies | Thermo Fisher Scientific, Sartorius AG, MilliporeSigma, GE Healthcare Life Sciences |

| Last Modified Date | 31 January 2026 |

Bioprocess Containers Market Overview

Customize Bioprocess Containers Market Report market research report

- ✔ Get in-depth analysis of Bioprocess Containers market size, growth, and forecasts.

- ✔ Understand Bioprocess Containers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioprocess Containers

What is the Market Size & CAGR of Bioprocess Containers market in 2023?

Bioprocess Containers Industry Analysis

Bioprocess Containers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

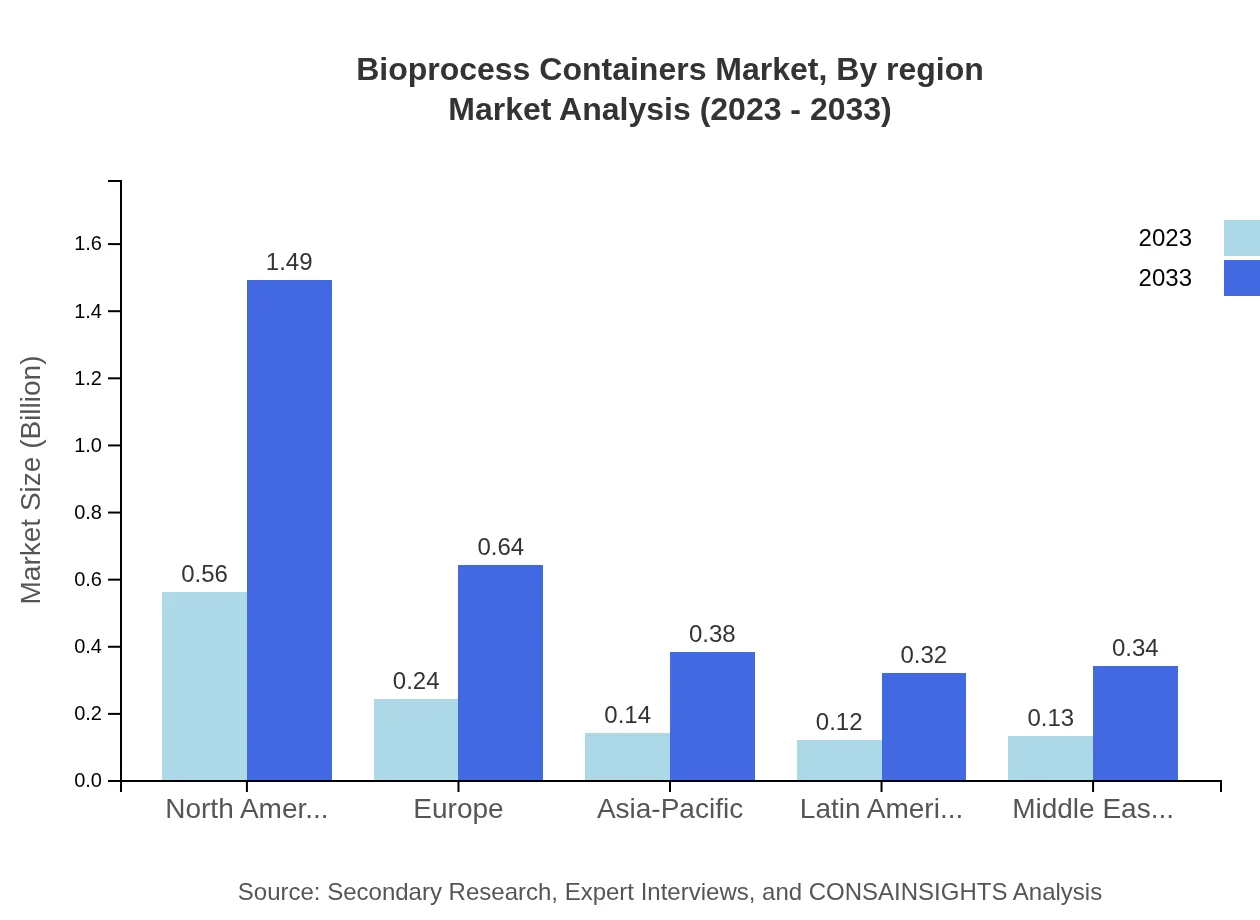

Bioprocess Containers Market Analysis Report by Region

Europe Bioprocess Containers Market Report:

In Europe, the market will expand from $0.35 billion in 2023 to $0.93 billion in 2033, propelled by stringent regulations ensuring product quality and safety, coupled with increasing production of biologics.Asia Pacific Bioprocess Containers Market Report:

In the Asia Pacific region, the bioprocess containers market is projected to grow from $0.23 billion in 2023 to $0.60 billion by 2033, driven by increased biopharmaceutical production and emerging markets like India and China investing in healthcare advancements.North America Bioprocess Containers Market Report:

North America, the largest region in terms of market share, is expected to grow from $0.45 billion in 2023 to $1.17 billion by 2033. Strong investments in R&D and the dominance of established biopharmaceutical firms significantly contribute to growth.South America Bioprocess Containers Market Report:

The South American market is expected to increase from $0.10 billion in 2023 to $0.26 billion in 2033. The growth opportunities stem from greater focus on inequality in healthcare access and increasing biopharmaceutical manufacturing capabilities.Middle East & Africa Bioprocess Containers Market Report:

The market in the Middle East and Africa is projected to grow from $0.08 billion in 2023 to $0.20 billion by 2033. Despite slower growth, rising investments in healthcare infrastructure and technology improvements are positive indicators.Tell us your focus area and get a customized research report.

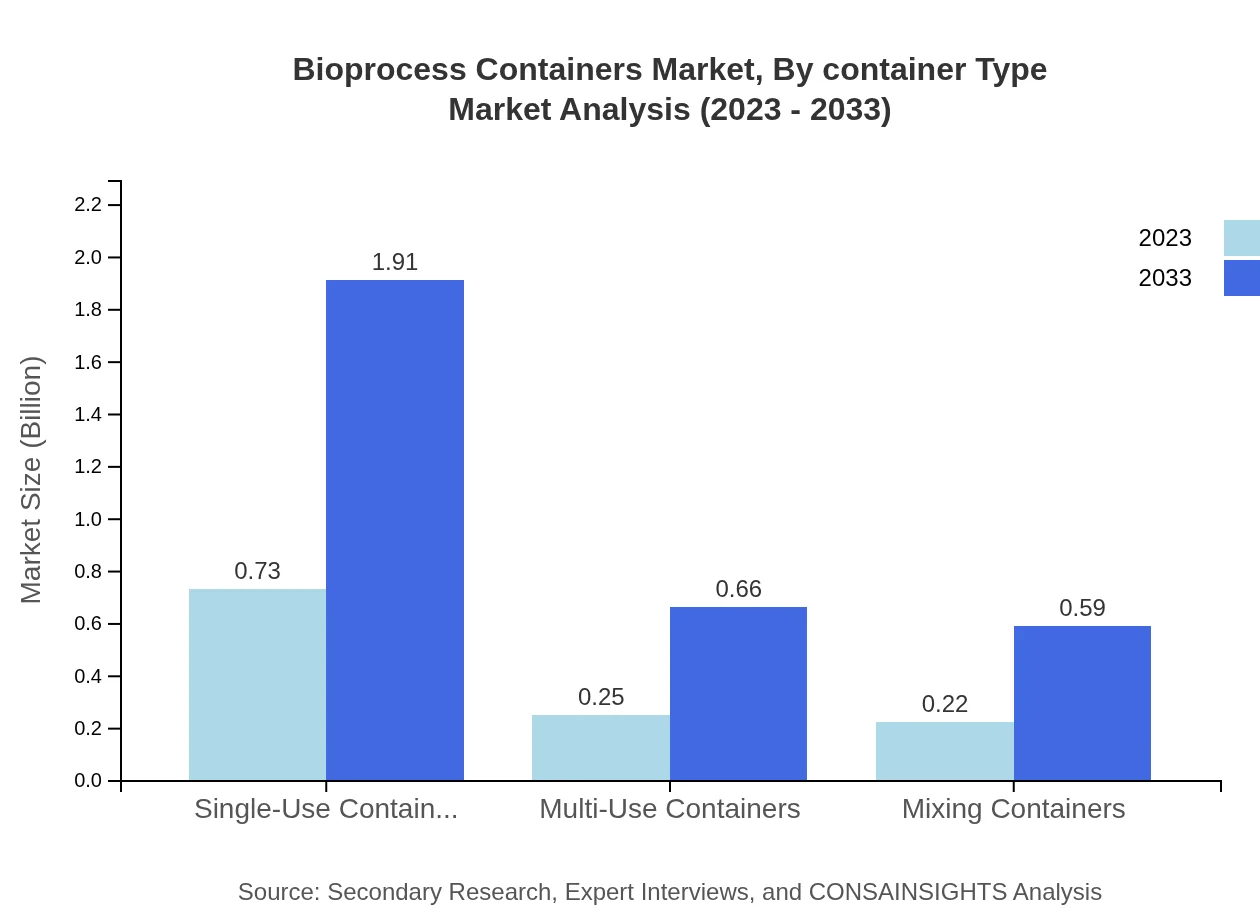

Bioprocess Containers Market Analysis By Container Type

Single-use containers dominate the market, having grown from a market size of $0.73 billion in 2023 to $1.91 billion in 2033, capturing over 60% of the market share. Multi-use containers, though trailing, are also expected to grow steadily.

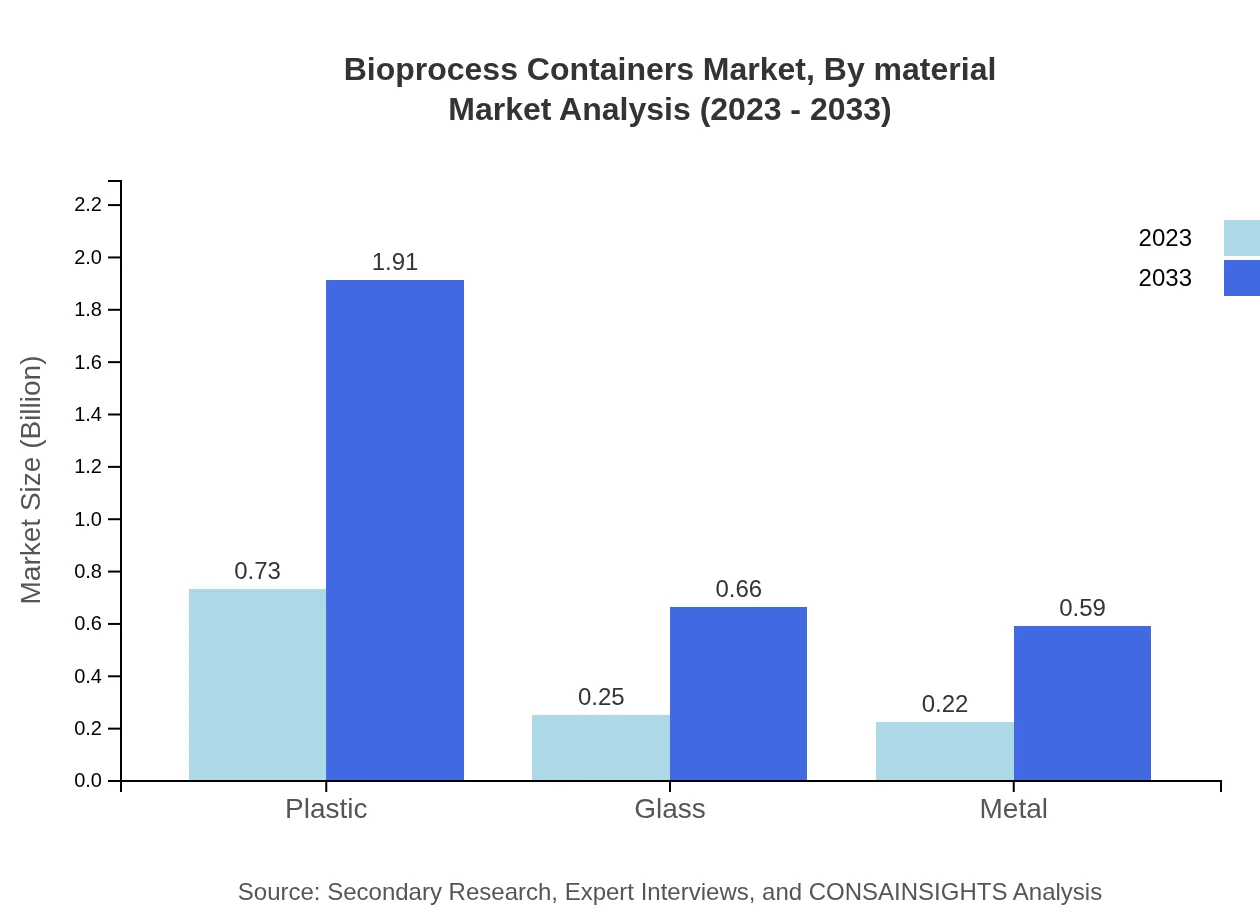

Bioprocess Containers Market Analysis By Material

The plastic segment, representing over 60% of the bioprocess container market, is projected to grow from $0.73 billion in 2023 to $1.91 billion in 2033, while glass and metal containers are also effective in niche applications, projected to grow modestly.

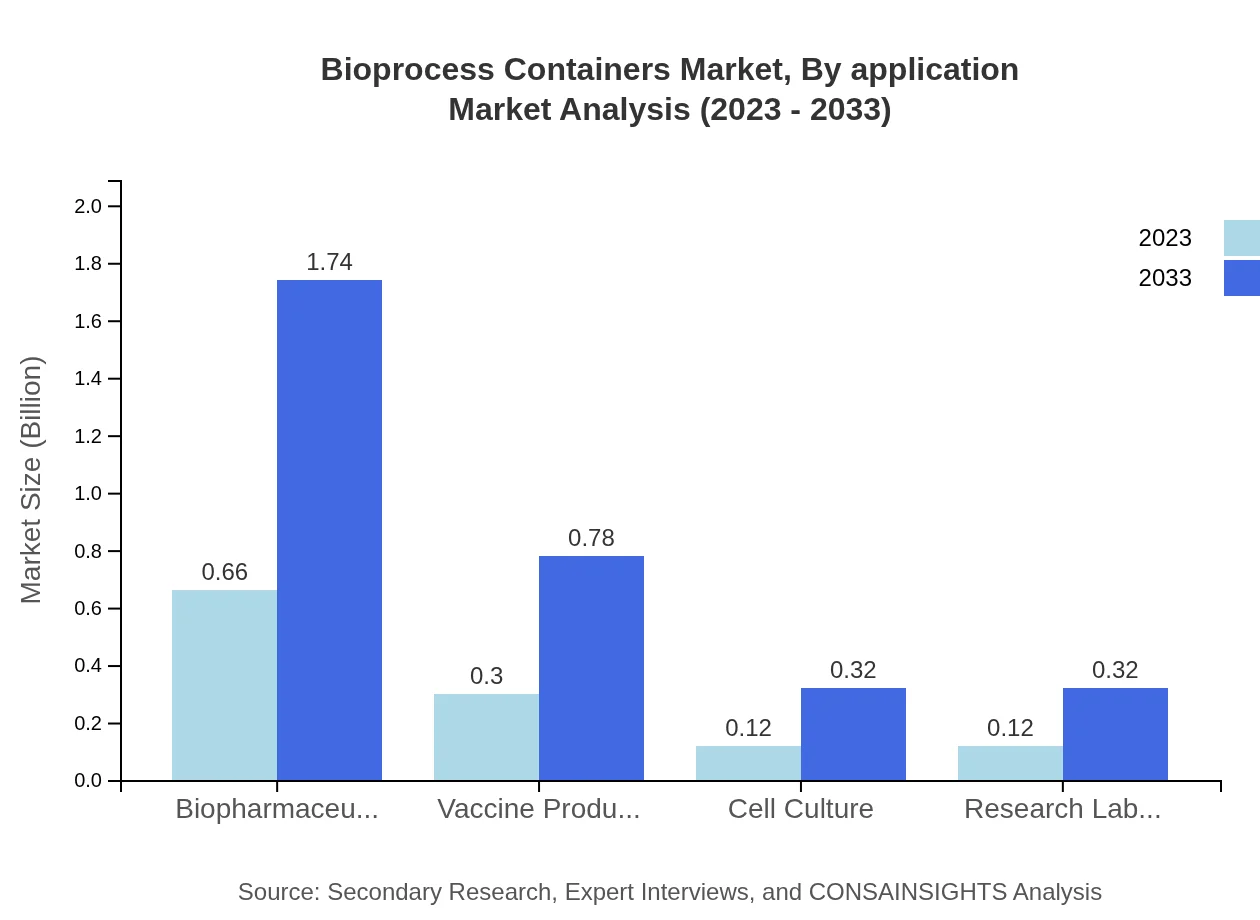

Bioprocess Containers Market Analysis By Application

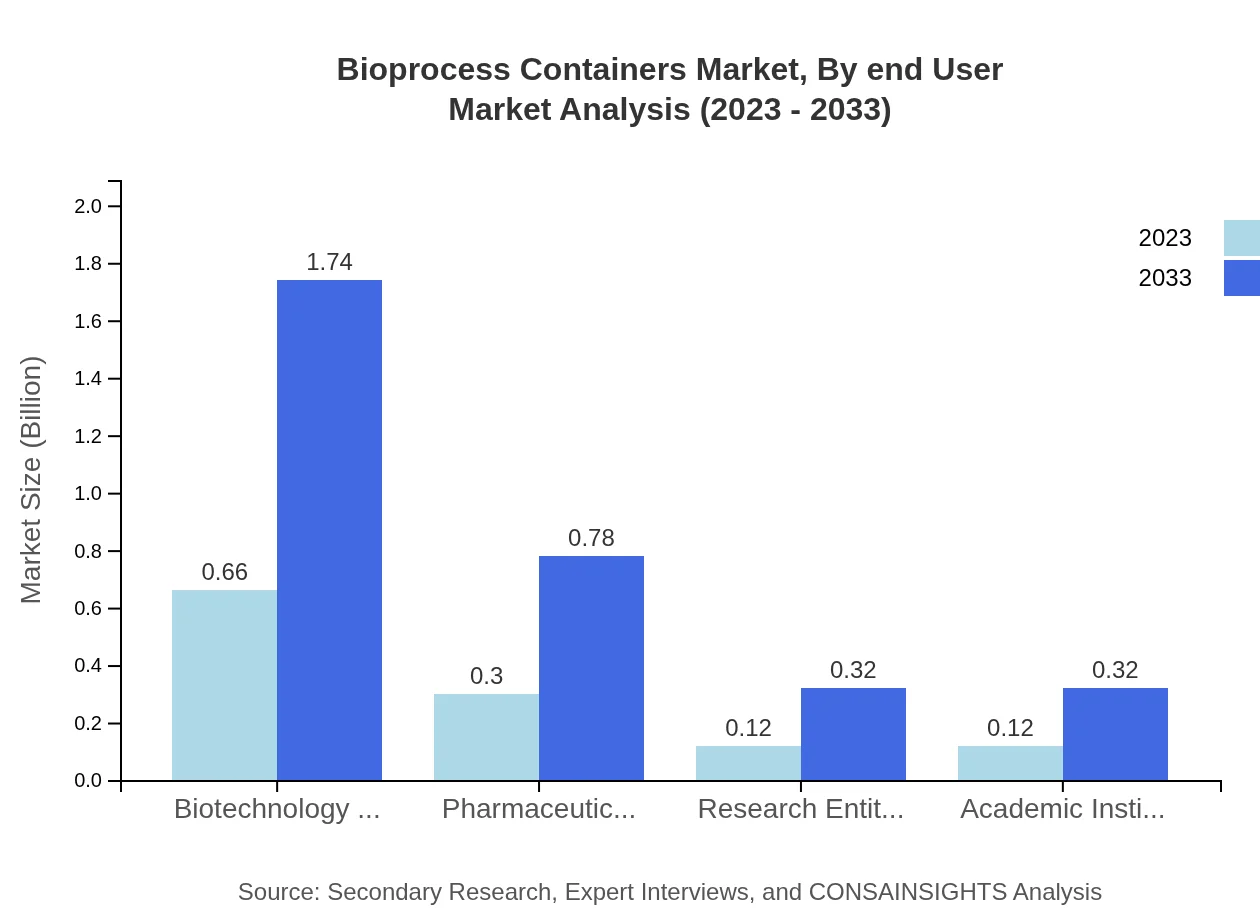

Biopharmaceutical production accounts for over 55% of the bioprocess container market, expected to rise from $0.66 billion in 2023 to $1.74 billion by 2033. Vaccine production also shows strong growth potential.

Bioprocess Containers Market Analysis By Region

Regionally, North America holds the largest share, with significant growth expected. Europe follows closely, benefitting from stringent regulations, while the Asia Pacific continues to see a faster growth rate due to improving manufacturing capabilities.

Bioprocess Containers Market Analysis By End User

The primary end-users of bioprocess containers include biotechnology companies, pharmaceutical firms, and research entities, with the biotechnology sector projected to continue leading in size and growth.

Bioprocess Containers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioprocess Containers Industry

Thermo Fisher Scientific:

A leading provider of scientific instrumentation, reagents and consumables, Thermo Fisher offers a wide range of bioprocess containers and single-use technology for biopharmaceutical production.Sartorius AG:

Well-known for its bioprocessing solutions, Sartorius develops innovative single-use technologies that enhance process efficiency and safety in biopharmaceutical manufacturing.MilliporeSigma:

Part of Merck Group, MilliporeSigma provides advanced bioprocessing products including single-use bioprocess containers used widely in biomanufacturing.GE Healthcare Life Sciences:

A trusted provider of equipment, reagents, and consumables for bioprocessing, GE's offerings include a diverse range of bioprocess containers.We're grateful to work with incredible clients.

FAQs

What is the market size of bioprocess Containers?

The bioprocess containers market is currently valued at approximately $1.2 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 9.8% through to 2033.

What are the key market players or companies in the bioprocess Containers industry?

Key players in the bioprocess containers market include top biotechnology, pharmaceutical firms, and various research entities that leverage these containers for efficient production and storage of biological materials.

What are the primary factors driving the growth in the bioprocess Containers industry?

The growth of bioprocess containers is driven by increasing demand in biopharmaceutical production, advancements in single-use technologies, and a growing focus on reduced contamination risks in production processes.

Which region is the fastest Growing in the bioprocess Containers?

The North American region is the fastest-growing market for bioprocess containers, with size projected to increase from $0.45 billion in 2023 to $1.17 billion by 2033.

Does ConsaInsights provide customized market report data for the bioprocess Containers industry?

Yes, ConsaInsights offers tailored market report data specifically for the bioprocess containers industry, reflecting unique insights based on client requirements and market trends.

What deliverables can I expect from this bioprocess Containers market research project?

Expect comprehensive analyses encompassing market size data, growth forecasts, competitive landscape, regional trends, and in-depth segment breakdowns for informed strategic decision-making.

What are the market trends of bioprocess Containers?

Current trends in the bioprocess containers market include a shift towards single-use solutions, increased focus on sustainability, and advancements in manufacturing processes to enhance efficiency and reduce costs.