Bioprocess Validation Market Report

Published Date: 31 January 2026 | Report Code: bioprocess-validation

Bioprocess Validation Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the bioprocess validation market, focusing on market size, segments, and regional insights with forecasts covering 2023 to 2033.

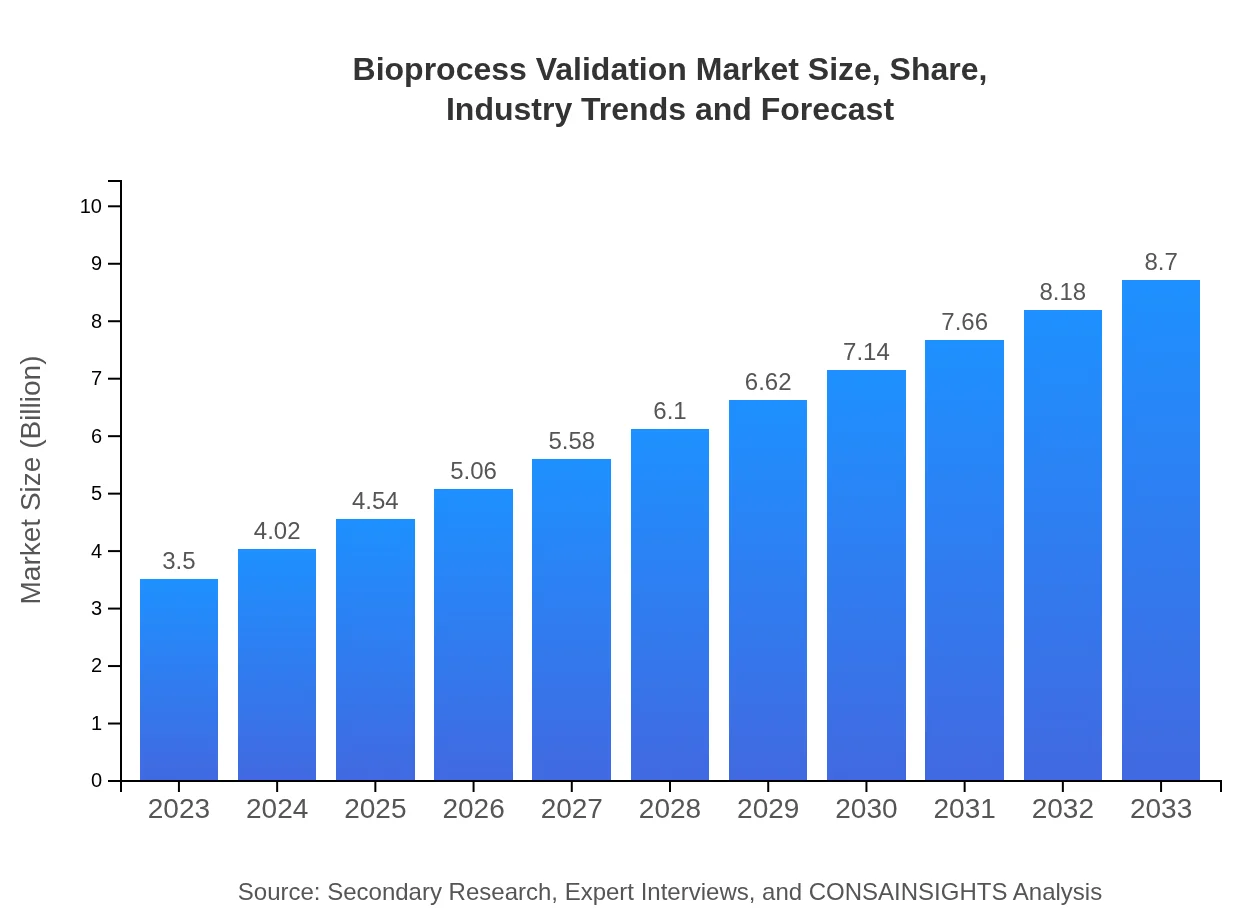

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $8.70 Billion |

| Top Companies | Sartorius AG, Thermo Fisher Scientific, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Bioprocess Validation Market Overview

Customize Bioprocess Validation Market Report market research report

- ✔ Get in-depth analysis of Bioprocess Validation market size, growth, and forecasts.

- ✔ Understand Bioprocess Validation's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioprocess Validation

What is the Market Size & CAGR of Bioprocess Validation market in 2023?

Bioprocess Validation Industry Analysis

Bioprocess Validation Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioprocess Validation Market Analysis Report by Region

Europe Bioprocess Validation Market Report:

Europe's market size is forecasted at $1.09 billion in 2023, expected to expand to $2.71 billion by 2033, indicating a CAGR of 9.3%. The European market benefits from stringent regulatory standards and a strong focus on quality assurance.Asia Pacific Bioprocess Validation Market Report:

In 2023, the Asia Pacific market size is estimated at $0.67 billion, projected to grow to $1.67 billion by 2033, reflecting a significant CAGR of 9.4%. This growth is driven by increase in biomanufacturing facilities and improving regulatory frameworks in countries like China and India.North America Bioprocess Validation Market Report:

North America holds a substantial share of the market, valued at $1.19 billion in 2023 and projected to grow to $2.96 billion by 2033, with a robust CAGR of 9.2%. The presence of major biopharmaceutical companies and stringent regulations are driving this growth.South America Bioprocess Validation Market Report:

The South American market is relatively smaller, currently valued at $0.19 billion in 2023. By 2033, it is expected to reach $0.48 billion, growing at a CAGR of 9.6%. Increasing investments in biotechnology are enhancing the demand for validation processes in this region.Middle East & Africa Bioprocess Validation Market Report:

In 2023, the Middle East and Africa market is estimated at $0.35 billion, with projections reaching $0.87 billion by 2033, reflecting a CAGR of 9.0%. Rising health initiatives and investments in bioprocessing capabilities in the region drive growth.Tell us your focus area and get a customized research report.

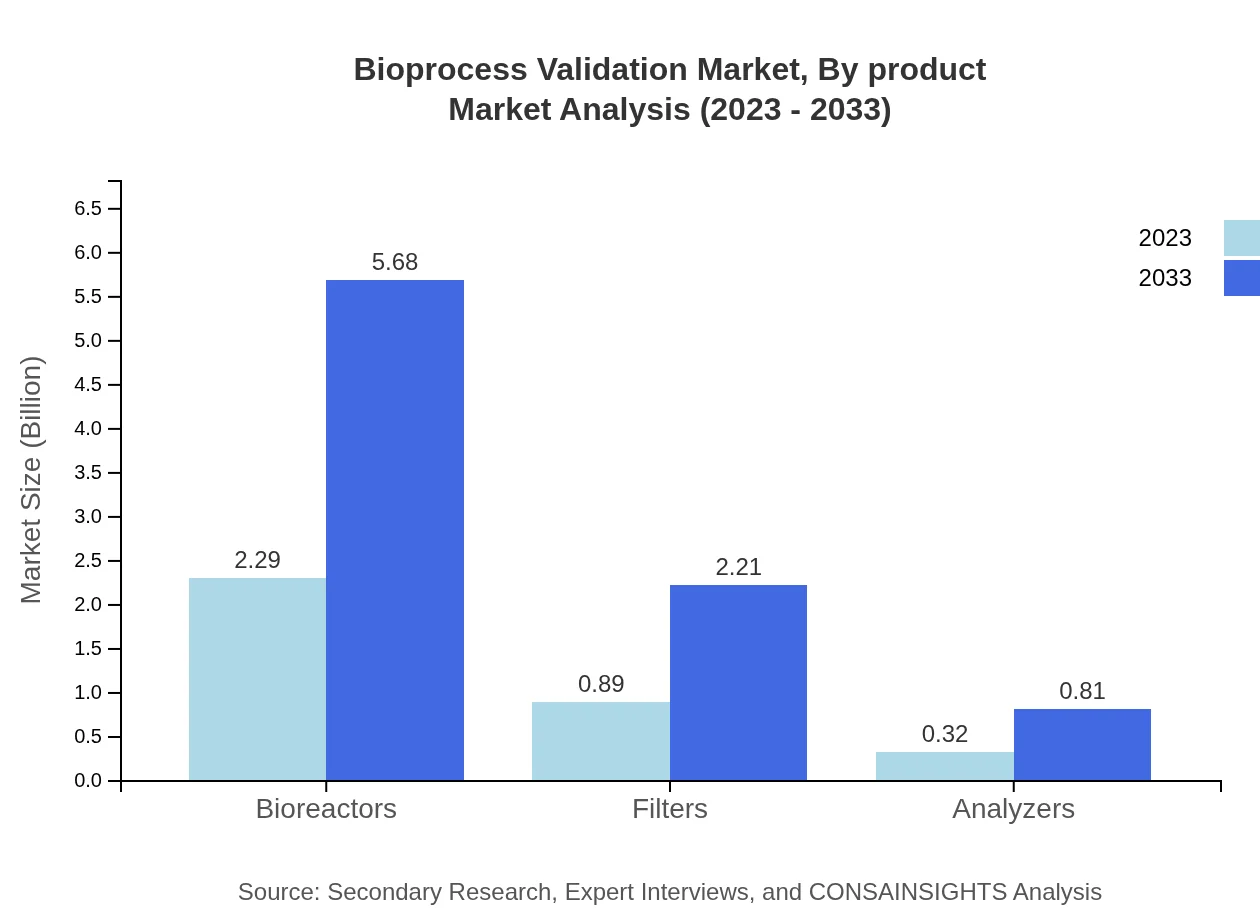

Bioprocess Validation Market Analysis By Product

The product type segment includes key components such as bioreactors, filters, and analytical instruments. In 2023, bioreactors account for a market size of $2.29 billion, expected to reach $5.68 billion by 2033. Filters and analyzers also contribute significantly, highlighting the integral role of these products in achieving compliance.

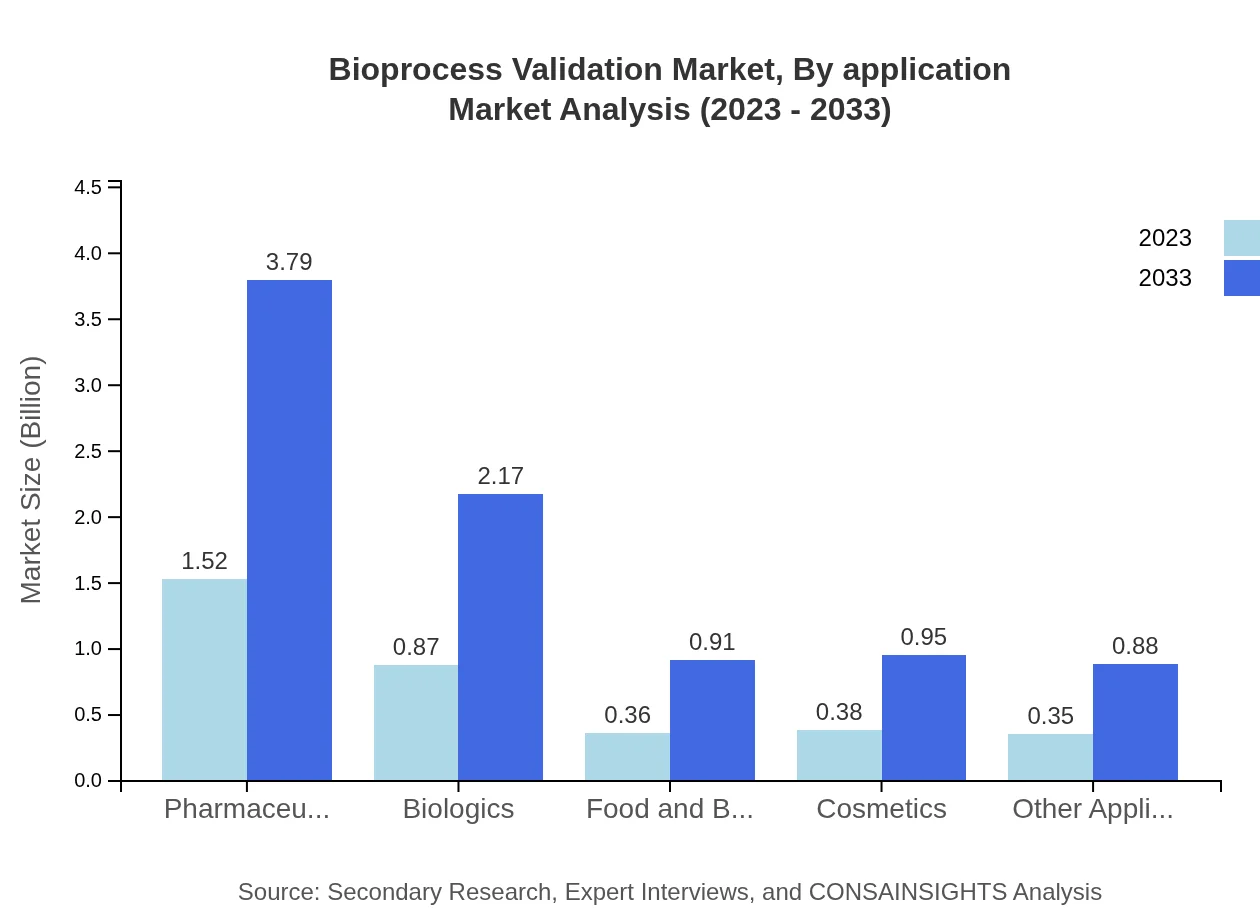

Bioprocess Validation Market Analysis By Application

Applications span pharmaceuticals, biologics, food and beverage, and cosmetics. Pharmaceuticals lead the market, with a size of $1.52 billion in 2023 and projected growth to $3.79 billion by 2033. Biologics and other sectors are also expanding considerably as regulatory scrutiny increases.

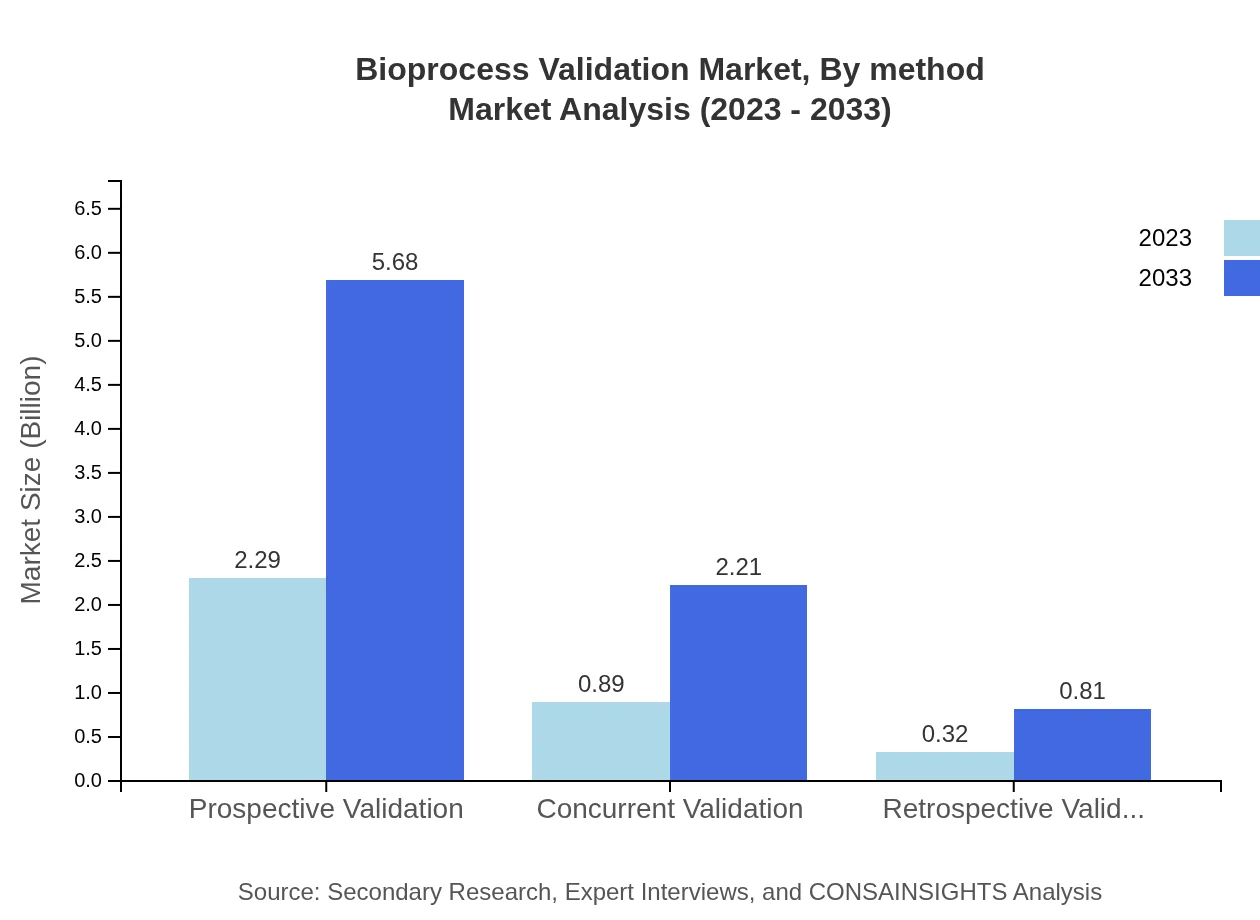

Bioprocess Validation Market Analysis By Method

The market is segmented into prospective, concurrent, and retrospective validation. Prospective validation leads this segment with a size of $2.29 billion in 2023, changing to $5.68 billion by 2033, underscoring its importance for pre-market approvals.

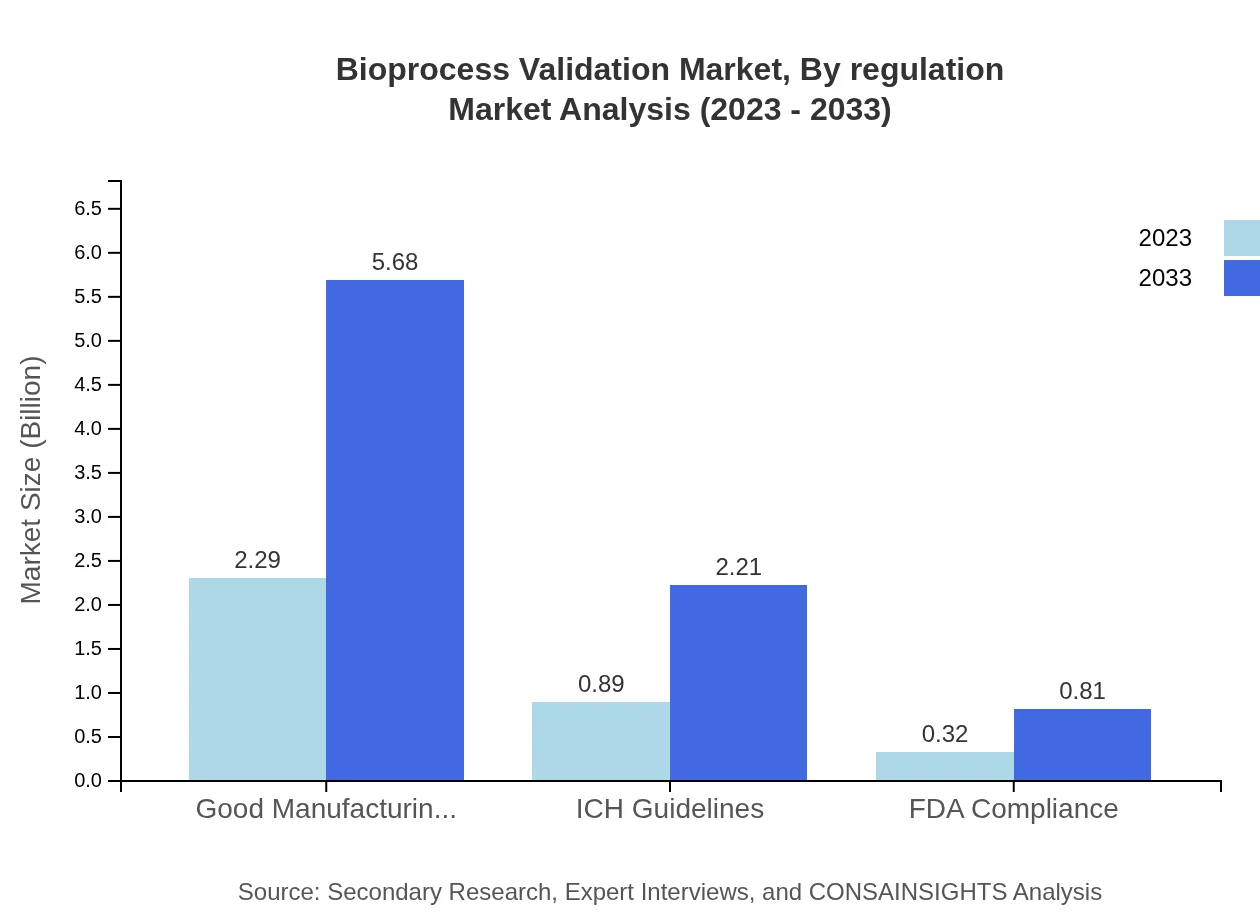

Bioprocess Validation Market Analysis By Regulation

The regulatory standards segment includes GMP, ICH Guidelines, and FDA Compliance. GMP leads with a substantial market share of $2.29 billion in 2023, projected to expand to $5.68 billion by 2033. This reflects the growing emphasis on stringent quality assurance practices across the sector.

Bioprocess Validation Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioprocess Validation Industry

Sartorius AG:

Sartorius AG is a leading global pharmaceutical and laboratory equipment supplier. They provide extensive solutions in bioprocess validation, focusing on innovative technologies and compliance.Thermo Fisher Scientific:

Thermo Fisher Scientific is a world leader in serving science. With a comprehensive portfolio, they offer state-of-the-art bioprocess validation tools and resources to support the biopharmaceutical workflow.GE Healthcare:

GE Healthcare provides technologies and solutions that help healthcare providers deliver better care to patients. Their bioprocess validation offerings support efficient drug development processes.We're grateful to work with incredible clients.

FAQs

What is the market size of bioprocess Validation?

The bioprocess-validation market is currently valued at approximately $3.5 billion and is projected to grow at a CAGR of 9.2%. This growth reflects the increasing demand for robust compliance solutions in biopharmaceutical production.

What are the key market players or companies in this bioprocess Validation industry?

Key market players in the bioprocess-validation industry include major pharmaceutical companies and specialized bioprocess validation firms. These players are pivotal in driving innovations and adhering to stringent quality control standards.

What are the primary factors driving the growth in the bioprocess Validation industry?

The primary factors driving growth in the bioprocess-validation industry include rising biopharmaceutical demand, stringent regulatory requirements, and increasing investments in bioprocess technologies to enhance product quality and compliance.

Which region is the fastest Growing in the bioprocess Validation?

The fastest-growing region in the bioprocess-validation market is Europe, which is expected to grow from $1.09 billion in 2023 to $2.71 billion by 2033, reflecting significant advancements in biopharmaceutical manufacturing.

Does ConsaInsights provide customized market report data for the bioprocess Validation industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the bioprocess-validation industry, ensuring relevant insights and strategic analysis.

What deliverables can I expect from this bioprocess Validation market research project?

Expect comprehensive market analysis, including detailed segmentation, competitive landscape, forecast data, and actionable insights to inform strategic decisions in the bioprocess-validation market.

What are the market trends of bioprocess Validation?

Key market trends in bioprocess-validation include the adoption of automation technologies, increasing emphasis on Good Manufacturing Practices (GMP), and a focus on sustainable biomanufacturing practices, all enhancing efficiency.