Biopsy Devices Market Report

Published Date: 31 January 2026 | Report Code: biopsy-devices

Biopsy Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the biopsy devices market, which encompasses size estimates, trends, opportunities, and competitive landscape from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

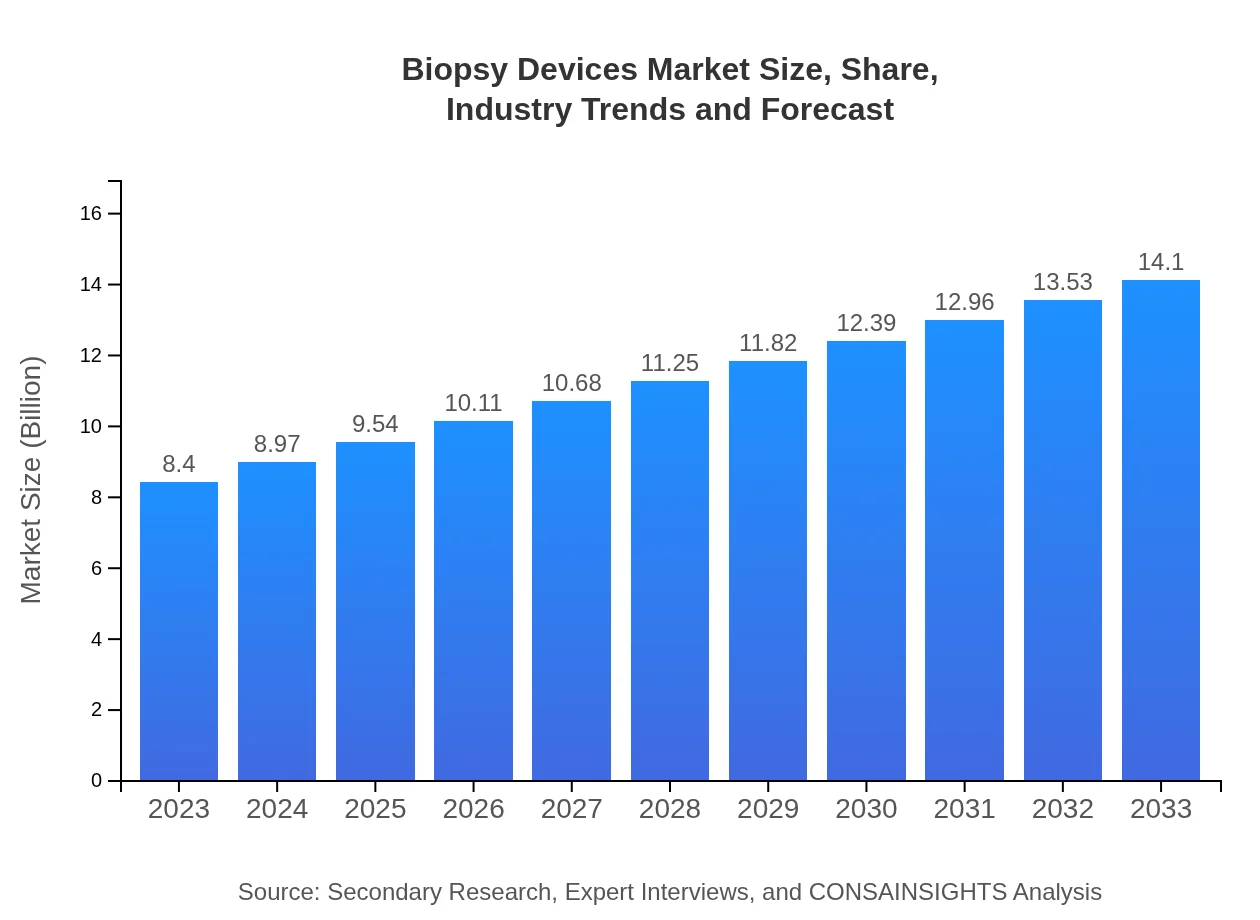

| 2023 Market Size | $8.40 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $14.10 Billion |

| Top Companies | Thermo Fisher Scientific Inc., Danaher Corporation, Boston Scientific Corporation, Becton, Dickinson and Company |

| Last Modified Date | 31 January 2026 |

Biopsy Devices Market Overview

Customize Biopsy Devices Market Report market research report

- ✔ Get in-depth analysis of Biopsy Devices market size, growth, and forecasts.

- ✔ Understand Biopsy Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biopsy Devices

What is the Market Size & CAGR of Biopsy Devices market in 2023?

Biopsy Devices Industry Analysis

Biopsy Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biopsy Devices Market Analysis Report by Region

Europe Biopsy Devices Market Report:

The European market is poised to grow from $2.76 billion in 2023 to $4.63 billion by 2033. The region benefits from stringent regulatory frameworks, high levels of investment in healthcare innovation, and a focus on improving diagnostic accuracy.Asia Pacific Biopsy Devices Market Report:

The Asia Pacific region is expected to witness significant growth in the biopsy devices market, with an increase from $1.52 billion in 2023 to $2.55 billion by 2033. Factors contributing to this growth include increasing healthcare expenditure, rising prevalence of cancer, and advancements in technology.North America Biopsy Devices Market Report:

North America will continue to dominate the biopsy devices market, expanding from $2.90 billion in 2023 to $4.86 billion by 2033. The growth is fueled by high healthcare spending, widespread availability of advanced healthcare technologies, and a large patient pool requiring diagnostic testing.South America Biopsy Devices Market Report:

The South American market is projected to grow from $0.83 billion in 2023 to $1.39 billion by 2033, driven by improving healthcare access and increased investments in healthcare infrastructure, alongside rising chronic disease rates.Middle East & Africa Biopsy Devices Market Report:

The Middle East and Africa region is expected to grow modestly, from $0.40 billion in 2023 to $0.66 billion by 2033. Increasing awareness regarding early cancer detection and the expansion of healthcare facilities are key growth drivers.Tell us your focus area and get a customized research report.

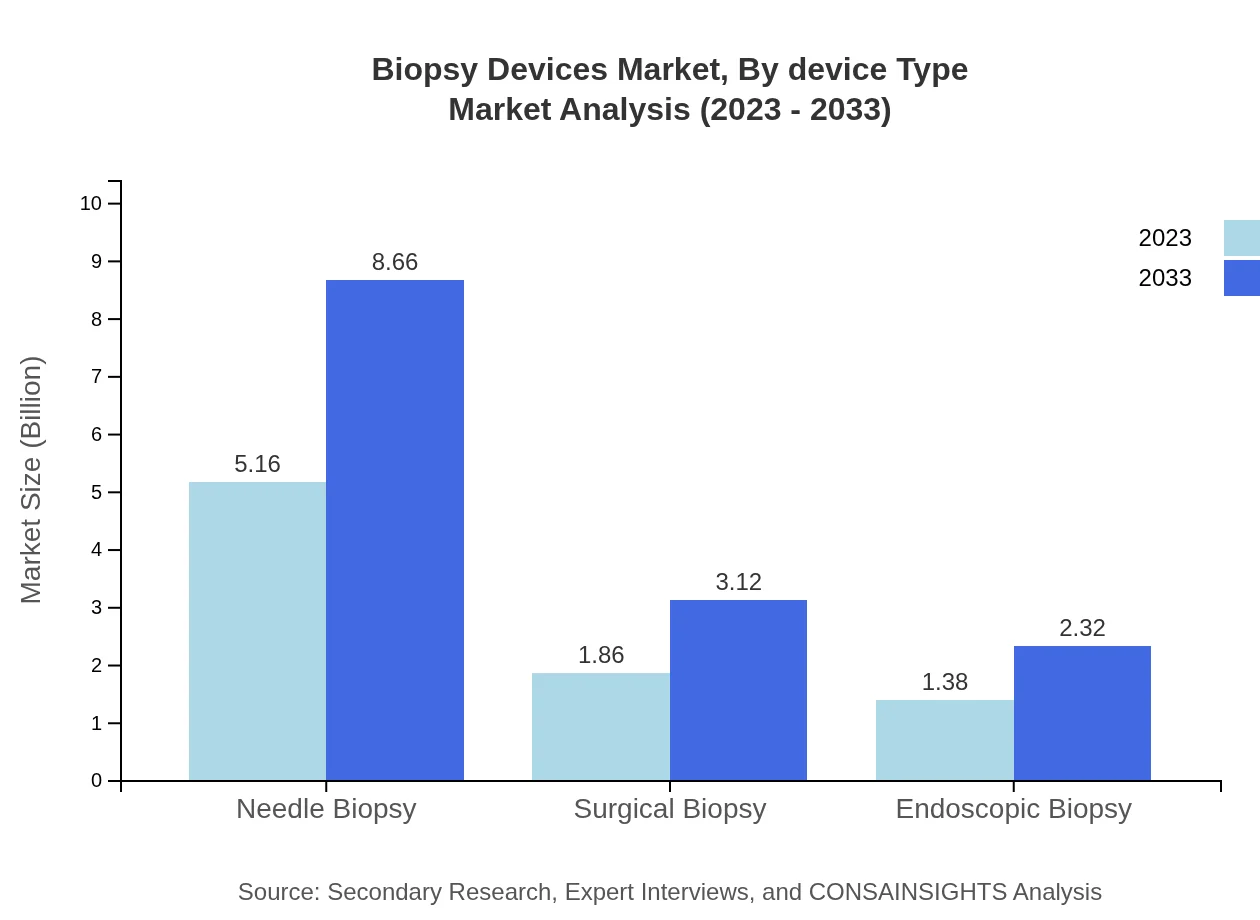

Biopsy Devices Market Analysis By Device Type

In 2023, the needle biopsy segment was valued at $5.16 billion, accounting for 61.39% market share, and is expected to grow to $8.66 billion by 2033. Surgical biopsy follows with $1.86 billion in 2023, expected to reach $3.12 billion by 2033. Endoscopic biopsy is also growing from $1.38 billion to $2.32 billion over the same period.

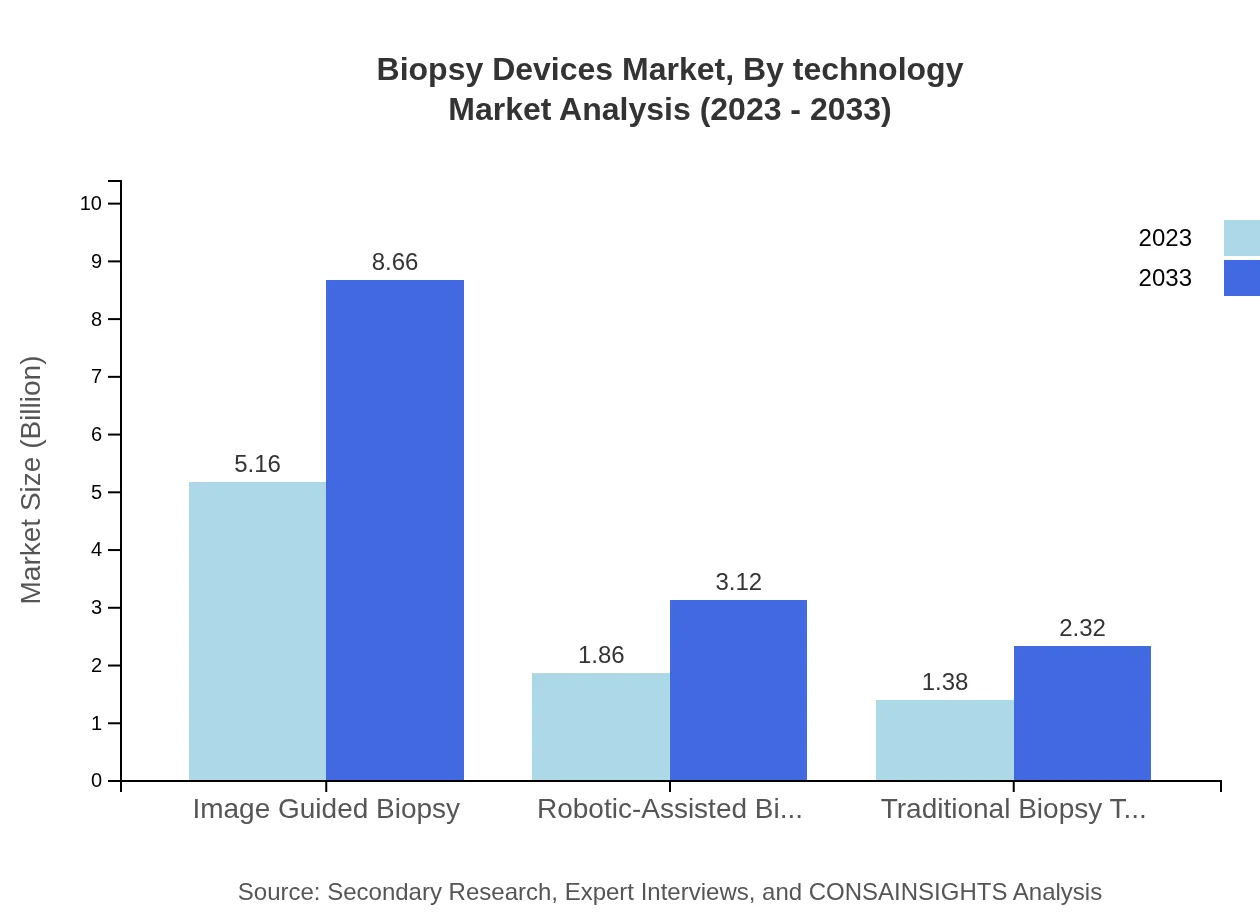

Biopsy Devices Market Analysis By Technology

Image-guided biopsy, representing 61.39% share in 2023 with a market size of $5.16 billion, is anticipated to grow to $8.66 billion by 2033. Robotic-assisted biopsy, accounting for about 22.16% share with a market value of $1.86 billion, is expected to reach $3.12 billion by 2033, representing a significant technological advancement in the sector.

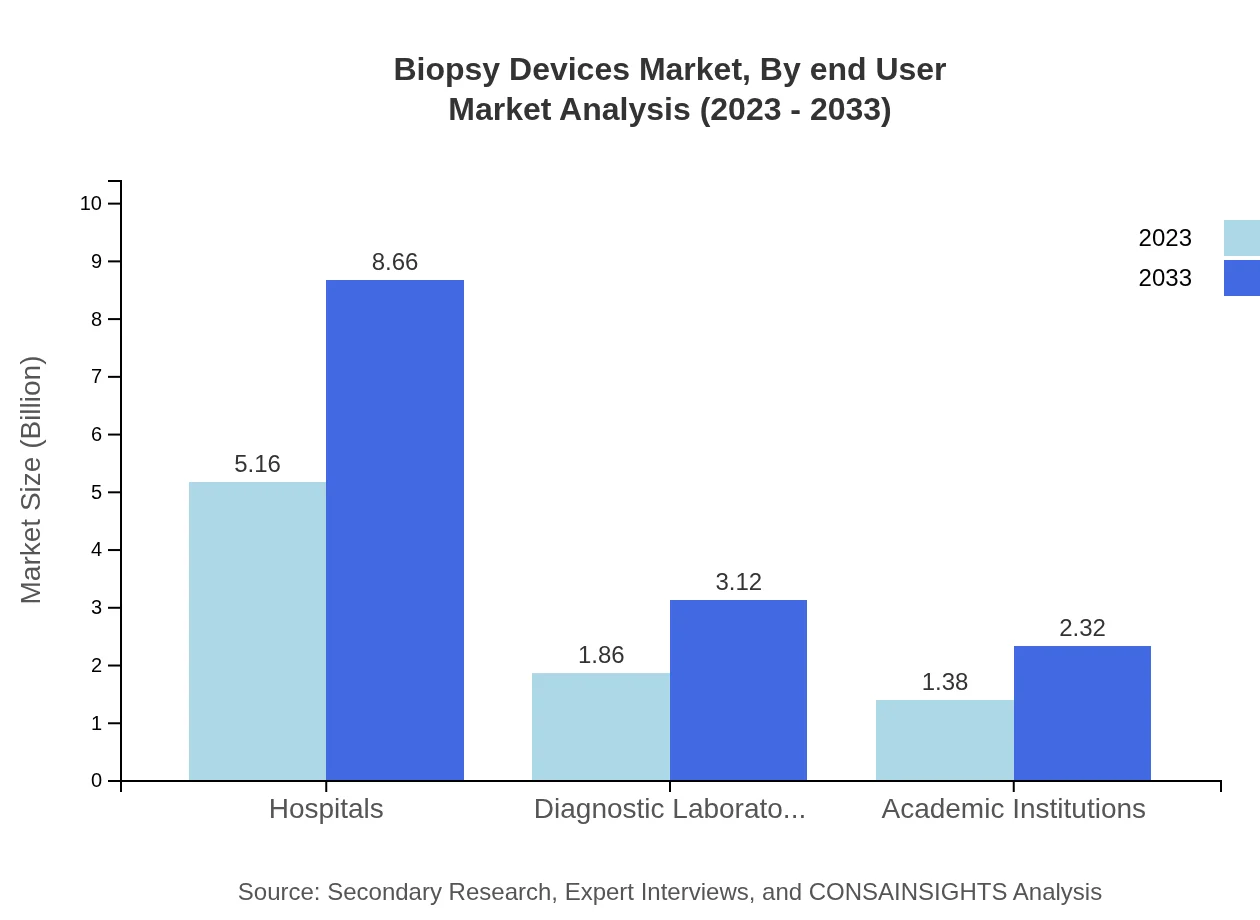

Biopsy Devices Market Analysis By End User

Hospitals dominate the end-user segment, holding a market size of $5.16 billion in 2023, projected to grow to $8.66 billion by 2033, accounting for 61.39% market share. Diagnostic laboratories and academic institutions follow, expected to grow from $1.86 billion to $3.12 billion and $1.38 billion to $2.32 billion respectively.

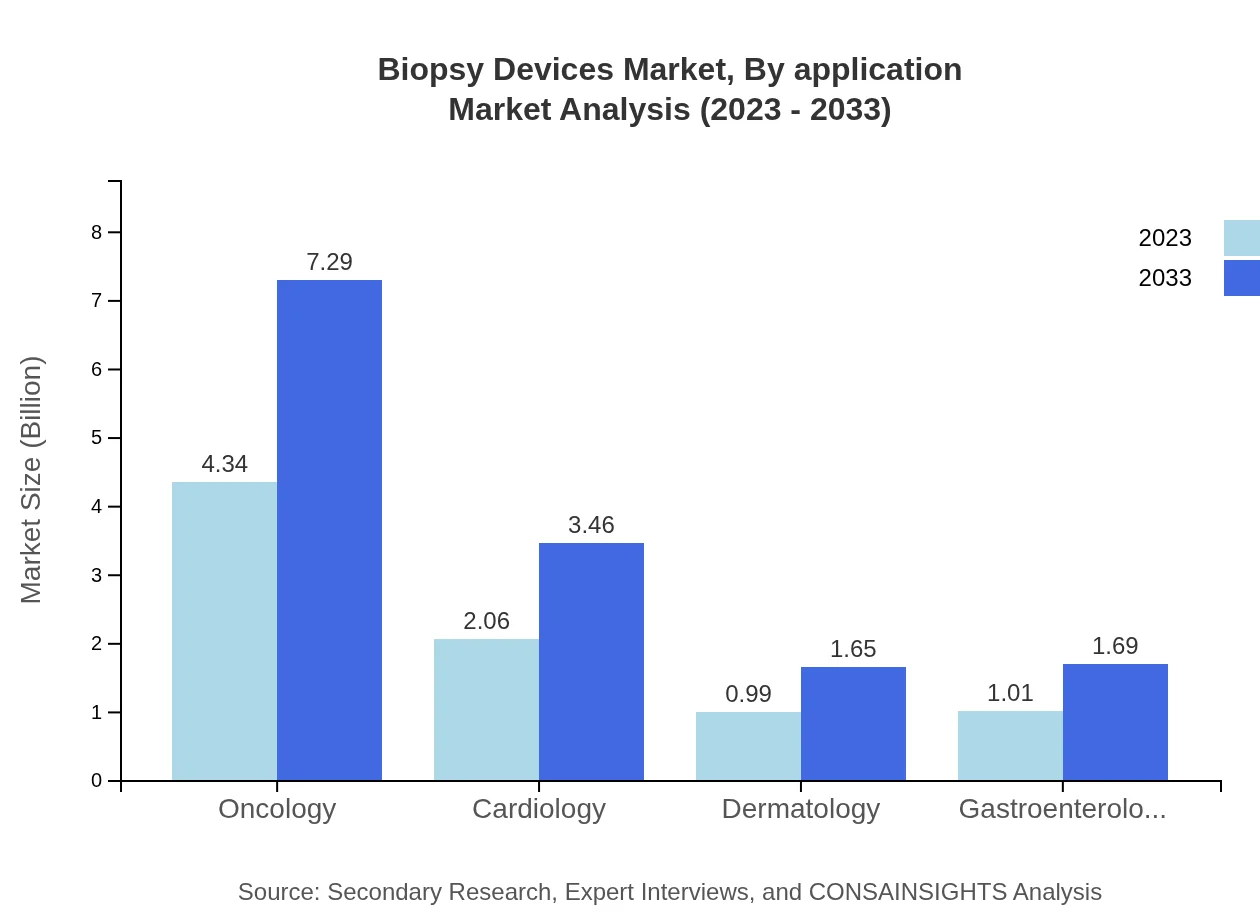

Biopsy Devices Market Analysis By Application

Oncology is the leading application area, with market sizes of $4.34 billion in 2023 expected to increase to $7.29 billion by 2033, representing a 51.68% share. The cardiology market is also vital, growing from $2.06 billion to $3.46 billion in the same period.

Biopsy Devices Market Analysis By Region

Global Biopsy Devices Market, By Region Market Analysis (2023 - 2033)

Regional analysis shows that North America holds the largest market share due to advanced healthcare systems, while Asia Pacific is growing rapidly due to increasing healthcare investments. Europe presents substantial growth opportunities with high R&D expenditure, while Latin America focuses on enhancing healthcare access.

Biopsy Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biopsy Devices Industry

Thermo Fisher Scientific Inc.:

A leading provider of innovative diagnostic solutions, they are committed to advancing the healthcare landscape through research and development.Danaher Corporation:

Known for its precision instruments, Danaher's technologies improve the quality of biopsies through analytical advancements.Boston Scientific Corporation:

A global leader in medical devices, Boston Scientific offers diverse biopsy solutions and actively invests in R&D.Becton, Dickinson and Company:

BD is highly regarded for its biopsy needles and related products, known for their quality and performance in diagnostics.We're grateful to work with incredible clients.

FAQs

What is the market size of biopsy devices?

As of 2023, the global biopsy devices market is valued at approximately $8.4 billion, and it is projected to grow at a CAGR of 5.2% over the next decade, reaching substantial market size by 2033.

What are the key market players or companies in the biopsy devices industry?

Key players in the biopsy devices market include large medical technology firms such as Medtronic, Boston Scientific, and BD. These companies are known for their innovative biopsy solutions and play a significant role in driving market growth and advancements.

What are the primary factors driving the growth in the biopsy devices industry?

The growth in the biopsy devices industry is driven by increasing cancer incidence, advancements in minimally invasive techniques, and greater emphasis on early diagnosis. Additionally, technological advancements and rising healthcare expenditure are contributing to market expansion.

Which region is the fastest Growing in the biopsy devices?

The Asia-Pacific region is experiencing rapid growth in the biopsy devices market, expected to grow from $1.52 billion in 2023 to $2.55 billion by 2033. This growth is attributed to rising healthcare access and increasing cancer prevalence in the region.

Does ConsaInsights provide customized market report data for the biopsy devices industry?

Yes, ConsaInsights offers customized market report data for the biopsy devices industry, enabling clients to obtain tailored insights, market size, growth forecasts, and competitive analysis to suit specific business needs.

What deliverables can I expect from this biopsy devices market research project?

Deliverables from the biopsy devices market research project typically include comprehensive reports, market analysis, regional insights, segment data, competitive landscape overviews, and actionable recommendations for strategic decision-making.

What are the market trends of biopsy devices?

Current market trends in the biopsy devices sector include a shift towards image-guided biopsies, increased adoption of robotic-assisted technologies, and a growing focus on patient safety and comfort, all driving innovation and market growth.