Biorational Market Report

Published Date: 02 February 2026 | Report Code: biorational

Biorational Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Biorational market from 2023 to 2033, including market size, growth projections, industry trends, and regional insights, offering comprehensive data for stakeholders and decision-makers.

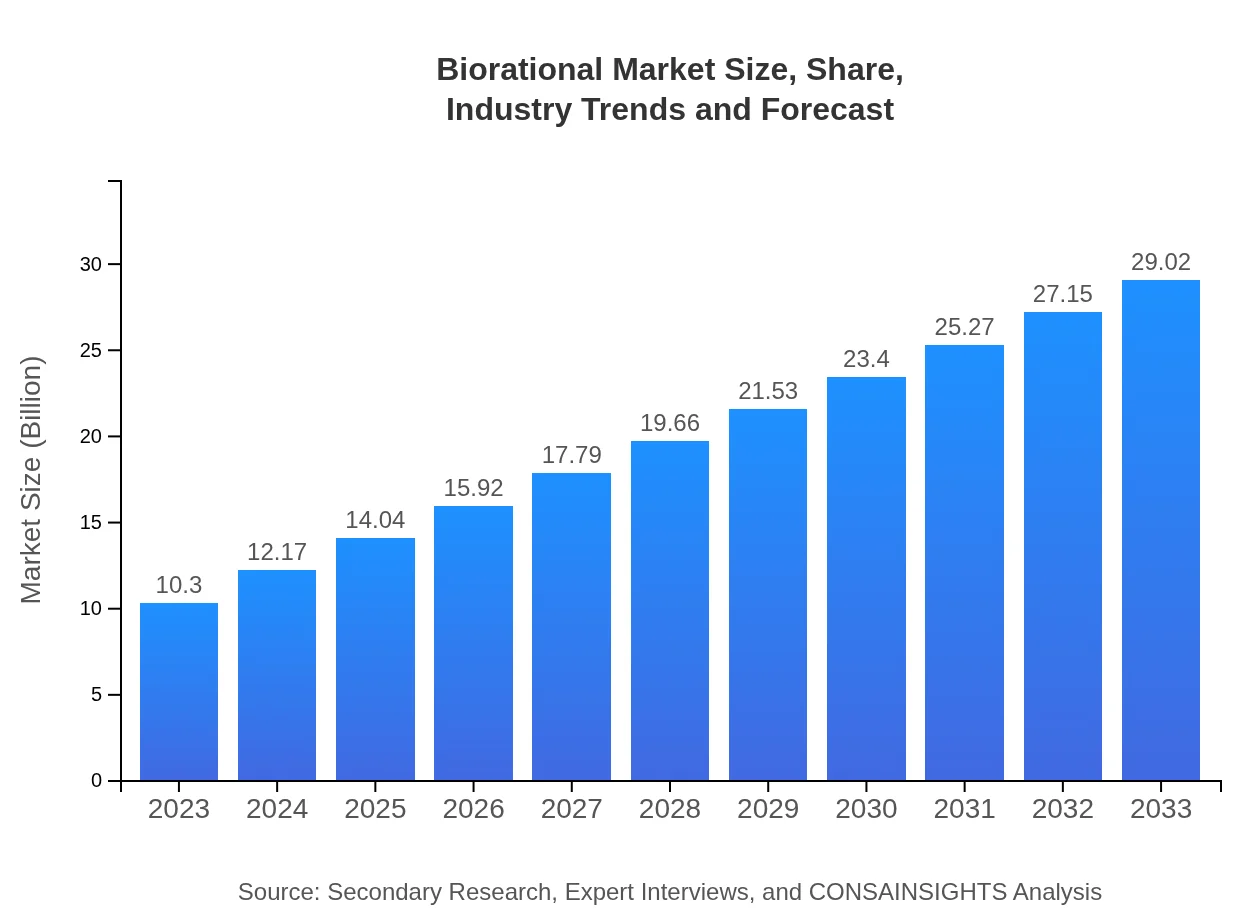

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.30 Billion |

| CAGR (2023-2033) | 10.5% |

| 2033 Market Size | $29.02 Billion |

| Top Companies | BASF SE, Syngenta AG, Bayer AG, Novozymes A/S |

| Last Modified Date | 02 February 2026 |

Biorational Market Overview

Customize Biorational Market Report market research report

- ✔ Get in-depth analysis of Biorational market size, growth, and forecasts.

- ✔ Understand Biorational's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biorational

What is the Market Size & CAGR of the Biorational market in 2023 and 2033?

Biorational Industry Analysis

Biorational Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biorational Market Analysis Report by Region

Europe Biorational Market Report:

Europe's market is significant, initially estimated at $2.62 billion in 2023 and projected to hit $7.37 billion by 2033, thanks largely to consumer demand for organic produce and robust regulatory frameworks promoting the use of Biorational products.Asia Pacific Biorational Market Report:

The Asia Pacific region boasts a market size of $2.02 billion in 2023, projected to grow to $5.70 billion by 2033. This growth is propelled by increasing agricultural activities and a shift towards organic farming practices in countries like China and India, which prioritize sustainable pest management solutions.North America Biorational Market Report:

In North America, the market size is projected to reach $3.80 billion in 2023 and expand to $10.70 billion by 2033. The United States leads in Biorational product adoption due to stringent regulations regarding chemical pesticides, fostering rapid growth for Biorational alternatives.South America Biorational Market Report:

South America currently holds a market size of $0.97 billion in 2023, expected to reach $2.72 billion by 2033. The heightened demand for organic and sustainable agricultural products, primarily in Brazil and Argentina, drives the adoption of Biorational solutions across the region.Middle East & Africa Biorational Market Report:

The Middle East and Africa region is starting small with a market size of $0.90 billion in 2023, looking to grow to $2.53 billion by 2033. The rising awareness about sustainable agriculture coupled with government initiatives to support organic farming practices contributes to this growth.Tell us your focus area and get a customized research report.

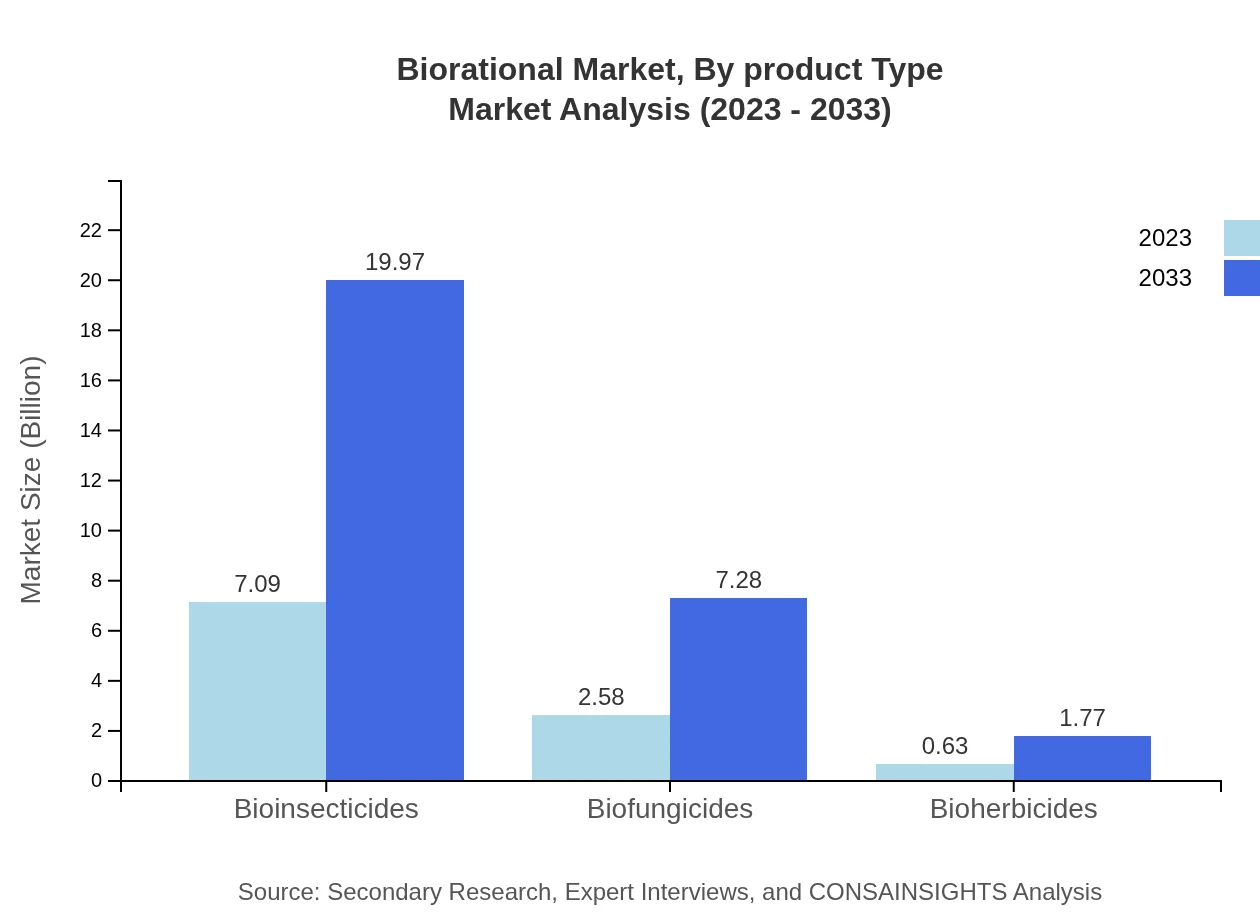

Biorational Market Analysis By Product Type

In 2023, the biorational market for bioinsecticides is projected at $7.09 billion, growing to $19.97 billion by 2033, dominating the field with a market share of 68.83%. Similarly, biofungicides and bioherbicides are expected to witness growth, with biofungicides moving from $2.58 billion to $7.28 billion and bioherbicides from $0.63 billion to $1.77 billion.

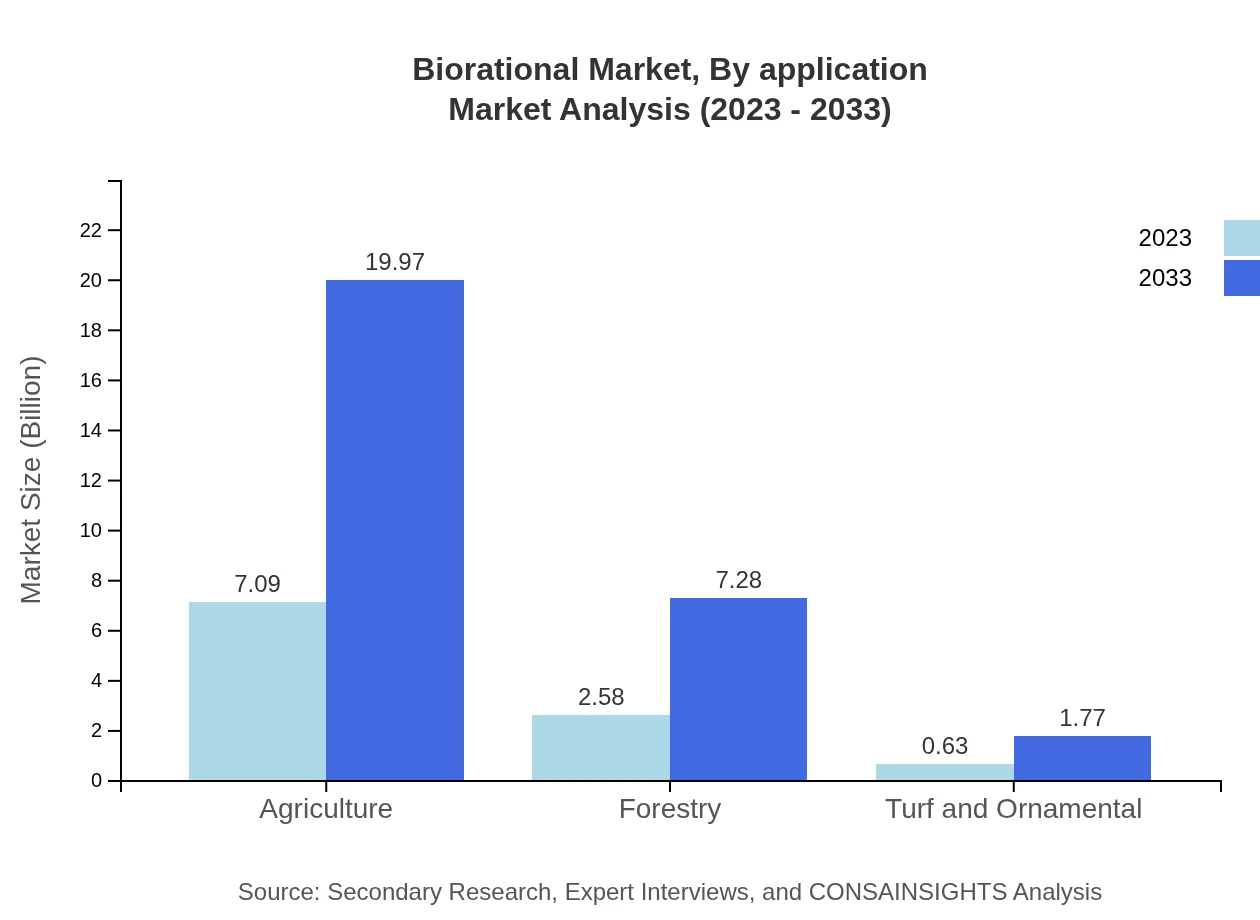

Biorational Market Analysis By Application

The agriculture segment, which focuses on pest and disease control in crops, is anticipated to hold a sizeable share of 68.83% in 2023, growing alongside the rising popularity of organic farming. The forestry and turf & ornamental segments are also significant, although they hold smaller market shares.

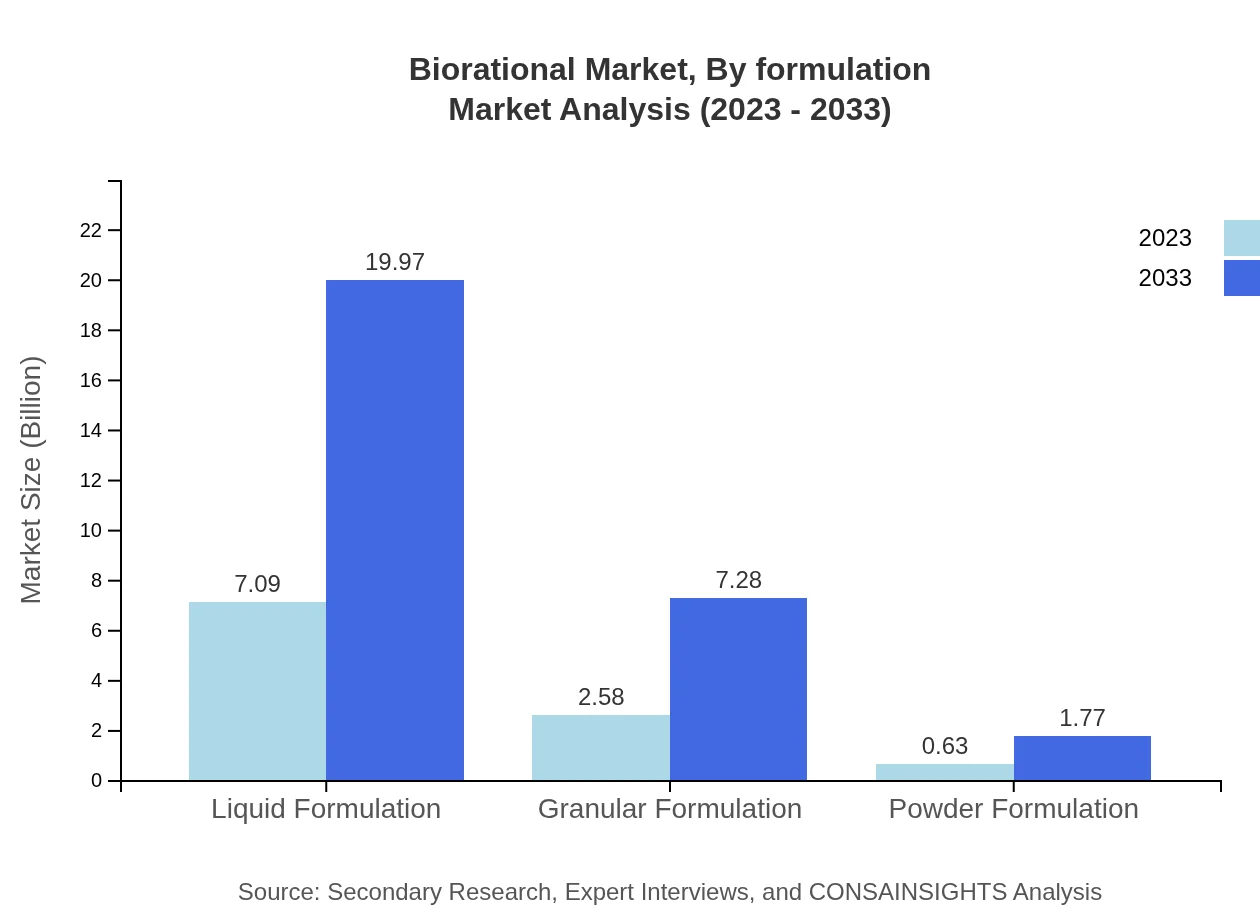

Biorational Market Analysis By Formulation

With liquid formulations leading the market at $7.09 billion in 2023 and expected to reach $19.97 billion by 2033, formulations are critical to product efficacy. Granular and powder formulations are following closely, with respective growth patterns stemming from their specific applications across agricultural segments.

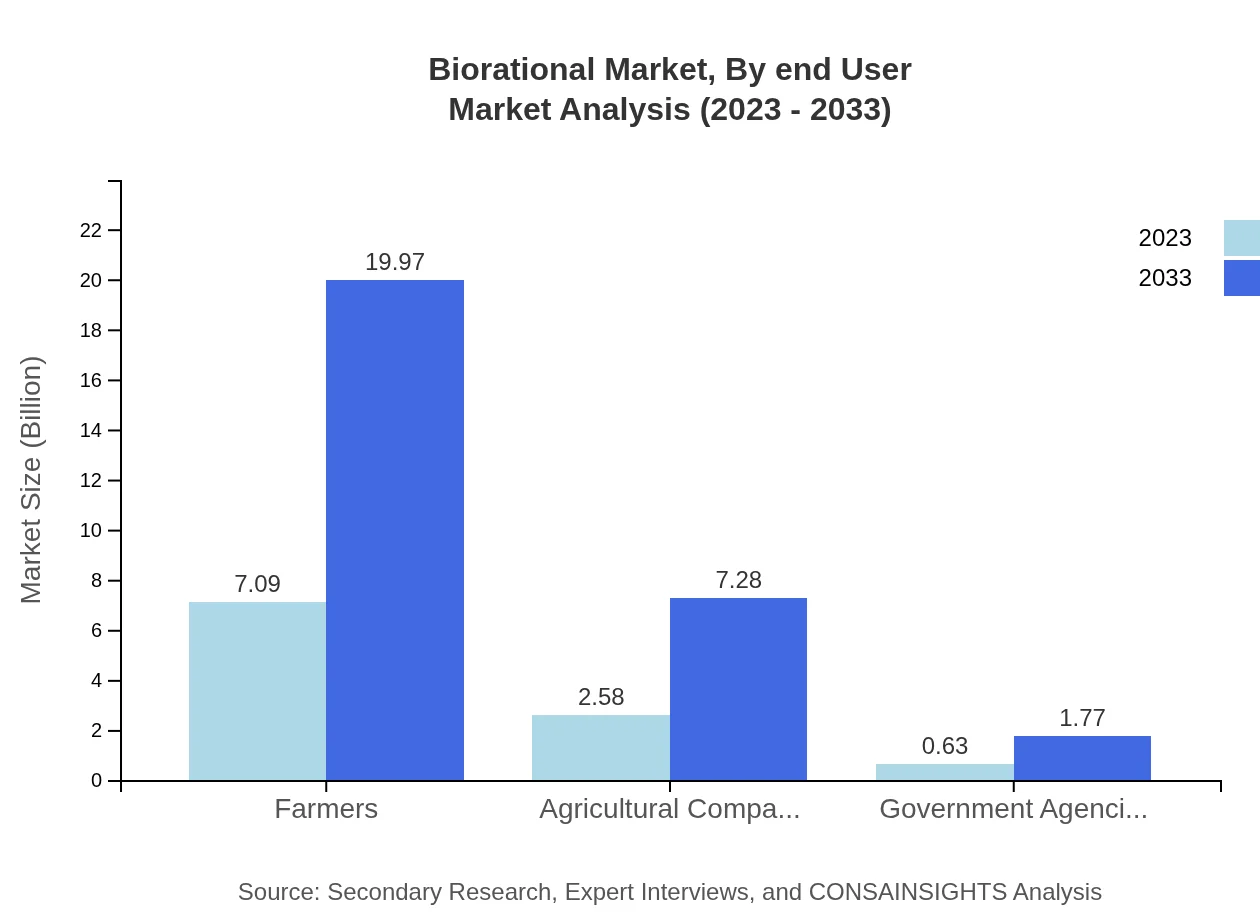

Biorational Market Analysis By End User

Farmers represent the largest end-user group in the Biorational market, projected at $7.09 billion in 2023, growing to $19.97 billion in 2033, maintaining a dominant market share. Agricultural companies and government agencies follow, reflecting a consolidated demand for sustainable agricultural practices.

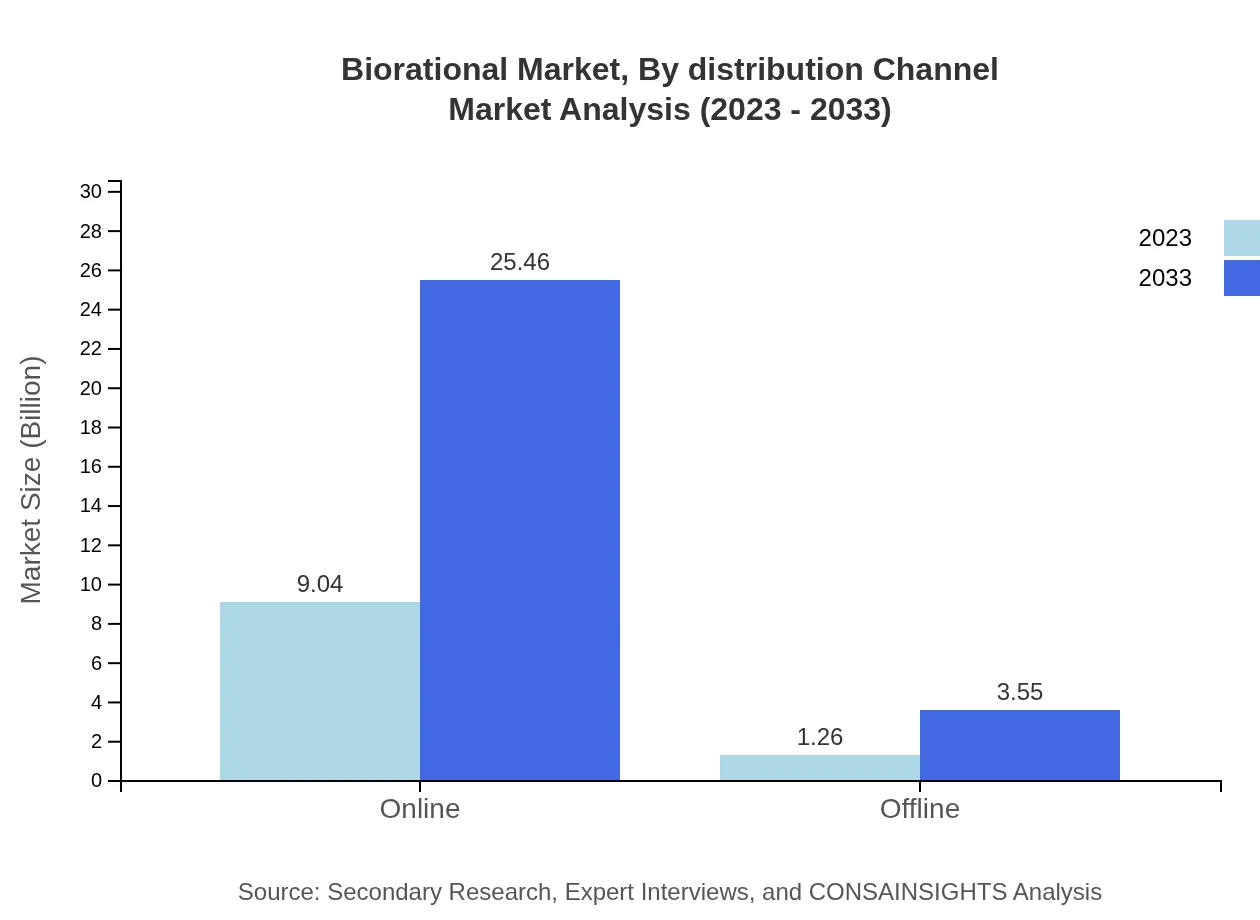

Biorational Market Analysis By Distribution Channel

The online distribution channel is expected to dominate, with a market size of $9.04 billion in 2023, marking a considerable shift in purchasing behavior. The offline channel will also remain relevant, albeit with a smaller share, reflecting the growing tendency for consumers to prefer digital solutions.

Biorational Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biorational Industry

BASF SE:

BASF SE is a global leader in the production of agricultural chemicals and products, with extensive research on Biorational solutions, helping farmers transition to eco-friendly practices.Syngenta AG:

Syngenta AG specializes in crop protection and seeds, offering innovative Biorational products aimed at sustainable farming while ensuring high agricultural yields.Bayer AG:

Bayer AG is committed to sustainability in agriculture, developing Biorational products that enhance food security while addressing environmental concerns.Novozymes A/S:

Novozymes A/S is a biotechnology company that specializes in renewable solutions, providing innovative Biorational solutions for pest management through natural enzymes.We're grateful to work with incredible clients.

FAQs

What is the market size of biorational?

The global biorational market is valued at approximately $10.3 billion in 2023, with an expected CAGR of 10.5%, indicating significant growth potential until 2033.

What are the key market players or companies in this biorational industry?

Key players in the biorational industry include prominent agricultural companies and manufacturers who specialize in bioinsecticides, biofungicides, and biopesticides, contributing to innovation and product development.

What are the primary factors driving the growth in the biorational industry?

Factors driving growth in the biorational industry include increasing demand for sustainable agriculture practices, consumer preference for organic produce, and stricter regulations on chemical pesticide use.

Which region is the fastest Growing in the biorational?

The fastest-growing region for the biorational market is North America, projected to grow from $3.80 billion in 2023 to $10.70 billion by 2033, reflecting a robust demand for sustainable agricultural solutions.

Does ConsaInsights provide customized market report data for the biorational industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, enabling clients to gain insights based on unique requirements and market segments in the biorational industry.

What deliverables can I expect from this biorational market research project?

Deliverables from the biorational market research project include comprehensive market analysis, segment breakdowns, regional insights, competitive landscape assessments, and strategic recommendations for market entry.

What are the market trends of biorational?

Current trends in the biorational market include a shift towards biopesticides, increased investment in research and development, and growing partnerships between agricultural firms and technology providers to drive innovation.