Biorational Pesticides Market Report

Published Date: 02 February 2026 | Report Code: biorational-pesticides

Biorational Pesticides Market Size, Share, Industry Trends and Forecast to 2033

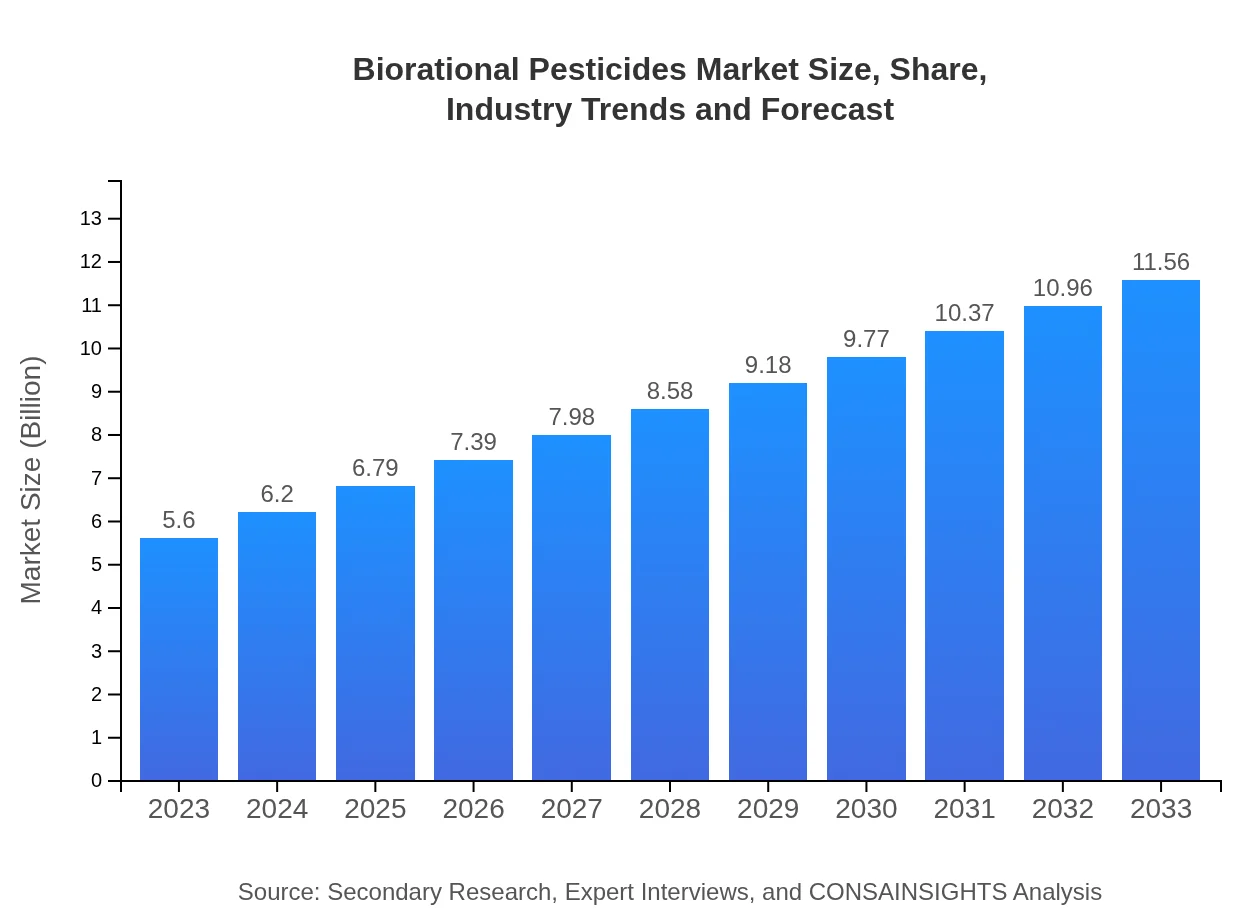

This report provides a comprehensive analysis of the Biorational Pesticides market, focusing on trends, growth opportunities, and key insights for the forecast period from 2023 to 2033. Key data regarding market size, growth rates, and segment performance are presented.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.3% |

| 2033 Market Size | $11.56 Billion |

| Top Companies | BASF SE, Syngenta AG, Marrone Bio Innovations, Inc., FMC Corporation, Certis USA LLC |

| Last Modified Date | 02 February 2026 |

Biorational Pesticides Market Overview

Customize Biorational Pesticides Market Report market research report

- ✔ Get in-depth analysis of Biorational Pesticides market size, growth, and forecasts.

- ✔ Understand Biorational Pesticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biorational Pesticides

What is the Market Size & CAGR of Biorational Pesticides market in 2023?

Biorational Pesticides Industry Analysis

Biorational Pesticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biorational Pesticides Market Analysis Report by Region

Europe Biorational Pesticides Market Report:

The European market, valued at USD 1.48 billion in 2023, is set to increase to USD 3.04 billion by 2033. Political and regulatory frameworks promoting sustainable agriculture catalyze the region’s quick adaptation of biorational pesticide solutions.Asia Pacific Biorational Pesticides Market Report:

The Asia-Pacific region is witnessing strong growth, with a market size of USD 1.22 billion in 2023, projected to reach USD 2.52 billion by 2033. The increasing adoption of organic farming practices, coupled with supportive government policies, is propelling market expansion.North America Biorational Pesticides Market Report:

North America leads the market with a valuation of USD 1.80 billion in 2023, expected to reach USD 3.71 billion by 2033. This is driven primarily by stringent regulations against chemical pesticide use and a surge in organic agricultural practices.South America Biorational Pesticides Market Report:

South America’s market is currently valued at USD 0.46 billion in 2023, with growth prospects reaching USD 0.95 billion by 2033. The region exhibits a growing awareness among farmers about sustainable practices, which is driving the adoption of biorational pesticides.Middle East & Africa Biorational Pesticides Market Report:

The Middle East and Africa market size is estimated at USD 0.65 billion in 2023 and expected to grow to USD 1.34 billion by 2033. The increasing population and subsequent food security challenges drive the adoption of sustainable agricultural practices in this region.Tell us your focus area and get a customized research report.

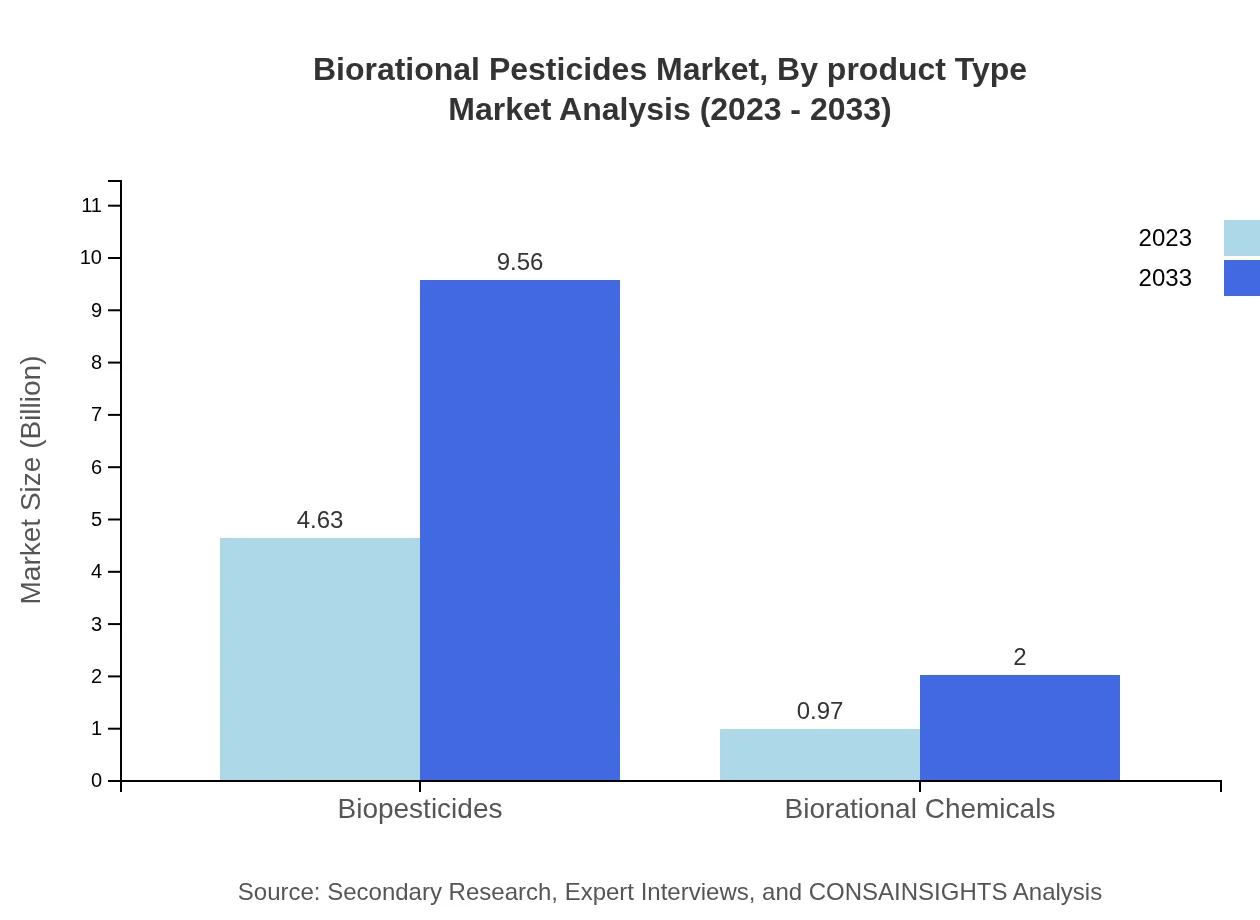

Biorational Pesticides Market Analysis By Product Type

In 2023, biopesticides dominate the Biorational Pesticides market, accounting for USD 4.63 billion and expected to grow to USD 9.56 billion by 2033, representing an 82.73% market share. Biorational chemicals follow with USD 0.97 billion in 2023, projected at USD 2.00 billion by 2033, holding a 17.27% market share.

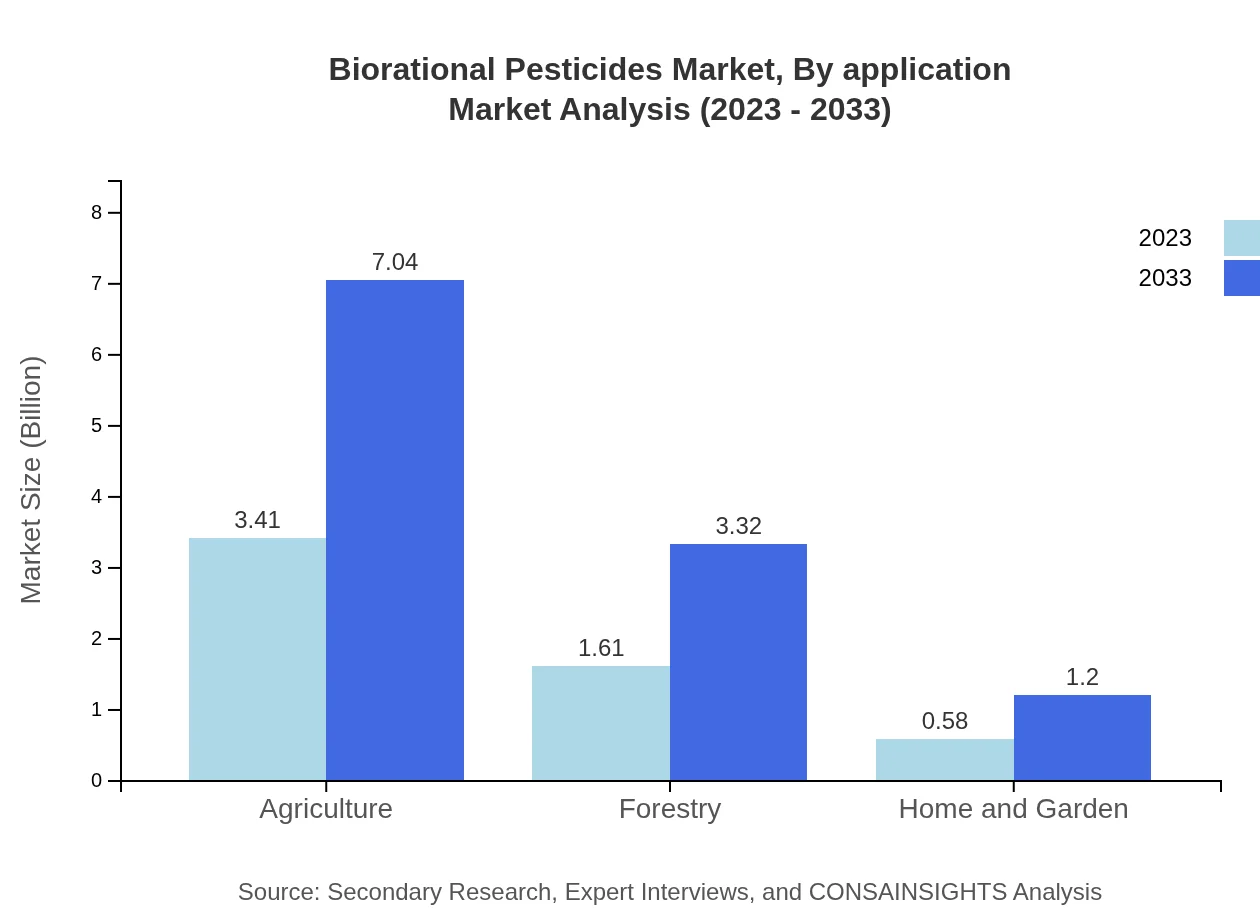

Biorational Pesticides Market Analysis By Application

The application of biorational pesticides primarily spans agriculture, forestry, and gardening. The agriculture segment holds the largest proportion of the market with USD 3.41 billion in 2023 and is forecasted to reach USD 7.04 billion by 2033, maintaining a 60.87% market share.

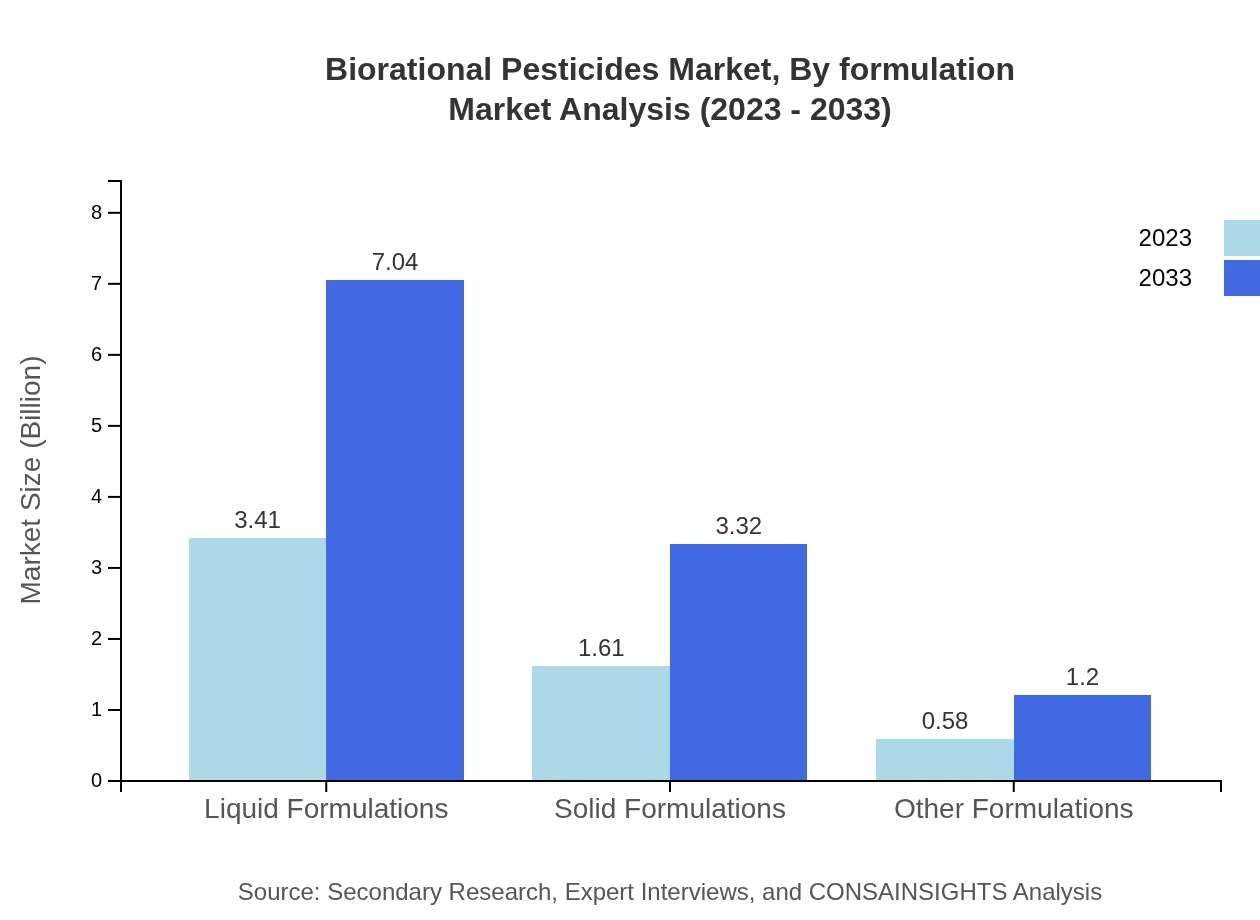

Biorational Pesticides Market Analysis By Formulation

Liquid formulations take precedence in the Biorational Pesticides market, valued at USD 3.41 billion in 2023 and anticipated to climb to USD 7.04 billion by 2033, with a share of 60.87%. Solid formulations come second at USD 1.61 billion, forecast to grow to USD 3.32 billion by 2033, representing 28.76%.

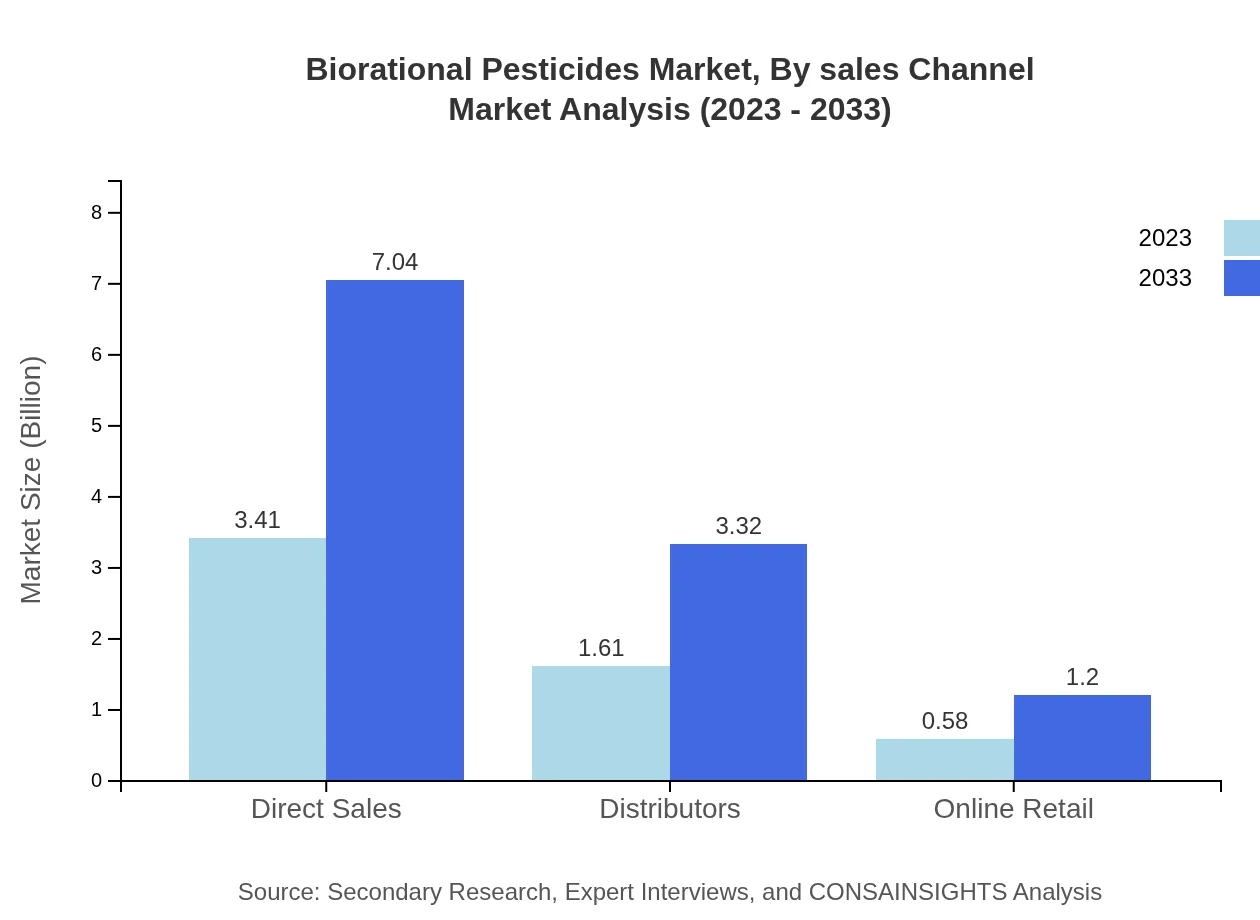

Biorational Pesticides Market Analysis By Sales Channel

Direct sales prove the most effective channel in the distribution of Biorational Pesticides, capturing a market size of USD 3.41 billion in 2023 and projected to reach USD 7.04 billion by 2033, holding a 60.87% share. Distributors follow with USD 1.61 billion and are expected to grow to USD 3.32 billion by 2033.

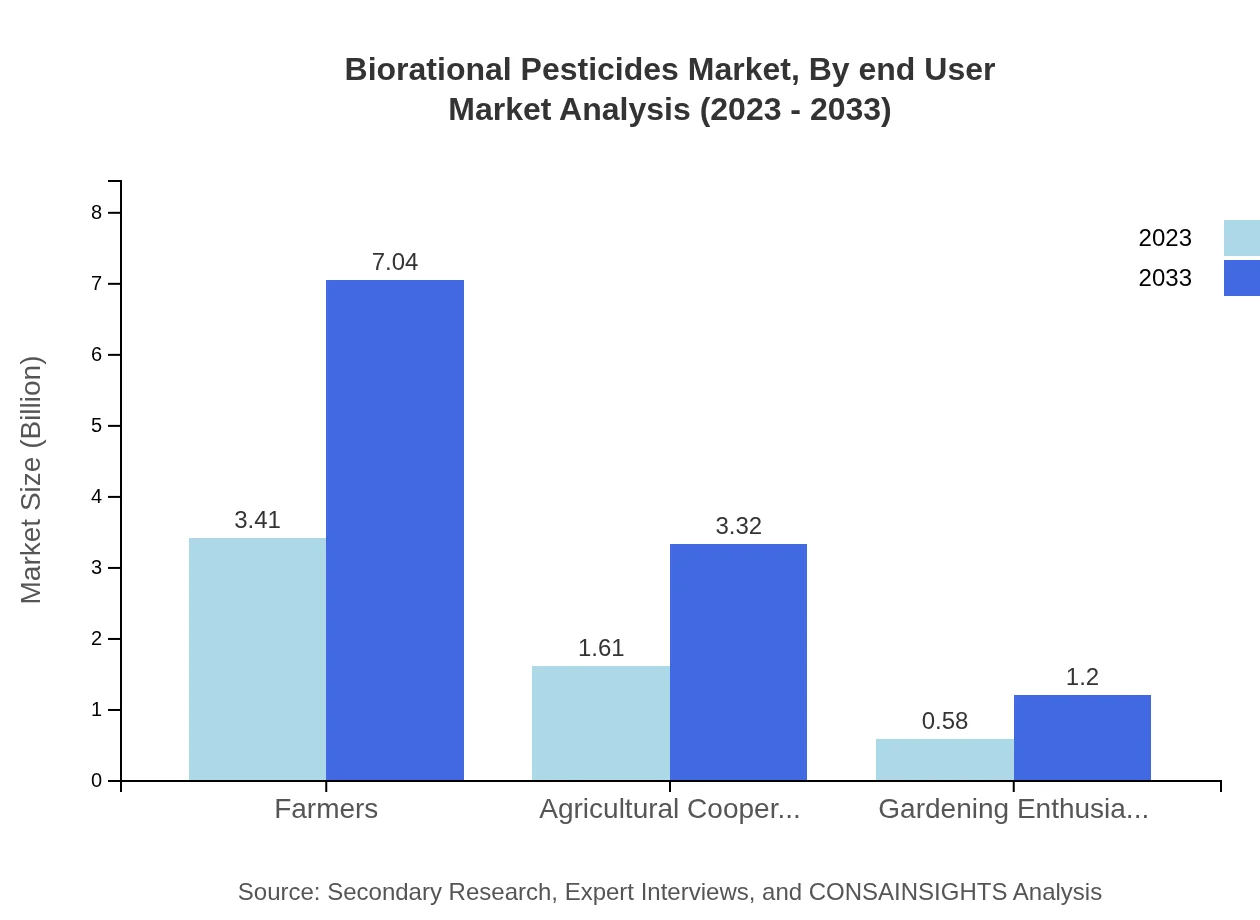

Biorational Pesticides Market Analysis By End User

Farmers remain the largest end-user group, accounting for USD 3.41 billion of the market in 2023 and projecting an increase to USD 7.04 billion by 2033, maintaining a 60.87% share. Agricultural cooperatives follow with USD 1.61 billion, growing to USD 3.32 billion by 2033.

Biorational Pesticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biorational Pesticides Industry

BASF SE:

BASF SE is a global leader in the agricultural industry, providing innovative biorational pesticides focused on sustainable practices and higher agricultural productivity.Syngenta AG:

With a strong portfolio of biopesticide solutions, Syngenta continues to lead market innovation and drive effective pest management across various crops.Marrone Bio Innovations, Inc.:

Marrone Bio Innovations specializes in developing environmentally sustainable plant protection products, emphasizing biorational pesticides and biostimulants.FMC Corporation:

FMC Corporation offers a wide range of crop protection products, leveraging advanced technologies to produce effective biorational solutions.Certis USA LLC:

Certis USA focuses on biorational products, aiming to promote environmentally sustainable pest control methods tailored for specialty crops.We're grateful to work with incredible clients.

FAQs

What is the market size of biorational Pesticides?

The global biorational pesticides market size is projected to reach $5.6 billion by 2033, growing at a CAGR of 7.3% from 2023. This growth indicates an increasing adoption of environmentally friendly agricultural practices.

What are the key market players or companies in the biorational Pesticides industry?

Key players in the biorational pesticides market include major agricultural firms and biopesticide companies actively delivering innovative solutions to promote sustainable farming practices, contributing to market growth and competitiveness.

What are the primary factors driving the growth in the biorational Pesticides industry?

The biorational pesticides industry is driven by increasing organic farming practices, stringent regulations against harmful chemicals, and a growing consumer preference for organic produce, enhancing market dynamics and opportunities.

Which region is the fastest Growing in the biorational Pesticides market?

The Asia-Pacific region is the fastest-growing market for biorational pesticides, expected to grow from $1.22 billion in 2023 to $2.52 billion by 2033, reflecting a robust CAGR and rising agricultural demands.

Does ConsaInsights provide customized market report data for the biorational Pesticides industry?

Yes, ConsaInsights offers customized market report data tailored to the biorational pesticides industry, which includes detailed insights and analytics based on specific client requirements and market needs.

What deliverables can I expect from this biorational Pesticides market research project?

Deliverables from the biorational-pesticides market research project will include comprehensive market analysis, actionable insights, regional segmentation, and competitive landscape evaluations to support strategic decisions.

What are the market trends of biorational Pesticides?

Trends in the biorational pesticides market include a shift towards integrated pest management, the increased use of biopesticides, and growth in direct sales channels, enhancing market accessibility and sustainability.