Bioreactors Market Report

Published Date: 31 January 2026 | Report Code: bioreactors

Bioreactors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the bioreactors market, offering insights into market size, trends, segmentation, and a comprehensive forecast for 2023 to 2033. Key players and regional dynamics are also explored.

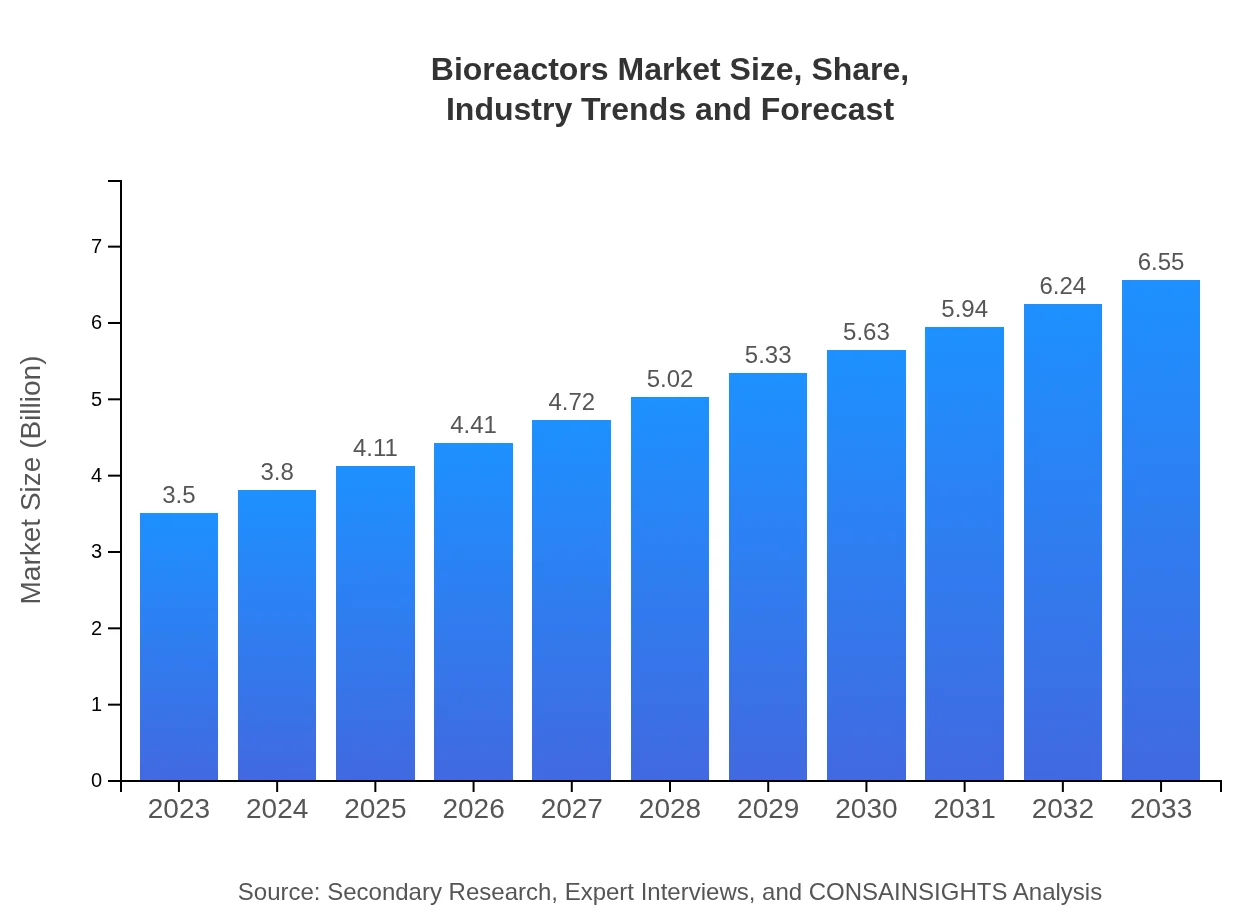

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $6.55 Billion |

| Top Companies | Sartorius AG, Thermo Fischer Scientific, Inc., Eppendorf AG |

| Last Modified Date | 31 January 2026 |

Bioreactors Market Overview

Customize Bioreactors Market Report market research report

- ✔ Get in-depth analysis of Bioreactors market size, growth, and forecasts.

- ✔ Understand Bioreactors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioreactors

What is the Market Size & CAGR of the Bioreactors market in 2023?

Bioreactors Industry Analysis

Bioreactors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioreactors Market Analysis Report by Region

Europe Bioreactors Market Report:

The European market is anticipated to grow from $1.15 billion in 2023 to $2.14 billion in 2033. The region is witnessing a growing trend toward sustainable bioprocessing solutions and increased government funding for biotechnology research.Asia Pacific Bioreactors Market Report:

In 2023, the Asia Pacific region is valued at approximately $0.65 billion, with a forecast to reach $1.22 billion by 2033. The market is driven by the increasing number of biotechnology firms and the rising investments in biomanufacturing infrastructure, particularly in countries like China and India.North America Bioreactors Market Report:

North America is expected to dominate the bioreactors market, with a projected size of $1.27 billion in 2023, growing to approximately $2.39 billion by 2033. The growth is fueled by the region's strong pharmaceutical sector and high adoption rates of advanced bioprocessing technologies.South America Bioreactors Market Report:

The South American bioreactors market is currently valued at around -$0.06 billion in 2023 and is expected to grow negatively to -$0.11 billion by 2033. This decline can be attributed to economic challenges and limited investment in biomanufacturing technologies in the region.Middle East & Africa Bioreactors Market Report:

The Middle East and Africa market for bioreactors is expected to rise from $0.49 billion in 2023 to $0.91 billion by 2033. This growth is supported by an expanding healthcare sector and increased focus on biopharmaceutical development.Tell us your focus area and get a customized research report.

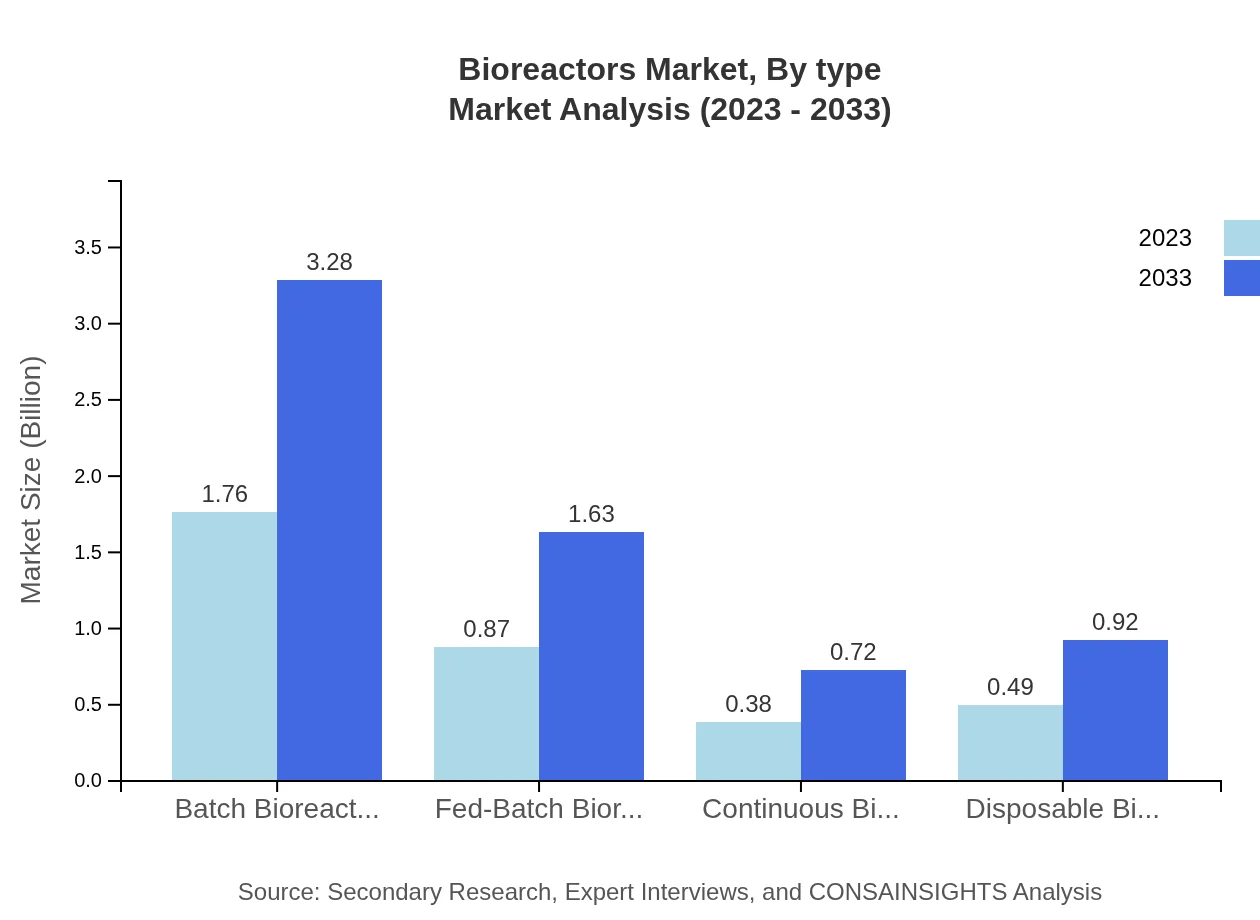

Bioreactors Market Analysis By Type

The bioreactors market is segmented into batch, fed-batch, and continuous bioreactors. Batch bioreactors dominate in terms of both market size and share due to their established usage and reliability. In 2023, batch bioreactors hold a market size of $1.76 billion, with expected growth to $3.28 billion by 2033. Fed-batch systems, growing in application for complex products, have a market size of $0.87 billion in 2023, forecasted to reach $1.63 billion by 2033. Continuous systems, while smaller in share, are gaining traction for specific applications, showing growth from $0.38 billion to $0.72 billion.

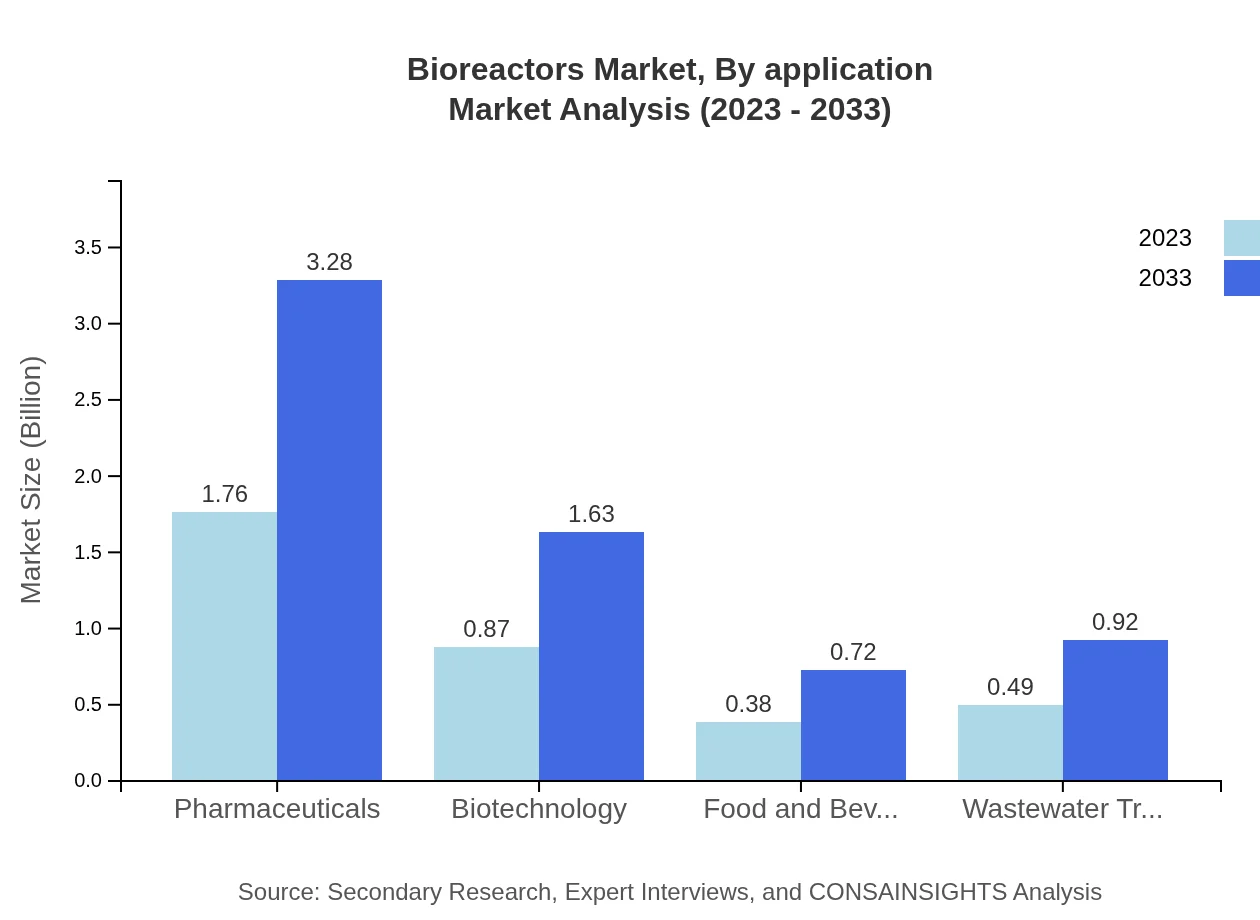

Bioreactors Market Analysis By Application

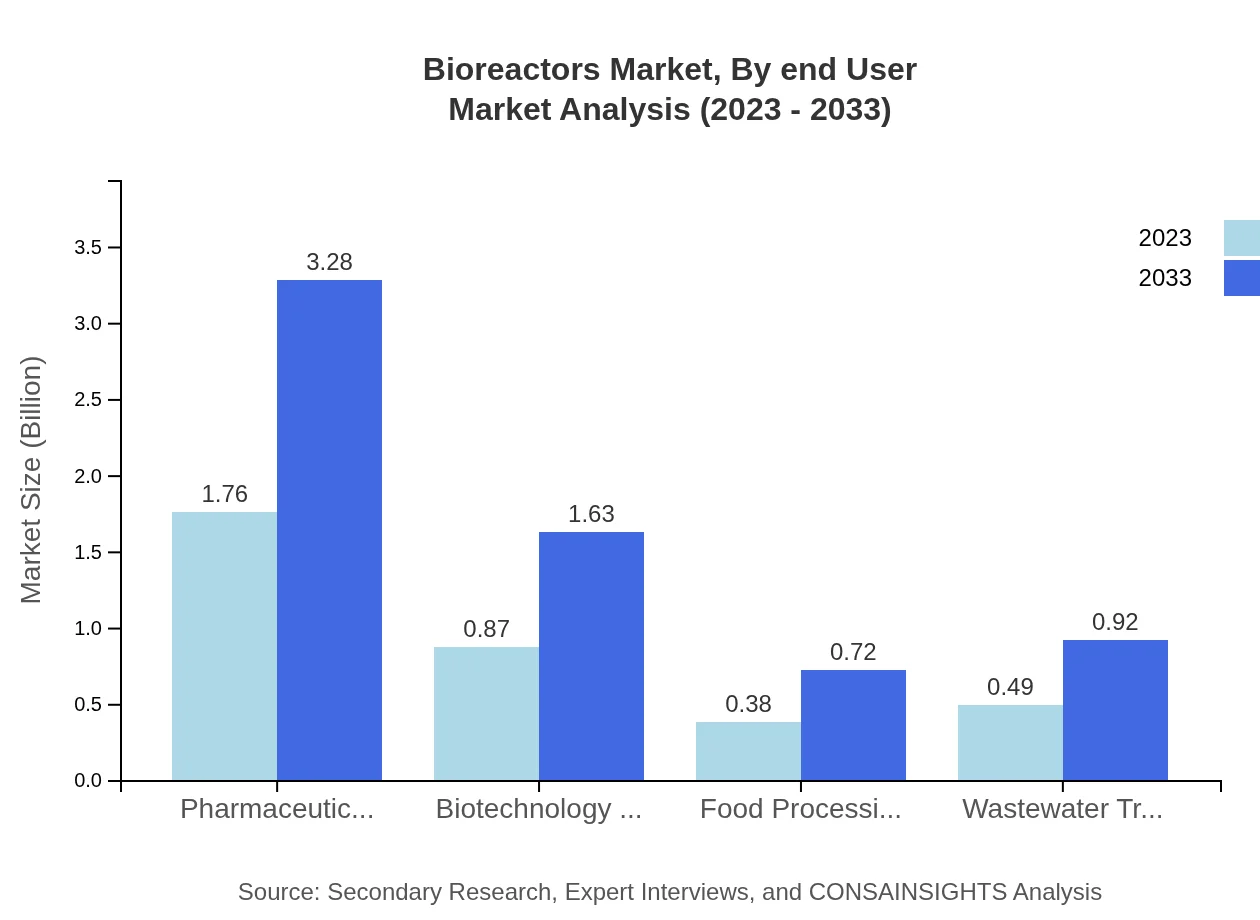

The application segment includes pharmaceuticals, biotechnology, food processing, and wastewater treatment. Pharmaceuticals remain the largest application area, representing a market of $1.76 billion in 2023 and forecasted to grow to $3.28 billion by 2033. Biotechnology applications are showing strong growth from $0.87 billion to $1.63 billion, driven by demand for monoclonal antibodies and cell therapies, while food and beverage applications contribute steadily to the overall market.

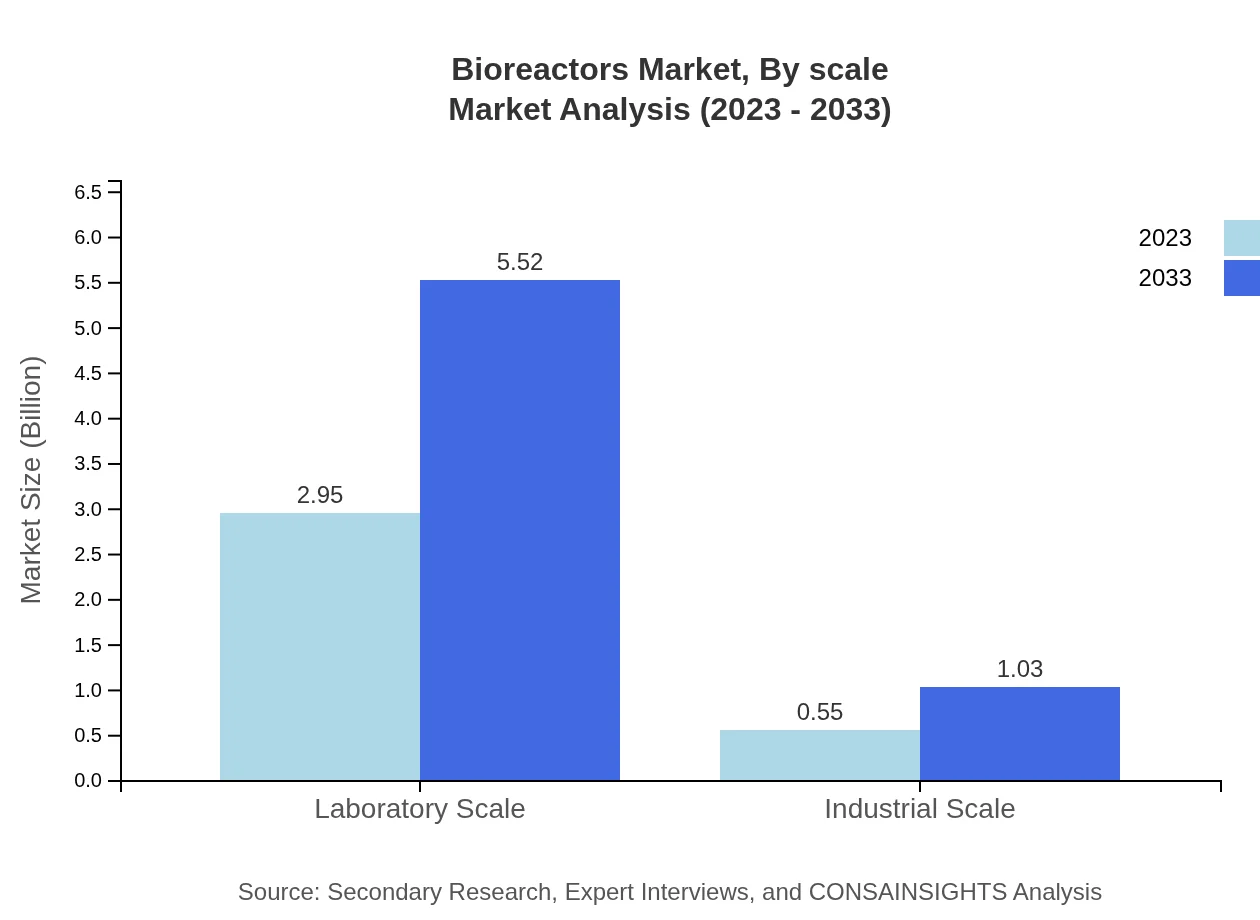

Bioreactors Market Analysis By Scale

This market segment is divided into laboratory scale and industrial scale types. Laboratory scale bioreactors constitute a significant share due to their extensive use in research and development, estimated to grow from $2.95 billion in 2023 to $5.52 billion by 2033. Industrial scale systems, essential for large-scale production, are projected to increase from $0.55 billion to $1.03 billion over the same period.

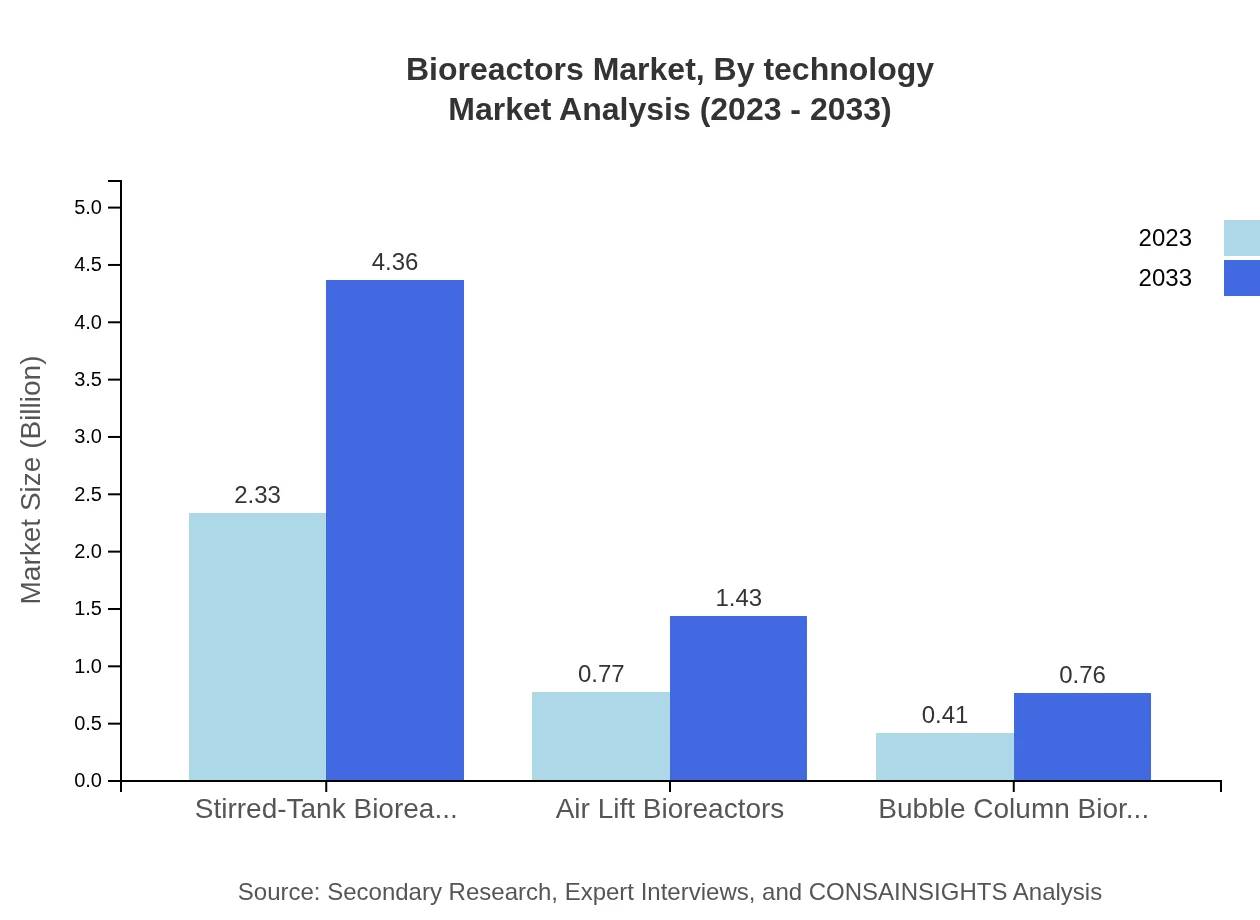

Bioreactors Market Analysis By Technology

Technological advancements play a critical role in bioreactor innovation, boosting efficiency and productivity. Automation and process control technologies enhance operational capabilities. The rise of single-use bioreactors is a significant trend, simplifying the cleaning processes and reducing cross-contamination risks, while also streamlining production timelines as they transition to disposable designs.

Bioreactors Market Analysis By End User

Key end-users of bioreactors include pharmaceutical companies, biotechnology firms, food processing units, and wastewater treatment plants. Pharmaceutical companies constitute the largest share, with a market value of $1.76 billion in 2023, expected to grow to $3.28 billion by 2033, influenced by the increasing prevalence of biopharmaceuticals.

Bioreactors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioreactors Industry

Sartorius AG:

A global leader in laboratory and bioprocessing technologies, Sartorius provides equipment such as bioreactors that improve the efficiency and quality of bioproduction processes.Thermo Fischer Scientific, Inc.:

Thermo Fischer Scientific is recognized for its comprehensive range of bioreactors and bioprocessing solutions that support pharmaceutical and biotechnology industries in scalable production.Eppendorf AG:

Eppendorf specializes in the supply of bioprocess equipment, focusing on innovative bioreactor solutions that improve yield and enhance usability for laboratory and industrial applications.We're grateful to work with incredible clients.

FAQs

What is the market size of bioreactors?

As of 2023, the bioreactors market is valued at approximately $3.5 billion, projected to grow at a CAGR of 6.3% from 2023 to 2033. This growth indicates increasing demand for bioprocessing technologies in various industries.

What are the key market players or companies in the bioreactor industry?

Key players in the bioreactor industry include major companies such as Thermo Fisher Scientific, GE Healthcare, Eppendorf AG, Sartorius AG, and Merck KGaA. These companies prominently influence market dynamics through innovation and strategic partnerships.

What are the primary factors driving the growth in the bioreactor industry?

The primary growth drivers include the rising demand for biopharmaceuticals, advancements in biotechnology, increasing investments in R&D, and a growing focus on sustainable and efficient manufacturing processes for biological products.

Which region is the fastest Growing in the bioreactor market?

The fastest-growing region is North America, where market size is expected to expand from $1.27 billion in 2023 to $2.39 billion by 2033. Strong healthcare infrastructure and high investment in bioprocessing technologies contribute to this growth.

Does ConsaInsights provide customized market report data for the bioreactor industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the bioreactor industry. Clients can request bespoke insights based on particular market segments, regions, or technological advancements.

What deliverables can I expect from this bioreactor market research project?

Deliverables from the bioreactor market research project typically include comprehensive market analysis, competitive landscape insights, segment and regional performance data, trends forecasting, and strategic recommendations tailored to clients' needs.

What are the market trends of bioreactors?

Current market trends include the increased use of disposable bioreactors for flexibility, advancements in automated bioprocessing technologies, and a shift toward continuous bioprocessing methods. These trends reflect a push for efficiency and cost-effectiveness in biomanufacturing.