Bioseparation Systems Market Report

Published Date: 31 January 2026 | Report Code: bioseparation-systems

Bioseparation Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bioseparation Systems market, including insights into market size, segmentation, industry analysis, regional dynamics, and future trends from 2023 to 2033.

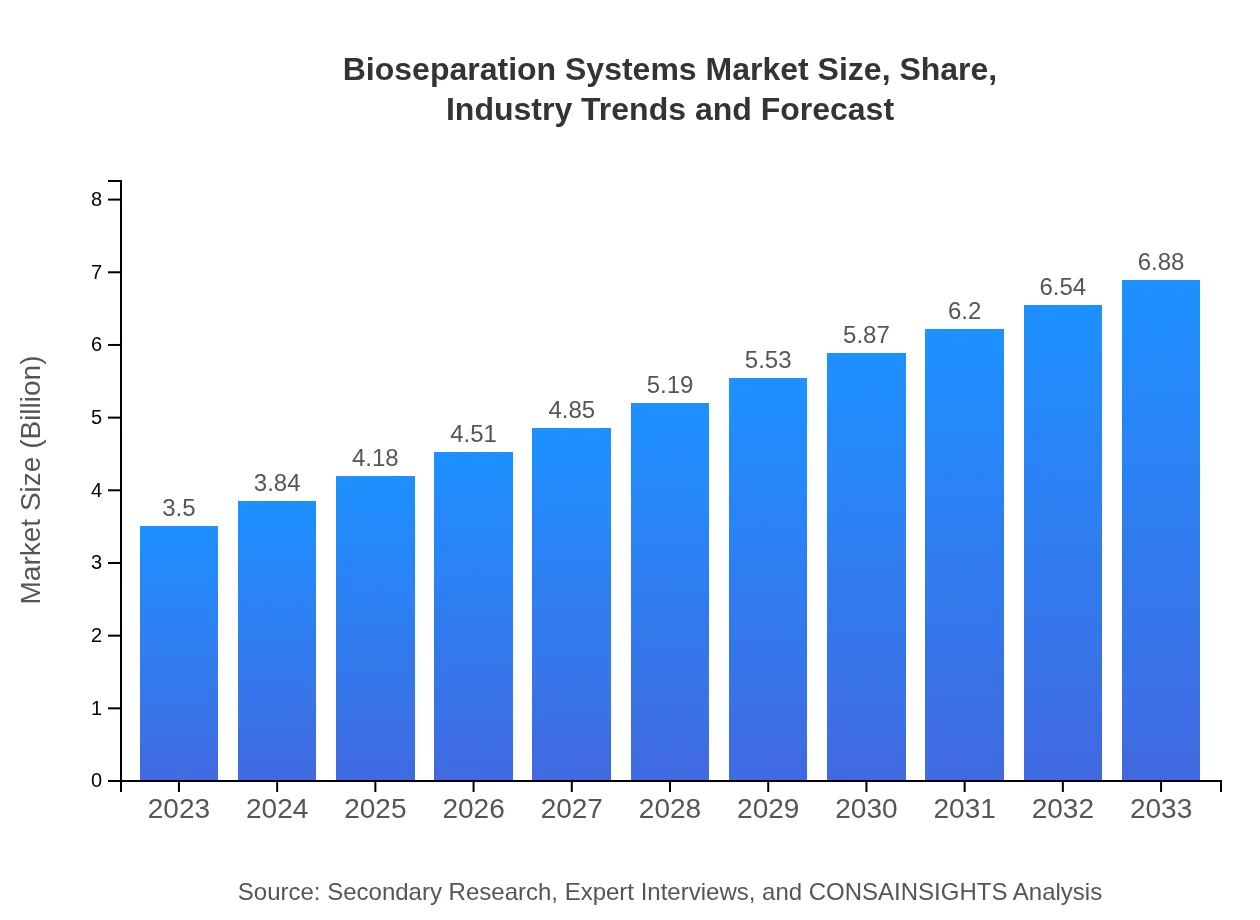

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Thermo Fisher Scientific, Merck KGaA, Danaher Corporation |

| Last Modified Date | 31 January 2026 |

Bioseparation Systems Market Overview

Customize Bioseparation Systems Market Report market research report

- ✔ Get in-depth analysis of Bioseparation Systems market size, growth, and forecasts.

- ✔ Understand Bioseparation Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioseparation Systems

What is the Market Size & CAGR of Bioseparation Systems market in 2023?

Bioseparation Systems Industry Analysis

Bioseparation Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioseparation Systems Market Analysis Report by Region

Europe Bioseparation Systems Market Report:

Europe's Bioseparation Systems market is projected to grow from $1.11 billion in 2023 to $2.19 billion by 2033. The region benefits from its strong pharmaceutical industry, with leading companies focusing on advanced purification technologies. Increased collaboration in research and stringent regulatory standards further bolster this market's growth.Asia Pacific Bioseparation Systems Market Report:

In the Asia Pacific region, the Bioseparation Systems market is projected to grow from $0.67 billion in 2023 to $1.31 billion by 2033. The growth is attributed to increased government funding in biotechnology, heightened pharmaceutical production, and rising healthcare demands. Countries like China and India are emerging as key players in biopharmaceutical manufacturing, thereby fostering market momentum in this region.North America Bioseparation Systems Market Report:

North America is the largest market for Bioseparation Systems, expected to increase from $1.19 billion in 2023 to $2.33 billion by 2033. The US leads this expansion, driven by advancements in biopharmaceuticals and robust R&D investments. Regulatory environments support innovation, making it a hub for bioseparation technology development.South America Bioseparation Systems Market Report:

The South American market for Bioseparation Systems is expected to see growth from $0.17 billion in 2023 to $0.34 billion in 2033. Factors propelling this growth include an increased focus on bioprocessing in the food and beverage sector and expanding biotechnology initiatives within the region. Brazil is anticipated to lead the market due to its strong agricultural sector supporting bioseparations.Middle East & Africa Bioseparation Systems Market Report:

The Middle East and Africa market for Bioseparation Systems is anticipated to expand from $0.36 billion in 2023 to $0.71 billion by 2033. Growth factors include rising investments in biotechnology, expansion of the healthcare sector, and increased disposable income. Countries such as South Africa are prioritizing biopharmaceuticals, leading to growth in bioseparation technologies.Tell us your focus area and get a customized research report.

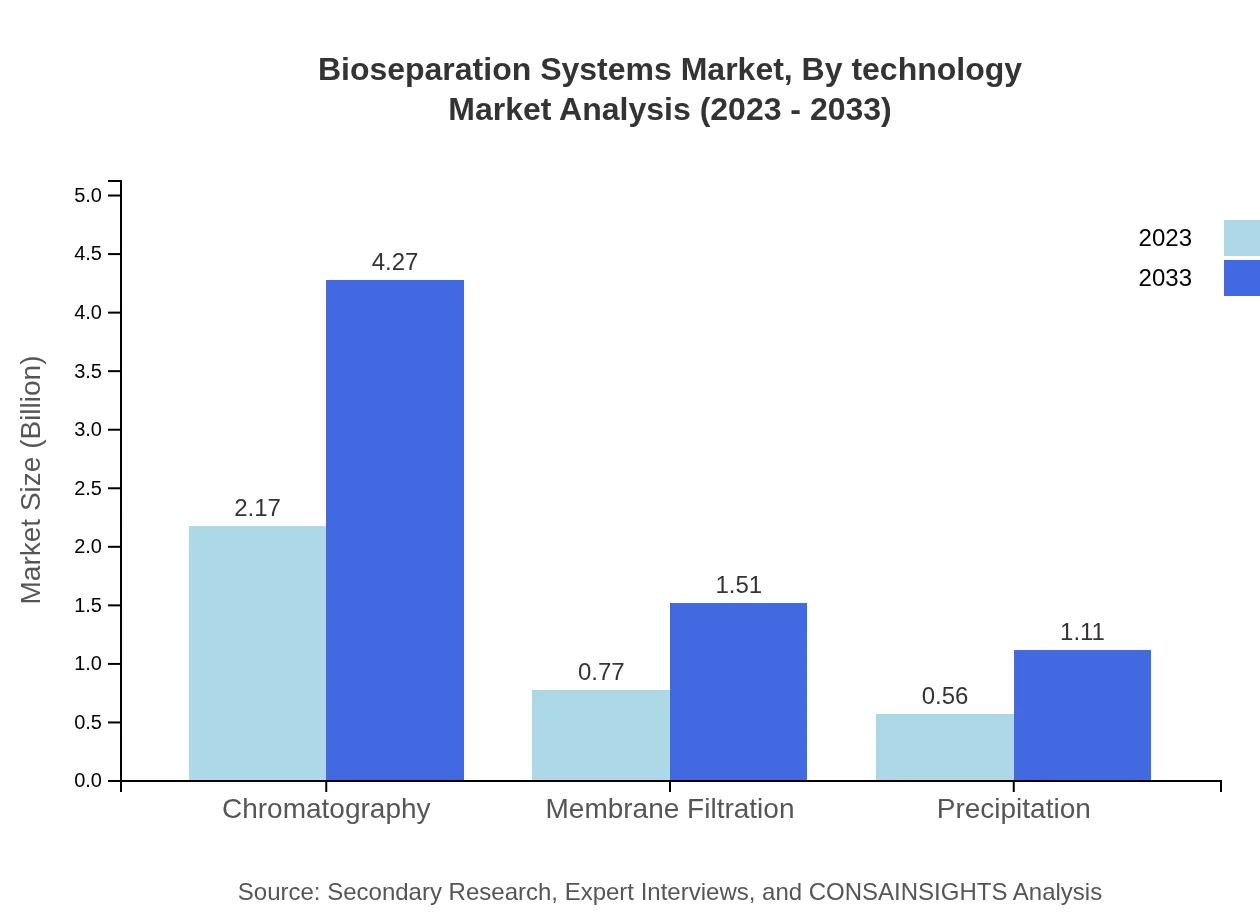

Bioseparation Systems Market Analysis By Technology

Chromatography remains the leading technology segment, valued at $2.17 billion in 2023 and projected to reach $4.27 billion by 2033, capturing 62.02% market share. The membrane filtration segment, accounting for $0.77 billion in 2023 with expectations of reaching $1.51 billion, is also significant due to its efficiency and effectiveness in separating large molecules.

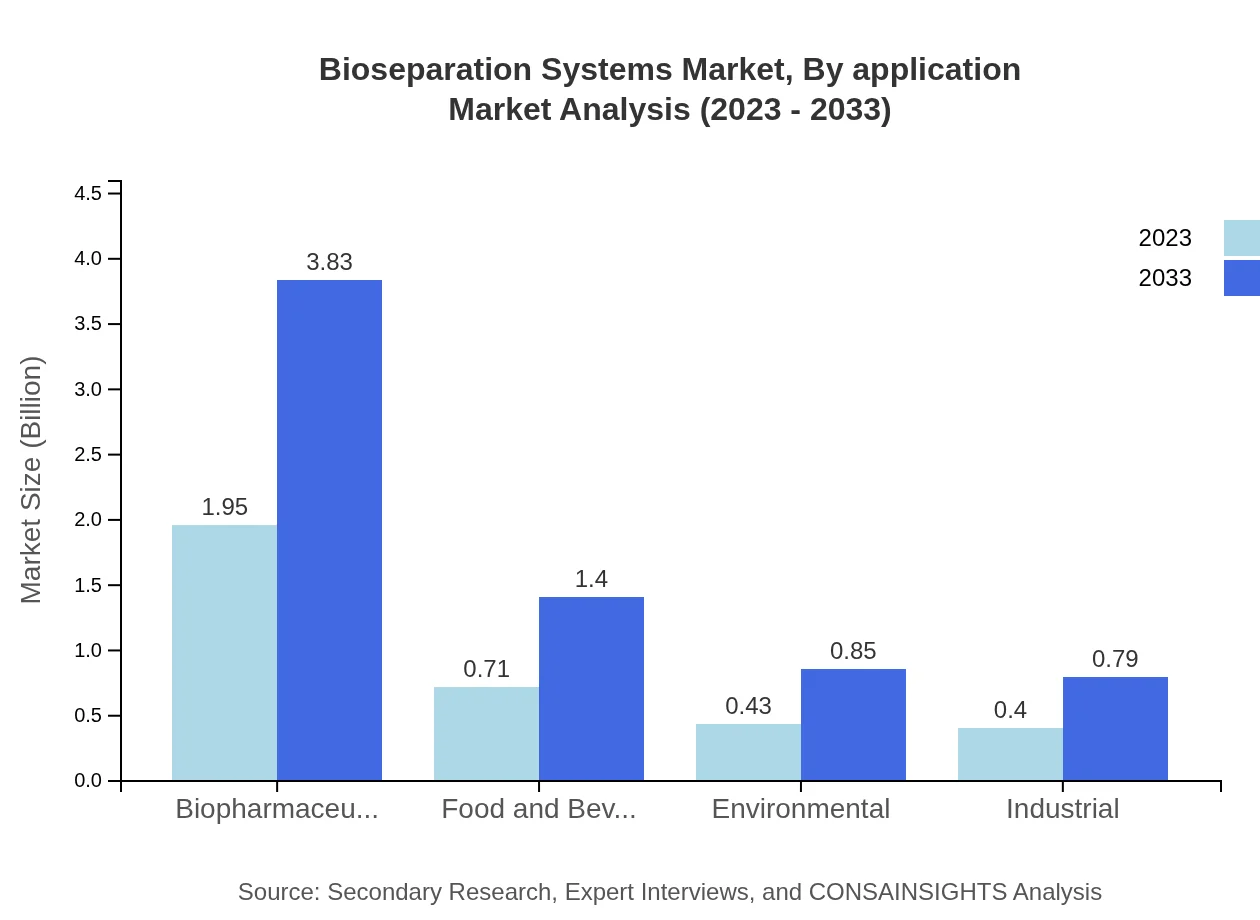

Bioseparation Systems Market Analysis By Application

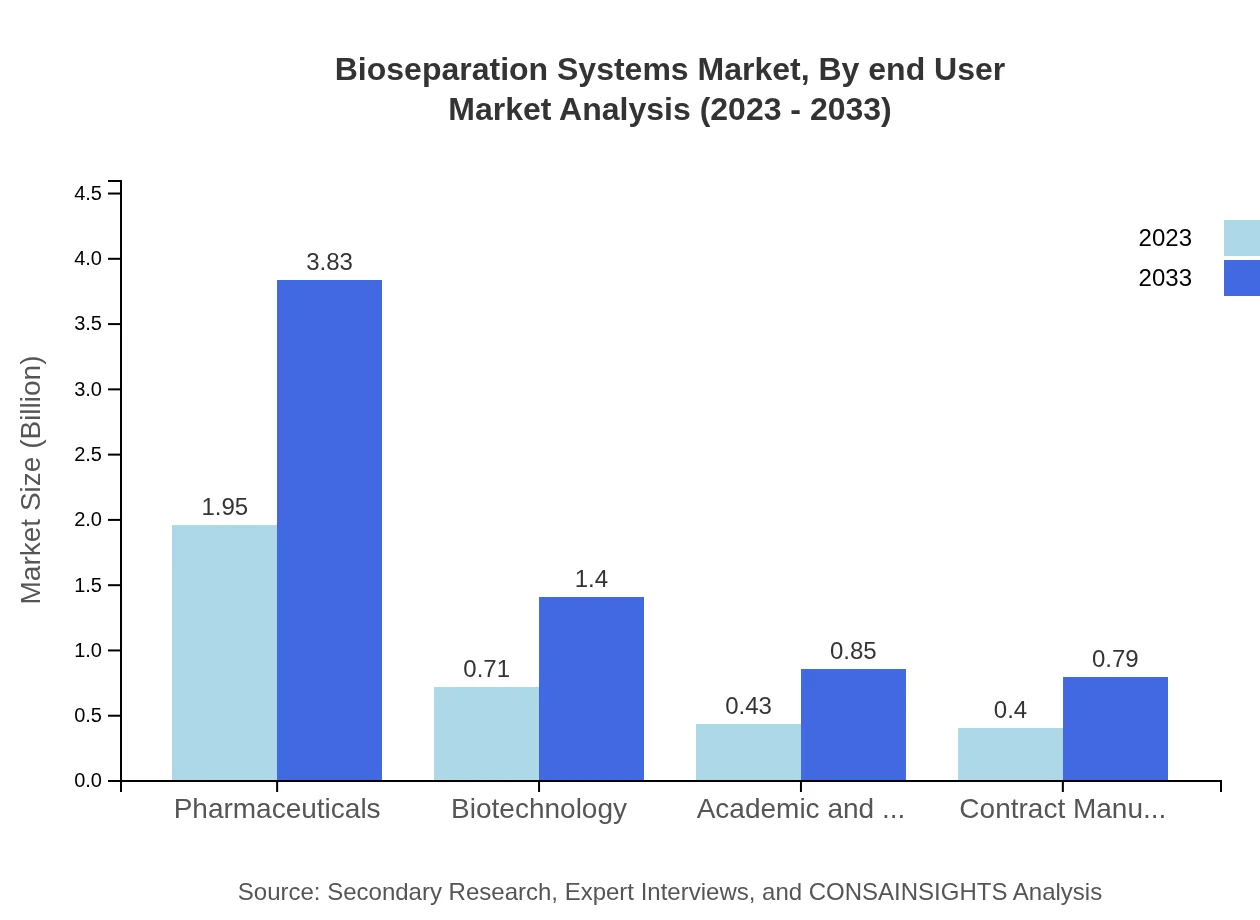

The application of bioseparation technologies spans pharmaceuticals, with a size of $1.95 billion in 2023 and a forecast of $3.83 billion. Biotechnology applications also account for an important share with projected growth driven by the necessity for advanced purification processes across various bioproducts.

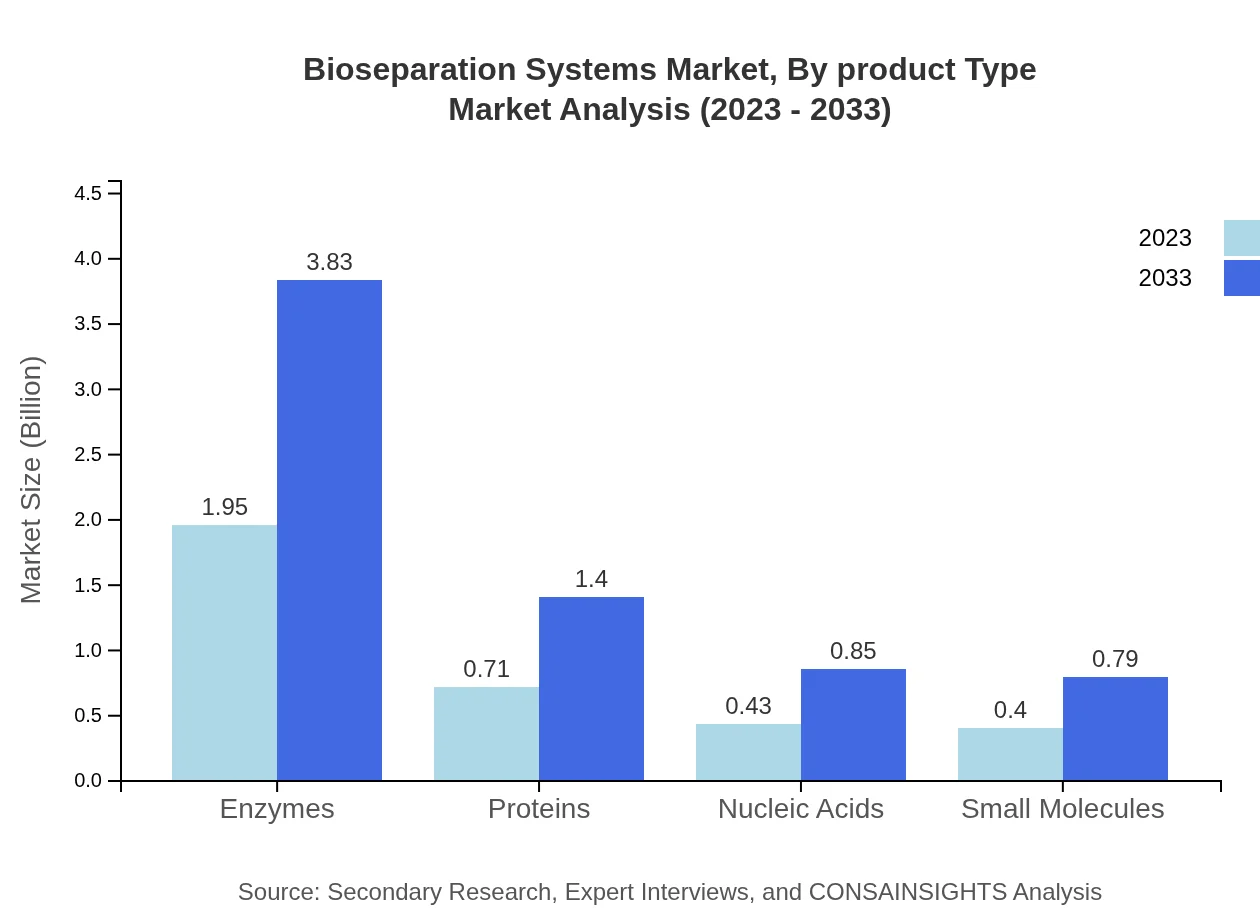

Bioseparation Systems Market Analysis By Product Type

In the product type sector, enzymes and proteins dominate, with both expected to maintain a share of over 55% in 2023. Bioseparation processes for small molecules have notable growth potential, reflecting the increasing demand for biologically derived drugs.

Bioseparation Systems Market Analysis By End User

The pharmaceutical industry is a leading end-user, represented by its significant investment in bioseparation processes to ensure product efficacy. Academic and research institutes also contribute to market growth through R&D activities aimed at developing innovative therapeutic solutions.

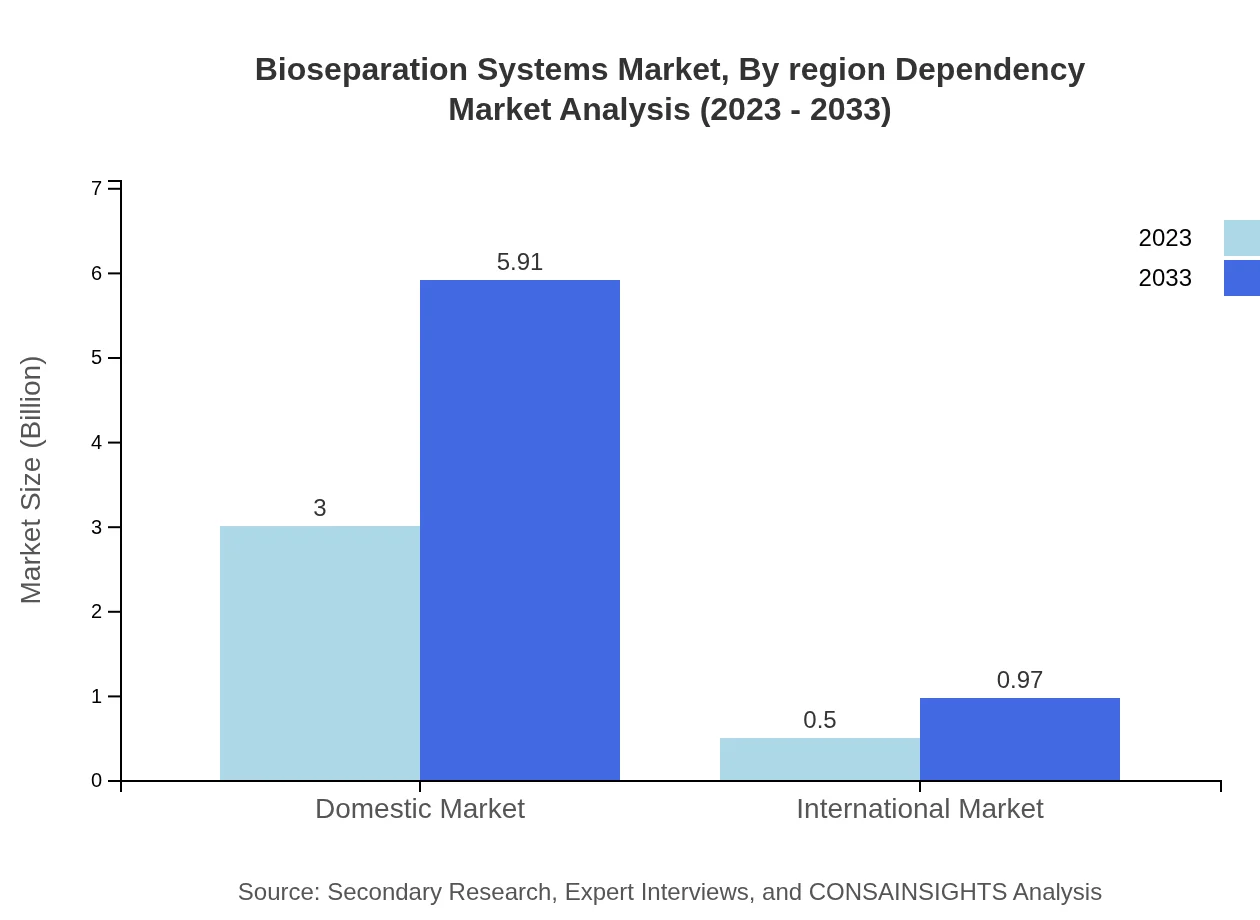

Bioseparation Systems Market Analysis By Region Dependency

Regional dependencies highlight that North America and Europe are pivotal markets due to advanced technological infrastructure and strong production capabilities. Emerging markets such as Asia Pacific show rapid growth trends facilitated by government initiatives and increased bioprocessing demands.

Bioseparation Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioseparation Systems Industry

Thermo Fisher Scientific:

A global leader in serving science, Thermo Fisher provides cutting-edge bioseparation technologies, notably in chromatography and filtration solutions, which enhance bioprocessing efficiencies.Merck KGaA:

Merck is recognized for its innovations in biopharmaceutical processing technologies, providing robust solutions in bioseparation systems that cater to the evolving demands of the healthcare industry.Danaher Corporation:

Danaher offers a range of filtration and bioseparation solutions that cater to the biotechnology and pharmaceutical sectors, focusing on high-quality product development and advanced manufacturing systems.We're grateful to work with incredible clients.

FAQs

What is the market size of bioseparation systems?

The bioseparation systems market is valued at approximately $3.5 billion in 2023, with a projected CAGR of 6.8% expected to drive growth through 2033, enhancing market viability across various industrial applications.

What are the key market players or companies in the bioseparation systems industry?

Key players in the bioseparation systems market include major biopharmaceutical companies, chromatography system manufacturers, and specialized bioprocessing firms. Their innovations and strategic collaborations significantly influence market trends and competition.

What are the primary factors driving the growth in the bioseparation systems industry?

Factors driving growth in the bioseparation systems industry include increasing demand for biopharmaceuticals, advancements in biotechnology, regulatory requirements for purity, and the need for cost-effective separation technologies.

Which region is the fastest Growing in the bioseparation systems?

North America is projected to be the fastest-growing region in the bioseparation systems market, expected to grow from $1.19 billion in 2023 to $2.33 billion by 2033, driven by strong pharmaceutical sectors and innovation.

Does ConsaInsights provide customized market report data for the bioseparation systems industry?

Yes, ConsaInsights offers tailored market report data for the bioseparation systems industry, accommodating specific client needs for insights into market trends, competitive analysis, and functional segmentation.

What deliverables can I expect from this bioseparation systems market research project?

Deliverables include detailed market analysis, growth forecasts, competitive landscape assessments, regional insights, and segment-specific data, empowering strategic decision-making in the bioseparation systems market.

What are the market trends of bioseparation systems?

Current trends in the bioseparation systems market feature innovations like membrane filtration and chromatography advancements, driven by biotechnology and environmental applications, shaping future strategies across all segments.