Biosimilars Market Report

Published Date: 31 January 2026 | Report Code: biosimilars

Biosimilars Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biosimilars market, covering key trends, segmentation, regional insights, and future forecasts from 2023 to 2033.

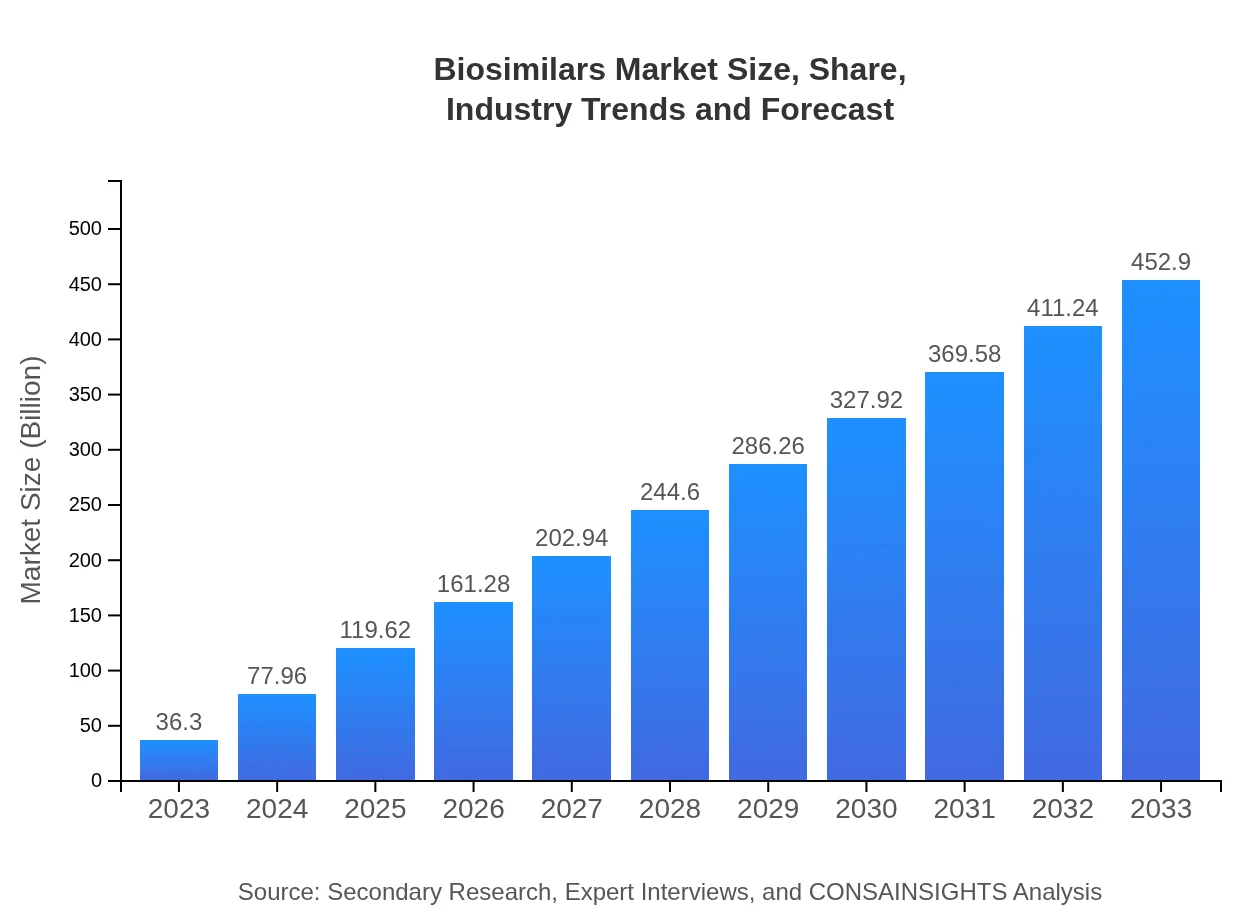

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $36.30 Billion |

| CAGR (2023-2033) | 26.8% |

| 2033 Market Size | $452.90 Billion |

| Top Companies | Roche, Samsung Bioepis, Amgen, Sandoz (a Novartis division), Pfizer |

| Last Modified Date | 31 January 2026 |

Biosimilars Market Overview

Customize Biosimilars Market Report market research report

- ✔ Get in-depth analysis of Biosimilars market size, growth, and forecasts.

- ✔ Understand Biosimilars's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biosimilars

What is the Market Size & CAGR of Biosimilars market in 2023 and 2033?

Biosimilars Industry Analysis

Biosimilars Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biosimilars Market Analysis Report by Region

Europe Biosimilars Market Report:

The European market is one of the largest for biosimilars, valued at $10.16 billion in 2023 with projections of $126.77 billion by 2033. The presence of leading pharmaceutical companies and strong governmental support for biosimilars contribute to growth, driven by initiatives to reduce healthcare costs.Asia Pacific Biosimilars Market Report:

The Asia Pacific region is witnessing substantial growth, with the market valued at $7.23 billion in 2023 and expected to reach $90.22 billion by 2033. Rising investment in healthcare infrastructure, coupled with a large patient population and increasing adoption of biosimilars, is driving this growth.North America Biosimilars Market Report:

North America holds a prominent share in the Biosimilars market, estimated at $12.73 billion in 2023 and predicted to grow to $158.88 billion by 2033. The region benefits from a well-established healthcare system, favorable regulatory environment, and high healthcare expenditure.South America Biosimilars Market Report:

In South America, the Biosimilars market is valued at $1.52 billion in 2023 and is projected to grow to $18.98 billion by 2033. Government initiatives aimed at promoting affordable healthcare solutions and the rising prevalence of chronic diseases are significant contributors to market expansion.Middle East & Africa Biosimilars Market Report:

The Middle East and Africa regions are also observing market growth, starting at $4.65 billion in 2023 and reaching $58.06 billion by 2033. Factors like increased healthcare competitions and the demand for affordable medication are key drivers facilitating this trend.Tell us your focus area and get a customized research report.

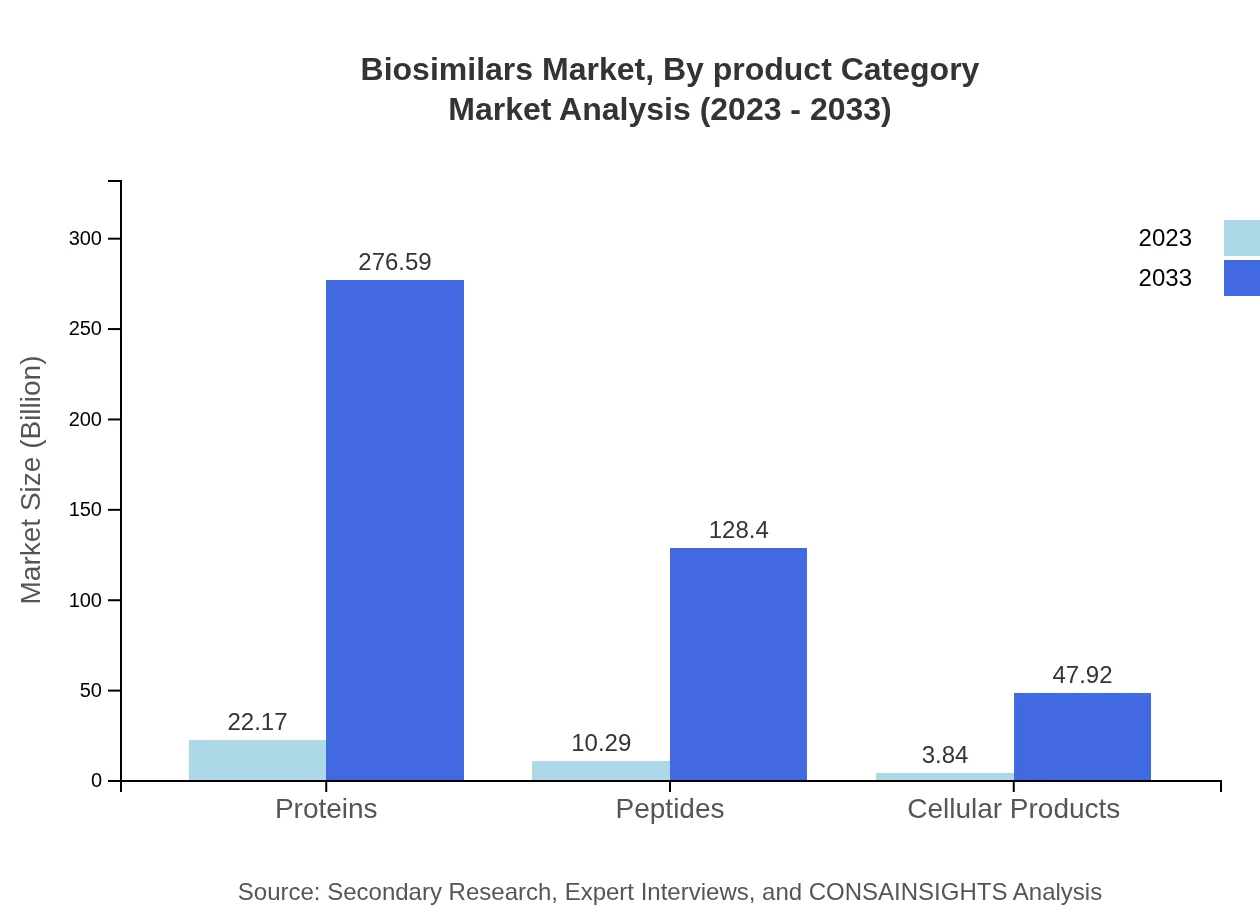

Biosimilars Market Analysis By Product Category

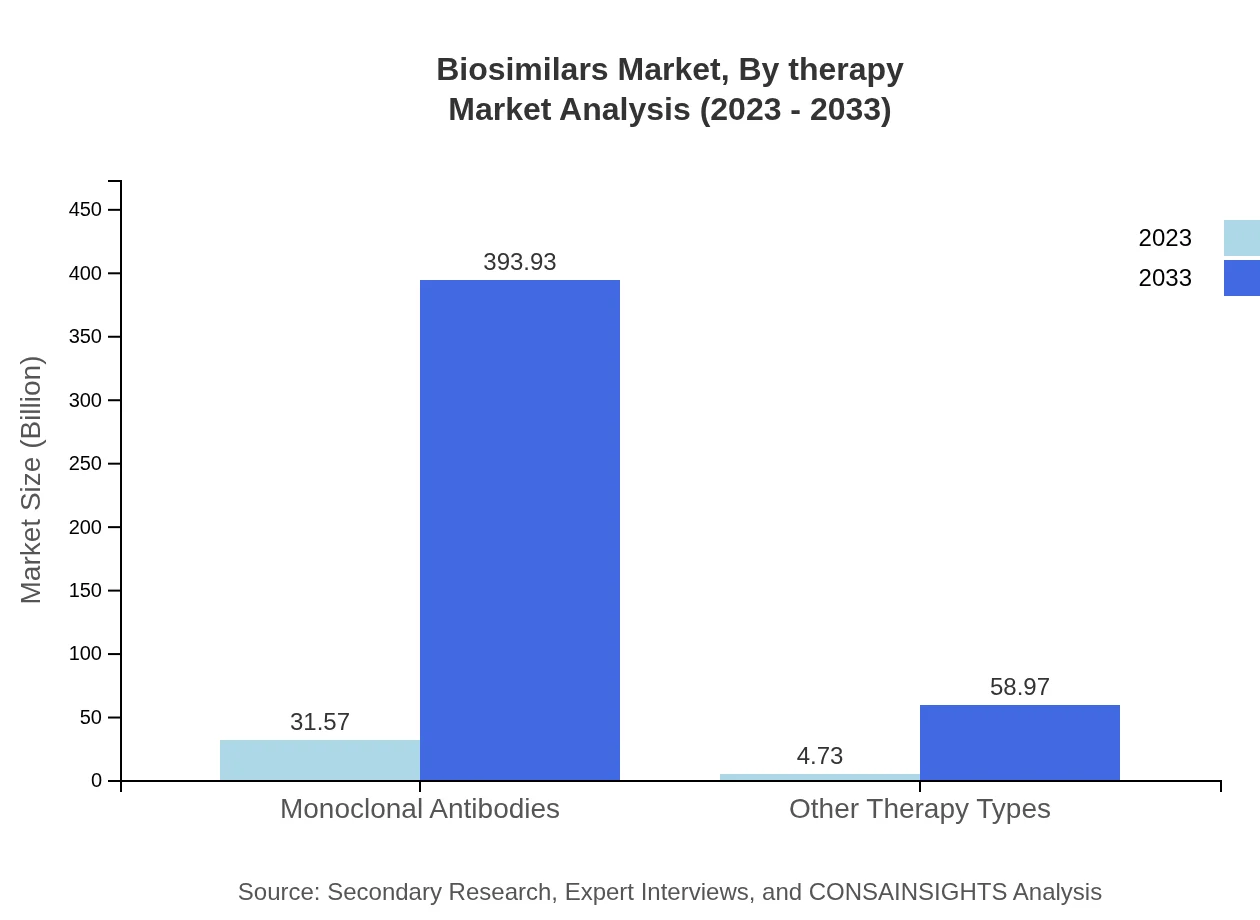

The market segmentation by product category shows strong dominance of monoclonal antibodies, which are projected to grow from $31.57 billion in 2023 to $393.93 billion by 2033, representing an 86.98% market share. Other therapy types, including peptides and proteins, will also expand significantly, demonstrating the versatility of biosimilars across therapeutic applications.

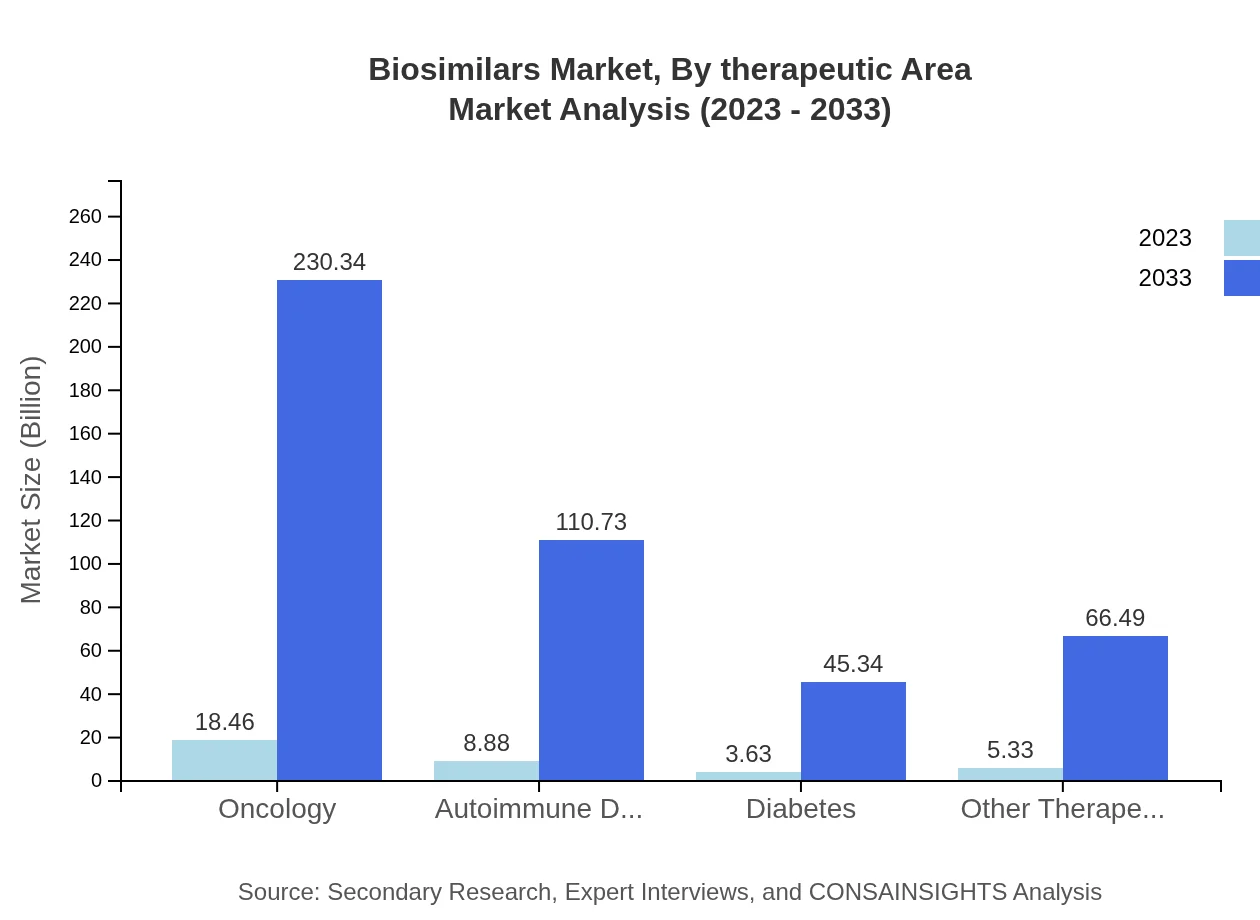

Biosimilars Market Analysis By Therapeutic Area

Oncology remains the leading therapeutic area for biosimilars, projected to grow from $18.46 billion in 2023 to $230.34 billion by 2033, capturing 50.86% of the market share. Autoimmune diseases and diabetes also represent key growth areas, developing alongside advancements in personalized medicine.

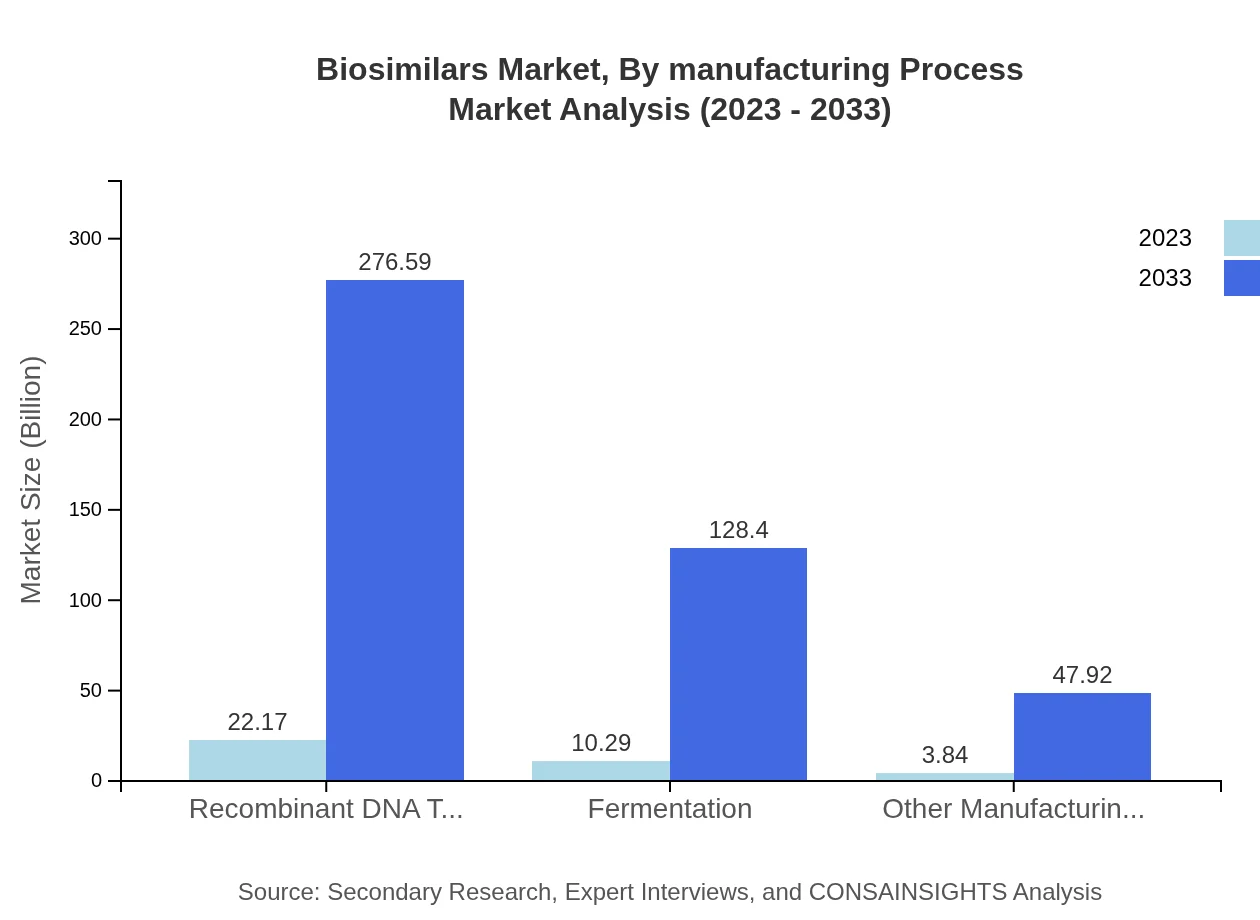

Biosimilars Market Analysis By Manufacturing Process

Manufacturing processes are pivotal for biosimilars, with recombinant DNA technology leading this segment, expected to maintain a dominant share of 61.07% while rising from $22.17 billion to $276.59 billion by 2033. Fermentation and other processes are set to experience significant growth rates as demand for various biosimilars accelerates.

Biosimilars Market Analysis By Therapy

The biosimilars market shows diverse therapy applications, primarily focused on monoclonal antibodies and other biotherapies. With effective treatment options emerging, the market shares for these respective therapies will remain substantial and vital to expanding the overall biosimilars market.

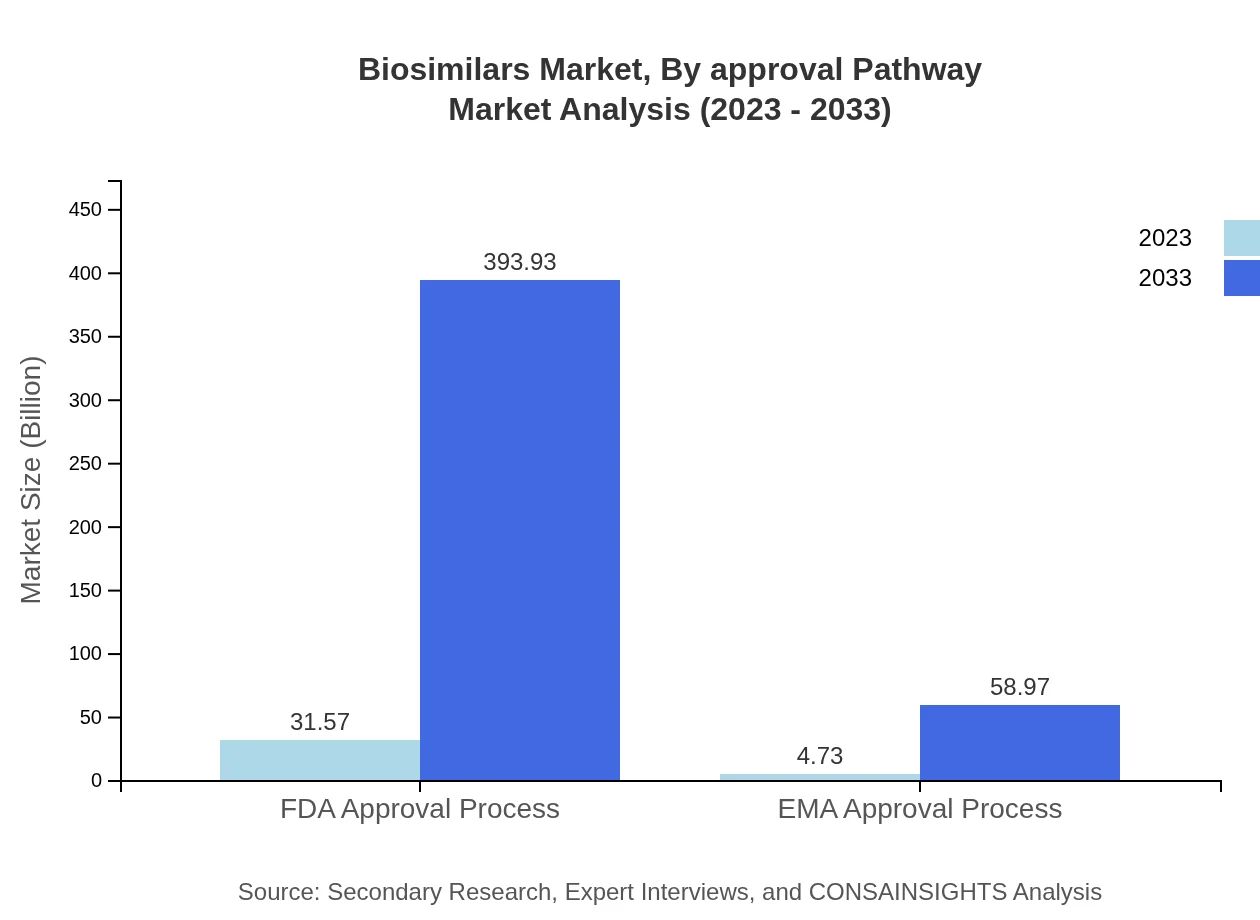

Biosimilars Market Analysis By Approval Pathway

The approval pathway for biosimilars includes stringent processes such as the FDA and EMA Approvals. Market segments show that products under FDA processes encapsulate 86.98% of the total market, expected to expand significantly over the next decade.

Biosimilars Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biosimilars Industry

Roche:

A leading player in the biosimilars sector, Roche is known for its innovation and extensive portfolio of monoclonal antibodies.Samsung Bioepis:

A prominent biosimilars company that produces high-quality biosimilars in various therapeutic areas, leveraging advanced biotechnology.Amgen:

Amgen develops and manufactures biosimilars and has invested significantly in expanding its capabilities in this space.Sandoz (a Novartis division):

Specializes in the development of biosimilars, contributing to market accessibility and affordability.Pfizer :

A major player in pharmaceuticals, Pfizer has a growing presence in the biosimilars market with a range of effective products.We're grateful to work with incredible clients.

FAQs

What is the market size of biosimilars?

The biosimilars market is projected to reach approximately $36.3 billion by 2033, growing at a robust CAGR of 26.8% from 2023. This growth reflects increasing adoption due to cost-effectiveness and rising chronic disease prevalence.

What are the key market players or companies in the biosimilars industry?

Key players in the biosimilars industry include Amgen, Sandoz, Pfizer, and Celltrion. These companies focus on developing innovative biosimilars, expanding their product offerings and strengthening market presence.

What are the primary factors driving the growth in the biosimilars industry?

Major factors driving biosimilars growth include escalating healthcare costs, increasing prevalence of chronic diseases, growing demand for affordable biological treatments, and favorable regulatory frameworks encouraging biosimilar development.

Which region is the fastest Growing in the biosimilars market?

Asia Pacific is emerging as the fastest-growing region in the biosimilars market, estimated to grow from $7.23 billion in 2023 to $90.22 billion by 2033, fueled by rising healthcare investments and population demands.

Does ConsaInsights provide customized market report data for the biosimilars industry?

Yes, ConsaInsights offers customized market report data tailored to individual client needs within the biosimilars industry, enabling detailed insights into specific segments, trends, and competitive landscapes.

What deliverables can I expect from this biosimilars market research project?

Deliverables include comprehensive market analysis reports, trend forecasts, competitive landscape summaries, and detailed segment-specific insights, providing a holistic view of the biosimilars market dynamics.

What are the market trends of biosimilars?

Current trends in the biosimilars market include increased regulatory approvals, partnerships between biotechnology firms, growing acceptance by healthcare providers, and advancements in manufacturing technologies enhancing product quality.