Biotech Flavor Market Report

Published Date: 31 January 2026 | Report Code: biotech-flavor

Biotech Flavor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biotech Flavor market, including insights on market size, growth rates, segmentation, regional dynamics, and key trends from 2023 to 2033.

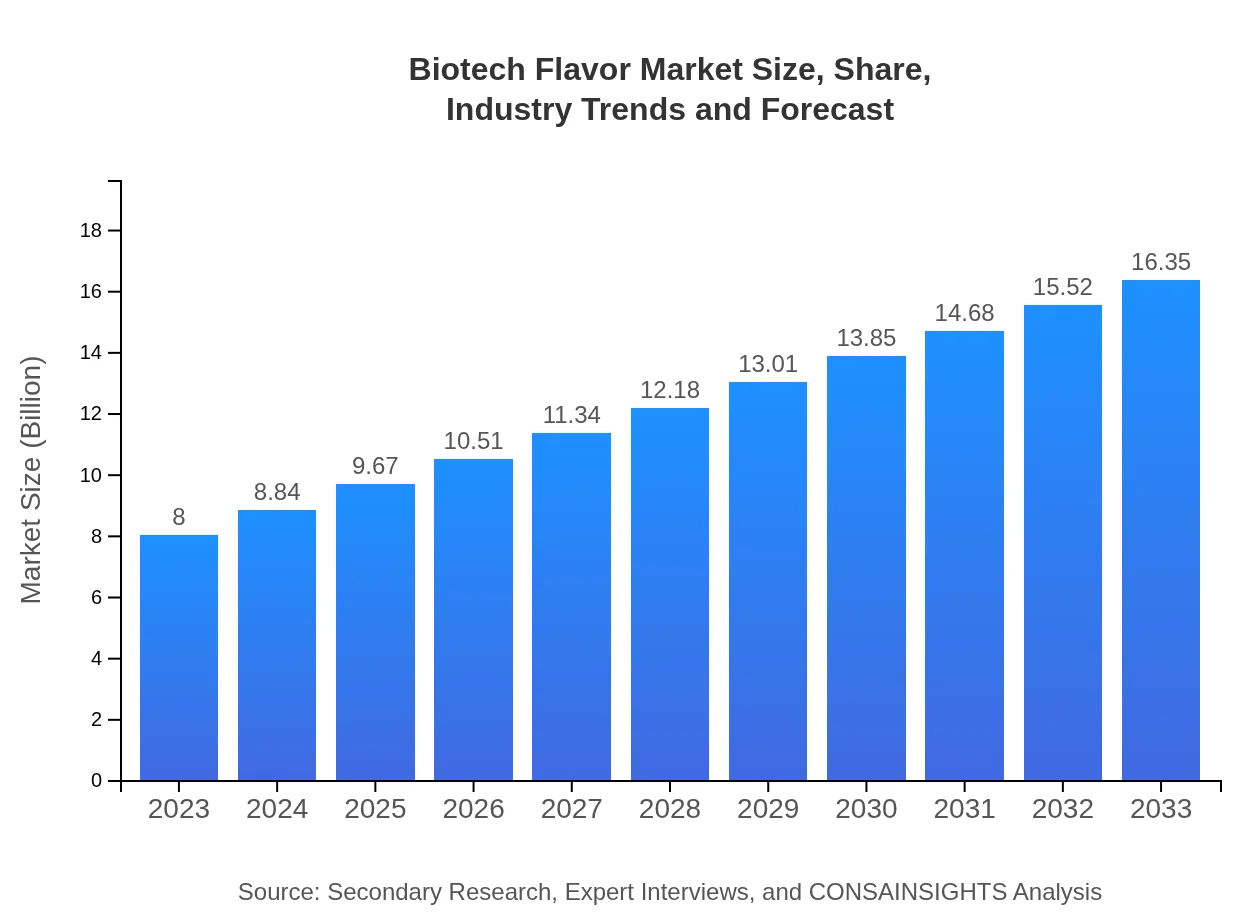

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $16.35 Billion |

| Top Companies | Givaudan, Firmenich, Symrise, International Flavors & Fragrances Inc. (IFF) |

| Last Modified Date | 31 January 2026 |

Biotech Flavor Market Overview

Customize Biotech Flavor Market Report market research report

- ✔ Get in-depth analysis of Biotech Flavor market size, growth, and forecasts.

- ✔ Understand Biotech Flavor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biotech Flavor

What is the Market Size & CAGR of Biotech Flavor market in 2023?

Biotech Flavor Industry Analysis

Biotech Flavor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biotech Flavor Market Analysis Report by Region

Europe Biotech Flavor Market Report:

Europe's Biotech Flavor market is anticipated to expand from $2.44 billion in 2023 to $4.98 billion by 2033, with the European Union pushing for strict regulations on synthetic additives, thereby increasing the shift towards natural options.Asia Pacific Biotech Flavor Market Report:

The Asia Pacific Biotech Flavor market is projected to grow from $1.49 billion in 2023 to $3.05 billion by 2033. This growth is driven by increasing population, rising disposable income, and rapid urbanization leading to a higher demand for processed foods and beverages infused with biotech flavors.North America Biotech Flavor Market Report:

North America is projected to see the market increase from $2.92 billion in 2023 to $5.96 billion by 2033. Advancements in food technology and high health consciousness among consumers are key drivers in the region, leading to a bigger demand for biotech flavors.South America Biotech Flavor Market Report:

In South America, the market is set to expand from $0.32 billion in 2023 to $0.66 billion by 2033. The demand for healthy food options and an increase in local production of biotech flavors reflect a growing interest in sustainable and natural flavoring solutions.Middle East & Africa Biotech Flavor Market Report:

In the Middle East and African regions, the market is estimated to rise from $0.83 billion in 2023 to $1.70 billion by 2033. The demand for quality food products is rising, alongside an increase in food safety regulations, which will benefit the biotech flavor industry.Tell us your focus area and get a customized research report.

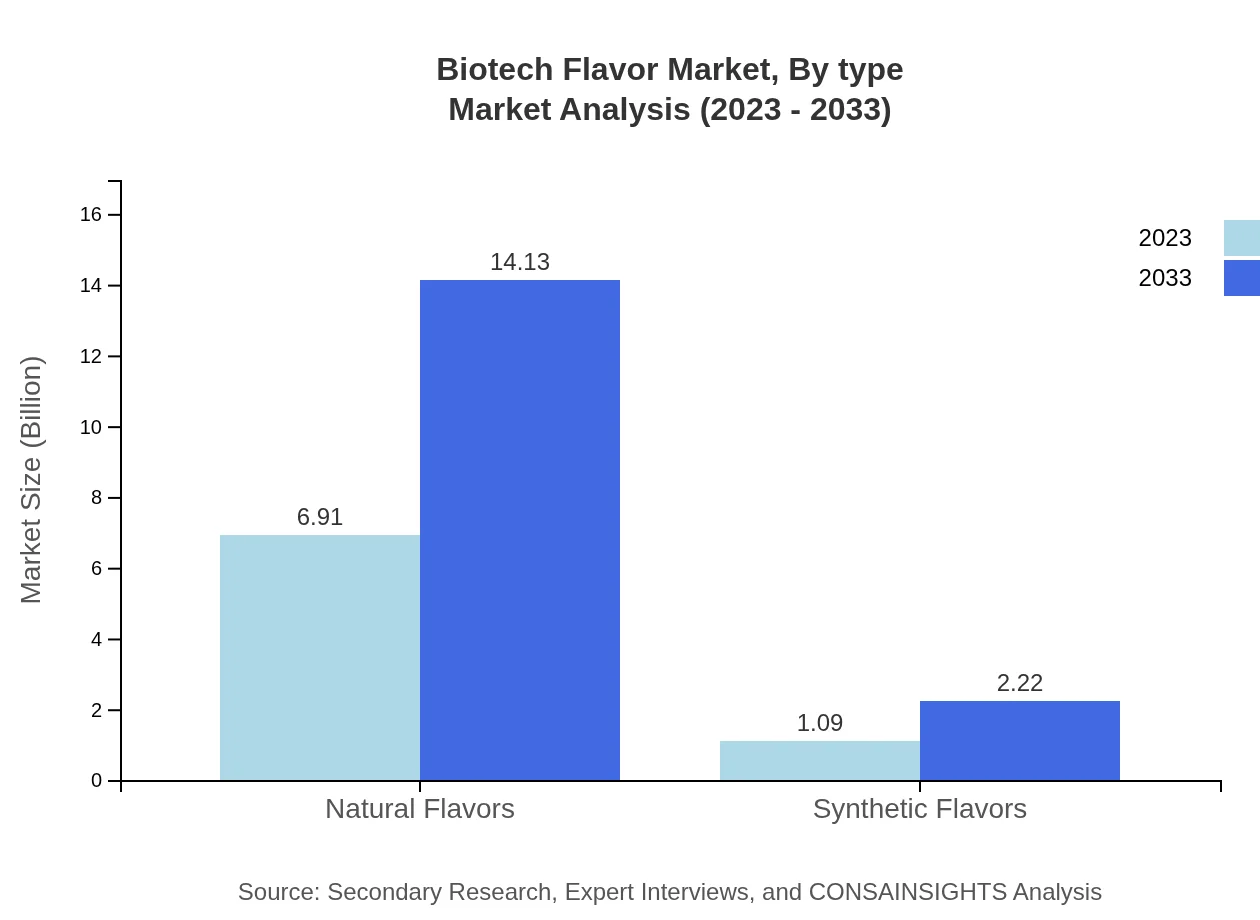

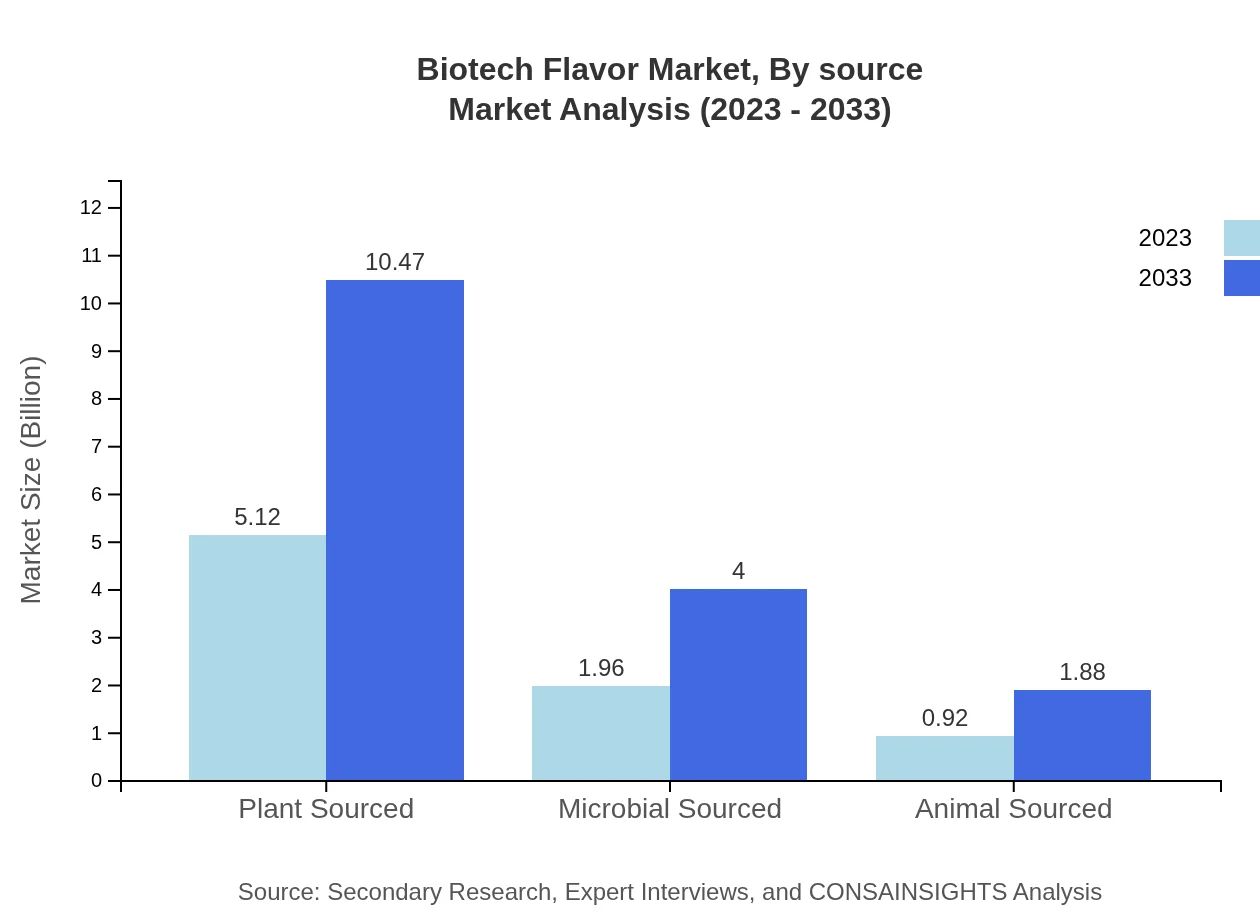

Biotech Flavor Market Analysis By Type

Natural Flavors dominate the Biotech Flavor segment, accounting for $6.91 billion in 2023 projected to rise to $14.13 billion by 2033. This growth accounts for 86.43% market share. Plant Sourced flavors represent a significant portion with $5.12 billion in 2023 expected to grow to $10.47 billion. Microbial Sourced flavors also see growth from $1.96 billion to $4.00 billion and Animal Sourced flavors from $0.92 billion to $1.88 billion.

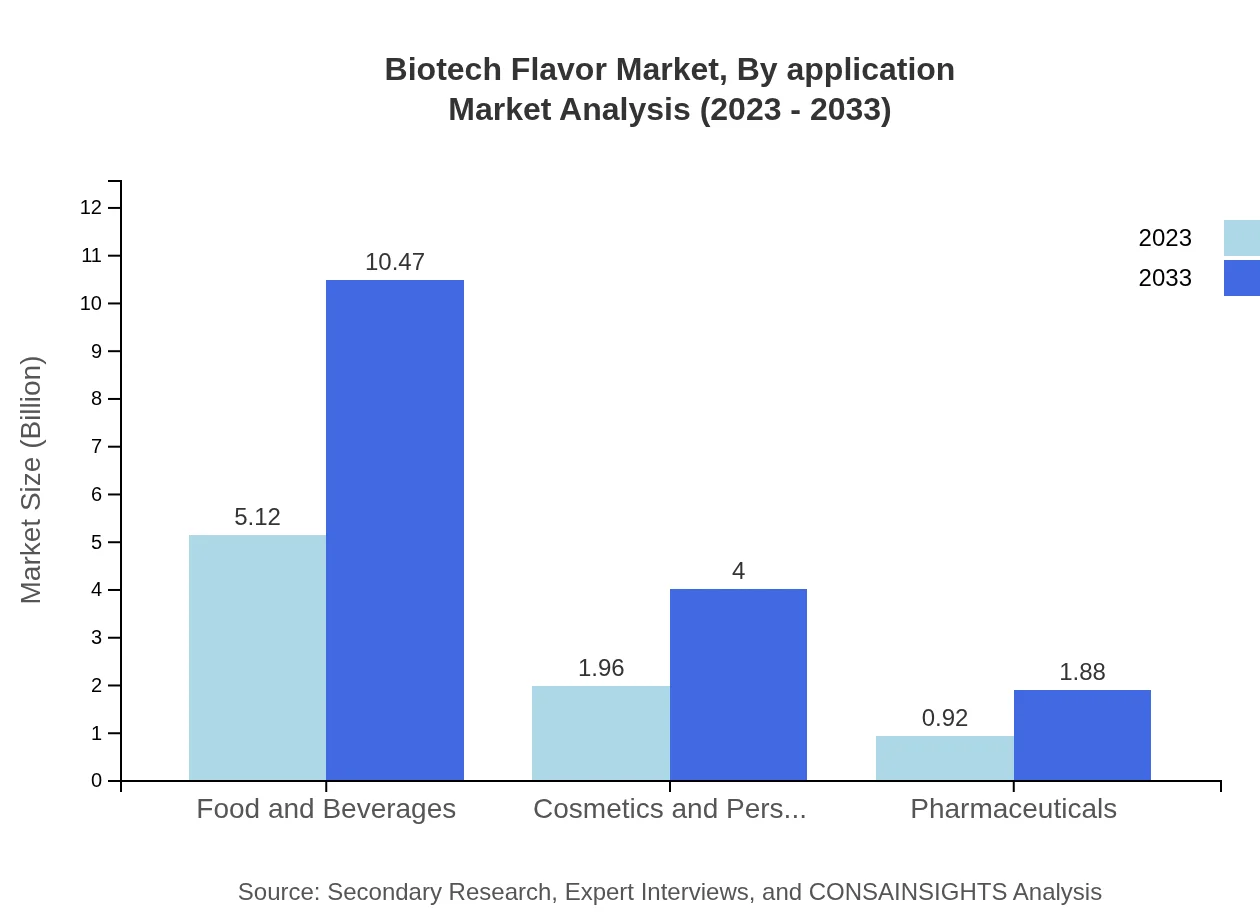

Biotech Flavor Market Analysis By Application

The Food and Beverage Applications contribute a substantial part of the market, valued at $5.12 billion in 2023, expanding to $10.47 billion by 2033, maintaining a market share of 64.05%. The Beverage segment leads with $1.96 billion transitioning to $4.00 billion whilst Pharmaceuticals and Nutraceuticals are expected to grow from $0.92 billion to $1.88 billion.

Biotech Flavor Market Analysis By Source

Natural flavors, including those extracted from plant sources, dominate the market with an impressive growth trajectory, while synthetic flavors have been witnessing steady demand, growing from $1.09 billion in 2023 to $2.22 billion by 2033 with a steady share of 13.57%. Meanwhile, sourced from plants constitute 64.05% share currently.

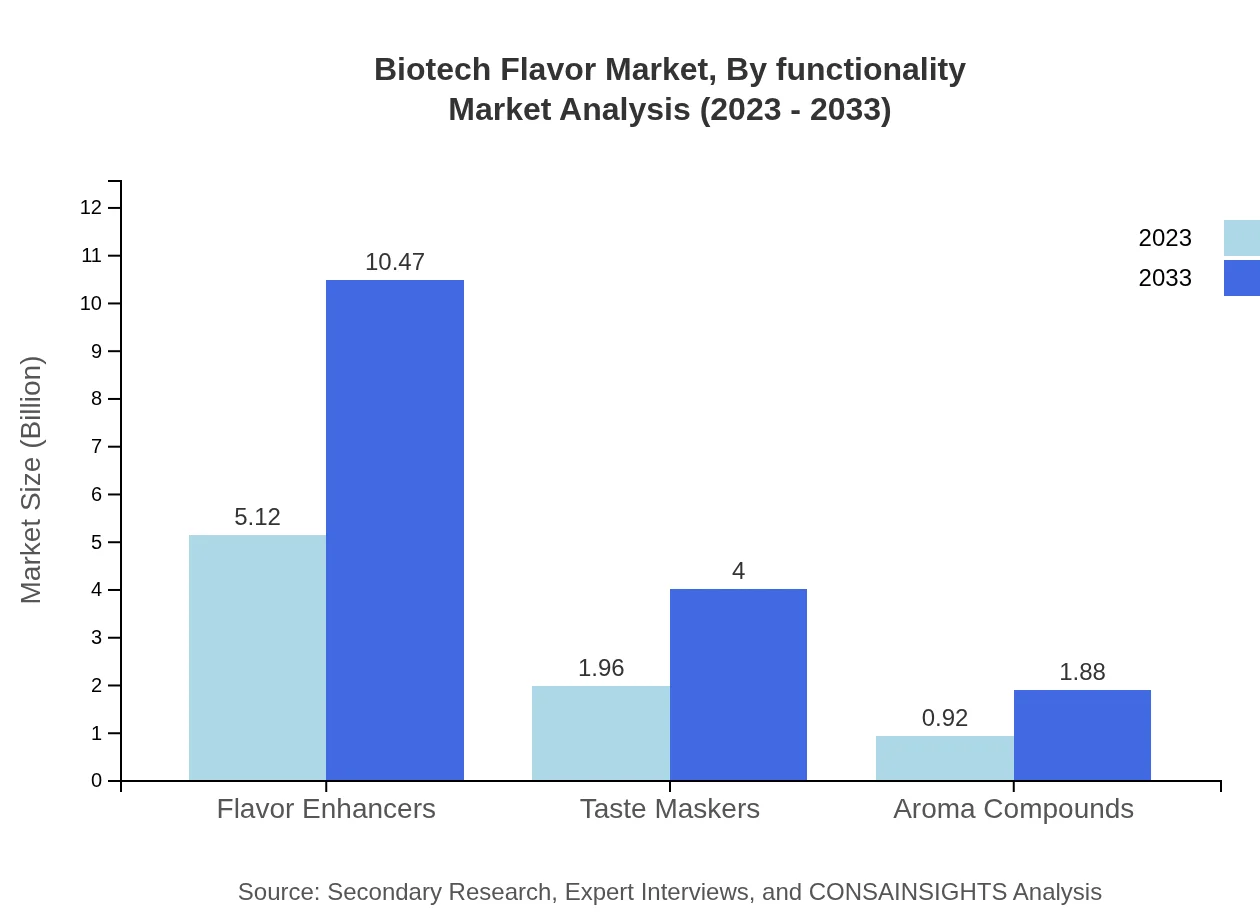

Biotech Flavor Market Analysis By Functionality

Biotech Flavors serve multiple functionalities including flavor enhancers, taste maskers, and aroma compounds. Flavor enhancers are predicted to sustain a robust share while gaining market traction due to the rise in demand for taste enhancement in food products. Taste maskers and aroma compounds have their respective shares of 24.46% and 11.49%, and will continue to grow steadily in the coming decade.

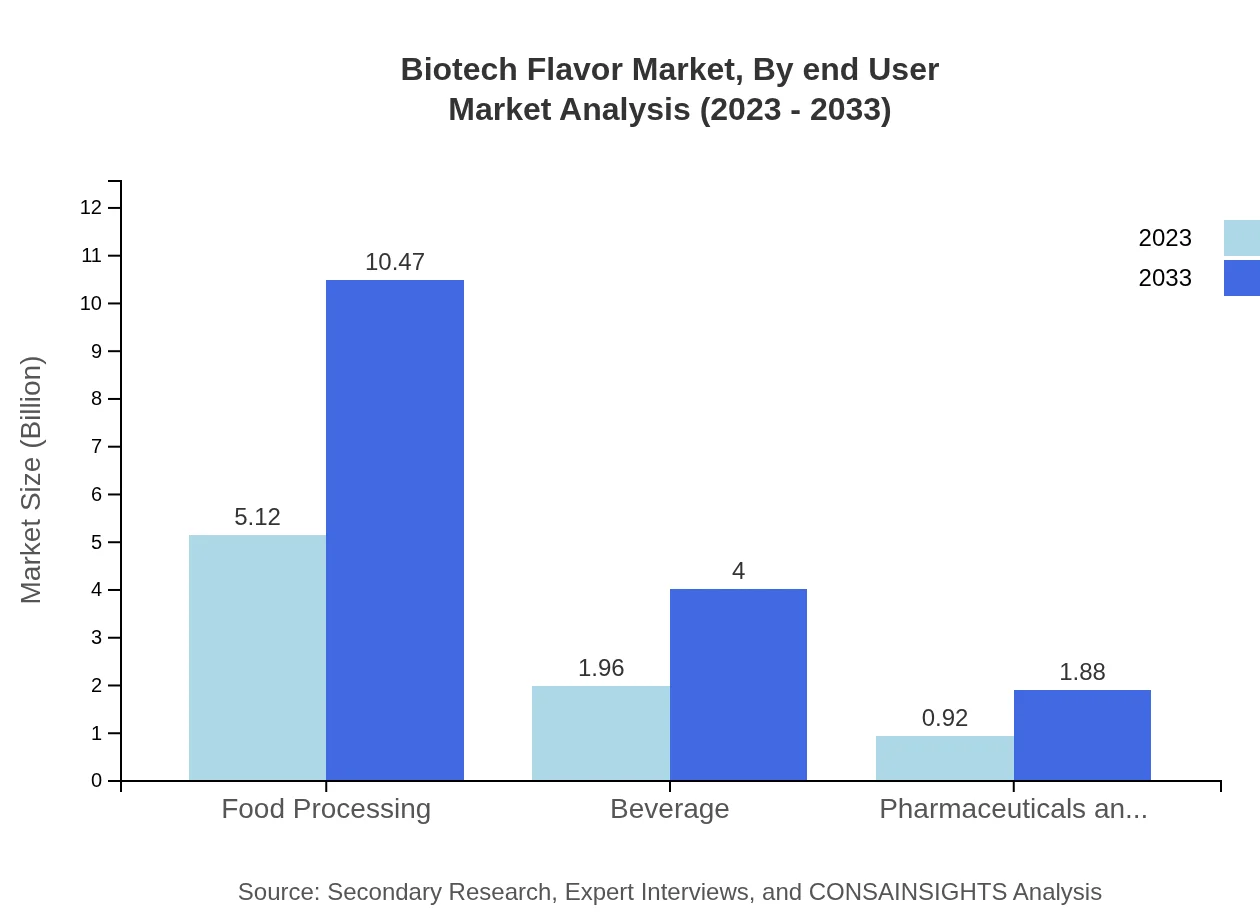

Biotech Flavor Market Analysis By End User

Across industries, the Food Processing sector garners significant market share at 64.05%, indicating robust utilization of biotech flavors to enhance product offerings. The Beverage sector closely follows, exhibiting considerable growth potential alongside steady performance seen in the cosmetics and personal care industry.

Biotech Flavor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biotech Flavor Industry

Givaudan:

A leading global company in flavor and fragrance, Givaudan focuses on delivering innovative solutions in the food and beverage sector and has pioneered research in biotech flavors.Firmenich:

Firmenich is renowned for its commitment to sustainability in flavor creation, helping transition the market towards natural flavors through biotech innovations.Symrise:

Symrise is recognized for its diverse offering of natural and synthetic flavors, actively investing in biotechnology to lead in flavor innovation.International Flavors & Fragrances Inc. (IFF):

IFF is a global leader in flavor and fragrance solutions, developing high-quality biotech flavors with a focus on consumer needs and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of biotech Flavor?

The biotech flavor market is projected to reach $8 billion by 2033, growing from $4 billion in 2023, representing a CAGR of 7.2%. This growth indicates strong demand and innovation within the industry.

What are the key market players or companies in the biotech Flavor industry?

Key players in the biotech flavor industry include significant global companies such as Givaudan, Firmenich, and Symrise. These companies are at the forefront of developing innovative flavors using biotechnological methods.

What are the primary factors driving the growth in the biotech flavor industry?

Key factors driving growth include increasing consumer demand for natural flavors, rising health consciousness, and the popularity of plant-based diets. Additionally, advancements in biotechnology are enabling more efficient flavor production.

Which region is the fastest Growing in the biotech flavor market?

North America is expected to be the fastest-growing region, with the market size projected to increase from $2.92 billion in 2023 to $5.96 billion by 2033, reflecting a strong consumer base and innovation.

Does ConsaInsights provide customized market report data for the biotech Flavor industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the biotech flavor industry. This includes detailed analyses and insights according to client requirements.

What deliverables can I expect from this biotech Flavor market research project?

Deliverables include comprehensive reports with market size data, trend analyses, competitive landscape evaluation, and forecasts for regions and segments, ensuring actionable insights for strategic decision-making.

What are the market trends of biotech Flavor?

Current trends in the biotech flavor market include a shift towards sustainable sourcing, increased use of plant and microbial sources, and a growing emphasis on health-oriented products, driving innovation in flavor development.