Bitcoin Technology Market Report

Published Date: 31 January 2026 | Report Code: bitcoin-technology

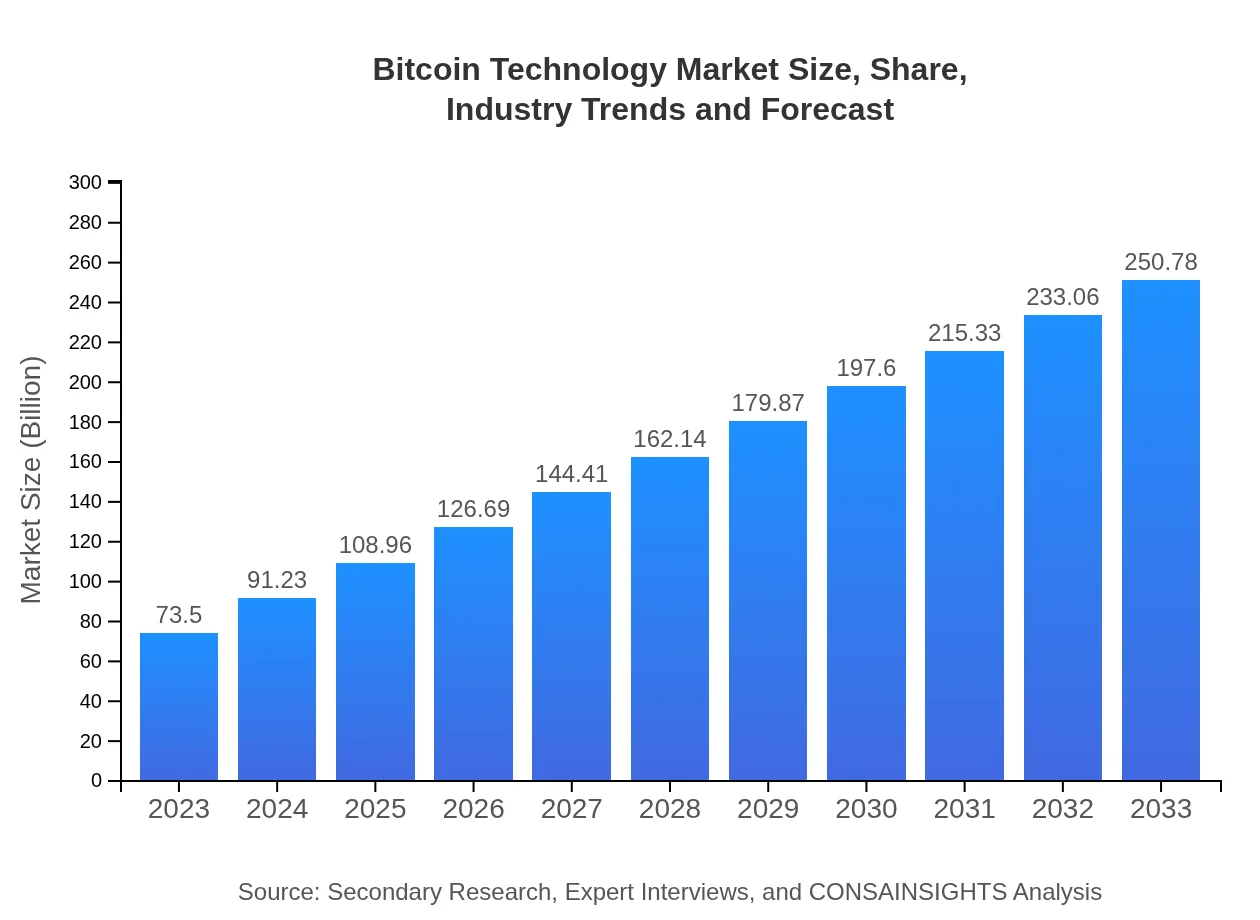

Bitcoin Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Bitcoin Technology market from 2023 to 2033, covering key insights, market dynamics, segmentation, and forecasts. It aims to equip stakeholders with valuable data to make informed strategic decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $73.50 Billion |

| CAGR (2023-2033) | 12.5% |

| 2033 Market Size | $250.78 Billion |

| Top Companies | Coinbase , Binance, BitPay, Blockstream |

| Last Modified Date | 31 January 2026 |

Bitcoin Technology Market Overview

Customize Bitcoin Technology Market Report market research report

- ✔ Get in-depth analysis of Bitcoin Technology market size, growth, and forecasts.

- ✔ Understand Bitcoin Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bitcoin Technology

What is the Market Size & CAGR of the Bitcoin Technology market in 2023?

Bitcoin Technology Industry Analysis

Bitcoin Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bitcoin Technology Market Analysis Report by Region

Europe Bitcoin Technology Market Report:

The European market is anticipated to see substantial growth from $22.84 billion in 2023 to $77.92 billion by 2033. Countries like Germany and the UK are leading due to favorable regulations and robust fintech sectors facilitating Bitcoin adoption.Asia Pacific Bitcoin Technology Market Report:

In the Asia Pacific region, the Bitcoin Technology market is expected to expand from $14.62 billion in 2023 to $49.88 billion by 2033. The high prevalence of mobile financial services and increasing financial technology investments in countries like China and India are major growth drivers.North America Bitcoin Technology Market Report:

North America holds a substantial market share, with the Bitcoin Technology market set to increase from $24.90 billion in 2023 to $84.97 billion by 2033. The growth is supported by high cryptocurrency ownership rates and regulatory clarity, especially in the US.South America Bitcoin Technology Market Report:

The South American market is projected to grow from $6.73 billion in 2023 to $22.95 billion by 2033. Countries like Brazil and Argentina are leading adoption, spurred by economic instability and the need for alternative financial solutions.Middle East & Africa Bitcoin Technology Market Report:

In the Middle East and Africa, the market is expected to rise from $4.42 billion in 2023 to $15.07 billion by 2033. Growing digital infrastructures and increasing investments in fintech are enhancing Bitcoin's presence in the region.Tell us your focus area and get a customized research report.

Bitcoin Technology Market Analysis Individuals

Global Bitcoin Technology Market, By Individuals (2023 - 2033)

The individual segment is poised to experience significant growth, increasing from $49.08 billion in 2023 to $167.45 billion in 2033. Individuals' market share remains steady at 66.77%, driven by growing public awareness and acceptance of cryptocurrencies as a valid payment method.

Bitcoin Technology Market Analysis Businesses

Global Bitcoin Technology Market, By Businesses (2023 - 2033)

Businesses are projected to see their market size grow from $19.18 billion in 2023 to $65.43 billion by 2033, maintaining a market share of 26.09%. The increasing adoption of Bitcoin for transactions and investments by corporations is a key growth factor.

Bitcoin Technology Market Analysis Governments_and_regulatory_bodies

Global Bitcoin Technology Market, By Governments and Regulatory Bodies (2023 - 2033)

Governments and regulatory bodies are expected to gain a market size of $5.25 billion in 2023, growing to $17.91 billion by 2033. Their market share is crucial, representing 7.14%, as regulatory clarity aids in expanding the cryptocurrency ecosystem.

Bitcoin Technology Market Analysis Payment_systems

Global Bitcoin Technology Market, By Payment Systems (2023 - 2033)

In the payment systems segment, the market is projected to grow from $49.08 billion in 2023 to $167.45 billion by 2033, with a 66.77% market share. This growth underscores the increasing adoption of cryptocurrency for various transaction types.

Bitcoin Technology Market Analysis Investment_and_trading

Global Bitcoin Technology Market, By Investment and Trading (2023 - 2033)

The investment and trading segment is likely to expand from $19.18 billion in 2023 to $65.43 billion in 2033, with a steady market share of 26.09%. Retail and institutional investors are key drivers for this growth.

Bitcoin Technology Market Analysis Decentralized_finance

Global Bitcoin Technology Market, By Decentralized Finance (DeFi) (2023 - 2033)

The DeFi segment is expected to grow from $5.25 billion in 2023 to $17.91 billion by 2033. This growth is characterized by the innovative financial products built on Bitcoin technology, attracting diverse user groups.

Bitcoin Technology Market Analysis Digital_wallets

Global Bitcoin Technology Market, By Digital Wallets (2023 - 2033)

Digital wallets are projected to see exponential growth from $63.21 billion in 2023 to $215.67 billion by 2033, reflecting a strong adoption rate among users for secure cryptocurrency storage.

Bitcoin Technology Market Analysis Cryptocurrency_exchanges

Global Bitcoin Technology Market, By Cryptocurrency Exchanges (2023 - 2033)

Cryptocurrency exchanges are also witnessing growth, from $10.29 billion in 2023 to $35.11 billion by 2033, as trading volumes rise and the number of platforms increases.

Bitcoin Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bitcoin Technology Industry

Coinbase :

Coinbase is a leading cryptocurrency exchange that allows users to buy, sell, and store Bitcoin and other cryptocurrencies. Its user-friendly platform has contributed significantly to the crypto adoption among retail investors.Binance:

Binance is the largest cryptocurrency exchange in the world by trading volume, offering a wide range of services for trading and investing in Bitcoin and other digital currencies.BitPay:

BitPay is a payment service provider that facilitates transactions in Bitcoin, enabling businesses and consumers to make payments using the cryptocurrency seamlessly.Blockstream:

Blockstream focuses on advancing blockchain technology and Bitcoin's functionality, contributing to the development of essential infrastructure and applications in the industry.We're grateful to work with incredible clients.

FAQs

What is the market size of bitcoin Technology?

The Bitcoin Technology market is valued at approximately $73.5 billion in 2023, with a projected CAGR of 12.5%. This growth reflects the increasing adoption of Bitcoin and related technologies across various sectors globally.

What are the key market players or companies in the bitcoin Technology industry?

The Bitcoin Technology industry includes major players such as Coinbase, Binance, Bitfinex, and other cryptocurrency exchanges, along with blockchain technology firms, mining solutions companies, and digital wallet providers that contribute significantly to market growth.

What are the primary factors driving the growth in the bitcoin Technology industry?

Key growth factors in the Bitcoin Technology market include increasing investment in cryptocurrencies, greater public awareness, technological advancements in blockchain and digital wallets, regulatory developments, and expanding acceptance of Bitcoin for transactions in various sectors.

Which region is the fastest Growing in the bitcoin Technology market?

Asia Pacific is the fastest-growing region in the Bitcoin Technology market, expected to grow from $14.62 billion in 2023 to $49.88 billion by 2033. North America also shows significant growth potential, with a market size increasing from $24.90 billion to $84.97 billion.

Does ConsaInsights provide customized market report data for the bitcoin Technology industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the Bitcoin Technology industry, allowing users to obtain insights relevant to their interests and operational requirements from the comprehensive data available.

What deliverables can I expect from this bitcoin Technology market research project?

Deliverables from the Bitcoin Technology market research project typically include in-depth market analysis reports, competitor profiles, growth forecasts, regional insights, market segmentation breakdowns, and actionable recommendations based on the latest trends.

What are the market trends of bitcoin Technology?

Market trends in Bitcoin Technology indicate a rise in decentralized finance (DeFi) applications, increased innovation in digital wallets, growing adoption of cryptocurrencies in payment systems, and regulatory shifts shaping the industry's future directions.