Blockchain Ai Market Report

Published Date: 31 January 2026 | Report Code: blockchain-ai

Blockchain Ai Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Blockchain Ai market from 2023 to 2033. It includes market size insights, segmentation, regional analysis, trends, key players, and future forecasts, aimed at helping stakeholders understand the dynamics of this rapidly evolving sector.

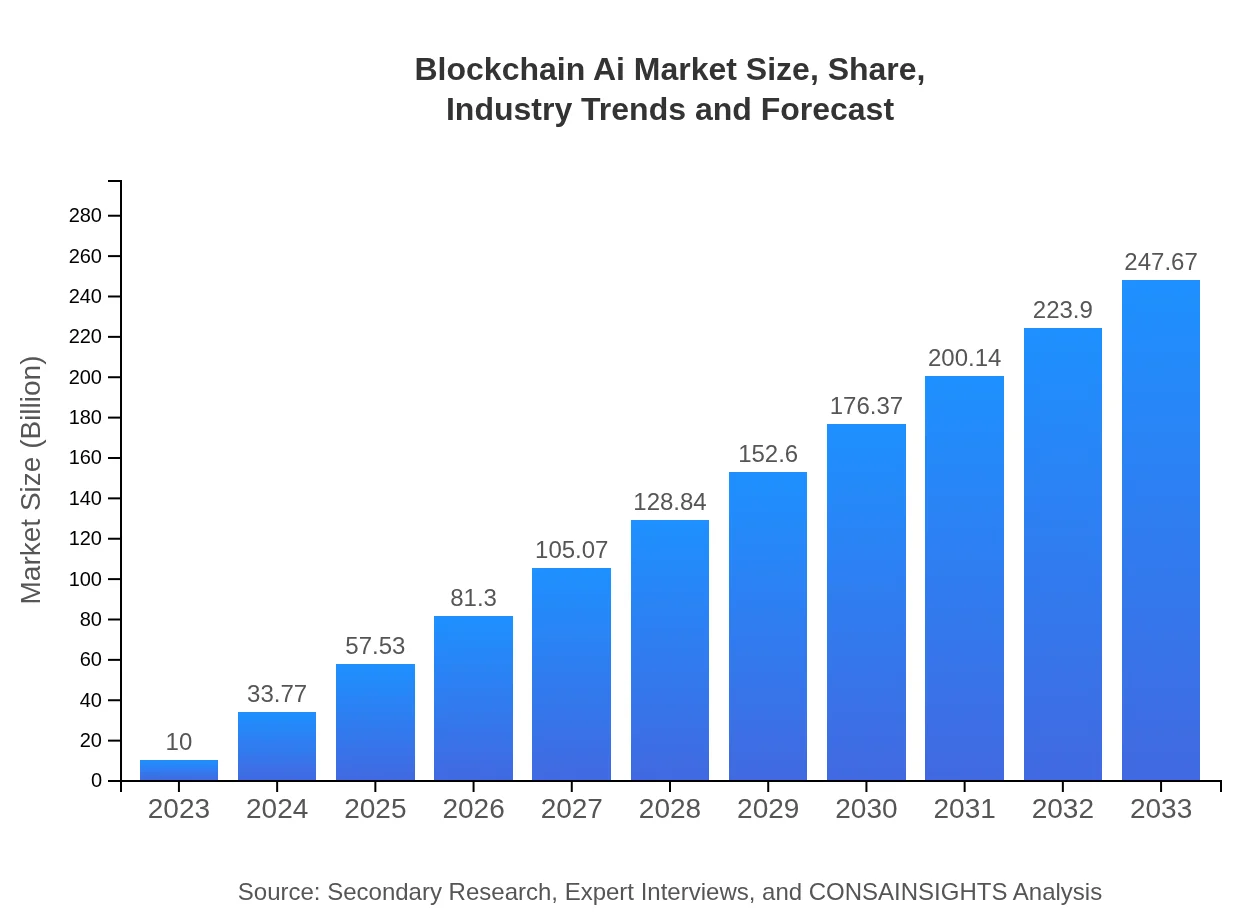

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 35% |

| 2033 Market Size | $247.67 Billion |

| Top Companies | IBM, Microsoft, Oracle, SAP, Accenture |

| Last Modified Date | 31 January 2026 |

Blockchain Ai Market Overview

Customize Blockchain Ai Market Report market research report

- ✔ Get in-depth analysis of Blockchain Ai market size, growth, and forecasts.

- ✔ Understand Blockchain Ai's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain Ai

What is the Market Size & CAGR of Blockchain Ai market in 2023?

Blockchain Ai Industry Analysis

Blockchain Ai Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blockchain Ai Market Analysis Report by Region

Europe Blockchain Ai Market Report:

The European Blockchain Ai market was valued at approximately $2.76 billion in 2023 and is anticipated to surge to $68.41 billion by 2033. Europe is witnessing significant governmental support for technology adoption and a rapid shift towards digital services, further enhanced by an emphasis on ethical AI and regulatory compliance.Asia Pacific Blockchain Ai Market Report:

In 2023, the Asia Pacific Blockchain Ai market is valued at approximately $2.18 billion, projected to grow significantly to $54.02 billion by 2033. The region is witnessing rapid technological advancements and a favorable regulatory environment, leading to increased investments in blockchain initiatives. Moreover, Asia Pacific's large population and growing digital economy present immense opportunities for Blockchain Ai applications across industries.North America Blockchain Ai Market Report:

North America holds a leading position in the Blockchain Ai market with an estimated size of $3.38 billion in 2023, expected to reach $83.79 billion by 2033. The presence of major technology firms, an advanced regulatory framework, and high investment in AI-driven solutions contribute to robust market growth. Key sectors driving demand include finance, healthcare, and supply chain.South America Blockchain Ai Market Report:

The South American market for Blockchain Ai stood at $0.98 billion in 2023 and is estimated to expand to $24.22 billion by 2033. Development in infrastructure and rising demand for enhanced security and transparency in transactions are driving growth within this region. The adoption of blockchain in agriculture and public services is particularly notable.Middle East & Africa Blockchain Ai Market Report:

In the Middle East and Africa, the market was valued at $0.70 billion in 2023 and is forecast to reach $17.24 billion by 2033. Key drivers include investments in digital transformation projects, particularly in financial services and logistics. The region’s young population and increasing smartphone penetration are also fostering growth.Tell us your focus area and get a customized research report.

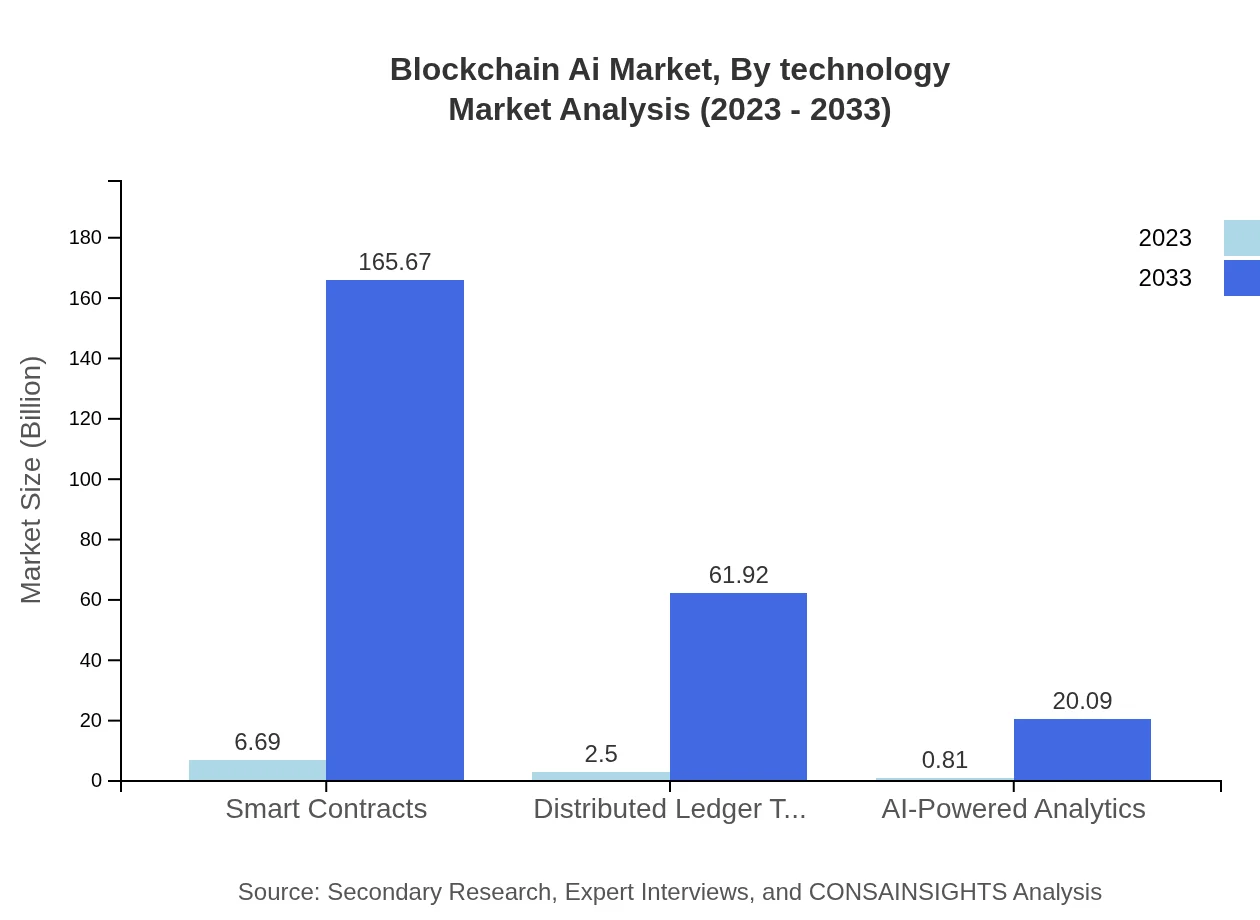

Blockchain Ai Market Analysis By Technology

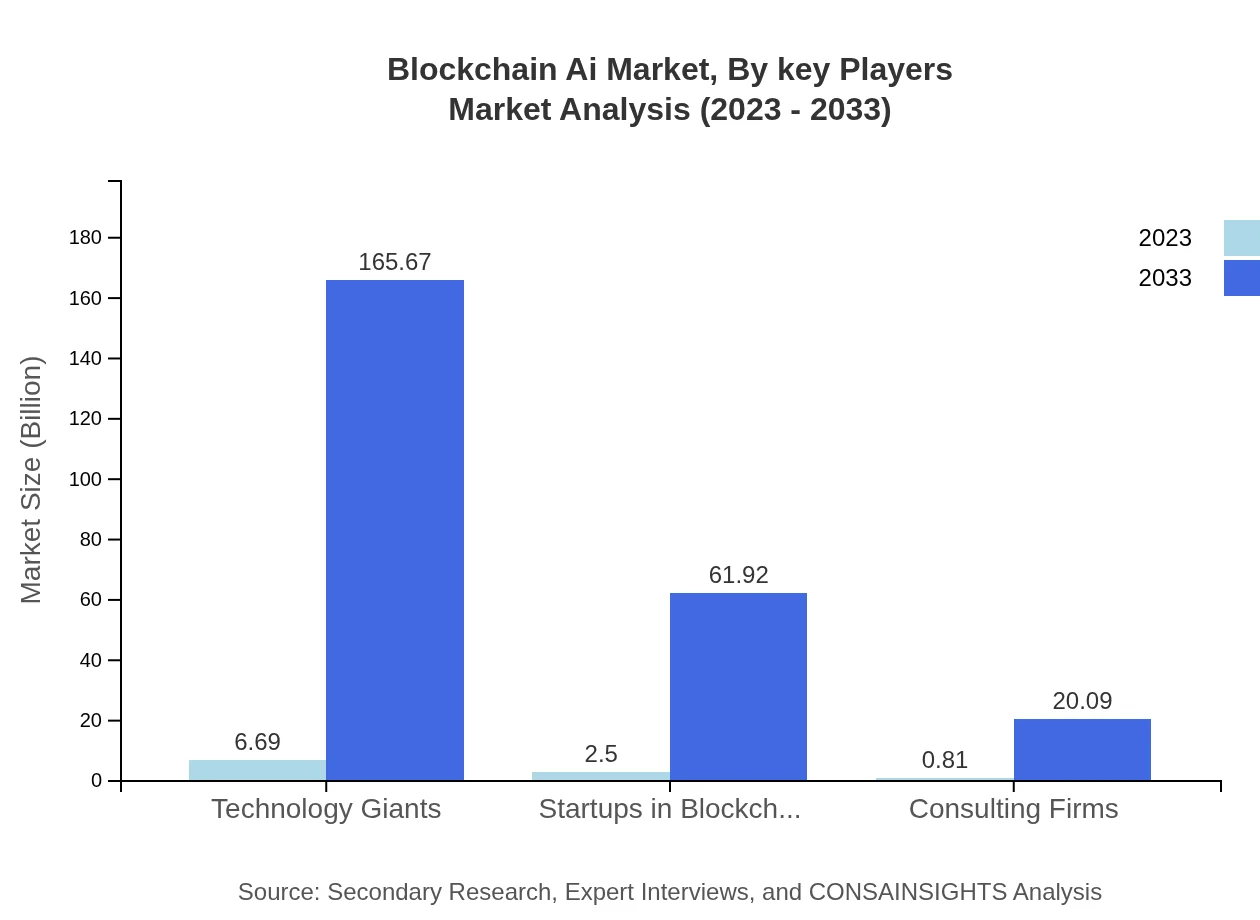

Innovative technologies within the Blockchain Ai sector include: - **Smart Contracts**: Estimated to grow from $6.69 billion in 2023 to $165.67 billion in 2033, accounting for 66.89% share of the market. - **Distributed Ledger Technology**: Projected growth from $2.50 billion to $61.92 billion, maintaining a 25% market share. - **AI-Powered Analytics**: Expected increase from $0.81 billion to $20.09 billion, with an 8.11% market share.

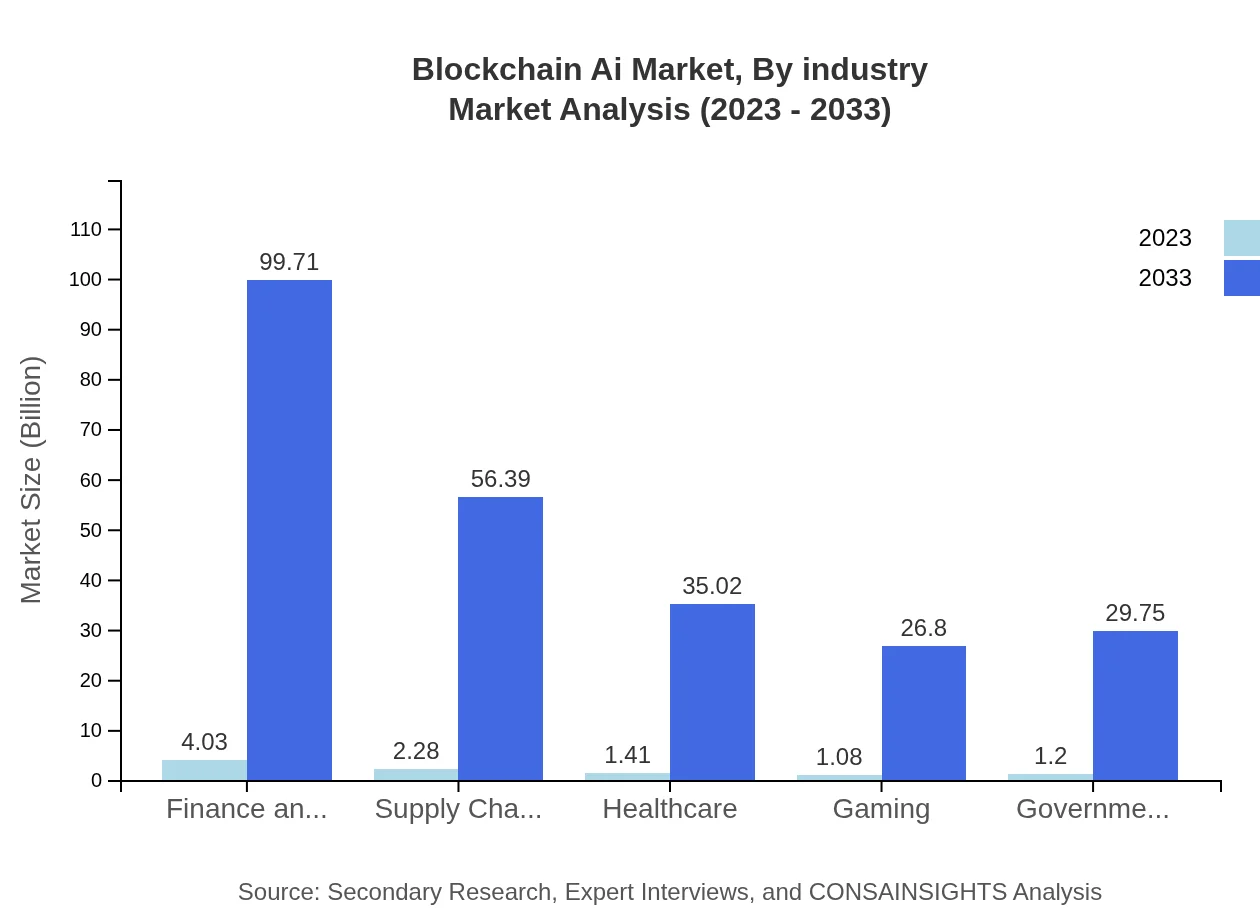

Blockchain Ai Market Analysis By Industry

Industry distribution reflects significant growth opportunities: - **Finance and Banking**: From $4.03 billion in 2023 to $99.71 billion in 2033, with a consistent 40.26% market share. - **Supply Chain Management**: Expected to reach $56.39 billion from $2.28 billion, thereby holding a 22.77% share. - **Healthcare**: Anticipated to grow from $1.41 billion to $35.02 billion, representing a 14.14% market share.

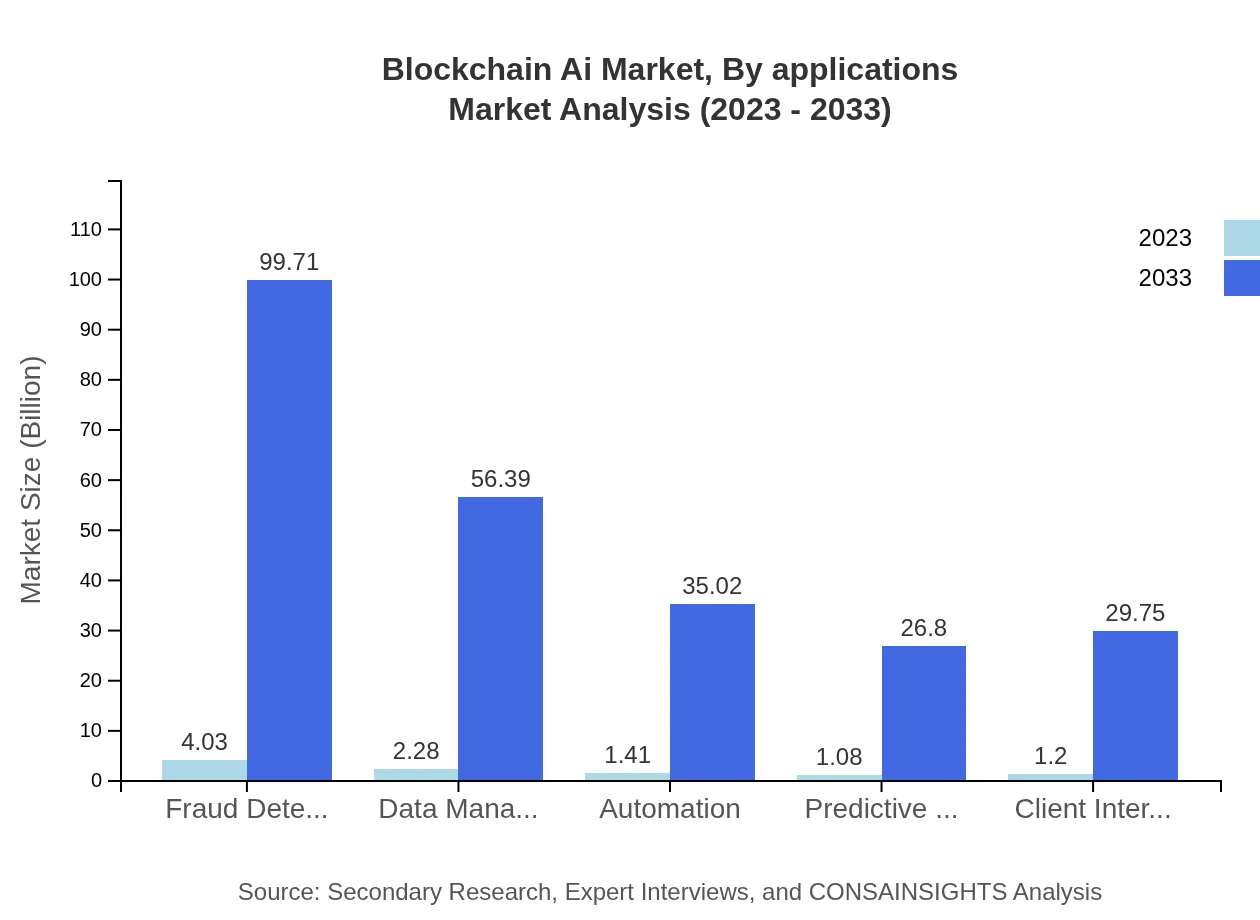

Blockchain Ai Market Analysis By Applications

Key application areas include: - **Fraud Detection**: Increasing significantly from $4.03 billion to $99.71 billion, solidifying its 40.26% market share. - **Data Management**: Expected to rise from $2.28 billion to $56.39 billion, maintaining a 22.77% market share. - **Client Interactions**: Projected to scale from $1.20 billion to $29.75 billion, with a 12.01% market share.

Blockchain Ai Market Analysis By Key Players

Key players in the Blockchain Ai market include: - **IBM**: Renowned for its blockchain solutions and AI integration, making significant contributions to enterprise applications. - **Microsoft**: Active in developing blockchain services on its Azure cloud platform, focusing on AI-supported transactions. - **Oracle**: Provides a suite of blockchain tools alongside AI analytics that enhances data security and business intelligence.

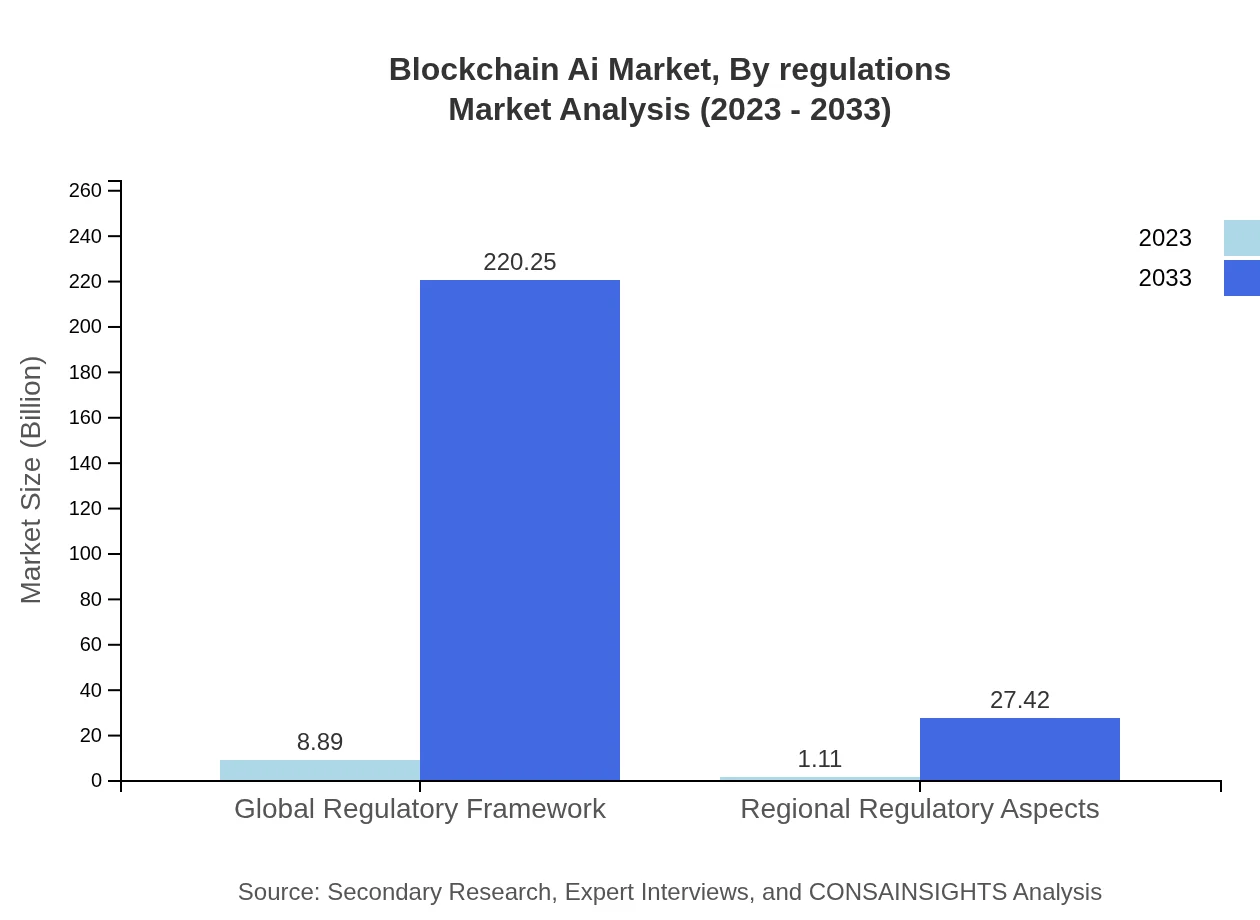

Blockchain Ai Market Analysis By Regulations

Regulatory landscapes significantly influence Blockchain Ai growth, with: - **Global Regulatory Framework**: Expected to grow from $8.89 billion to $220.25 billion, contributing 88.93% market share from regulatory compliance solutions. - **Regional Regulatory Aspects**: Projected growth from $1.11 billion to $27.42 billion, signaling important compliance systems due to varying local regulations.

Blockchain Ai Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain Ai Industry

IBM:

IBM is a leader in blockchain technology offering robust integration with artificial intelligence, particularly through its IBM Cloud platform.Microsoft:

Microsoft offers advanced blockchain solutions integrated with their Azure cloud services, empowering enterprise clients with data-driven AI analytics.Oracle:

Oracle focuses on providing blockchain applications that enhance enterprise efficiency while utilizing AI capabilities for data analysis and decision-making.SAP:

SAP leverages blockchain technology to enhance data integrity and transparency within supply chains, offering solutions that combine AI for predictive analytics.Accenture:

Accenture supports numerous blockchain initiatives globally, focusing on integrating AI solutions to streamline operations across different industries.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain Ai?

The global Blockchain-AI market is currently valued at approximately $10 billion and is projected to grow at a significant CAGR of 35% over the next decade. This growth showcases the increasing integration of AI technologies in blockchain applications.

What are the key market players or companies in this blockchain Ai industry?

Key players in the Blockchain-AI industry include technology giants, startups dedicated to blockchain innovations, and consulting firms. These entities are leading the charge in developing integrated solutions that leverage distributed ledger technology alongside artificial intelligence.

What are the primary factors driving the growth in the blockchain Ai industry?

Growth in the Blockchain-AI industry is driven by factors such as increasing demand for efficient data management, the need for improved fraud detection systems, and a surge in automation across sectors. Additionally, the rise in decentralization trends boosts adoption.

Which region is the fastest Growing in the blockchain Ai?

The fastest-growing region in the Blockchain-AI market is expected to be North America, which is projected to grow from $3.38 billion in 2023 to $83.79 billion by 2033. This rapid growth indicates a robust demand for innovative solutions.

Does ConsaInsights provide customized market report data for the blockchain Ai industry?

Yes, Consainsights provides tailored market reports for the Blockchain-AI industry, allowing clients to obtain specific insights that cater to their unique needs, preferences, and strategic goals.

What deliverables can I expect from this blockchain Ai market research project?

From the Blockchain-AI market research project, you can expect comprehensive reports detailing market size, CAGR projections, competitive landscapes, regional analyses, segment data, and key trends shaping the industry's future.

What are the market trends of blockchain Ai?

Current trends in the Blockchain-AI market include the rising utilization of smart contracts across various sectors, enhanced data security measures, and advancements in AI-powered analytics that streamline operations and improve client interactions.