Blockchain As A Service Market Report

Published Date: 31 January 2026 | Report Code: blockchain-as-a-service

Blockchain As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Blockchain as a Service market, examining key trends, insights, and forecasts for the period of 2023 to 2033, including market size, growth potential, segmentation, and key players.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

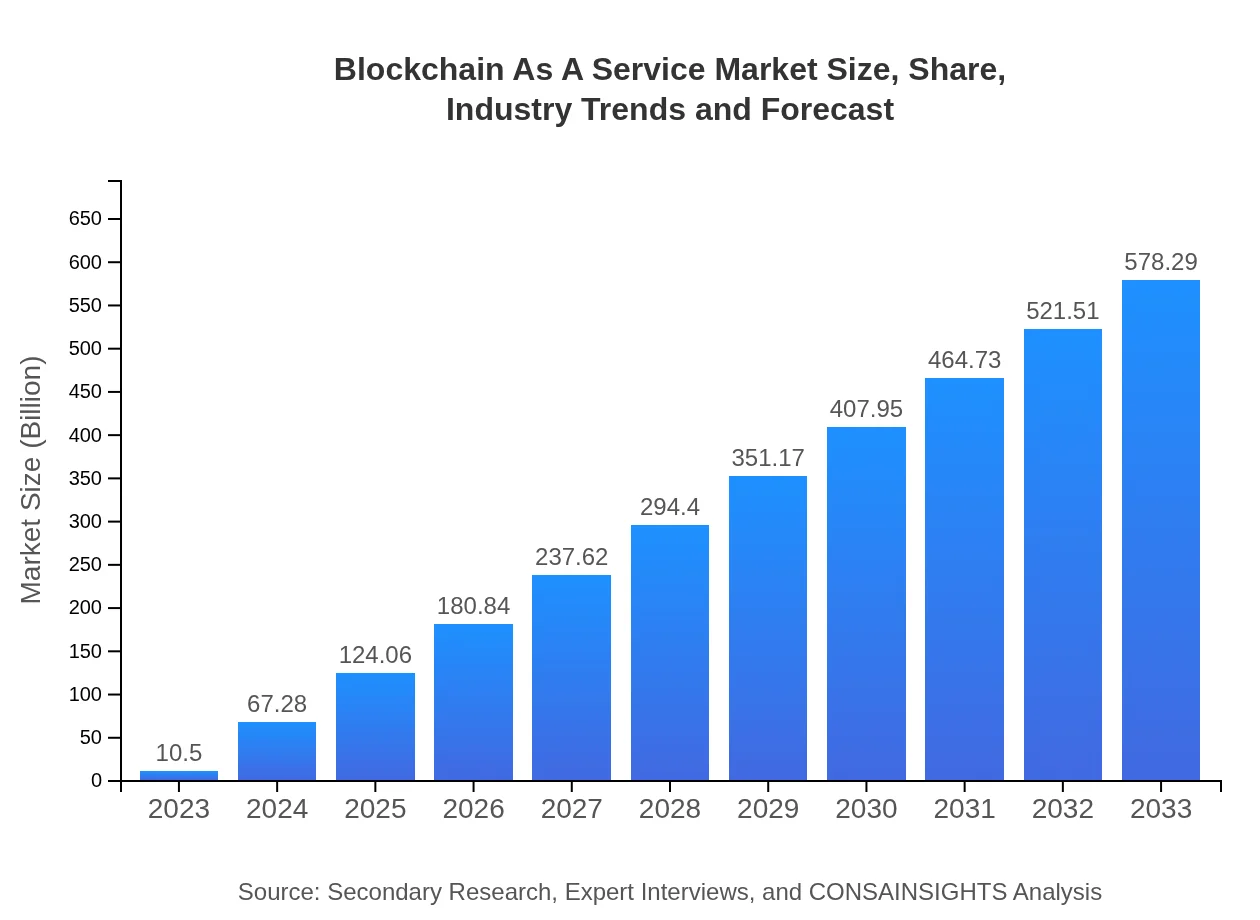

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 45.2% |

| 2033 Market Size | $578.29 Billion |

| Top Companies | IBM, Microsoft, Amazon Web Services (AWS), Oracle |

| Last Modified Date | 31 January 2026 |

Blockchain As A Service Market Overview

Customize Blockchain As A Service Market Report market research report

- ✔ Get in-depth analysis of Blockchain As A Service market size, growth, and forecasts.

- ✔ Understand Blockchain As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain As A Service

What is the Market Size & CAGR of Blockchain As A Service market in 2023?

Blockchain As A Service Industry Analysis

Blockchain As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blockchain As A Service Market Analysis Report by Region

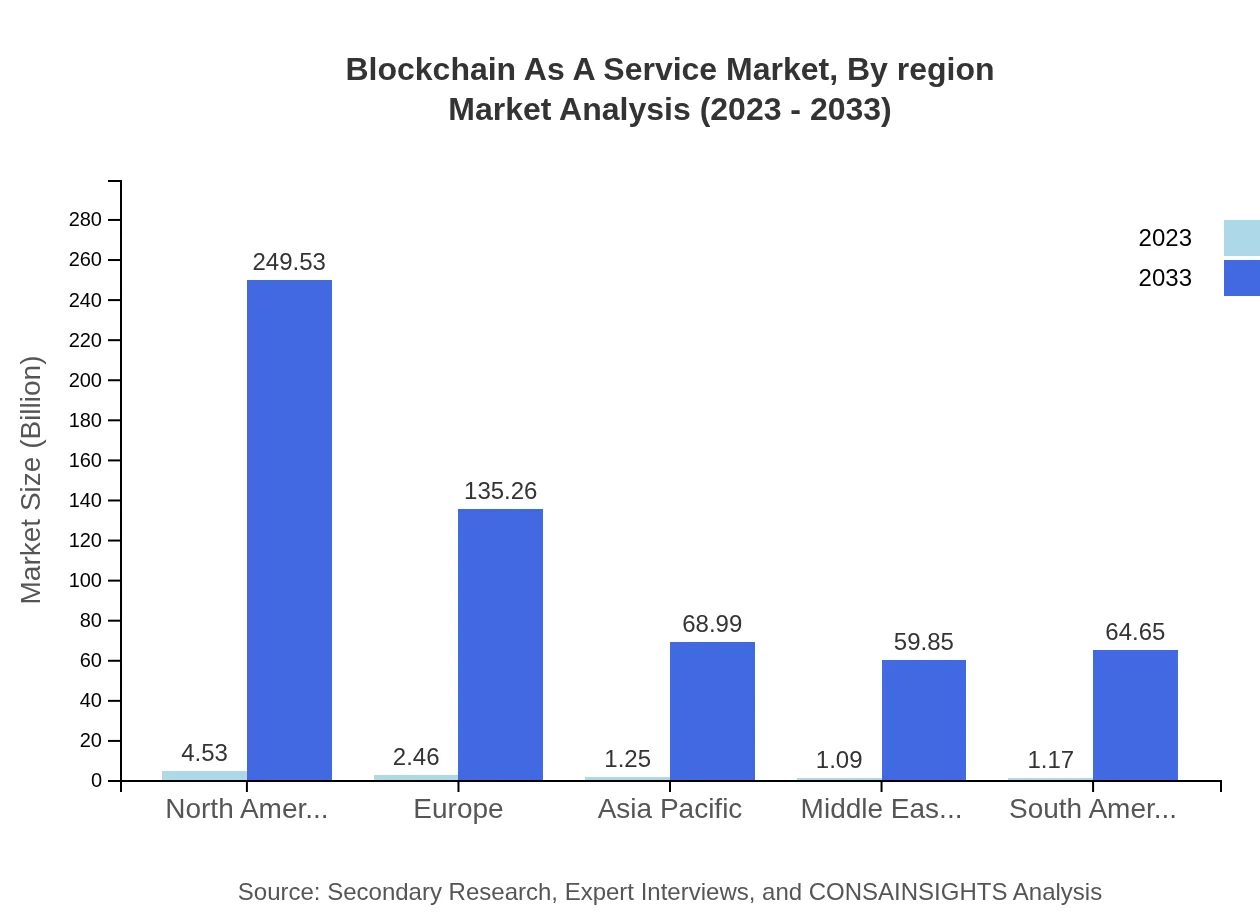

Europe Blockchain As A Service Market Report:

In Europe, the market is projected to grow from $3.51 billion in 2023 to $193.15 billion by 2033. European countries are actively exploring blockchain technology for applications in fintech, identity management, and supply chain transparency to comply with strict regulations and enhance operational efficiency.Asia Pacific Blockchain As A Service Market Report:

In 2023, the Asia Pacific BaaS market is valued at $1.98 billion, with projections of reaching $108.89 billion by 2033, driven by a surge in digital transformation initiatives across countries like China and India. The growing number of startups in the region is fostering innovation, while government initiatives for adopting blockchain in various applications further propel market growth.North America Blockchain As A Service Market Report:

North America, particularly the United States, remains a significant contributor to the BaaS market, estimated at $3.61 billion in 2023, with an expected rise to $198.99 billion by 2033. The region benefits from strong investment in technology, prominent tech companies offering BaaS solutions, and a highly developed digital economy.South America Blockchain As A Service Market Report:

The South American BaaS market is anticipated to grow from $0.64 billion in 2023 to $35.22 billion by 2033. This region is witnessing increased interest in blockchain from sectors such as agriculture, healthcare, and logistics as enterprises seek to enhance transparency and efficiency. The regulatory environment is also evolving, facilitating broader adoption of blockchain solutions.Middle East & Africa Blockchain As A Service Market Report:

The Middle East and Africa market is currently valued at $0.76 billion in 2023, expected to increase to $42.04 billion by 2033. Countries in this region are starting to invest in blockchain technologies to improve transparency in public services and enhance the efficiency of their financial systems.Tell us your focus area and get a customized research report.

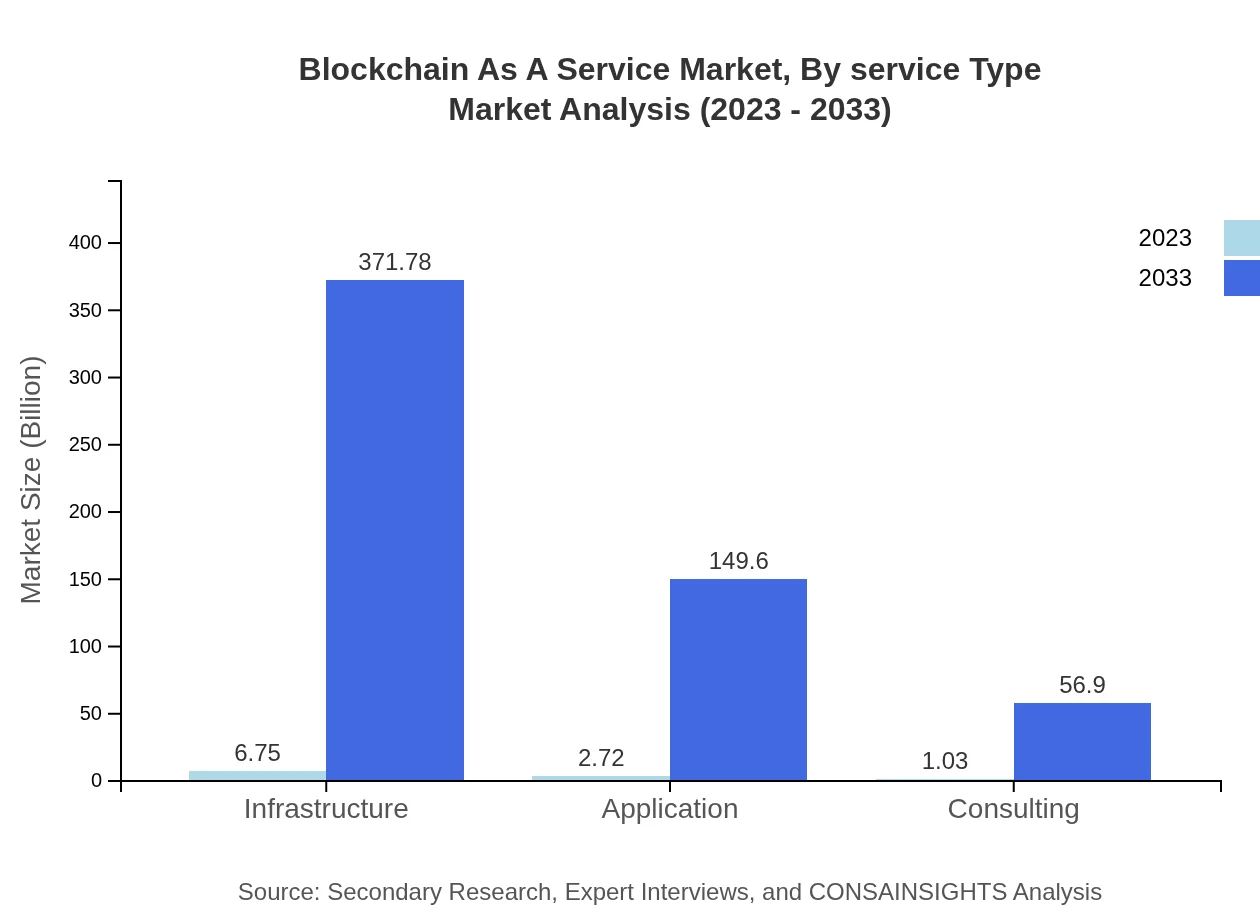

Blockchain As A Service Market Analysis By Service Type

The service type segment of the BaaS market includes Infrastructure as a Service (IaaS), Application as a Service (AaaS), and consulting services. IaaS is currently leading, accounting for a significant share due to the high demand for reliable and scalable infrastructure. AaaS is also gaining traction as organizations look to develop customized applications rapidly. Consulting services are critical for guiding organizations through blockchain integration and adoption challenges.

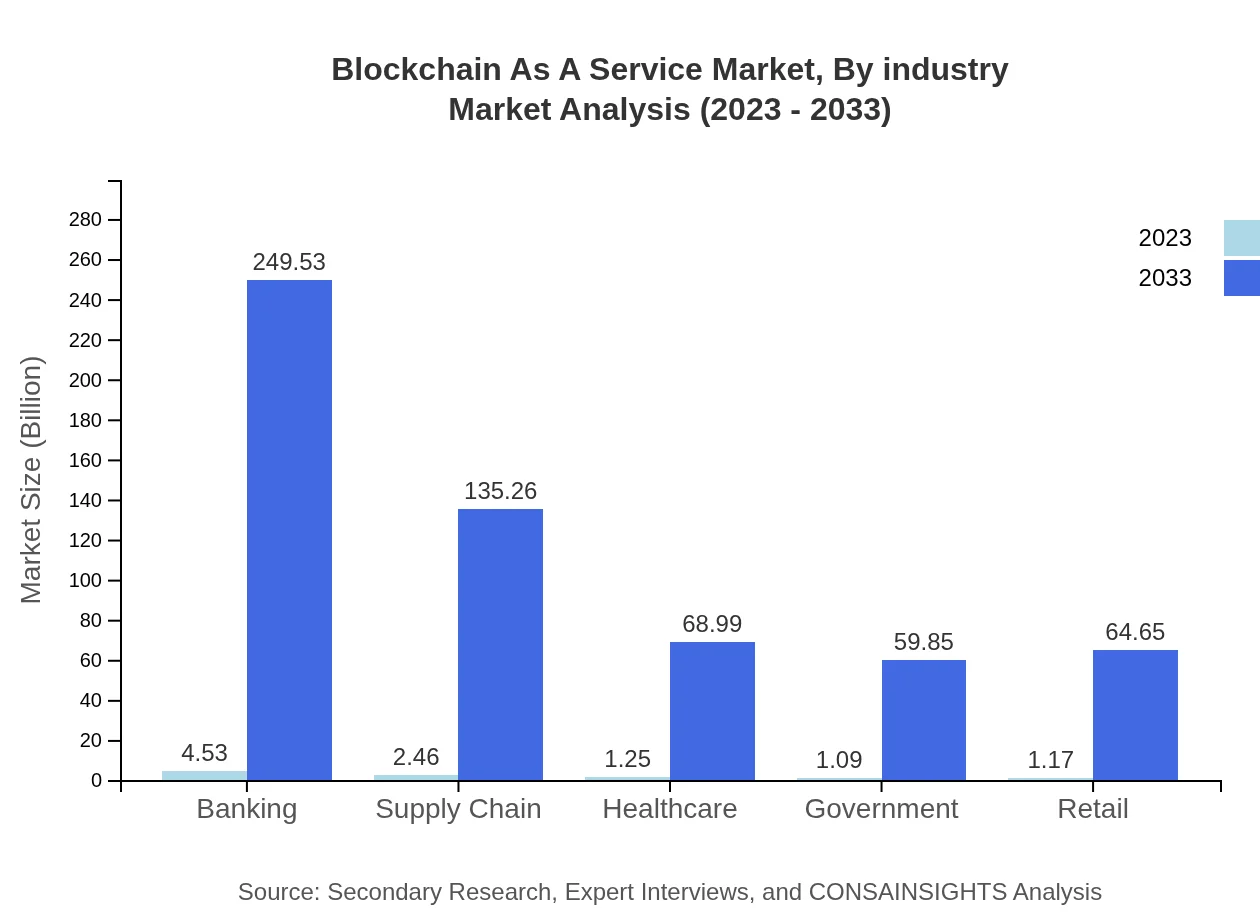

Blockchain As A Service Market Analysis By Industry

The primary industries leveraging BaaS include banking, supply chain, healthcare, government, and retail. Banking dominates the market owing to its continual efforts to enhance security and streamline transactions with blockchain technology, representing 43.15% in 2023. Supply chain and healthcare sectors are progressively adopting BaaS for improving traceability and efficiency in operations.

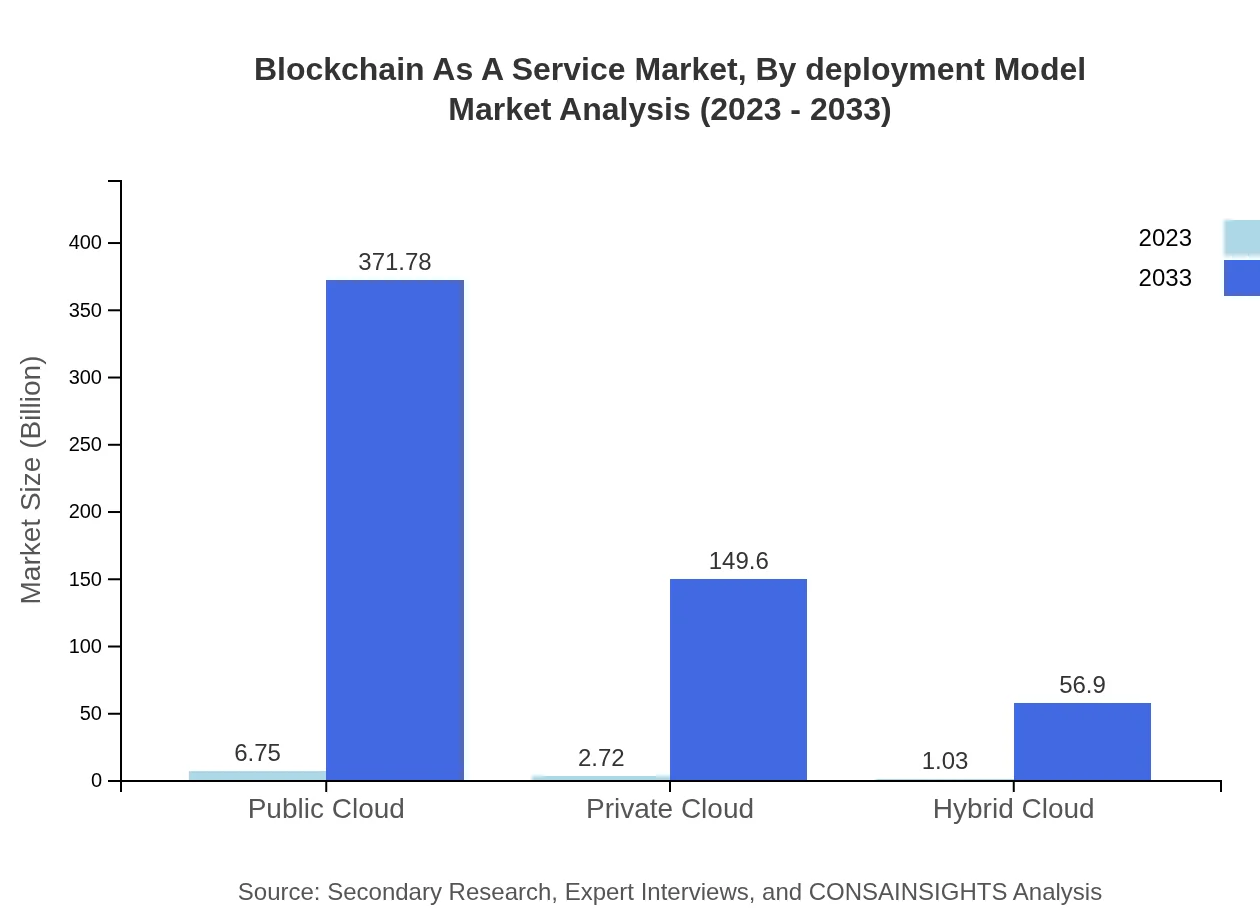

Blockchain As A Service Market Analysis By Deployment Model

The deployment model segment includes public, private, and hybrid clouds. The public cloud segment exhibits the largest market share due to its lower costs and broad accessibility. Private cloud deployments are preferred by many enterprises for enhanced security, while hybrid cloud solutions offer a blend of scalability and security suitable for diverse needs across organizations.

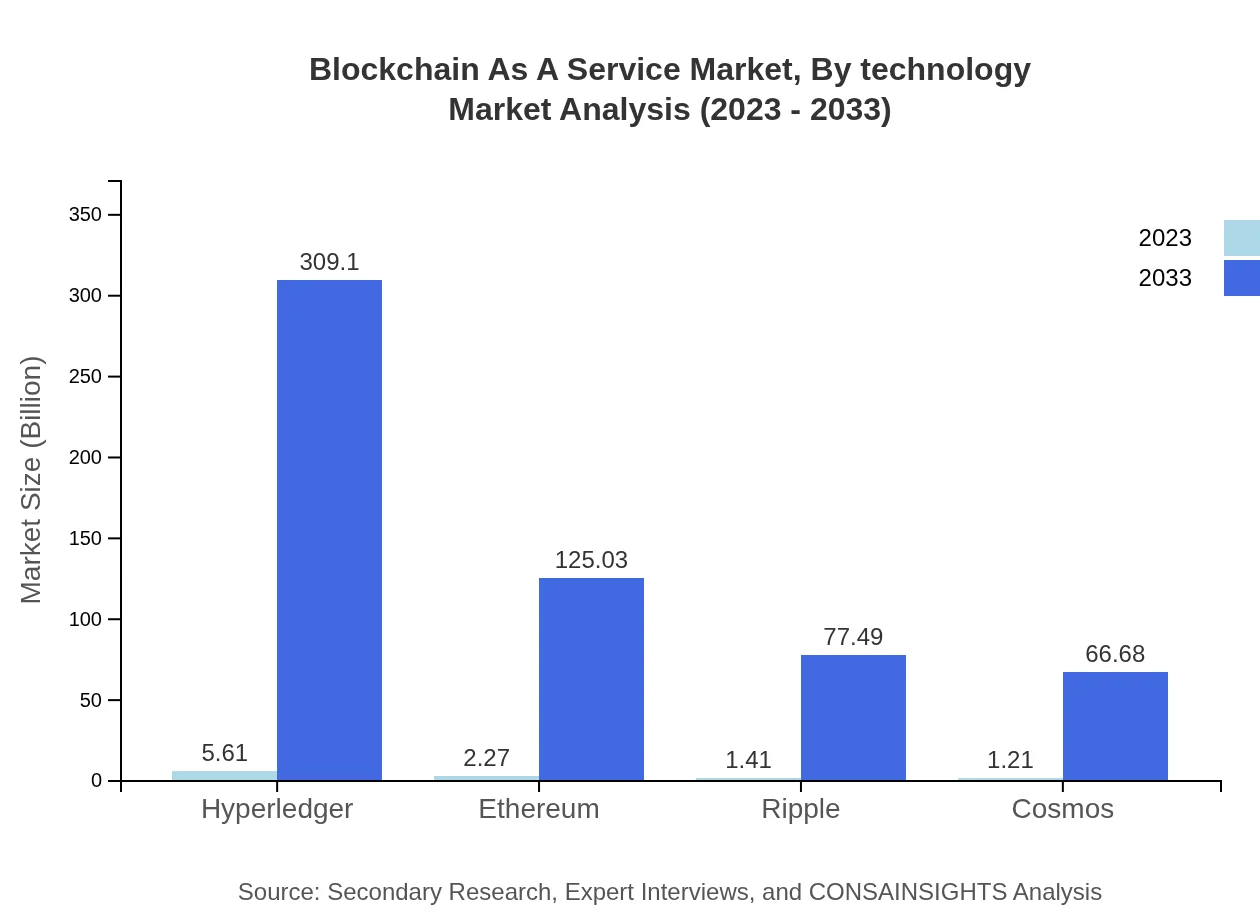

Blockchain As A Service Market Analysis By Technology

In terms of technology, platforms such as Ethereum, Hyperledger, and Ripple are at the forefront. Hyperledger accounts for 53.45% of the market in 2023, favored for enterprise solutions. Ethereum follows as a popular public blockchain supporting decentralized applications, while Ripple is recognized for its robust financial transaction capabilities, each exhibiting significant growth potential over the forecast period.

Blockchain As A Service Market Analysis By Region

Regional segmentation provides insights into unique drivers and trends influencing the BaaS market dynamics in different areas. North America commands a significant position due to its investment in technology. Europe is accelerating blockchain adoption through regulatory initiatives, while the Asia Pacific is rapidly growing due to increasing digital transformation efforts. Understanding these regional nuances is crucial for stakeholders to devise effective strategies.

Blockchain As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain As A Service Industry

IBM:

IBM leads the BaaS market, providing robust solutions for various industries, highlighting its capabilities in enterprise blockchain applications through IBM Blockchain.Microsoft:

Microsoft Azure Blockchain Service facilitates organizations in building blockchain networks, providing essential tools for blockchain application development and management.Amazon Web Services (AWS):

AWS offers Blockchain as a Service, enabling users to build and manage blockchain networks with enterprise-grade capabilities and services.Oracle:

Oracle’s Blockchain Cloud Service addresses enterprise blockchain needs, offering tools for comprehensive governance, security, and scalability.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain As A Service?

The global blockchain-as-a-service market is projected to reach approximately $10.5 billion by 2033, growing at a remarkable CAGR of 45.2% from its current valuation in 2023.

What are the key market players or companies in this blockchain As A Service industry?

Key players in the blockchain-as-a-service market include major technology giants such as Microsoft, IBM, Amazon Web Services, and Oracle that are leading innovations and capturing significant market share in this rapidly evolving sector.

What are the primary factors driving the growth in the blockchain As A Service industry?

Key drivers for growth in this industry include increased demand for decentralized applications, rising need for enhanced security measures in data transactions, and the growing adoption of blockchain technology across various sectors like finance, healthcare, and supply chain management.

Which region is the fastest Growing in the blockchain As A Service?

The fastest-growing region for blockchain-as-a-service is North America, with a projected market size increase from $3.61 billion in 2023 to $198.99 billion by 2033, driven by early adoption and strong technological infrastructure.

Does ConsInsights provide customized market report data for the blockchain As A Service industry?

Yes, ConsInsights offers customized market research reports tailored to specific needs in the blockchain-as-a-service sector, ensuring businesses receive relevant insights and data to guide strategic decisions.

What deliverables can I expect from this blockchain As A Service market research project?

Deliverables from this market research project typically include comprehensive reports, data analytics, market trends, competitive analysis, and strategic recommendations to aid stakeholders in making informed business decisions.

What are the market trends of blockchain As A Service?

Market trends in blockchain-as-a-service indicate a shift towards greater integration of AI and blockchain technologies, an increase in collaborations among tech firms, and a growing interest in hybrid blockchain solutions from businesses seeking scalability and efficiency.