Blockchain Devices Market Report

Published Date: 31 January 2026 | Report Code: blockchain-devices

Blockchain Devices Market Size, Share, Industry Trends and Forecast to 2033

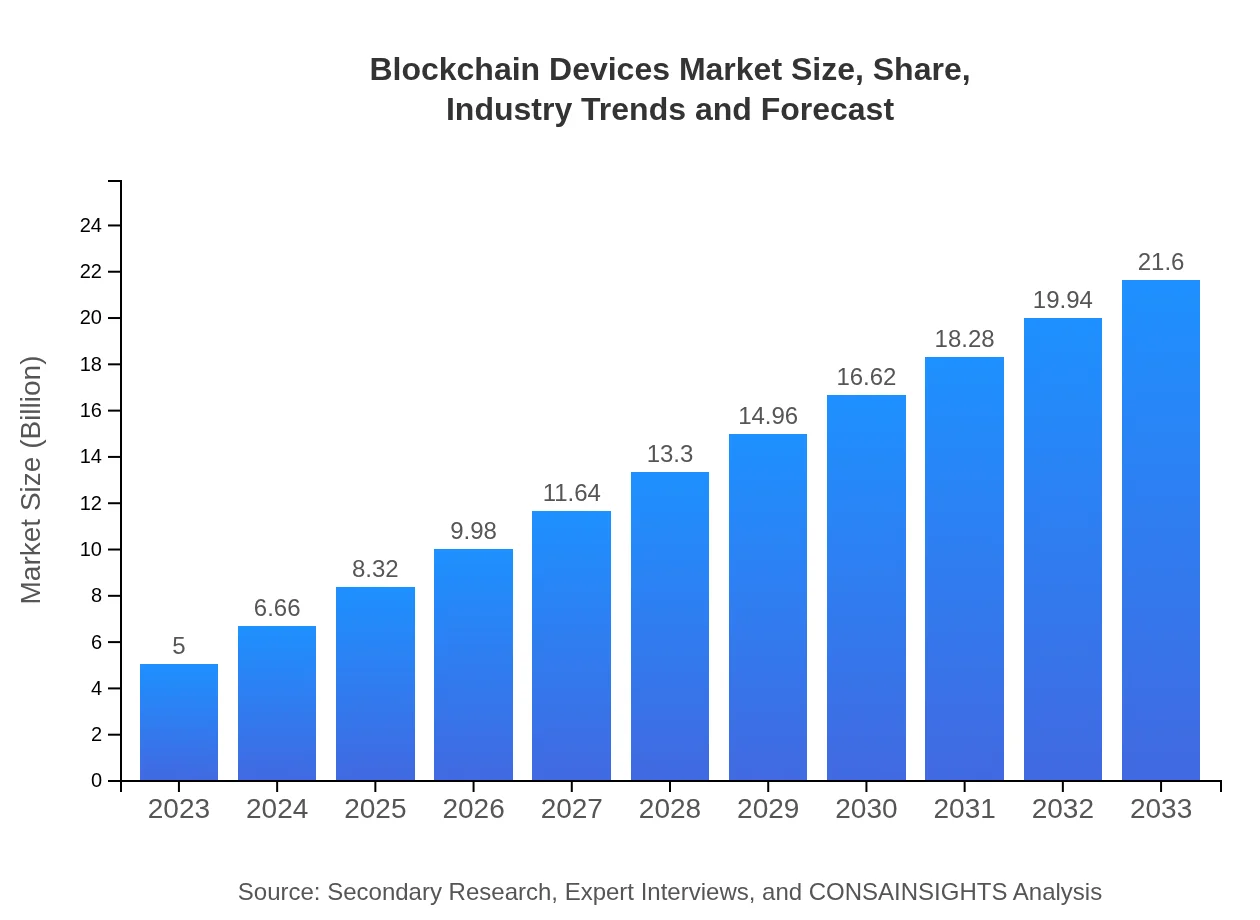

This report explores the Blockchain Devices market, focusing on its growth from 2023 to 2033. Insights into market trends, segment performance, and forecasts highlight key opportunities and challenges in this evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 15% |

| 2033 Market Size | $21.60 Billion |

| Top Companies | IBM, Ledger, Ripple Labs, Coinbase |

| Last Modified Date | 31 January 2026 |

Blockchain Devices Market Overview

Customize Blockchain Devices Market Report market research report

- ✔ Get in-depth analysis of Blockchain Devices market size, growth, and forecasts.

- ✔ Understand Blockchain Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain Devices

What is the Market Size & CAGR of Blockchain Devices market in 2033?

Blockchain Devices Industry Analysis

Blockchain Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blockchain Devices Market Analysis Report by Region

Europe Blockchain Devices Market Report:

Europe's market is projected to grow from USD 1.23 billion in 2023 to USD 5.30 billion in 2033, driven by increasing regulatory clarity, digital transformation initiatives, and a focus on sustainable energy solutions in blockchain devices.Asia Pacific Blockchain Devices Market Report:

In the Asia Pacific region, the Blockchain Devices market is predicted to grow from USD 1.07 billion in 2023 to USD 4.64 billion by 2033. Influenced by countries like China and India that are investing heavily in blockchain technology, the region is seeing substantial advancements in fintech innovations and large-scale blockchain applications.North America Blockchain Devices Market Report:

North America, comprising the largest share of the Blockchain Devices market, will see growth from USD 1.90 billion in 2023 to USD 8.20 billion by 2033 as organizations adopt blockchain for security and operational efficiency, supported by strong regulatory backing and technological partnerships.South America Blockchain Devices Market Report:

South America is expected to experience significant growth, with the market increasing from USD 0.40 billion in 2023 to USD 1.74 billion by 2033. Factors contributing to this growth include the rise of financial inclusion initiatives that utilize blockchain technology to enhance access to banking services.Middle East & Africa Blockchain Devices Market Report:

The market in the Middle East and Africa is expected to show steady growth from USD 0.40 billion in 2023 to USD 1.72 billion by 2033. The burgeoning interest in cryptocurrency and government initiatives to implement blockchain solutions for transparency and efficiency will serve as crucial growth drivers.Tell us your focus area and get a customized research report.

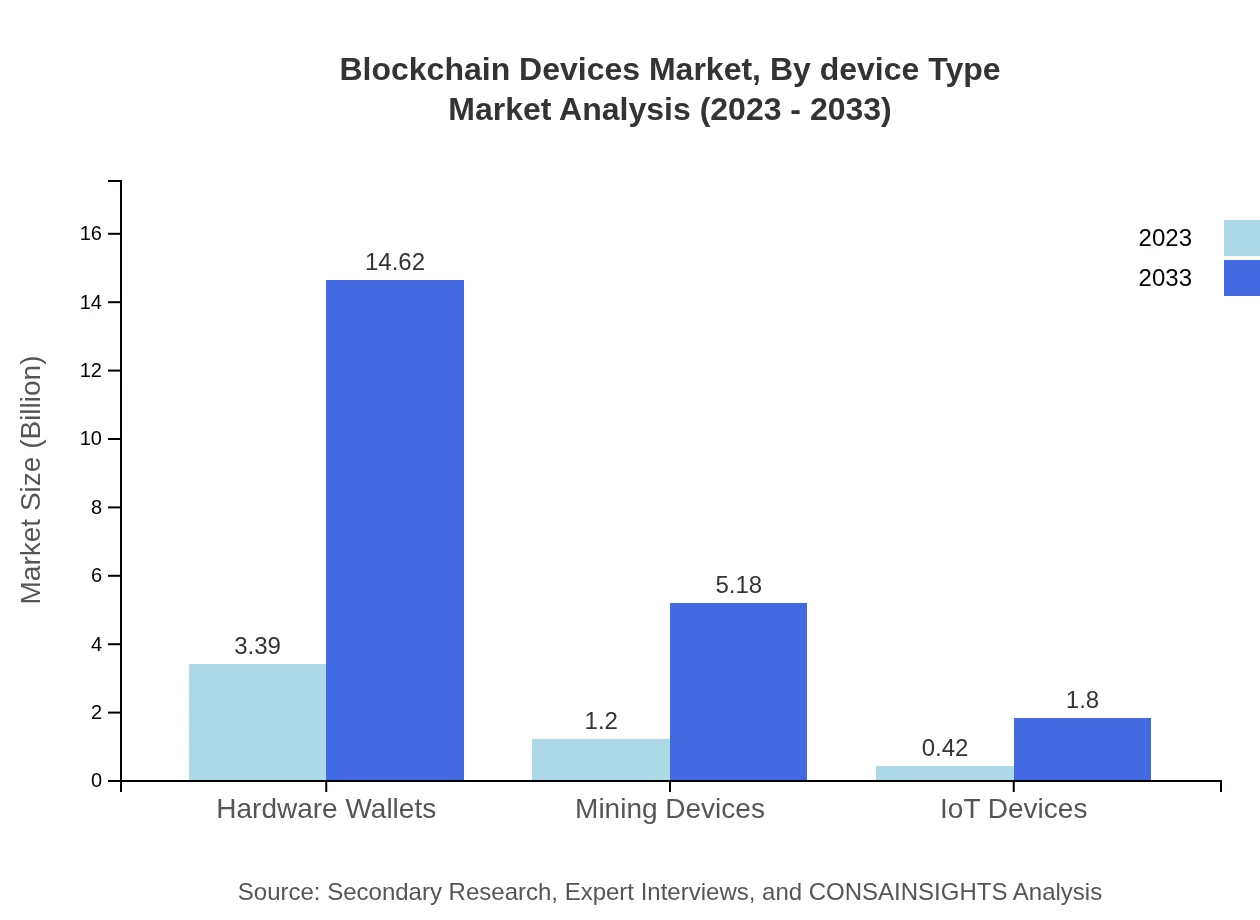

Blockchain Devices Market Analysis By Device Type

The Blockchain Devices market is significantly influenced by device types such as public and private blockchains, hardware wallets, mining devices, and IoT devices. The public blockchain segment dominates the market size, expected to grow from USD 3.39 billion in 2023 to USD 14.62 billion by 2033, maintaining its position due to widespread adoption in cryptocurrency transactions.

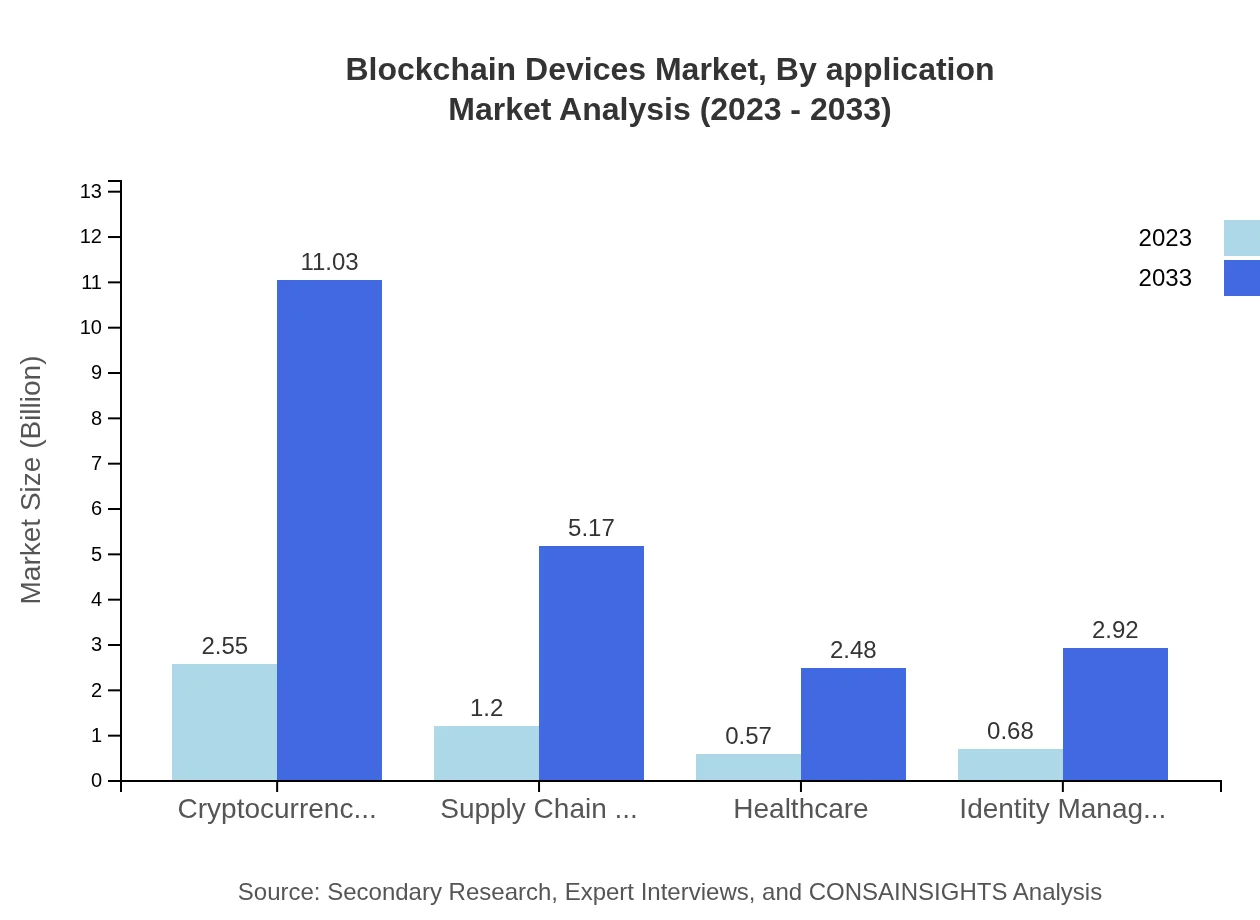

Blockchain Devices Market Analysis By Application

The applications of Blockchain Devices are vast, spanning cryptocurrency transactions, supply chain management, healthcare, and identity management. The cryptocurrency transactions application is particularly prominent, projected to rise from USD 2.55 billion in 2023 to USD 11.03 billion by 2033, driven by the growing acceptance of digital currencies.

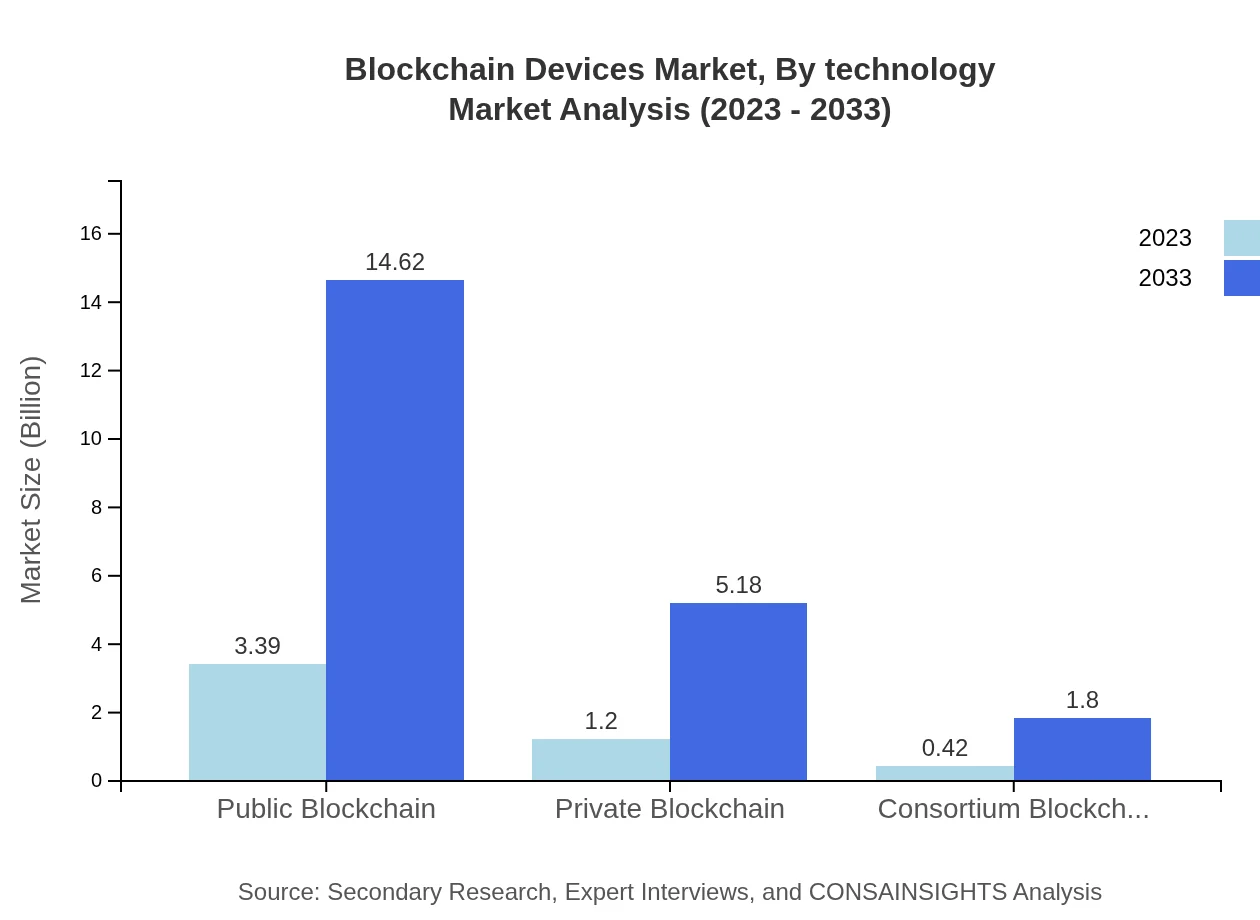

Blockchain Devices Market Analysis By Technology

Technological advancements in blockchain including the emergence of smart contracts, decentralized finance applications, and improved security protocols are shaping the Blockchain Devices market. Innovations in connectivity, such as interoperability solutions, are enhancing functionality and efficiency within blockchain systems.

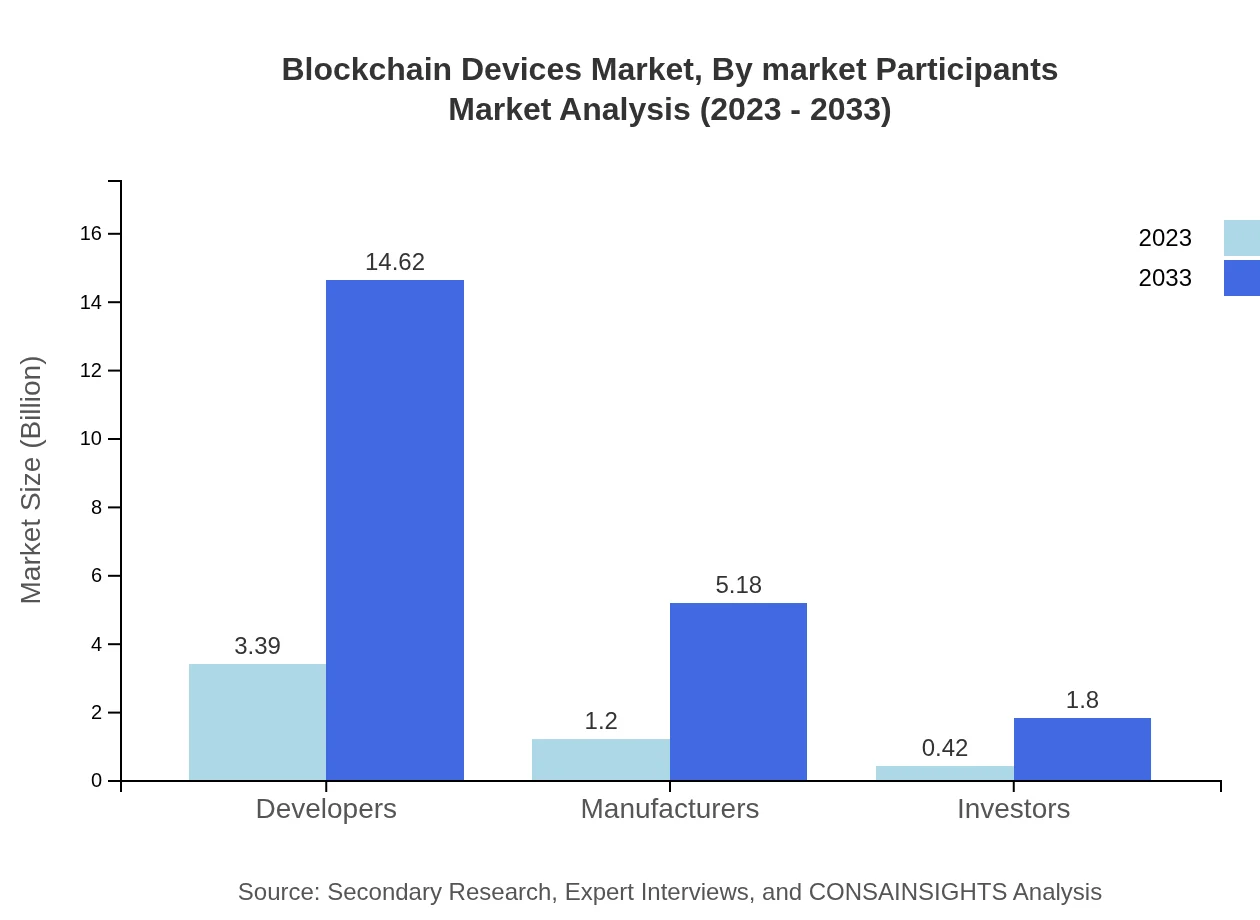

Blockchain Devices Market Analysis By Market Participants

The market participants playing a role in the Blockchain Devices landscape include manufacturers, developers, and investors. Each group contributes uniquely to development, with manufacturers focused on producing secure and reliable devices, developers working on software solutions, and investors driving financial support.

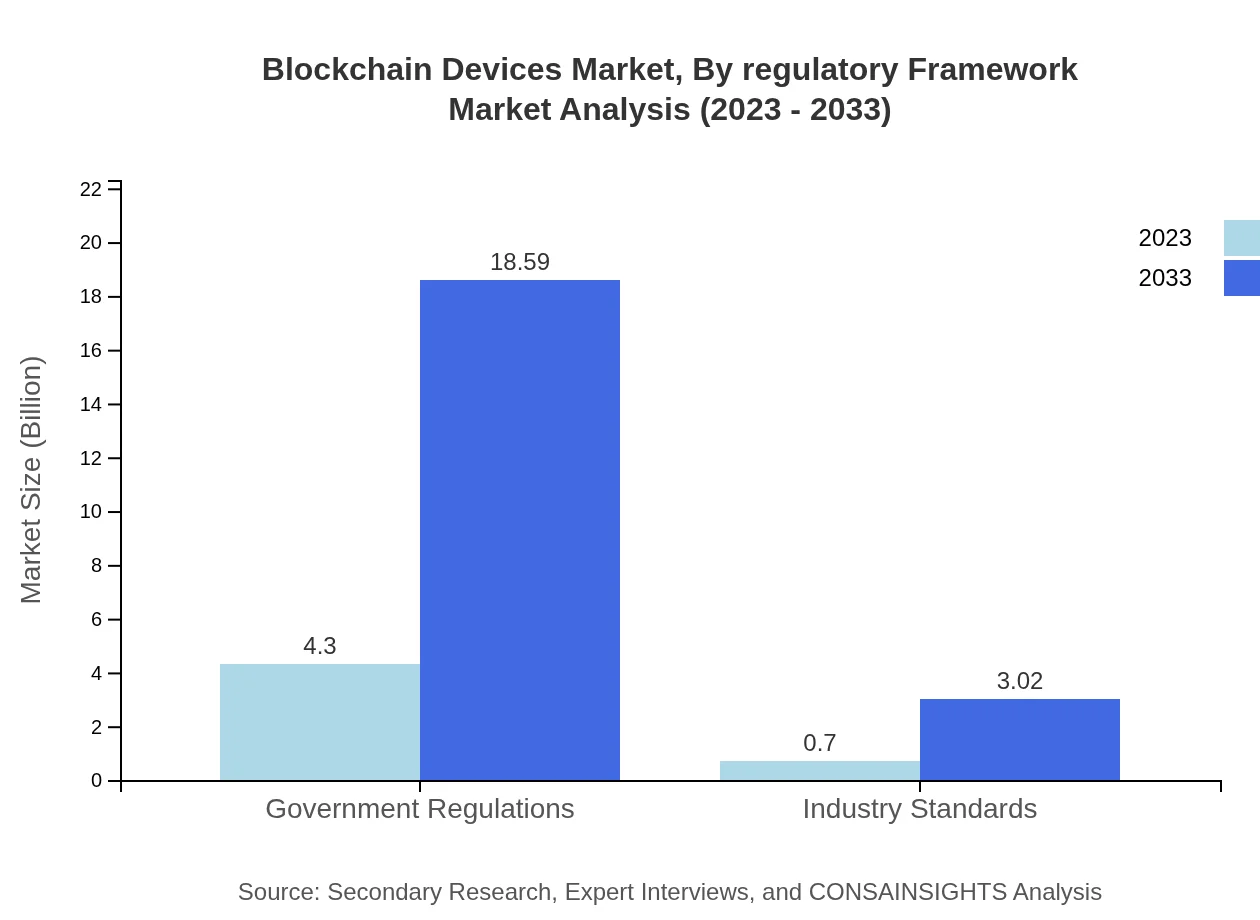

Blockchain Devices Market Analysis By Regulatory Framework

Regulatory frameworks are becoming increasingly vital in ensuring the legitimacy and smooth operation of the Blockchain Devices market. Government regulations are projected to rise from USD 4.30 billion in 2023 to USD 18.59 billion by 2033 as authorities establish formal guidelines to protect consumers and foster innovation.

Blockchain Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain Devices Industry

IBM:

A leader in blockchain technology, IBM offers various blockchain solutions to enhance transparency and security in businesses, along with hardware solutions like IBM Blockchain Platform.Ledger:

Known for its hardware wallets, Ledger provides secure solutions for cryptocurrencies, catering to a broad audience from individual users to enterprises.Ripple Labs:

Ripple focuses on blockchain solutions for cross-border payments, providing technology that enhances transaction speed and security.Coinbase :

As one of the largest cryptocurrency exchanges, Coinbase also develops blockchain technologies, contributing to the growth and adoption of digital currencies.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain devices?

The market size for blockchain devices stands at approximately $5 billion in 2023, with a projected CAGR of 15% leading up to 2033, indicating substantial growth in this sector over the coming decade.

What are the key market players or companies in the blockchain devices industry?

Key players in the blockchain devices market include companies specializing in hardware wallets, manufacturing devices for mining, and developing IoT solutions, all contributing to the overall ecosystem and technological advancements.

What are the primary factors driving the growth in the blockchain devices industry?

Driving factors include the rise in cryptocurrency usage, increased demand for secure transactions, advancements in IoT technology, and supportive government regulations fostering blockchain integration across various industries.

Which region is the fastest Growing in the blockchain devices market?

North America is the fastest-growing region in the blockchain devices sector, projected to grow from $1.90 billion in 2023 to $8.20 billion by 2033, reflecting robust investment and innovation in this area.

Does Consainsights provide customized market report data for the blockchain devices industry?

Yes, Consainsights offers customized market reports tailored to specific interests and needs in the blockchain devices industry, delivering nuanced analysis and insights to support strategic decision-making.

What deliverables can I expect from this blockchain devices market research project?

Deliverables typically include comprehensive industry reports, market size analysis, growth trend forecasts, competitor landscape assessments, and segmentation insights, ensuring a well-rounded understanding of market dynamics.

What are the market trends of blockchain devices?

Current trends in the blockchain devices market include growing adoption of public blockchains, rising investment in security-focused hardware, and an increased focus on regulatory compliance as businesses seek to leverage blockchain technology.