Blockchain In Energy Market Report

Published Date: 31 January 2026 | Report Code: blockchain-in-energy

Blockchain In Energy Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Blockchain in Energy market from 2023 to 2033, offering insights on market size, trends, regional breakdowns, and technological advancements shaping the industry.

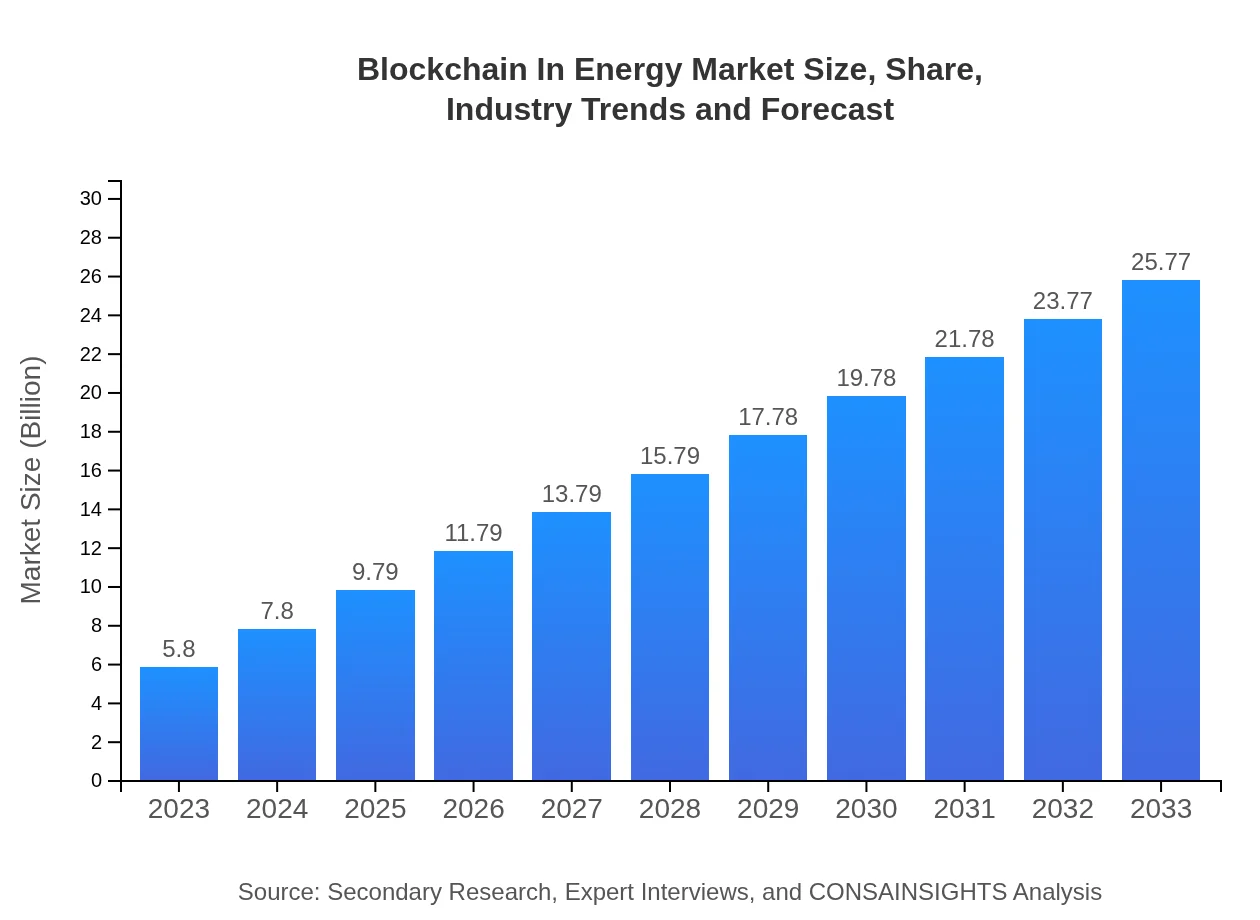

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 15.3% |

| 2033 Market Size | $25.77 Billion |

| Top Companies | IBM Blockchain, Power Ledger, VeChain, Energi Mine |

| Last Modified Date | 31 January 2026 |

Blockchain In Energy Market Overview

Customize Blockchain In Energy Market Report market research report

- ✔ Get in-depth analysis of Blockchain In Energy market size, growth, and forecasts.

- ✔ Understand Blockchain In Energy's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain In Energy

What is the Market Size & CAGR of Blockchain In Energy market in 2023-2033?

Blockchain In Energy Industry Analysis

Blockchain In Energy Market Segmentation and Scope

Tell us your focus area and get a customized research report.

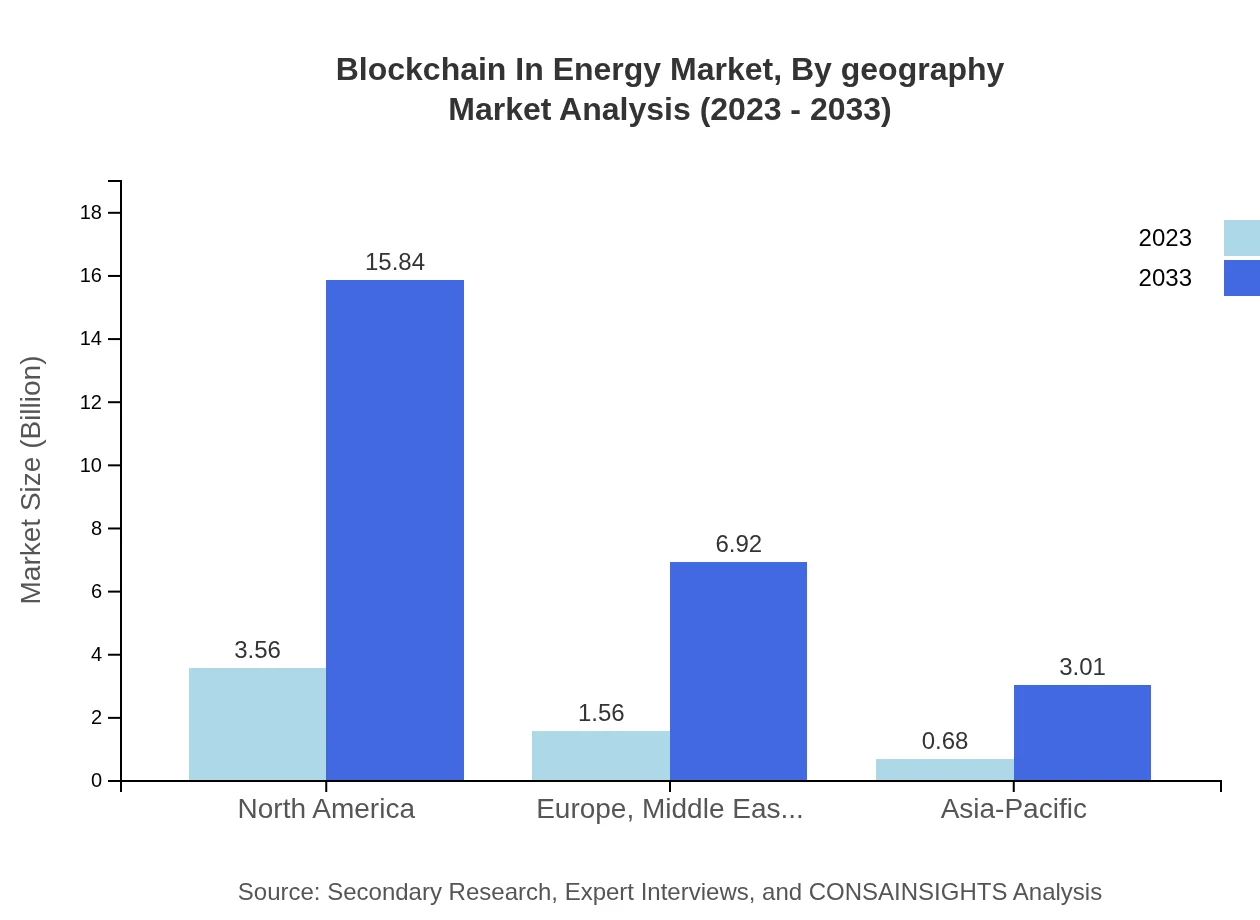

Blockchain In Energy Market Analysis Report by Region

Europe Blockchain In Energy Market Report:

Europe's market is anticipated to rise from $1.91 billion in 2023 to $8.47 billion in 2033. Stringent regulatory frameworks favoring green energy alongside a strong push towards digitalization in the power sector are contributing factors.Asia Pacific Blockchain In Energy Market Report:

The Asia-Pacific region is poised for substantial growth, with the market expected to grow from $1.05 billion in 2023 to $4.68 billion in 2033. Governments are emphasizing the adoption of renewable energy solutions and promoting blockchain for improving energy efficiency.North America Blockchain In Energy Market Report:

North America leads the market, projected to grow from $2.11 billion in 2023 to $9.36 billion by 2033. The presence of established energy companies and a robust technological landscape underpin this growth, bolstered by innovations in energy trading via blockchain.South America Blockchain In Energy Market Report:

In South America, the Blockchain in Energy market is expected to increase from $0.16 billion in 2023 to $0.71 billion by 2033. Increasing investment in renewable energy and regulatory support are significant factors driving market growth.Middle East & Africa Blockchain In Energy Market Report:

The Middle East and Africa market is projected to expand from $0.57 billion in 2023 to $2.55 billion by 2033, driven by increasing investments in energy infrastructure and the adoption of decentralized energy models.Tell us your focus area and get a customized research report.

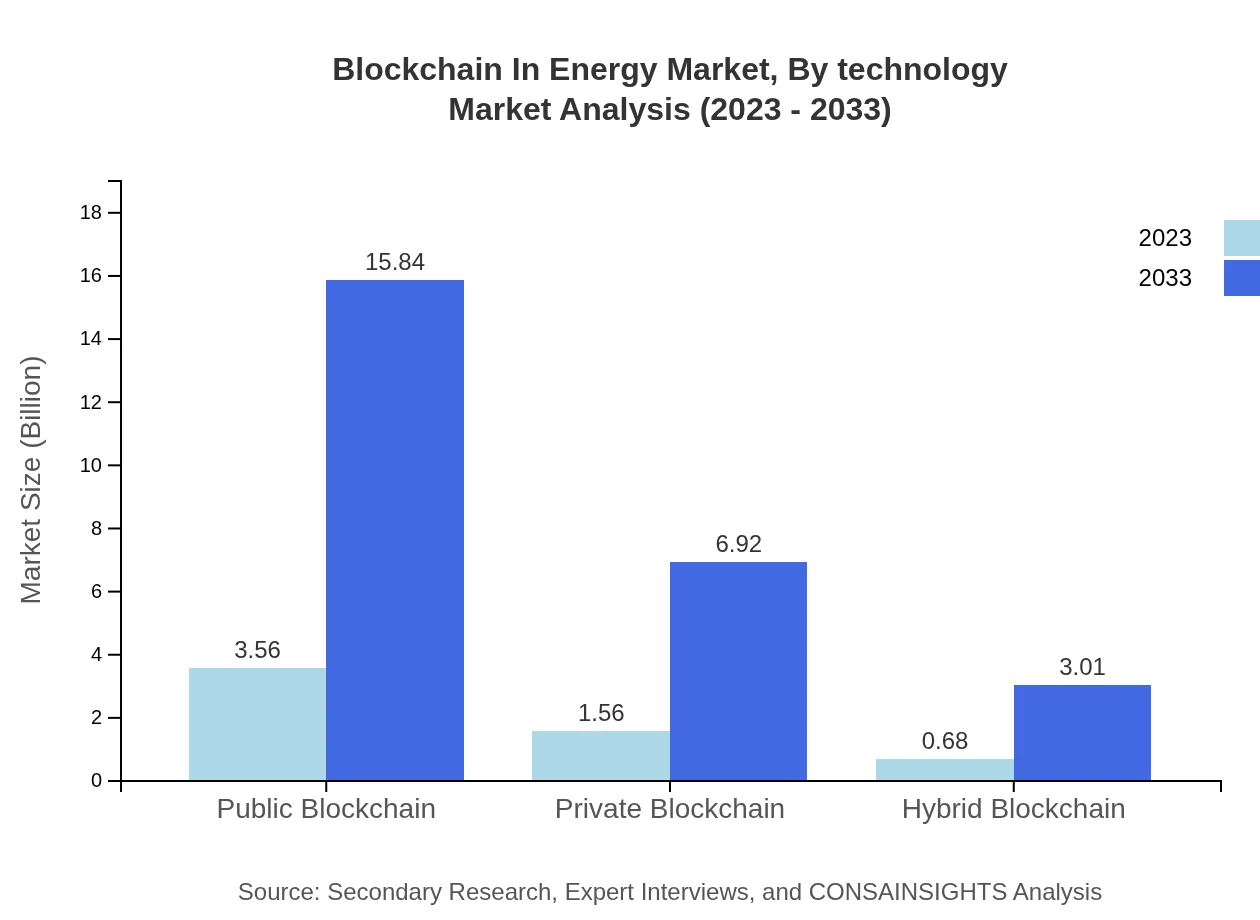

Blockchain In Energy Market Analysis By Technology

The technology segment of Blockchain in Energy comprises public blockchain, private blockchain, and hybrid blockchain applications. Public blockchain leads the share with an aggregate market representation of about 61.46% in 2023, driven by innovations in transparency and security for transactions. Private blockchains constitute around 26.86% and cater primarily to utilities with stringent regulations. The hybrid blockchains offer the flexibility of both public and private solutions, representing an emerging preference in the market.

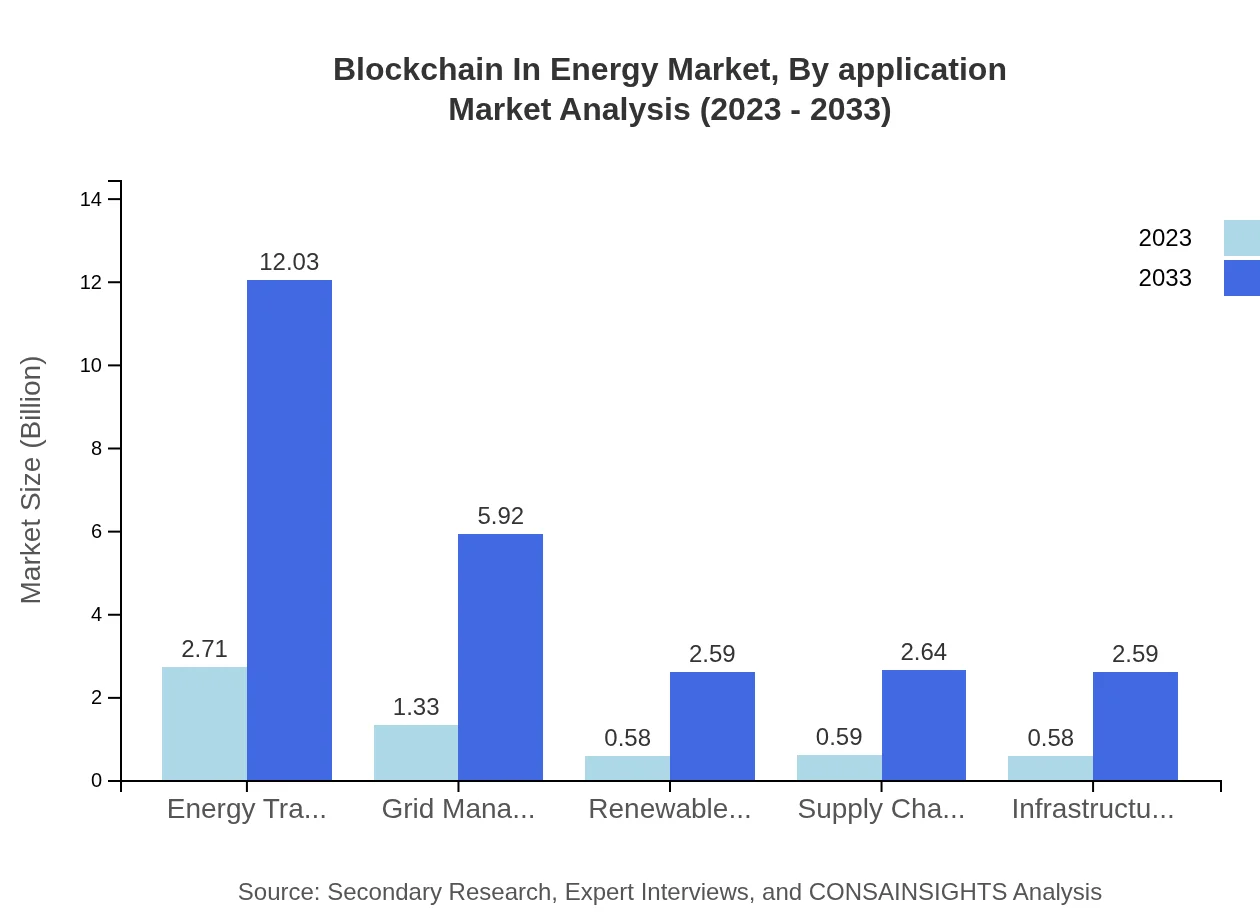

Blockchain In Energy Market Analysis By Application

Key applications under the Blockchain in Energy market include energy trading, grid management, supply chain, and renewable energy certificates. Energy trading dominates with a market size of $2.71 billion in 2023, indicating its importance in facilitating real-time energy transactions. Grid management and renewable energy certificates are also critical, supporting the growth of decentralized energy systems across various regions.

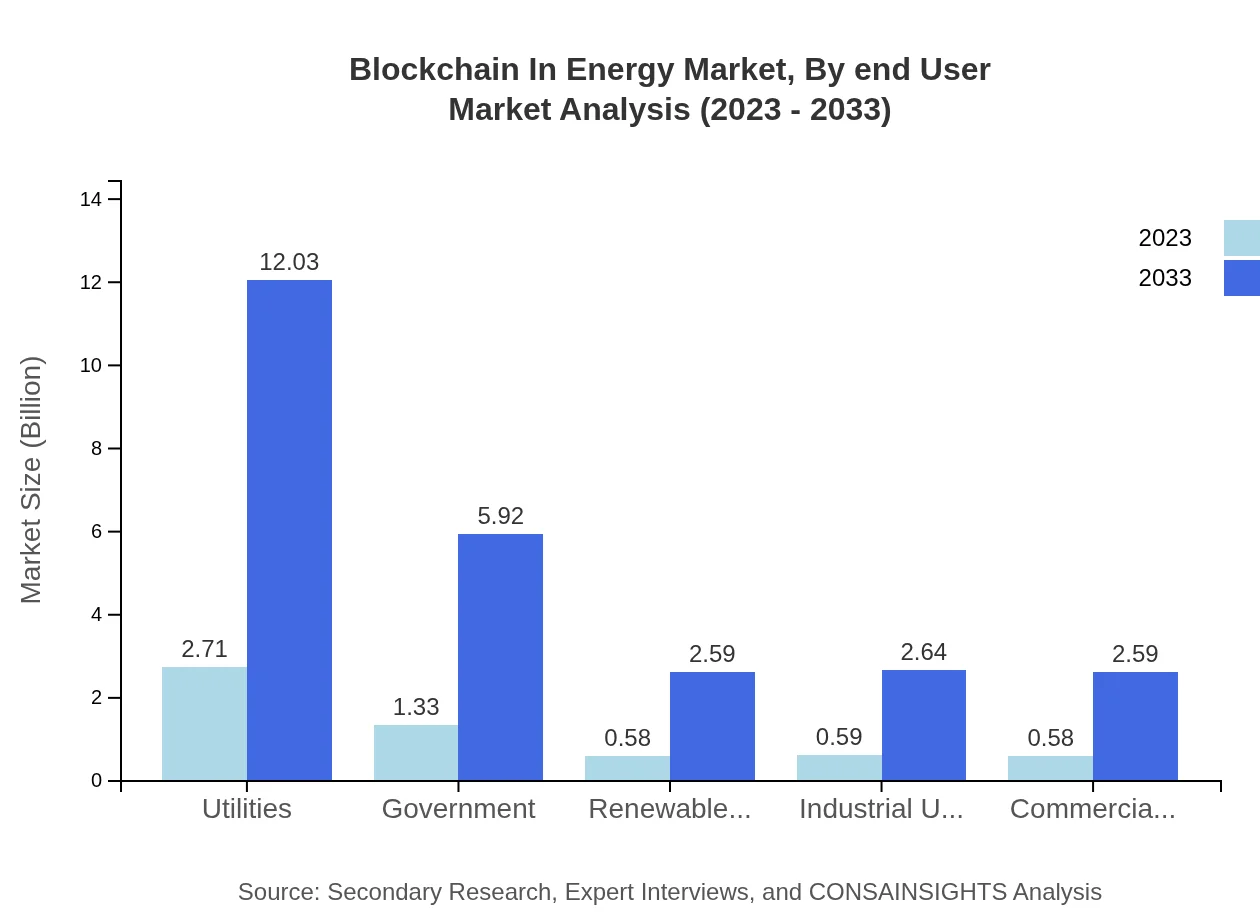

Blockchain In Energy Market Analysis By End User

End-users of blockchain in energy encompass utilities, government entities, renewable energy companies, industrial users, and commercial consumers. Utilities significantly hold market shares, accounting for 46.69% in 2023 due to their iterative adaptation of blockchain for operational efficiency. Government participation is also vital, representing policy frameworks that support the integration of blockchain technology within the energy sector.

Blockchain In Energy Market Analysis By Geography

Geographically, North America remains the largest market, expected to maintain its share of approximately 61.46% throughout the forecast period. Europe follows closely, given its robust regulatory support for renewable technologies and digital transformation in energy systems. Asia-Pacific, while currently smaller, exhibits rapid growth potential with projected increases in clean energy investments and blockchain applications in energy trading and management.

Blockchain In Energy Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain In Energy Industry

IBM Blockchain:

IBM Blockchain is a leader in blockchain technology, providing solutions for energy trading platforms that enhance transparency and boost efficiency for energy transactions.Power Ledger:

Power Ledger offers a decentralized energy trading platform powered by blockchain, enabling peer-to-peer energy transactions and facilitating renewable energy exchanges.VeChain:

VeChain utilizes blockchain technology to enhance supply chain management in the energy sector, focusing on increasing transparency and minimizing fraud.Energi Mine:

Energi Mine pioneers in blockchain-based energy trading and rewards systems, promoting the adoption of renewable energy practices among consumers.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain In Energy?

The blockchain in energy market reached a size of approximately $5.8 billion in 2023, with an expected compound annual growth rate (CAGR) of 15.3% over the next 10 years, indicating significant growth potential.

What are the key market players or companies in the blockchain In Energy industry?

Key players in the blockchain in energy market include major tech companies and startups specializing in distributed ledger technology, such as IBM, Accenture, and various renewable energy firms that leverage blockchain for energy trading and management.

What are the primary factors driving the growth in the blockchain In Energy industry?

Growth in the blockchain in energy sector is primarily driven by the increasing demand for transparency in energy transactions, rising integration of renewable energy sources, and the need for efficient grid management solutions that blockchain technology facilitates.

Which region is the fastest Growing in the blockchain In Energy?

Europe is expected to be the fastest-growing region in the blockchain in energy market, projected to grow from $1.91 billion in 2023 to $8.47 billion by 2033, showcasing a robust increase in adoption across the energy sector.

Does ConsaInsights provide customized market report data for the blockchain In Energy industry?

Yes, ConsaInsights offers customized market report data tailored specifically to the blockchain in energy industry, allowing clients to gain insights that align with their strategic interests and research needs.

What deliverables can I expect from this blockchain In Energy market research project?

The deliverables from the blockchain in energy market research project typically include comprehensive reports, market forecasts, segment analysis, and insights on industry trends, catering to specific client requirements.

What are the market trends of blockchain In Energy?

Key market trends include the increasing use of smart contracts in energy trading, rising investments in renewable energy, and a growing focus on regulatory compliance, all contributing to blockchain's transformative impact in the energy sector.