Blockchain In Insurance Market Report

Published Date: 31 January 2026 | Report Code: blockchain-in-insurance

Blockchain In Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Blockchain in Insurance market, detailing market size, growth predictions, and key trends from 2023 to 2033. It covers regional insights, competitive landscape, and the impact of technological advancements in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

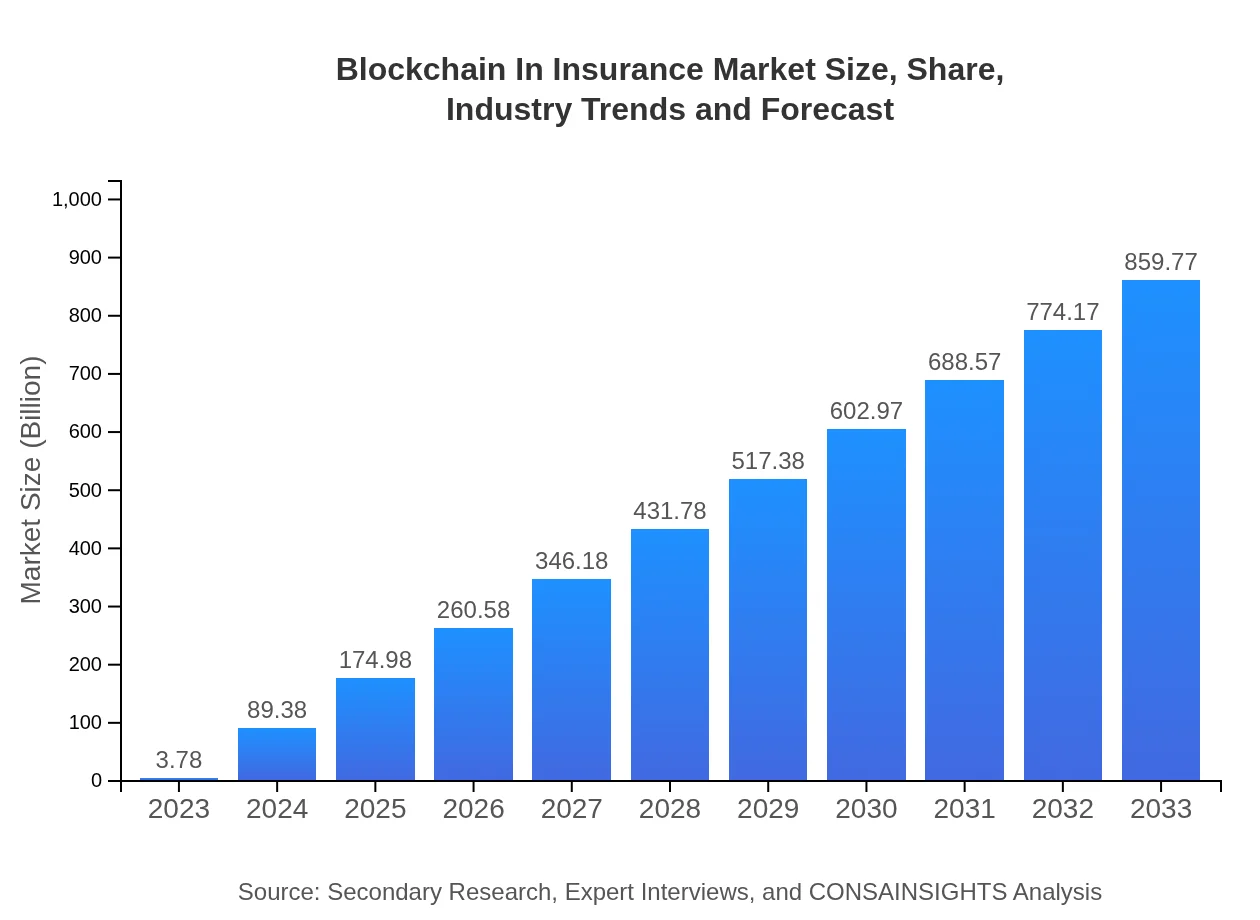

| 2023 Market Size | $3.78 Billion |

| CAGR (2023-2033) | 65.2% |

| 2033 Market Size | $859.77 Billion |

| Top Companies | IBM, Accenture, Anthem, Aon, Genpact |

| Last Modified Date | 31 January 2026 |

Blockchain In Insurance Market Overview

Customize Blockchain In Insurance Market Report market research report

- ✔ Get in-depth analysis of Blockchain In Insurance market size, growth, and forecasts.

- ✔ Understand Blockchain In Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain In Insurance

What is the Market Size & CAGR of Blockchain In Insurance market in 2023?

Blockchain In Insurance Industry Analysis

Blockchain In Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blockchain In Insurance Market Analysis Report by Region

Europe Blockchain In Insurance Market Report:

In Europe, the Blockchain in Insurance market is expected to evolve from $1.14 billion in 2023 to $259.74 billion by 2033. The region integrates stringent regulatory requirements that can benefit from blockchain's secure and transparent nature, with nations like the UK and Germany leading the way in blockchain adoption for insurance applications.Asia Pacific Blockchain In Insurance Market Report:

In the Asia-Pacific region, the Blockchain in Insurance market was valued at $0.74 billion in 2023, with expectations to reach $167.23 billion by 2033. This growth is primarily driven by the region's burgeoning tech ecosystem and increasing efforts by insurance providers to digitize their operations. Countries like China and India are at the forefront of adopting blockchain tech in ensuring better service delivery and compliance with region-specific regulations.North America Blockchain In Insurance Market Report:

North America is the largest market for Blockchain in Insurance, valued at $1.33 billion in 2023 and forecasted to grow to $302.47 billion by 2033. The presence of major insurance companies and strong investment in technology positions this region as a key player in the adoption of blockchain solutions, particularly in areas like smart contracts and data management.South America Blockchain In Insurance Market Report:

The South American market for Blockchain in Insurance was valued at $0.24 billion in 2023, projected to reach $53.99 billion by 2033. The region is gradually embracing blockchain technology to address systemic issues such as fraud and inefficient paper-based processes. Countries like Brazil are leading this charge, leveraging blockchain for tracking policy transactions securely.Middle East & Africa Blockchain In Insurance Market Report:

The Middle East and Africa market was valued at $0.34 billion in 2023, with projections of reaching $76.35 billion by 2033. The insurance sector in this region is beginning to explore blockchain options, primarily due to a rising demand for transparency and reduced fraud. Countries such as UAE are positively impacting this growth with initiatives aimed at fostering innovation and fintech development.Tell us your focus area and get a customized research report.

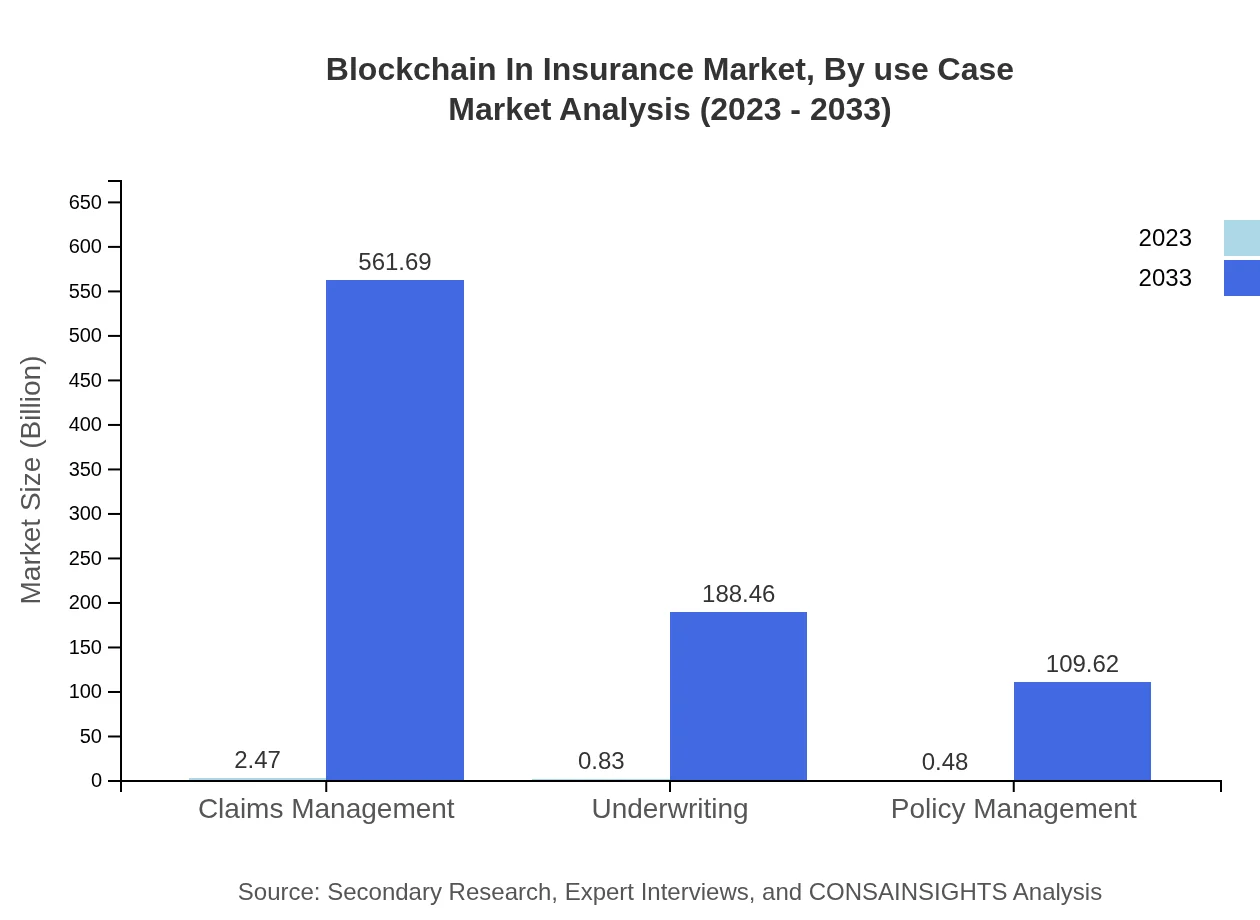

Blockchain In Insurance Market Analysis By Use Case

The use case segmentation highlights the pivotal areas benefiting from blockchain technology, notably Claims Management, which is expected to grow from $2.47 billion in 2023 to $561.69 billion by 2033. Underwriting and Policy Management segments also play vital roles, projected to reach $188.46 billion and $109.62 billion respectively, showing the comprehensive impact blockchain has on various operational facets.

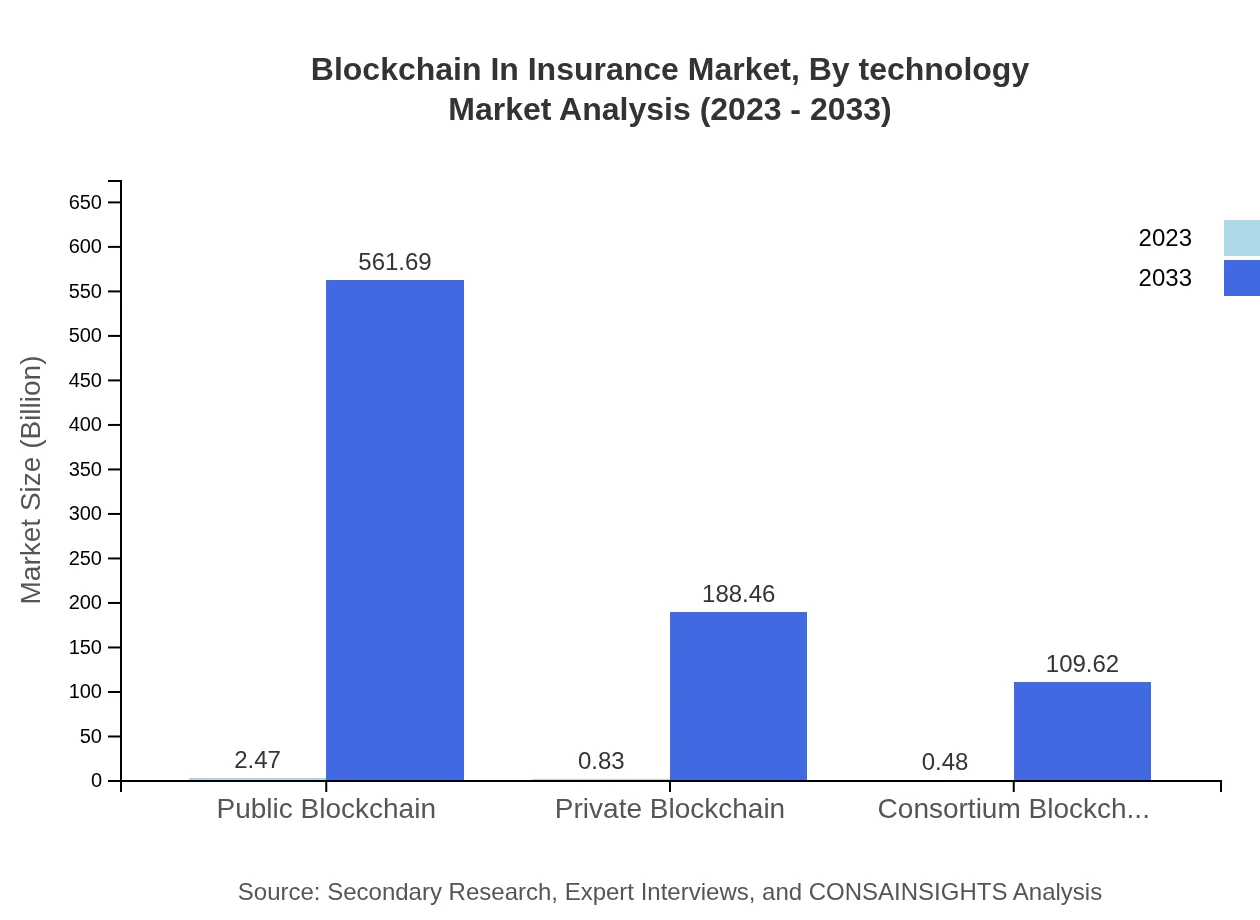

Blockchain In Insurance Market Analysis By Technology

The technology segment is divided into Public, Private, and Consortium blockchains, with Public Blockchain leading the market. It is expected to increase from $2.47 billion in 2023 to $561.69 billion by 2033. Private and Consortium Blockchains are also growing, anticipated to reach $188.46 billion and $109.62 billion respectively, facilitating tailored solutions for different insurance needs.

Blockchain In Insurance Market Analysis By Insurance_type

Global Blockchain in Insurance Market, By Insurance Type Market Analysis (2023 - 2033)

The insurance type segmentation reveals that Life Insurance is a dominant segment, projected to grow to $561.69 billion by 2033. Health Insurance and Property & Casualty Insurance are significant segments as well, with expected growth trajectories that demonstrate the adaptability of blockchain solutions across various insurance categories.

Blockchain In Insurance Market Analysis By Key_players

Global Blockchain in Insurance Market, By Key Players Market Analysis (2023 - 2033)

Key players such as IBM, Accenture, and Anthem are pivotal in driving blockchain innovation in the insurance sector. These organizations have developed various solutions focused on claims processing and policy management, thereby enhancing operational efficiencies and customer engagement in the insurance landscape.

Blockchain In Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain In Insurance Industry

IBM:

IBM is a pioneer in blockchain technology, offering innovative solutions that transform insurance operations, focusing on automation and smart contracts.Accenture:

Accenture specializes in consulting and technology services, helping insurance firms implement blockchain solutions that streamline processes and enhance customer relations.Anthem:

Anthem integrates blockchain solutions across its health insurance offerings, significantly improving data security and operational efficiencies.Aon:

Aon utilizes blockchain technology to enhance risk management and insurance broking processes, delivering innovative solutions to clients worldwide.Genpact:

Genpact provides advanced technology solutions that leverage blockchain to address complex challenges in the insurance sector, focusing on transparency and resilience.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain In Insurance?

The blockchain-in-insurance market is valued at approximately $3.78 billion in 2023, with a projected compound annual growth rate (CAGR) of 65.2%. This rapid growth reflects the increasing adoption of blockchain technologies within the insurance sector.

What are the key market players or companies in this blockchain In Insurance industry?

Key players in the blockchain-in-insurance sector include prominent insurance companies, technology providers, and blockchain specialists. These entities work collaboratively to define innovative solutions, enhance operational efficiencies, and improve transparency in insurance operations.

What are the primary factors driving the growth in the blockchain In Insurance industry?

Growth in the blockchain-in-insurance industry is driven by increased demand for transparency, enhanced security, cost reduction, and improved claims management. Furthermore, regulatory support and the need for efficient data sharing among stakeholders are significant factors bolstering market expansion.

Which region is the fastest Growing in the blockchain In Insurance?

North America is the fastest-growing region in the blockchain-in-insurance market, projected to grow from $1.33 billion in 2023 to $302.47 billion by 2033. Other regions like Europe and Asia Pacific also exhibit significant growth potential during this period.

Does ConsaInsights provide customized market report data for the blockchain In Insurance industry?

Yes, ConsaInsights offers customized market report data for the blockchain-in-insurance industry. Clients can obtain tailored insights and analyses that align with their specific needs, enhancing decision-making and strategic planning.

What deliverables can I expect from this blockchain In Insurance market research project?

Deliverables from the blockchain-in-insurance market research project include detailed market analysis reports, segment evaluations, competitive landscape insights, forecasts, and recommendations for strategic initiatives to capitalize on emerging opportunities.

What are the market trends of blockchain In Insurance?

Market trends in blockchain-in-insurance include a shift towards enhanced data privacy, growing interest in decentralized solutions, and increased investment in technology integrations. These trends reflect the industry's evolution and the urgency for adopting advanced technologies.