Blockchain In Retail Market Report

Published Date: 31 January 2026 | Report Code: blockchain-in-retail

Blockchain In Retail Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Blockchain In Retail market from 2023 to 2033, including market size, trends, technological advancements, and key players. It delivers critical insights and forecasts to help stakeholders understand the evolving landscape of Blockchain applications in the retail sector.

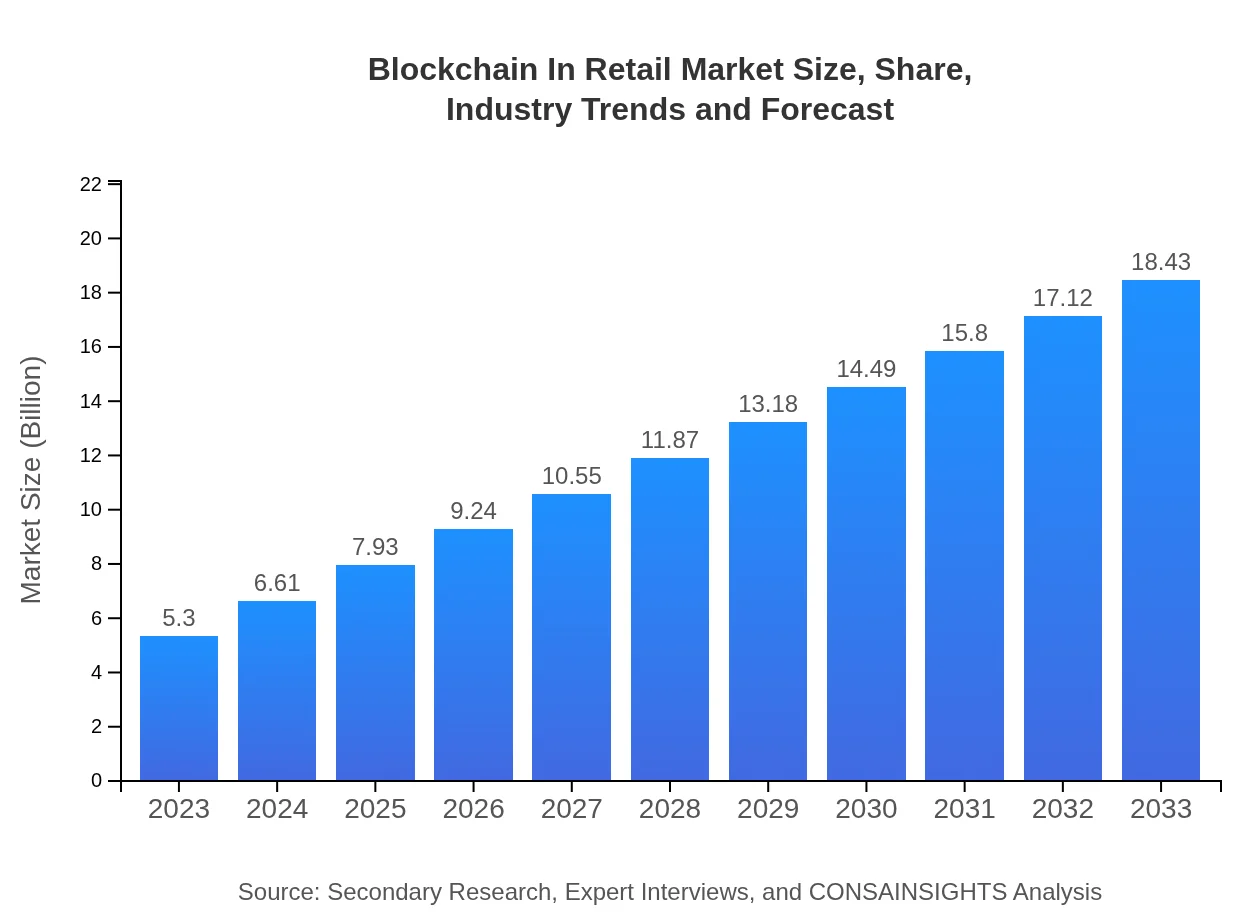

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.30 Billion |

| CAGR (2023-2033) | 12.7% |

| 2033 Market Size | $18.43 Billion |

| Top Companies | IBM, SAP, Microsoft, Oracle |

| Last Modified Date | 31 January 2026 |

Blockchain In Retail Market Overview

Customize Blockchain In Retail Market Report market research report

- ✔ Get in-depth analysis of Blockchain In Retail market size, growth, and forecasts.

- ✔ Understand Blockchain In Retail's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain In Retail

What is the Market Size & CAGR of Blockchain In Retail market in 2023?

Blockchain In Retail Industry Analysis

Blockchain In Retail Market Segmentation and Scope

Tell us your focus area and get a customized research report.

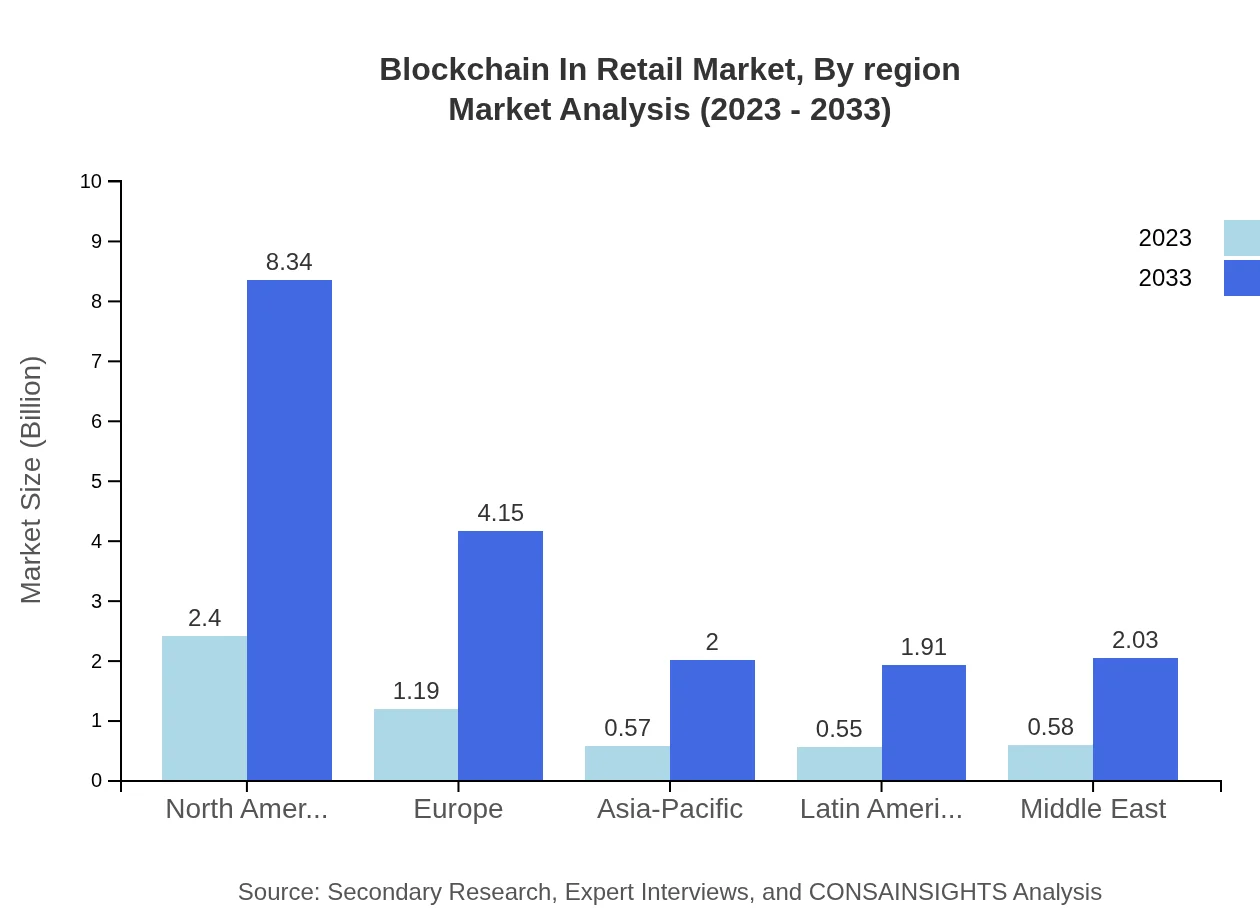

Blockchain In Retail Market Analysis Report by Region

Europe Blockchain In Retail Market Report:

Europe's Blockchain In Retail market is projected to grow from $1.74 billion in 2023 to $6.06 billion by 2033. The region is focusing on regulatory compliance and security, with blockchain being increasingly integrated for payment systems and supply chain transparency from retail sectors.Asia Pacific Blockchain In Retail Market Report:

The Asia Pacific region is expected to experience substantial growth, with the market size projected to increase from $1.00 billion in 2023 to $3.46 billion by 2033. This growth is fueled by rising internet penetration, increasing adoption of digital payment solutions, and the presence of numerous retail giants in the region, enhancing competition and innovation.North America Blockchain In Retail Market Report:

North America leads the Blockchain In Retail market with an expected growth from $1.79 billion in 2023 to $6.21 billion by 2033. The region's mature retail landscape, combined with high investment levels in technology and innovation, positions North America as a key player in the blockchain evolution in retail.South America Blockchain In Retail Market Report:

In South America, the Blockchain In Retail market is anticipated to grow from $0.38 billion in 2023 to $1.33 billion in 2033. The transformation towards digital retail in emerging economies is propelling this market growth, with blockchain technology being seen as a solution to enhance supply chain efficiency and customer experience.Middle East & Africa Blockchain In Retail Market Report:

In the Middle East and Africa, the market is expected to reach $0.40 billion in 2023 and grow to $1.38 billion by 2033. The increasing awareness of blockchain benefits among retail businesses and policies supporting digital transformations are expected to drive this growth.Tell us your focus area and get a customized research report.

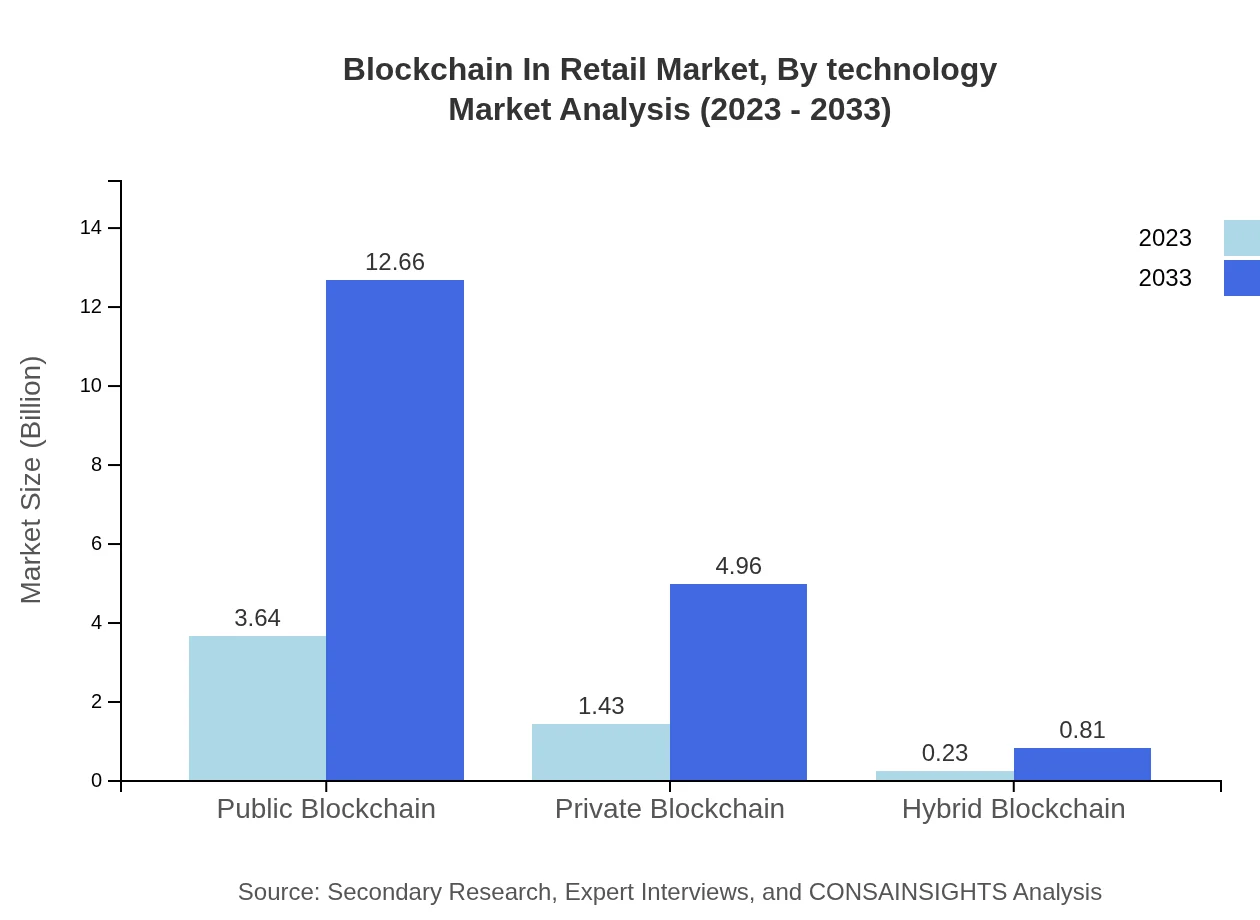

Blockchain In Retail Market Analysis By Technology

The market segments into public, private, and hybrid blockchains. Public blockchains dominate the market due to their open and decentralized nature, comprising 68.67% market share in 2023. Private blockchains, while holding 26.93% of the market share, are increasingly favored for secure data management within retail enterprises. Hybrid models are also gaining traction, expected to grow steadily, meeting specific security and transparency needs of the retail industry.

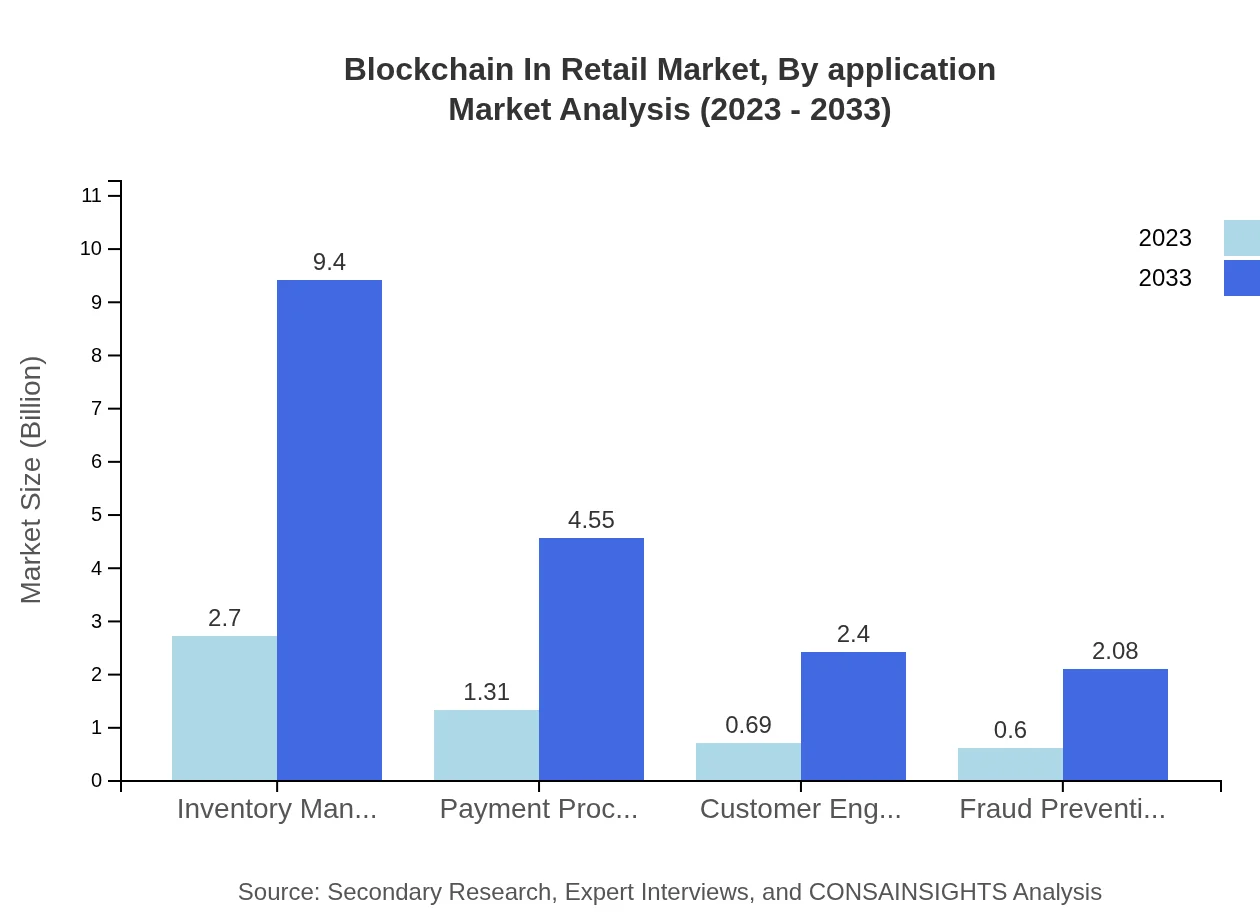

Blockchain In Retail Market Analysis By Application

Applications in inventory management are leading the market with a share of 51.01% in 2023, followed by payment processing at 24.7%. Customer engagement and fraud prevention also contribute significantly to market growth. The rising need for accurate inventory tracking and streamlined payment processes is driving retailers to invest increasingly in blockchain technologies.

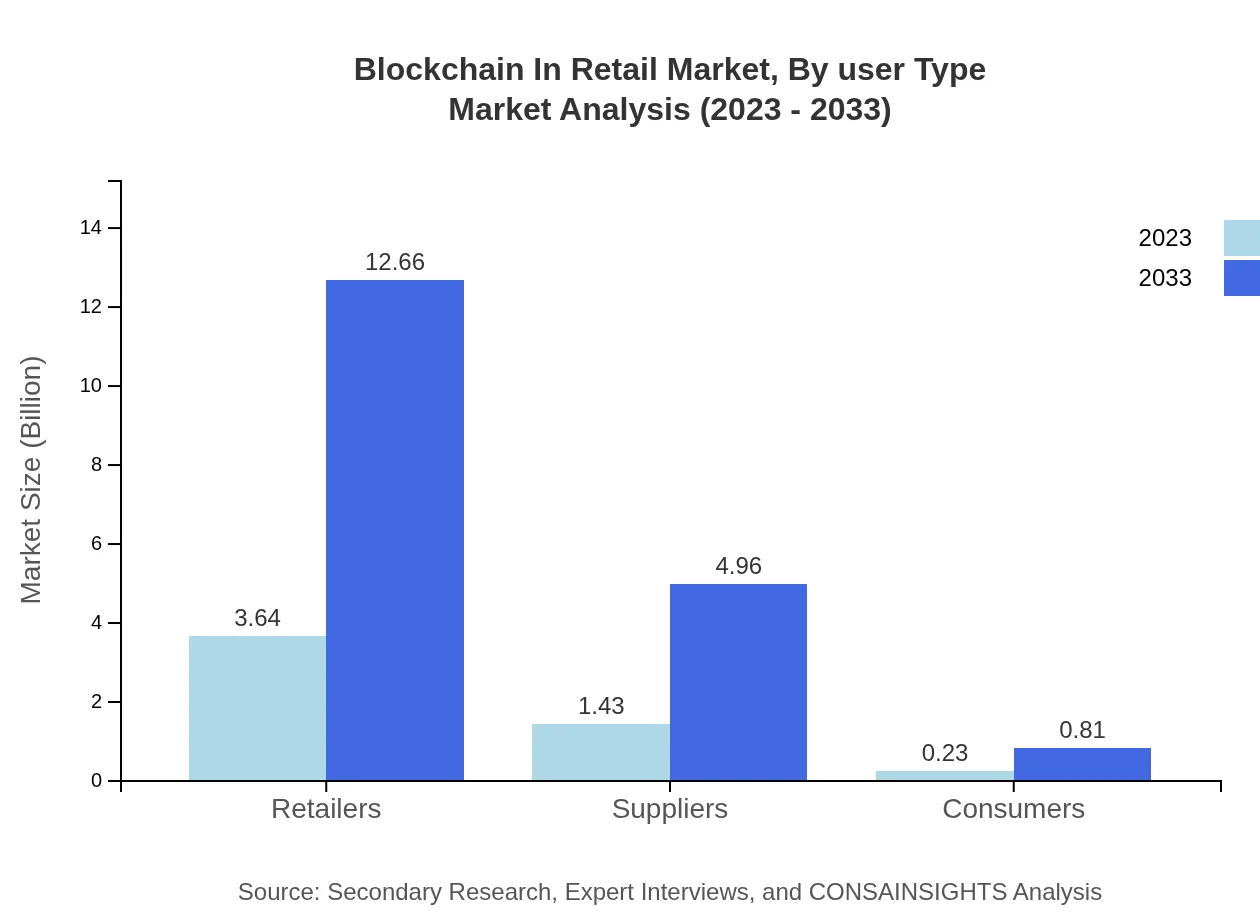

Blockchain In Retail Market Analysis By User Type

The market is segmented by user type into retailers, suppliers, and consumers. Retailers dominate the market size with $3.64 billion in 2023, representing 68.67% of the market share, reflecting their extensive needs for operational efficiencies. Suppliers and consumers also hold significant stakes, with ongoing trends indicating a growing advantage for all user types as blockchain adoption increases.

Blockchain In Retail Market Analysis By Region

Regional analysis indicates North America as the leading market with robust infrastructure and funding driving growth. Europe follows with significant enhancements in regulatory support, while growing business awareness prevails in Asia Pacific and South America. The Middle East and Africa are gradually adopting blockchain, creating potential growth opportunities.

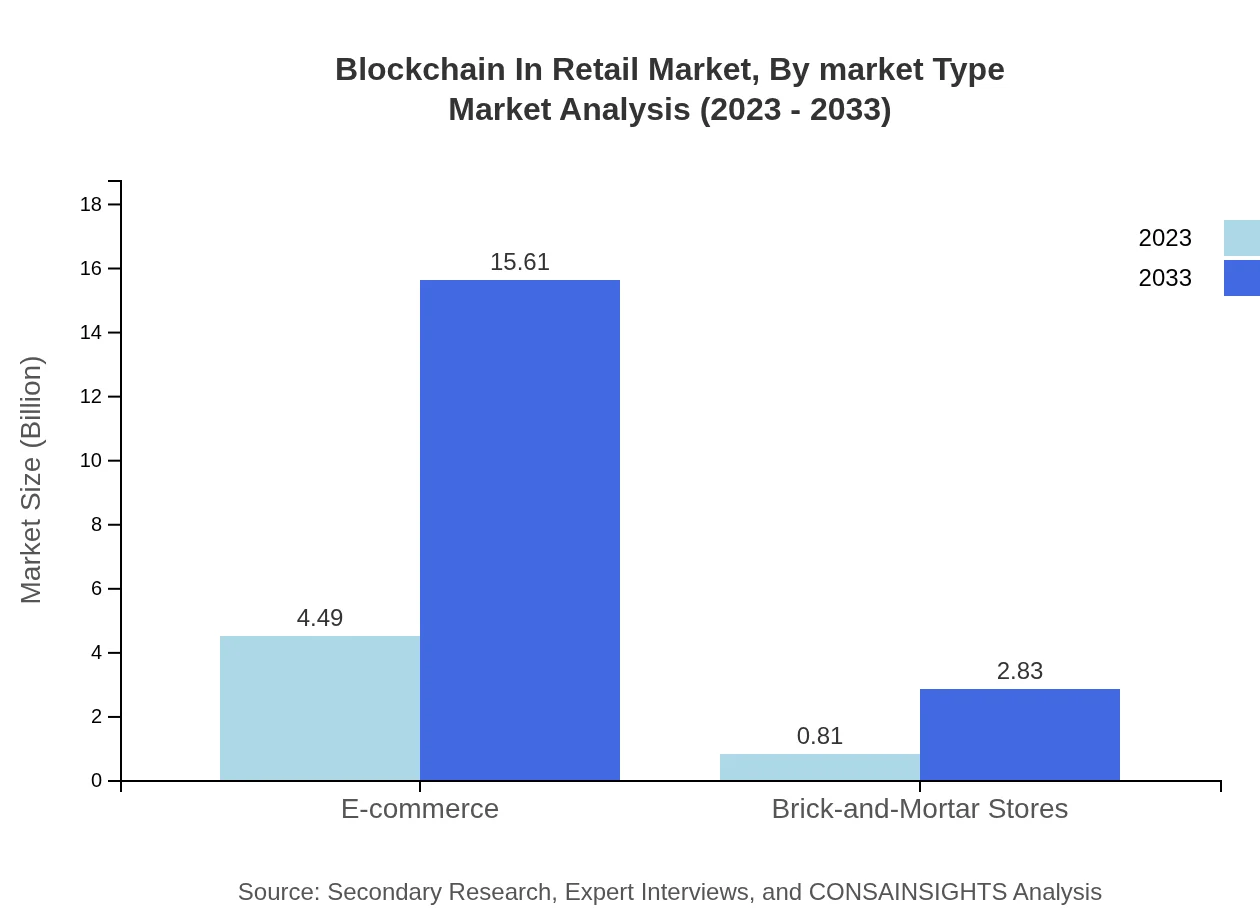

Blockchain In Retail Market Analysis By Market Type

The market categorizes into B2B and B2C sectors. The B2B segment is rapidly expanding due to growing partnerships and collaborations between retailers and technology providers, while the B2C segment focuses on enhancing customer experience and trust. Both segments emphasize the importance of a robust blockchain infrastructure tailored to specific market needs.

Blockchain In Retail Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain In Retail Industry

IBM:

IBM provides blockchain solutions that enhance supply chain transparency and efficiency, catering to major retail clients and promoting innovative uses of blockchain in operations.SAP:

SAP offers integrated blockchain services aimed at improving inventory management and operational efficiency, significantly impacting the retail landscape.Microsoft:

Microsoft’s Azure blockchain services empower retailers to build trusted networks and gain insightful data, driving the digital transformation of retail supply chains.Oracle:

Oracle provides enterprise-grade blockchain solutions helping retailers streamline operations, reduce fraud, and enhance customer engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain in retail?

The blockchain in retail market is currently valued at approximately $5.3 billion with a projected compound annual growth rate (CAGR) of 12.7% over the next decade, suggesting robust growth potential and increasing adoption in the sector.

What are the key market players or companies in the blockchain in retail industry?

Key players in the blockchain in retail industry include prominent companies such as IBM, Microsoft, Oracle, and SAP, which are leveraging blockchain technology to enhance transparency, efficiency, and security in retail operations.

What are the primary factors driving the growth in the blockchain in retail industry?

The growth of the blockchain in retail industry is primarily driven by the need for enhanced supply chain transparency, increased consumer demand for authenticity, and the growing prevalence of e-commerce, necessitating robust security measures.

Which region is the fastest Growing in the blockchain in retail?

The North America region is currently the fastest-growing market for blockchain in retail, projected to grow from $1.79 billion in 2023 to $6.21 billion by 2033, reflecting significant investment and technological adoption.

Does ConsaInsights provide customized market report data for the blockchain in retail industry?

Yes, ConsaInsights offers tailored market report data for the blockchain in retail industry, providing in-depth insights, customized analyses, and relevant data to fit specific business needs and strategic objectives.

What deliverables can I expect from this blockchain in retail market research project?

From the blockchain in retail market research project, you can expect a comprehensive report detailing market size, trends, regional insights, competitive landscape analysis, and potential growth opportunities identified through rigorous data analysis.

What are the market trends of blockchain in retail?

Notable trends in the blockchain in retail market include increased adoption of smart contracts, the integration of blockchain technology with AI for analytics, and significant investments in enhancing customer engagement and fraud prevention solutions.