Blockchain Market Report

Published Date: 31 January 2026 | Report Code: blockchain

Blockchain Market Size, Share, Industry Trends and Forecast to 2033

This market report delves into the blockchain industry, covering critical insights and detailed analyses from 2023 to 2033, including market size, growth forecasts, emerging technologies, and regional breakdowns of the blockchain market.

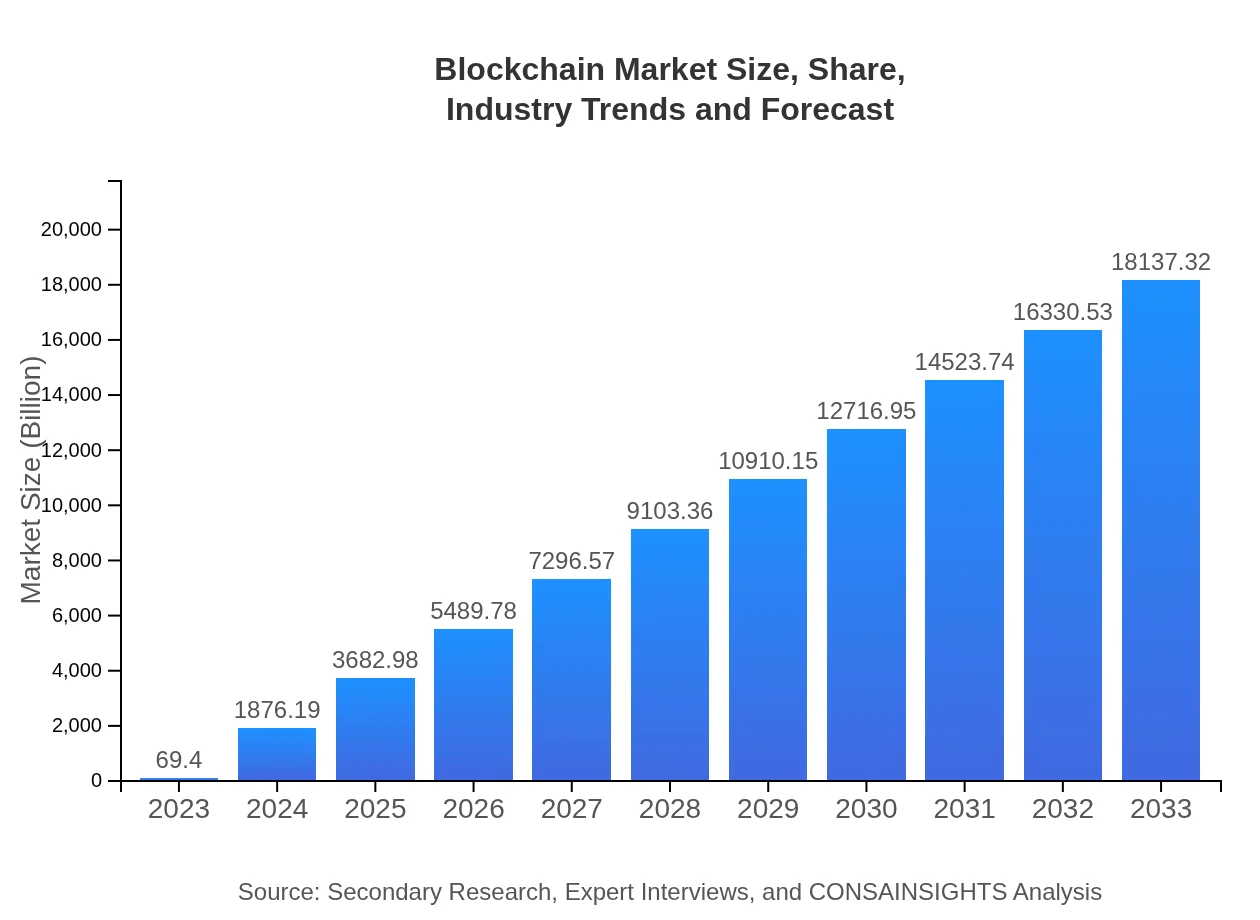

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $69.40 Billion |

| CAGR (2023-2033) | 67.3% |

| 2033 Market Size | $18137.32 Billion |

| Top Companies | Ethereum Foundation, IBM, Ripple Labs, Hyperledger (Linux Foundation), Consensys |

| Last Modified Date | 31 January 2026 |

Blockchain Market Overview

Customize Blockchain Market Report market research report

- ✔ Get in-depth analysis of Blockchain market size, growth, and forecasts.

- ✔ Understand Blockchain's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain

What is the Market Size & CAGR of Blockchain market in 2023?

Blockchain Industry Analysis

Blockchain Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blockchain Market Analysis Report by Region

Europe Blockchain Market Report:

Europe's blockchain market is expected to expand from $17.73 billion in 2023 to $4,634.09 billion by 2033, largely due to the European Union’s proactive approach towards blockchain technology, strategic investments in research, and partnerships aimed at bolstering digital solutions across member states.Asia Pacific Blockchain Market Report:

The Asia-Pacific blockchain market is projected to grow from $15.11 billion in 2023 to $3,948.50 billion by 2033, highlighting a robust CAGR driven by investment in technological innovations and increasing applications across industries such as supply chain, finance, and governmental services. Countries like China and India are leading in blockchain adoption, significantly impacting the region.North America Blockchain Market Report:

North America currently holds the largest blockchain market, valued at $23.91 billion in 2023 and poised to reach $6,248.31 billion by 2033. The dominant presence of leading tech companies, substantial venture capital investments, and a stable regulatory environment foster an ecosystem conducive to blockchain innovation.South America Blockchain Market Report:

South America's blockchain market exhibits promising potential, with market size expanding from $6.24 billion in 2023 to $1,630.55 billion by 2033. The growth is underpinned by an increasing focus on digital transformation and the need for secure transaction methods amid rising fraud cases within the region.Middle East & Africa Blockchain Market Report:

The blockchain market in the Middle East and Africa is set to transition from a modest valuation of $6.41 billion in 2023 to $1,675.89 billion by 2033. This growth reflects increased governmental initiatives and a surge in financial technology innovation, characterizing the region’s entrepreneurial landscape.Tell us your focus area and get a customized research report.

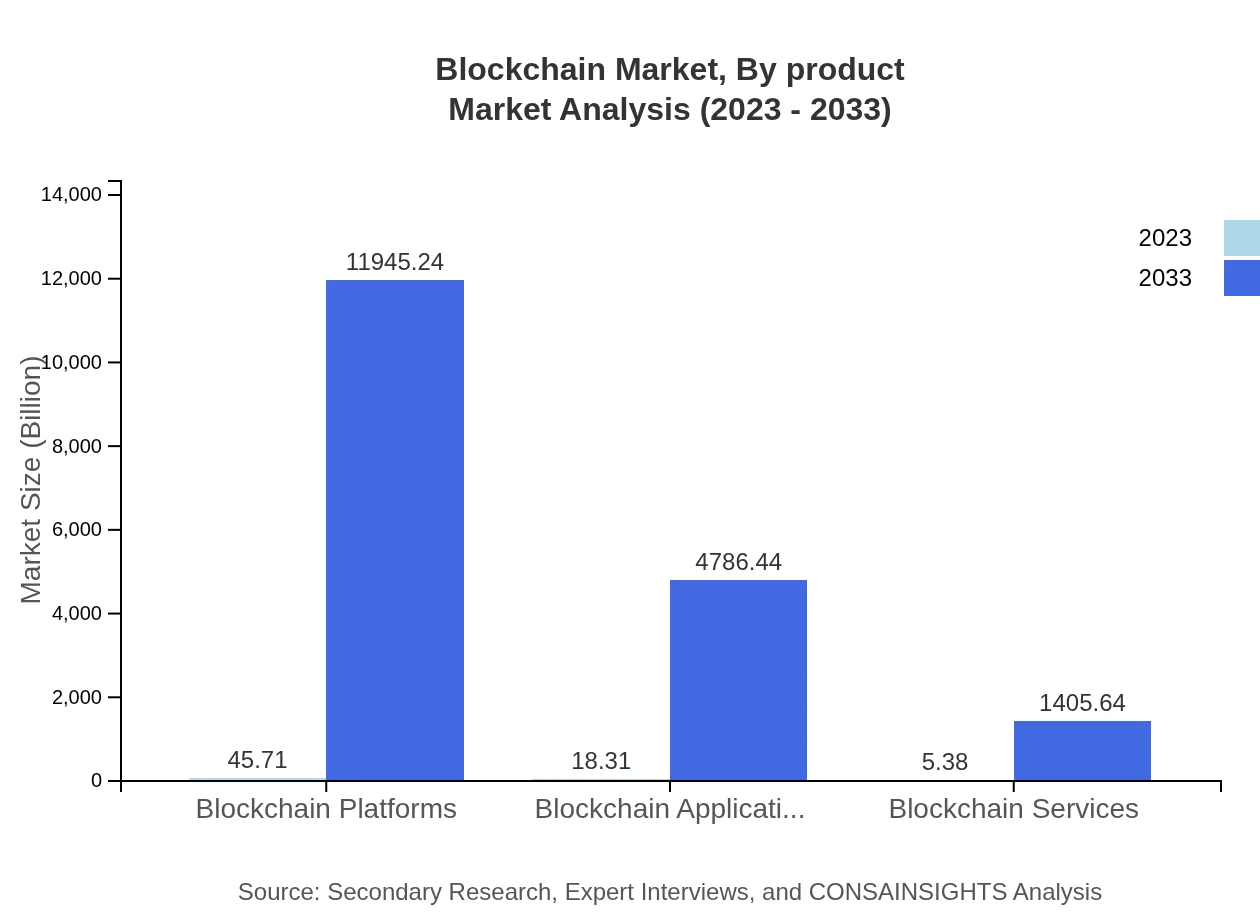

Blockchain Market Analysis By Product

The blockchain market is significantly characterized by blockchain platforms generating $45.71 billion in 2023 with projections to reach $11,945.24 billion by 2033, accounting for 65.86% market share. Blockchain applications are anticipated to rise from $18.31 billion in 2023 to $4,786.44 billion by 2033, representing a vital expansion. Blockchain services are projected to increase from $5.38 billion in 2023 to $1,405.64 billion by 2033, reflecting growing demand for advisory and integration services.

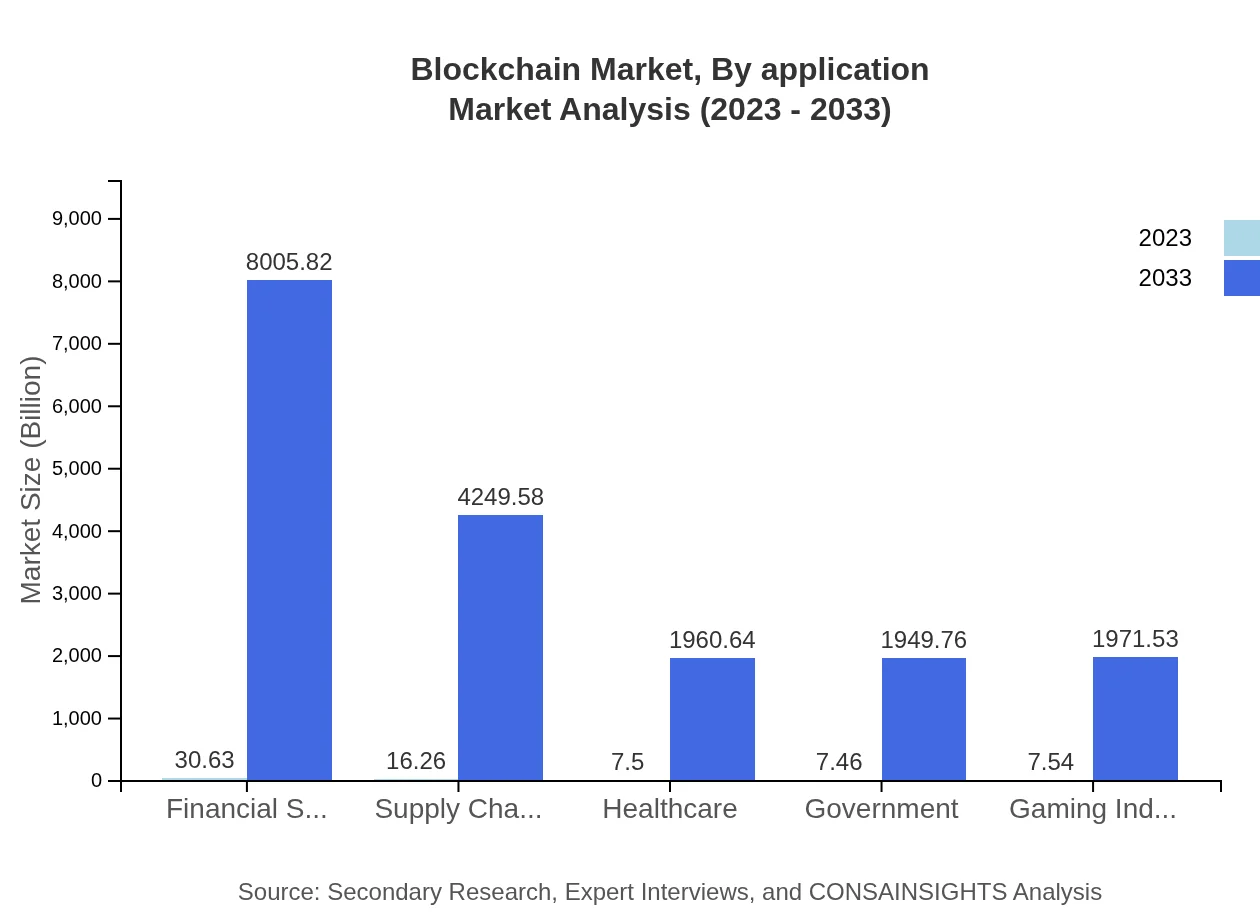

Blockchain Market Analysis By Application

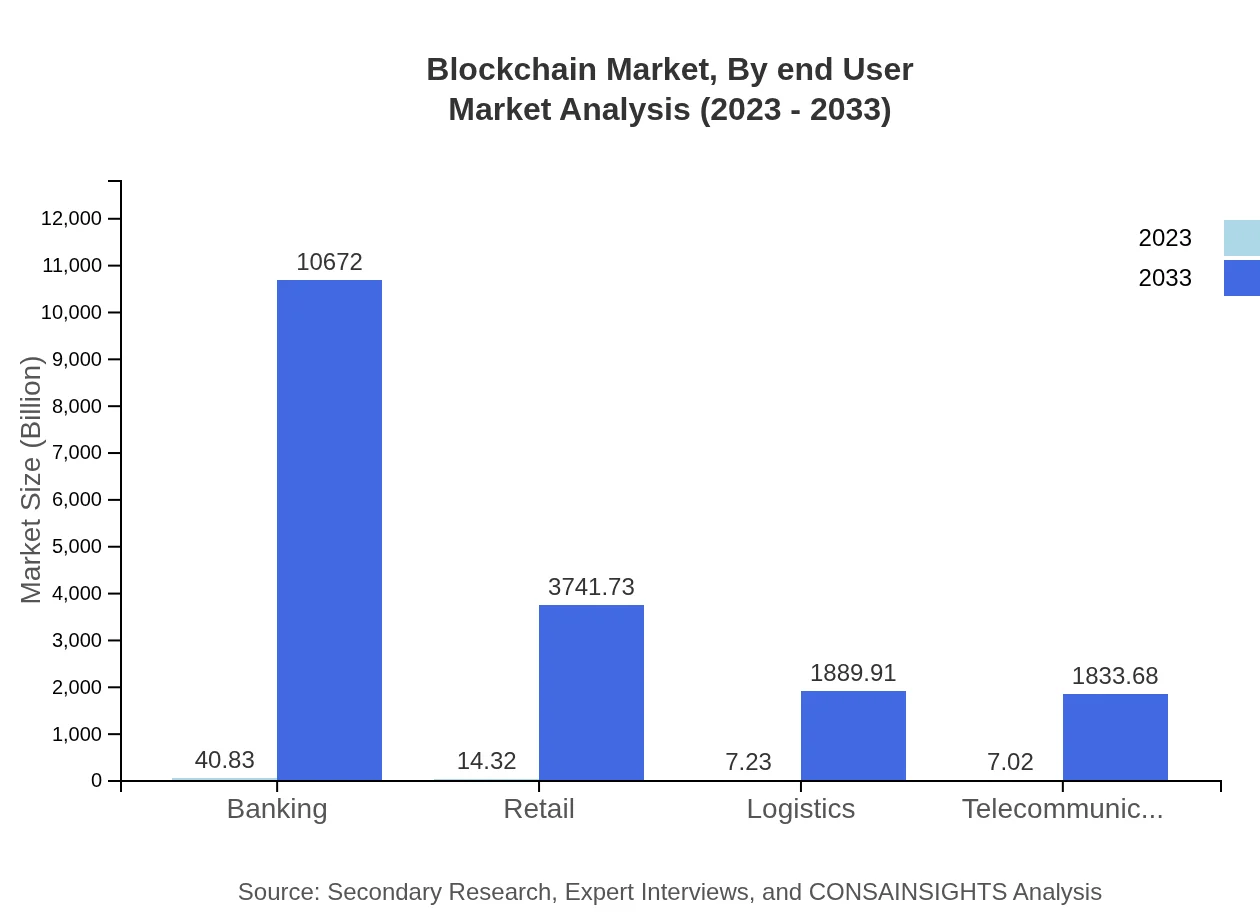

Applications of blockchain technology are driving significant growth across various industries. Banking applications will grow from $40.83 billion in 2023 to $10,672.00 billion by 2033, maintaining a 58.84% share, while retail applications will increase from $14.32 billion to $3,741.73 billion, with similar traction in logistics, telecommunications, and healthcare applications contributing to the overall adoption and market expansion.

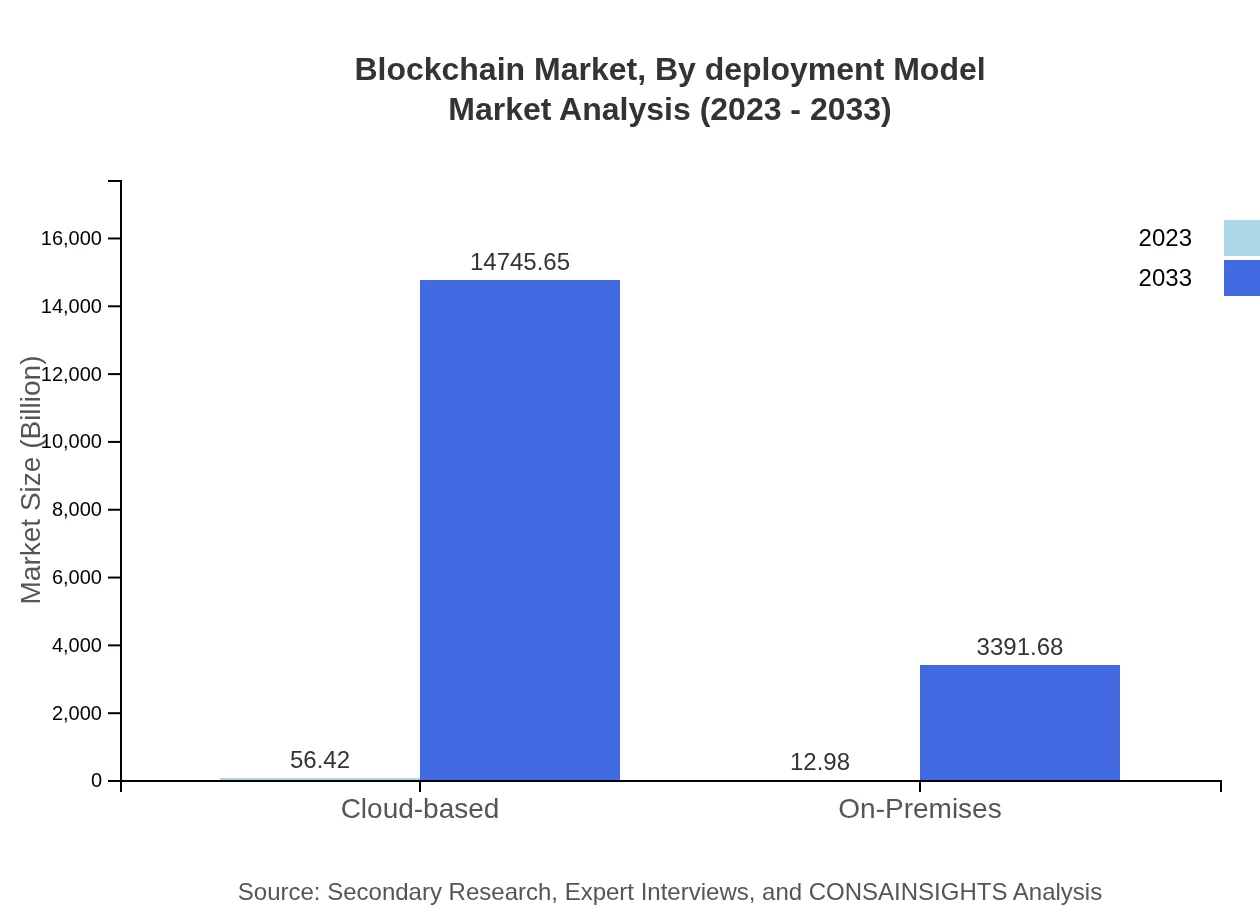

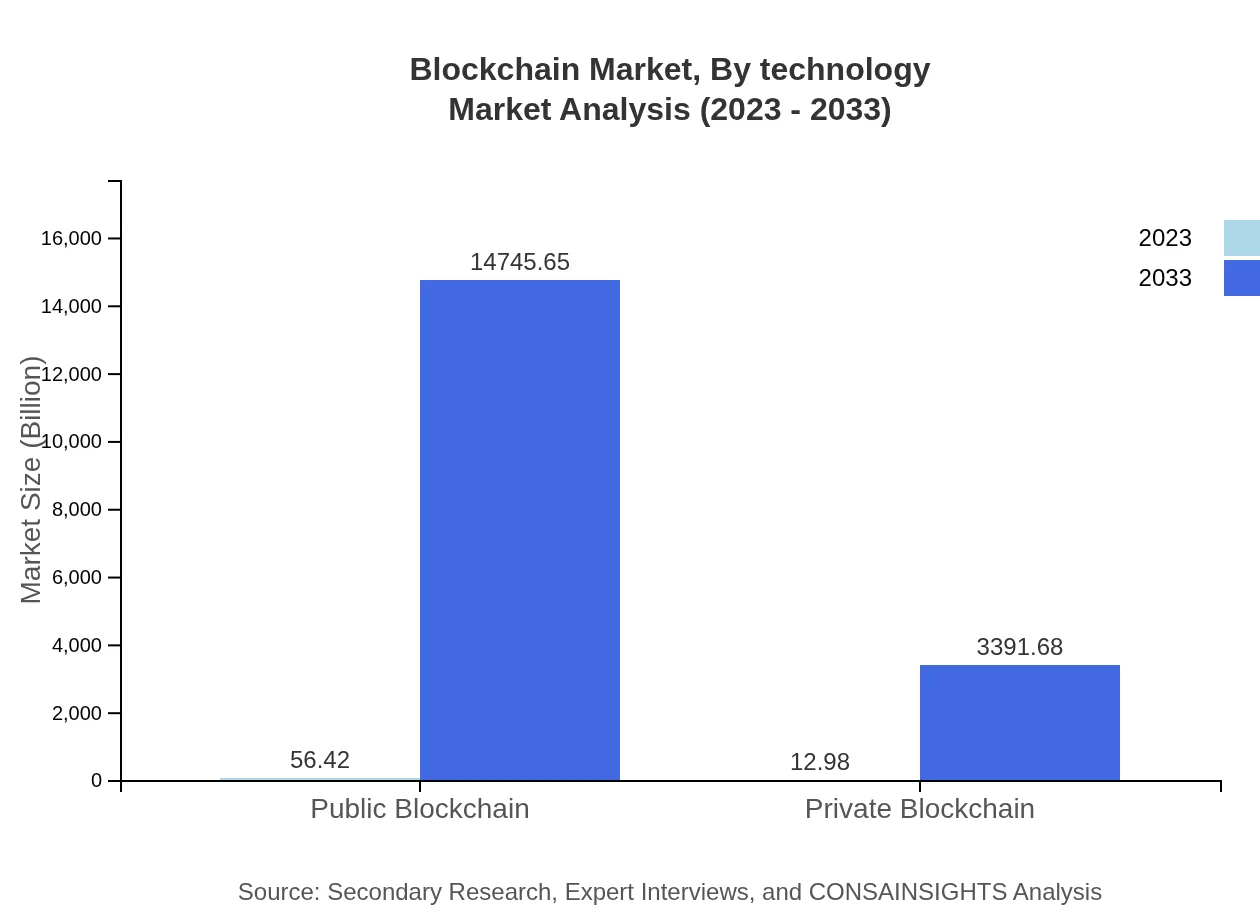

Blockchain Market Analysis By Deployment Model

The blockchain deployment model is categorized into cloud-based and on-premises segments. The cloud-based segment is the largest, forecasted to grow from $56.42 billion in 2023 to $14,745.65 billion by 2033, highlighting a significant interest in scalable and flexible solutions. Conversely, on-premises deployment is projected to reach $3,391.68 billion by 2033 from $12.98 billion in 2023, reflecting niche demand for security-conscious environments.

Blockchain Market Analysis By End User

The end-user industry analysis reveals banking sectors commanding the market at $40.83 billion in 2023, projected to reach $10,672 billion by 2033. Other sectors like financial services, with a market of $30.63 billion in 2023, will rise to $8,005.82 billion. Healthcare, government, and gaming industries are also critical players, each contributing to the market's overall vibrancy and potential.

Blockchain Market Analysis By Technology

The technology behind blockchain continues to evolve, with advancements in consensus algorithms, data security, and scalability options enhancing its implementation across sectors. Innovations like sharding, layer 2 solutions, and interoperability tools are gaining traction and presenting businesses with improved operational capabilities. These technological trends are instrumental in overcoming existing barriers to blockchain adoption and ensuring sustained market growth.

Blockchain Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain Industry

Ethereum Foundation:

The Ethereum Foundation is a non-profit organization that supports the Ethereum platform, a leading blockchain enabling smart contracts and decentralized applications.IBM:

IBM has established itself as a key player in the blockchain space with its IBM Blockchain platform, providing solutions for identity management, supply chain, and various industries.Ripple Labs:

Ripple Labs has developed blockchain payment protocols and exchange networks that facilitate real-time cross-border transactions.Hyperledger (Linux Foundation):

Hyperledger is an open-source collaborative effort created to advance cross-industry blockchain technologies, providing frameworks and tools for enterprise-level solutions.Consensys:

Consensys builds decentralized applications and developer tools primarily on the Ethereum blockchain, supporting the ecosystem with innovating platforms and resources.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain?

The blockchain market is projected to reach approximately $69.4 billion by 2033, growing at a remarkable CAGR of 67.3%. This growth is driven by increasing demand across various sectors.

What are the key market players or companies in the blockchain industry?

Key players in the blockchain industry include major technology firms and startups like IBM, Microsoft, and Coinbase, which are pioneering innovations and solutions in blockchain technology.

What are the primary factors driving the growth in the blockchain industry?

Growth in the blockchain industry is fueled by rising adoption in financial services, increasing awareness of decentralized solutions, and growing investments in blockchain infrastructure among enterprises and governments.

Which region is the fastest Growing in the blockchain market?

Asia Pacific is the fastest-growing region in the blockchain market, showing significant growth from $15.11 billion in 2023 to an expected $3948.50 billion by 2033, due to increasing tech adoption.

Does ConsaInsights provide customized market report data for the blockchain industry?

Yes, ConsaInsights offers customized market report data on the blockchain industry, allowing businesses to tailor insights specific to their needs and industry focus.

What deliverables can I expect from this blockchain market research project?

Deliverables from the blockchain market research project typically include detailed market analysis reports, insights on key trends, competitive landscape, and forecasts for segment growth.

What are the market trends of blockchain?

Current trends in the blockchain market include increasing adoption in logistics, finance, and healthcare sectors, with a strong push towards cloud-based solutions reflecting the industry's shift towards decentralized technologies.