Blockchain Supply Chain Market Report

Published Date: 31 January 2026 | Report Code: blockchain-supply-chain

Blockchain Supply Chain Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Blockchain Supply Chain market from 2023 to 2033, discussing market size, trends, regional analysis, and technology advancements that are shaping the industry.

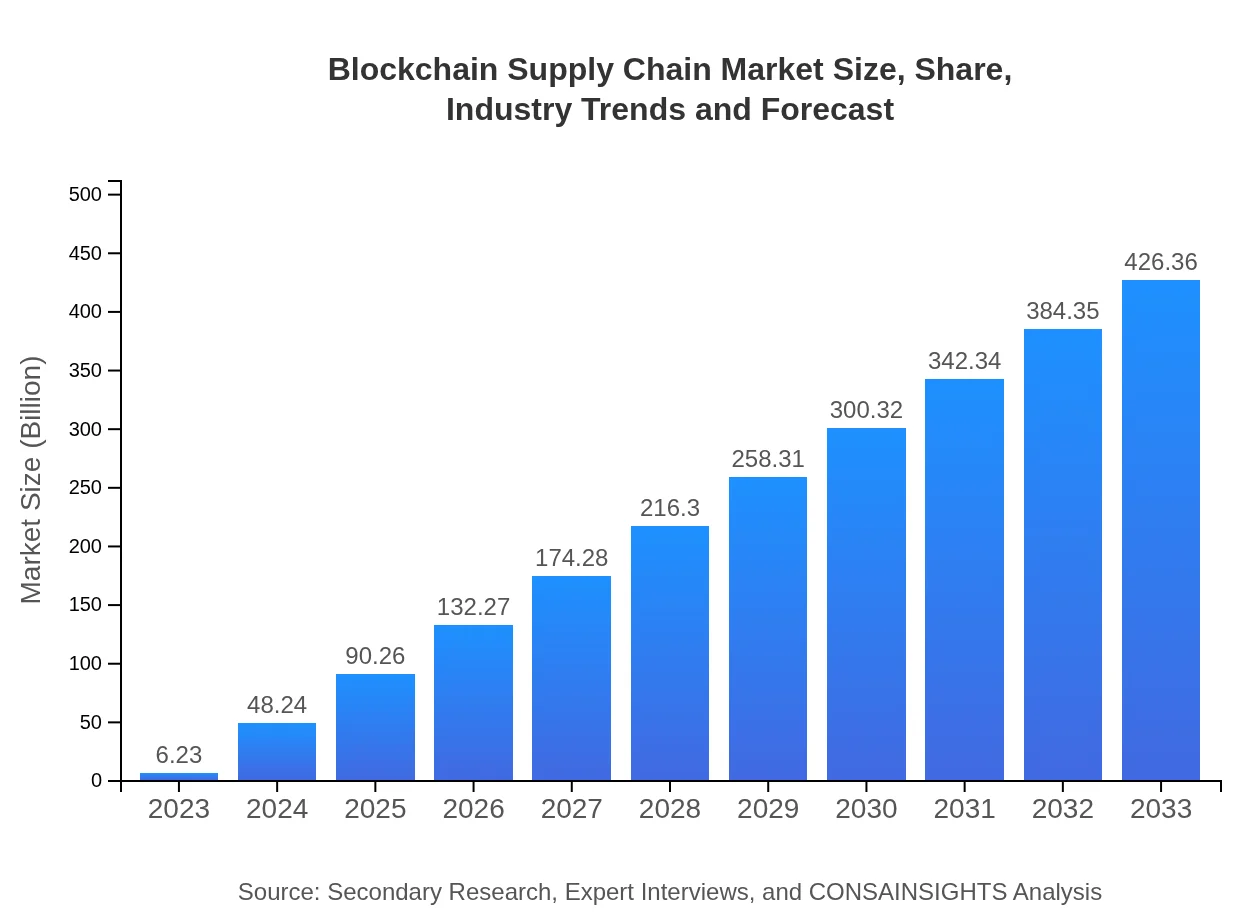

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.23 Billion |

| CAGR (2023-2033) | 48.1% |

| 2033 Market Size | $426.36 Billion |

| Top Companies | IBM, Accenture, VeChain, Microsoft, Oracle |

| Last Modified Date | 31 January 2026 |

Blockchain Supply Chain Market Overview

Customize Blockchain Supply Chain Market Report market research report

- ✔ Get in-depth analysis of Blockchain Supply Chain market size, growth, and forecasts.

- ✔ Understand Blockchain Supply Chain's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blockchain Supply Chain

What is the Market Size & CAGR of Blockchain Supply Chain market in 2023 and 2033?

Blockchain Supply Chain Industry Analysis

Blockchain Supply Chain Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blockchain Supply Chain Market Analysis Report by Region

Europe Blockchain Supply Chain Market Report:

Europe's Blockchain Supply Chain market will grow significantly from $1.88 billion in 2023 to $128.38 billion by 2033, influenced by stringent regulations and consumer demand for supply chain transparency.Asia Pacific Blockchain Supply Chain Market Report:

In the Asia Pacific region, the market size is $1.08 billion in 2023, expected to grow to $74.10 billion by 2033. The growth is driven by the increasing adoption of blockchain in manufacturing and logistics sectors.North America Blockchain Supply Chain Market Report:

North America leads the market with a size projected to rise from $2.38 billion in 2023 to $162.70 billion in 2033. High levels of investments from key players and an innovation-driven environment are major growth drivers.South America Blockchain Supply Chain Market Report:

The South American market is witnessing growth from $0.37 billion in 2023 to an estimated $25.07 billion by 2033. Innovations in logistics and improved transparency in supply chains are key factors.Middle East & Africa Blockchain Supply Chain Market Report:

The Middle East and Africa is gradually gaining traction, with expected growth from $0.53 billion in 2023 to $36.11 billion by 2033. Increasing digitization efforts in various sectors are propelling this growth.Tell us your focus area and get a customized research report.

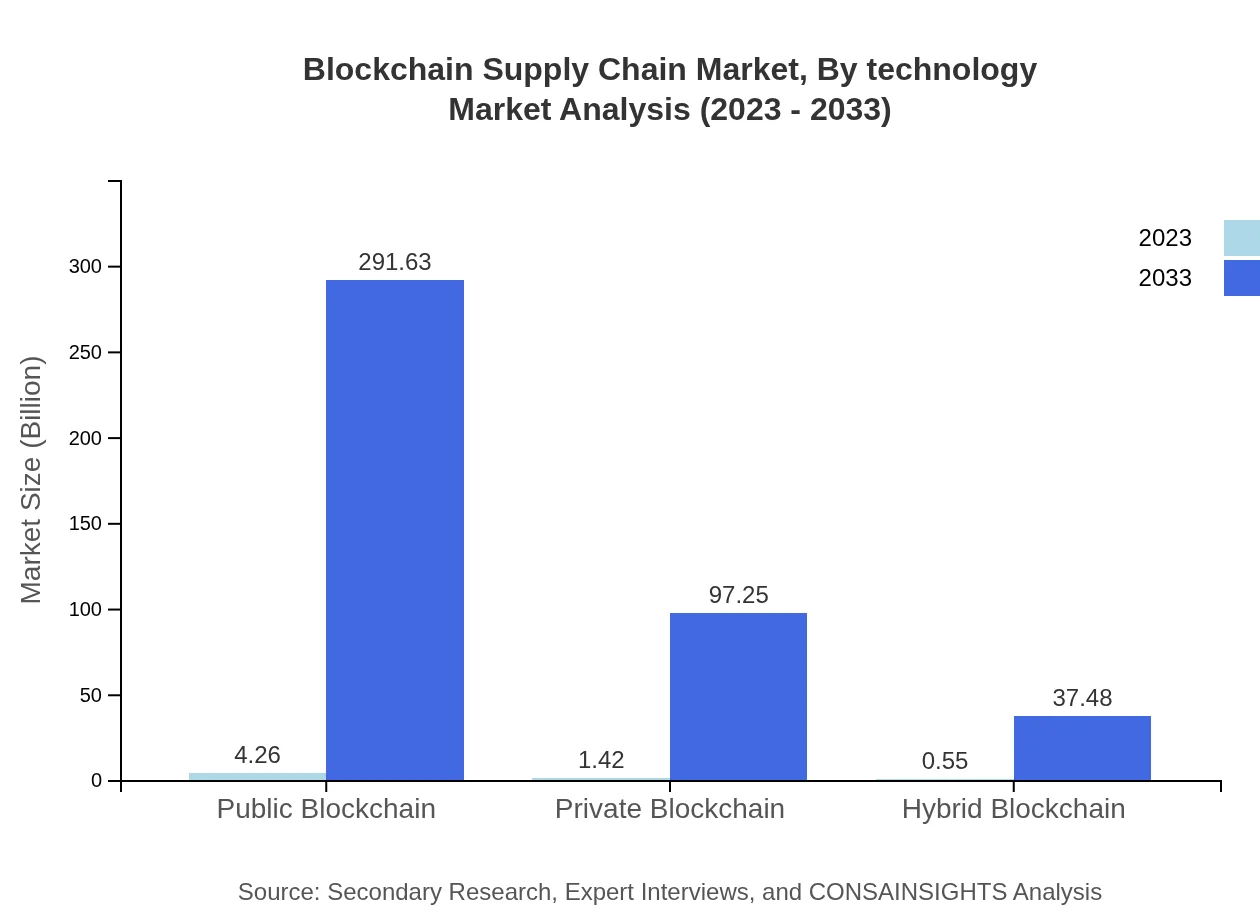

Blockchain Supply Chain Market Analysis By Technology

The technology segment includes public, private, and hybrid blockchains, with a strong focus on public blockchains which accounted for a market size of $4.26 billion in 2023 and is projected to rise to $291.63 billion by 2033, indicating a significant share in enhancing transparency across the supply chain.

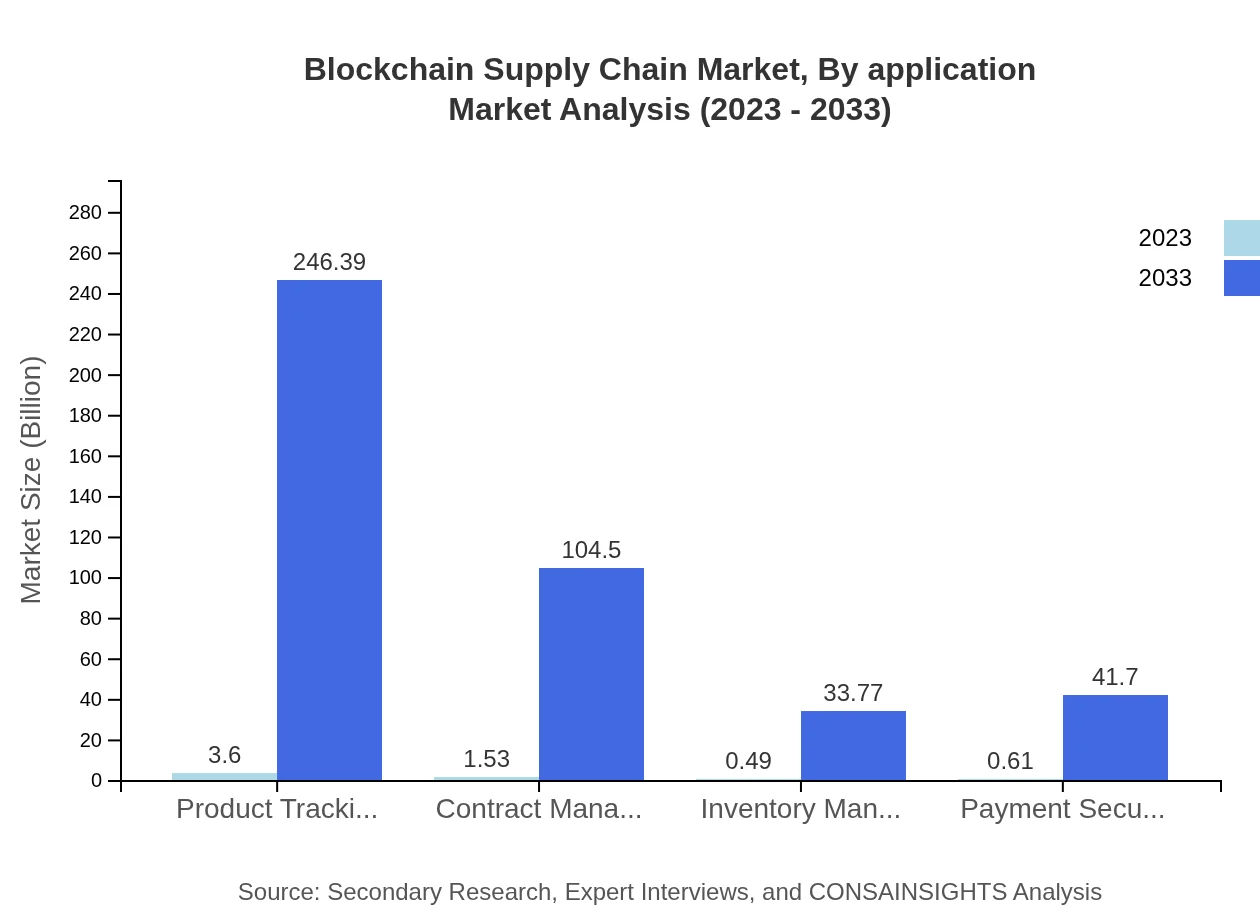

Blockchain Supply Chain Market Analysis By Application

Applications such as product tracking and contract management play vital roles in the Blockchain Supply Chain, with product tracking alone expected to grow from $3.60 billion in 2023 to $246.39 billion by 2033, underlining the importance of real-time tracking solutions.

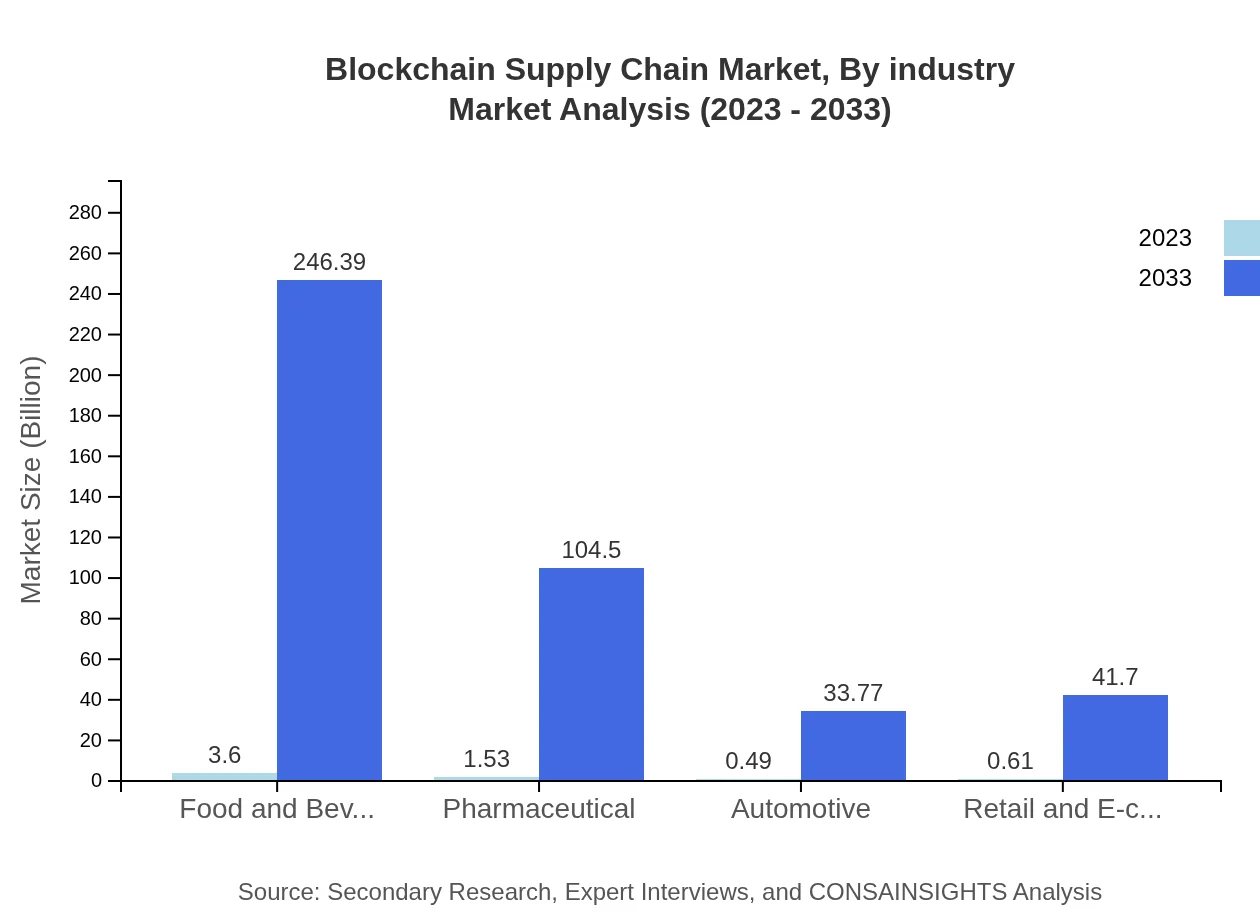

Blockchain Supply Chain Market Analysis By Industry

The Food and Beverage industry shows the largest growth potential, with expected size growth from $3.60 billion in 2023 to $246.39 billion by 2033. Pharmaceuticals and retail also represent significant segments due to their reliance on traceability and compliance.

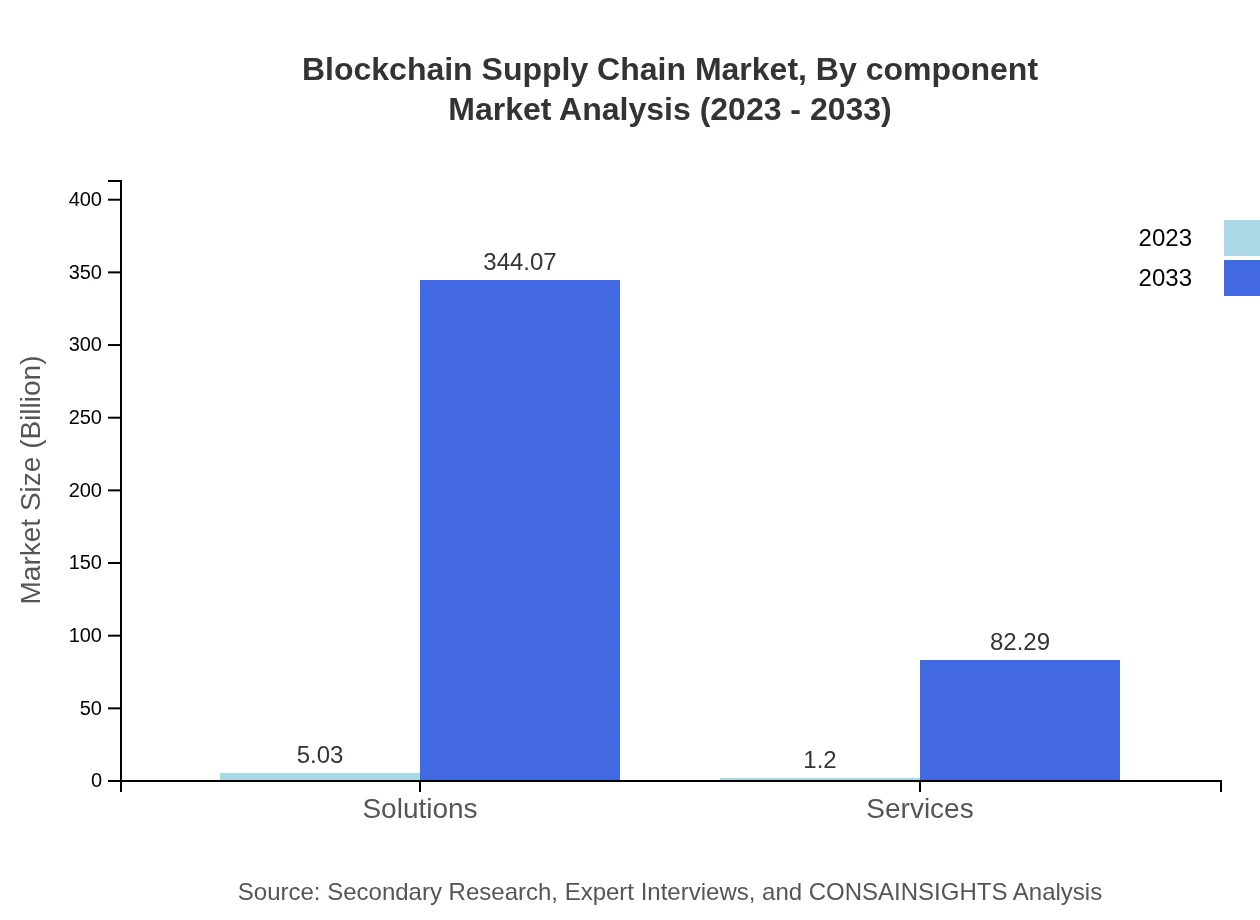

Blockchain Supply Chain Market Analysis By Component

The market is divided into solutions and services, with solutions dominating at $5.03 billion in 2023 expected to reach $344.07 billion by 2033. Services are also forecasted to experience substantial growth, reaching $82.29 billion in the same time frame.

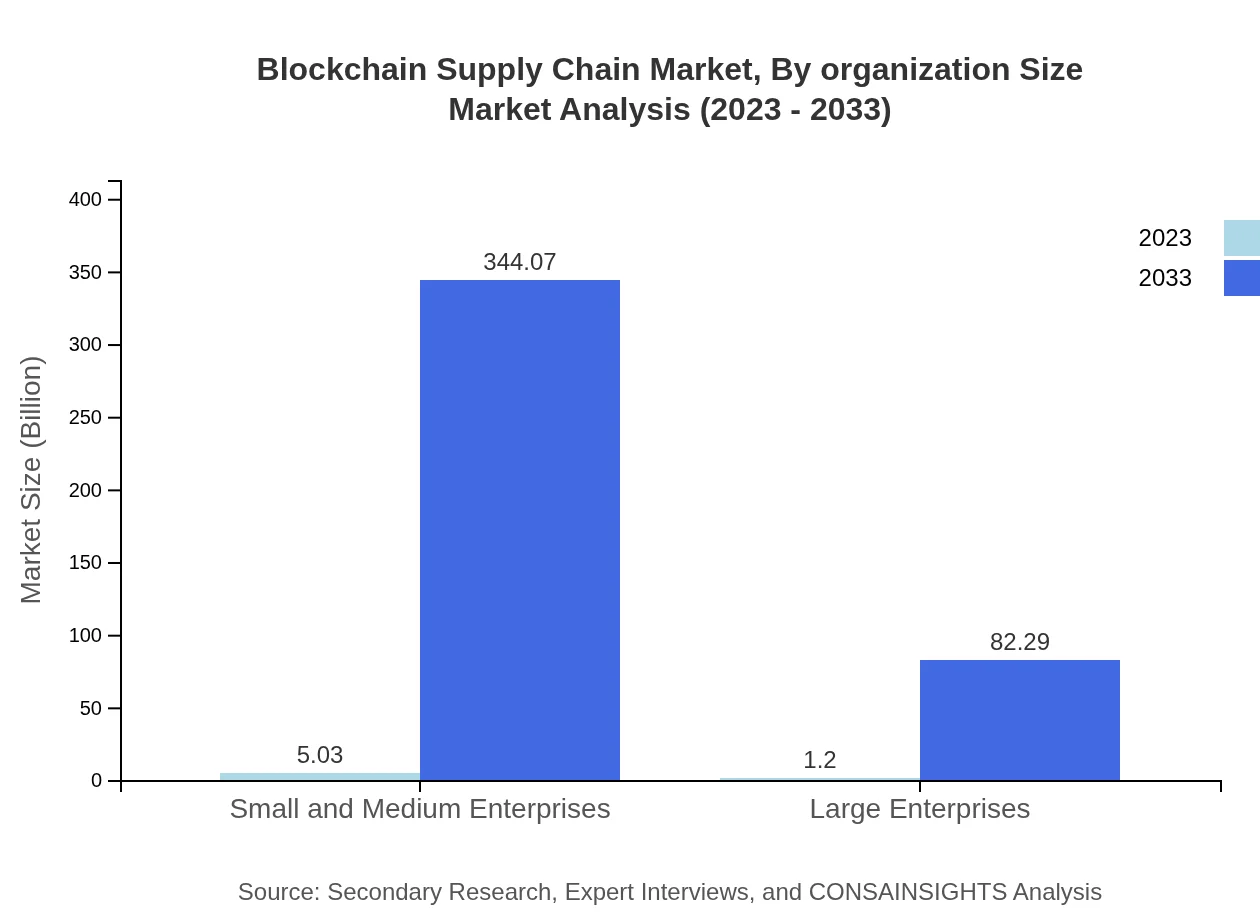

Blockchain Supply Chain Market Analysis By Organization Size

The market for small and medium enterprises (SMEs) is substantial, with an expected growth from $5.03 billion in 2023 to $344.07 billion by 2033. This reflects the increasing accessibility of blockchain solutions to smaller organizations.

Blockchain Supply Chain Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blockchain Supply Chain Industry

IBM:

IBM leads with its Hyperledger Fabric, delivering blockchain solutions that promote transparency and efficiency in supply chains.Accenture:

Accenture provides blockchain consulting and technology services, helping organizations integrate blockchain for improved supply chain management.VeChain:

VeChain specializes in supply chain logistics, leveraging blockchain to provide transparency and traceability for products.Microsoft:

Microsoft offers Azure Blockchain Service, enabling businesses to build and manage blockchain networks for supply chain applications.Oracle:

Oracle enables supply chain automation and transparency through its blockchain applications, catering to a wide range of industries.We're grateful to work with incredible clients.

FAQs

What is the market size of blockchain Supply Chain?

The global blockchain supply chain market was valued at approximately $6.23 billion in 2023 and is projected to reach around $129.3 billion by 2033, reflecting a robust CAGR of 48.1% over this period.

What are the key market players or companies in this blockchain Supply Chain industry?

Key market players in the blockchain supply chain industry include IBM, Microsoft, Oracle, SAP, and VeChain, which are actively developing and implementing blockchain-based solutions to enhance transparency and efficiency in supply chains.

What are the primary factors driving the growth in the blockchain supply chain industry?

The primary factors driving growth include increased demand for supply chain transparency, enhanced security through blockchain technology, the need for efficient tracking and tracing of products, and rising regulatory requirements for transparency in logistics.

Which region is the fastest Growing in the blockchain supply chain?

North America is currently leading the blockchain supply chain market, anticipated to grow from $2.38 billion in 2023 to $162.70 billion by 2033. However, Europe also shows significant growth potential from $1.88 billion to $128.38 billion.

Does Consainsights provide customized market report data for the blockchain supply chain industry?

Yes, Consainsights offers customized market report data tailored to specific needs within the blockchain supply chain industry, allowing clients to focus on particular segments, regions, or emerging trends.

What deliverables can I expect from this blockchain Supply Chain market research project?

Deliverables typically include a comprehensive market analysis report with insights on market size, trends, segment analysis, competitive landscapes, and forecasts, ensuring actionable intelligence for strategic decision-making.

What are the market trends of blockchain Supply Chain?

Key trends in the blockchain supply chain market include the increasing adoption of public and private blockchain solutions, growing focus on product tracking, and rising implementation of blockchain in logistics for improved efficiency.