Blood Gas And Electrolyte Analyzer Market Report

Published Date: 31 January 2026 | Report Code: blood-gas-and-electrolyte-analyzer

Blood Gas And Electrolyte Analyzer Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Blood Gas and Electrolyte Analyzer market from 2023 to 2033, offering insights into market dynamics, trends, and forecasts, along with segmented data and regional analysis.

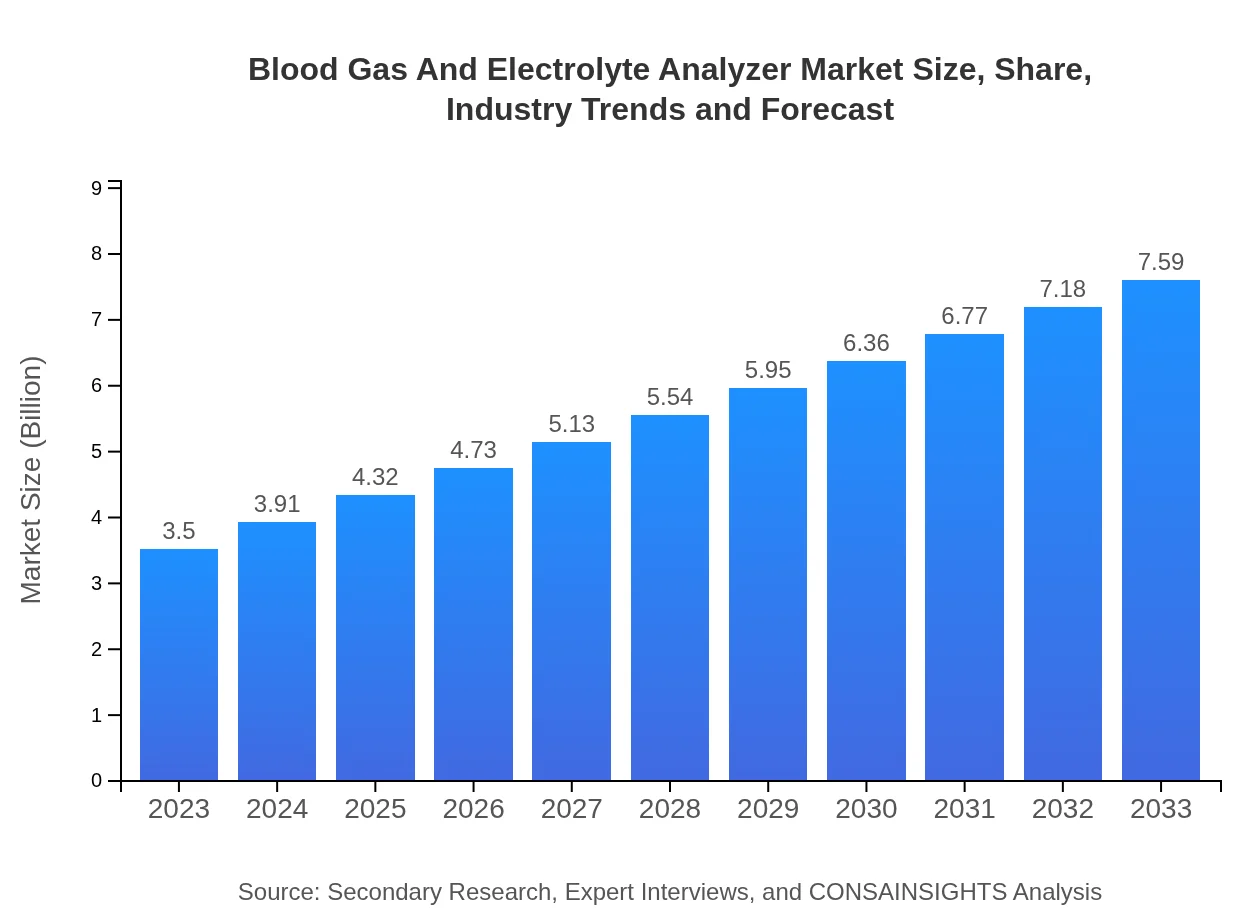

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $7.59 Billion |

| Top Companies | Abbott Laboratories, Siemens Healthineers, Roche Diagnostics |

| Last Modified Date | 31 January 2026 |

Blood Gas And Electrolyte Analyzer Market Overview

Customize Blood Gas And Electrolyte Analyzer Market Report market research report

- ✔ Get in-depth analysis of Blood Gas And Electrolyte Analyzer market size, growth, and forecasts.

- ✔ Understand Blood Gas And Electrolyte Analyzer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blood Gas And Electrolyte Analyzer

What is the Market Size & CAGR of Blood Gas And Electrolyte Analyzer market in 2023?

Blood Gas And Electrolyte Analyzer Industry Analysis

Blood Gas And Electrolyte Analyzer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blood Gas And Electrolyte Analyzer Market Analysis Report by Region

Europe Blood Gas And Electrolyte Analyzer Market Report:

The European market is projected to transition from $0.98 billion in 2023 to $2.12 billion in 2033. The region's growth is influenced by high healthcare standards, coupled with government funding for healthcare advancements.Asia Pacific Blood Gas And Electrolyte Analyzer Market Report:

In the Asia-Pacific region, the Blood Gas and Electrolyte Analyzer market is anticipated to grow from $0.74 billion in 2023 to $1.61 billion in 2033, driven by increasing healthcare investments and the rising burden of chronic diseases.North America Blood Gas And Electrolyte Analyzer Market Report:

In North America, the market is expected to develop from $1.23 billion in 2023 to $2.66 billion in 2033. Factors such as advanced healthcare systems and a high emphasis on research and development for new technologies support this increase.South America Blood Gas And Electrolyte Analyzer Market Report:

The South American market is projected to expand from $0.29 billion in 2023 to $0.62 billion in 2033. This growth is attributed to the improving healthcare infrastructure and increased awareness about early disease detection.Middle East & Africa Blood Gas And Electrolyte Analyzer Market Report:

The Middle East and Africa region's market is set to grow from $0.26 billion in 2023 to $0.57 billion in 2033, aided by enhanced healthcare initiatives and rising investments in healthcare technologies.Tell us your focus area and get a customized research report.

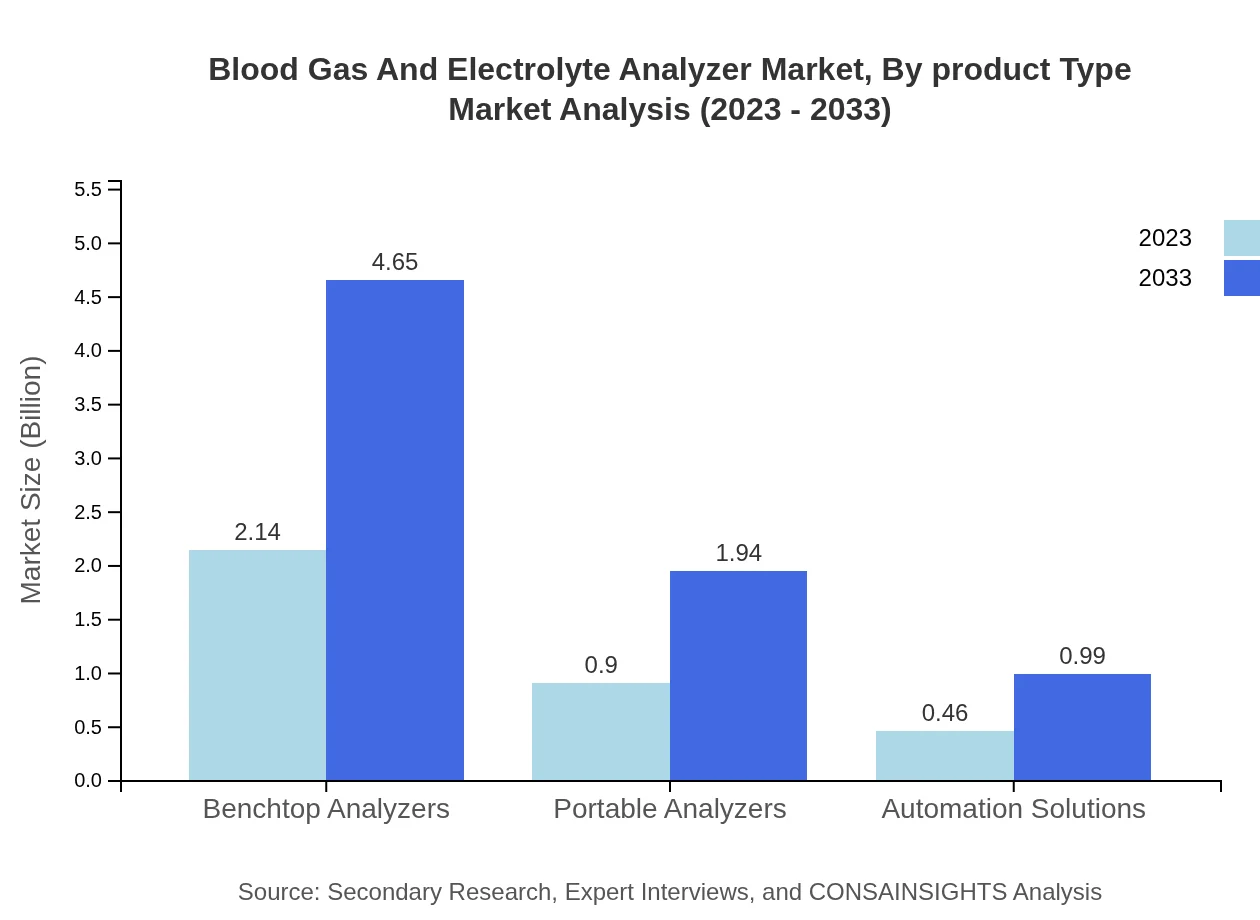

Blood Gas And Electrolyte Analyzer Market Analysis By Product Type

The market is primarily segmented into benchtop analyzers and portable analyzers. Benchtop analyzers dominate the market, accounting for approximately 61.28% in both 2023 and 2033, projected to grow from $2.14 billion to $4.65 billion. Portable analyzers follow, with a market share of 25.61%, expanding from $0.90 billion in 2023 to $1.94 billion by 2033.

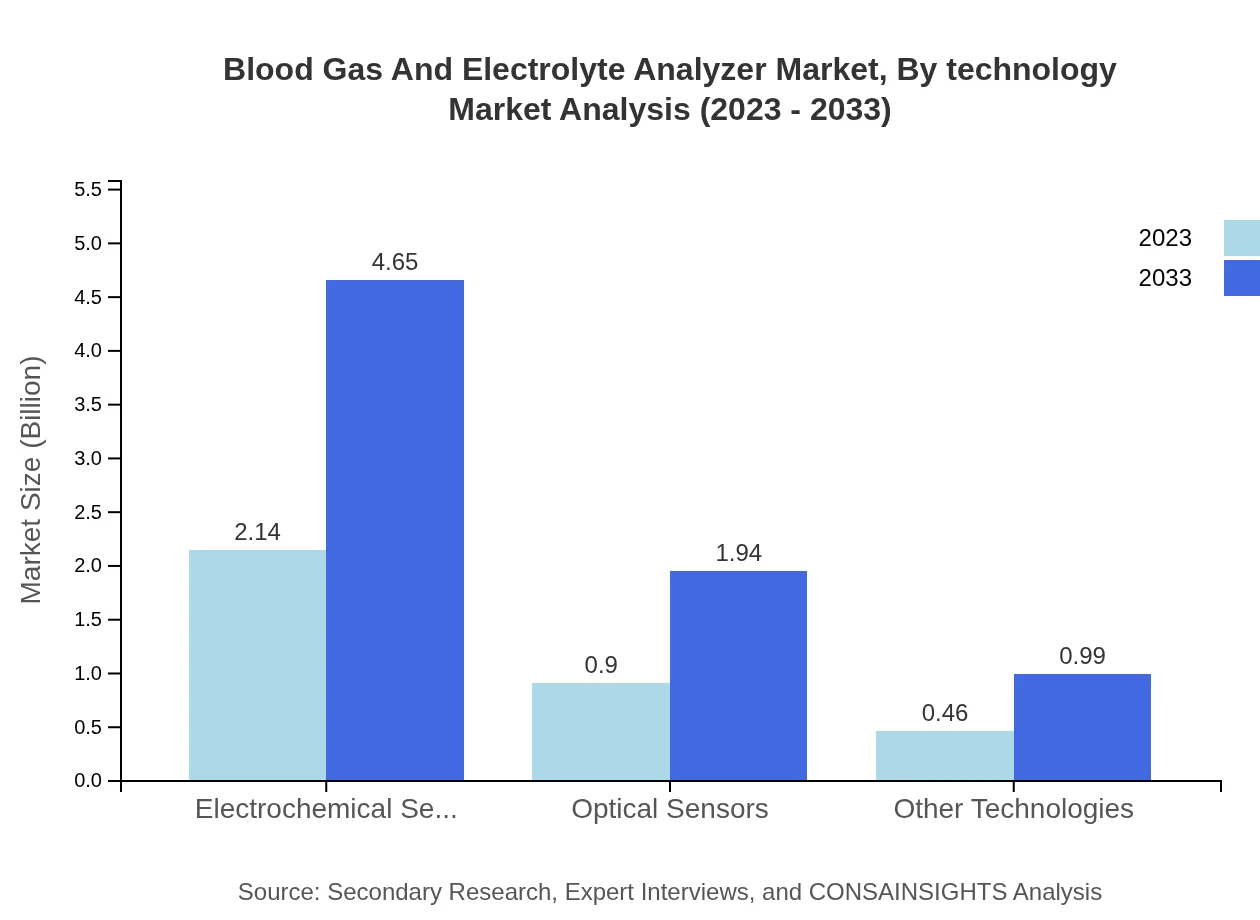

Blood Gas And Electrolyte Analyzer Market Analysis By Technology

The market is divided into electrochemical sensors, optical sensors, and other technologies. Electrochemical sensors cover a significant segment, holding 61.28% of the market share in both years and growing from $2.14 billion to $4.65 billion. Optical sensors also play a crucial role with a share of 25.61%.

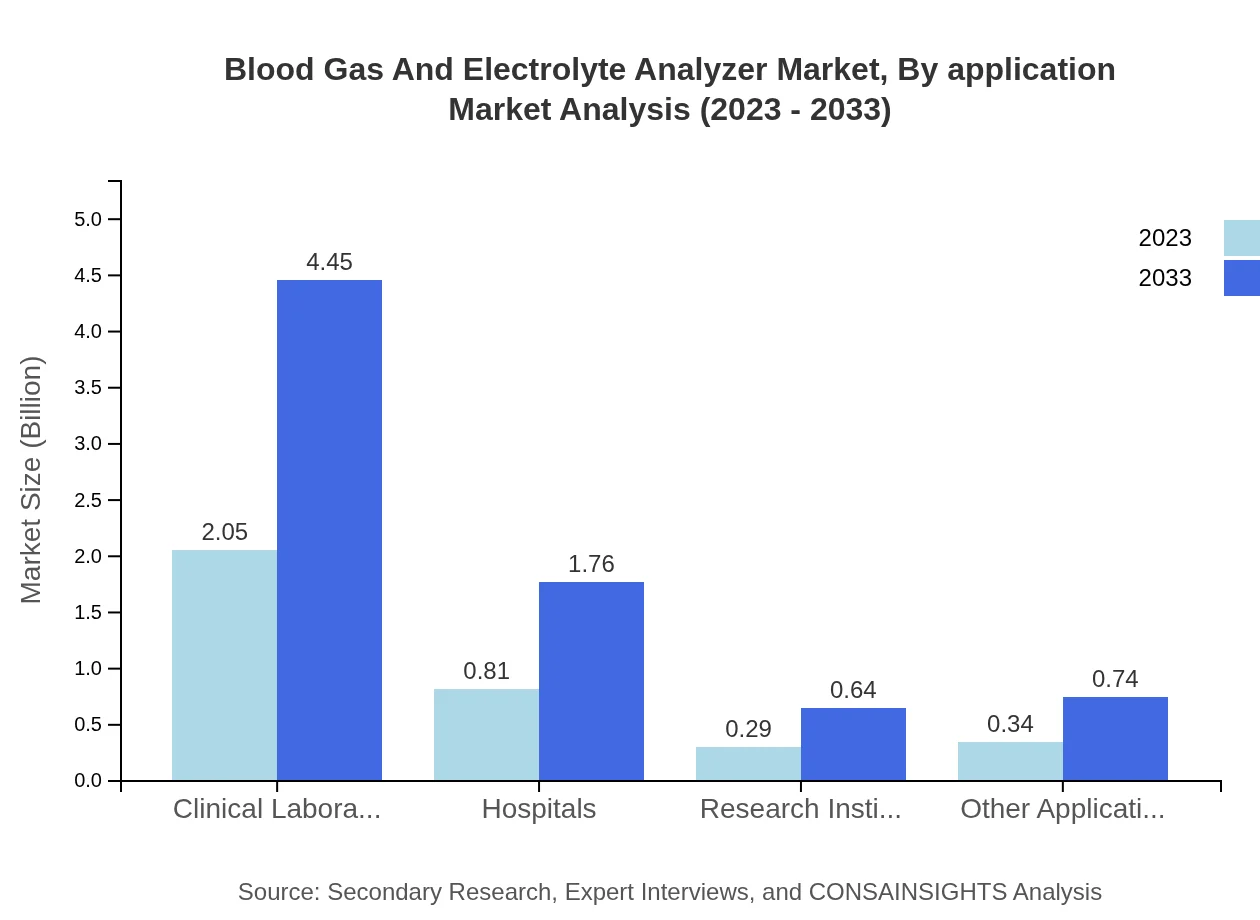

Blood Gas And Electrolyte Analyzer Market Analysis By Application

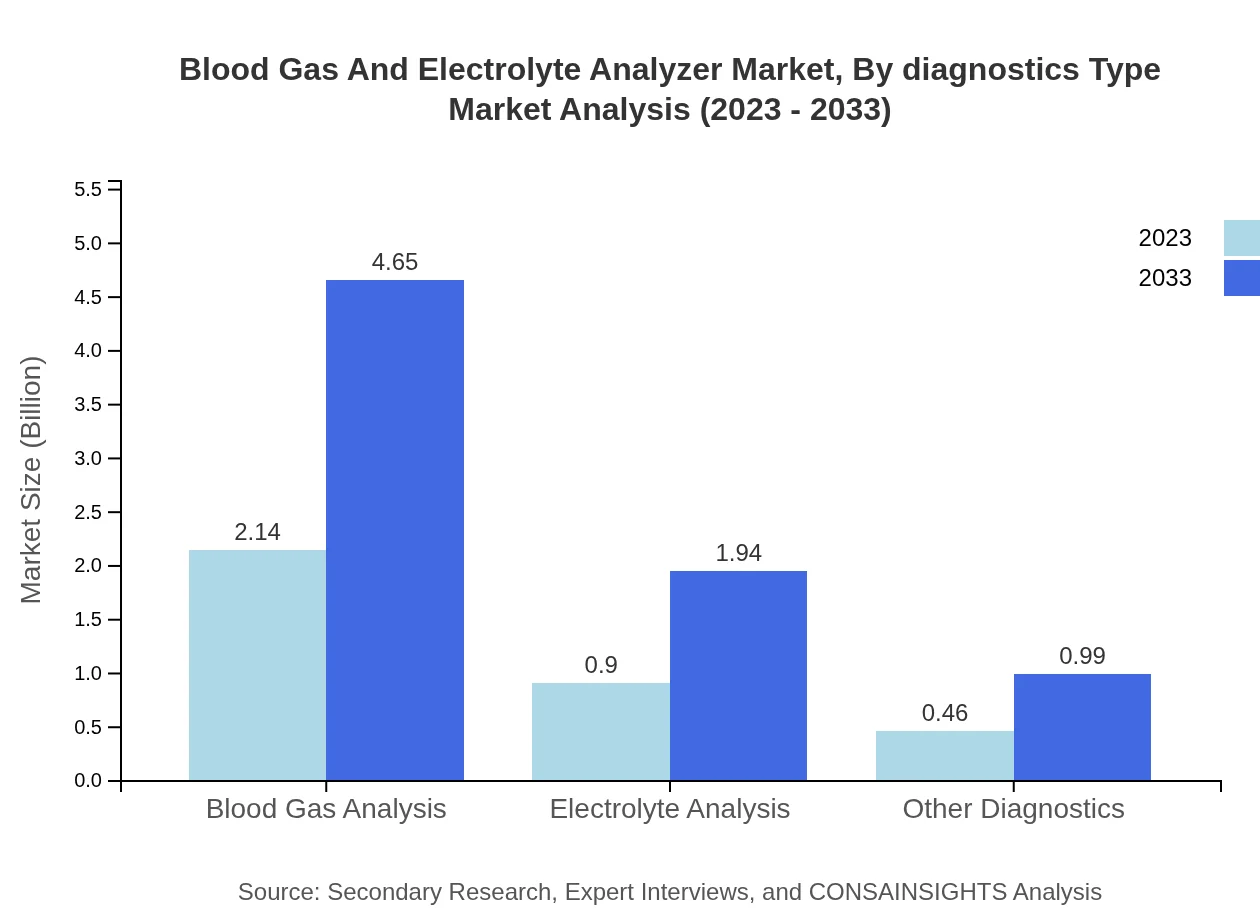

Significant applications include blood gas analysis, electrolyte analysis, and other diagnostics. Blood gas analysis maintains a share of 61.28%, increasing from $2.14 billion in 2023 to $4.65 billion in 2033. Electrolyte analysis represents a share of 25.61% with comparable growth.

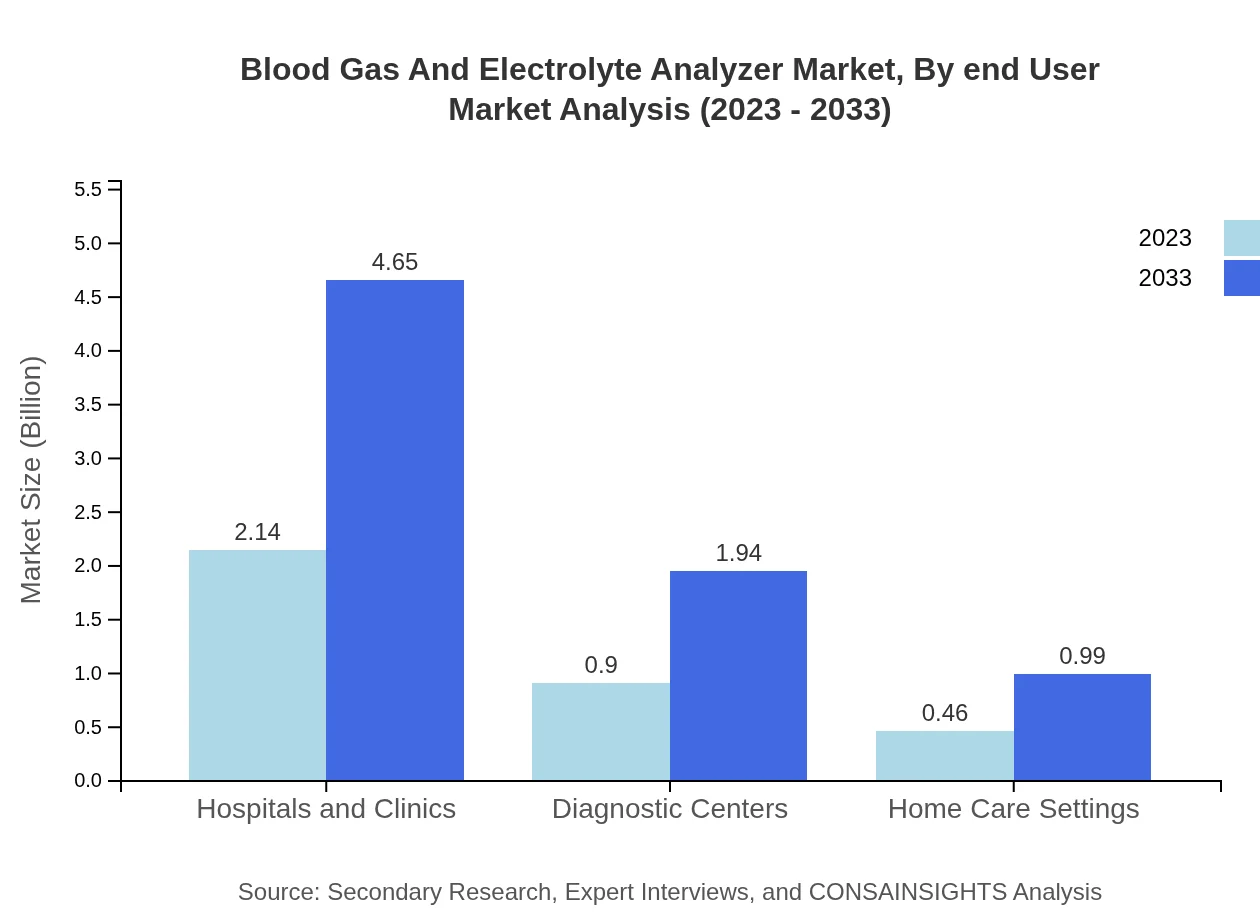

Blood Gas And Electrolyte Analyzer Market Analysis By End User

The end-user segmentation comprises hospitals, diagnostic centers, and home care settings. Hospitals dominate the market with a share of 61.28%, increasing from $2.14 billion in 2023 to $4.65 billion in 2033, as they continue to be the primary users of these analyzers.

Blood Gas And Electrolyte Analyzer Market Analysis By Diagnostics Type

The diagnostics types encompass various approaches used in medical settings. The segment is driven by the growing need for accurate and timely diagnostics, which enhances patient management and outcomes.

Blood Gas And Electrolyte Analyzer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blood Gas And Electrolyte Analyzer Industry

Abbott Laboratories:

A leading global healthcare company specializing in diagnostics and technologies, Abbott is known for its innovative blood gas analysis instruments that improve patient outcomes and streamline laboratory processes.Siemens Healthineers:

Siemens Healthineers offers a range of diagnostic solutions including advanced blood gas analyzers, known for their reliability and accuracy in clinical settings.Roche Diagnostics:

Roche is a pioneer in the healthcare sector, developing integrated blood gas and electrolyte analysis systems that enhance diagnostic efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of blood Gas And Electrolyte Analyzer?

The global blood gas and electrolyte analyzer market is projected to reach approximately $3.5 billion by 2033, with a compound annual growth rate (CAGR) of 7.8% from 2023 to 2033.

What are the key market players or companies in the blood Gas And Electrolyte Analyzer industry?

Key players in the blood gas and electrolyte analyzer market include companies like Abbott, Siemens Healthineers, Roche, Beckman Coulter, and Nova Biomedical, which are known for their advanced diagnostic solutions and technologies.

What are the primary factors driving the growth in the blood Gas And Electrolyte Analyzer industry?

Growth in the blood gas and electrolyte analyzer market is primarily driven by rising incidences of chronic diseases, advancements in technology, increased demand for point-of-care testing, and improvements in clinical laboratory testing capabilities.

Which region is the fastest Growing in the blood Gas And Electrolyte Analyzer?

The Asia Pacific region is expected to experience the fastest growth in the blood gas and electrolyte analyzer market, forecasted to grow from $0.74 billion in 2023 to $1.61 billion by 2033, due to rising healthcare expenditures and population growth.

Does ConsaInsights provide customized market report data for the blood Gas And Electrolyte Analyzer industry?

Yes, ConsaInsights offers customized market report data tailored specifically to client needs in the blood gas and electrolyte analyzer industry, allowing for in-depth analysis and insights.

What deliverables can I expect from this blood Gas And Electrolyte Analyzer market research project?

Deliverables from the blood gas and electrolyte analyzer market research project include comprehensive reports, data analysis, market forecasts, and segmentation insights, aimed at aiding strategic decision-making.

What are the market trends of blood Gas And Electrolyte Analyzer?

Current market trends include increased adoption of portable and benchtop analyzers, a shift towards automation in laboratories, and a growing focus on personalized medicine and rapid diagnostic solutions.