Blood Glucose Monitoring Market Report

Published Date: 31 January 2026 | Report Code: blood-glucose-monitoring

Blood Glucose Monitoring Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Blood Glucose Monitoring market, covering market size, growth forecasts, technological advancements, and regional insights from 2023 to 2033.

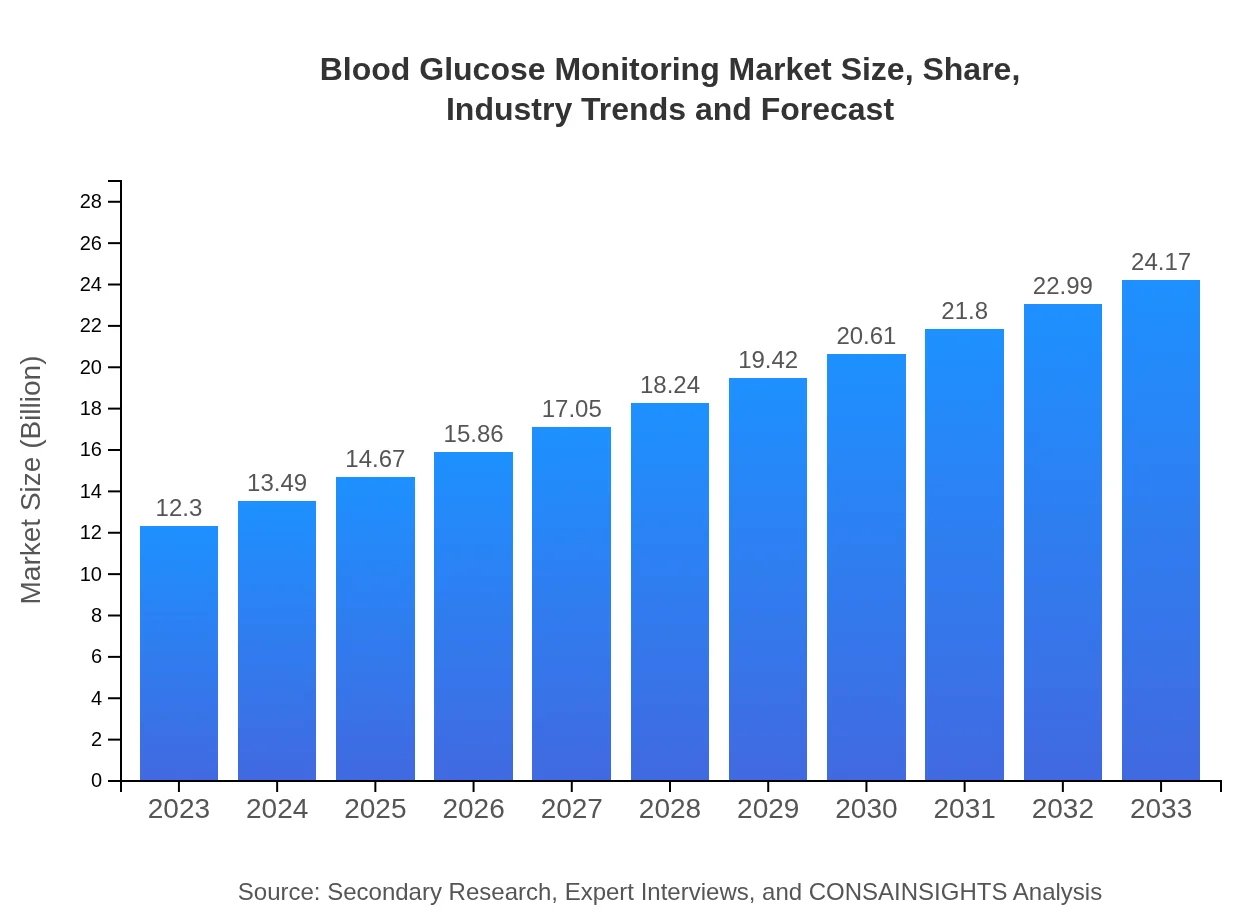

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.17 Billion |

| Top Companies | Abbott Laboratories, Roche Diagnostics, Bayer AG, Dexcom, Inc., Johnson & Johnson |

| Last Modified Date | 31 January 2026 |

Blood Glucose Monitoring Market Overview

Customize Blood Glucose Monitoring Market Report market research report

- ✔ Get in-depth analysis of Blood Glucose Monitoring market size, growth, and forecasts.

- ✔ Understand Blood Glucose Monitoring's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blood Glucose Monitoring

What is the Market Size & CAGR of Blood Glucose Monitoring market in 2023?

Blood Glucose Monitoring Industry Analysis

Blood Glucose Monitoring Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blood Glucose Monitoring Market Analysis Report by Region

Europe Blood Glucose Monitoring Market Report:

In Europe, the market is estimated at $3.51 billion in 2023, growing to $6.89 billion by 2033. Key drivers include rising health awareness, regulatory support for diabetes care, and the proliferation of advanced monitoring technologies.Asia Pacific Blood Glucose Monitoring Market Report:

In the Asia Pacific region, the Blood Glucose Monitoring market is valued at approximately $2.44 billion in 2023, projected to grow to $4.80 billion by 2033. This growth is driven by the increasing prevalence of diabetes, rising awareness of diabetes management, and healthcare investments in emerging economies.North America Blood Glucose Monitoring Market Report:

North America dominates the Blood Glucose Monitoring market with a valuation of around $4.48 billion in 2023, expected to reach $8.80 billion by 2033. The growth trajectory is supported by high diabetes prevalence, advanced healthcare infrastructure, and significant government investments in health technology.South America Blood Glucose Monitoring Market Report:

The South American market size is estimated at $0.98 billion in 2023, with projected growth to $1.92 billion by 2033. Factors include rising healthcare costs, increasing diabetes rates, and a growing emphasis on preventive care.Middle East & Africa Blood Glucose Monitoring Market Report:

The Middle East and Africa market is valued at $0.90 billion in 2023 and is expected to reach $1.76 billion by 2033. Increasing healthcare access, combined with government initiatives to combat diabetes, drives this growth.Tell us your focus area and get a customized research report.

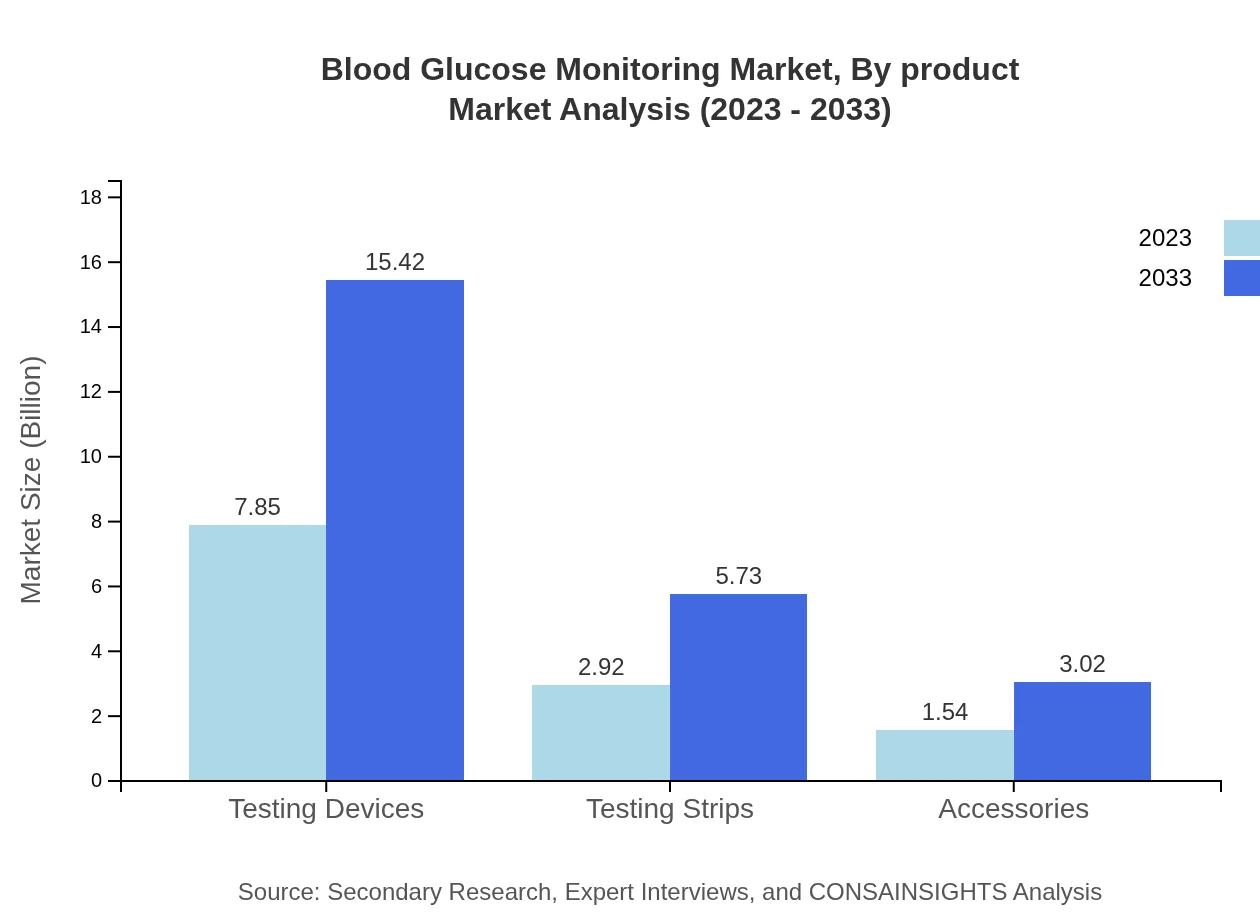

Blood Glucose Monitoring Market Analysis By Product

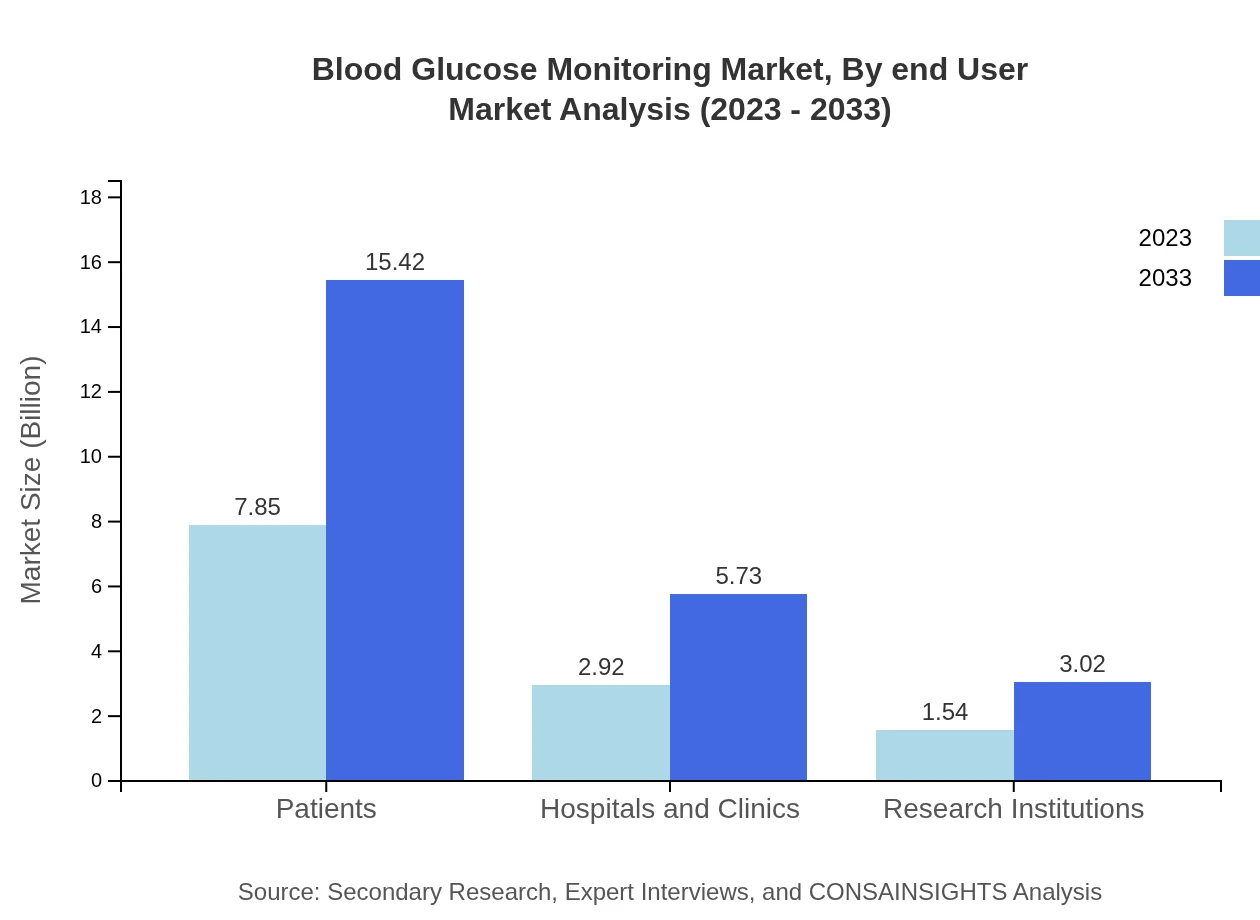

The Blood Glucose Monitoring market by product consists mainly of testing devices, testing strips, and accessories. Testing devices dominate the market, with a size of $7.85 billion in 2023, projected to reach $15.42 billion by 2033. Testing strips follow closely, currently valued at $2.92 billion, and expected to grow to $5.73 billion. Accessories, vital for enhancing user experience, are growing from $1.54 billion to $3.02 billion in the same period.

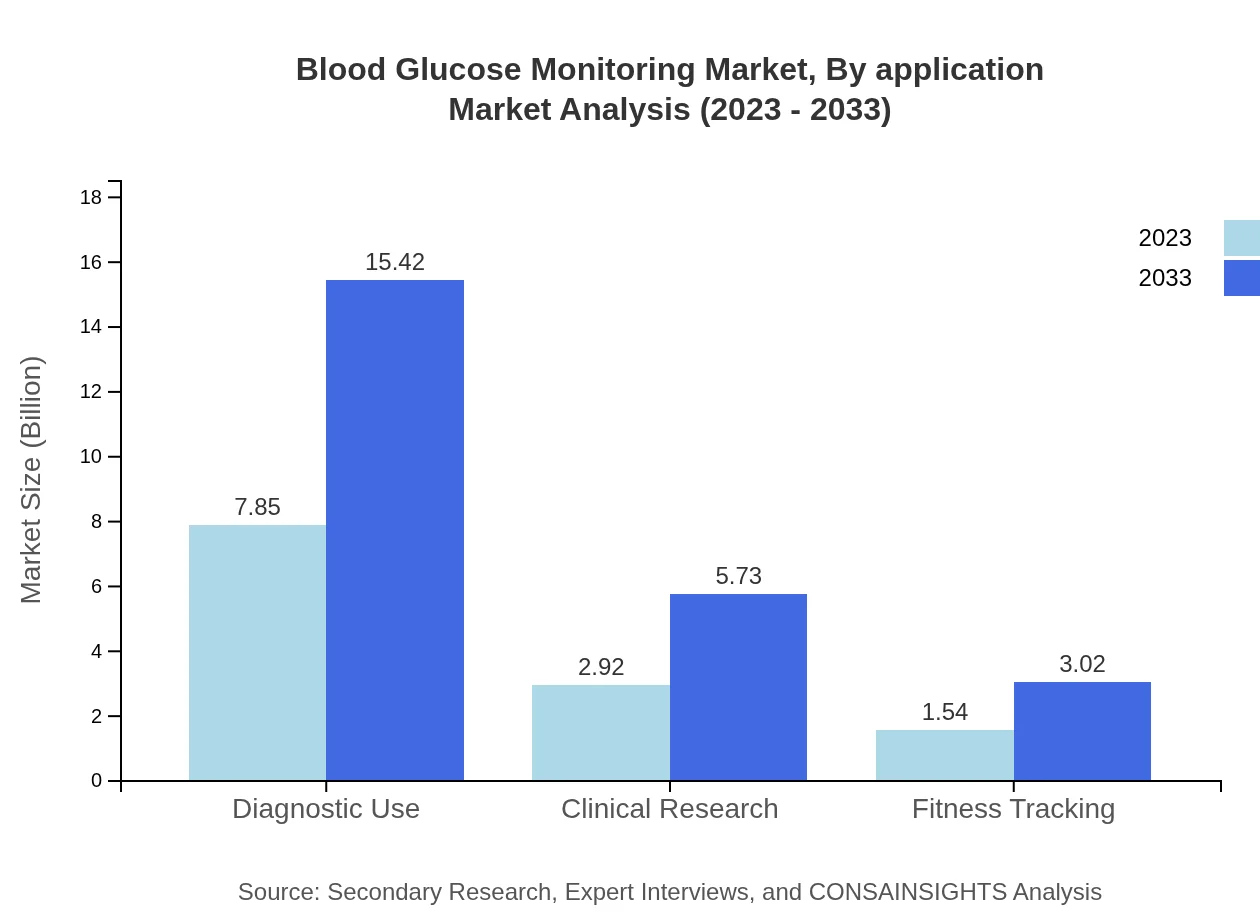

Blood Glucose Monitoring Market Analysis By Application

In terms of application, the Blood Glucose Monitoring market includes diagnostic use, clinical research, and fitness tracking. Diagnostic use is the largest segment, with a size of $7.85 billion in 2023 and projected to grow to $15.42 billion by 2033. Clinical research applications are also significant, growing from $2.92 billion to $5.73 billion.

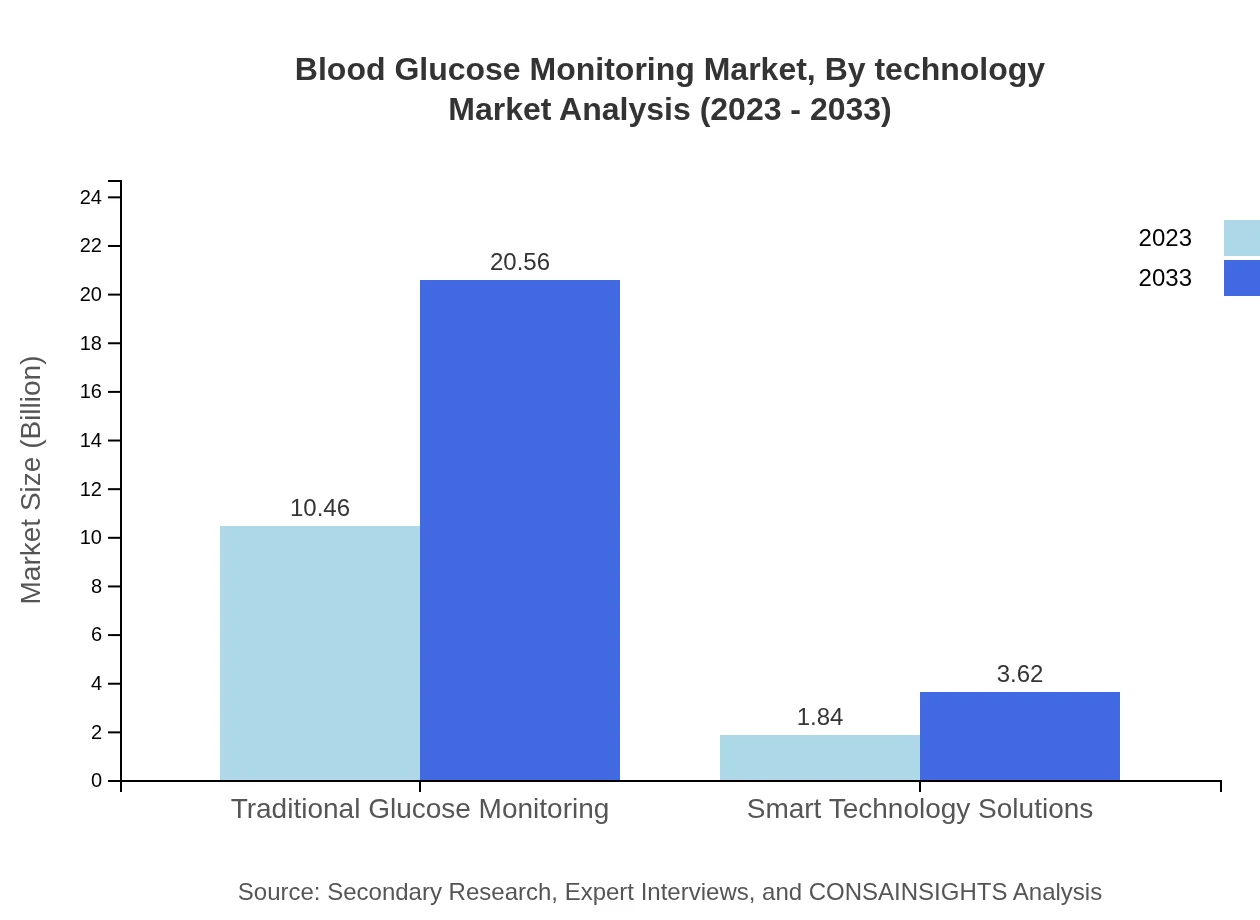

Blood Glucose Monitoring Market Analysis By Technology

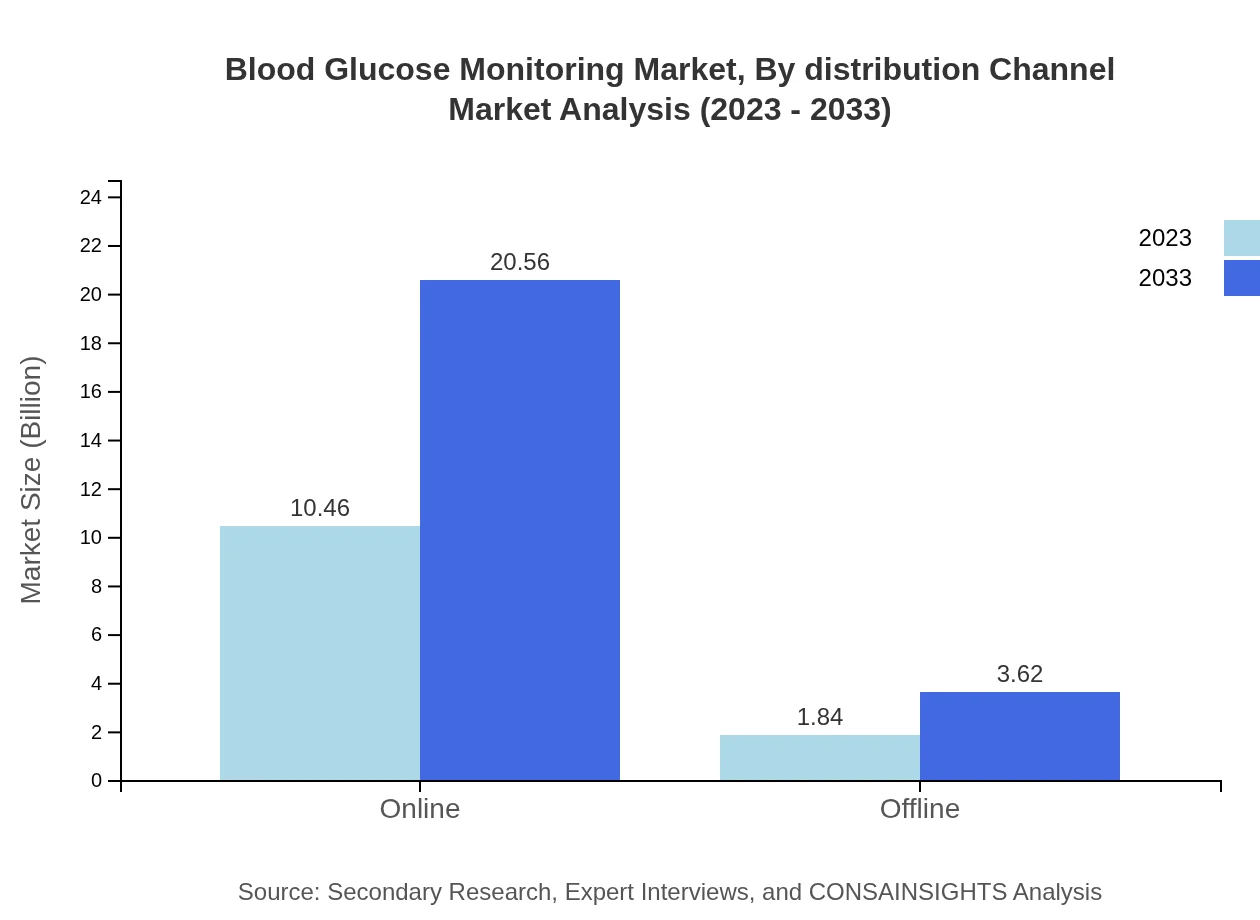

The technology segment consists of traditional glucose monitoring and smart technology solutions. Traditional glucose monitoring solutions still have the largest share, growing from $10.46 billion in 2023 to $20.56 billion by 2033. However, smart technology solutions are gaining traction, projected to grow from $1.84 billion to $3.62 billion, showcasing the industry's trend towards more sophisticated and interconnected devices.

Blood Glucose Monitoring Market Analysis By End User

The end-user segments include homecare settings, hospitals, clinics, and research institutions. Homecare settings dominate with a significant market size attributed to the convenience and comfort they provide patients, boasting an expected growth from $10.46 billion to $20.56 billion during the forecast period.

Blood Glucose Monitoring Market Analysis By Distribution Channel

Distribution channels for blood glucose monitoring products include online and offline sales. The market is heavily skewed towards online sales, reflecting a shift in consumer purchasing behaviors, projected to grow from $10.46 billion to $20.56 billion by 2033. Offline channels remain relevant, expected to expand from $1.84 billion to $3.62 billion.

Blood Glucose Monitoring Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blood Glucose Monitoring Industry

Abbott Laboratories:

Abbott is a global healthcare company known for its innovative blood glucose monitoring devices, including the FreeStyle Libre continuous glucose monitoring system.Roche Diagnostics:

Roche provides a comprehensive range of diabetes care products, including the Accu-Chek line, which enhances patients' blood glucose management.Bayer AG:

Bayer is recognized for its expertise in healthcare and offers a range of blood glucose monitoring solutions that address the needs of diabetes patients efficiently.Dexcom, Inc.:

Dexcom specializes in continuous glucose monitoring technology, which has revolutionized diabetes management for patients worldwide.Johnson & Johnson:

Through its subsidiary LifeScan, Johnson & Johnson is a significant player in blood glucose monitoring with its OneTouch brand offering users accessible solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of blood Glucose Monitoring?

The blood glucose monitoring market is valued at $12.3 billion in 2023, with a projected CAGR of 6.8%. This strong growth reflects increasing diabetes prevalence and technological advancements within the sector.

What are the key market players or companies in the blood Glucose Monitoring industry?

Key players in the blood glucose monitoring industry include Abbott Laboratories, Bayer AG, Johnson & Johnson, and Roche Diagnostics. These companies lead in innovation and products catered towards diabetes management and monitoring.

What are the primary factors driving the growth in the blood Glucose Monitoring industry?

Increasing diabetes prevalence, rising awareness of glucose monitoring, and advancements in technology are primary growth drivers. Additionally, population aging and favorable reimbursement policies enhance the market landscape significantly.

Which region is the fastest Growing in the blood Glucose Monitoring?

The Asia-Pacific region is the fastest-growing area in the blood glucose monitoring market. Forecasted growth from $2.44 billion in 2023 to $4.80 billion by 2033 indicates a significant opportunity for market expansion.

Does ConsaInsights provide customized market report data for the blood Glucose Monitoring industry?

Yes, ConsaInsights offers customized market report data tailored to the blood glucose monitoring industry. This includes specific trends, regional insights, and in-depth analyses based on client requirements.

What deliverables can I expect from this blood Glucose Monitoring market research project?

Expect comprehensive reports featuring market analysis, segments data, regional insights, competitive landscapes, and growth projections. These deliverables will assist in strategic planning and informed decision-making.

What are the market trends of blood Glucose Monitoring?

Key trends include increased adoption of smart technology solutions, growth in diabetes self-management, and the rise of online sales channels. Additionally, the emphasis on patient-centric solutions is shaping the industry approach.