Blood Screening Market Report

Published Date: 31 January 2026 | Report Code: blood-screening

Blood Screening Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Blood Screening market, covering current market conditions, trends, technological advancements, and forecasts through 2033. Insights on regional performance, market segmentation, and key industry players are included to inform strategic decisions.

| Metric | Value |

|---|---|

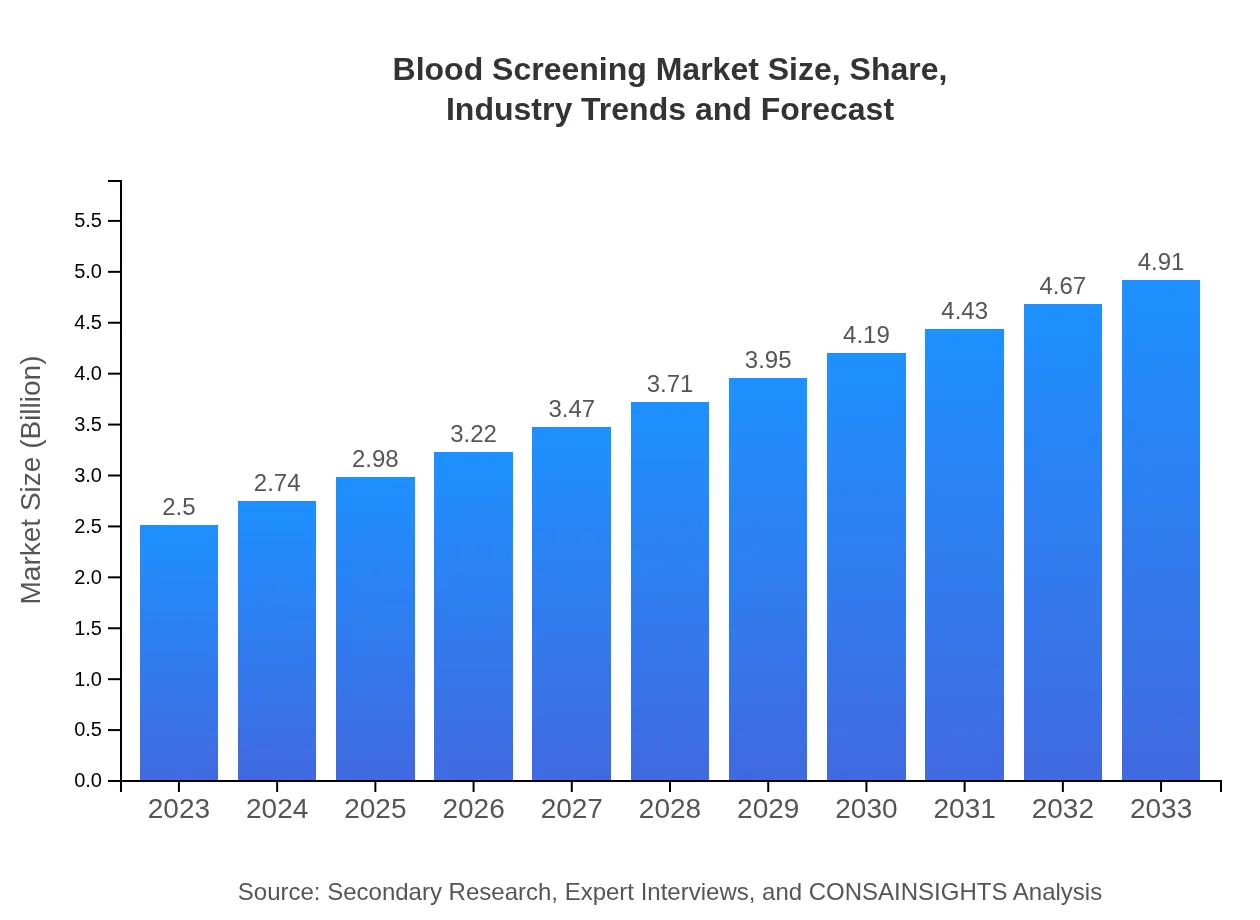

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Roche Diagnostics, Abbott Laboratories, Thermo Fisher Scientific, Siemens Healthineers, bioMérieux |

| Last Modified Date | 31 January 2026 |

Blood Screening Market Overview

Customize Blood Screening Market Report market research report

- ✔ Get in-depth analysis of Blood Screening market size, growth, and forecasts.

- ✔ Understand Blood Screening's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Blood Screening

What is the Market Size & CAGR of Blood Screening market in 2023?

Blood Screening Industry Analysis

Blood Screening Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Blood Screening Market Analysis Report by Region

Europe Blood Screening Market Report:

In Europe, the Blood Screening market is expected to increase from $0.74 billion in 2023 to $1.45 billion in 2033. The market benefits from advanced healthcare systems, regulatory support, and increasing awareness regarding the importance of blood safety.Asia Pacific Blood Screening Market Report:

The Asia Pacific region is projected to experience rapid growth in the Blood Screening market, with the market size expected to rise from $0.51 billion in 2023 to $1.01 billion in 2033. Growth drivers include increasing healthcare expenditure, a rising prevalence of infectious diseases, and advancements in screening technologies.North America Blood Screening Market Report:

North America, particularly the United States, leads the market with projected growth from $0.87 billion in 2023 to $1.71 billion in 2033. This growth can be attributed to the advanced healthcare infrastructure, significant investment in R&D, and stringent safety regulations imposed by health authorities.South America Blood Screening Market Report:

In South America, the Blood Screening market is anticipated to grow from $0.21 billion in 2023 to $0.41 billion by 2033. Key drivers include growing awareness of blood safety among healthcare professionals and the rising prevalence of diseases that necessitate blood screening.Middle East & Africa Blood Screening Market Report:

The Middle East and Africa are projected to exhibit steady growth from $0.17 billion in 2023 to $0.34 billion in 2033, driven primarily by improving healthcare infrastructure and government efforts to enhance blood safety standards.Tell us your focus area and get a customized research report.

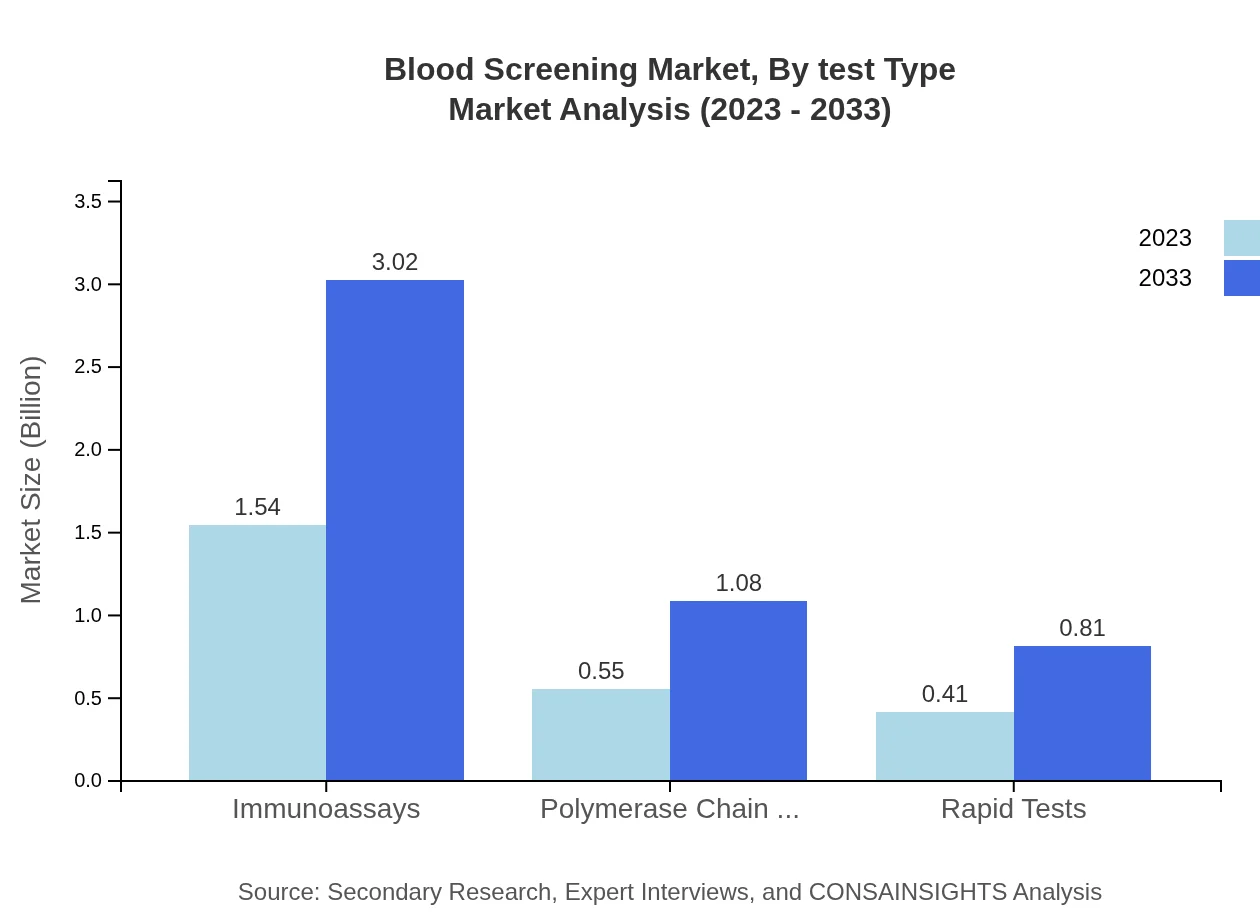

Blood Screening Market Analysis By Test Type

The market is divided into several test types, including immunoassays, polymerase chain reaction (PCR), rapid tests, traditional technologies, and advanced technologies. Immunoassays currently dominate the market due to their reliability and precision, whereas PCR is gaining traction thanks to its rapid results. These advancements cater to the need for effective disease detection, thus enhancing the overall safety of blood donations and transfusions.

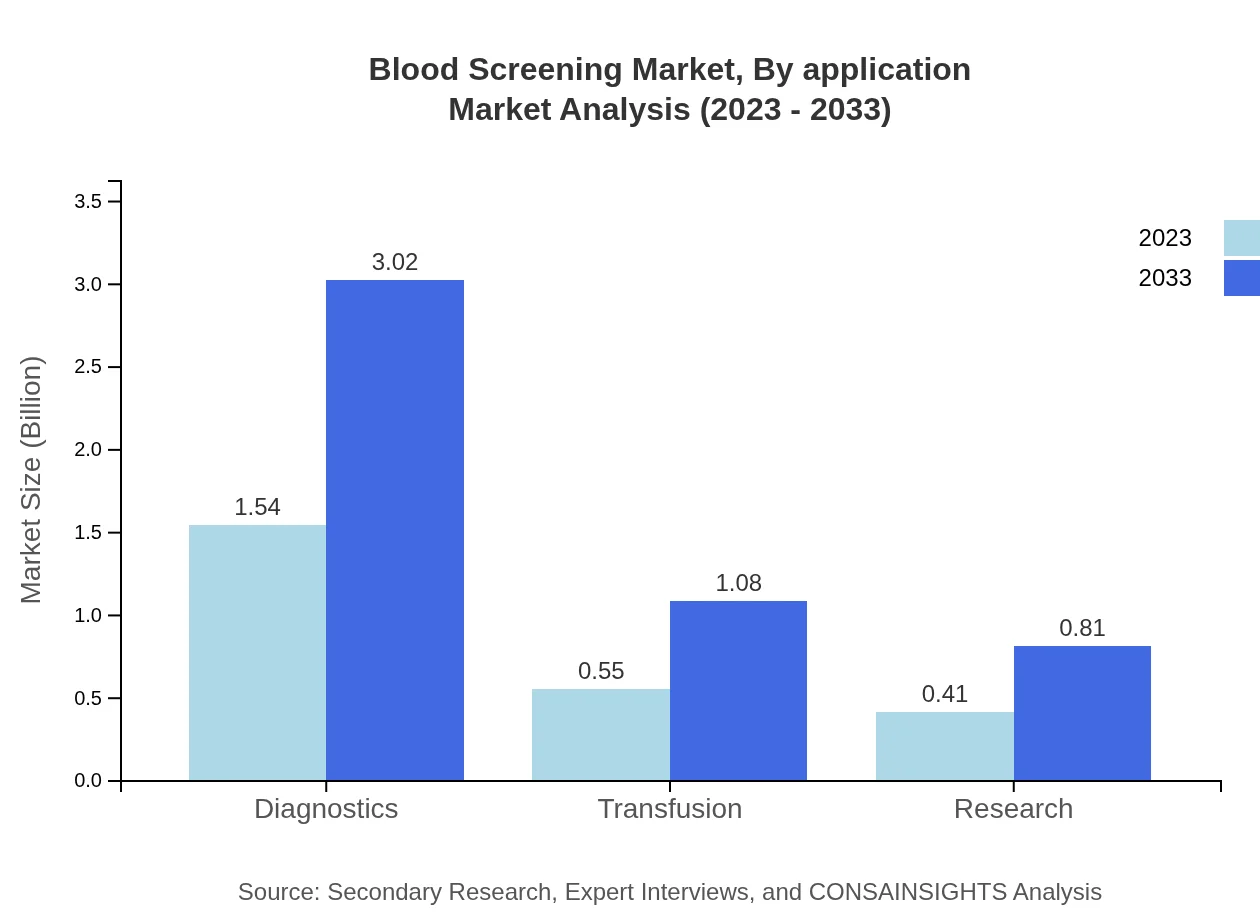

Blood Screening Market Analysis By Application

The applications of blood screening include diagnostics, transfusion, and research. Diagnostics hold the largest market share, driven by hospitals and laboratories focusing on patient safety. The transfusion application is vital for ensuring the safety of blood products, especially amidst rising vaccination and transfusion rates. Research applications are also gaining momentum, aiding in vaccine development and disease surveillance.

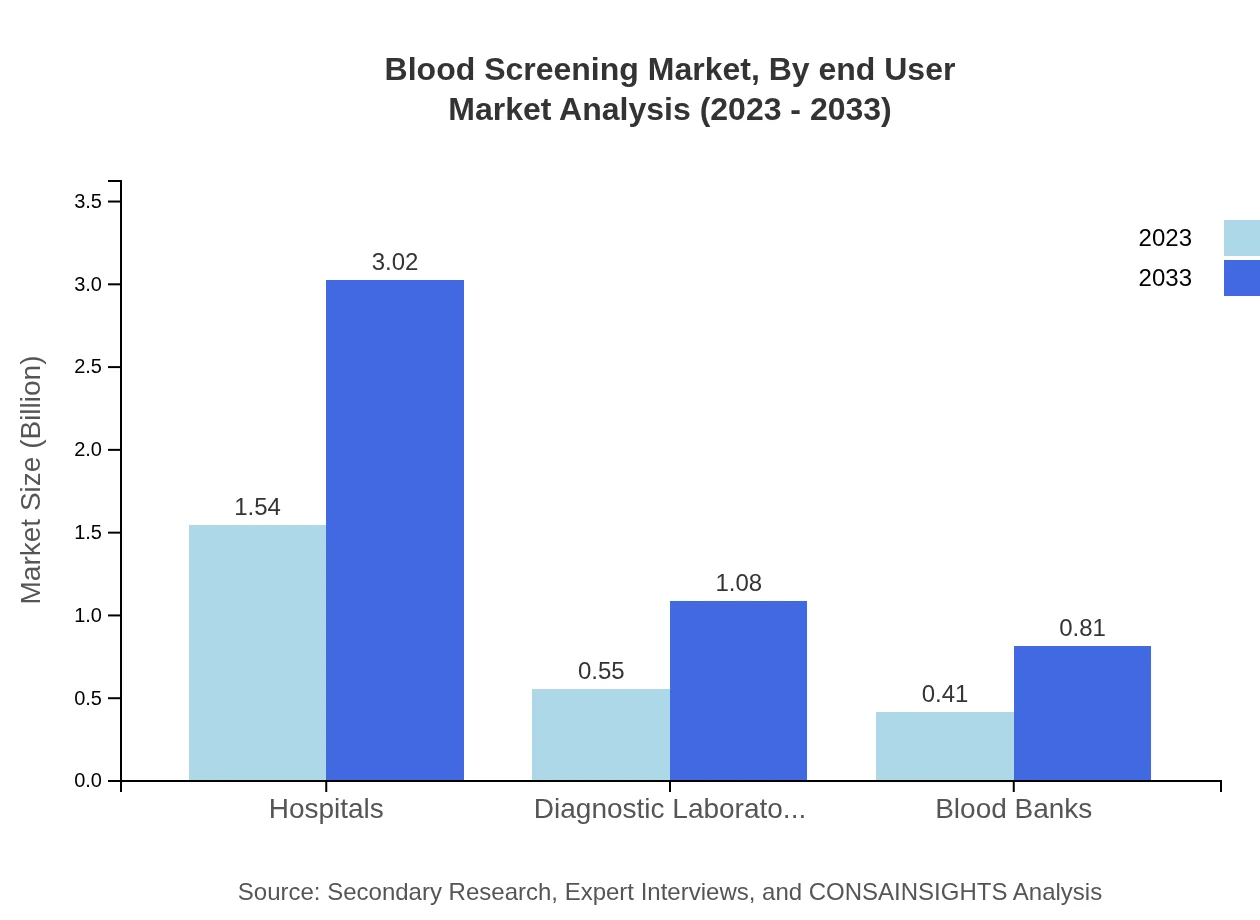

Blood Screening Market Analysis By End User

End-users of blood screening services include hospitals, diagnostic laboratories, blood banks, and research labs. Hospitals represent the largest segment, accounting for approximately 61.46% of the market share in 2023, projected to remain stable over the next decade. Diagnostic laboratories are expanding rapidly, reflecting the growing emphasis on accurate and prompt testing to avoid transfusion-related complications.

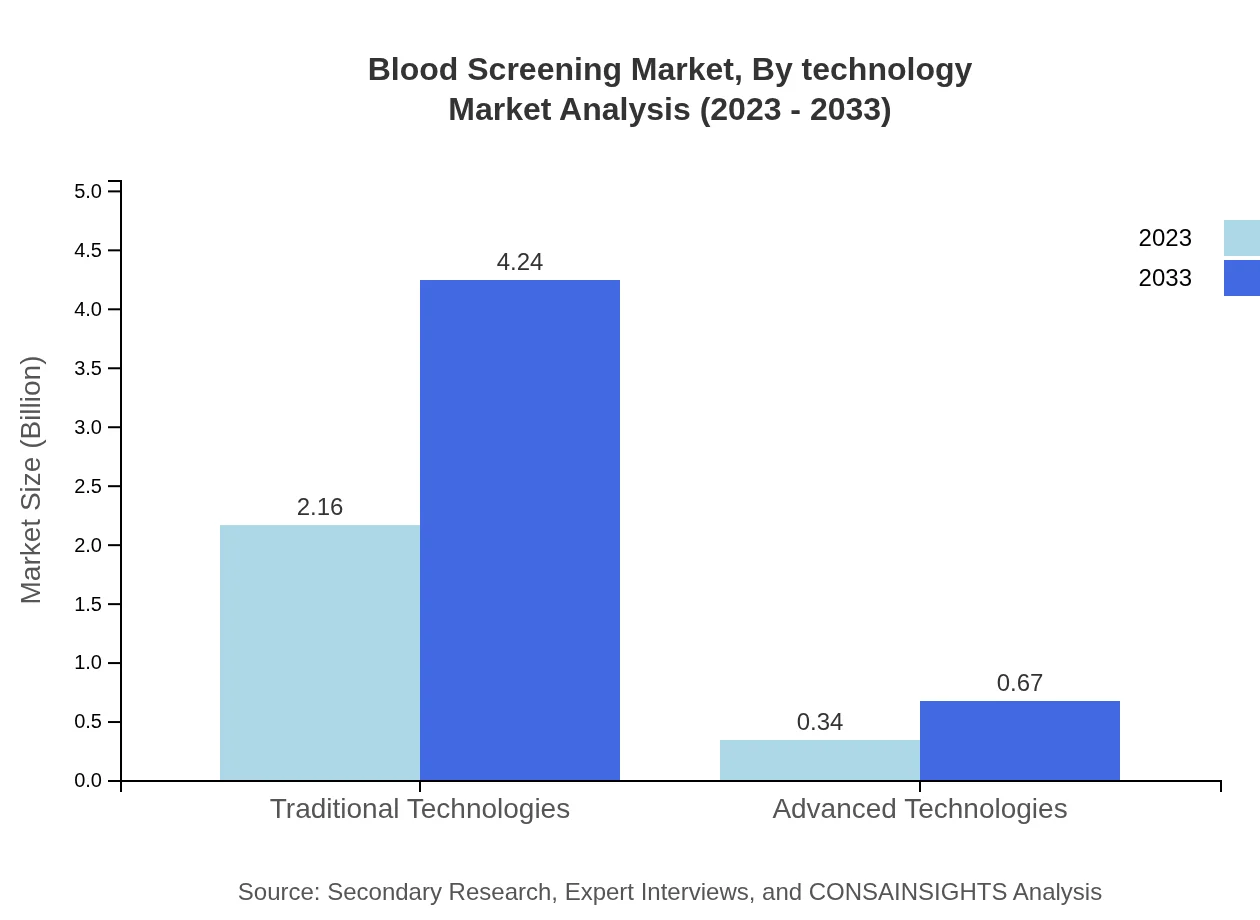

Blood Screening Market Analysis By Technology

The technologies utilized in blood screening are crucial for enhancing efficiency and accuracy. Traditional technologies still dominate the market; however, advanced technologies are increasingly gaining a foothold due to their rapid results and improved sensitivity. Automation and point-of-care testing technologies are creating new avenues for growth in the blood screening space.

Blood Screening Market Analysis By Region

Global Blood Screening Market, By Region Market Analysis (2023 - 2033)

Regional analysis of the Blood Screening market highlights varying growth rates and challenges. North America and Europe dominate the market in terms of revenue, due to stringent regulations and advanced healthcare systems, whereas the Asia Pacific and Latin America regions showcase higher growth rates fueled by rising healthcare investments and increasing prevalence of infectious diseases.

Blood Screening Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Blood Screening Industry

Roche Diagnostics:

A leader in the diagnostics industry, Roche develops innovative solutions in blood screening, focusing on immunoassays and molecular diagnostics.Abbott Laboratories:

Abbott provides a wide range of blood screening solutions and is known for its advanced technologies that enhance diagnostic accuracy.Thermo Fisher Scientific:

Thermo Fisher specializes in blood diagnostics and screening technologies, focusing on providing cutting-edge solutions for healthcare providers.Siemens Healthineers:

This company is renowned for pioneering technologies in blood screening and diagnostics, contributing significantly to safety in healthcare practices.bioMérieux:

Known for its role in infectious disease management, bioMérieux offers a variety of blood screening technologies that ensure quality and safety in transfusions.We're grateful to work with incredible clients.

FAQs

What is the market size of blood Screening?

The blood screening market is currently valued at $2.5 billion in 2023 and is projected to grow at a CAGR of 6.8% over the next decade, indicating significant expansion and innovation opportunities in this critical healthcare sector.

What are the key market players or companies in this blood screening industry?

Key players in the blood screening market include major diagnostic companies like Abbott Laboratories, Roche Diagnostics, and Siemens Healthineers, which drive innovation and contribute to market growth through advanced diagnostic solutions and technologies.

What are the primary factors driving the growth in the blood screening industry?

Growth drivers include an increasing prevalence of infectious diseases, advancements in diagnostic technology, and heightened awareness of preventive healthcare measures, aligning with a global trend towards early detection and improved patient outcomes.

Which region is the fastest Growing in the blood screening?

The fastest-growing region in blood screening is expected to be Europe, with market growth projected from $0.74 billion in 2023 to $1.45 billion by 2033, demonstrating a robust demand for innovative screening solutions in this region.

Does ConsaInsights provide customized market report data for the blood screening industry?

Yes, ConsaInsights offers tailored market research solutions for the blood screening industry, allowing clients to access specific data and insights that meet their unique business needs and strategic objectives.

What deliverables can I expect from this blood screening market research project?

From this project, you can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape reviews, and insights into consumer behavior, ensuring informed decision-making for strategic planning.

What are the market trends of blood screening?

Key trends include the shift towards advanced technologies like PCR and immunoassays, increased integration of digital health solutions, and an emphasis on rapid testing methods, allowing for efficient and accurate diagnostics in healthcare settings.