Bluetooth Smart And Smart Ready Market Report

Published Date: 31 January 2026 | Report Code: bluetooth-smart-and-smart-ready

Bluetooth Smart And Smart Ready Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bluetooth Smart and Smart Ready market, covering insights on market size, growth, trends, and forecasts from 2023 to 2033. Detailed segmentation by products, regions, and applications is included for a thorough understanding of market dynamics.

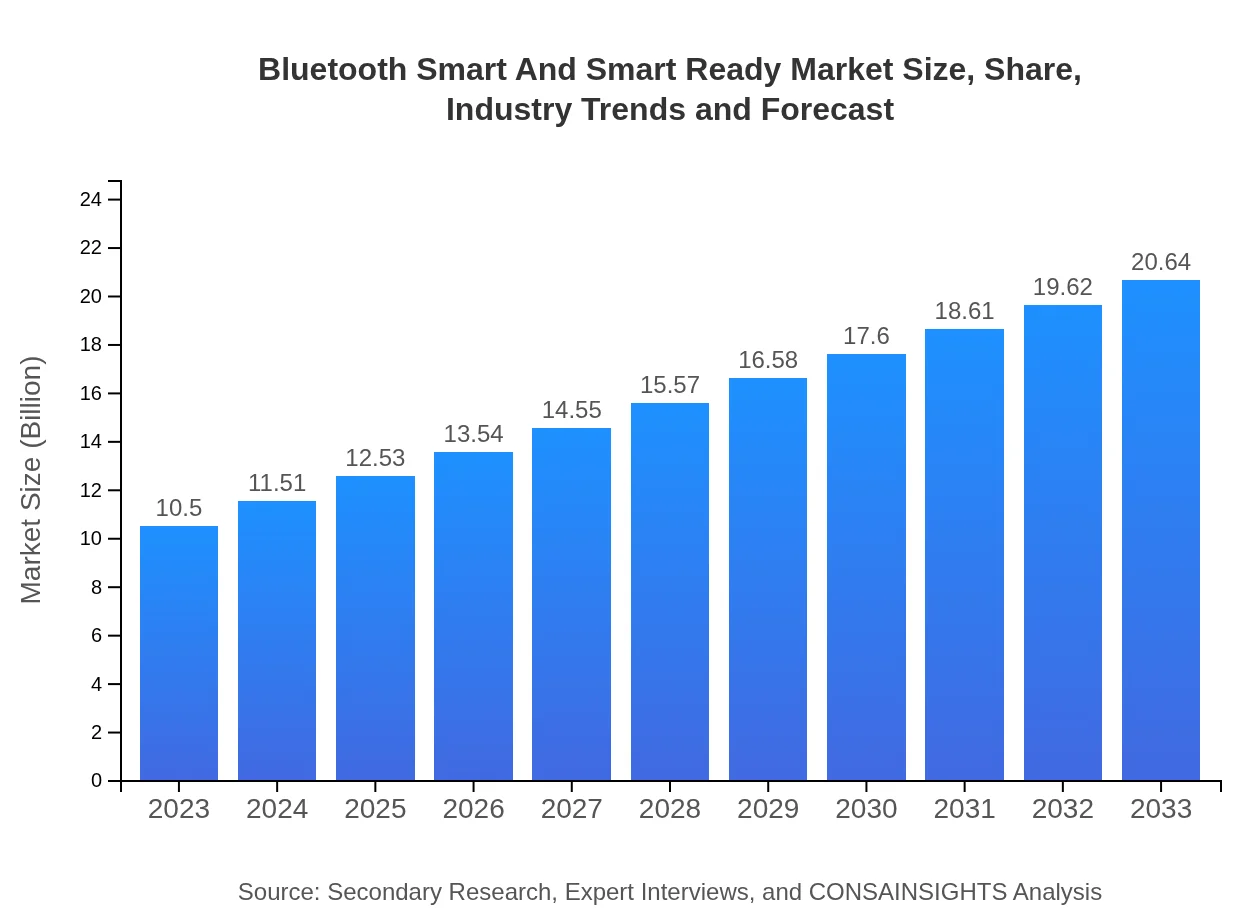

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Qualcomm Technologies, Inc., Texas Instruments Incorporated, NXP Semiconductors N.V., Broadcom Inc., STMicroelectronics |

| Last Modified Date | 31 January 2026 |

Bluetooth Smart And Smart Ready Market Overview

Customize Bluetooth Smart And Smart Ready Market Report market research report

- ✔ Get in-depth analysis of Bluetooth Smart And Smart Ready market size, growth, and forecasts.

- ✔ Understand Bluetooth Smart And Smart Ready's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bluetooth Smart And Smart Ready

What is the Market Size & CAGR of Bluetooth Smart And Smart Ready market in 2023?

Bluetooth Smart And Smart Ready Industry Analysis

Bluetooth Smart And Smart Ready Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bluetooth Smart And Smart Ready Market Analysis Report by Region

Europe Bluetooth Smart And Smart Ready Market Report:

By 2033, the European region is expected to grow from a market size of $3.48 billion in 2023 to $6.84 billion. The growth is bolstered by stringent regulations encouraging wireless innovations, consumer adoption of smart technologies, and an increase in the deployment of Bluetooth-based applications in healthcare and automotive sectors.Asia Pacific Bluetooth Smart And Smart Ready Market Report:

The Asia Pacific region is expected to experience significant growth in the Bluetooth Smart and Smart Ready market, with a market size projected to reach $3.92 billion by 2033, up from $1.99 billion in 2023. Factors driving this growth include increased smartphone penetration, innovative smart device applications, and rising consumer electronics demand in emerging markets like India and China.North America Bluetooth Smart And Smart Ready Market Report:

North America reports a robust market for Bluetooth Smart and Smart Ready technology with an anticipated growth to $7.49 billion by 2033 from $3.81 billion in 2023. The region's leadership is fueled by high consumer adoption rates, a strong presence of key market players, and continuous advancements in connected devices across industries.South America Bluetooth Smart And Smart Ready Market Report:

The South American market for Bluetooth Smart and Smart Ready is projected to grow from $-0.20 billion in 2023 to $-0.39 billion by 2033, indicative of a contracting segment as market challenges persist. Economic instability and lack of infrastructure investment hinder growth, but emerging technologies could redefine the market outlook with appropriate strategies.Middle East & Africa Bluetooth Smart And Smart Ready Market Report:

The Middle East and Africa region is projected to grow from $1.42 billion in 2023 to $2.79 billion by 2033. Factors such as urbanization, increasing adoption of smart technologies, and the expansion of the telecommunications sector drive growth. However, growth may be tempered by economic challenges and infrastructure limitations in certain areas.Tell us your focus area and get a customized research report.

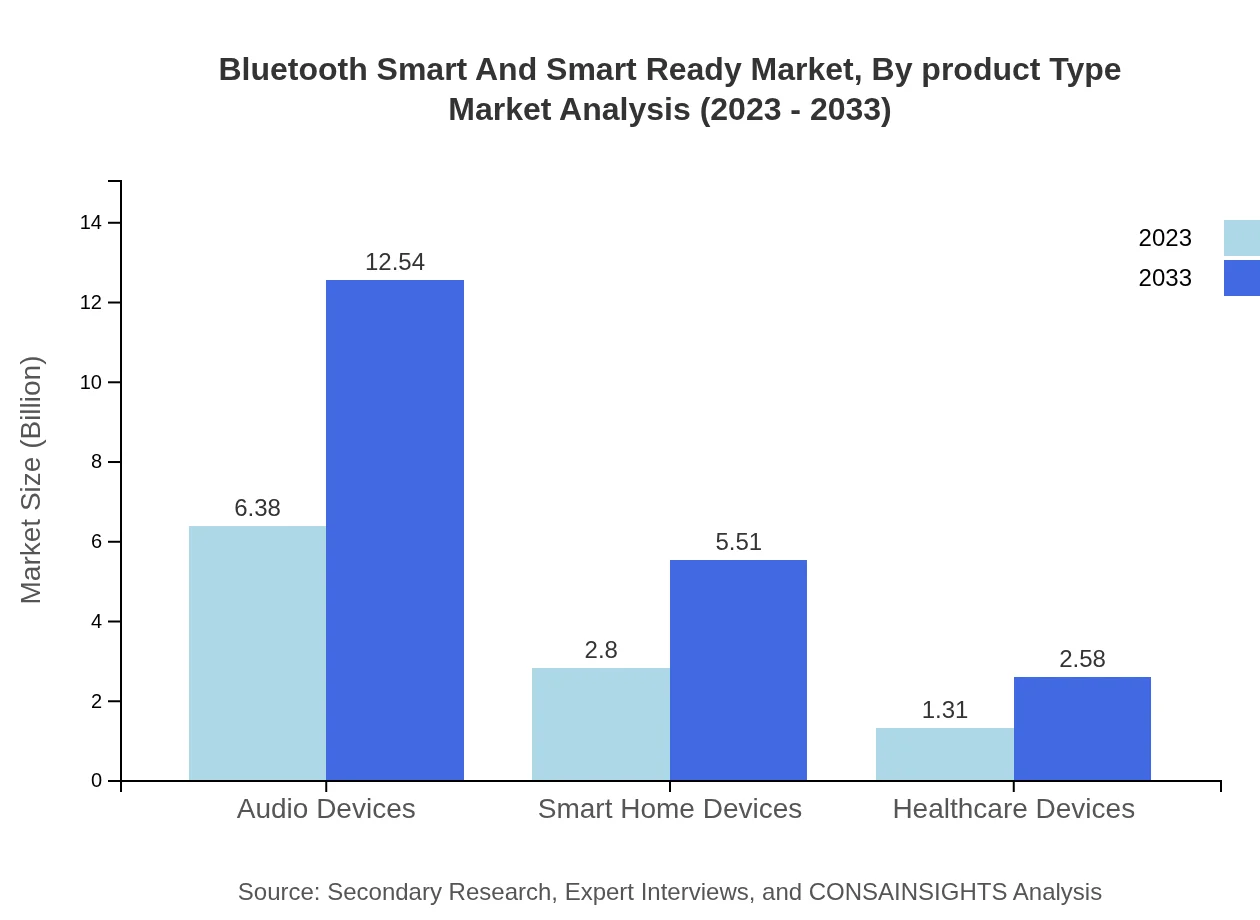

Bluetooth Smart And Smart Ready Market Analysis By Product Type

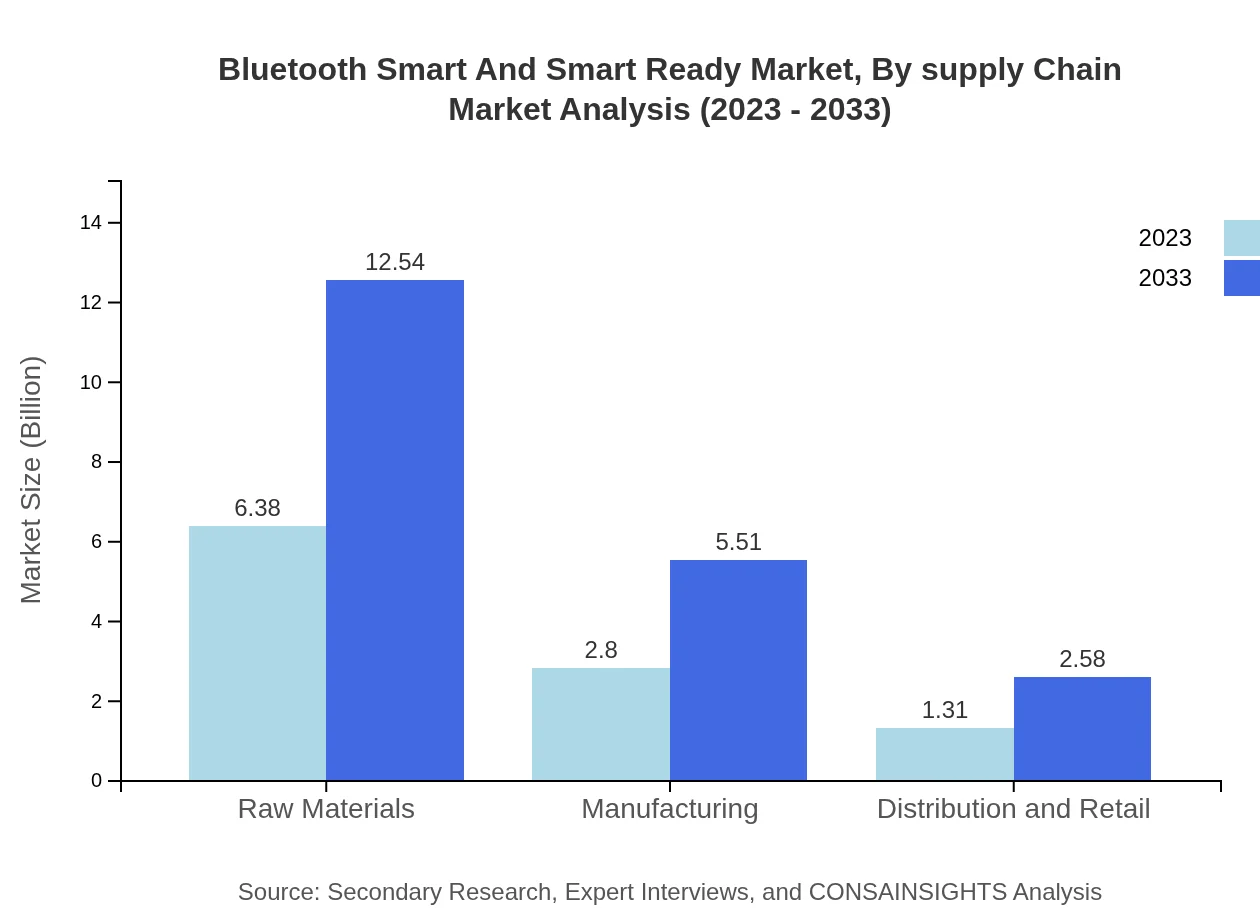

The Bluetooth Smart and Smart Ready market is segmented by product type including audio devices, smart home devices, healthcare devices, and automotive applications. Audio devices dominate the market with a size of $6.38 billion, projected to reach $12.54 billion by 2033, while smart home devices follow closely with growth from $2.80 billion to $5.51 billion. Healthcare devices are seeing a steady increment from $1.31 billion to $2.58 billion, pointing towards increased demand in remote monitoring applications.

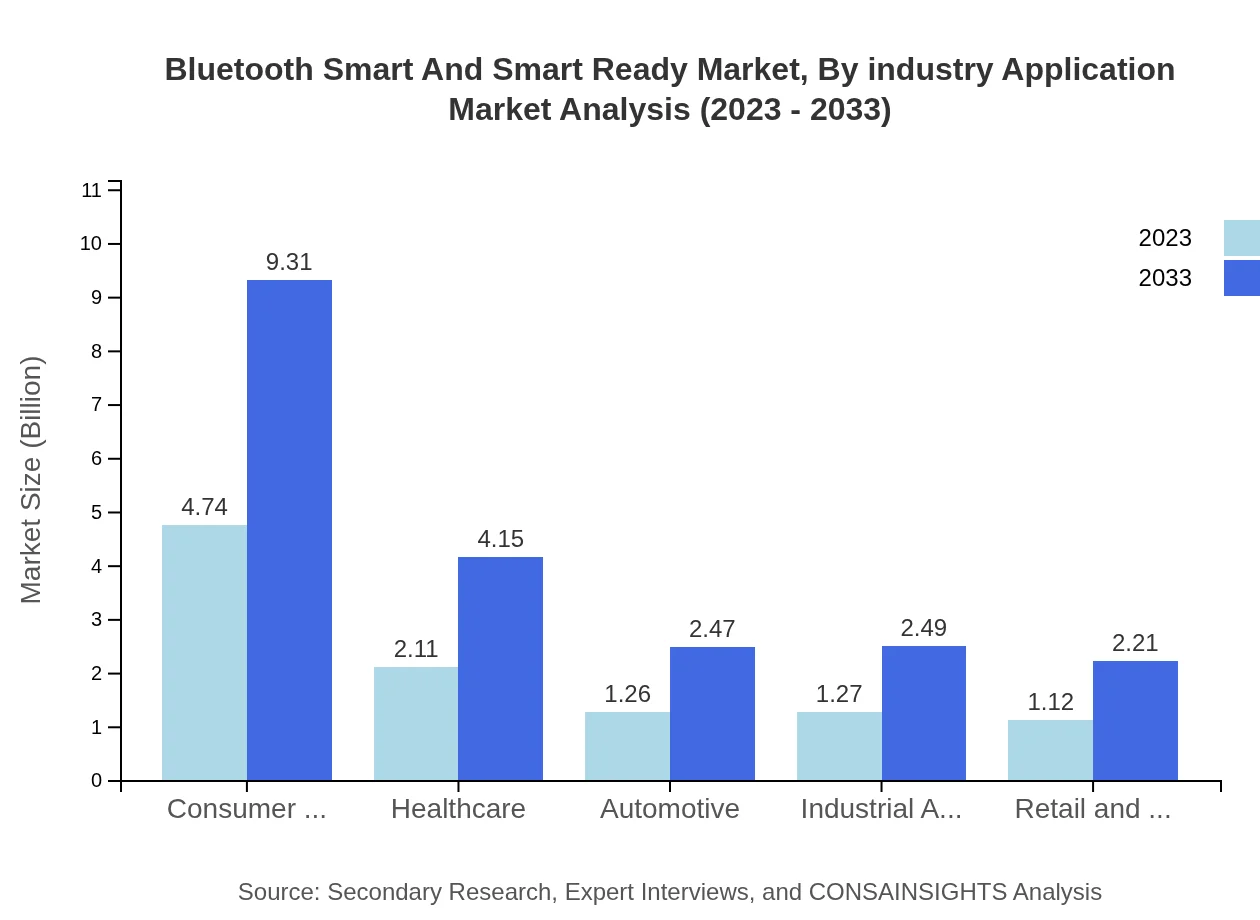

Bluetooth Smart And Smart Ready Market Analysis By Industry Application

Various industry applications drive the Bluetooth Smart and Smart Ready market performance, including consumer electronics, healthcare, automotive, and industrial applications. Consumer electronics represent a significant share, comprising 45.13% of the market, reflecting widespread integration. Healthcare applications, gaining attention through innovative devices, occupy a 20.13% share, while automotive applications represent an 11.98% share as the sector embraces connected car technology.

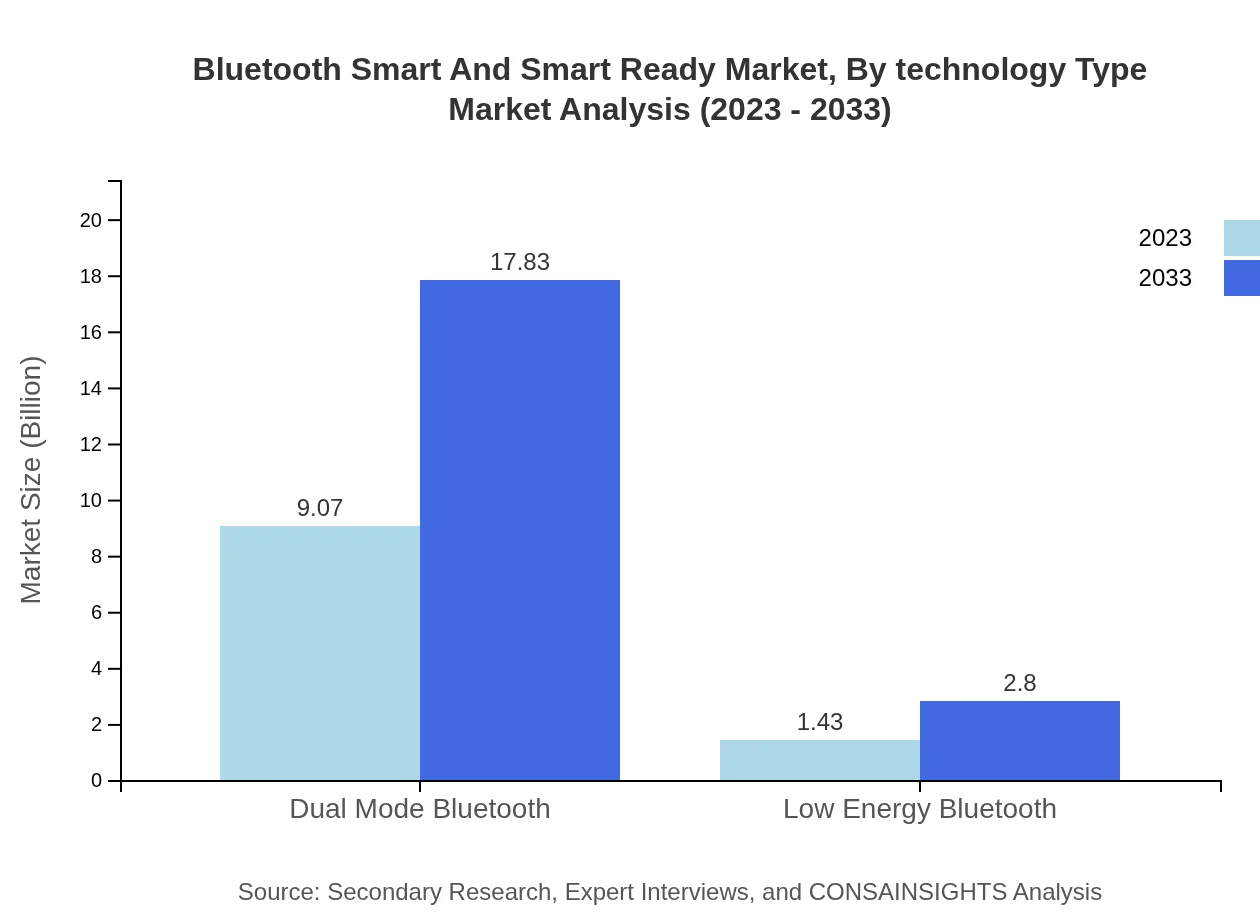

Bluetooth Smart And Smart Ready Market Analysis By Technology Type

The market encompasses two prominent technology types: Dual Mode Bluetooth, which accounts for 86.42% of the share, and Low Energy Bluetooth at 13.58%. Dual Mode Bluetooth devices, offering versatility and extensive connectivity, are projected to grow significantly, while Low Energy Bluetooth is ideal for battery-powered applications, sustainable growth is also expected in this segment.

Bluetooth Smart And Smart Ready Market Analysis By Supply Chain

The supply chain segment includes manufacturers, distributors, and retailers focused on the Bluetooth Smart and Smart Ready devices. Strong competition along the supply chain enables rapid innovation and efficient distribution of products. Manufacturers contribute significantly to market dynamics, with key innovations driving the push towards enhanced smart technology solutions across various applications.

Bluetooth Smart And Smart Ready Market Analysis By End User Segment

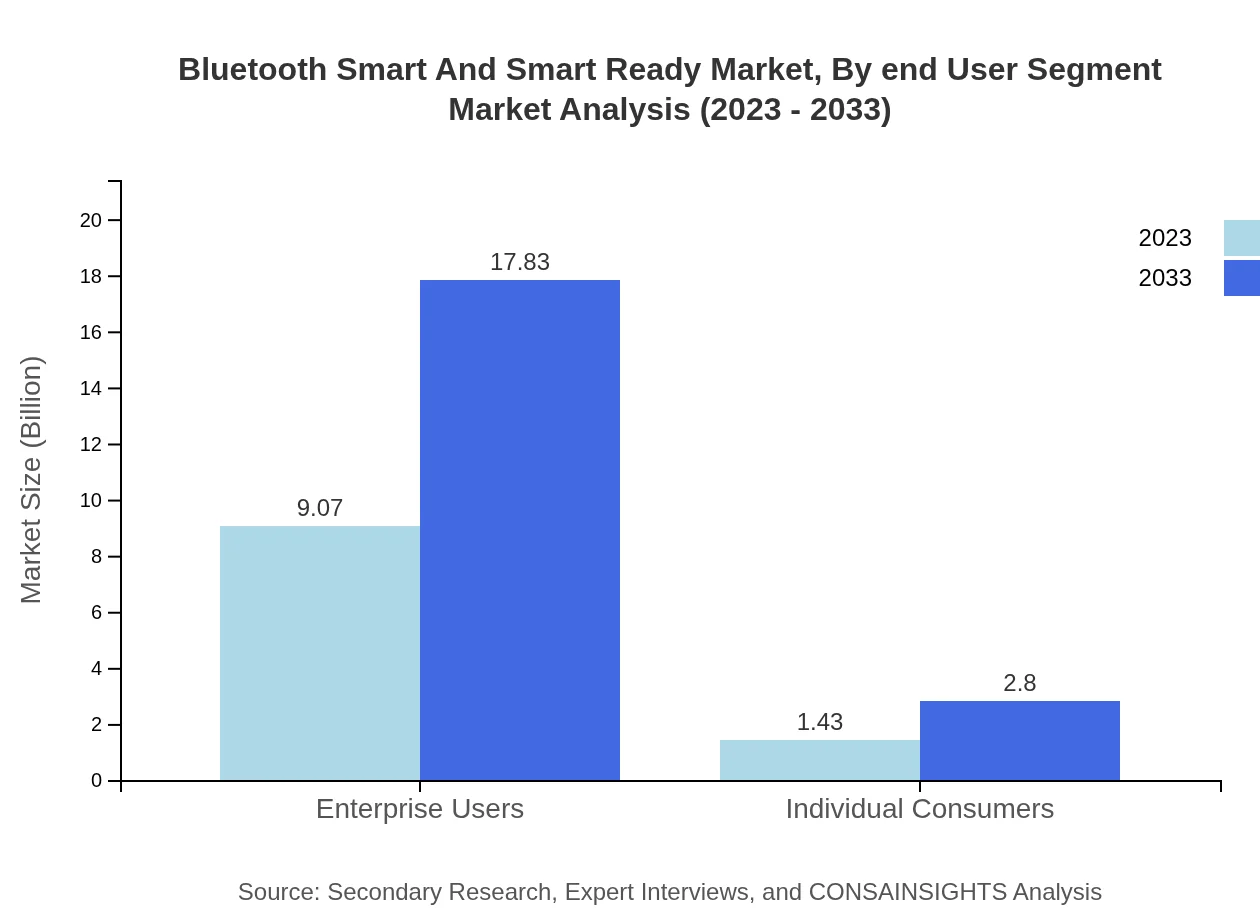

End-user segmentation reveals high demand within enterprise and consumer markets, with enterprise users accounting for an impressive 86.42% market share versus individual consumers at 13.58%. This trend underscores the growing reliance on Bluetooth technology in business operations, while individual consumer adoption is expected to increase as more smart home and wearable devices come to market.

Bluetooth Smart And Smart Ready Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bluetooth Smart And Smart Ready Industry

Qualcomm Technologies, Inc.:

A leading player in Bluetooth technologies, Qualcomm focuses on innovations in wireless communication and IoT applications, significantly impacting the Bluetooth Smart and Smart Ready market through active components.Texas Instruments Incorporated:

Texas Instruments leads in semiconductor solutions, emphasizing Bluetooth solutions for various applications, which contributes to the expanding ecosystem of smart and connected devices.NXP Semiconductors N.V.:

NXP is influential in offering Bluetooth-enabled solutions for automotive, industrial, consumer electronics, and personal health areas, pushing forward the use of Bluetooth technologies globally.Broadcom Inc.:

Broadcom is renowned for its wireless semiconductor solutions, continuously innovating to enhance Bluetooth technology used in various applications, thereby shaping market trends.STMicroelectronics:

STMicroelectronics specializes in creating smart connectivity solutions through Bluetooth technology in markets such as automotive and industrial applications, reinforcing their leadership role.We're grateful to work with incredible clients.

FAQs

What is the market size of bluetooth Smart And Smart Ready?

The global Bluetooth Smart and Smart Ready market is projected to grow from $10.5 billion in 2023 to a significant valuation by 2033, with a CAGR of 6.8%. This growth is attributed to increasing demand in various sectors including healthcare and consumer electronics.

What are the key market players or companies in this bluetooth Smart And Smart Ready industry?

Key players in the Bluetooth Smart and Smart Ready market include major technology companies, semiconductor manufacturers, and device manufacturers. These players focus on innovation and partnerships to enhance their product offerings and expand their market presence.

What are the primary factors driving the growth in the bluetooth Smart And Smart Ready industry?

Growth in the Bluetooth Smart and Smart Ready industry is driven by the increasing adoption of IoT devices, advancements in wireless technology, and rising consumer demand for smart and connected products across various applications.

Which region is the fastest Growing in the bluetooth Smart And Smart Ready?

The fastest-growing region in the Bluetooth Smart and Smart Ready market is North America, expected to increase from $3.81 billion in 2023 to $7.49 billion by 2033, driven by technological advancements and high consumer adoption rates.

Does ConsaInsights provide customized market report data for the bluetooth Smart And Smart Ready industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of the Bluetooth Smart and Smart Ready industry, allowing businesses to obtain insights that align with their strategic goals and market dynamics.

What deliverables can I expect from this bluetooth Smart And Smart Ready market research project?

Deliverables from the Bluetooth Smart and Smart Ready market research include comprehensive reports detailing market size, CAGR forecasts, segment analysis, competitive landscape, and regional insights to aid strategic decision-making.

What are the market trends of bluetooth Smart And Smart Ready?

Trends in the Bluetooth Smart and Smart Ready market include a focus on low-energy technology, increased integration in consumer electronics, expansion into healthcare applications, and a growing emphasis on seamless connectivity and smart home solutions.