Body Sensor Market Report

Published Date: 31 January 2026 | Report Code: body-sensor

Body Sensor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Body Sensor market, emphasizing trends, market size, and forecast from 2023 to 2033, alongside insights on regional dynamics and key players in the industry.

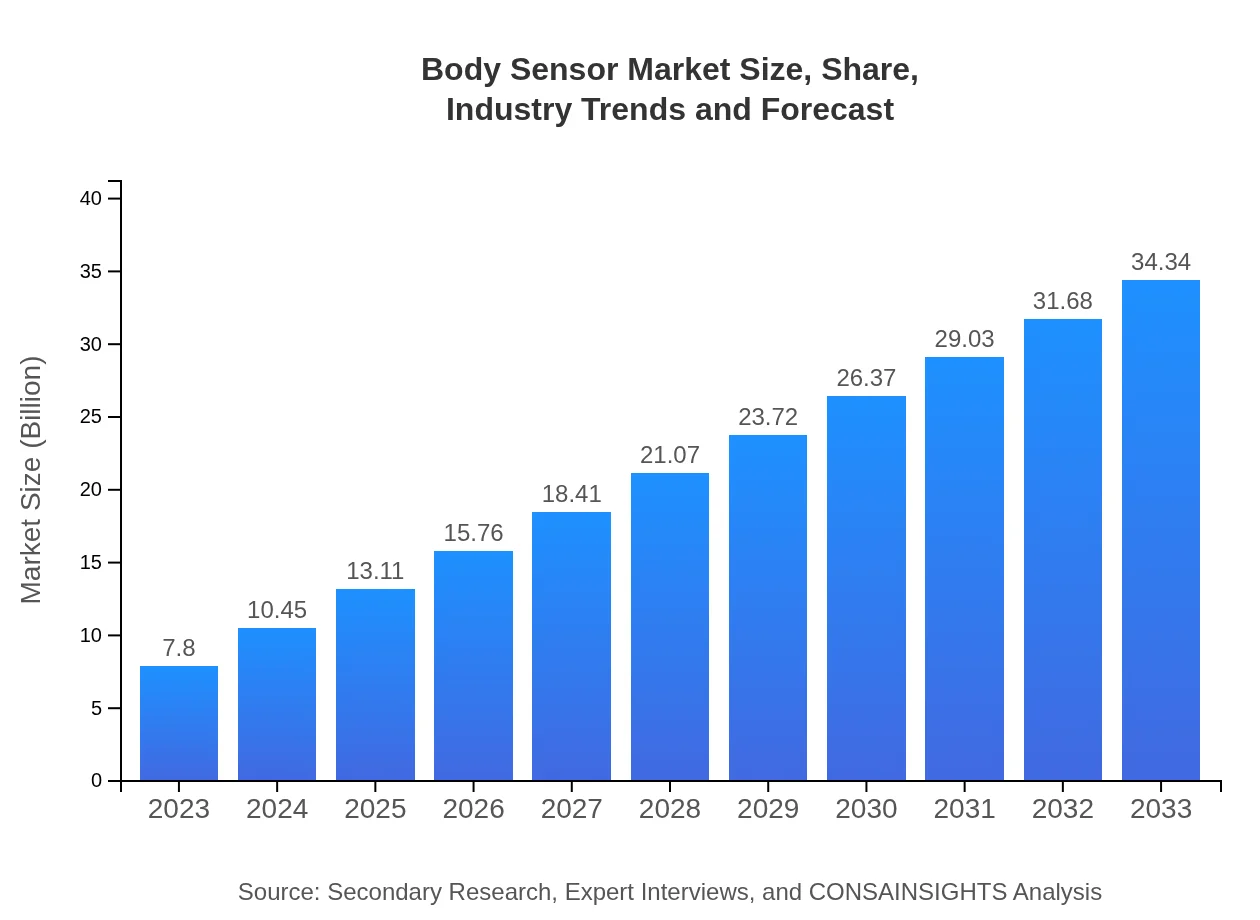

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.80 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $34.34 Billion |

| Top Companies | Apple Inc., Fitbit, Philips Healthcare, Garmin |

| Last Modified Date | 31 January 2026 |

Body Sensor Market Overview

Customize Body Sensor Market Report market research report

- ✔ Get in-depth analysis of Body Sensor market size, growth, and forecasts.

- ✔ Understand Body Sensor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Body Sensor

What is the Market Size & CAGR of Body Sensor market in 2023 and 2033?

Body Sensor Industry Analysis

Body Sensor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Body Sensor Market Analysis Report by Region

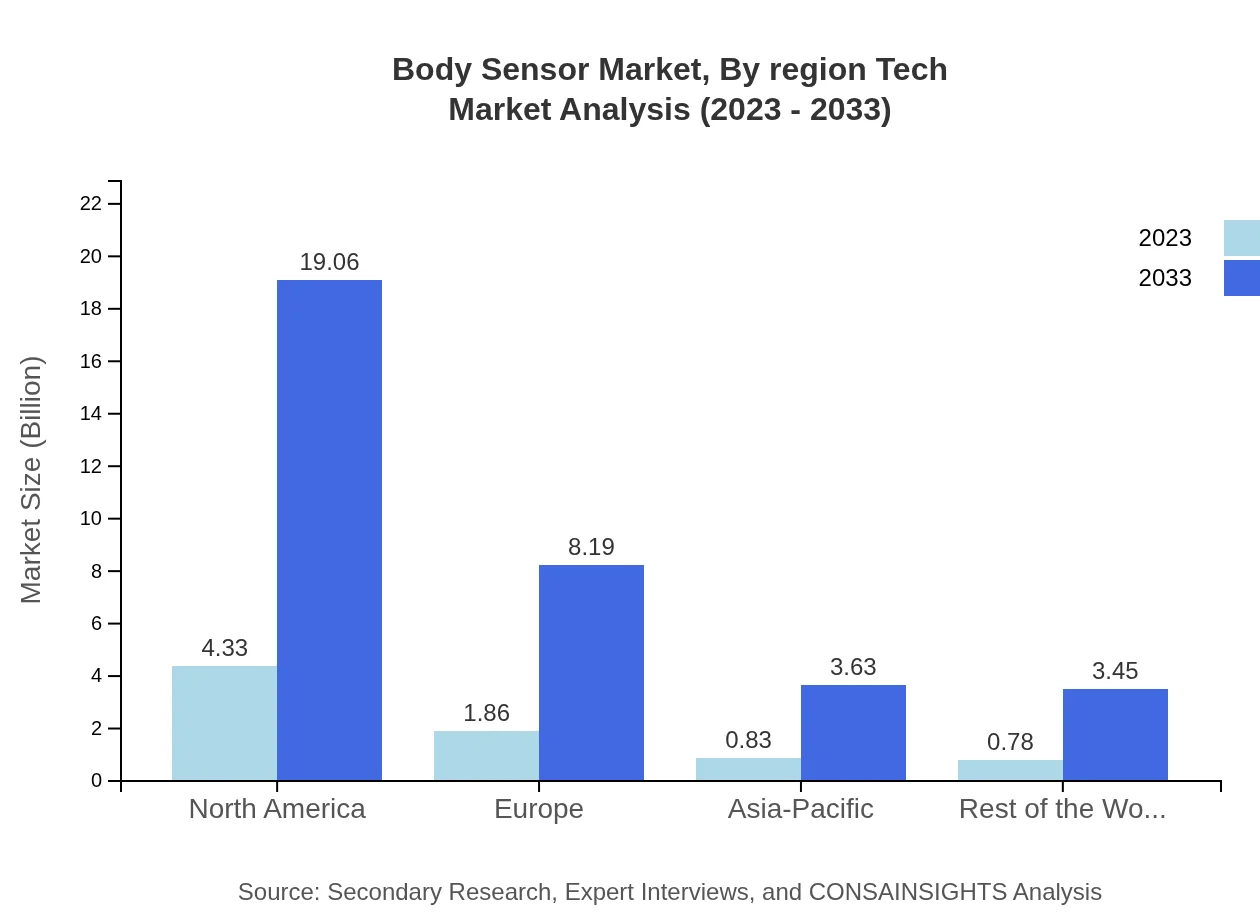

Europe Body Sensor Market Report:

The European market is experiencing rapid growth, anticipated to increase from $2.48 billion in 2023 to $10.92 billion in 2033. Innovative healthcare solutions and increased government funding for health technology are major contributors.Asia Pacific Body Sensor Market Report:

The Asia Pacific region is witnessing robust growth, driven by increasing investments in healthcare technology and a rising population focusing on health and fitness. The market size is expected to grow from $1.37 billion in 2023 to $6.01 billion by 2033, reflecting a significant CAGR.North America Body Sensor Market Report:

North America remains the largest market for Body Sensors, with a market size expected to expand from $2.80 billion in 2023 to $12.31 billion by 2033. Advanced healthcare infrastructure and a tech-savvy population are key drivers.South America Body Sensor Market Report:

In South America, the Body Sensor market is projected to grow from $0.41 billion in 2023 to $1.81 billion by 2033, as health awareness and demand for personal electronic health monitoring devices rise among consumers.Middle East & Africa Body Sensor Market Report:

The Middle East and Africa market is emerging, with growth expected from $0.75 billion in 2023 to $3.29 billion by 2033, driven by rising healthcare investments and the adoption of new technologies.Tell us your focus area and get a customized research report.

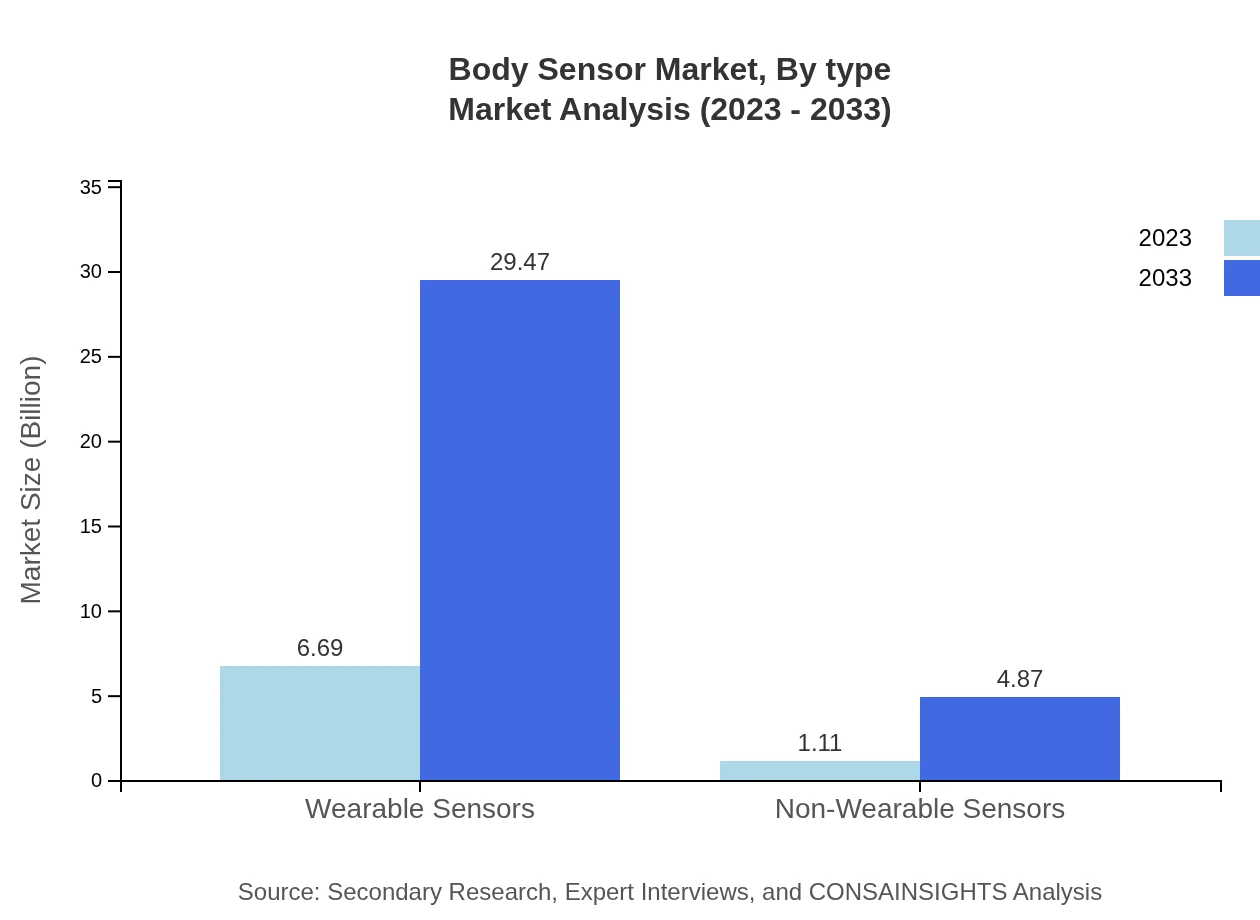

Body Sensor Market Analysis By Type

Wearable sensors dominate the Body Sensor market, with a size expected to grow from $6.69 billion in 2023 to $29.47 billion by 2033, accounting for 85.83% of the market share consistently over this period. Non-wearable sensors, while smaller, are projected to expand from $1.11 billion to $4.87 billion, maintaining a 14.17% market share.

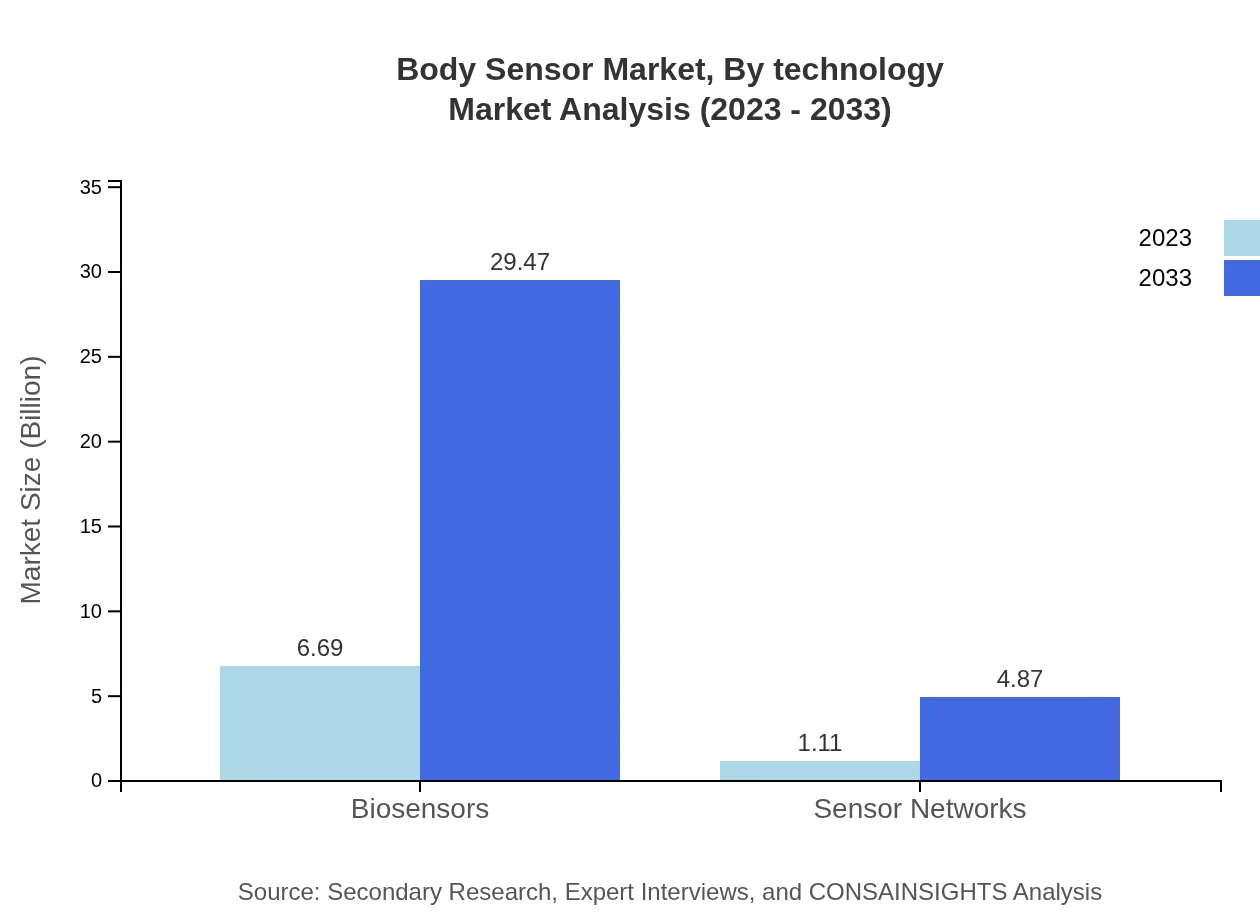

Body Sensor Market Analysis By Technology

Technological segment analyses indicate Bluetooth and Wi-Fi as the principal technologies used in Body Sensors, enabling communication between devices and better data tracking. The advent of IoT technologies further enhances capabilities, promoting seamless integration of devices.

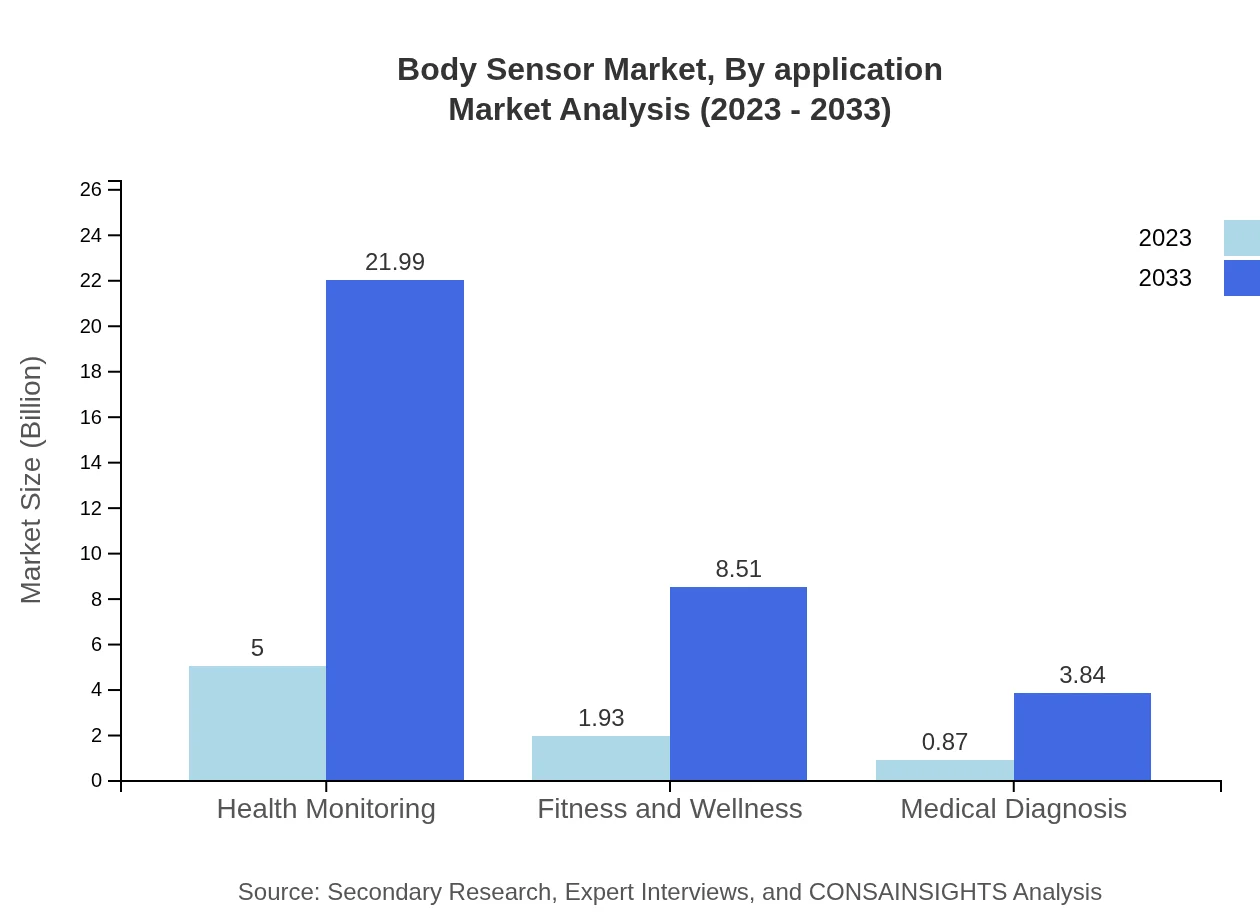

Body Sensor Market Analysis By Application

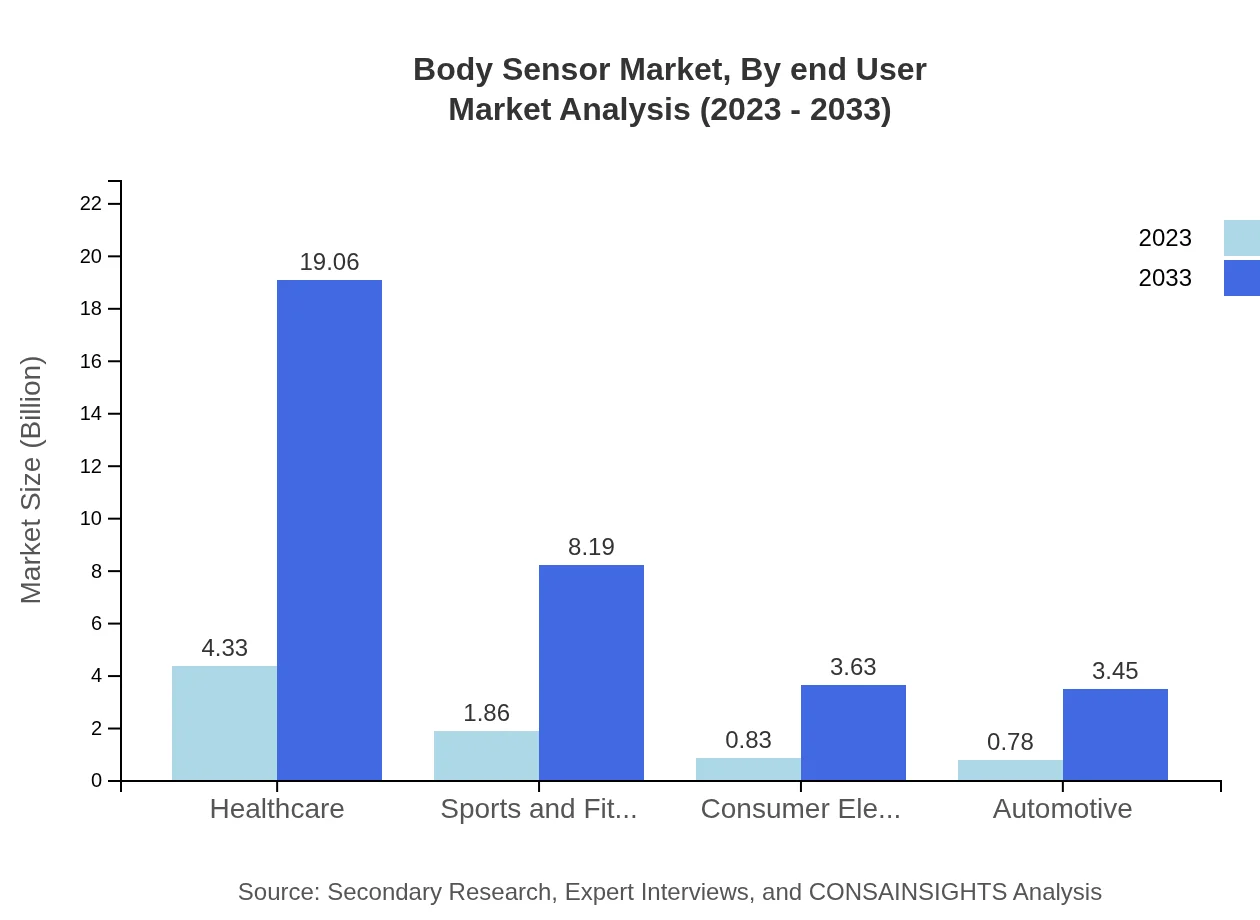

Healthcare is the leading application area, expanding from $4.33 billion in 2023 to $19.06 billion by 2033, holding a market share of 55.52%. This is closely followed by fitness and wellness applications, projected to grow from $1.93 billion to $8.51 billion.

Body Sensor Market Analysis By End User

End-user analysis reveals significant demand from healthcare providers and fitness enthusiasts. Hospitals and clinics focus heavily on health monitoring technologies, while sports industries utilize sensors for performance tracking and injury prevention.

Body Sensor Market Analysis By Region Tech

Regionally, North America and Europe lead in technology adoption, leveraging advanced IoT and AI features in Body Sensors. Asia Pacific is catching up, investing in smart health monitoring and connected devices, thus presenting lucrative opportunities.

Body Sensor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Body Sensor Industry

Apple Inc.:

Apple is a market leader in wearable technology, known for its Apple Watch, which incorporates advanced body sensors for health monitoring.Fitbit:

Fitbit specializes in fitness tracking devices, pioneering various sensors for health monitoring and activity tracking.Philips Healthcare:

Philips leverages its vast experience in healthcare technology to develop comprehensive health monitoring solutions, including body sensors.Garmin:

Garmin offers diverse fitness-focused wearable devices that utilize body sensors to enhance athletic performance and health tracking.We're grateful to work with incredible clients.

FAQs

What is the market size of body Sensor?

The body sensor market is projected to reach approximately $7.8 billion by 2033, growing at a compound annual growth rate (CAGR) of 15.2%. This growth indicates a robust demand for bio-monitoring technologies.

What are the key market players or companies in this body sensor industry?

Key players in the body sensor market include major technology firms and startups specializing in wearable technology, health monitoring devices, and biosensors, ensuring a competitive landscape with continual innovations and partnerships.

What are the primary factors driving the growth in the body sensor industry?

Growth in the body sensor industry is driven by rising healthcare awareness, increased adoption of fitness and wellness products, technological advancements in sensor technology, and growing acceptance of telehealth solutions.

Which region is the fastest Growing in the body sensor?

The North American region is expected to grow substantially, with market size projected to increase from $2.80 billion in 2023 to $12.31 billion by 2033, driven by innovation and healthcare integration.

Does ConsaInsights provide customized market report data for the body sensor industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the body sensor industry, ensuring clients receive relevant and actionable insights for strategic decision-making.

What deliverables can I expect from this body sensor market research project?

Expect comprehensive deliverables, including detailed market analysis, segment data, regional insights, competitor analysis, and future growth forecasts, all designed to support informed business strategies.

What are the market trends of body sensor?

Current trends in the body sensor market include the rise of wearable technology, a focus on health monitoring solutions, advancements in biosensor technology, and increased integration of IoT, enhancing data accessibility.