Bone Cement And Glue Market Report

Published Date: 31 January 2026 | Report Code: bone-cement-and-glue

Bone Cement And Glue Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Bone Cement and Glue market, covering its size, trends, and forecasts from 2023 to 2033. It provides insights into the competitive landscape, market segmentation, and regional growth dynamics.

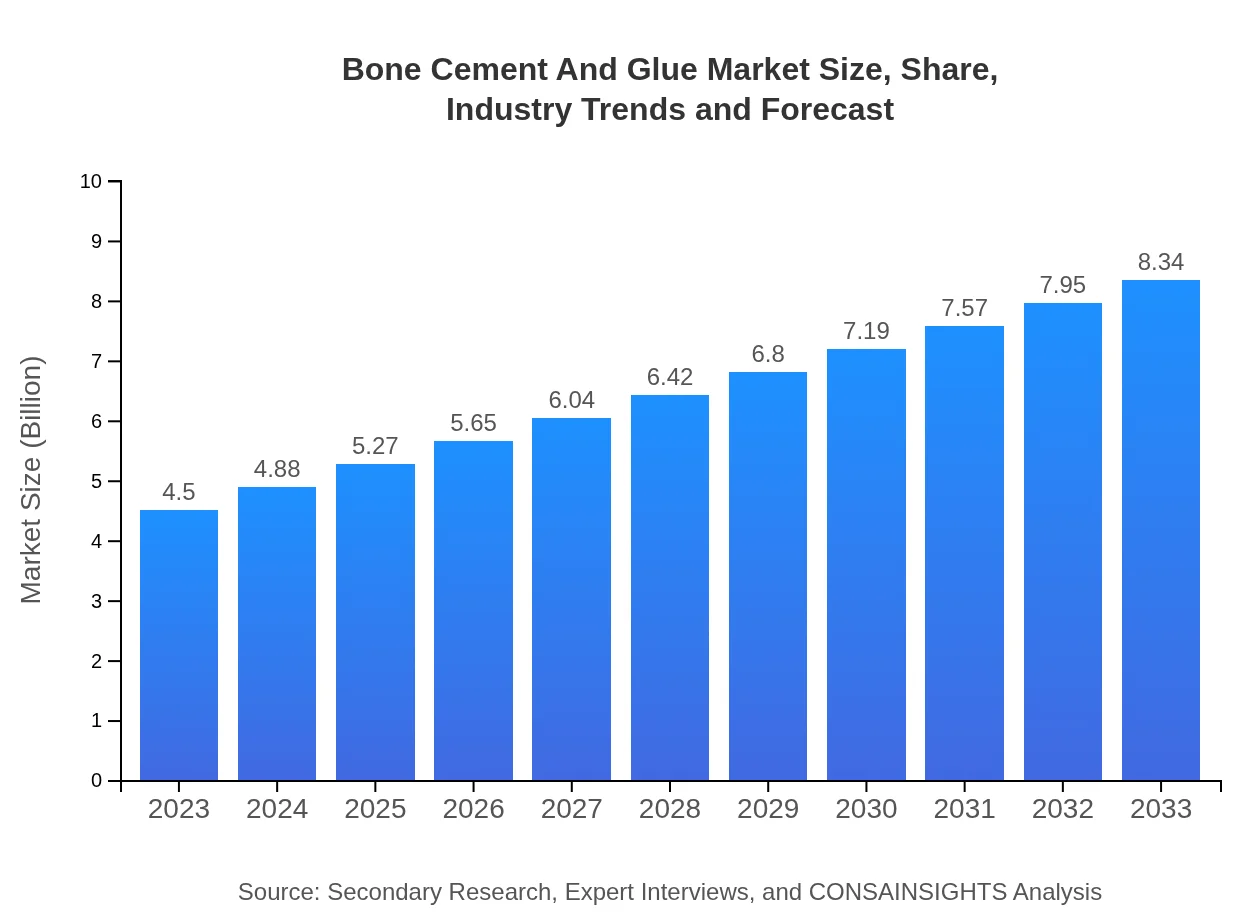

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $8.34 Billion |

| Top Companies | DePuy Synthes, Stryker Corporation, Medtronic , Zimmer Biomet, Heraeus Medical |

| Last Modified Date | 31 January 2026 |

Bone Cement And Glue Market Overview

Customize Bone Cement And Glue Market Report market research report

- ✔ Get in-depth analysis of Bone Cement And Glue market size, growth, and forecasts.

- ✔ Understand Bone Cement And Glue's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bone Cement And Glue

What is the Market Size & CAGR of Bone Cement And Glue market in 2023?

Bone Cement And Glue Industry Analysis

Bone Cement And Glue Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bone Cement And Glue Market Analysis Report by Region

Europe Bone Cement And Glue Market Report:

The European market, estimated to grow from $1.42 billion in 2023 to $2.63 billion by 2033, is driven by aging demographics and increased surgical procedures. Innovation and adaptation to regulatory changes are also pivotal in maintaining market competitiveness.Asia Pacific Bone Cement And Glue Market Report:

In the Asia Pacific region, the Bone Cement and Glue market is expected to grow from $0.86 billion in 2023 to $1.59 billion in 2033. Increased healthcare expenditure, aging population, and a rise in orthopedic surgeries drive the demand for bone welding products in countries like China and India.North America Bone Cement And Glue Market Report:

North America leads the Bone Cement and Glue market with a forecasted growth from $1.55 billion in 2023 to $2.86 billion in 2033. The region benefits from advanced healthcare infrastructure, high surgical volumes, and major players investing in research and development.South America Bone Cement And Glue Market Report:

The South American market, with a valuation of $0.25 billion in 2023, is projected to reach $0.46 billion by 2033. Factors contributing to growth include increased access to healthcare services and rising awareness regarding advanced surgical solutions.Middle East & Africa Bone Cement And Glue Market Report:

The Middle East and Africa market is projected to grow from $0.43 billion to $0.79 billion by 2033. Increased investment in healthcare infrastructure and rising awareness of advanced surgical methodologies are key growth factors.Tell us your focus area and get a customized research report.

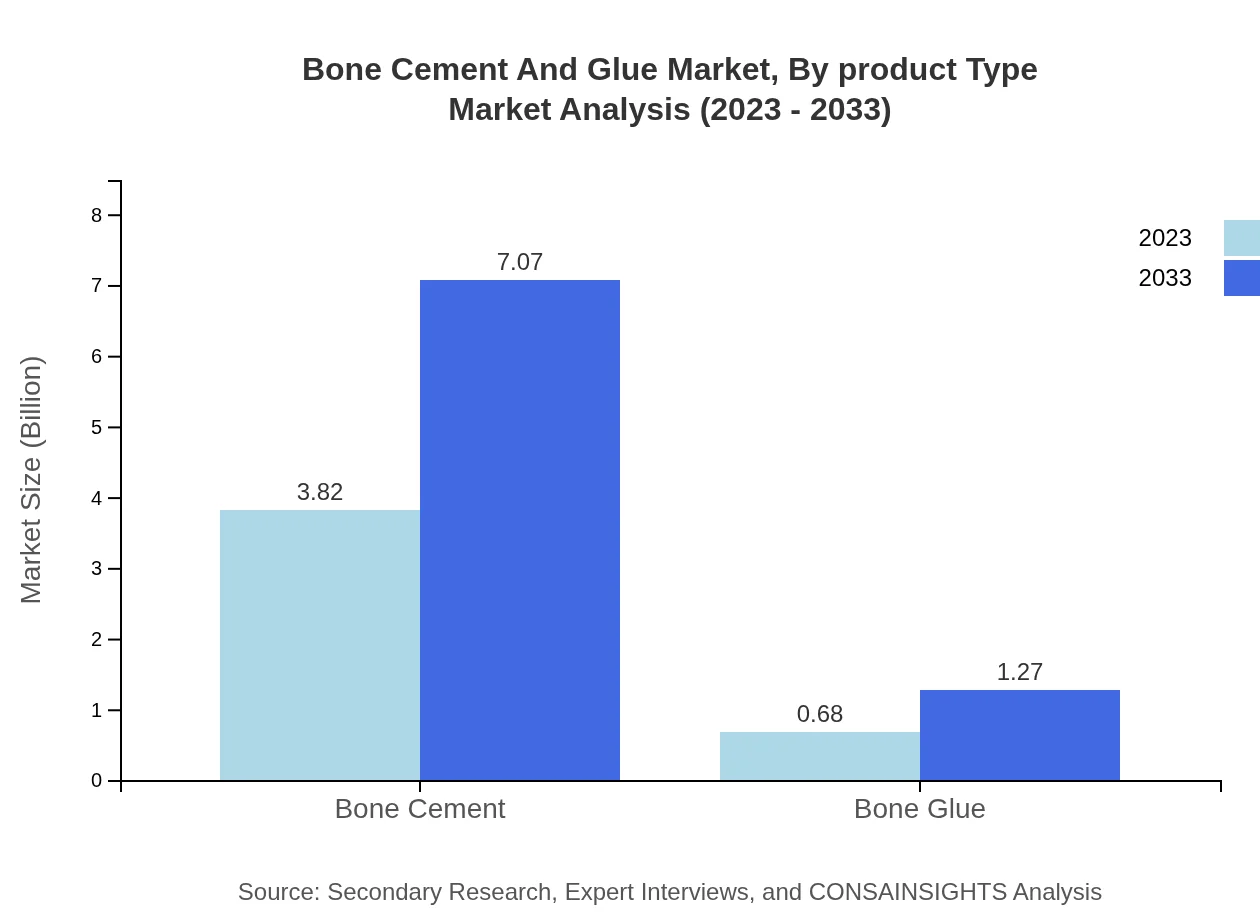

Bone Cement And Glue Market Analysis By Product Type

The Bone Cement segment, valued at $3.82 billion in 2023, dominates the market with an 84.81% share, anticipated to reach $7.07 billion by 2033. Bone Glue, garnering a 15.19% share, shows significant growth potential increasing from $0.68 billion to $1.27 billion. This trend reflects the rising demand for fast-acting and reliable fixation solutions in osteosynthesis.

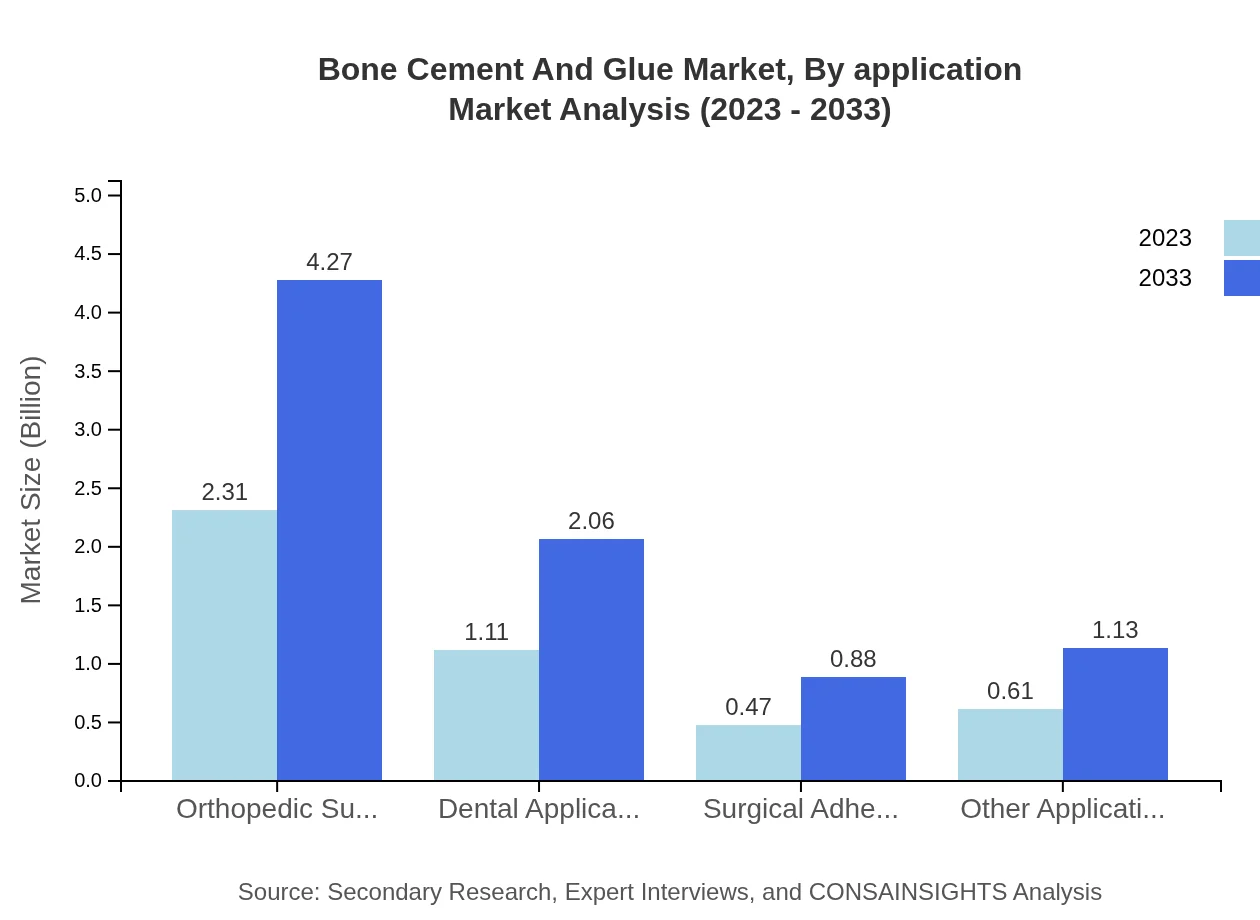

Bone Cement And Glue Market Analysis By Application

Orthopedic surgery, accounting for a 51.25% share, is the leading application segment with a market size projected to grow from $2.31 billion in 2023 to $4.27 billion in 2033. The Dental Application segment follows, expected to rise from $1.11 billion to $2.06 billion, reflecting increasing usage in dental surgeries. Other applications like surgical adhesives are also expected to witness growth as healthcare adapts to newer materials.

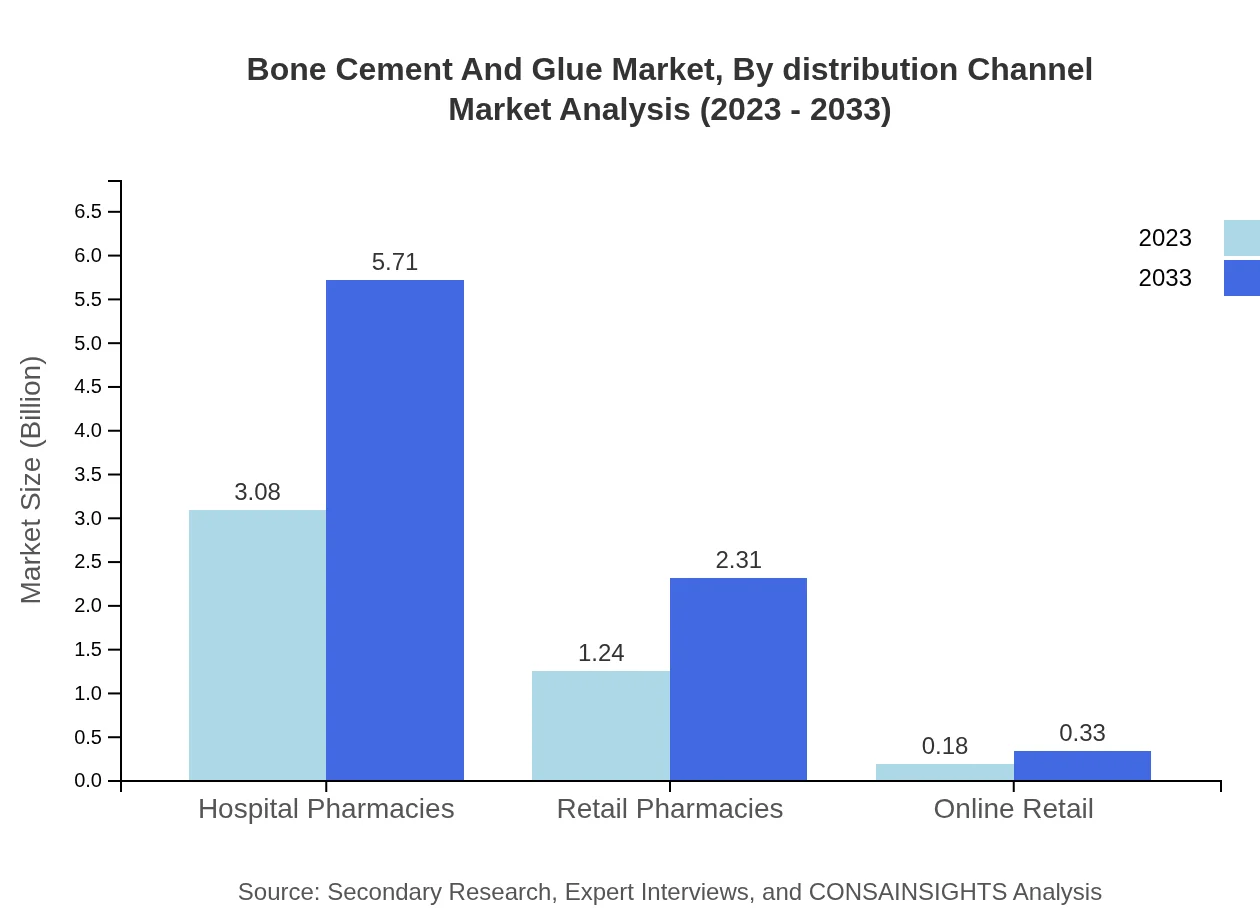

Bone Cement And Glue Market Analysis By Distribution Channel

Hospital pharmacies command the largest market share at 68.44% in 2023, with a market size growing from $3.08 billion to $5.71 billion by 2033, as hospitals remain the main setting for surgical procedures. Retail pharmacies and online retail channels are also gaining traction, with retail pharmacies valued at $1.24 billion and expected to grow to $2.31 billion.

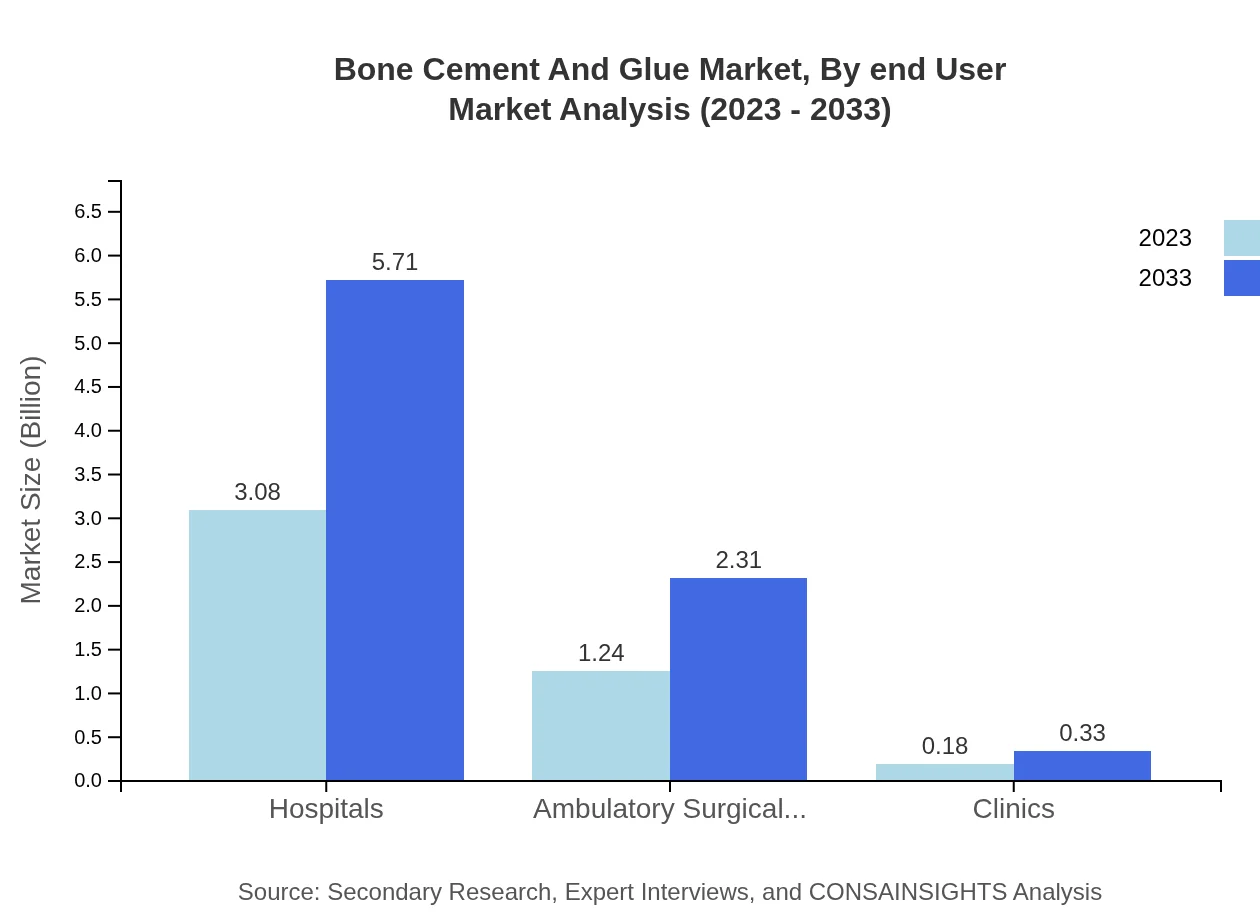

Bone Cement And Glue Market Analysis By End User

Hospitals are the primary end-users, currently holding a market size of $3.08 billion in 2023, anticipated to grow significantly to $5.71 billion by 2033. Ambulatory surgical centers and clinics are notable contributors, with respective market sizes of $1.24 billion and $0.18 billion, both showing promising growth rates driven by patient preference for less invasive procedures.

Bone Cement And Glue Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bone Cement And Glue Industry

DePuy Synthes:

A leader in orthopedic solutions, DePuy Synthes produces a wide range of bone cement and products that enhance surgical outcomes.Stryker Corporation:

Known for its innovative medical devices, Stryker offers advanced bone cements and adhesives that facilitate surgical application and efficacy.Medtronic :

A global leader in medical technology, Medtronic's focus includes bone cement solutions designed for improved performance and patient outcomes.Zimmer Biomet:

Zimmer Biomet specializes in orthopedic treatment options, providing leading bone cements that emphasize safety and efficacy in surgical procedures.Heraeus Medical:

Heraeus Medical is recognized for its high-quality bone cements which are widely used in a variety of orthopedic surgeries.We're grateful to work with incredible clients.

FAQs

What is the market size of bone Cement And Glue?

The global market size for bone cement and glue is projected to reach $4.5 billion by 2033, growing at a CAGR of 6.2% from the current value, indicating substantial growth potential in orthopedic and dental applications.

What are the key market players or companies in the bone Cement And Glue industry?

Key market players in the bone cement and glue industry include Stryker Corporation, DePuy Synthes, Zimmer Biomet, and Merck KGaA, who lead in innovation and product development.

What are the primary factors driving the growth in the bone Cement And Glue industry?

The growth in the bone cement and glue industry is primarily driven by the increasing prevalence of orthopedic surgeries, technological advancements in surgical products, and rising demand for minimally invasive procedures.

Which region is the fastest Growing in the bone Cement And Glue market?

The Asia-Pacific region is the fastest-growing in the bone cement and glue market, with a projected increase from $0.86 billion in 2023 to $1.59 billion by 2033.

Does ConsaInsights provide customized market report data for the bone Cement And Glue industry?

Yes, ConsaInsights offers customized market report data for the bone cement and glue industry, allowing clients to obtain insights tailored to their specific requirements and market needs.

What deliverables can I expect from this bone Cement And Glue market research project?

From this market research project, you can expect detailed reports, market analysis, segmentation data, regional insights, and trends that facilitate informed decision-making.

What are the market trends of bone Cement And Glue?

Current market trends in the bone cement and glue industry include the rising adoption of innovative surgical products, increasing investment in healthcare infrastructure, and growing awareness among patients regarding advanced surgical treatments.