Bone Cement Market Report

Published Date: 31 January 2026 | Report Code: bone-cement

Bone Cement Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bone Cement market from 2023 to 2033, offering insights into market size, growth trends, industry dynamics, regional performance, and technological advancements shaping the sector.

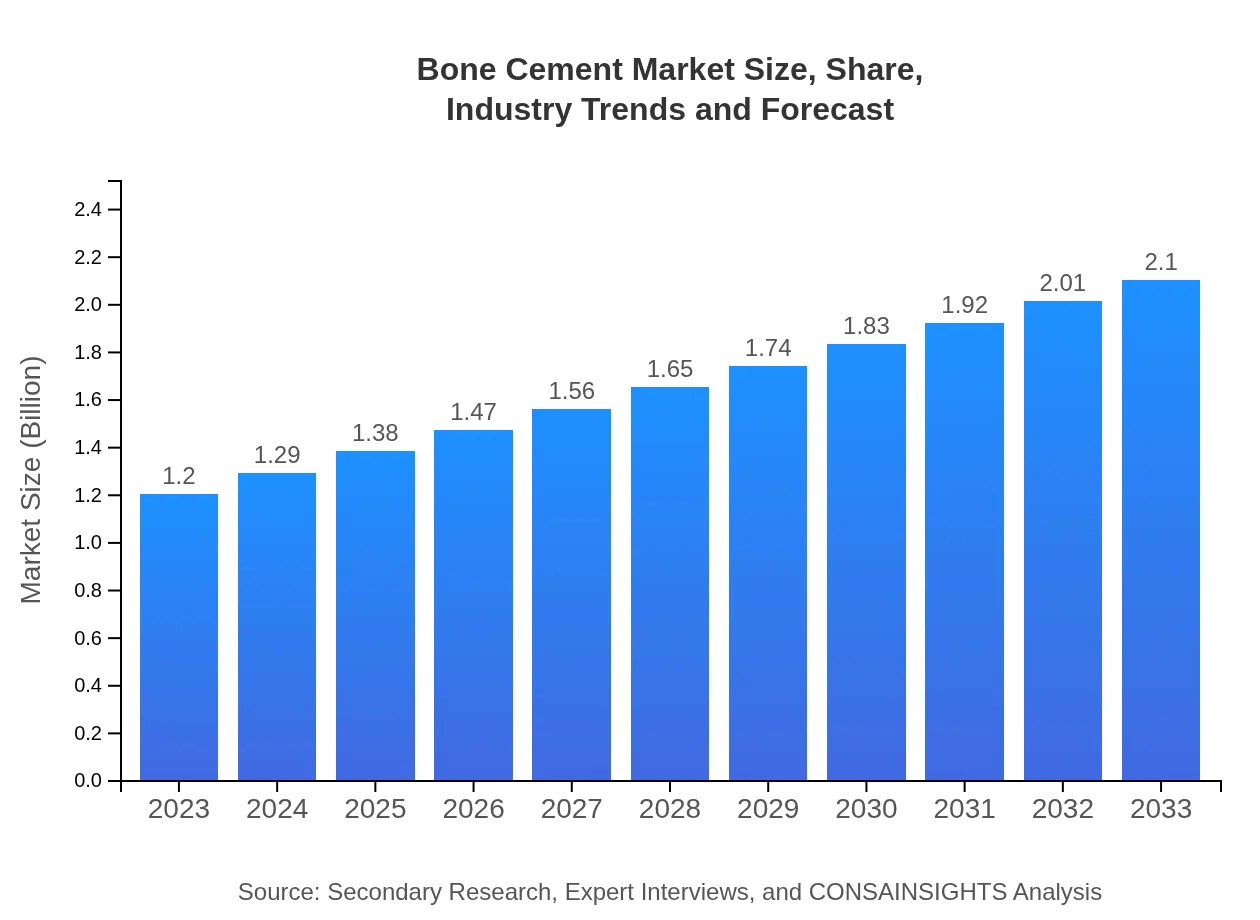

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $2.10 Billion |

| Top Companies | Stryker Corporation, Zimmer Biomet Holdings, Inc., DePuy Synthes, Medtronic PLC, B.Braun Melsungen AG |

| Last Modified Date | 31 January 2026 |

Bone Cement Market Overview

Customize Bone Cement Market Report market research report

- ✔ Get in-depth analysis of Bone Cement market size, growth, and forecasts.

- ✔ Understand Bone Cement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bone Cement

What is the Market Size & CAGR of Bone Cement market in 2023?

Bone Cement Industry Analysis

Bone Cement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bone Cement Market Analysis Report by Region

Europe Bone Cement Market Report:

In Europe, the market is expected to grow from $0.33 billion in 2023 to $0.57 billion in 2033, driven by the growing geriatric population and the prevalence of arthritic conditions necessitating surgical interventions.Asia Pacific Bone Cement Market Report:

In the Asia-Pacific region, the Bone Cement market is projected to grow from $0.23 billion in 2023 to $0.41 billion by 2033. Factors driving this growth include increasing healthcare expenditures and rising surgical procedures, particularly orthopedic interventions as populations age and lifestyles change.North America Bone Cement Market Report:

North America dominates the Bone Cement market, with a projected increase from $0.40 billion in 2023 to $0.69 billion by 2033, driven by advanced healthcare infrastructures, higher adoption rates of innovations, and a significant number of orthopedic surgeries performed annually.South America Bone Cement Market Report:

The South American Bone Cement market is expected to evolve from $0.08 billion in 2023 to $0.13 billion in 2033. Despite economic challenges, the rising incidence of musculoskeletal disorders and an increasing focus on healthcare improvement will support market expansion.Middle East & Africa Bone Cement Market Report:

The Middle East and Africa region anticipates growth from $0.17 billion in 2023 to $0.29 billion in 2033, supported by expanding healthcare systems and increasing awareness regarding advanced surgical techniques.Tell us your focus area and get a customized research report.

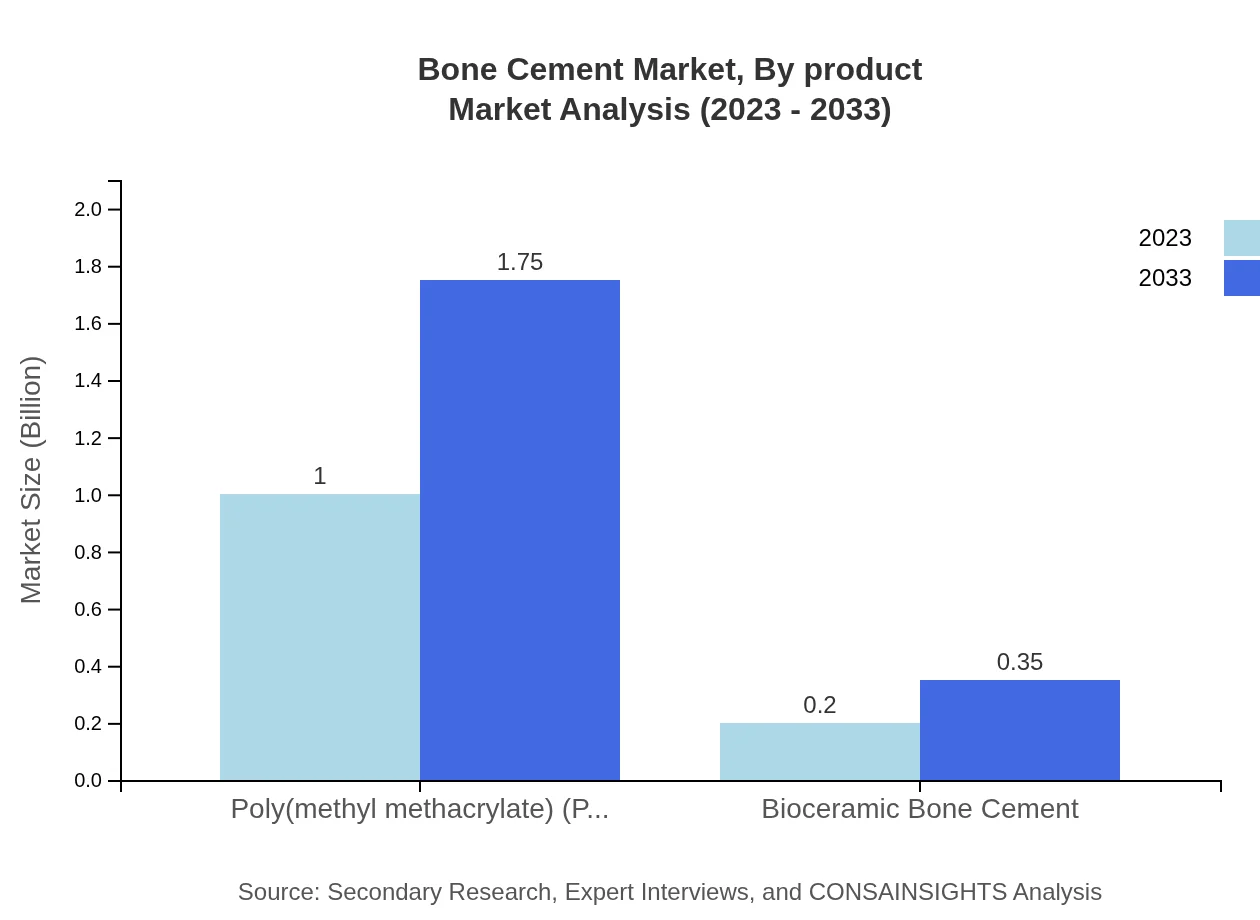

Bone Cement Market Analysis By Product

Poly(methyl methacrylate) (PMMA) is the leading product type in the Bone Cement market, generating $1.00 billion in 2023 and projected to grow to $1.75 billion by 2033, maintaining an 83.46% market share across the decade. Bioceramic Cements, while smaller, are seeing strong growth trajectories, projected to increase from $0.20 billion (16.54% share) in 2023 to $0.35 billion by 2033.

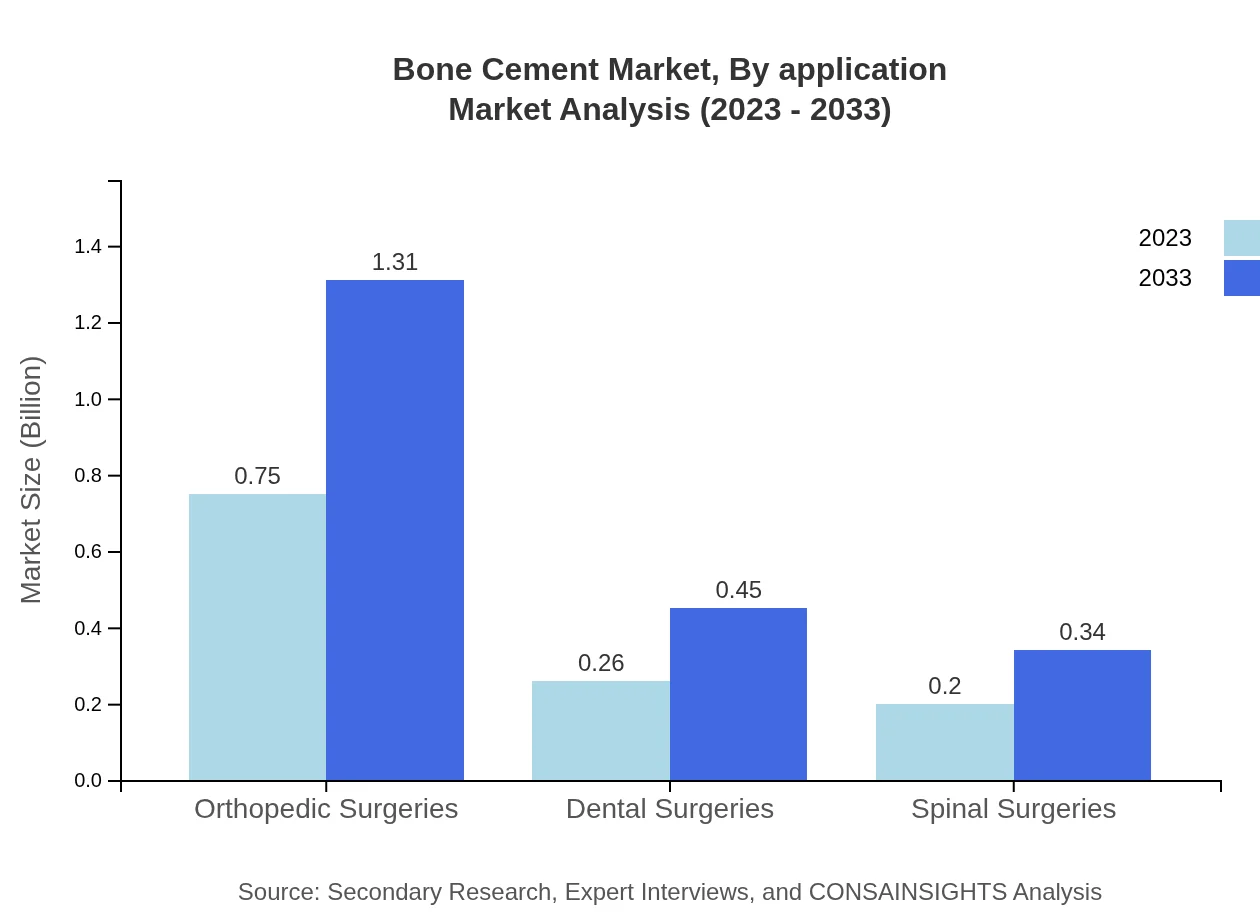

Bone Cement Market Analysis By Application

Orthopedic surgeries account for the largest share of the Bone Cement market, valued at $0.75 billion in 2023 and expected to grow to $1.31 billion by 2033 (62.31% share). Dental surgeries and spinal surgeries are also significant, each contributing approximately $0.26 billion and $0.20 billion respectively in 2023.

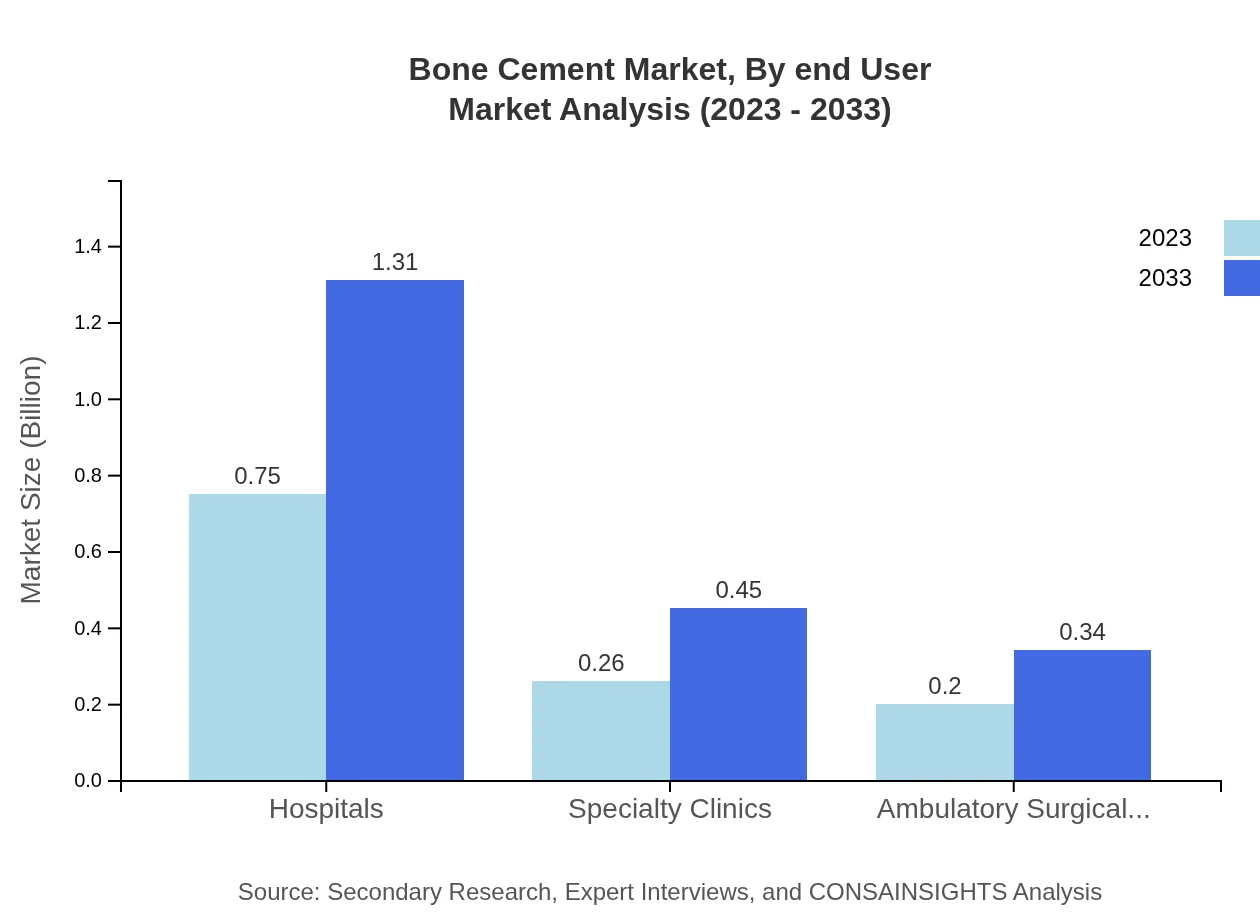

Bone Cement Market Analysis By End User

Hospitals are the predominant end-users, with a market size of $0.75 billion in 2023, leading to a projected increase to $1.31 billion by 2033, representing a 62.31% share. Specialty clinics and ambulatory surgical centers, while smaller, are also significant contributors with predicted growth.

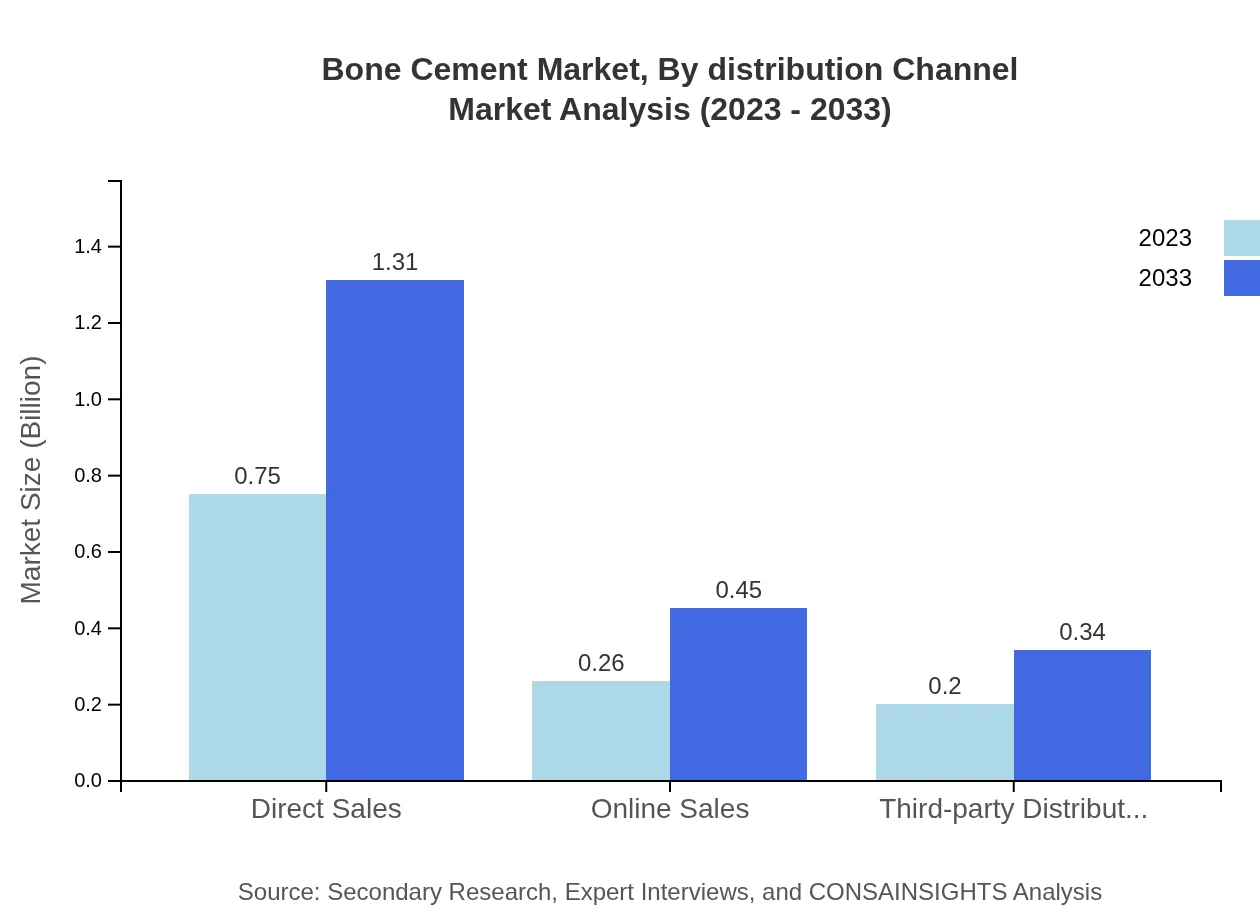

Bone Cement Market Analysis By Distribution Channel

The direct sales channel is the most significant in distributing Bone Cement, valued at $0.75 billion in 2023 and expected to rise to $1.31 billion by 2033, showing a consistent trend of 62.31% market share. Online sales and third-party distributors also hold their ground, capturing essential market segments.

Bone Cement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bone Cement Industry

Stryker Corporation:

Stryker is a leading manufacturer of medical devices, including surgical equipment and bone cement. They focus heavily on innovation and bolstering patient outcomes with advanced technologies.Zimmer Biomet Holdings, Inc.:

Zimmer Biomet specializes in musculoskeletal healthcare, providing a wide range of bone cement products that enhance stability and performance in orthopedic surgeries.DePuy Synthes:

A subsidiary of Johnson & Johnson, DePuy Synthes is one of the pioneers in developing new bone cement formulations to improve surgical efficiency and patient recovery.Medtronic PLC:

Medtronic is known for its diverse medical products, including innovative bone cement solutions utilized in various surgical procedures.B.Braun Melsungen AG:

B.Braun focuses on advanced medical devices and solutions, including manufacturing a range of bone cement products notable for their quality and effectiveness.We're grateful to work with incredible clients.

FAQs

What is the market size of bone Cement?

The global bone cement market is valued at approximately $1.2 billion in 2023 and is projected to grow at a CAGR of 5.6%, reaching around $2 billion by 2033, driven by increasing orthopedic surgeries.

What are the key market players or companies in the bone Cement industry?

Some key players in the bone cement market include Stryker Corporation, Johnson & Johnson, Zimmer Biomet, and DePuy Synthes. These companies lead the market with innovative products and strategic acquisitions, enhancing their market presence.

What are the primary factors driving the growth in the bone Cement industry?

The growth in the bone cement market is primarily driven by an aging population, rising incidences of orthopedic diseases, advancements in cement technology, and the increasing number of surgical procedures including orthopedic and dental surgeries.

Which region is the fastest Growing in the bone Cement market?

North America is the fastest-growing region, with market size expected to grow from $0.40 billion in 2023 to $0.69 billion by 2033. Europe and Asia-Pacific also show significant growth due to rising healthcare investments.

Does ConsaInsights provide customized market report data for the bone Cement industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs. This includes detailed analysis, market trends, and forecasts that cater to various stakeholders in the bone cement industry.

What deliverables can I expect from this bone Cement market research project?

Deliverables from the bone-cement market research include comprehensive reports detailing market size, segment analysis, competitive landscape, growth drivers, and strategic recommendations based on the latest market trends.

What are the market trends of bone Cement?

Key market trends include increased adoption of bioceramic bone cements for enhanced biocompatibility, digital integration in surgical procedures, and a rising preference for minimally invasive surgeries, improving patient outcomes.