Bone Grafts And Substitutes Market Report

Published Date: 31 January 2026 | Report Code: bone-grafts-and-substitutes

Bone Grafts And Substitutes Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bone Grafts And Substitutes market, including market size, segmentation, regional insights, leading players, and emerging trends, with forecasts extending to 2033.

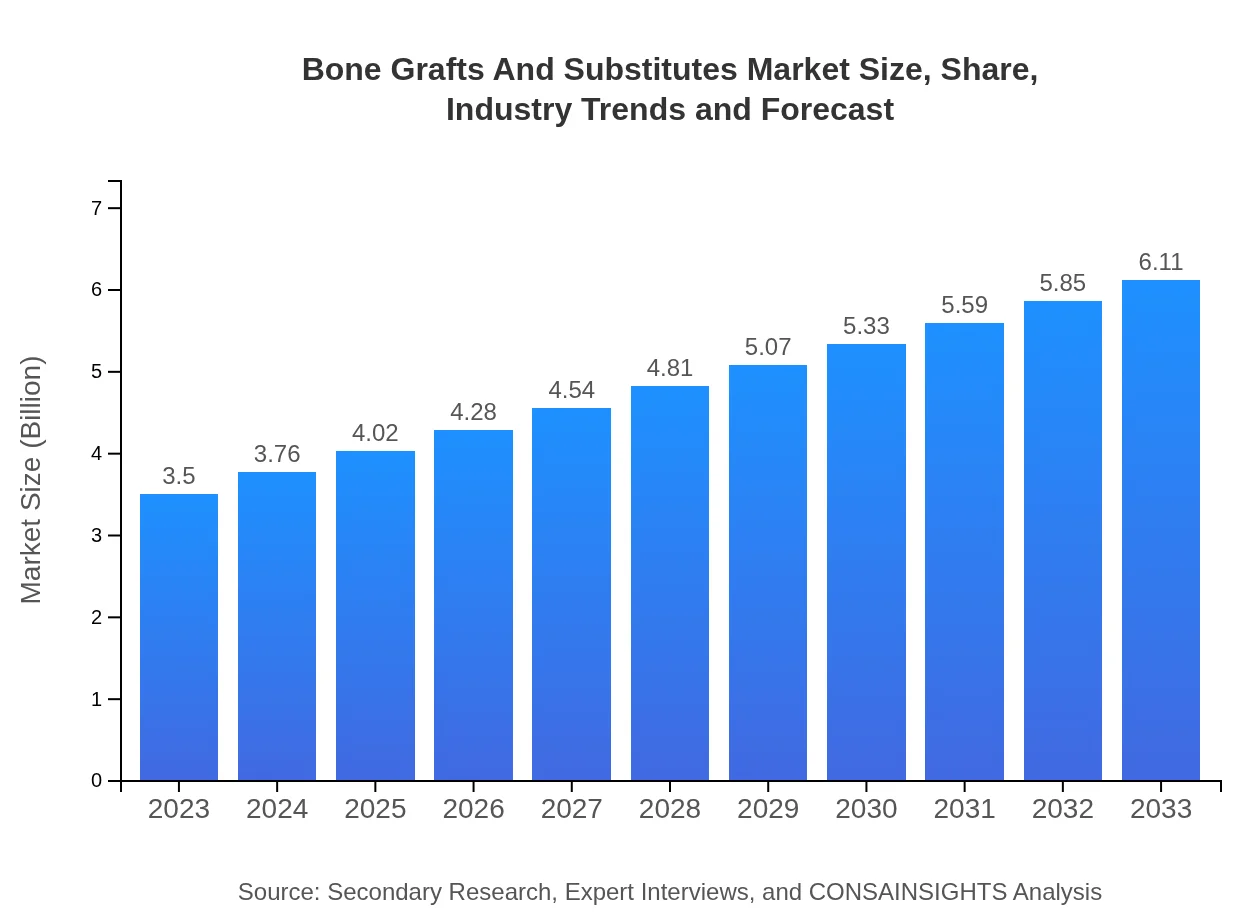

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 5.6% |

| 2033 Market Size | $6.11 Billion |

| Top Companies | DePuy Synthes, Medtronic , Stryker Corporation, Zimmer Biomet, allograft |

| Last Modified Date | 31 January 2026 |

Bone Grafts And Substitutes Market Overview

Customize Bone Grafts And Substitutes Market Report market research report

- ✔ Get in-depth analysis of Bone Grafts And Substitutes market size, growth, and forecasts.

- ✔ Understand Bone Grafts And Substitutes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bone Grafts And Substitutes

What is the Market Size & CAGR of Bone Grafts And Substitutes market in 2023?

Bone Grafts And Substitutes Industry Analysis

Bone Grafts And Substitutes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bone Grafts And Substitutes Market Analysis Report by Region

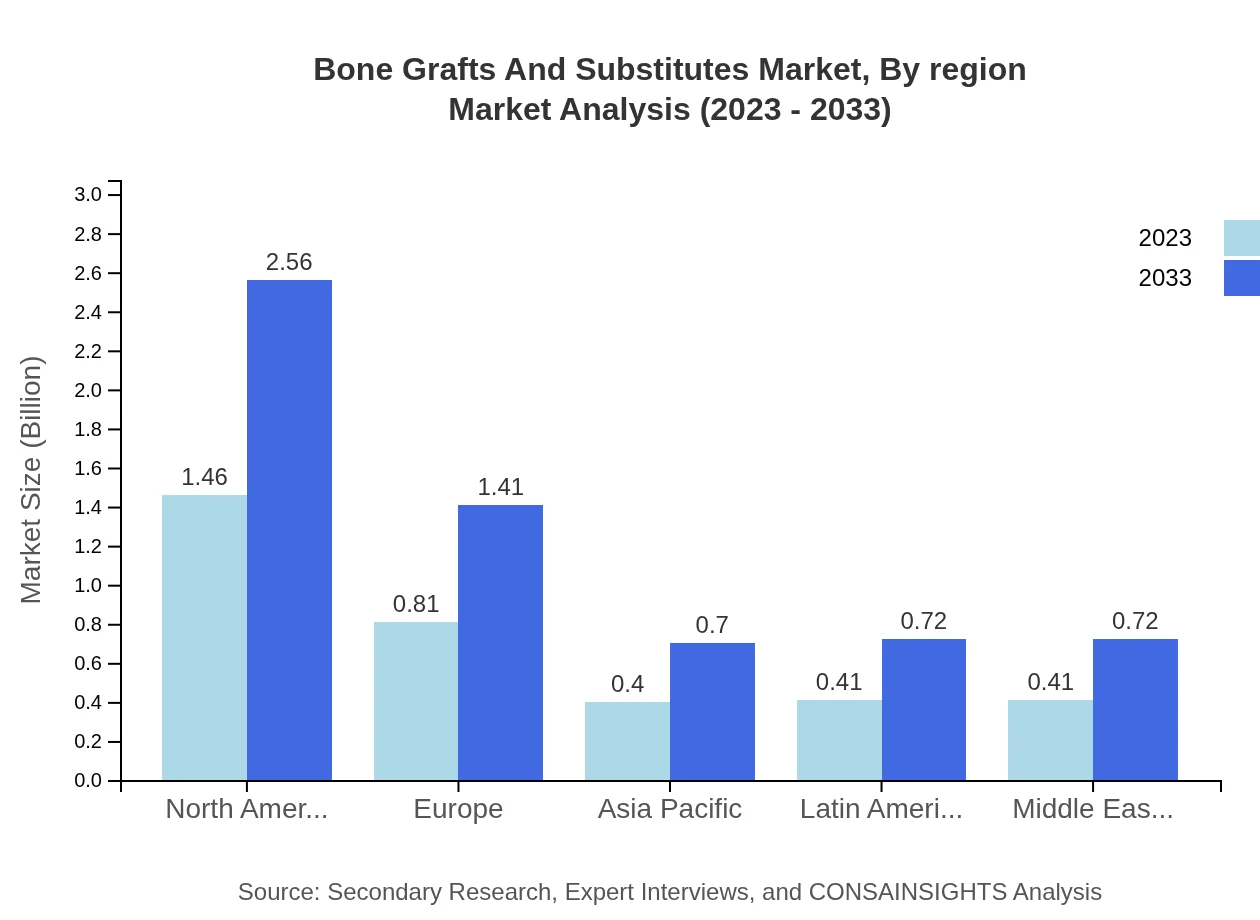

Europe Bone Grafts And Substitutes Market Report:

In Europe, the market is projected to grow from $0.94 billion in 2023 to $1.65 billion by 2033. The region's advanced healthcare systems and high incidences of osteoporosis drive the demand for Bone Grafts And Substitutes. Collaboration among leading companies and research institutions to produce innovative graft materials also plays a critical role in market development.Asia Pacific Bone Grafts And Substitutes Market Report:

The Asia Pacific region exhibits rapid market growth, with estimates indicating a market value of $0.67 billion in 2023 and expected to rise to $1.17 billion by 2033. The rise is driven by increasing healthcare expenditure, expanding surgical capabilities, and a growing elderly population requiring orthopedic surgeries. Technological advancements and improved patient access also contribute significantly to market acceleration.North America Bone Grafts And Substitutes Market Report:

North America remains the largest market for Bone Grafts And Substitutes, with a valuation of $1.21 billion in 2023 and a forecast to expand to $2.11 billion by 2033. The region benefits from robust healthcare facilities, high levels of orthopedic surgeries, and strong research activities. Moreover, favorable reimbursement policies and technological advancements are facilitating market growth.South America Bone Grafts And Substitutes Market Report:

In South America, the Bone Grafts And Substitutes market was valued at $0.20 billion in 2023, with projections to reach $0.34 billion by 2033. Growth is propelled by a rising awareness of advanced treatment options and improving healthcare infrastructure. Despite challenges such as economic constraints, innovative local companies are beginning to emerge, developing affordable alternatives for bone grafting procedures.Middle East & Africa Bone Grafts And Substitutes Market Report:

For the Middle East and Africa, the market size is projected to increase from $0.48 billion in 2023 to $0.84 billion by 2033. Growth factors include rising investment in healthcare infrastructure, a higher prevalence of injuries and trauma requiring surgical intervention, and increasing awareness regarding advanced treatment methods.Tell us your focus area and get a customized research report.

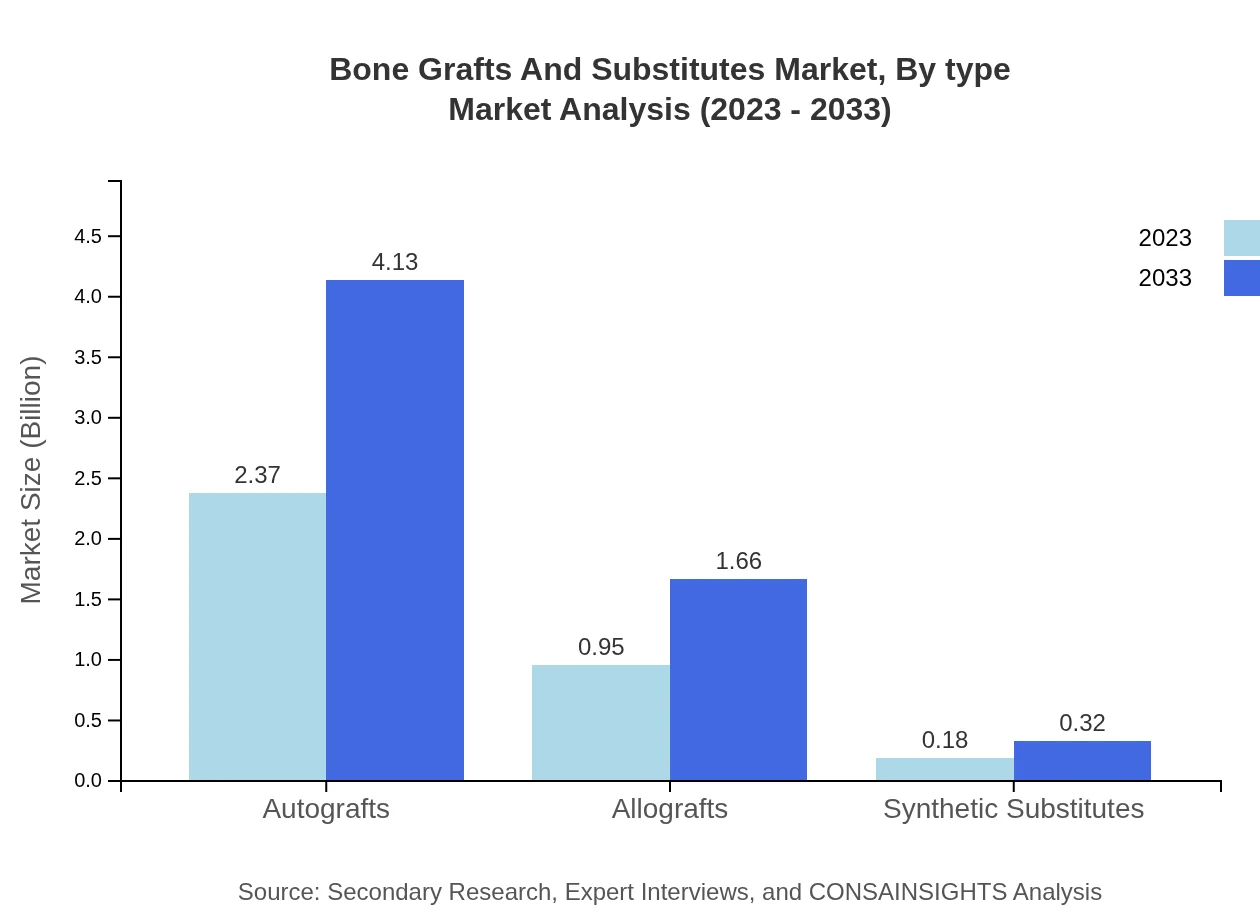

Bone Grafts And Substitutes Market Analysis By Type

The market for Bone Grafts and Substitutes is categorized into three main types: Autografts, Allografts, and Synthetic Substitutes. Autografts dominate the market due to their high compatibility and effectiveness, with a market size of $2.37 billion in 2023 expected to grow to $4.13 billion by 2033. Allografts, valued at $0.95 billion in 2023, will reach $1.66 billion by 2033, making them the second-largest contributor. Synthetic Substitutes represent a smaller segment, with anticipated growth from $0.18 billion in 2023 to $0.32 billion by 2033, appealing due to their ease of availability and reduced risk of infectious transmission.

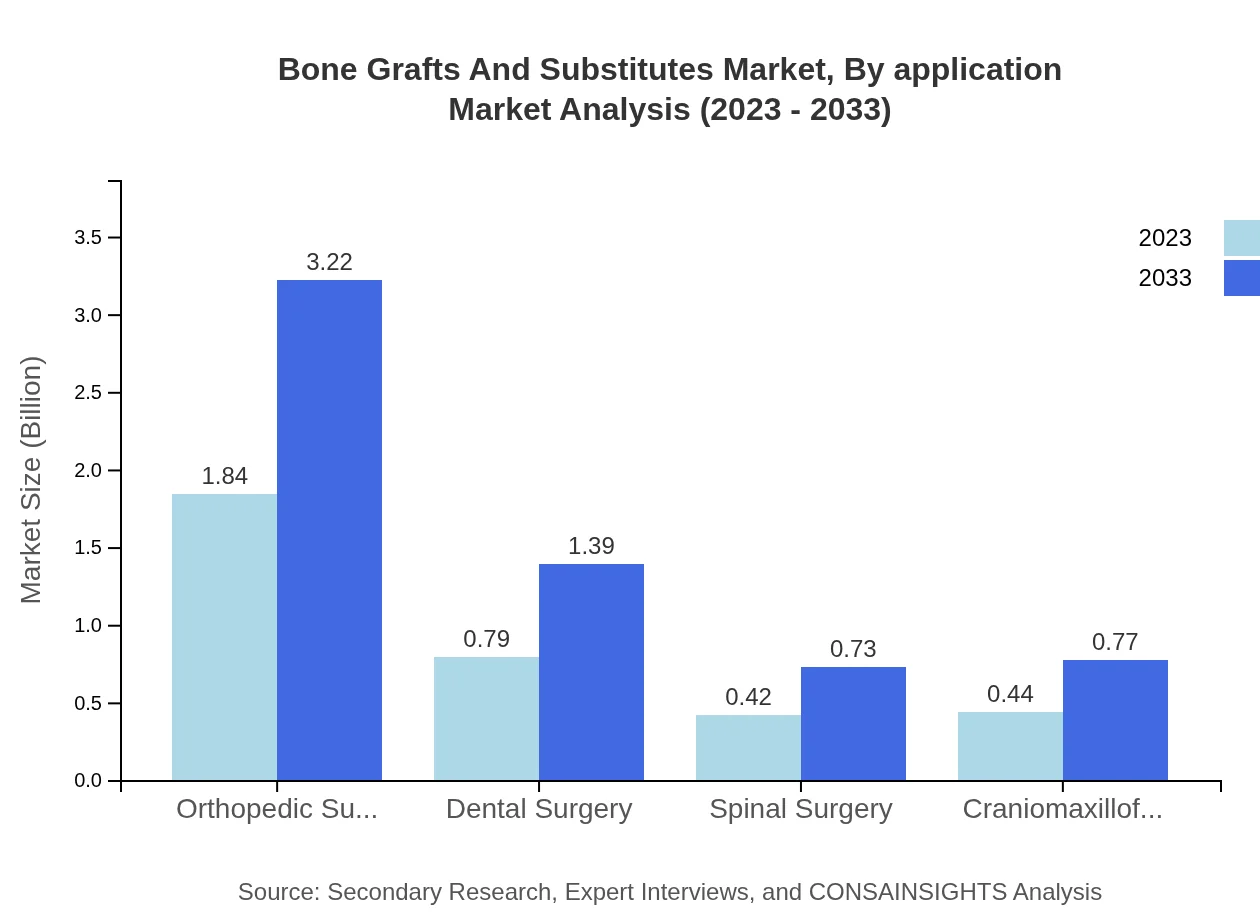

Bone Grafts And Substitutes Market Analysis By Application

In terms of application, the Bone Grafts and Substitutes market is primarily focused on Orthopedic Surgery, Dental Surgery, Spinal Surgery, and Craniomaxillofacial Surgery. Orthopedic Surgery leads, holding a market share of 52.66% in 2023 and projected to grow to 52.66% in 2033. Dental Surgery follows closely, holding a 22.7% share in 2023, expected to maintain this percentage by 2033. Spinal and Craniomaxillofacial surgeries each represent 12.01% and 12.63% respectively, both showing steady growth as more surgical procedures are performed.

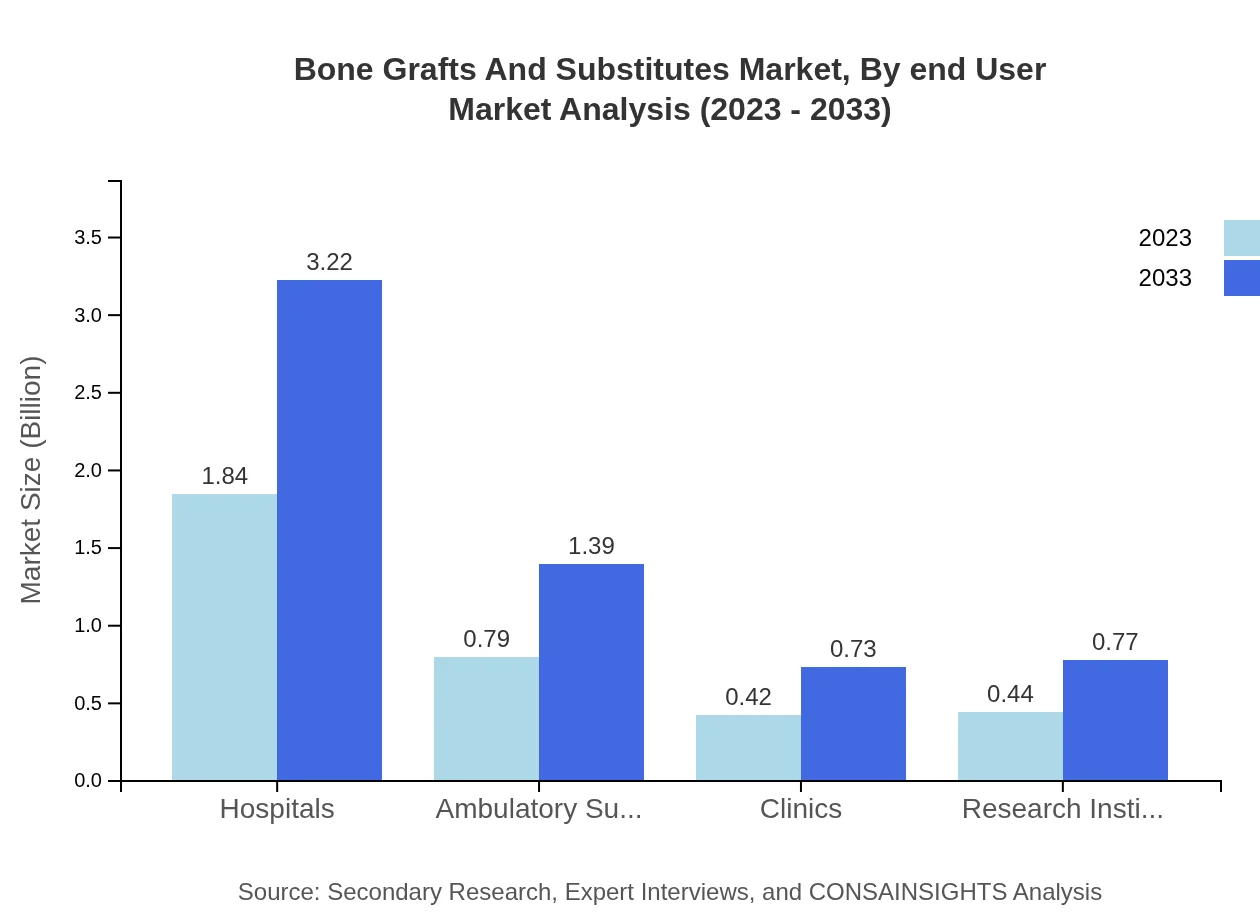

Bone Grafts And Substitutes Market Analysis By End User

The market by end-user includes Hospitals, Ambulatory Surgical Centers, Clinics, and Research Institutes. Hospitals are the leading end-user, with a market share of 52.66% in 2023, expected to remain dominant by 2033. Ambulatory Surgical Centers account for 22.7%, and their share is anticipated to grow as minimally invasive procedures gain popularity. Clinics and Research Institutes account for 12.01% and 12.63%, respectively, significantly contributing to research and development in Bone Grafts And Substitutes.

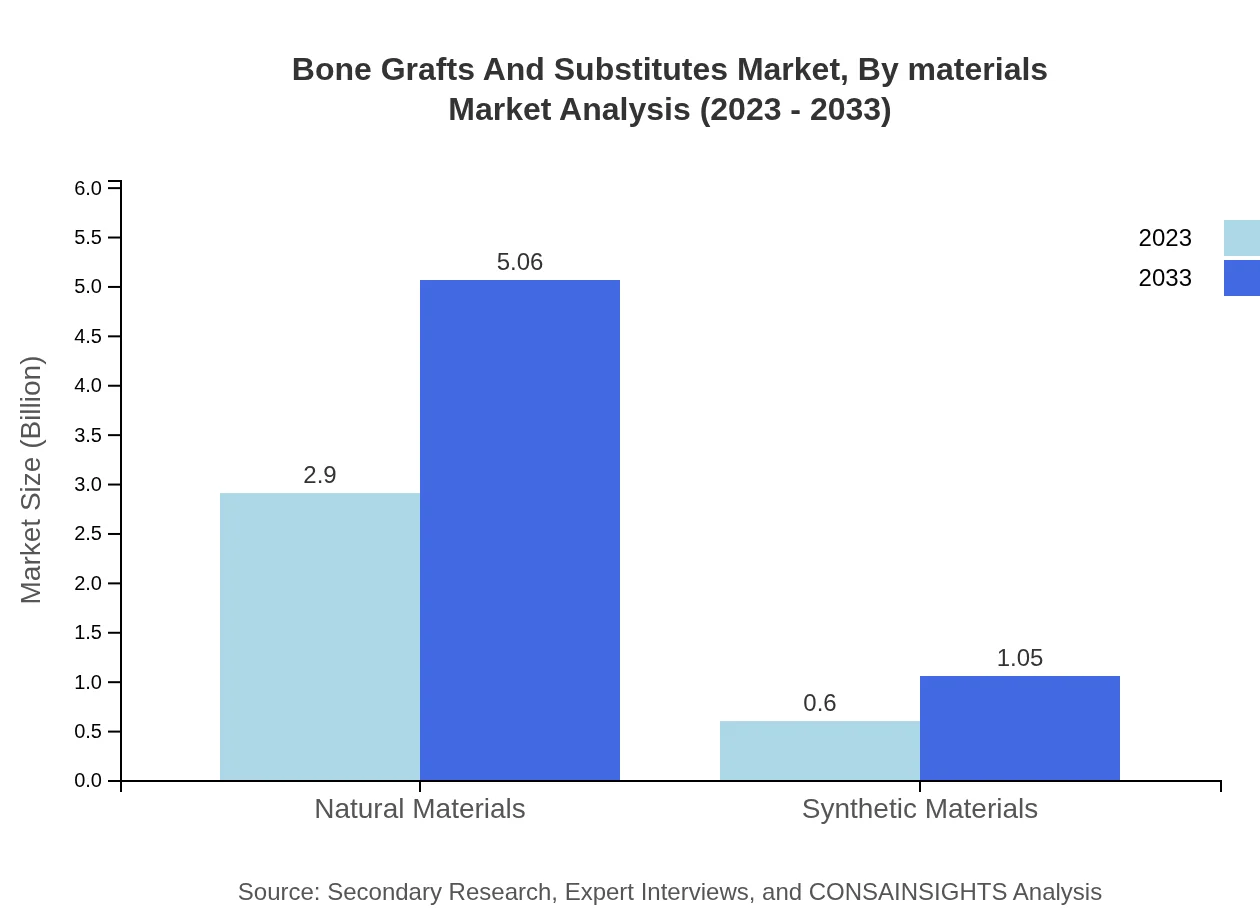

Bone Grafts And Substitutes Market Analysis By Materials

The materials segment includes Natural Materials, Synthetic Materials. Natural Materials, primarily autografts and allografts, dominate the market, accounting for 82.74% in 2023 and projected to remain stable. Synthetic Materials represented 17.26% in 2023, with further development likely to broaden their application, but they remain significantly lower than natural alternatives, appealing primarily due to lower healing time and infection rates.

Bone Grafts And Substitutes Market Analysis By Region

Regional analysis shows that North America holds the largest market share followed by Europe and Asia Pacific. North America's market share of 41.83% in 2023 is set to maintain its leadership, while Europe with a share of 23.15% and Asia Pacific at 11.5% are also crucial regions, highlighting the varied demand across different regions driven by local healthcare dynamics.

Bone Grafts And Substitutes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bone Grafts And Substitutes Industry

DePuy Synthes:

A subsidiary of Johnson & Johnson, specializing in orthopedic products and an extensive range of bone grafts and substitutes, including innovative synthetic and allograft solutions.Medtronic :

A global leader in medical technology, Medtronic has a strong portfolio in the Bone Grafts And Substitutes sector, focusing on innovative solutions for spinal and orthopedic surgeries.Stryker Corporation:

Stryker is a major player in the orthopedic segment, known for its advanced bone grafting and regenerative biological grafting solutions tailored for various applications.Zimmer Biomet:

Zimmer Biomet is dedicated to designing and manufacturing solutions that help in bone regeneration and healing, offering a comprehensive range of grafting materials.allograft:

A significant provider of grafting services, offering allografts as a safe alternative for bone repair, contributing immensely to the market share with growing distribution channels.We're grateful to work with incredible clients.

FAQs

What is the market size of bone Grafts And Substitutes?

The global bone grafts and substitutes market is valued at approximately $3.5 billion in 2023, and it is projected to grow at a CAGR of 5.6% over the next decade, reaching around $6 billion by 2033.

What are the key market players or companies in this bone Grafts And Substitutes industry?

Key players in the bone grafts and substitutes industry include companies like Medtronic, DePuy Synthes, Zimmer Biomet, Stryker, and Wright Medical. These companies dominate due to their innovative products and extensive distribution networks.

What are the primary factors driving the growth in the bone Grafts And Substitutes industry?

The growth in the bone grafts and substitutes industry is driven by factors such as an increasing geriatric population, rising incidences of orthopedic conditions, advancements in medical technology, and the growing preference for minimally invasive surgeries.

Which region is the fastest Growing in the bone Grafts And Substitutes?

Asia Pacific is the fastest-growing region in the bone grafts and substitutes market, anticipated to expand from $0.67 billion in 2023 to $1.17 billion by 2033, reflecting increased healthcare investments and rising awareness of advanced treatment options.

Does ConsaInsights provide customized market report data for the bone Grafts And Substitutes industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the bone grafts and substitutes industry. Clients can request reports that focus on particular regions, segments, or trends as needed.

What deliverables can I expect from this bone Grafts And Substitutes market research project?

From this market research project, you can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape overview, regional insights, and segment-wise breakdowns for informed decision-making.

What are the market trends of bone Grafts And Substitutes?

Current trends in the bone grafts and substitutes market include the increasing adoption of synthetic substitutes, a shift toward natural materials, rising popularity of autografts, and innovations in surgical techniques that enhance recovery times and outcomes.