Bone Replacement Market Report

Published Date: 31 January 2026 | Report Code: bone-replacement

Bone Replacement Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Bone Replacement market, including market trends, size, growth forecasts from 2023 to 2033, and insights by region and segments.

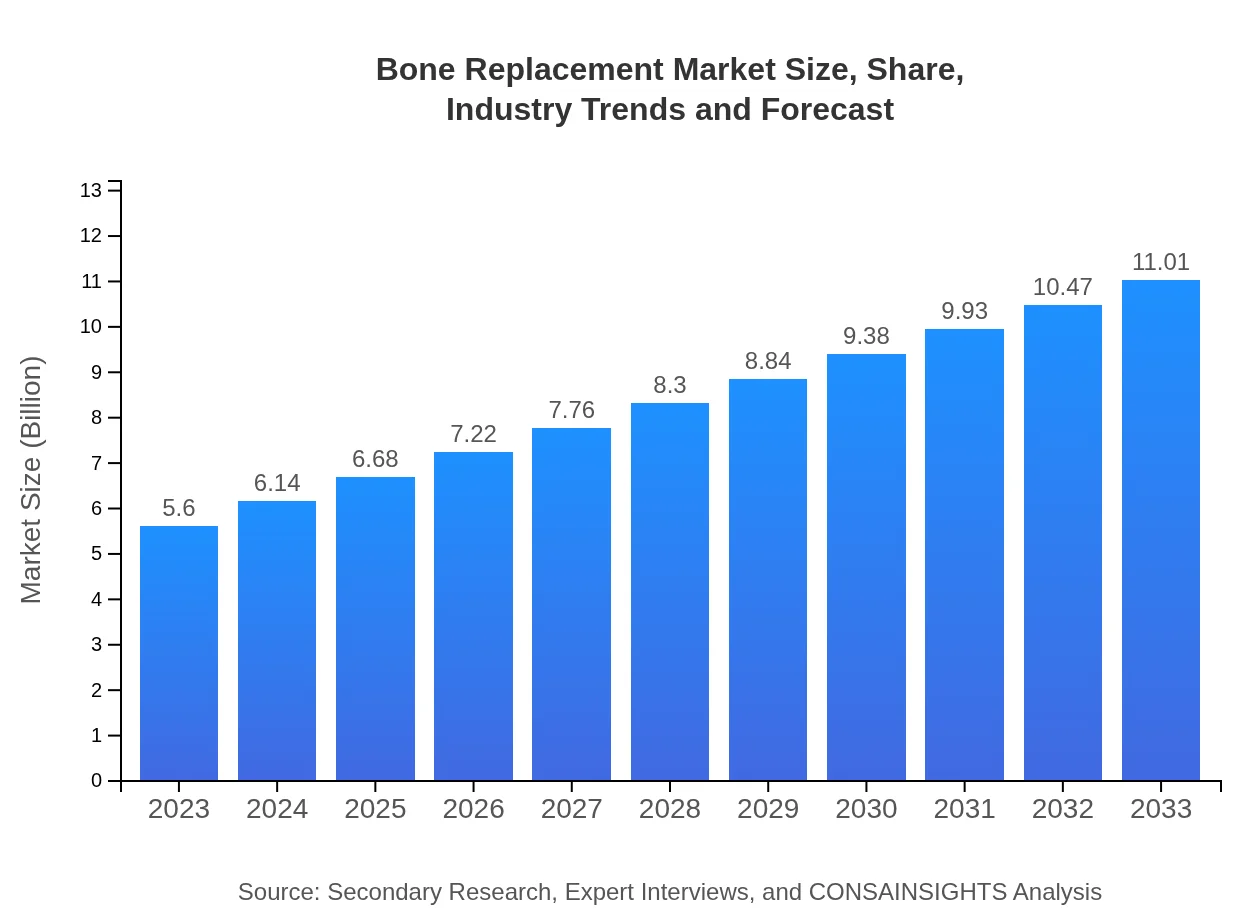

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | Medtronic , DePuy Synthes, Stryker Corporation, Zimmer Biomet |

| Last Modified Date | 31 January 2026 |

Bone Replacement Market Overview

Customize Bone Replacement Market Report market research report

- ✔ Get in-depth analysis of Bone Replacement market size, growth, and forecasts.

- ✔ Understand Bone Replacement's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bone Replacement

What is the Market Size & CAGR of Bone Replacement market in 2023?

Bone Replacement Industry Analysis

Bone Replacement Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bone Replacement Market Analysis Report by Region

Europe Bone Replacement Market Report:

Europe represented a valuation of $1.91 billion in 2023, anticipated to grow to $3.76 billion by 2033. The market's growth is supported by an aging population and the adoption of cutting-edge medical technologies.Asia Pacific Bone Replacement Market Report:

In the Asia-Pacific region, the Bone Replacement market was valued at approximately $0.99 billion in 2023, expected to reach $1.95 billion by 2033, propelled by rising healthcare expenditure, increasing incidences of sports injuries, and a burgeoning elderly population.North America Bone Replacement Market Report:

North America leads the global Bone Replacement market with an estimated value of $1.94 billion in 2023, expected to rise to $3.82 billion by 2033. The boom is fueled by advanced healthcare infrastructure, significant R&D investments, and a high prevalence of orthopedic surgeries.South America Bone Replacement Market Report:

The South American market, valued at $0.38 billion in 2023, is projected to grow to $0.75 billion by 2033. The region experiences rising demand for bone grafting procedures driven by increased road accidents and sporting activities.Middle East & Africa Bone Replacement Market Report:

The Middle East and Africa Bone Replacement market is valued at $0.37 billion in 2023 with the potential to grow to $0.73 billion by 2033. Growth is stimulated by increasing healthcare initiatives and investments in medical research.Tell us your focus area and get a customized research report.

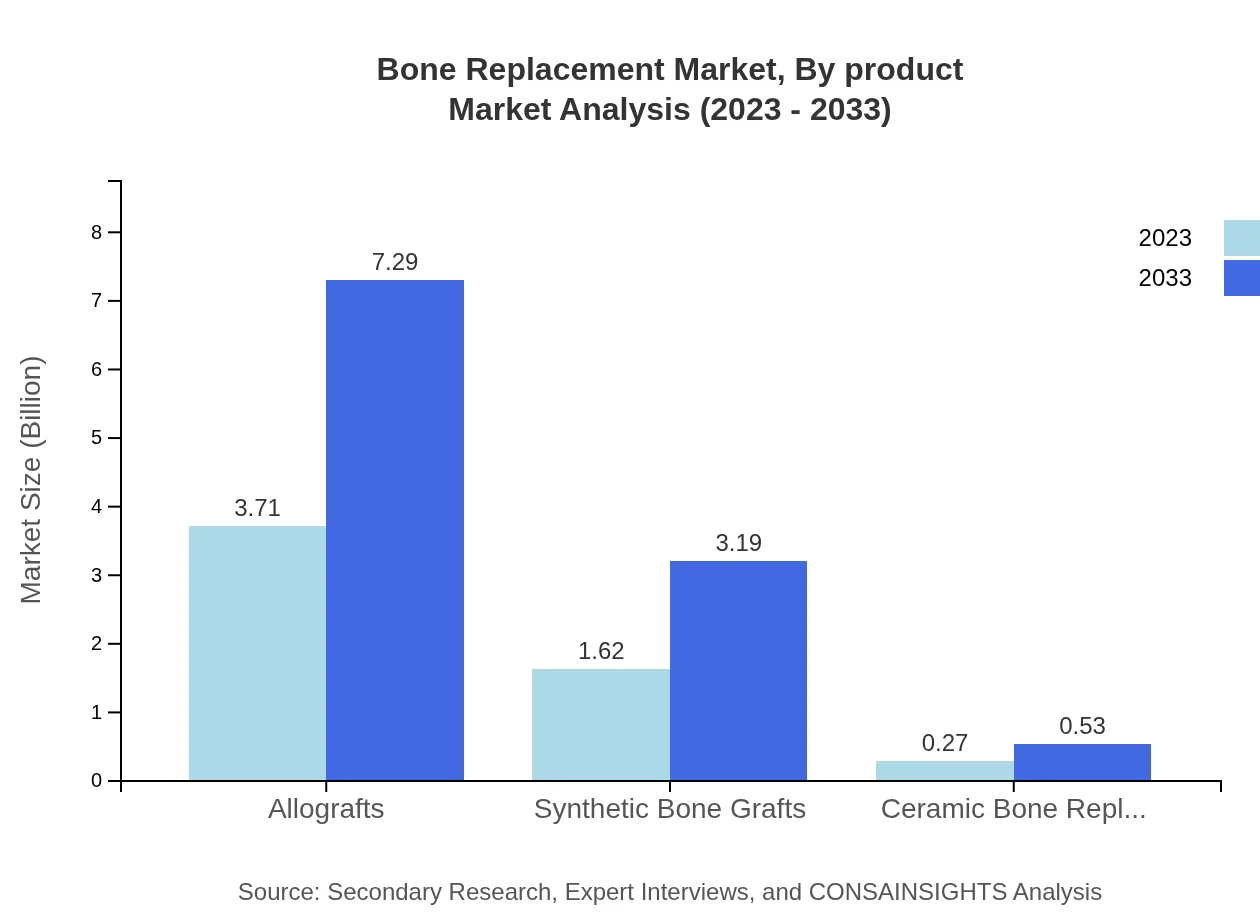

Bone Replacement Market Analysis By Product

The market is predominantly driven by the allografts segment, projected to grow from $3.71 billion in 2023 to $7.29 billion in 2033. Synthetic bone grafts follow with a growth from approximately $1.62 billion to $3.19 billion in the same period, demonstrating their increasing significance and innovation in the market.

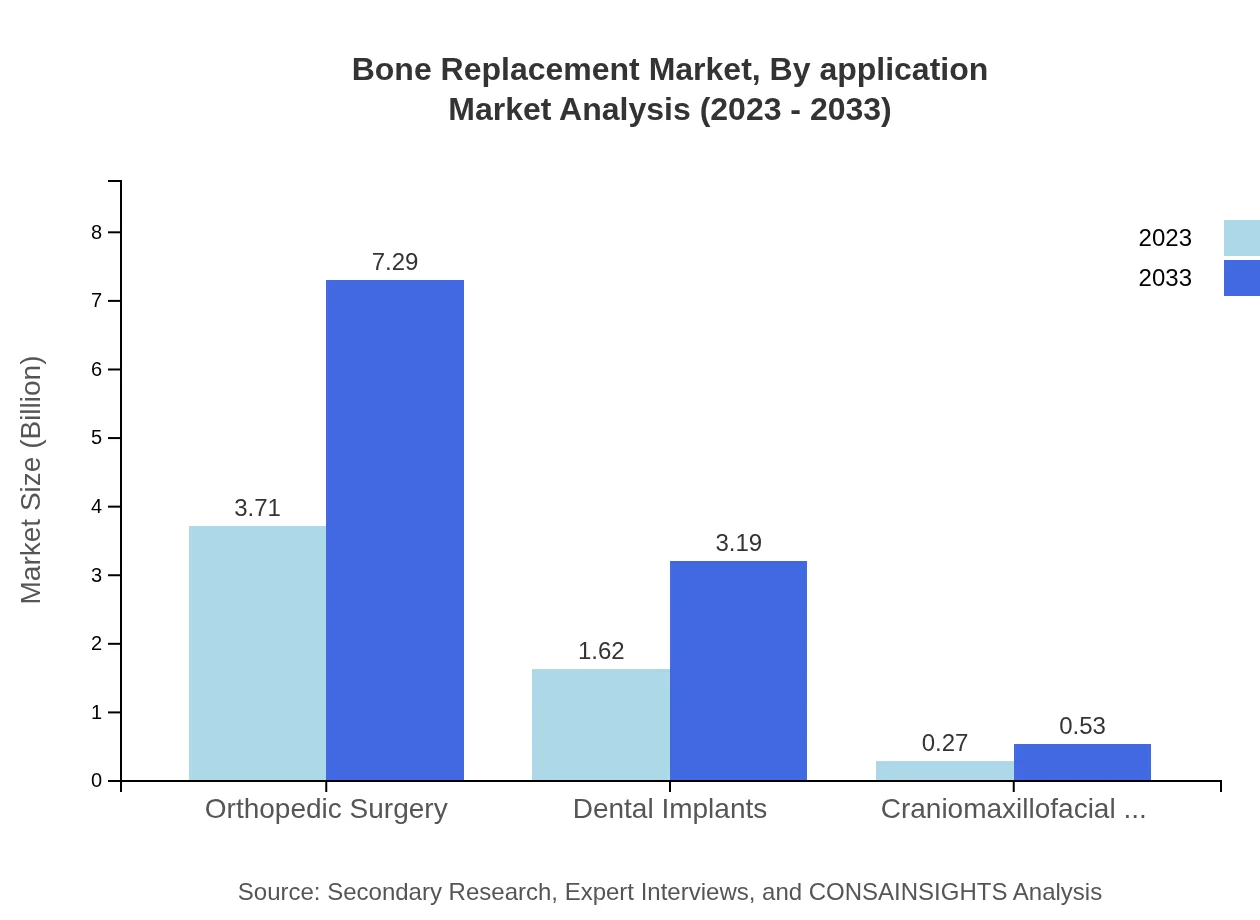

Bone Replacement Market Analysis By Application

In application segments, orthopedic surgeries represent the largest share, with an increase from $3.71 billion in 2023 to $7.29 billion by 2033. This is closely followed by dental implants, which rise from $1.62 billion to $3.19 billion, indicating significant growth in restorative dental procedures.

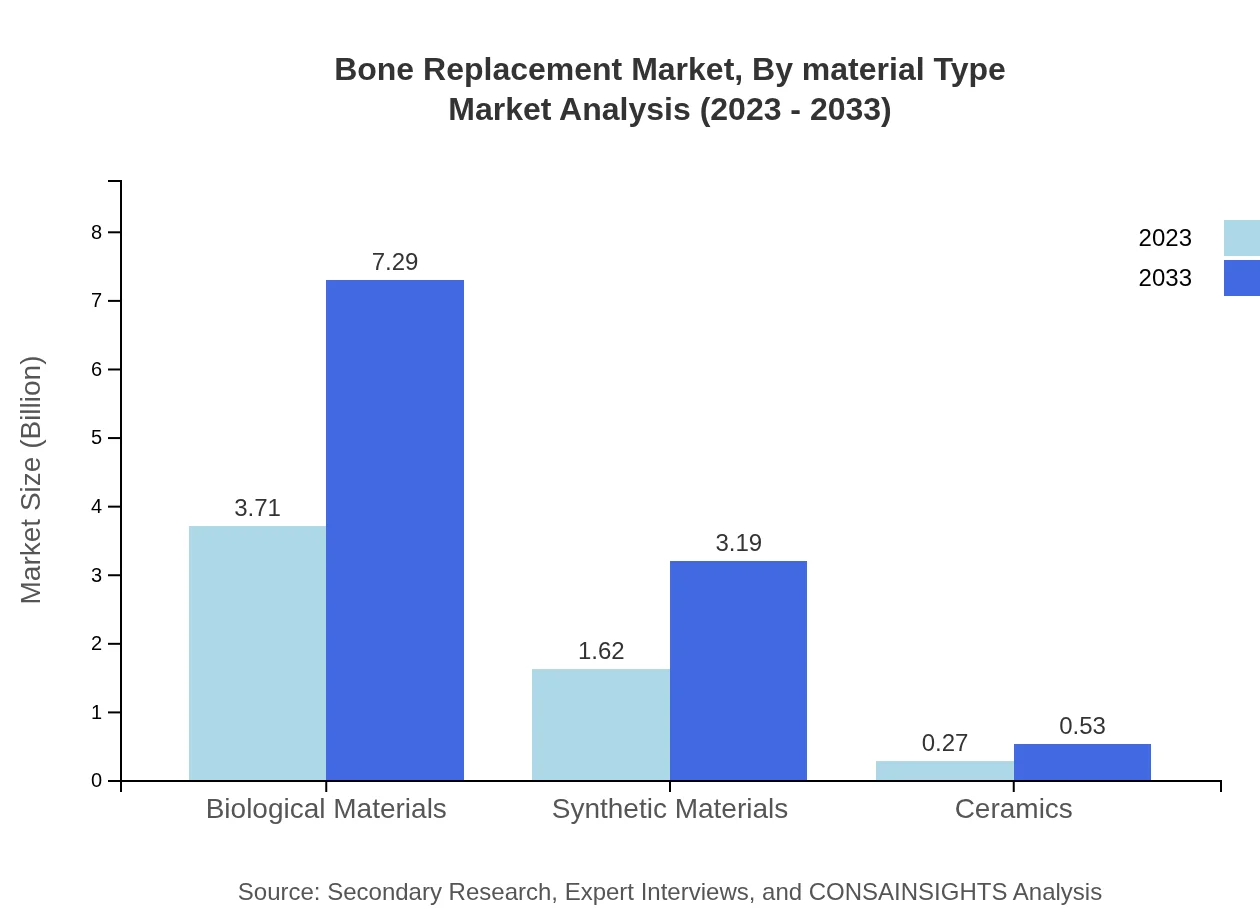

Bone Replacement Market Analysis By Material Type

Biological materials dominate the segment, with a size growth from $3.71 billion in 2023 to $7.29 billion by 2033. Synthetic materials are also growing significantly, from $1.62 billion to $3.19 billion, showcasing the trend towards engineered solutions.

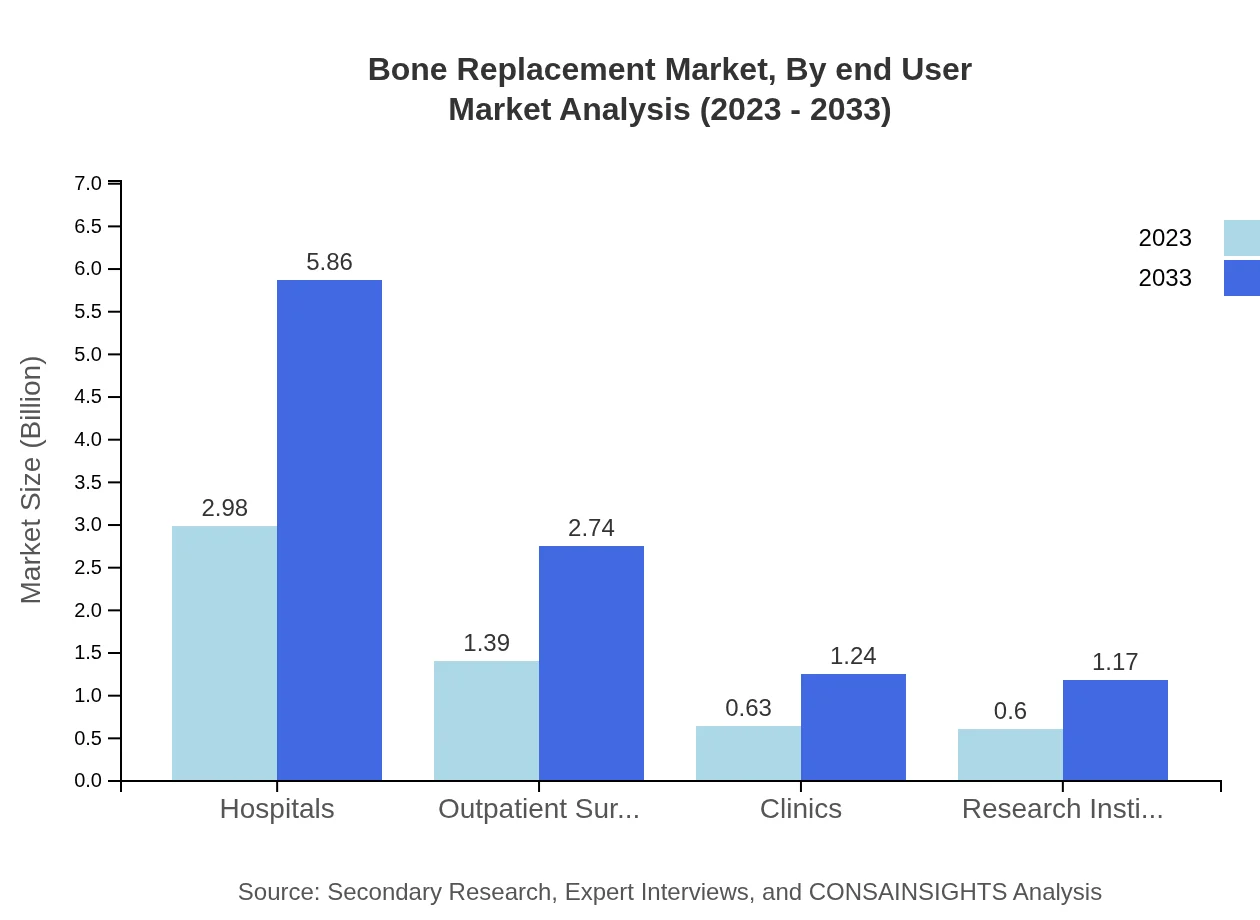

Bone Replacement Market Analysis By End User

Hospitals remain the leading end-user in the Bone Replacement market, expanding from $2.98 billion in 2023 to $5.86 billion by 2033. Outpatient surgical centers and clinics also demonstrate growth, signifying a shift toward less invasive procedures.

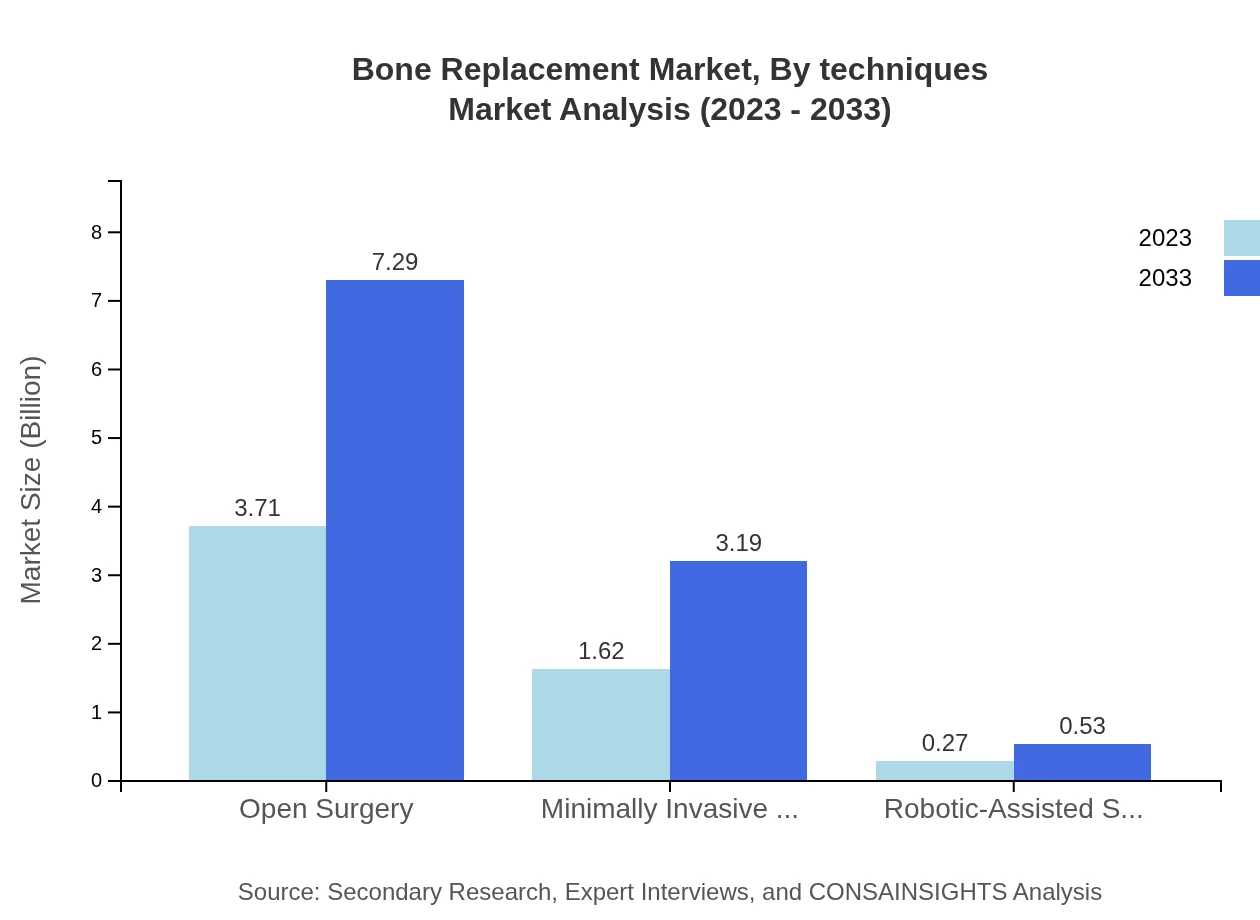

Bone Replacement Market Analysis By Techniques

Open surgery techniques hold significant market share, growing from $3.71 billion to $7.29 billion, while minimally invasive surgery methods also see a rise, emphasizing the trend towards reduced recovery times and improved patient outcomes.

Bone Replacement Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bone Replacement Industry

Medtronic :

A leading global healthcare solutions company, Medtronic offers a wide range of products and therapies including innovative bone grafting solutions.DePuy Synthes:

A subsidiary of Johnson & Johnson, DePuy Synthes specializes in orthopedic solutions including implants, bone grafts, and surgical instruments crucial for bone replacement procedures.Stryker Corporation:

Stryker is known for its comprehensive portfolio in orthopedic products, actively contributing to the growth of the Bone Replacement market with pioneering surgical technologies.Zimmer Biomet:

A prominent player in musculoskeletal health, Zimmer Biomet provides innovative solutions including joint reconstruction, spinal surgery, and advanced bone graft technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of bone Replacement?

The global bone-replacement market is valued at approximately $5.6 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, indicating robust growth driven by technological advancements and increasing orthopedic procedures.

What are the key market players or companies in this bone Replacement industry?

Key players in the bone-replacement market include Medtronic, Zimmer Biomet, Stryker Corporation, DePuy Synthes, and Wright Medical Group. These companies are prominent in research, innovation, and distribution of bone-replacement solutions across various regions.

What are the primary factors driving the growth in the bone Replacement industry?

Major growth drivers in the bone-replacement industry include rising orthopedic surgeries, aging population, advancements in biomaterials, and increasing prevalence of bone-related disorders. Innovations in surgical techniques also significantly boost market demand, enhancing recovery outcomes.

Which region is the fastest Growing in the bone Replacement?

The fastest-growing region in the bone-replacement market is Europe, with a market size expected to grow from $1.91 billion in 2023 to $3.76 billion in 2033. Asia Pacific is also rapidly expanding, rising from $0.99 billion to $1.95 billion.

Does ConsInsights provide customized market report data for the bone Replacement industry?

Yes, ConsInsights offers customized market report data for the bone-replacement industry, allowing clients to obtain specific insights tailored to their needs. This includes segment analyses, regional breakdowns, and competitive landscape assessments.

What deliverables can I expect from this bone Replacement market research project?

Deliverables from the bone-replacement market research project include comprehensive market reports, executive summaries, trend analyses, competitive assessments, and data insights segmented by region, product type, and end-user, providing strategic guidance.

What are the market trends of bone Replacement?

Current trends in the bone-replacement market include increasing adoption of minimally invasive surgeries, effective biomaterials development, and a growing focus on personalized medicine. There is also a notable shift towards biological grafts and synthetic options to meet diverse patient needs.