Botanical Extracts Market Report

Published Date: 31 January 2026 | Report Code: botanical-extracts

Botanical Extracts Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Botanical Extracts market, including insights into market size, growth trends, performance by regions, and key players from 2023 to 2033.

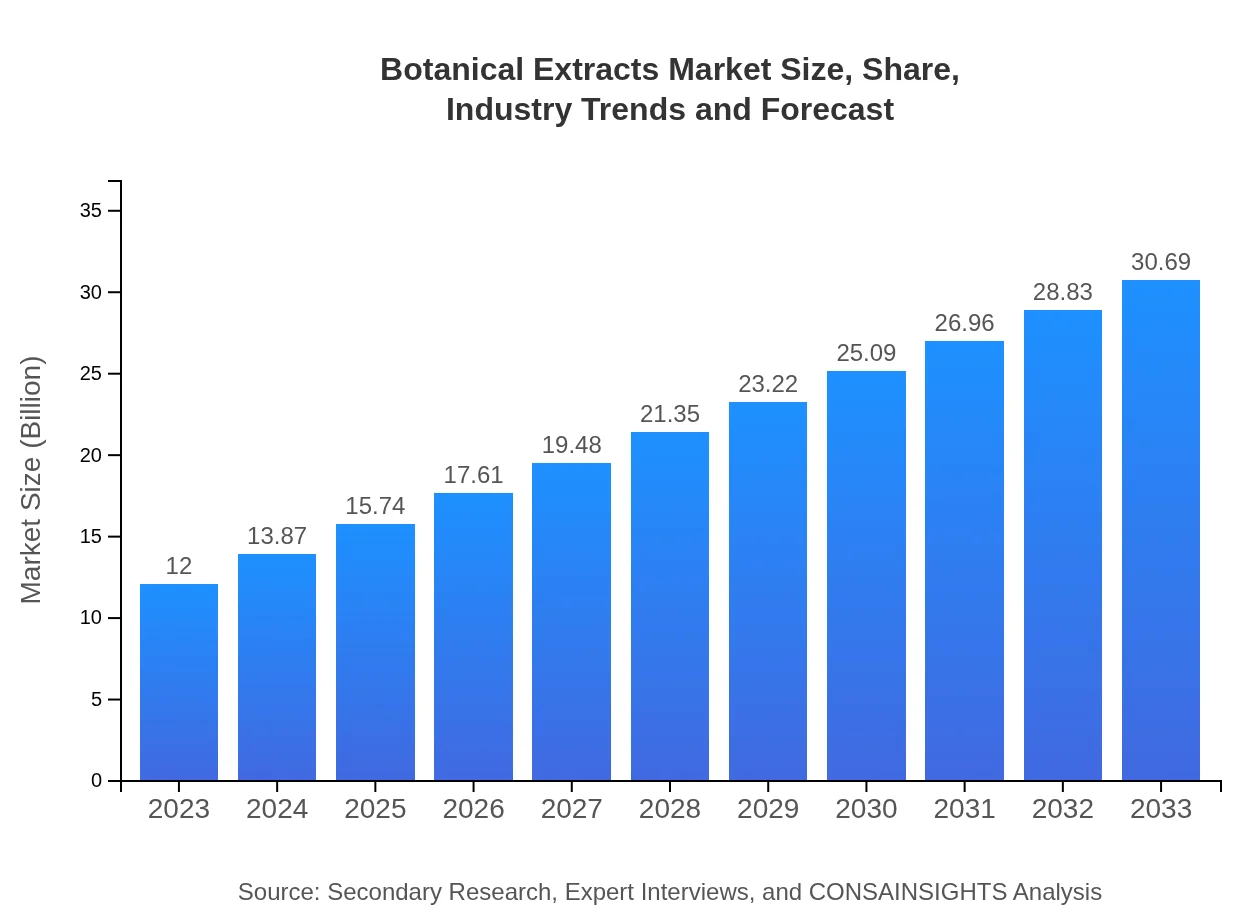

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Sabinsa Corporation, Indena, Givaudan, Symrise |

| Last Modified Date | 31 January 2026 |

Botanical Extracts Market Overview

Customize Botanical Extracts Market Report market research report

- ✔ Get in-depth analysis of Botanical Extracts market size, growth, and forecasts.

- ✔ Understand Botanical Extracts's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Botanical Extracts

What is the Market Size & CAGR of Botanical Extracts market in 2023?

Botanical Extracts Industry Analysis

Botanical Extracts Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Botanical Extracts Market Analysis Report by Region

Europe Botanical Extracts Market Report:

In Europe, the market size is expected to increase from $4.00 billion in 2023 to $10.23 billion in 2033. The stringent regulations on synthetic ingredients and the rising trend for clean label products sprout from natural extracts.Asia Pacific Botanical Extracts Market Report:

In the Asia Pacific region, the market for Botanical Extracts is projected to grow from $2.29 billion in 2023 to $5.87 billion by 2033. This growth is driven by rising populations, increasing interest in herbal remedies, and a booming nutraceutical market.North America Botanical Extracts Market Report:

North America holds a significant market share, growing from $3.89 billion in 2023 to $9.95 billion in 2033. A strong consumer preference for dietary supplements and natural products drives this growth.South America Botanical Extracts Market Report:

South America is anticipated to see a moderate growth from $0.23 billion in 2023 to $0.58 billion in 2033. The growth is primarily fueled by the expanding interest in organic and herbal products for health and wellness.Middle East & Africa Botanical Extracts Market Report:

For the Middle East and Africa, the market is projected to rise from $1.59 billion in 2023 to $4.06 billion in 2033, bolstered by the growing demand for herbal products especially in health and personal care sectors.Tell us your focus area and get a customized research report.

Botanical Extracts Market Analysis By Extract Type

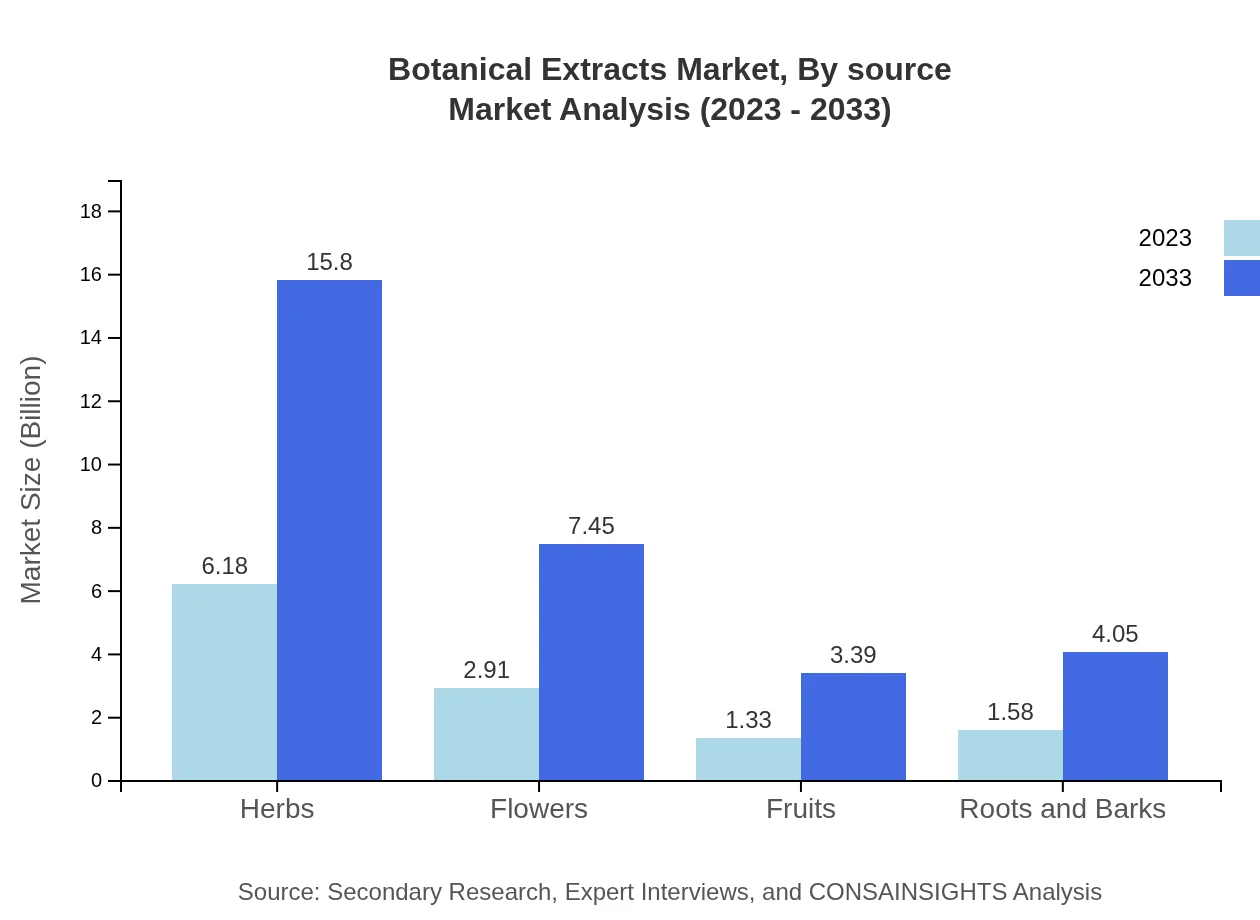

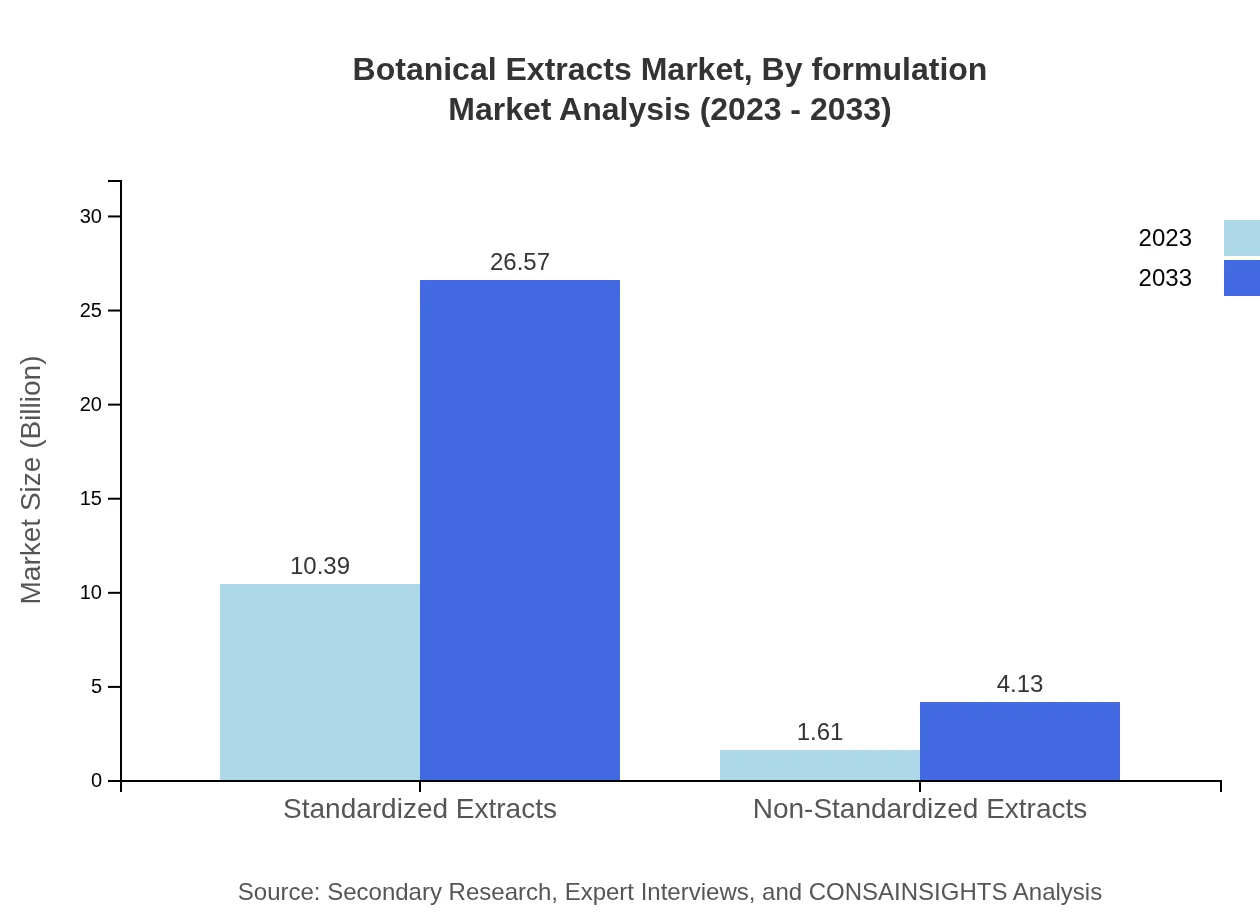

In the extract type category, the market is witnessing the highest growth in herbs, with an increase from $6.18 billion in 2023 to $15.80 billion by 2033. Standardized extracts dominate the market, accounting for 86.56% due to consistent quality standards required by the industries.

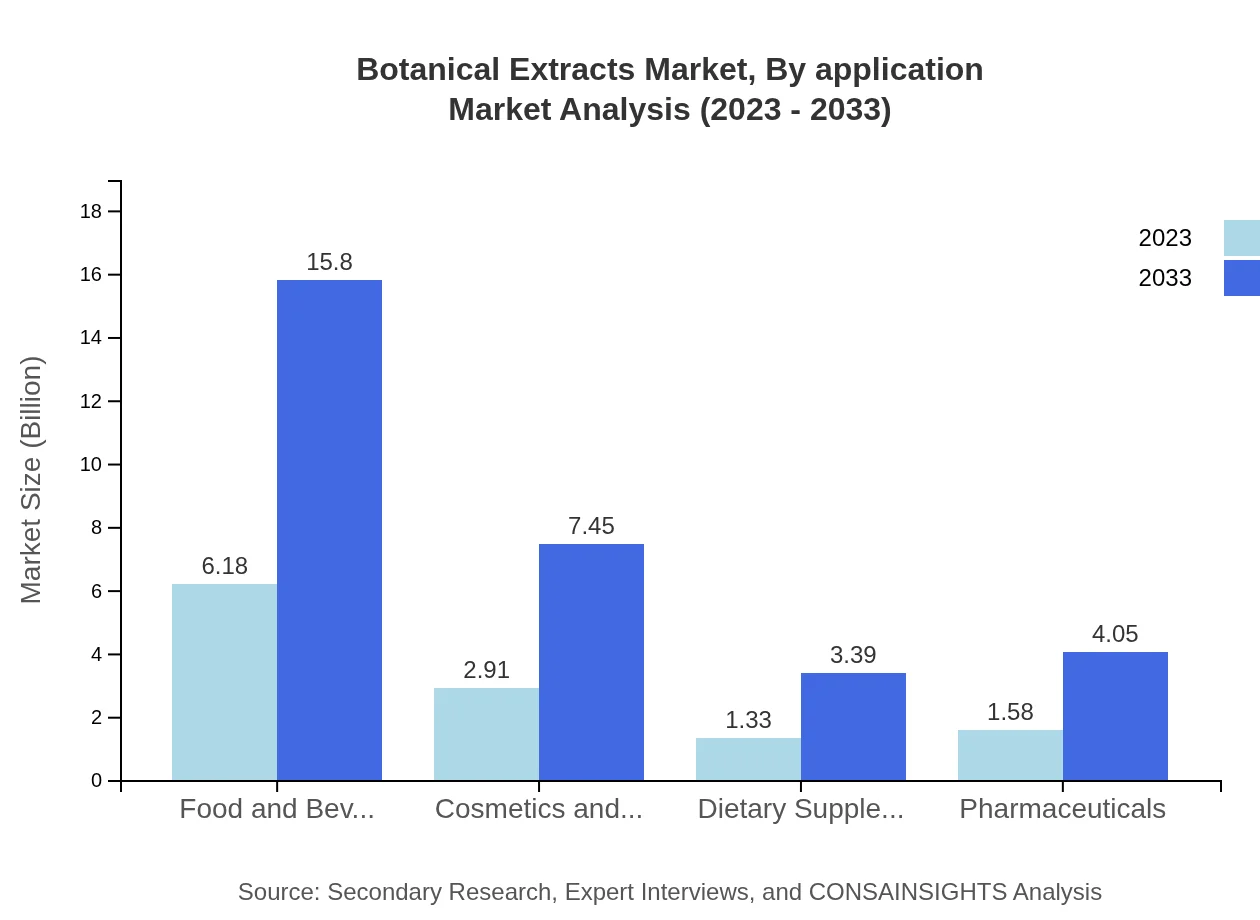

Botanical Extracts Market Analysis By Application

The food and beverage segment represents 51.46% of the market share and grows from $6.18 billion in 2023 to $15.80 billion in 2033. Cosmetics and personal care following closely increases from $2.91 billion to $7.45 billion during the same period.

Botanical Extracts Market Analysis By Source

The sourcing of botanical extracts is expanding towards organic and wild crafted sources, which are popular due to increasing environmental concerns. This ensures sustainability and quality compliance.

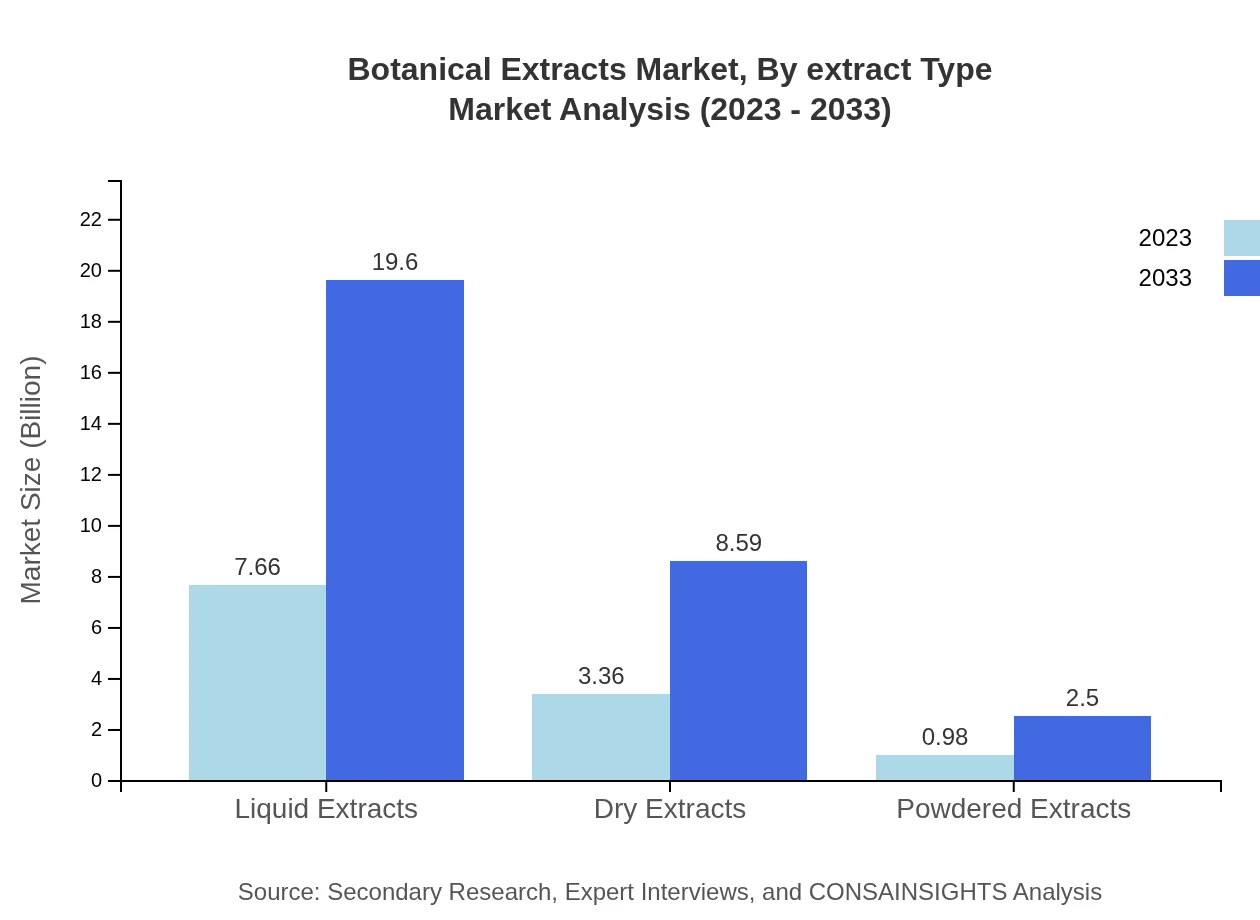

Botanical Extracts Market Analysis By Formulation

Different formulations of botanical extracts, including liquid extracts at $7.66 billion in 2023 and projected to rise to $19.60 billion by 2033, represent a significant market segment, showcasing the strong preference among consumers for easy-to-use products.

Botanical Extracts Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Botanical Extracts Industry

Sabinsa Corporation:

A leading player in the herbal extracts industry known for its innovative products and commitment to quality and sustainability.Indena:

Specializes in the manufacture of botanical extracts for pharmaceuticals, nutraceuticals, and cosmetics, recognized for its extensive research and development efforts.Givaudan:

A global leader in flavor and fragrance solutions with a strong portfolio of botanical extracts catering to the food and beverage sector.Symrise:

A major supplier of natural ingredients, focusing on creating innovative solutions in the cosmetic and food industries.We're grateful to work with incredible clients.

FAQs

What is the market size of botanical extracts?

The botanical extracts market is valued at approximately $12 billion in 2023, with a projected CAGR of 9.5% from 2023 to 2033. This growth reflects the increasing demand across various sectors including food, beverages, cosmetics, and dietary supplements.

What are the key market players or companies in the botanical extracts industry?

Key players in the botanical extracts industry include established firms specializing in natural extracts, pharmaceuticals, and dietary supplements. These companies focus on innovation, sustainability, and expanding their product portfolios to cater to the growing market.

What are the primary factors driving the growth in the botanical extracts industry?

Growth in the botanical extracts market is primarily driven by increased consumer demand for natural products, advancements in extraction technologies, and rising awareness of the health benefits associated with botanical extracts across various industries.

Which region is the fastest Growing in the botanical extracts market?

Currently, Europe is the fastest-growing region in the botanical extracts market, with projected growth from $4.00 billion in 2023 to $10.23 billion by 2033. Asia Pacific also shows substantial growth, expanding from $2.29 billion to $5.87 billion during the same period.

Does ConsaInsights provide customized market report data for the botanical extracts industry?

Yes, ConsaInsights offers customized market report data for the botanical extracts industry, providing tailored insights to meet specific client needs and preferences, ensuring comprehensive analysis that aligns with their strategic goals.

What deliverables can I expect from this botanical extracts market research project?

Clients can expect detailed reports, including market size analysis, segment-wise breakdown, growth forecasts, competitive landscape reviews, and actionable insights that can guide strategic decision-making in the botanical extracts sector.

What are the market trends of botanical extracts?

Market trends in botanical extracts show a shift towards premium products, increased demand for organic extracts, and a focus on sustainable sourcing and environmentally friendly production methods, reflecting changing consumer preferences.