Botanical Pesticides Market Report

Published Date: 31 January 2026 | Report Code: botanical-pesticides

Botanical Pesticides Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the botanical pesticides market, covering its growth potential, market trends, and insights from 2023 to 2033. Key data points and forecasts will aid stakeholders in strategic decision-making for future investments.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

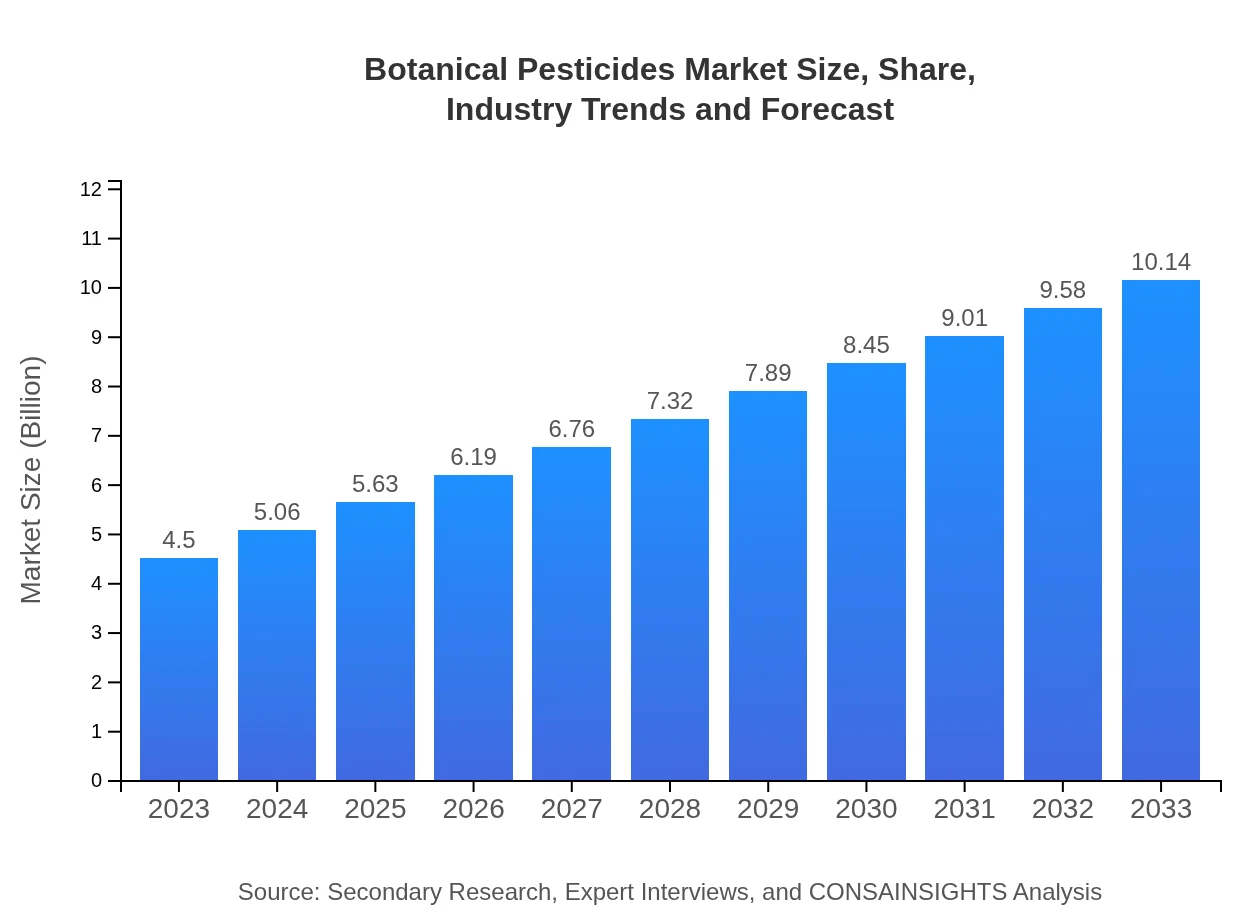

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $10.14 Billion |

| Top Companies | Bayer AG, Syngenta AG, Certis USA LLC, Dupont de Nemours, Inc. |

| Last Modified Date | 31 January 2026 |

Botanical Pesticides Market Overview

Customize Botanical Pesticides Market Report market research report

- ✔ Get in-depth analysis of Botanical Pesticides market size, growth, and forecasts.

- ✔ Understand Botanical Pesticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Botanical Pesticides

What is the Market Size & CAGR of Botanical Pesticides market in 2033?

Botanical Pesticides Industry Analysis

Botanical Pesticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Botanical Pesticides Market Analysis Report by Region

Europe Botanical Pesticides Market Report:

Europe's market will expand from USD 1.28 billion in 2023 to USD 2.89 billion by 2033. The growth is propelled by strong regulatory frameworks supporting organic agriculture and increasing investments in research and development for innovative botanical pesticide solutions.Asia Pacific Botanical Pesticides Market Report:

The Asia Pacific region is anticipated to witness substantial growth, with the market projected to grow from USD 0.96 billion in 2023 to USD 2.16 billion by 2033. Factors such as increasing agricultural activities, growing consumer awareness regarding organic farming, and government initiatives promoting eco-friendly farming practices are key drivers of this market growth.North America Botanical Pesticides Market Report:

North America is forecasted to grow from USD 1.44 billion in 2023 to USD 3.25 billion by 2033, fueled by stringent regulations regarding chemical pesticides, coupled with a strong consumer shift towards organic produce and biopesticides.South America Botanical Pesticides Market Report:

In South America, the market size is expected to increase from USD 0.29 billion in 2023 to USD 0.65 billion by 2033, driven by the expansion of organic farming and the rising demand for sustainable agricultural inputs, particularly in countries like Brazil and Argentina.Middle East & Africa Botanical Pesticides Market Report:

In the Middle East and Africa, the market is projected to grow from USD 0.53 billion in 2023 to USD 1.20 billion by 2033, driven by rising agricultural productivity needs and a growing focus on sustainable farming practices.Tell us your focus area and get a customized research report.

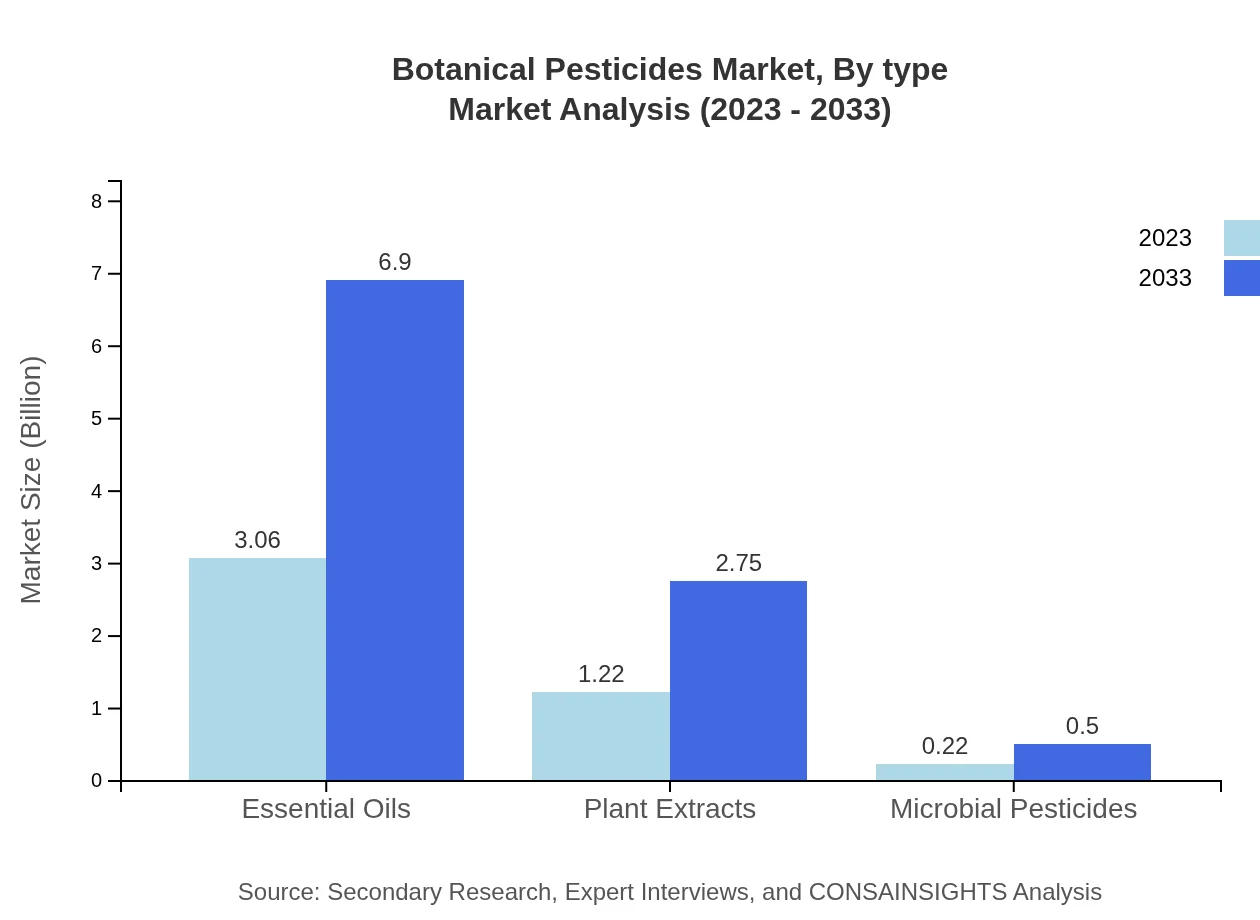

Botanical Pesticides Market Analysis By Type

The botanical pesticides market is significantly influenced by various product types, including essential oils, plant extracts, and microbial pesticides. In 2023, essential oils dominated the market with a size of USD 3.06 billion, representing a share of 68.02%. This trend is expected to continue, with an estimated market size of USD 6.90 billion and the same market share in 2033. Plant extracts are also critical, with expected growth from USD 1.22 billion in 2023 to USD 2.75 billion in 2033, holding a 27.08% share. Microbial pesticides, though smaller, are predicted to grow steadily, moving from USD 0.22 billion to USD 0.50 billion during the same period.

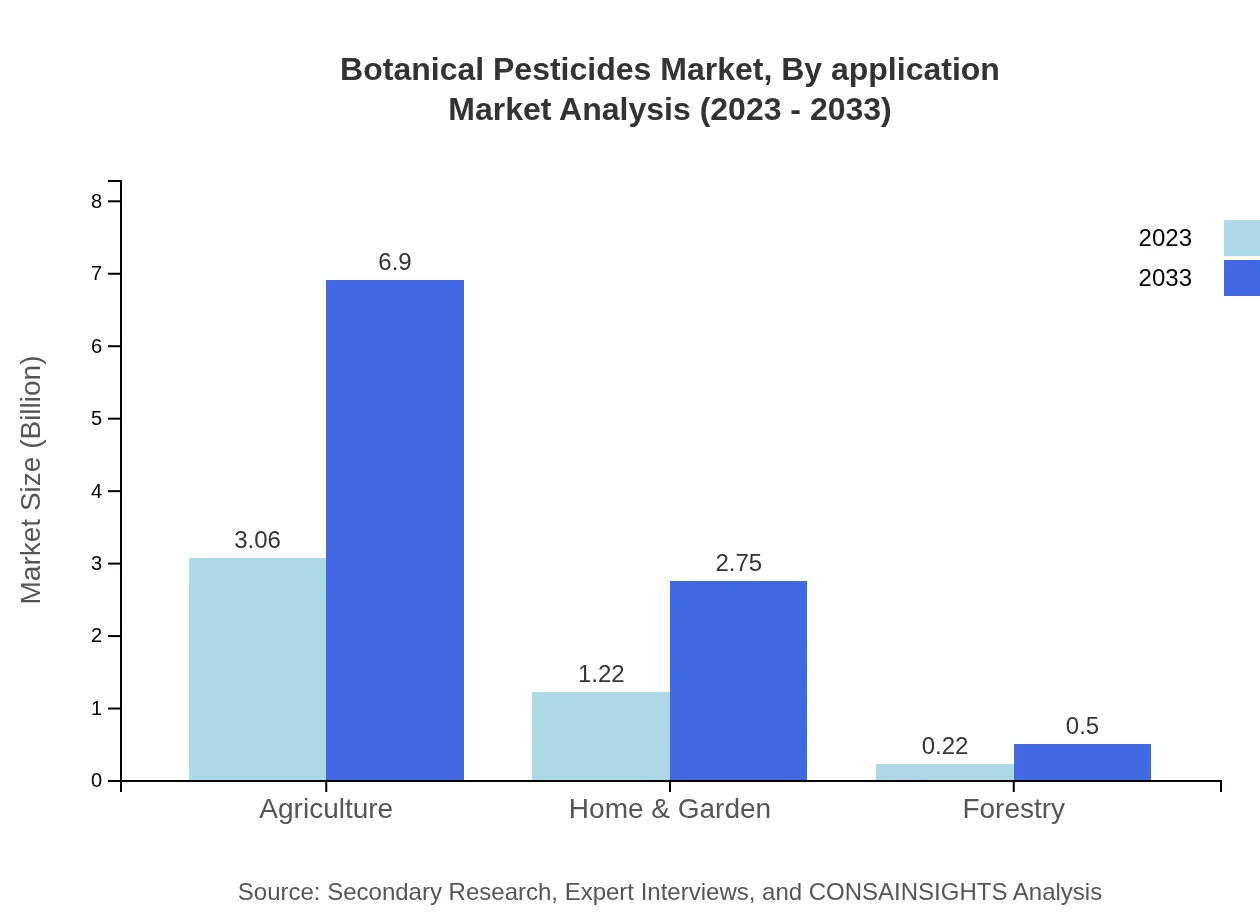

Botanical Pesticides Market Analysis By Application

The agricultural sector is primarily where botanical pesticides are utilized, with a significant focus on organic farming applications occupying 68.02% share in 2023 and projected to maintain this level leading to 2033. The market size for organic farming will increase from USD 3.06 billion in 2023 to USD 6.90 billion in 2033. In contrast, conventional farming is expected to see growth from USD 1.22 billion to USD 2.75 billion, maintaining a 27.08% share during this forecast period.

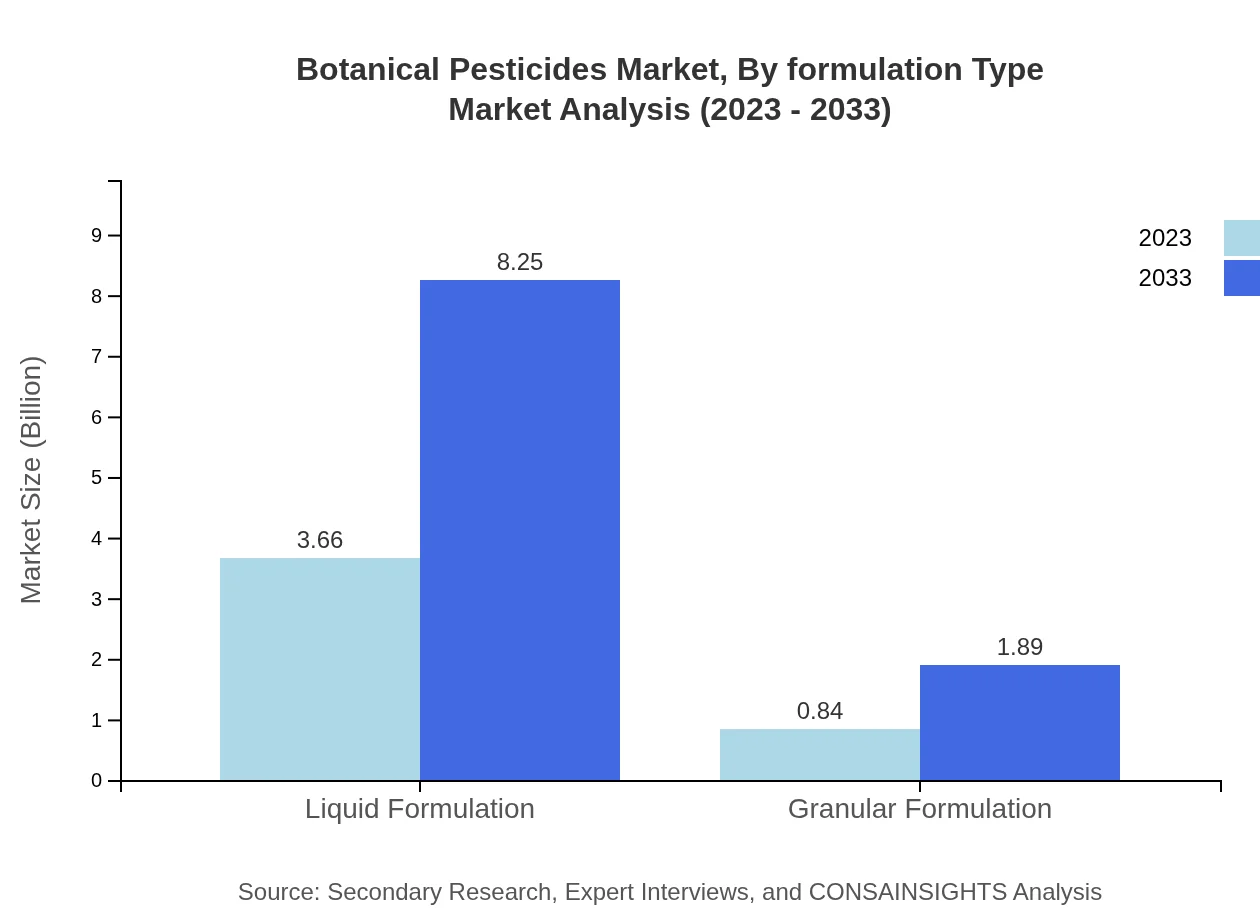

Botanical Pesticides Market Analysis By Formulation Type

Liquid formulations dominate the market, valued at USD 3.66 billion in 2023 and anticipated to grow to USD 8.25 billion by 2033, constituting 81.35% of the market. Granular formulations, while smaller, are also forecasted to grow from USD 0.84 billion to USD 1.89 billion, holding an 18.65% share. This segmentation indicates a preference for liquid forms among users for ease of application and effectiveness.

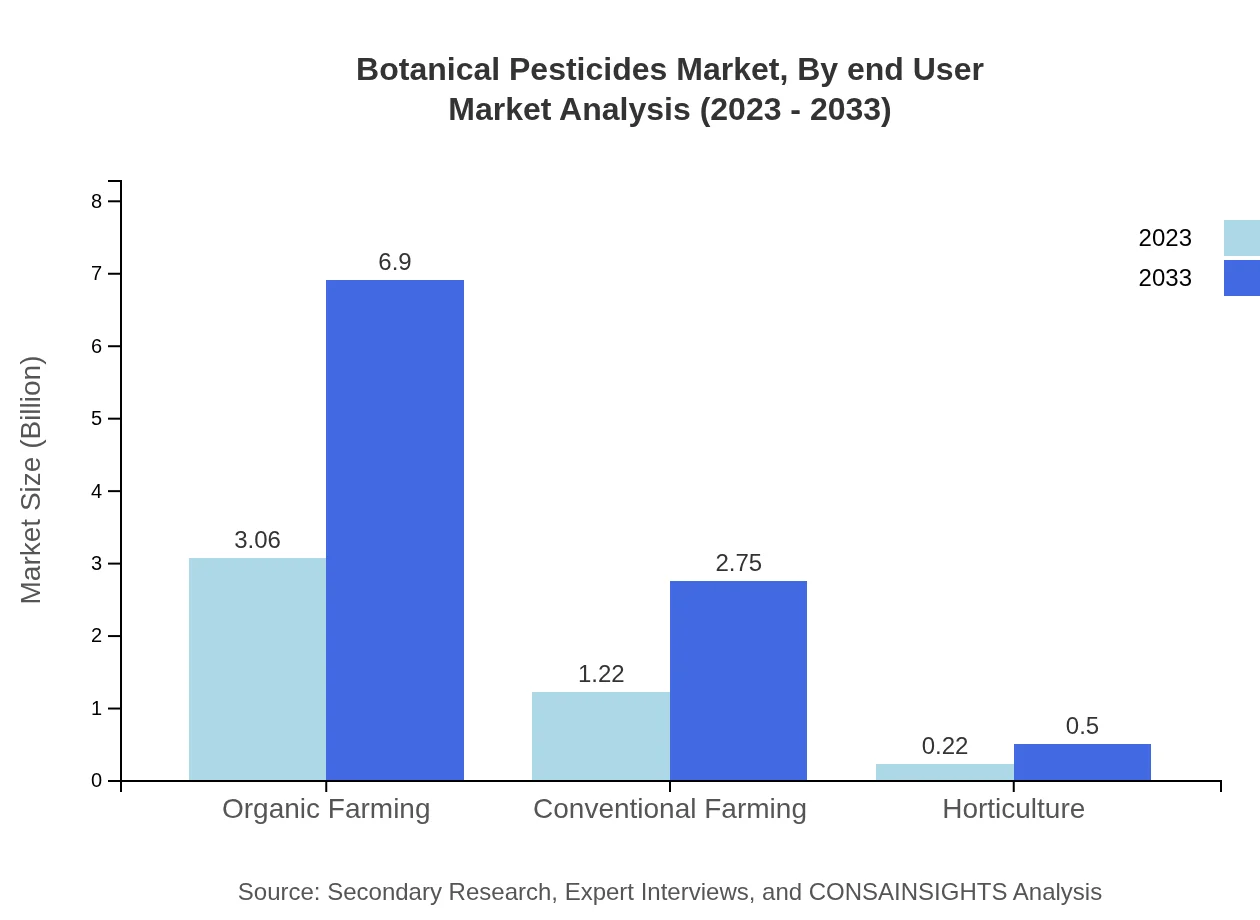

Botanical Pesticides Market Analysis By End User

The end-user segment outlines agriculture as the most significant contributor, expected to grow from USD 3.06 billion in 2023 to USD 6.90 billion in 2033. Home and garden sectors account for a considerable share, from USD 1.22 billion to USD 2.75 billion, indicating increased consumer interest in eco-friendly pest control products for residential use. Other sectors show growth potential, but agriculture and home & garden remain dominant.

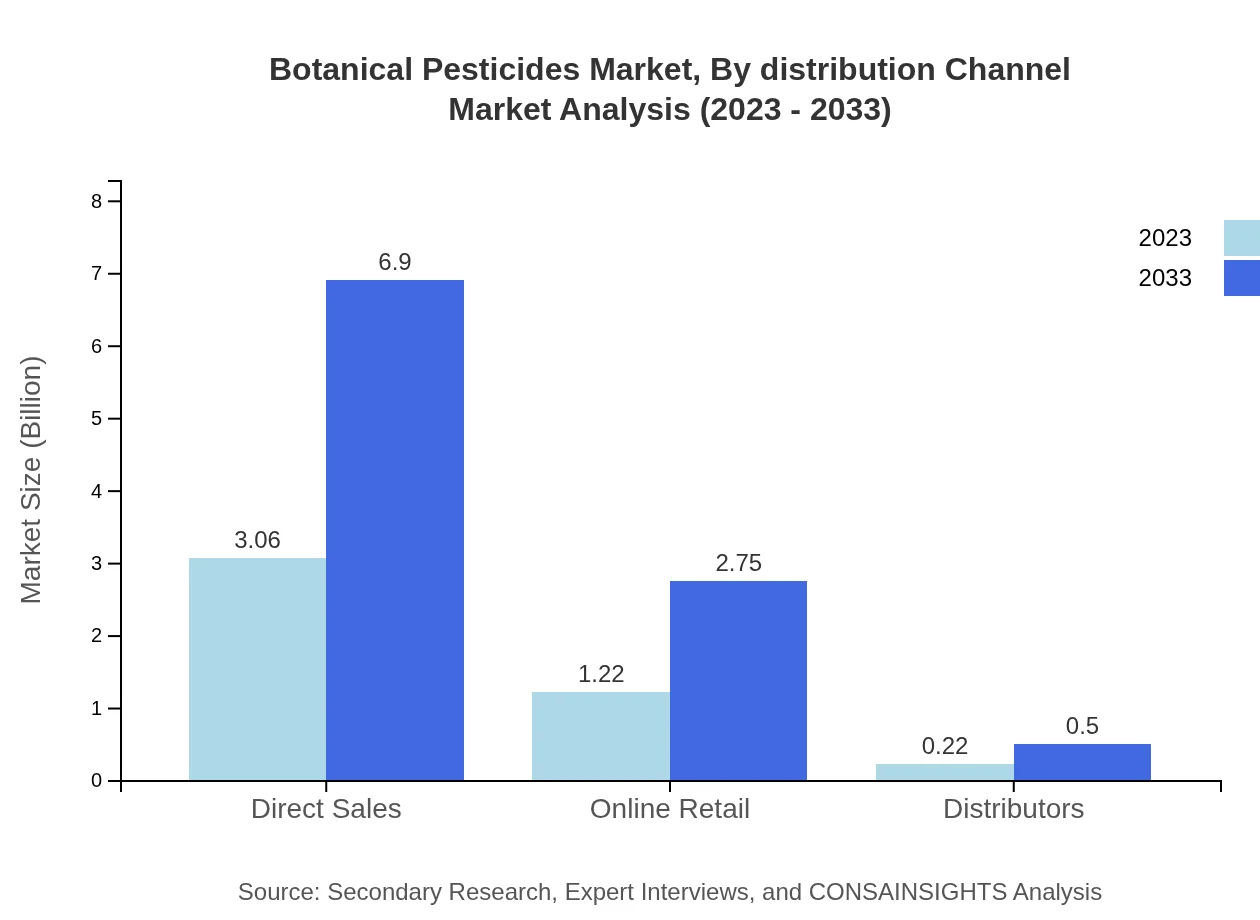

Botanical Pesticides Market Analysis By Distribution Channel

Direct sales remain the preferred distribution channel, projected to persist at a market size of USD 3.06 billion in 2023 growing to USD 6.90 billion by 2033, mirroring a 68.02% market share. Online retail is gaining traction, with anticipated growth from USD 1.22 billion to USD 2.75 billion. This shift reflects consumer behavior changes favoring online purchase options for convenience and product availability.

Botanical Pesticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Botanical Pesticides Industry

Bayer AG:

Bayer AG is a leading global enterprise with core competencies in the life science fields of health care and agriculture, offering innovative botanical pesticides that enhance crop protection sustainably.Syngenta AG:

Syngenta AG is renowned for its commitment to sustainable agriculture, providing a range of botanical solutions to improve farming productivity and environmental stewardship.Certis USA LLC:

Certis USA LLC specializes in biologically-based pest control solutions, producing high-quality botanical pesticides designed for eco-friendly applications.Dupont de Nemours, Inc.:

Dupont is engaged in the innovation of bio-based products that help farmers control pests while ensuring environmental safety and compliance with regulations.We're grateful to work with incredible clients.

FAQs

What is the market size of botanical Pesticides?

The global botanical pesticides market is projected to reach approximately $4.5 billion in 2023, with an impressive CAGR of 8.2% anticipated over the next decade, showcasing a robust growth trajectory in the organic farming sector.

What are the key market players or companies in this industry?

Leading companies in the botanical pesticides market include major players such as BASF, Syngenta, and Bayer. These firms have positioned themselves through innovation and sustainable practices, capitalizing on the rising demand for eco-friendly pest control solutions.

What are the primary factors driving the growth in the botanical Pesticides industry?

Key factors driving growth in the botanical pesticides market include increasing awareness of health hazards associated with chemical pesticides, a surge in organic farming practices, and government regulations promoting sustainable agriculture, all fostering market expansion.

Which region is the fastest Growing in the botanical Pesticides market?

The Asia-Pacific region is notably the fastest-growing market for botanical pesticides, projected to increase from $0.96 billion in 2023 to $2.16 billion by 2033, reflecting an exponential growth driven by rising agricultural demand.

Does ConsaInsights provide customized market report data for the botanical Pesticides industry?

Yes, ConsaInsights offers tailored market reports for the botanical pesticides industry, ensuring clients receive insights specific to their needs, preferences, and market dynamics for better decision-making.

What deliverables can I expect from this botanical Pesticides market research project?

In our botanical pesticides market research project, clients can expect comprehensive deliverables, including detailed industry analysis, competitive landscape assessments, regional market forecasts, and segmented data summaries to inform strategic planning.

What are the market trends of botanical Pesticides?

Emerging trends in the botanical pesticides market indicate a shift towards natural solutions, increased demand from organic agriculture, rise in liquid formulations, and the adoption of online retail channels, positioning the market for significant growth.