Botanical Supplements Market Report

Published Date: 31 January 2026 | Report Code: botanical-supplements

Botanical Supplements Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Botanical Supplements market, covering insights on current trends, segmentation, and forecasts from 2023 to 2033, including detailed market size data and competitive analysis.

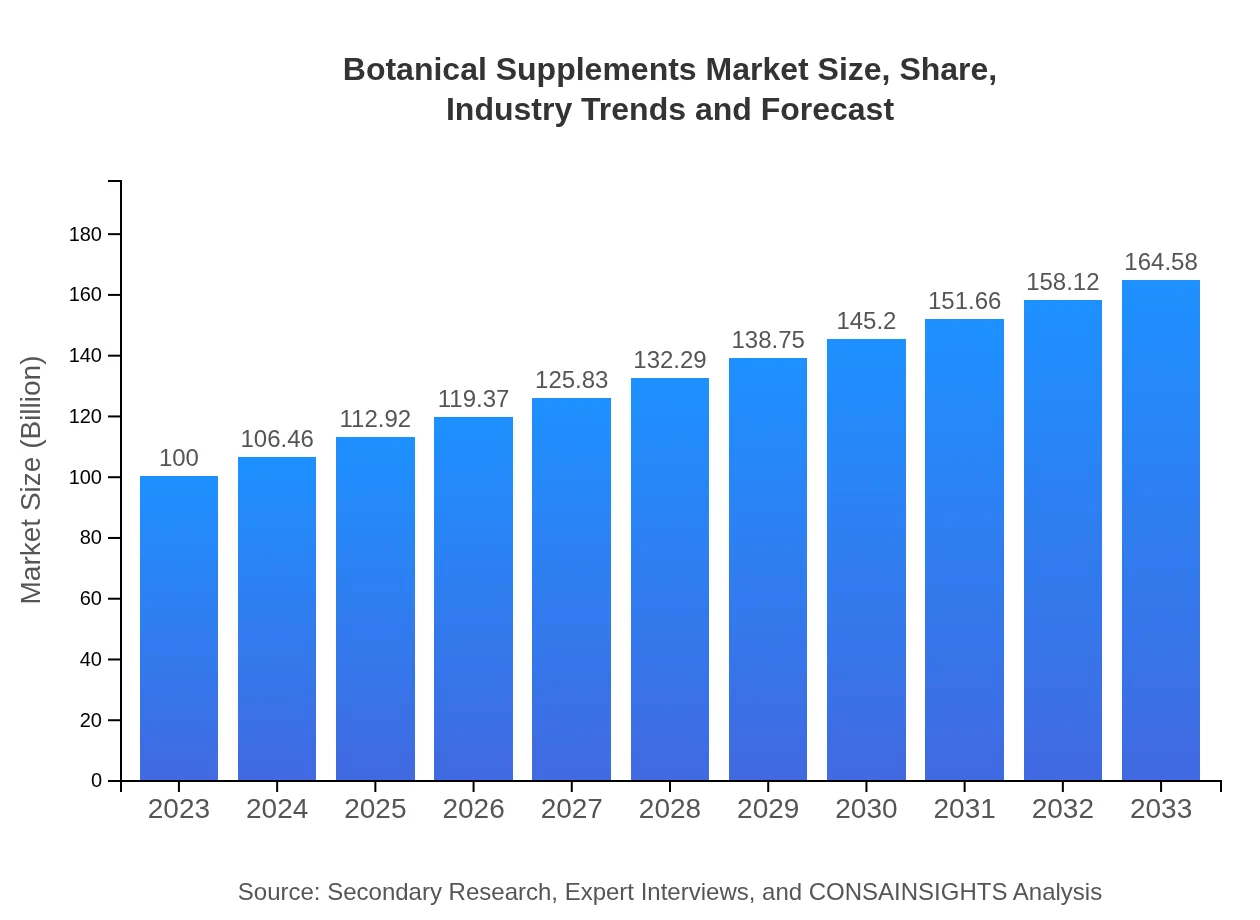

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Herbalife Nutrition Ltd., Nature's Way Products, LLC., GNC Holdings, Inc. |

| Last Modified Date | 31 January 2026 |

Botanical Supplements Market Overview

Customize Botanical Supplements Market Report market research report

- ✔ Get in-depth analysis of Botanical Supplements market size, growth, and forecasts.

- ✔ Understand Botanical Supplements's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Botanical Supplements

What is the Market Size & CAGR of Botanical Supplements market in 2023?

Botanical Supplements Industry Analysis

Botanical Supplements Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Botanical Supplements Market Analysis Report by Region

Europe Botanical Supplements Market Report:

Europe currently has a market size of $28.90 billion, anticipated to grow to $47.56 billion by 2033, supported by a robust regulatory framework that encourages high-quality herbal products.Asia Pacific Botanical Supplements Market Report:

In 2023, the Asia Pacific region held a market size of $18.94 billion, projected to reach $31.17 billion by 2033, showcasing a growing consumer base leaning towards herbal remedies and wellness products.North America Botanical Supplements Market Report:

North America leads the market with a size of $37.34 billion in 2023, expected to grow to $61.45 billion by 2033, fueled by strong consumer interest in preventive healthcare and the popularity of organic products.South America Botanical Supplements Market Report:

The South American market is smaller, currently valued at $0.98 billion in 2023, with expectations to grow to $1.61 billion by 2033, driven by local traditional practices and increasing adoption of herbal supplements.Middle East & Africa Botanical Supplements Market Report:

The Middle East and Africa market was valued at $13.84 billion in 2023, expected to reach $22.78 billion by 2033, due to rising health consciousness and a cultural inclination towards natural remedies.Tell us your focus area and get a customized research report.

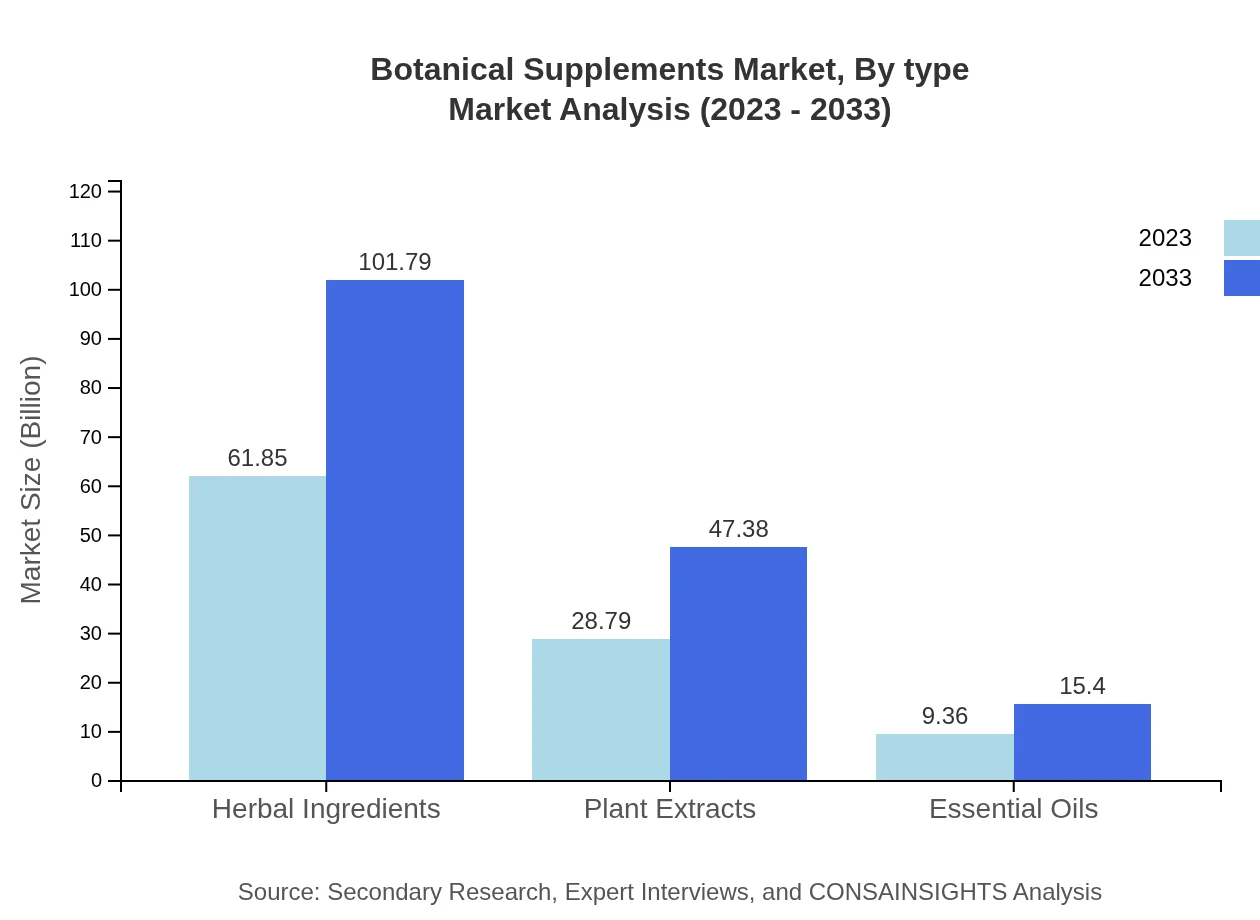

Botanical Supplements Market Analysis By Type

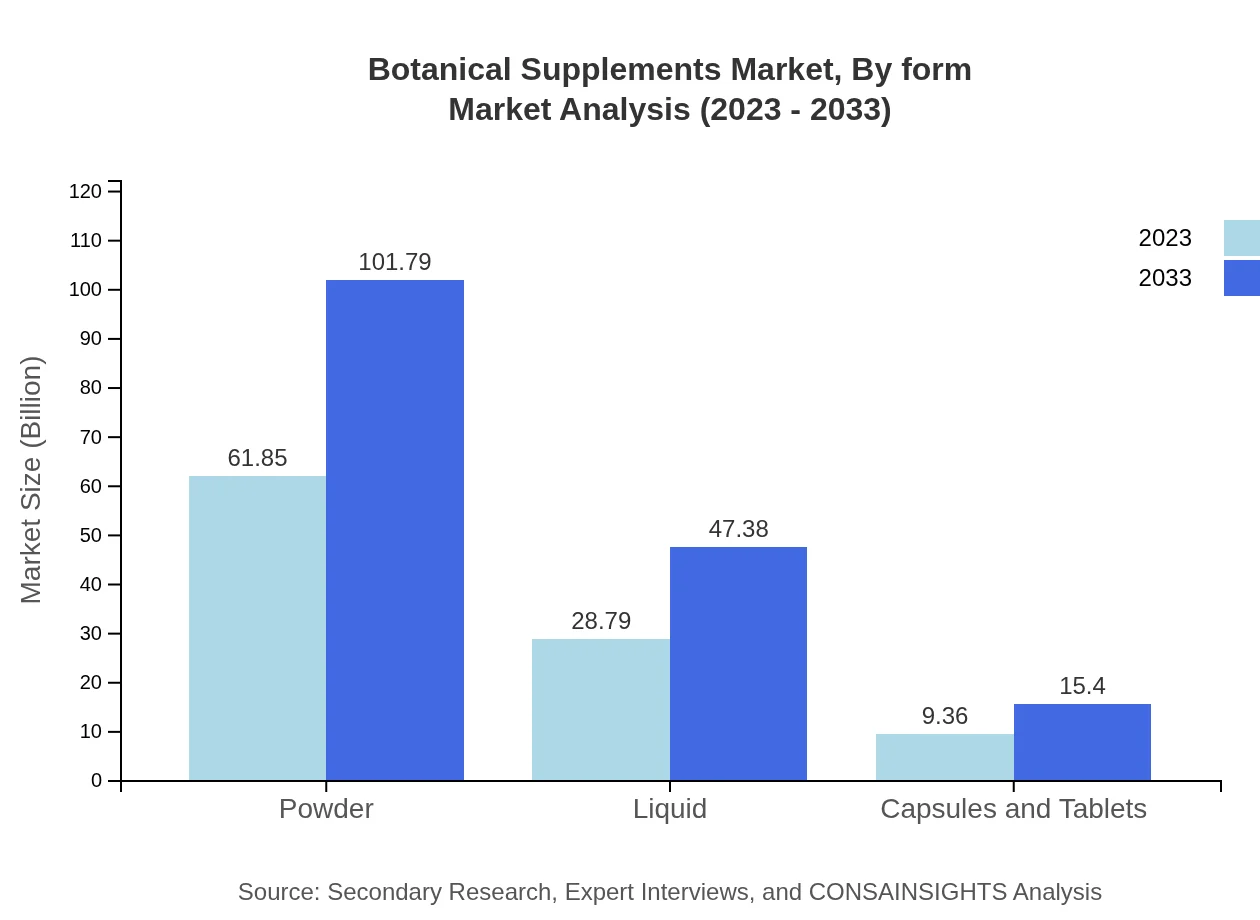

In 2023, the powders segment dominated with a market size of $61.85 billion, projected to grow to $101.79 billion by 2033, while liquids are expected to reach $47.38 billion from $28.79 billion. The capsules and tablets segment is also significant, growing from $9.36 billion to $15.40 billion during the same period.

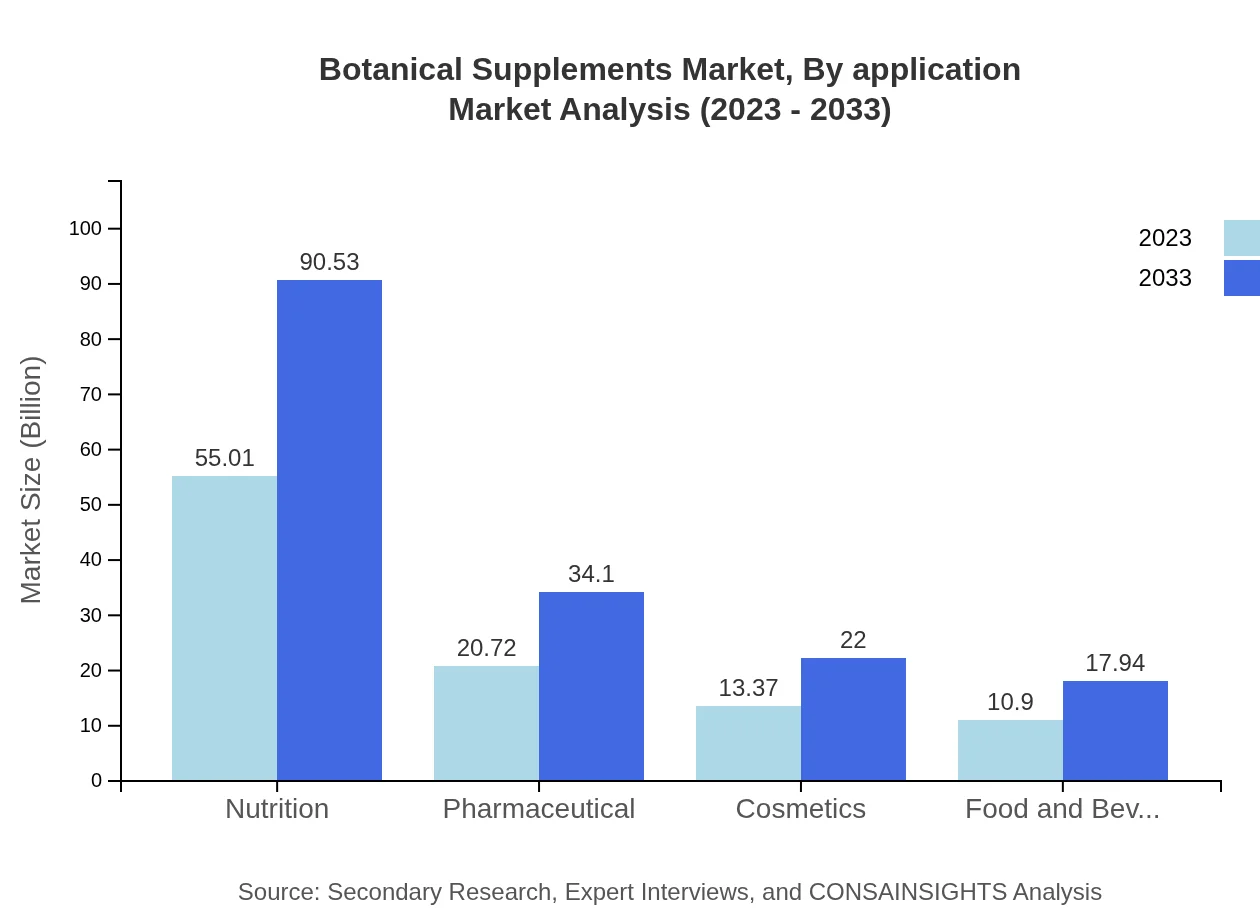

Botanical Supplements Market Analysis By Application

The nutrition application segment leads the market with a size of $55.01 billion in 2023, expected to rise to $90.53 billion by 2033, while the pharmaceutical segment grows from $20.72 billion to $34.10 billion.

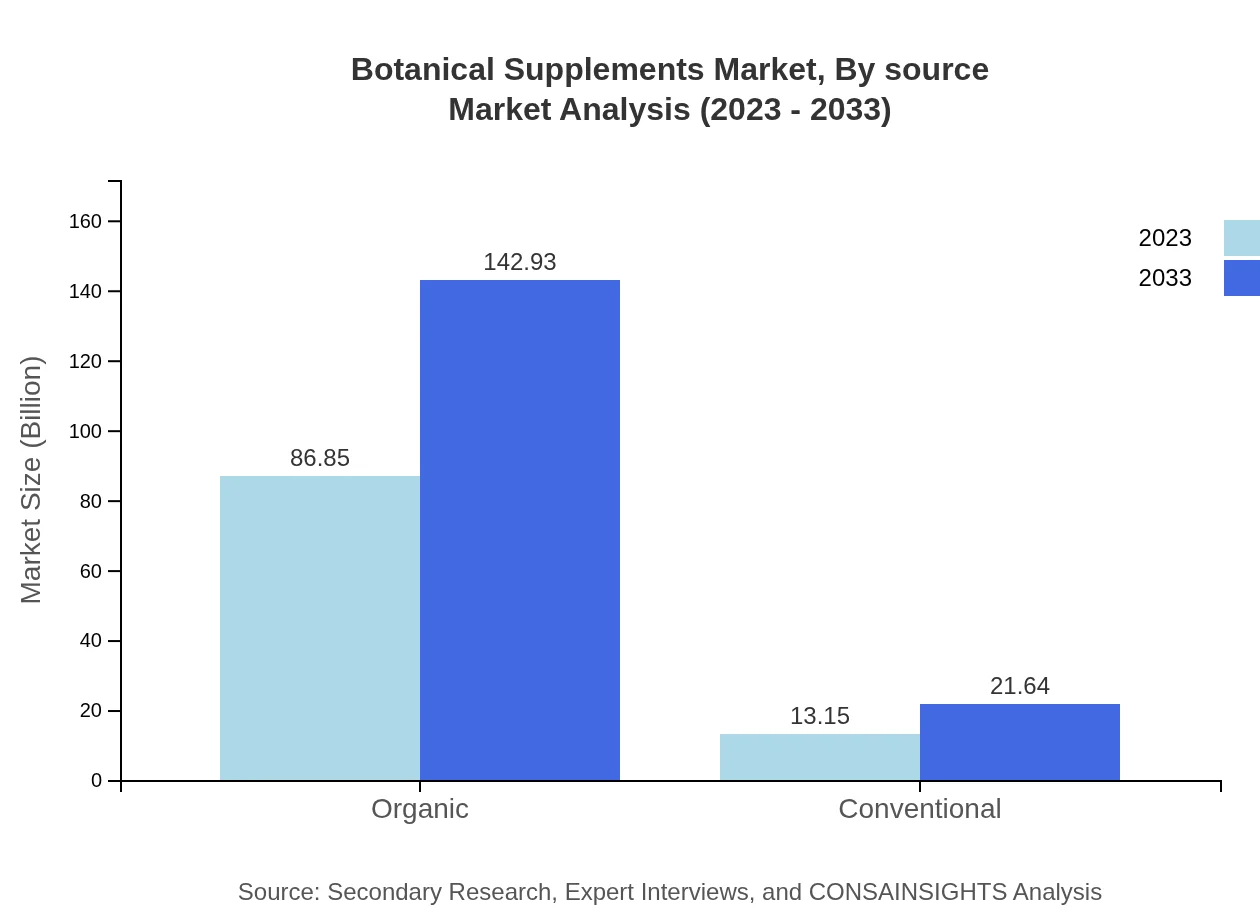

Botanical Supplements Market Analysis By Source

The organic segment accounts for a substantial share of the global market, with sizes of $86.85 billion in 2023 and projected to reach $142.93 billion by 2033, reflecting the consumer preference for organic products.

Botanical Supplements Market Analysis By Form

Products in powder form hold the largest market share, followed by liquid forms, which are becoming increasingly popular due to convenience, further reflected in their forecasted growth rates.

Botanical Supplements Market Analysis By Distribution Channel

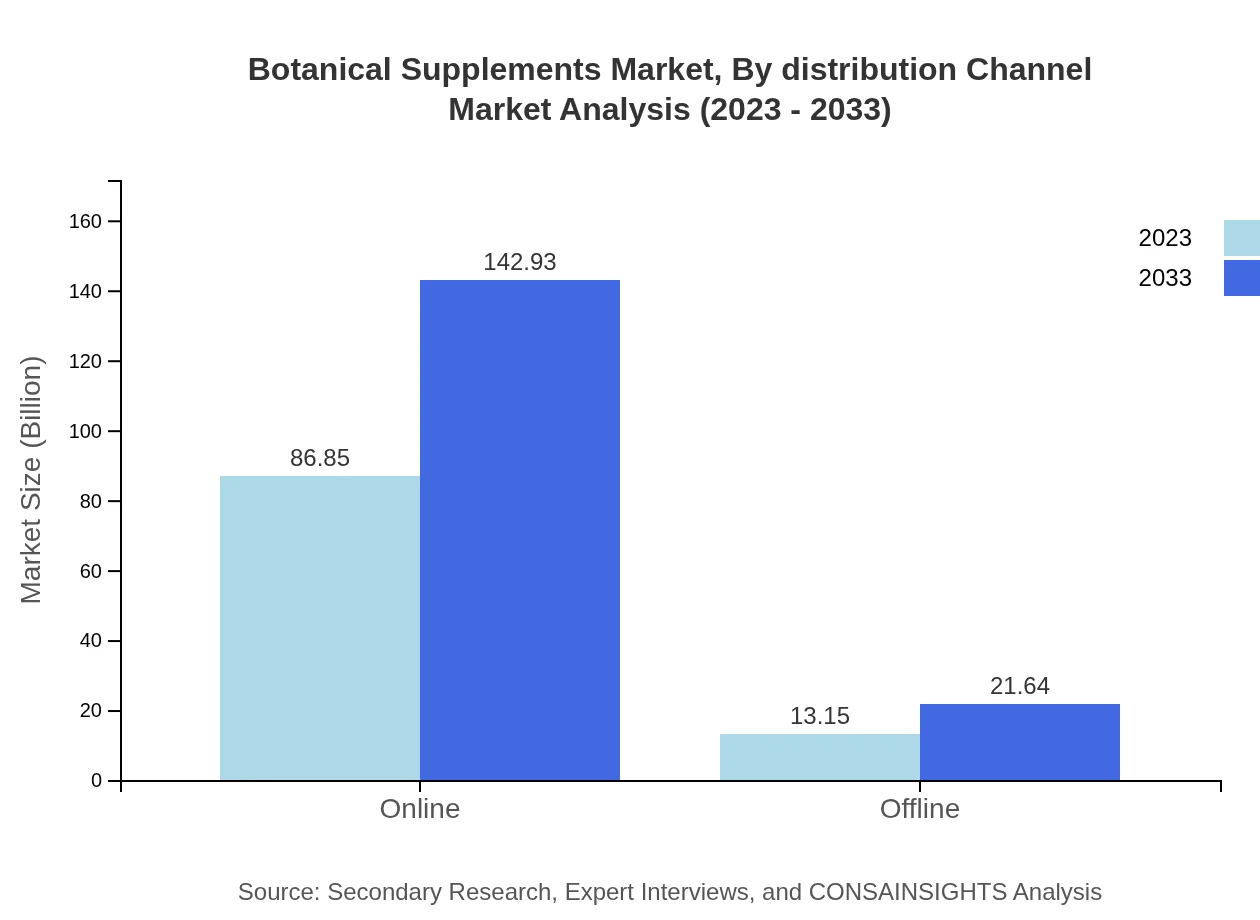

The online segment leads the distribution channels with a size of $86.85 billion in 2023, anticipated to reach $142.93 billion by 2033, driven by the rise in e-commerce and direct-to-consumer sales.

Botanical Supplements Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Botanical Supplements Industry

Herbalife Nutrition Ltd.:

A global leader in nutrition, Herbalife offers a range of botanical supplements focused on weight management, nutrition, and personal care.Nature's Way Products, LLC.:

Known for its high-quality herbal supplements, Nature's Way promotes wellness through products derived from natural sources.GNC Holdings, Inc.:

GNC specializes in health and wellness products with a focus on dietary supplements, health foods, and botanical wellness solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of botanical Supplements?

The botanical supplements market is projected to grow from a base market of $100 million in 2023, with a CAGR of 5%, indicating robust growth trends anticipated through 2033.

What are the key market players or companies in this botanical Supplements industry?

Key players in the botanical supplements industry include prominent companies that specialize in herbal products, nutraceuticals, and ingredient suppliers. They play a crucial role in driving innovation and market expansion.

What are the primary factors driving the growth in the botanical Supplements industry?

The growth in the botanical supplements industry is driven by rising consumer awareness of natural health products, increased demand for organic offerings, and a growing shift towards preventive healthcare solutions.

Which region is the fastest Growing in the botanical Supplements?

The North America region is the fastest-growing in the botanical supplements market, expected to grow from $37.34 million in 2023 to $61.45 million in 2033, driven by fitness trends and increased health consciousness.

Does ConsaInsights provide customized market report data for the botanical Supplements industry?

Yes, ConsaInsights offers tailored market report data for the botanical supplements industry, allowing businesses to obtain specific insights that address their unique market needs and strategic goals.

What deliverables can I expect from this botanical Supplements market research project?

Deliverables for the botanical supplements market research project include comprehensive market analysis reports, detailed segmentation insights, competitor profiling, and forecasts for multiple regions and product types.

What are the market trends of botanical Supplements?

Recent trends in the botanical supplements market include a growing emphasis on organic products, innovations in delivery forms like powders and liquids, and increasing sales through online channels, reflecting changing consumer behaviors.