Bottled Water Packaging Market Report

Published Date: 01 February 2026 | Report Code: bottled-water-packaging

Bottled Water Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bottled Water Packaging market, highlighting trends, growth patterns, and insights from 2023 to 2033. It covers market size, segmentation, regional analysis, and key players influencing the industry.

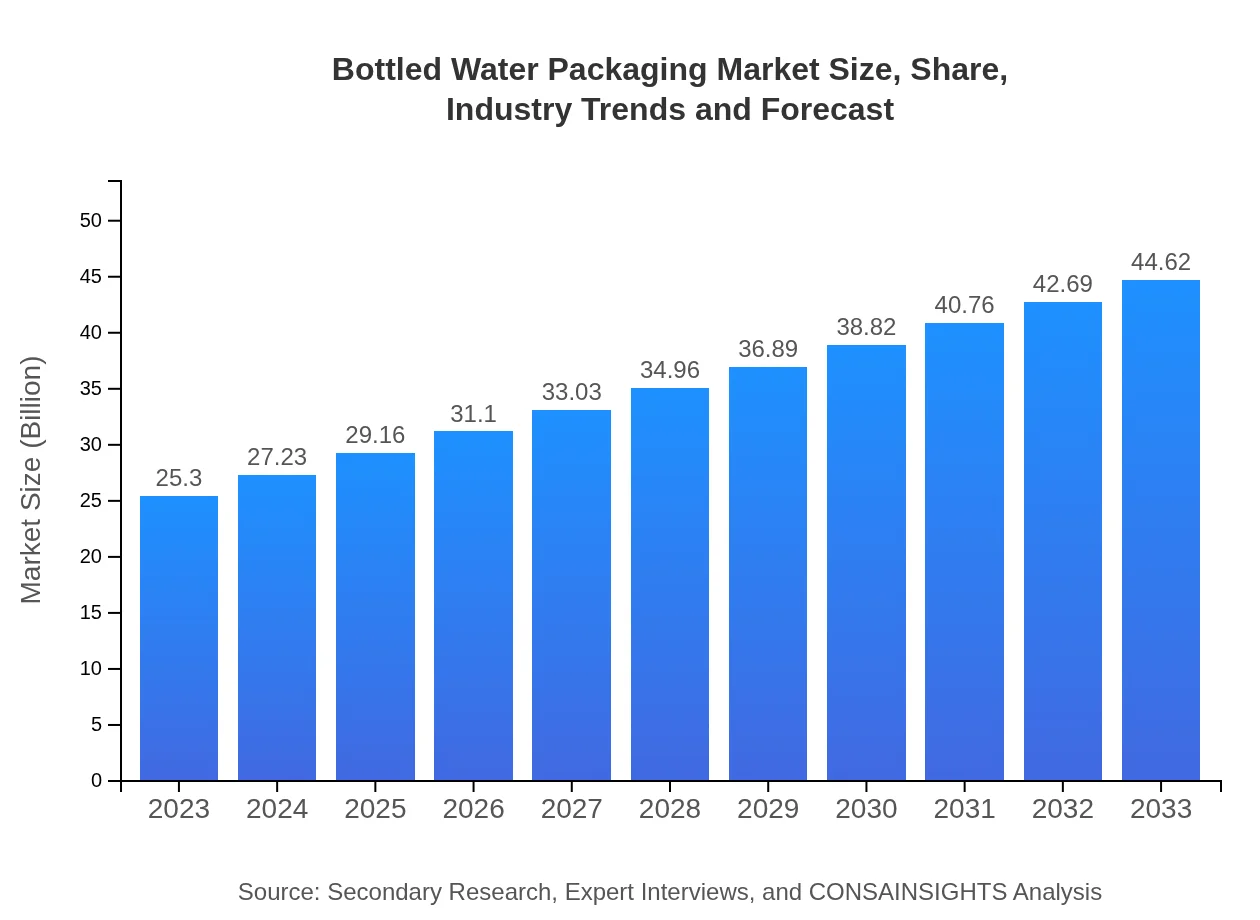

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.30 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $44.62 Billion |

| Top Companies | Nestlé Waters, Coca-Cola Company, PepsiCo, Danone, Refresco |

| Last Modified Date | 01 February 2026 |

Bottled Water Packaging Market Overview

Customize Bottled Water Packaging Market Report market research report

- ✔ Get in-depth analysis of Bottled Water Packaging market size, growth, and forecasts.

- ✔ Understand Bottled Water Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bottled Water Packaging

What is the Market Size & CAGR of Bottled Water Packaging market in 2023?

Bottled Water Packaging Industry Analysis

Bottled Water Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bottled Water Packaging Market Analysis Report by Region

Europe Bottled Water Packaging Market Report:

The European market is expected to grow from $8.46 billion in 2023 to $14.92 billion by 2033. Consumer preference for premium bottled water products and stringent packaging regulations promote sustainable practices.Asia Pacific Bottled Water Packaging Market Report:

In the Asia Pacific region, the Bottled Water Packaging market is projected to grow from $3.98 billion in 2023 to $7.02 billion by 2033. The growth is fueled by urbanization, rising disposable incomes, and growing health awareness.North America Bottled Water Packaging Market Report:

North America is witnessing a significant surge in the Bottled Water Packaging market, expanding from $9.22 billion in 2023 to $16.26 billion in 2033, supported by a strong trend towards healthier beverage options.South America Bottled Water Packaging Market Report:

The South American market, valued at approximately $1.07 billion in 2023, is anticipated to reach $1.88 billion by 2033. Increasing lifestyle changes and investments in infrastructure drive this growth.Middle East & Africa Bottled Water Packaging Market Report:

In the Middle East and Africa, the market is set to grow from $2.58 billion in 2023 to $4.54 billion by 2033, driven by increasing population and urbanization trends.Tell us your focus area and get a customized research report.

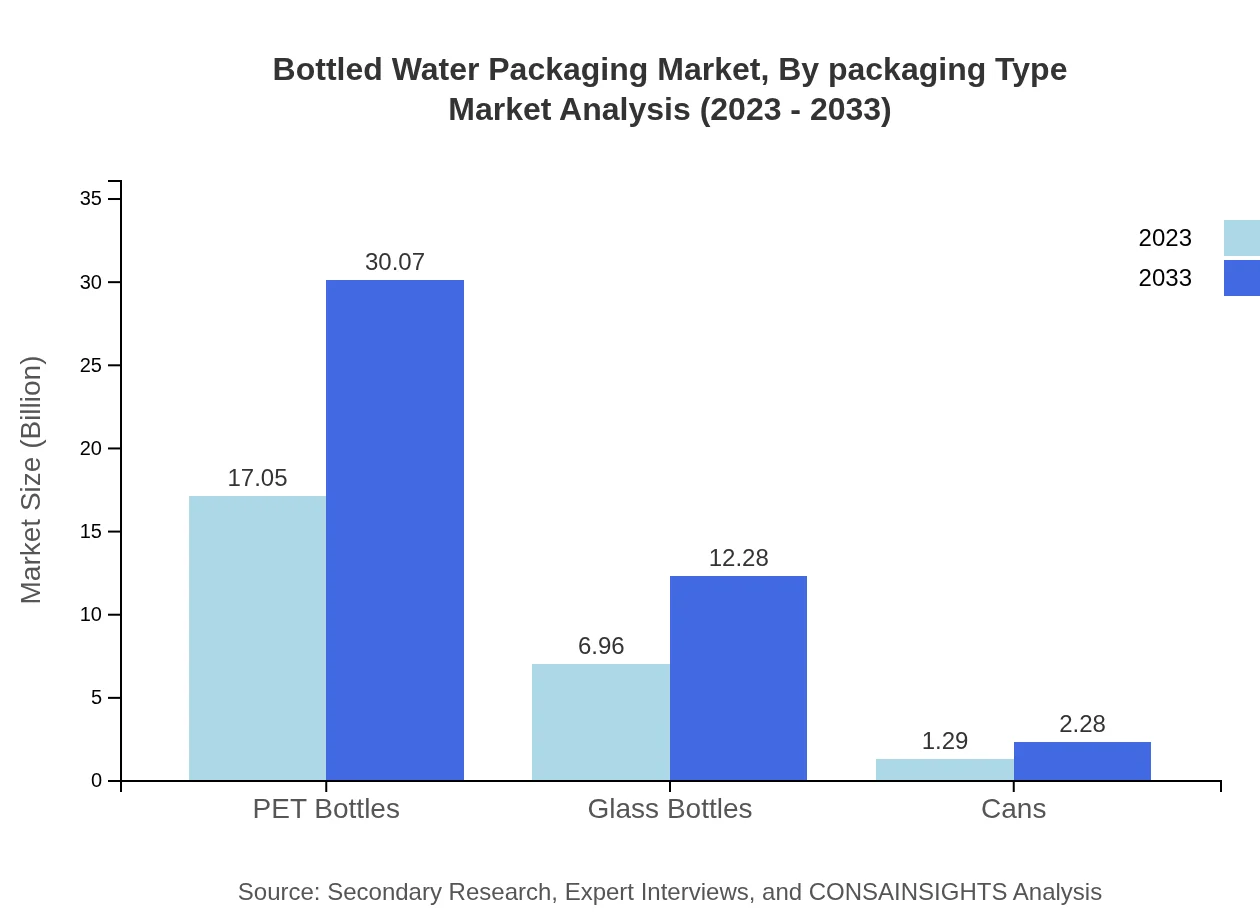

Bottled Water Packaging Market Analysis By Packaging Type

The Bottled Water Packaging market by packaging type includes PET bottles, glass bottles, and cans. PET bottles dominate the market due to their lightweight and recyclable nature. By 2033, the PET bottle segment is projected to reach $30.07 billion, maintaining a share of 67.39%. Glass bottles, while smaller in size, are anticipated to grow significantly, reaching $12.28 billion in the same period.

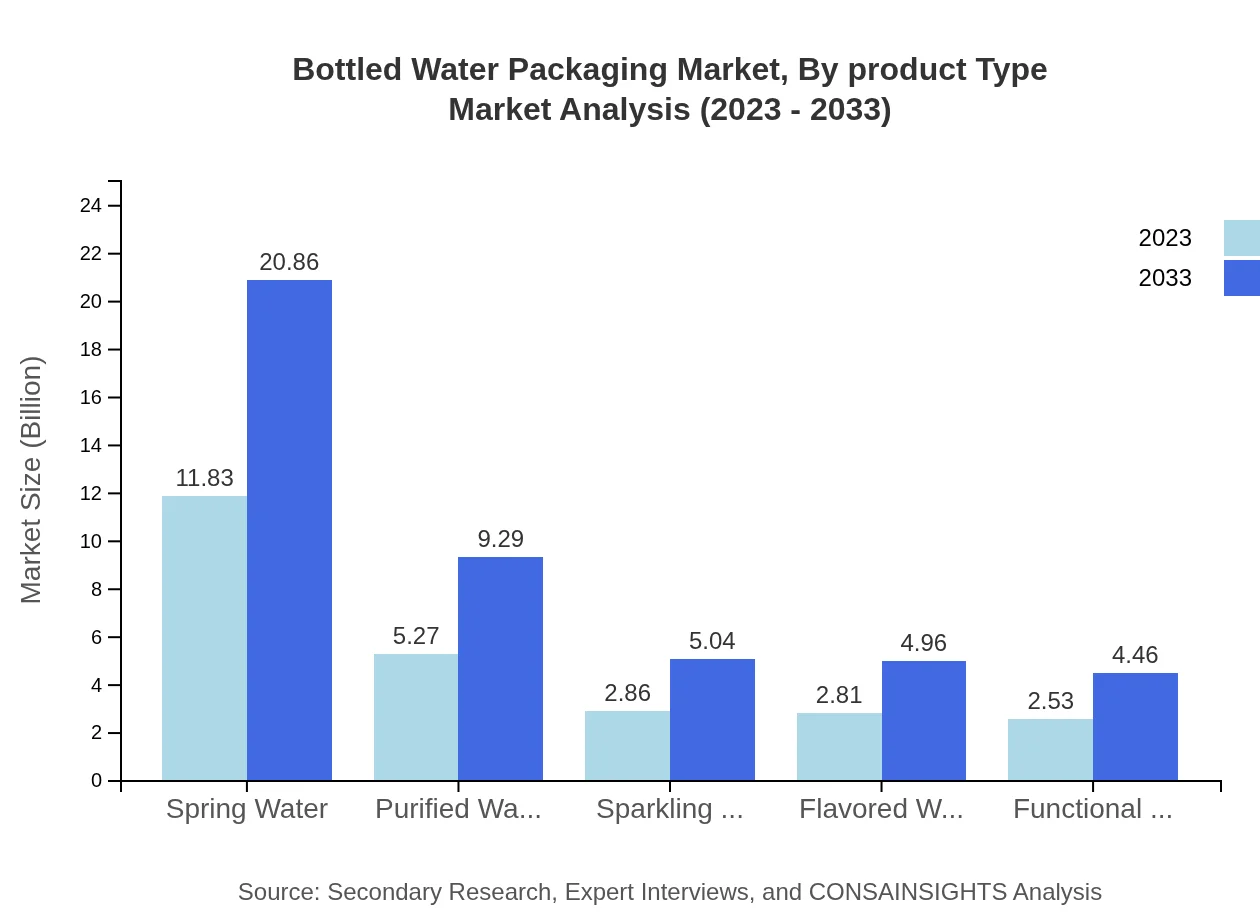

Bottled Water Packaging Market Analysis By Product Type

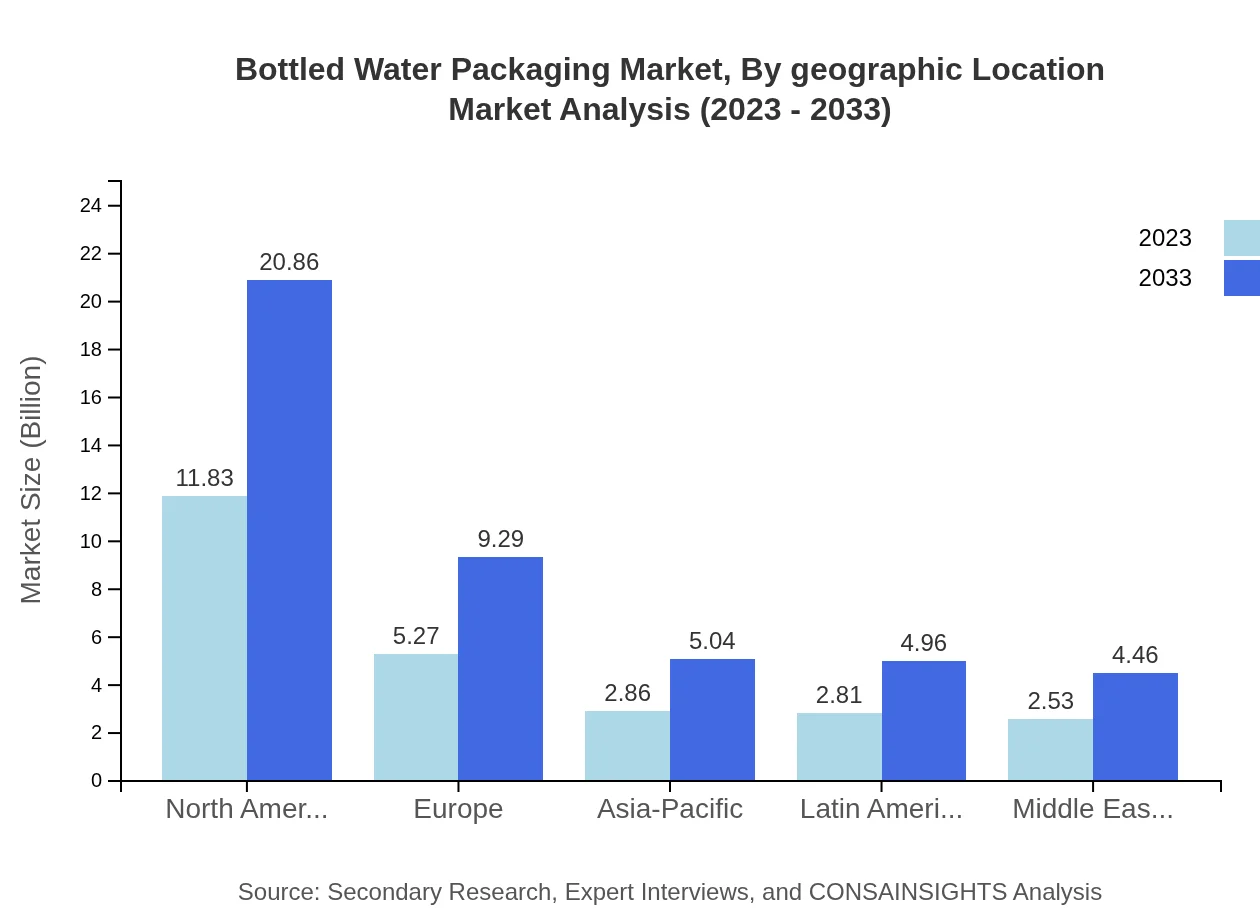

In the product type segment, spring water leads with a market size of $20.86 billion by 2033, reflecting a steady preference for natural sources. Purified water follows, set to grow to $9.29 billion, indicating strong consumer trust in processed water. Flavored water and functional water, while niche, are also expected to see impressive growth due to changing consumer tastes.

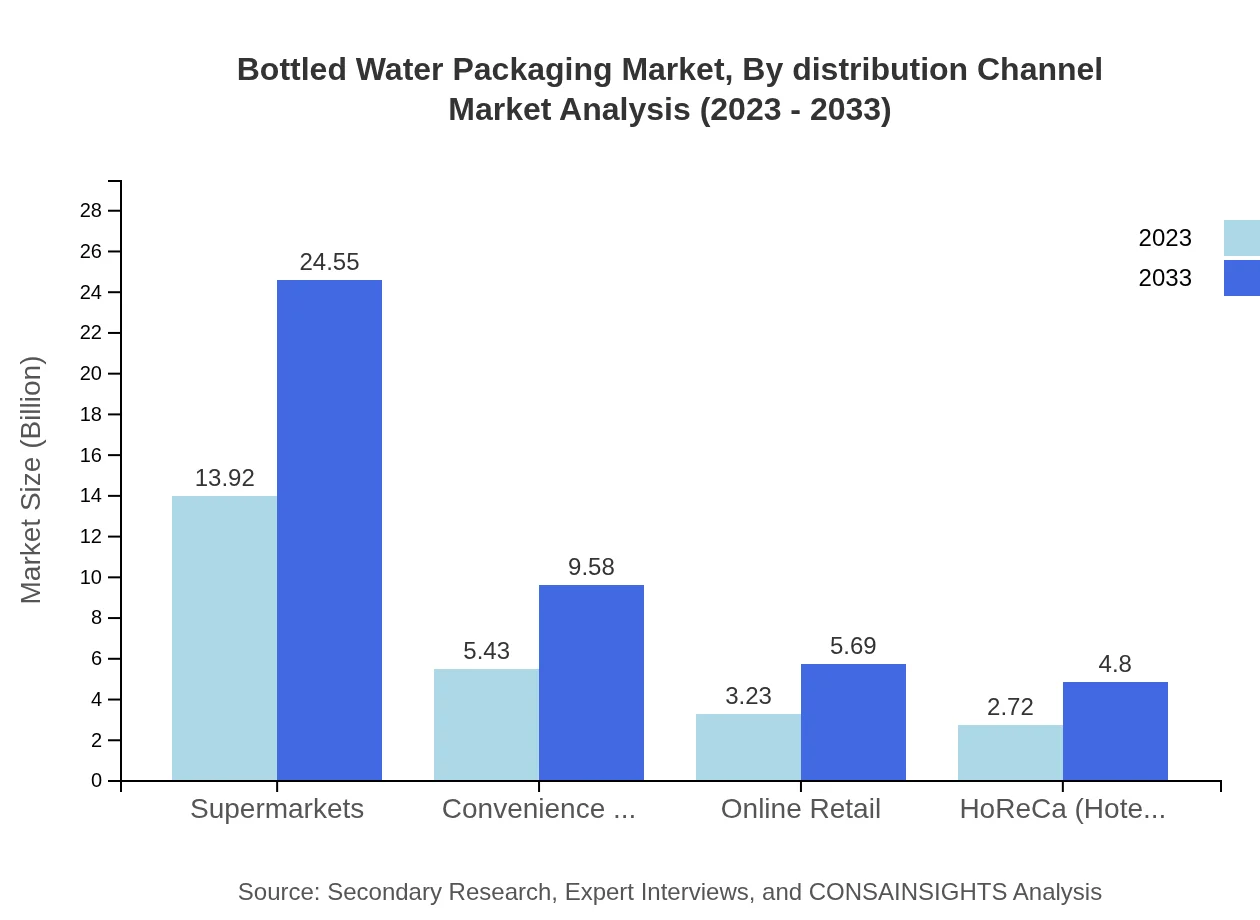

Bottled Water Packaging Market Analysis By Distribution Channel

The distribution channel analysis shows supermarkets holding the largest share, projected to reach $24.55 billion by 2033, underscoring their role as primary purchase locations. Convenience stores and online retail are also significant, driven by the need for accessible purchasing options, particularly in urban locales.

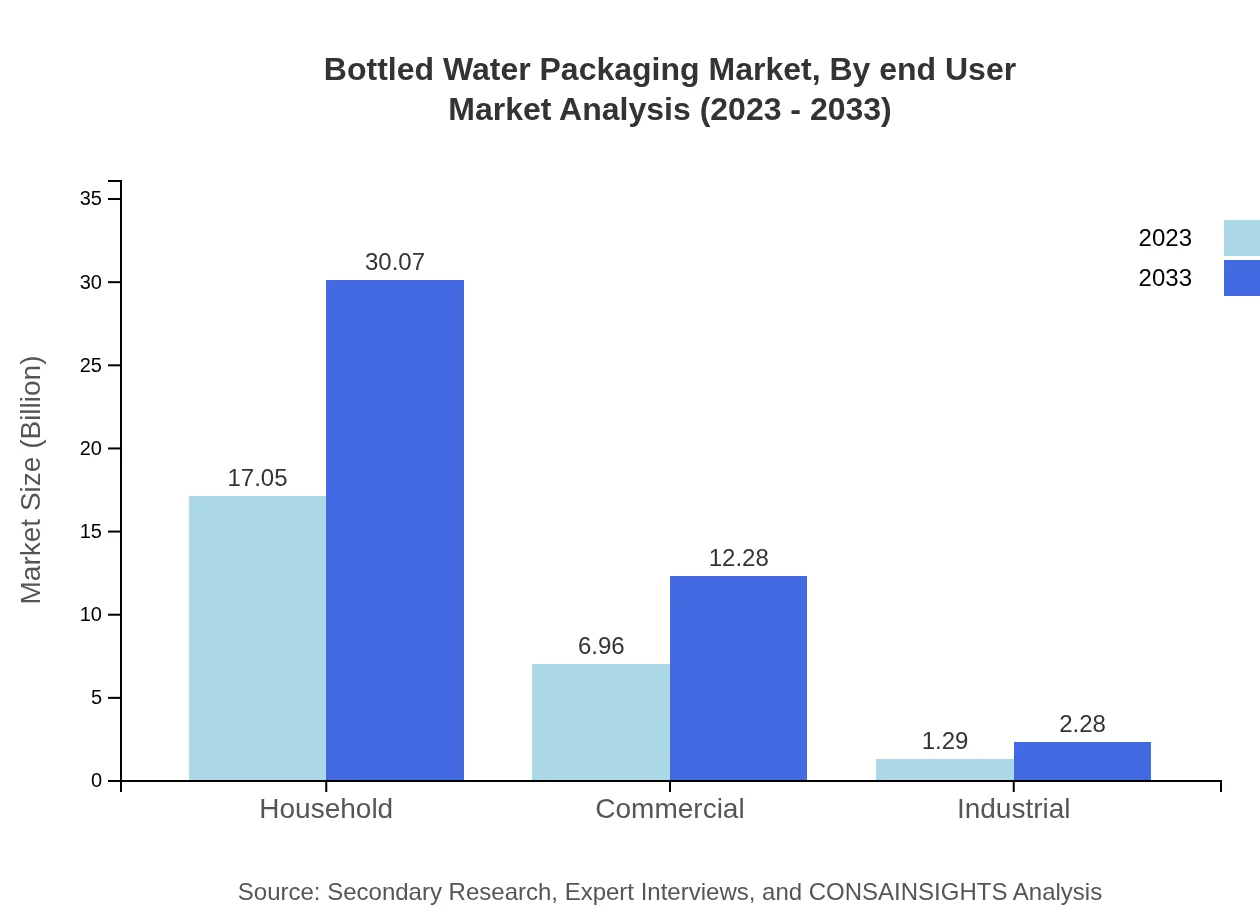

Bottled Water Packaging Market Analysis By End User

The household segment dominates the market, projected to grow from $17.05 billion in 2023 to $30.07 billion in 2033. The commercial segment follows with notable growth, anticipated to reach $12.28 billion, driven by increased consumption in offices and public spaces.

Bottled Water Packaging Market Analysis By Geographic Location

Geographically, North America and Europe are the largest markets due to advanced infrastructure and high consumer awareness. However, Asia Pacific's rapid growth highlights emerging opportunities, encouraging global players to invest in the region to capture evolving consumer preferences.

Bottled Water Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bottled Water Packaging Industry

Nestlé Waters:

A leading bottled water producer known for its strong portfolio of brands like Perrier and San Pellegrino, focusing on sustainability and quality.Coca-Cola Company:

A major player in the beverage sector, offering bottled water products through brands such as Dasani and Smartwater, emphasizing innovation and marketing.PepsiCo:

Recognized for its Aquafina brand, PepsiCo continuously seeks to enhance its bottled water offerings through new product launches and environmentally friendly packaging.Danone:

Owner of several mineral water brands, Danone focuses on health and wellness, driving market growth through product diversification.Refresco:

A leading bottler of soft drinks and fruit juices, Refresco has recently expanded into bottled water, leveraging its extensive distribution networks.We're grateful to work with incredible clients.

FAQs

What is the market size of Bottled Water Packaging?

The bottled water packaging market is projected to reach a size of $25.3 billion by 2033, growing at a CAGR of 5.7%. This growth reflects the increasing consumer demand for bottled water across various segments globally.

What are the key market players or companies in the Bottled Water Packaging industry?

Key players in the bottled water packaging industry include prominent companies like Nestlé Waters, Coca-Cola, PepsiCo, Danone, and others. These companies drive innovation and quality standards in bottled water packaging.

What are the primary factors driving the growth in the Bottled Water Packaging industry?

The growth in the bottled water packaging industry is driven by factors such as increased health consciousness, rising disposable income, and a preference for convenient and portable drinking solutions among consumers.

Which region is the fastest Growing in the Bottled Water Packaging?

The fastest-growing region in the bottled water packaging market is North America, expected to grow from $9.22 billion in 2023 to $16.26 billion by 2033, with a robust demand for bottled water.

Does ConsaInsights provide customized market report data for the Bottled Water Packaging industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications in the bottled water packaging industry. These reports can include insights based on specific regions, segments, or market dynamics.

What deliverables can I expect from this Bottled Water Packaging market research project?

Deliverables from the bottled water packaging market research project typically include a comprehensive report, market analysis, trend insights, and projections for various segments and regions.

What are the market trends of Bottled Water Packaging?

Key market trends in bottled water packaging include the rising demand for eco-friendly packaging, increasing interest in flavored and functional waters, and the growth of online retail channels for distribution.