Bottled Water Processing Market Report

Published Date: 31 January 2026 | Report Code: bottled-water-processing

Bottled Water Processing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Bottled Water Processing market from 2023 to 2033. It highlights market trends, sizes, technological advances, and key players, delivering essential insights for stakeholders in this dynamic industry.

| Metric | Value |

|---|---|

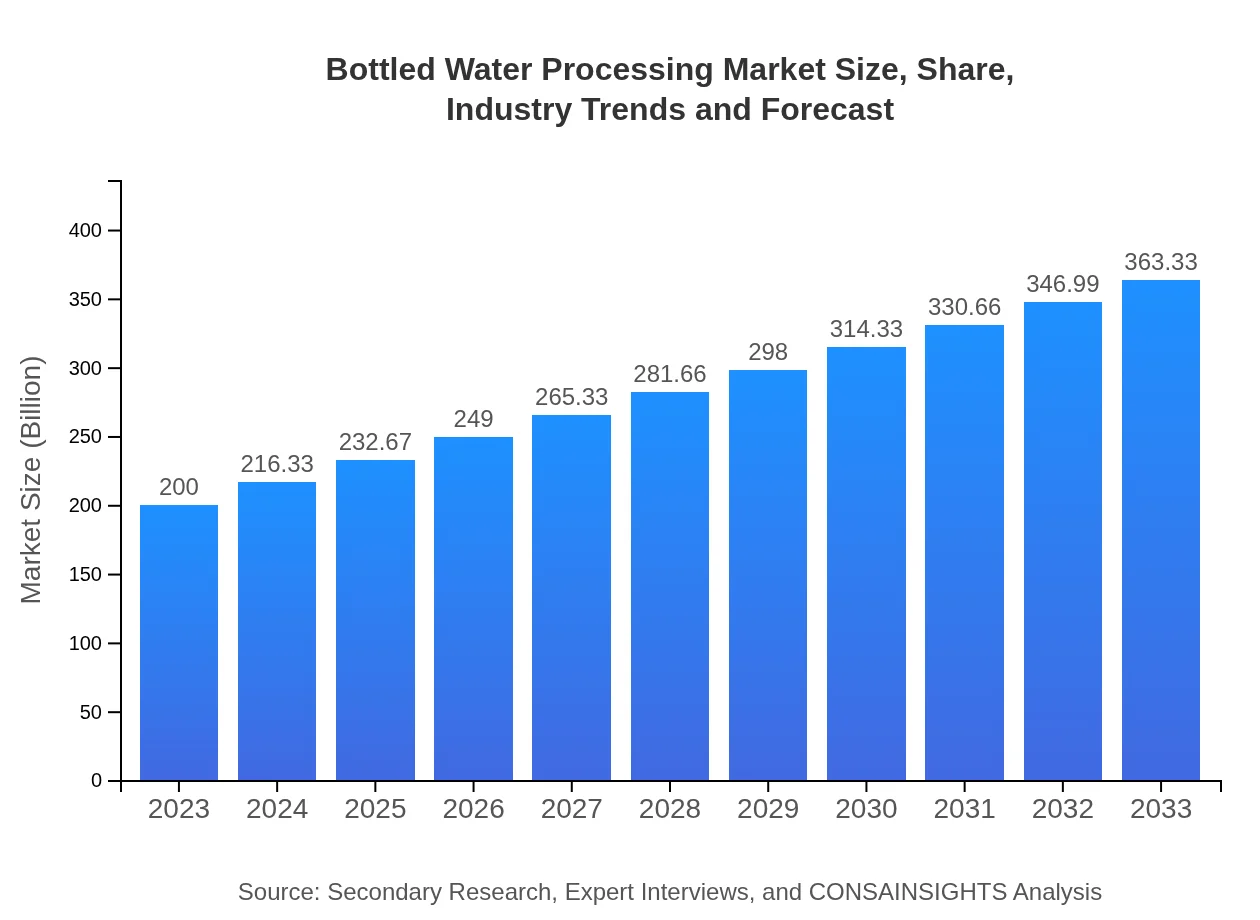

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 6.0% |

| 2033 Market Size | $363.33 Billion |

| Top Companies | Nestlé Waters, Coca-Cola Company, PepsiCo, Danone, FiJI Water |

| Last Modified Date | 31 January 2026 |

Bottled Water Processing Market Overview

Customize Bottled Water Processing Market Report market research report

- ✔ Get in-depth analysis of Bottled Water Processing market size, growth, and forecasts.

- ✔ Understand Bottled Water Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bottled Water Processing

What is the Market Size & CAGR of Bottled Water Processing market in 2023?

Bottled Water Processing Industry Analysis

Bottled Water Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bottled Water Processing Market Analysis Report by Region

Europe Bottled Water Processing Market Report:

In Europe, the market is set to rise from $62.92 billion in 2023 to $114.30 billion by 2033, influenced by stringent regulations enhancing water quality standards and a growing preference for premium bottled water brands.Asia Pacific Bottled Water Processing Market Report:

In the Asia Pacific region, the Bottled Water Processing market is expected to grow from $33.20 billion in 2023 to $60.31 billion by 2033. This growth is due to increasing disposable incomes, urbanization, and a growing trend of health and wellness among consumers.North America Bottled Water Processing Market Report:

The North American market is forecasted to grow from $75.10 billion in 2023 to $136.43 billion by 2033, with a notable shift towards flavored and functional waters gaining popularity among health-conscious consumers.South America Bottled Water Processing Market Report:

South America's market is projected to increase from $19.06 billion in 2023 to $34.63 billion by 2033, driven by rising consumer interest in bottled water as a healthy alternative to sugary drinks and local bottled brands expanding their reach.Middle East & Africa Bottled Water Processing Market Report:

The Middle East and Africa region will see market growth from $9.72 billion in 2023 to $17.66 billion by 2033, propelled by increasing awareness of clean drinking water and significant investments in bottled water production facilities.Tell us your focus area and get a customized research report.

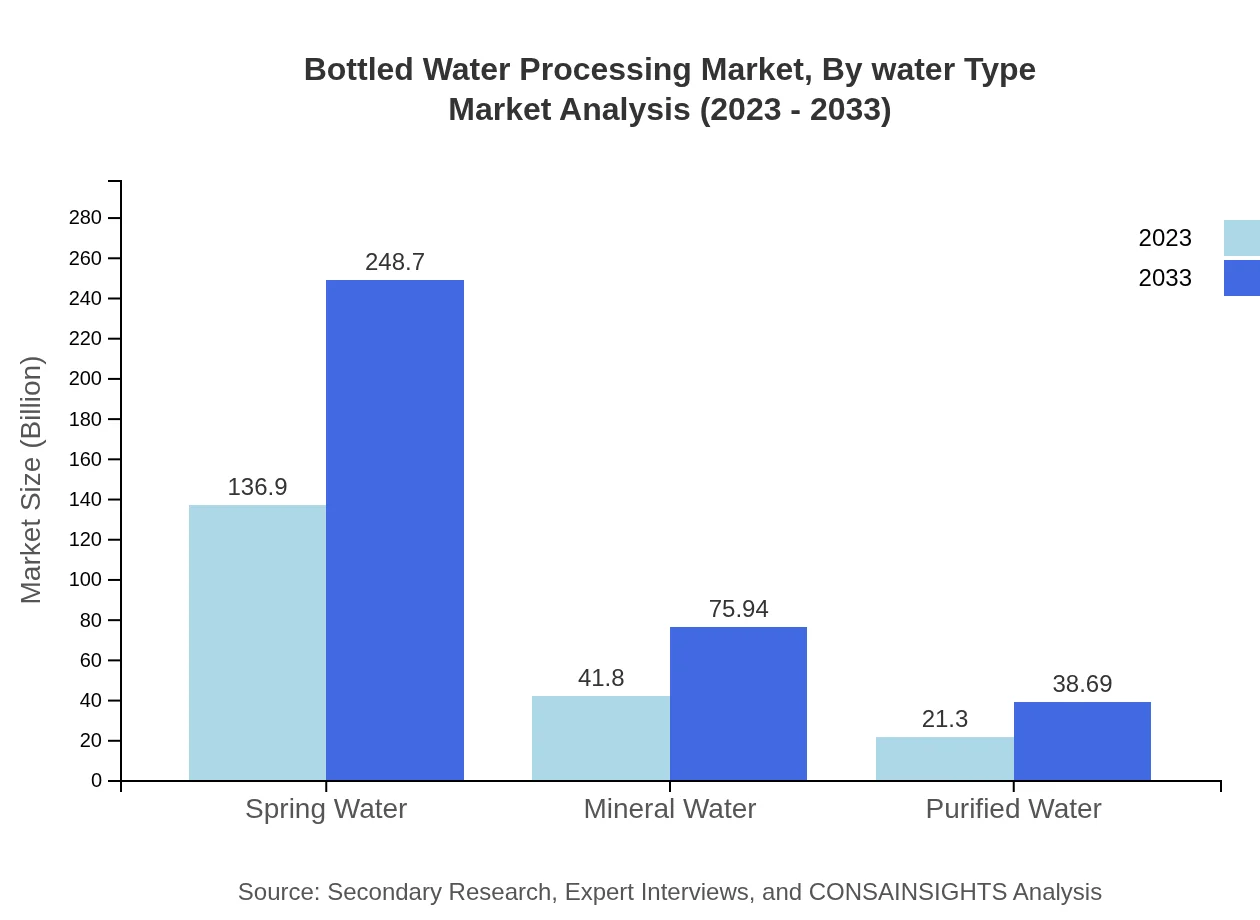

Bottled Water Processing Market Analysis By Water Type

The Bottled Water Processing market, segmented by water type, is dominated by spring water and mineral water. In 2023, spring water accounted for $136.90 billion, while mineral water stood at $41.80 billion. The demand for mineral water is anticipated to rise significantly, expanding towards $75.94 billion by 2033, demonstrating substantial growth potential.

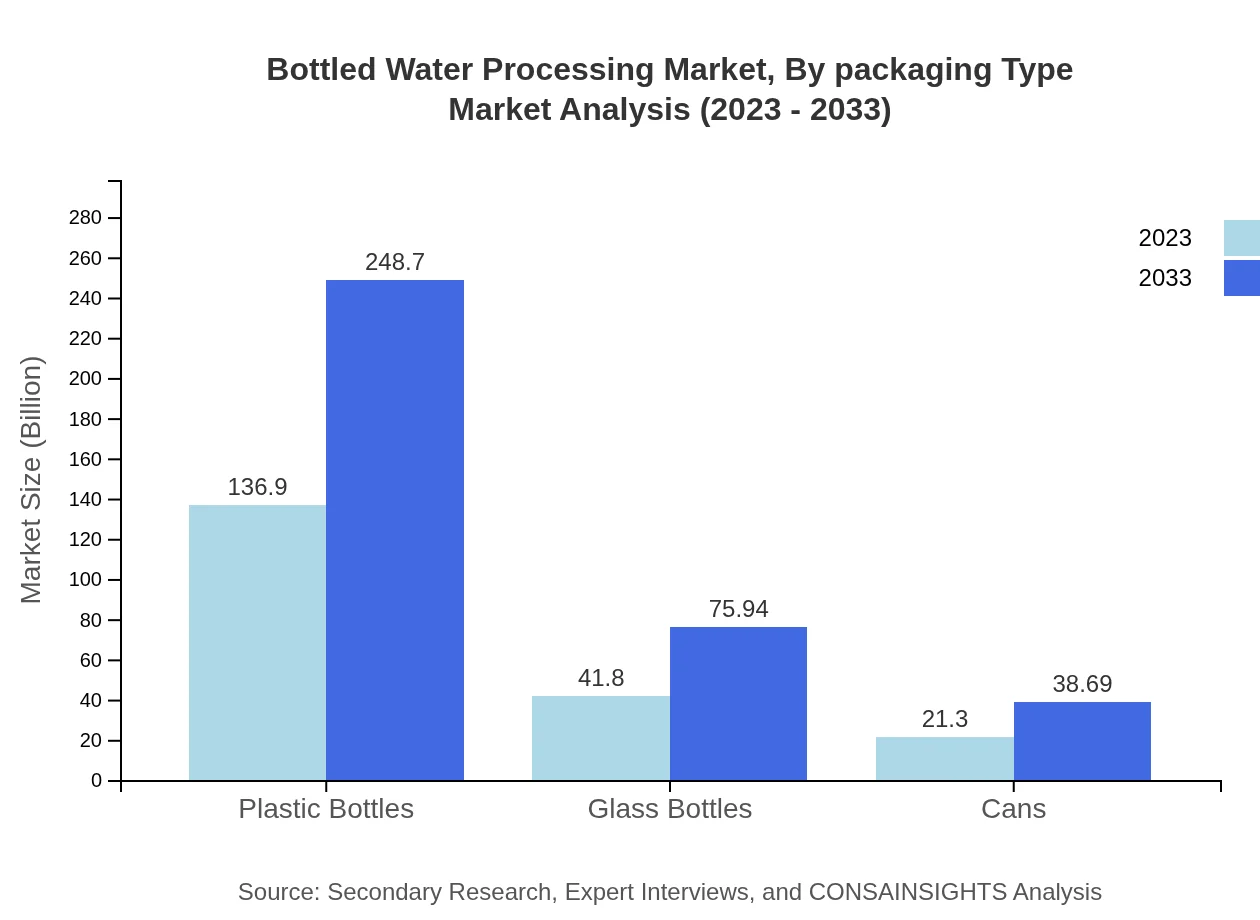

Bottled Water Processing Market Analysis By Packaging Type

The packaging segment is primarily categorized into plastic bottles, glass bottles, and cans. Plastic bottles lead the market with a size of $136.90 billion in 2023, expected to reach $248.70 billion by 2033, supported by convenience and affordability. Glass bottles are also gaining traction, with a projected growth from $41.80 billion to $75.94 billion in the same period.

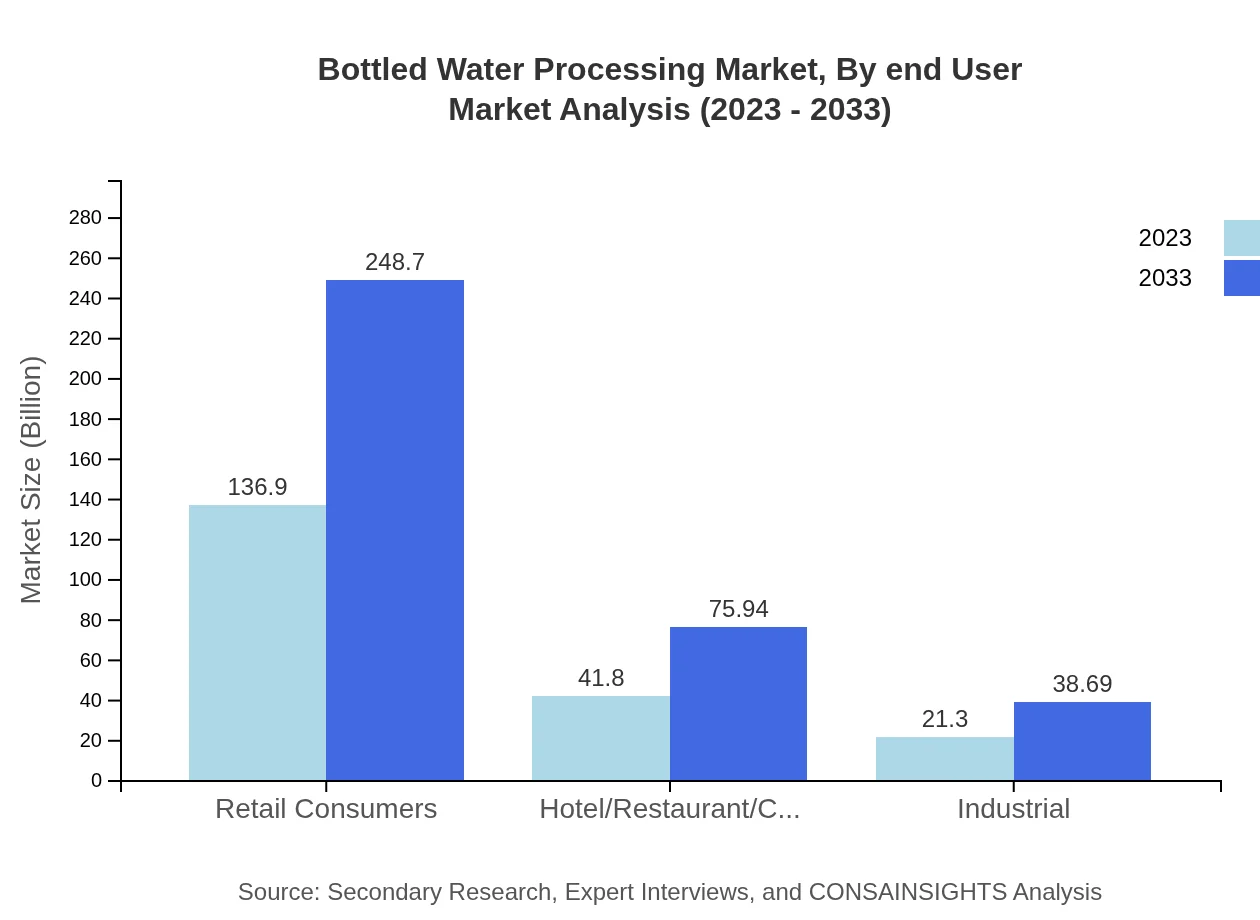

Bottled Water Processing Market Analysis By End User

Retail consumers remain the largest segment in the Bottled Water market, generating $136.90 billion in 2023 with steady growth expected to $248.70 billion by 2033. The HoReCa segment is also significant, growing from $41.80 billion to $75.94 billion, driven by premium offerings and increased dining out.

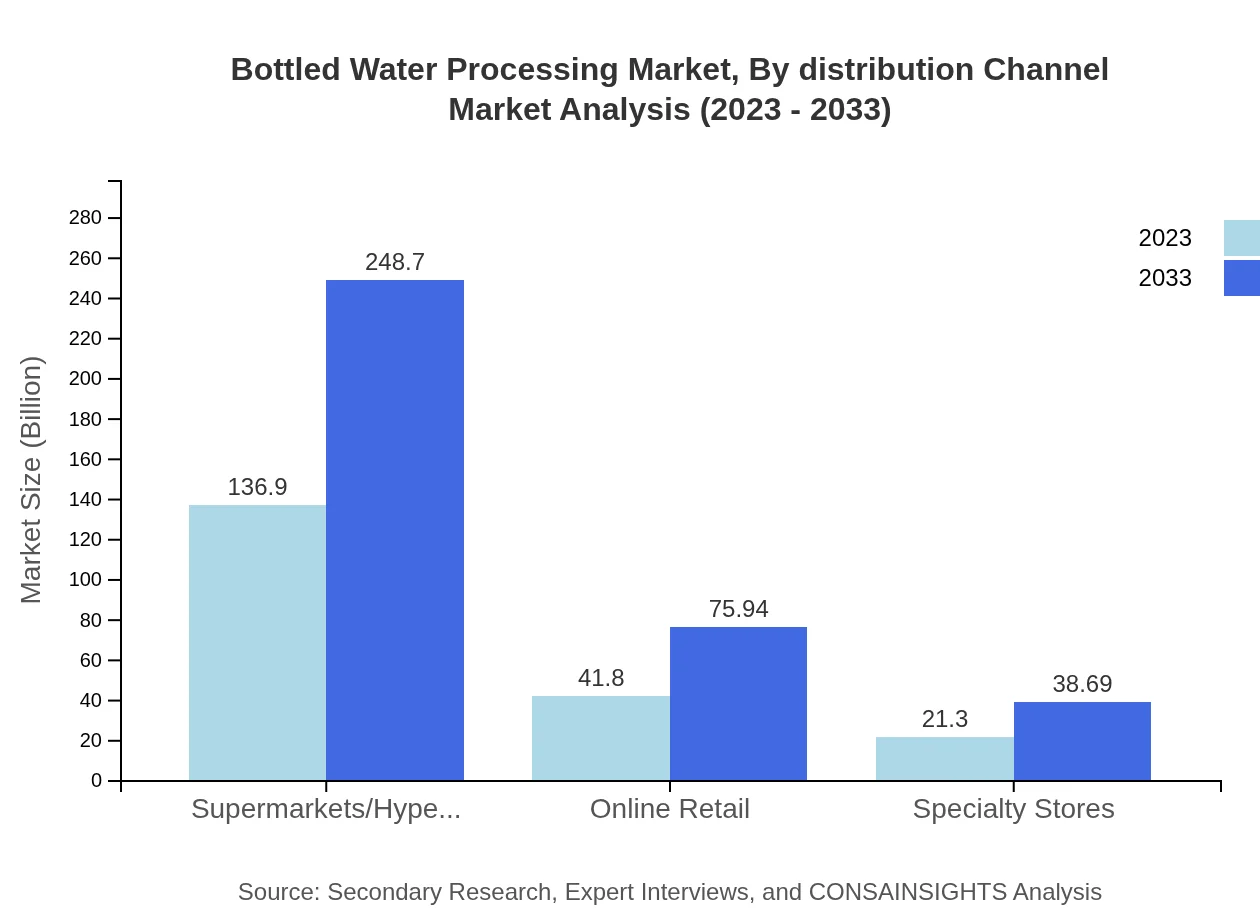

Bottled Water Processing Market Analysis By Distribution Channel

The distribution channels for bottled water include supermarkets/hypermarkets, online retail, and specialty stores. The supermarkets/hypermarkets segment holds a leading share of $136.90 billion with projected growth to $248.70 billion due to their wide reach, while online retail channels are increasingly gaining popularity, reflecting changing consumer shopping habits.

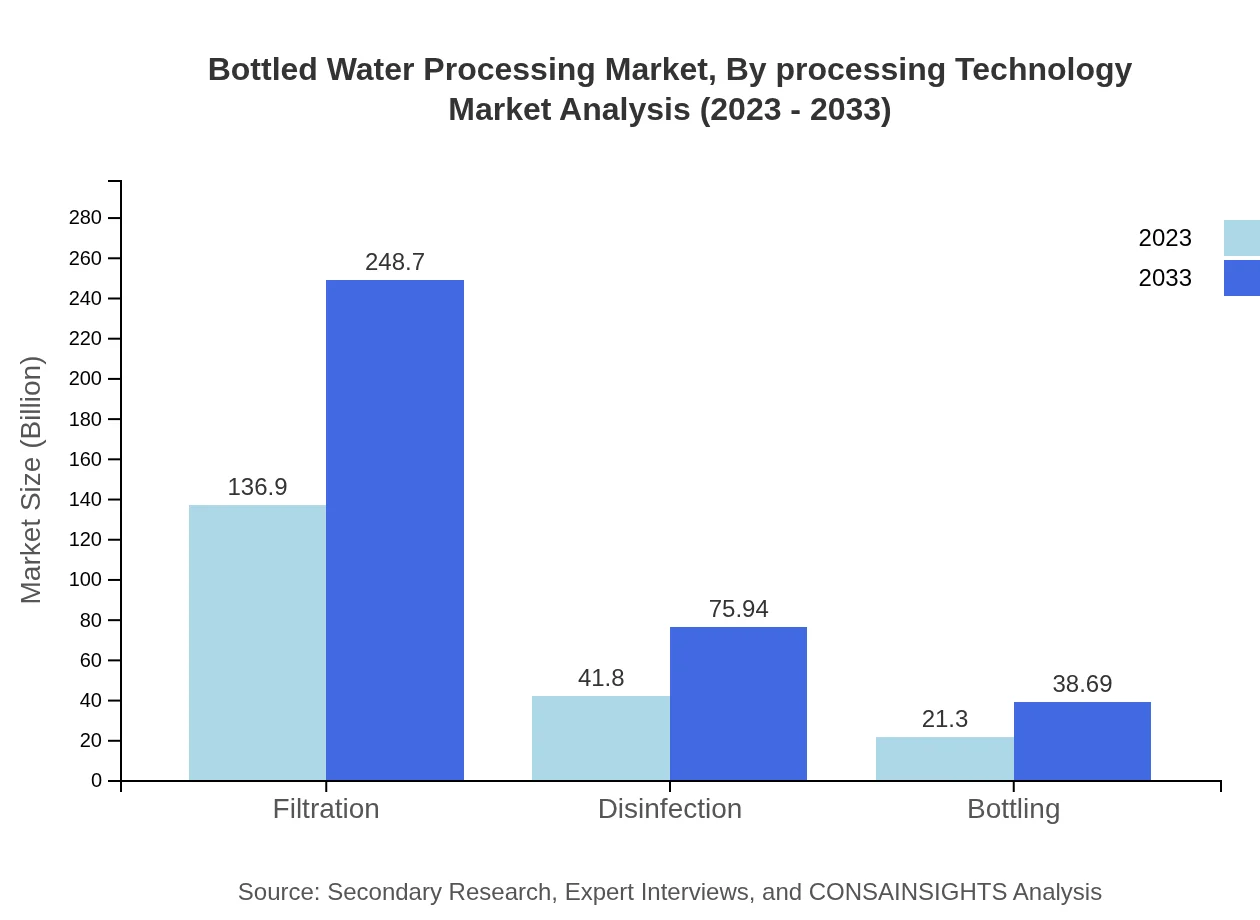

Bottled Water Processing Market Analysis By Processing Technology

Processing technologies are key components in ensuring the quality and safety of bottled water. The main technologies include filtration, disinfection, and bottling. Filtration techniques will grow notably from $136.90 billion in 2023 to $248.70 billion by 2033, aligning with regulatory standards and consumer preference for clean hydration options.

Bottled Water Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bottled Water Processing Industry

Nestlé Waters:

One of the leading bottled water companies globally, offering a diverse portfolio of brands focused on sustainability and quality.Coca-Cola Company:

Known for its Dasani brand, Coca-Cola has made significant investments in bottled water processing innovations and sustainability initiatives.PepsiCo:

Owner of Aquafina, PepsiCo is a significant player in the bottled water market, appealing to health-conscious consumers.Danone:

A key player in the bottled water industry known for brands like Evian, focusing on premium water offerings and environmental initiatives.FiJI Water:

Renowned for its natural Artesian water sourced from Fiji, positioned as a premium bottled water brand with a strong environmental commitment.We're grateful to work with incredible clients.

FAQs

What is the market size of bottled Water Processing?

The global bottled water processing market is valued at approximately $200 billion in 2023, with a projected CAGR of 6.0% through 2033. This growth indicates a robust demand for processed bottled water globally.

What are the key market players or companies in this bottled Water Processing industry?

Key players in the bottled water processing industry include major beverage corporations and local bottlers, who focus on quality, sustainability, and distribution to capture market share effectively.

What are the primary factors driving the growth in the bottled Water Processing industry?

Factors driving growth include increasing health awareness, rising disposable incomes, environmental concerns promoting bottled water over sugary beverages, and advancements in bottling technologies enhancing efficiency.

Which region is the fastest Growing in the bottled Water Processing?

The North American region shows the fastest growth in bottled water processing, projected to increase from $75.10 billion in 2023 to $136.43 billion by 2033, driven by consumer demand for convenience and health.

Does ConsaInsights provide customized market report data for the bottled Water Processing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the bottled-water processing sector, ensuring clients have pertinent information for strategic decision-making.

What deliverables can I expect from this bottled Water Processing market research project?

Deliverables typically include comprehensive market analysis reports, segmentation studies, competitive landscape reviews, and forecasts covering market size, trends, and regional insights.

What are the market trends of bottled Water Processing?

Current trends include a shift towards eco-friendly packaging, increased preference for premium water types, and embracing technology for efficient processing, which reflect consumer priorities on health and sustainability.