Brewery Equipment Market Report

Published Date: 31 January 2026 | Report Code: brewery-equipment

Brewery Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Brewery Equipment market from 2023 to 2033, highlighting market trends, size, and anticipated growth. It provides vital insights into the regional dynamics, technology advancements, and competitive landscape in the brewing industry.

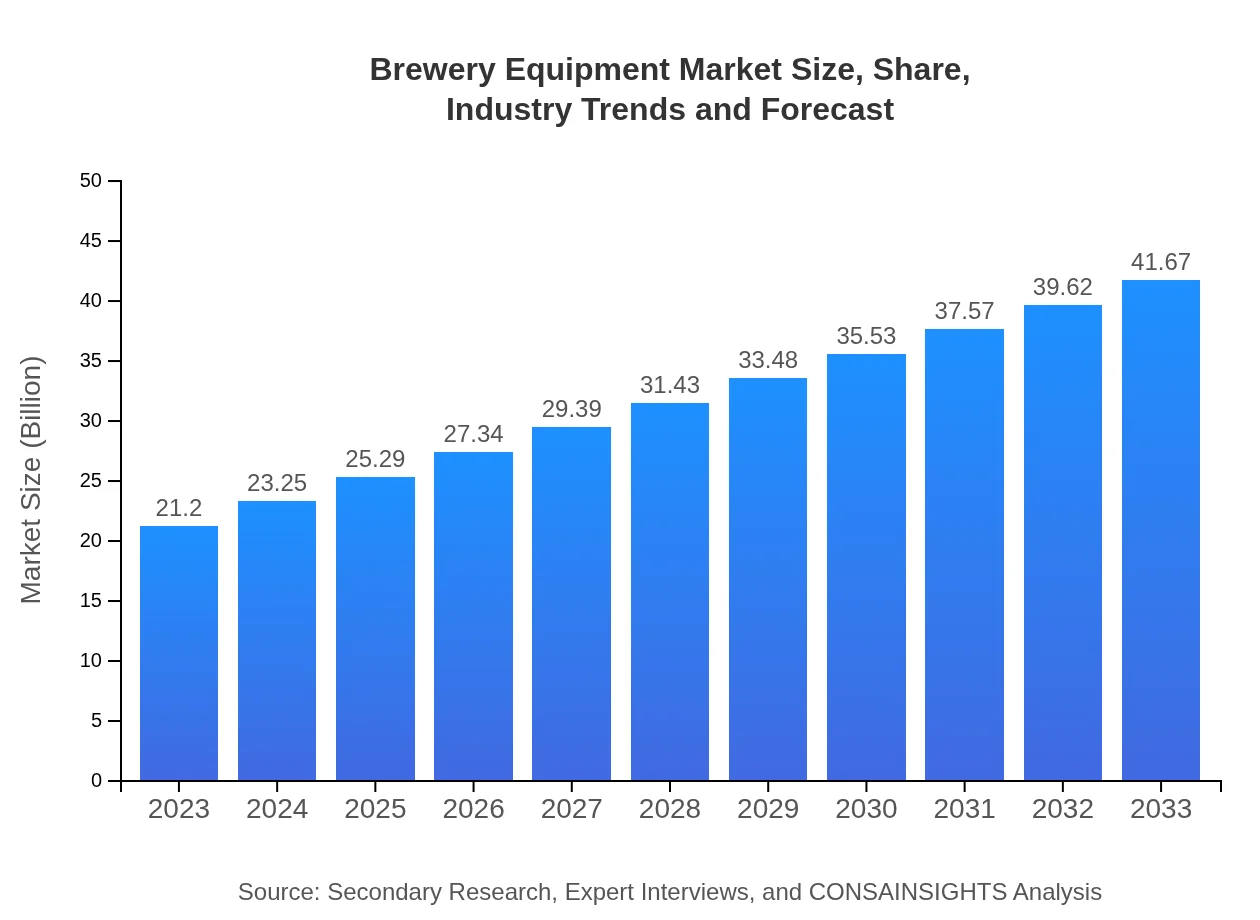

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.20 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $41.67 Billion |

| Top Companies | Krones AG, GEA Group, Miller Brewing Company, BrauKon GmbH |

| Last Modified Date | 31 January 2026 |

Brewery Equipment Market Overview

Customize Brewery Equipment Market Report market research report

- ✔ Get in-depth analysis of Brewery Equipment market size, growth, and forecasts.

- ✔ Understand Brewery Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Brewery Equipment

What is the Market Size & CAGR of Brewery Equipment market in 2023?

Brewery Equipment Industry Analysis

Brewery Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Brewery Equipment Market Analysis Report by Region

Europe Brewery Equipment Market Report:

Europe stands as the largest market for Brewery Equipment, projected to grow from $6.88 billion in 2023 to $13.52 billion by 2033. With historical roots in beer production, the region is witnessing a surge in craft breweries and investments in energy-efficient brewing technologies.Asia Pacific Brewery Equipment Market Report:

In the Asia Pacific region, the Brewery Equipment market is projected to grow from $4.03 billion in 2023 to $7.93 billion by 2033. This growth is fueled by increasing disposable incomes, a burgeoning middle class, and a growing preference for premium beer products. Major players are also expanding their presence in this region, driven by significant investments in local breweries.North America Brewery Equipment Market Report:

The North American market, valued at $7.06 billion in 2023, is expected to escalate to $13.88 billion by 2033. This region is a leader in the craft brewing revolution, supported by a strong consumer base for innovative and varied beer flavors, driving demand for advanced brewing equipment.South America Brewery Equipment Market Report:

The South American Brewery Equipment market, with a current valuation of $0.38 billion in 2023, is anticipated to reach $0.75 billion by 2033. This growth can be attributed to increasing beer consumption, particularly in Brazil and Argentina, and the growing trend towards craft brewing.Middle East & Africa Brewery Equipment Market Report:

In the Middle East and Africa, the Brewery Equipment market is expected to grow from $2.84 billion in 2023 to $5.58 billion by 2033. This increase is driven by a growing interest in beer consumption and a rise in the establishment of breweries in several countries within this region.Tell us your focus area and get a customized research report.

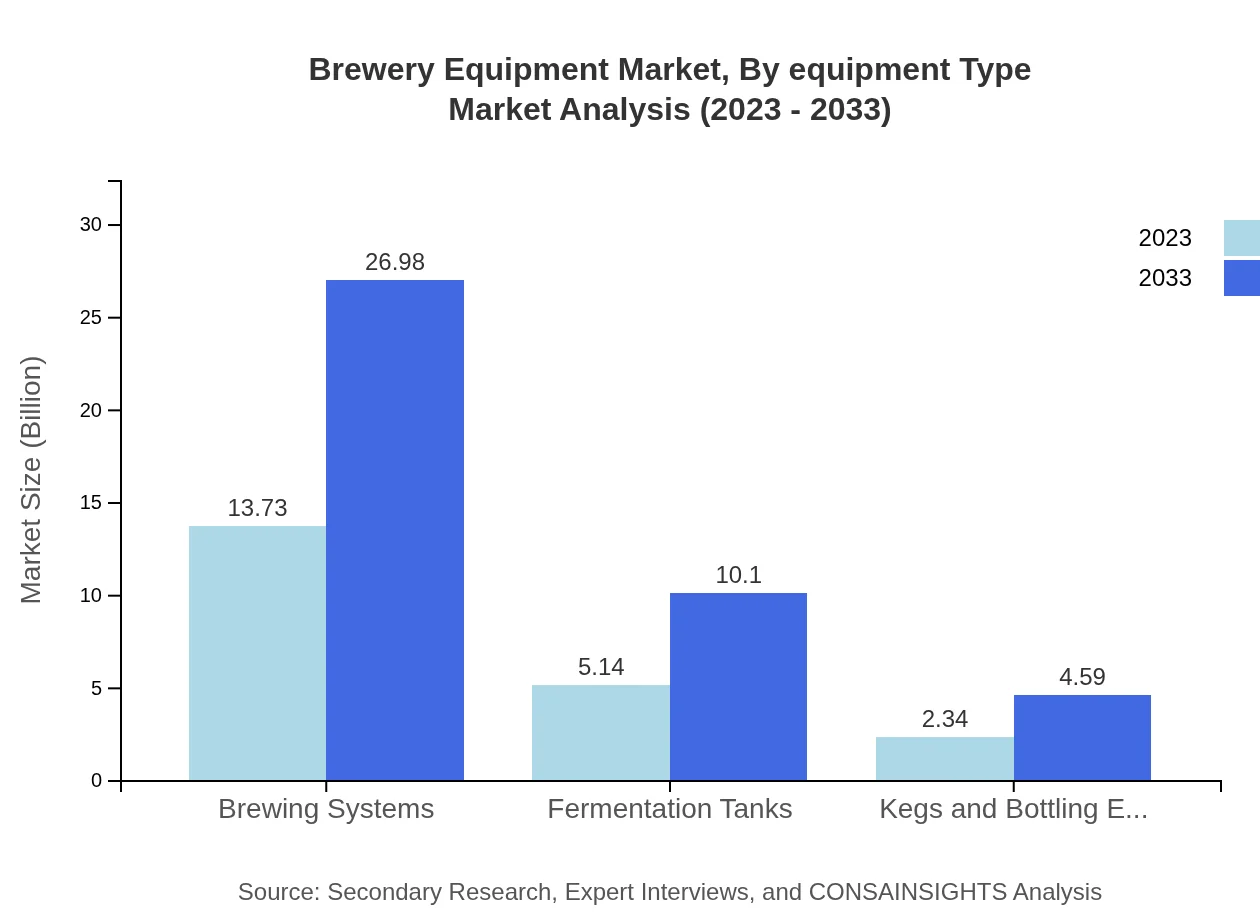

Brewery Equipment Market Analysis By Equipment Type

The equipment type segment indicates a significant growth trajectory, with 'Basic Components' leading the market size from $13.73 billion in 2023 to $26.98 billion by 2033. Control Systems, also crucial, are expected to rise from $5.14 billion to $10.10 billion during the same period, reflecting the industry's shift towards automation.

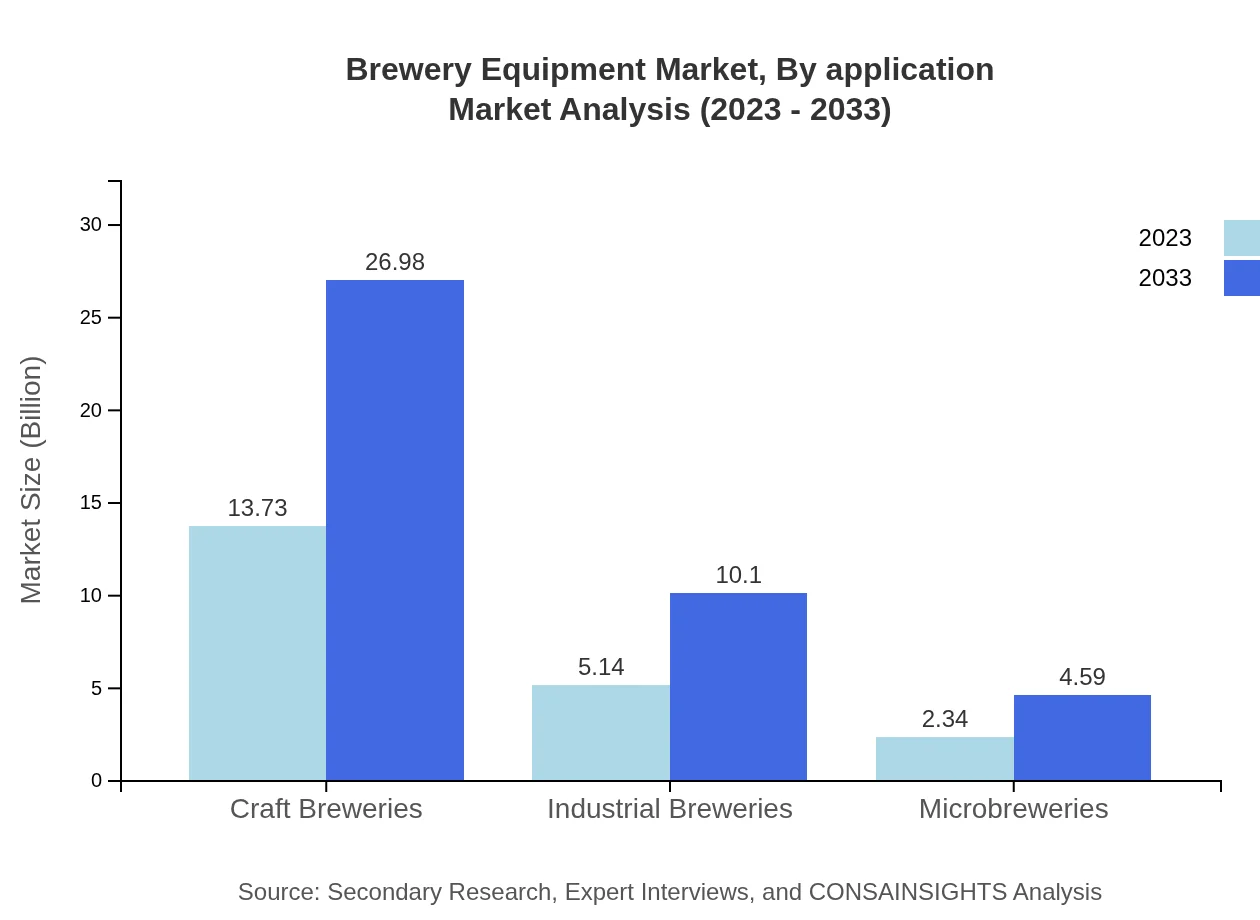

Brewery Equipment Market Analysis By Application

Within the application segment, 'Craft Breweries' hold a major share, with a market size expanding from $13.73 billion in 2023 to $26.98 billion by 2033. Industrial Breweries are also significant contributors, growing from $5.14 billion to $10.10 billion, showcasing the importance of both craft and large-scale production in the market.

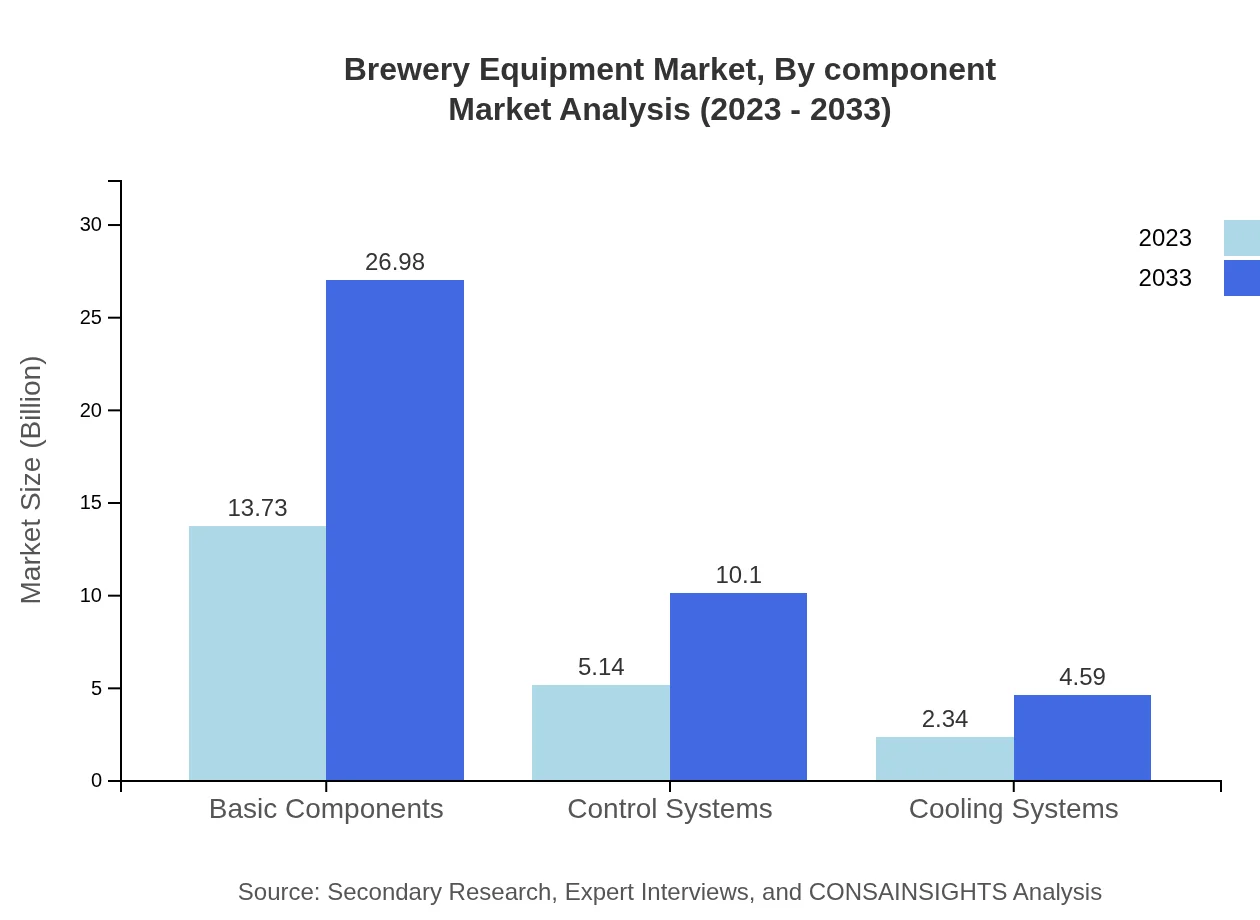

Brewery Equipment Market Analysis By Component

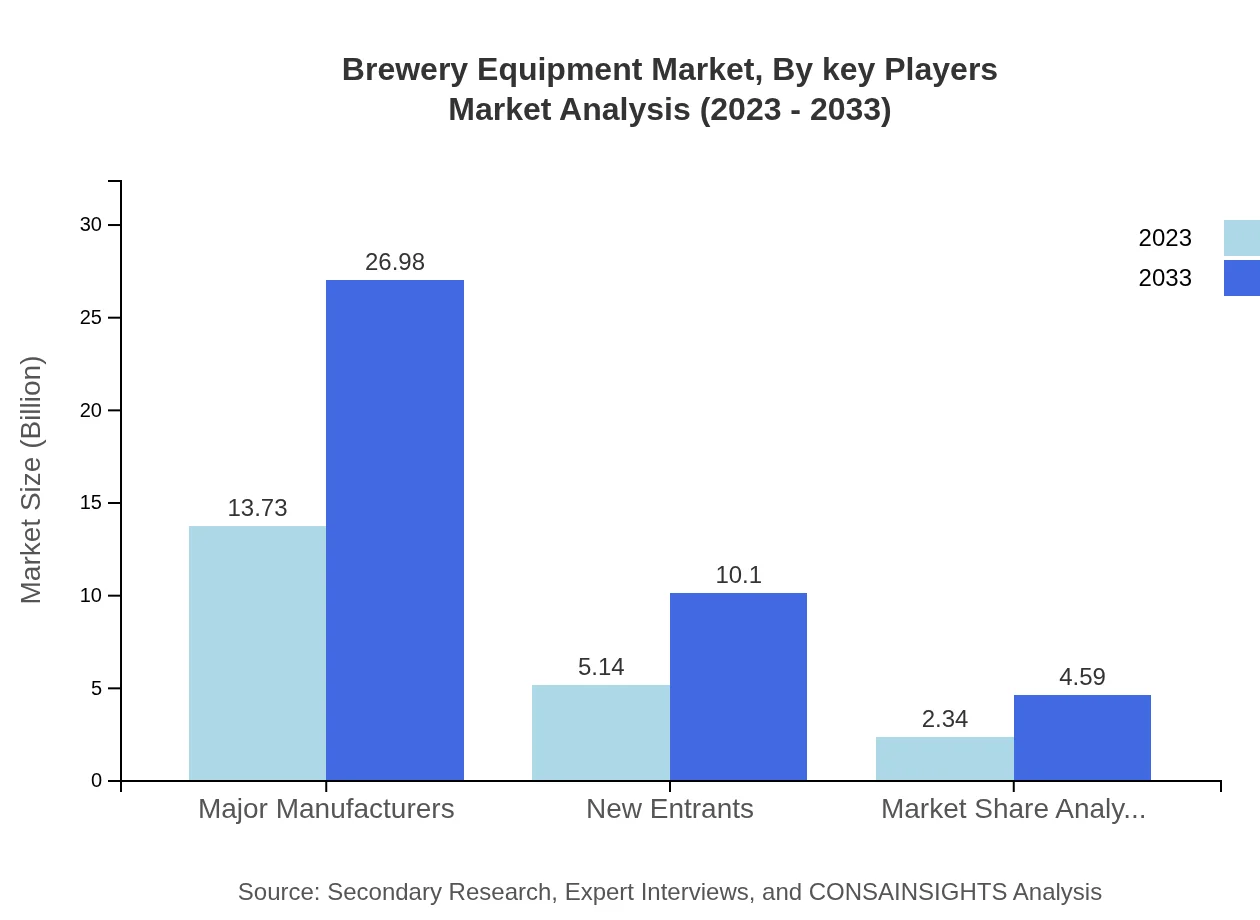

The component analysis reveals 'Major Manufacturers' holding substantial market share, with growth from $13.73 billion in 2023 to $26.98 billion by 2033. New Entrants are also notable, poised to grow from $5.14 billion to $10.10 billion, reflecting the dynamic landscape of the Brewery Equipment market.

Brewery Equipment Market Analysis By Key Players

Key players significantly influence the Brewery Equipment market dynamics, contributing to innovation and market reach. Partnerships and collaborations among established firms and new entrants are pivotal for driving technological advancements and meeting evolving market needs.

Brewery Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Brewery Equipment Industry

Krones AG:

Krones AG is a leading player in the Brewery Equipment market, known for its advanced production solutions and innovative technologies aimed at increasing efficiency in beverage production from brewing to packaging.GEA Group:

GEA Group specializes in providing solutions that maximize the efficiency of the brewing process, offering a range of products from processing and fermentation technologies to automation systems tailored for major breweries.Miller Brewing Company:

As a globally renowned brewery, Miller Brewing Company also contributes to the Brewery Equipment market by investing in innovative brewing technologies that enhance product quality and production efficiency.BrauKon GmbH:

BrauKon GmbH is recognized for its high-end brewery equipment and utilizes modern brewing techniques and technologies, focusing on small and medium-sized breweries.We're grateful to work with incredible clients.

FAQs

What is the market size of brewery equipment?

The brewery equipment market is valued at approximately $21.2 billion in 2023, with a projected CAGR of 6.8% through 2033, indicating robust growth as demand for innovative brewing solutions increases globally.

What are the key market players or companies in the brewery equipment industry?

Key players in the brewery equipment sector include major manufacturers and new entrants, focusing on market share and competitive strategies to enhance product offerings and cater to craft and commercial brewers.

What are the primary factors driving the growth in the brewery equipment industry?

Factors driving growth include increasing consumer demand for craft beers, technological advancements in brewing processes, and the expansion of small and medium breweries worldwide.

Which region is the fastest Growing in the brewery equipment market?

Europe shows strong growth prospects, with the market expected to grow from $6.88 billion in 2023 to $13.52 billion by 2033, driven by craft brewing popularity and innovative brewing techniques.

Does ConsaInsights provide customized market report data for the brewery equipment industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs, allowing clients to gain insights into the brewery equipment market’s dynamics and trends for informed decision-making.

What deliverables can I expect from this brewery equipment market research project?

Deliverables include comprehensive market analysis, segmented data by region and type, growth forecasts, and insights into competitive landscape and consumer trends within the brewery equipment sector.

What are the market trends of brewery equipment?

Current trends include increased automation in production lines, rising investment in craft breweries, and sustainability initiatives driving innovation within brewing technologies.