Brewing Enzymes Market Report

Published Date: 31 January 2026 | Report Code: brewing-enzymes

Brewing Enzymes Market Size, Share, Industry Trends and Forecast to 2033

This report provides detailed insights into the Brewing Enzymes market from 2023 to 2033, covering market size, growth forecasts, segmentation, regional insights, and technological advancements in the industry.

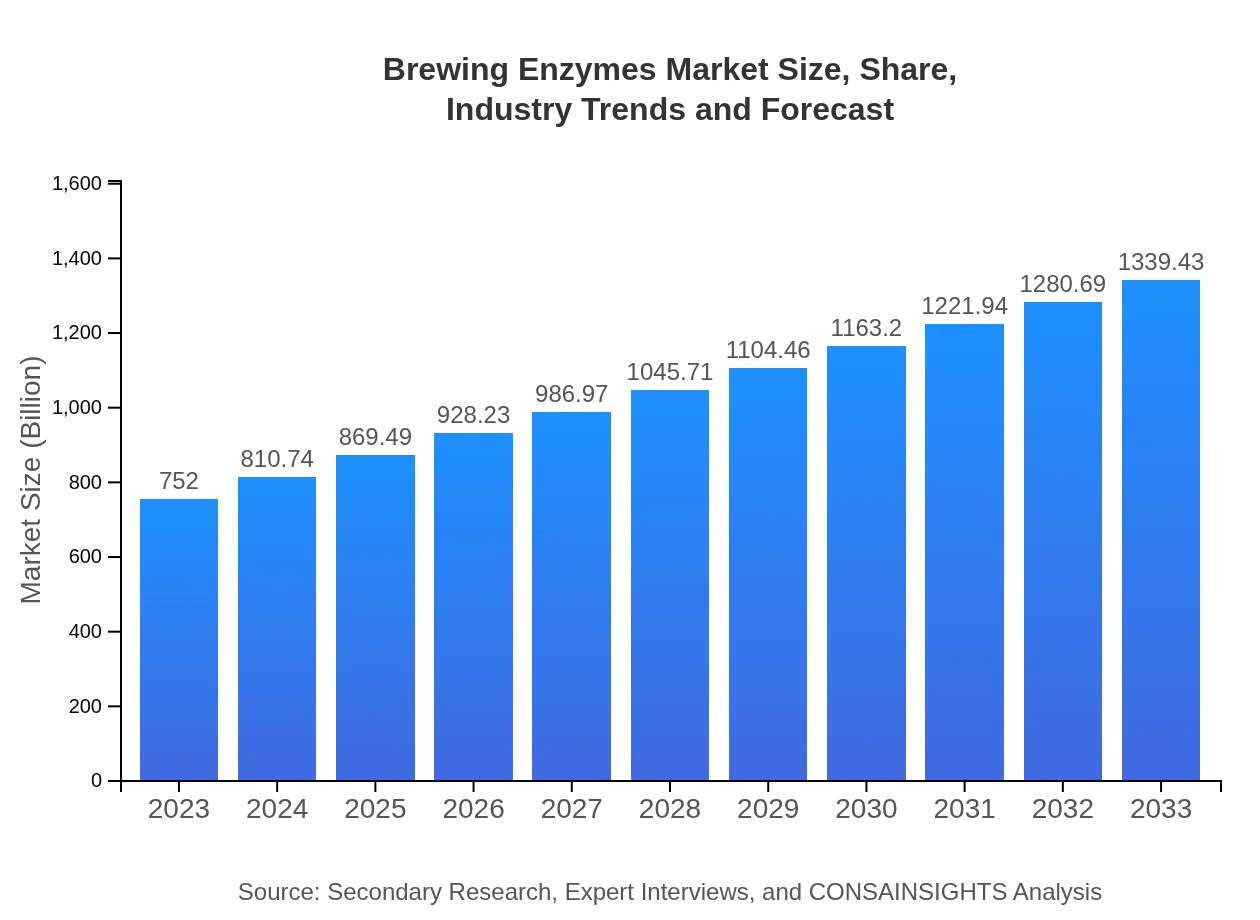

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $752.00 Million |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $1339.43 Million |

| Top Companies | Novozymes A/S, Südzucker AG, DuPont de Nemours, Inc. |

| Last Modified Date | 31 January 2026 |

Brewing Enzymes Market Overview

Customize Brewing Enzymes Market Report market research report

- ✔ Get in-depth analysis of Brewing Enzymes market size, growth, and forecasts.

- ✔ Understand Brewing Enzymes's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Brewing Enzymes

What is the Market Size & CAGR of Brewing Enzymes market in 2023?

Brewing Enzymes Industry Analysis

Brewing Enzymes Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Brewing Enzymes Market Analysis Report by Region

Europe Brewing Enzymes Market Report:

Europe holds a significant share of the Brewing Enzymes market, anticipated to expand from $210.33 million in 2023 to $374.64 million by 2033. The increase in demand for high-quality beers and biodegradability credentials in brewing processes are pivotal for growth.Asia Pacific Brewing Enzymes Market Report:

In the Asia-Pacific region, the market for Brewing Enzymes was valued at approximately $146.41 million in 2023 and is expected to grow to $260.79 million by 2033, driven by increasing beer consumption and a rise in craft brewing in countries like China and Japan.North America Brewing Enzymes Market Report:

North America dominates the Brewing Enzymes market with a size of $281.10 million in 2023, expected to reach $500.68 million by 2033. The region's advanced brewing technology and a growing preference for craft beers are key growth factors.South America Brewing Enzymes Market Report:

The South American Brewing Enzymes market is projected to grow from $51.96 million in 2023 to $92.55 million by 2033. This growth is catalyzed by the burgeoning craft beer scene and an increasing focus on optimizing brewing efficiency.Middle East & Africa Brewing Enzymes Market Report:

The Middle East and Africa market was valued at $62.19 million in 2023, projected to reach $110.77 million by 2033. The region is witnessing a gradual shift towards craft brewing, generating opportunities for enzyme manufacturers.Tell us your focus area and get a customized research report.

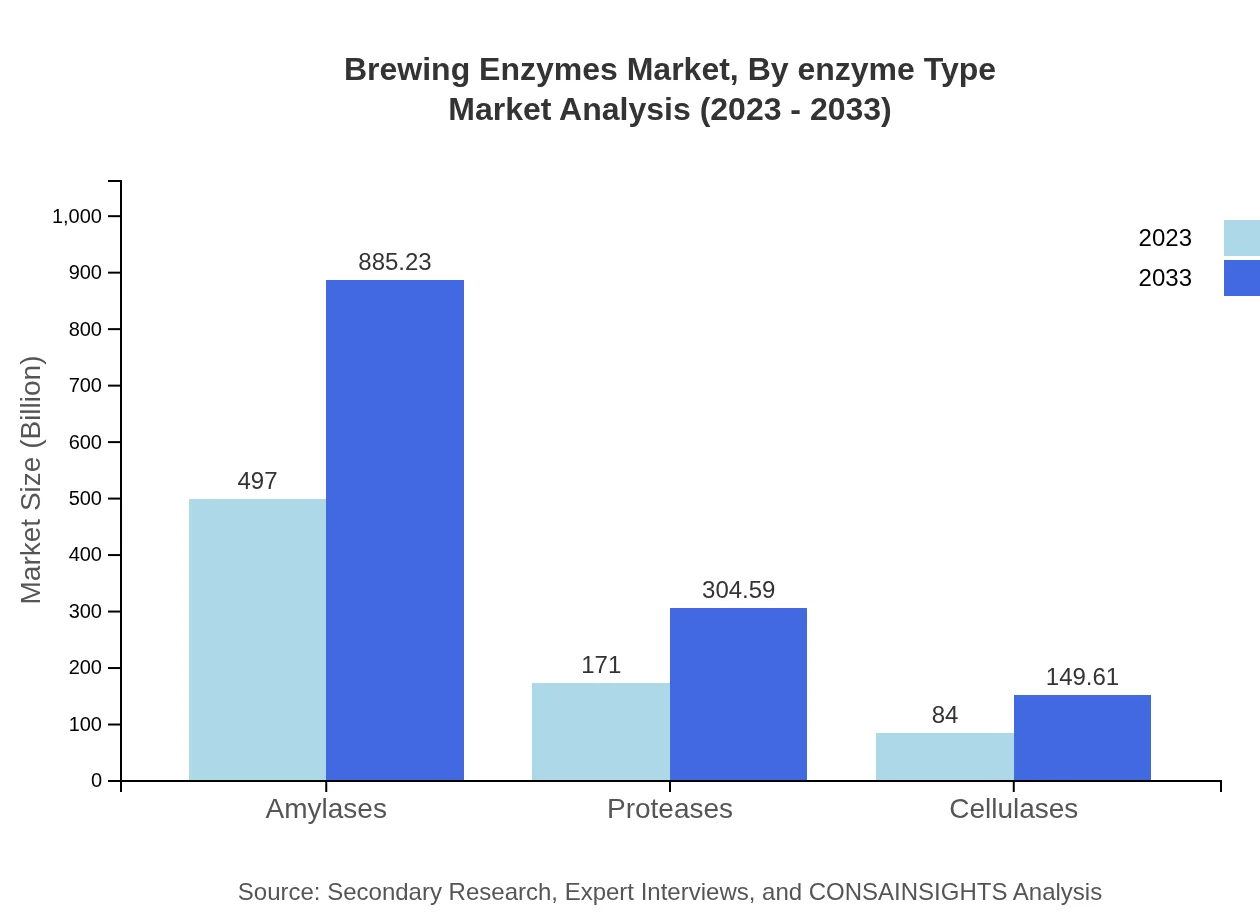

Brewing Enzymes Market Analysis By Enzyme Type

The enzyme type segment is dominated by Amylases, which contributed $497.00 million in 2023 and is expected to reach $885.23 million by 2033. Proteases, valued at $171.00 million in 2023, will grow to $304.59 million in the same period. Cellulases are also essential, growing from $84.00 million to $149.61 million over the forecast period.

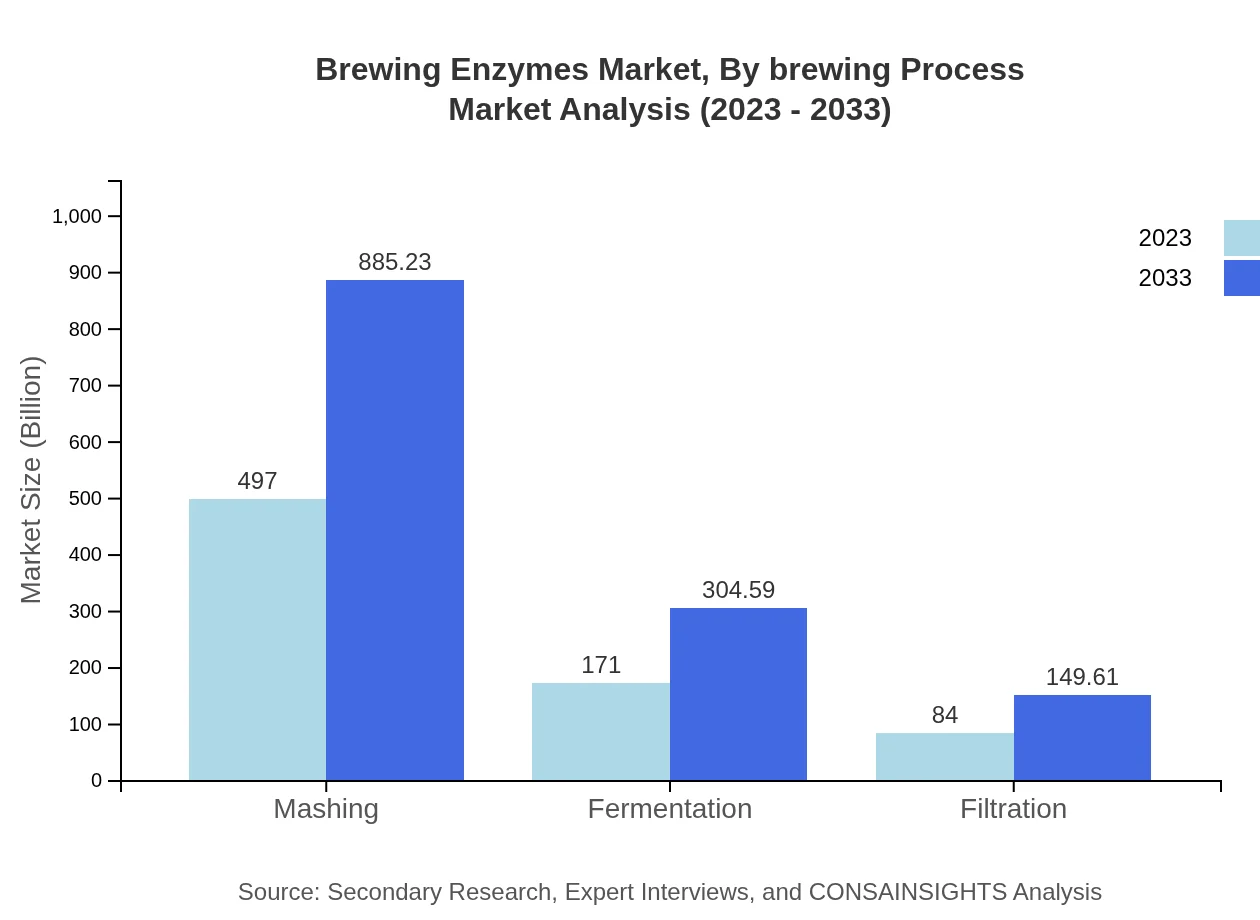

Brewing Enzymes Market Analysis By Brewing Process

The brewing process segment highlights Mashing as the major contributor with a market size of $497.00 million in 2023, expected to reach $885.23 million by 2033. Fermentation and Filtration processes also represent significant market values of $171.00 million and $84.00 million, respectively, showcasing growth opportunities in optimizing these processes.

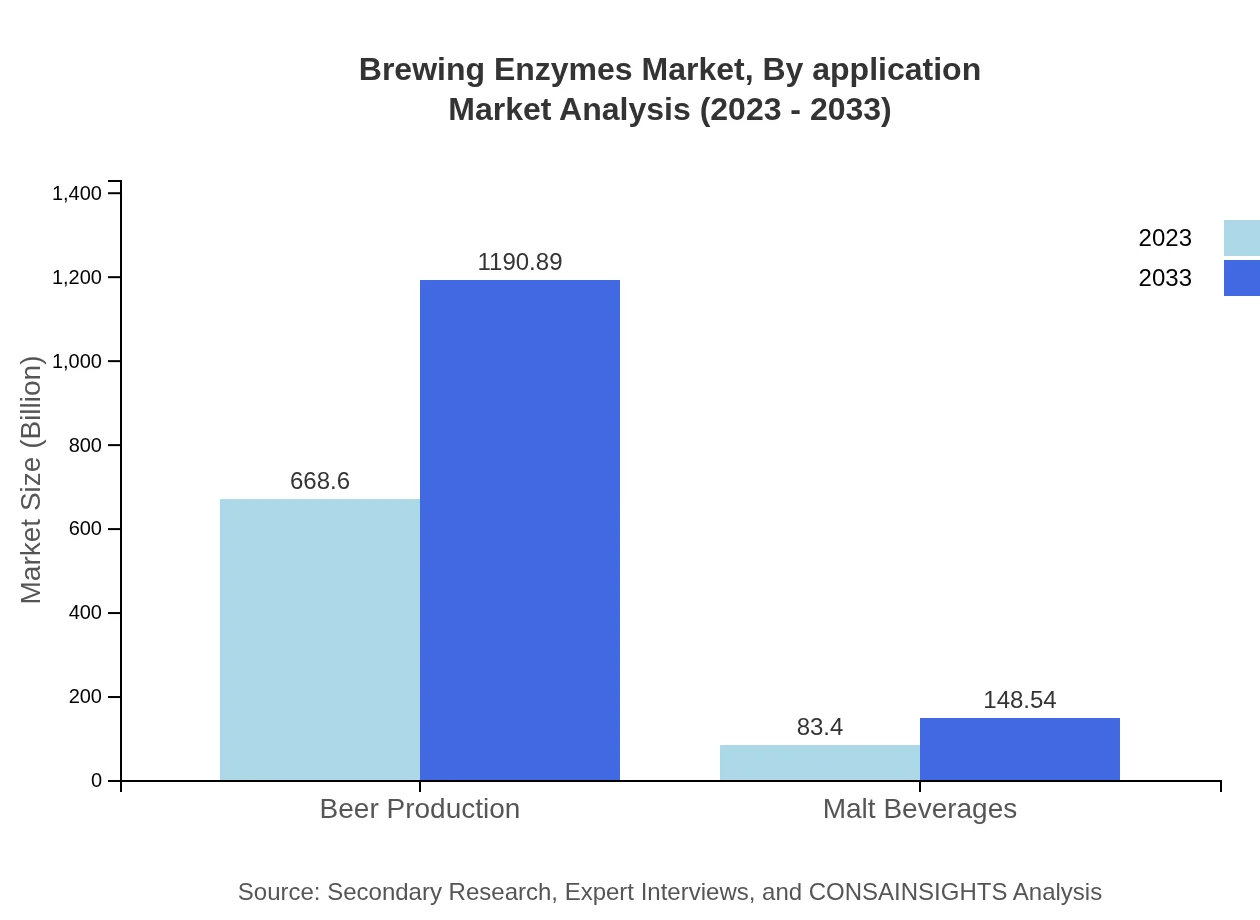

Brewing Enzymes Market Analysis By Application

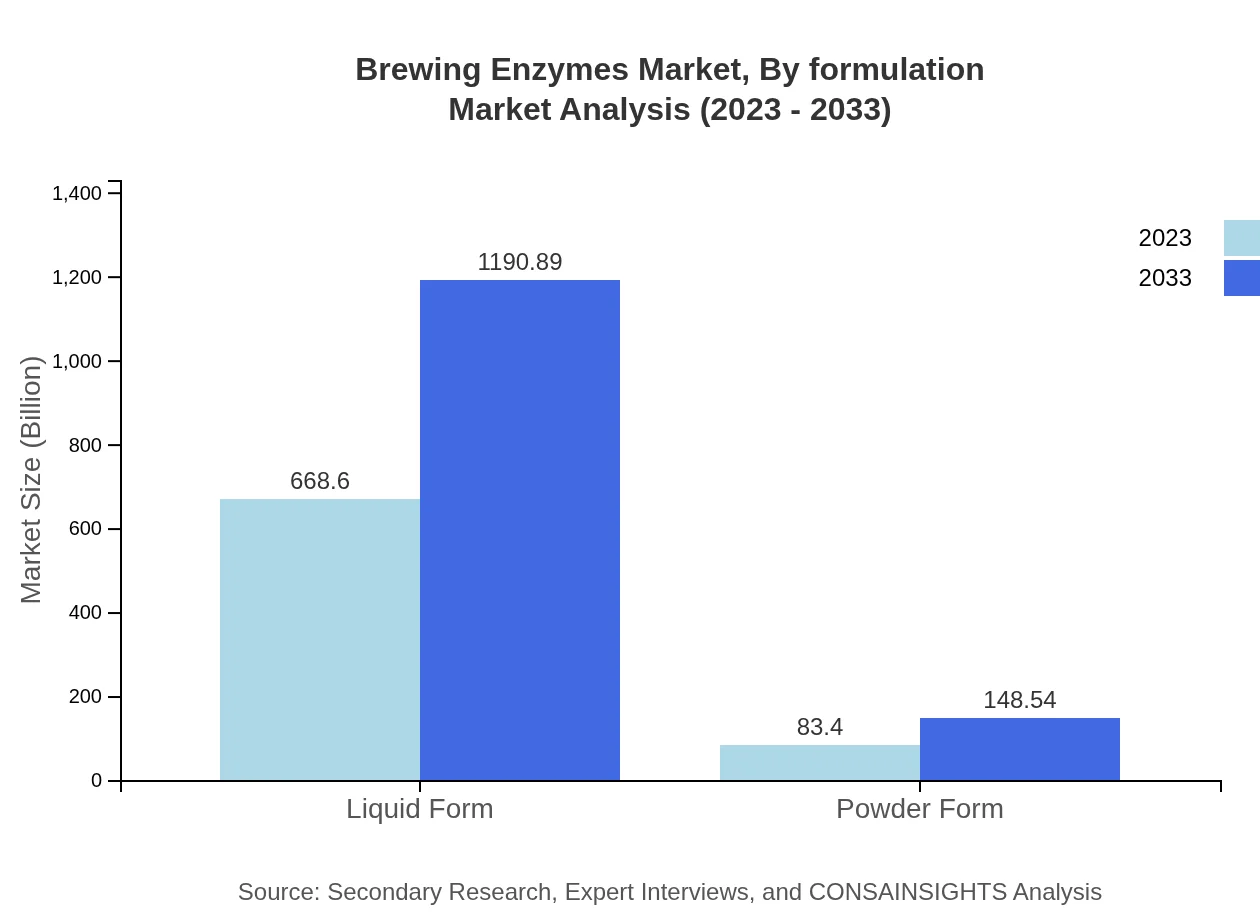

The application of Brewing Enzymes is chiefly in Beer Production, generating $668.60 million in 2023 and projected to grow to $1,190.89 million in 2033. Malt beverages follow with a modest growth from $83.40 million to $148.54 million, reflecting consistent consumer preferences.

Brewing Enzymes Market Analysis By Formulation

Liquid Forms dominate the market, valued at $668.60 million in 2023, growing to $1,190.89 million by 2033. Powder forms, although smaller at $83.40 million currently, show potential for growth, reaching $148.54 million as manufacturers explore diverse formulations.

Brewing Enzymes Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Brewing Enzymes Industry

Novozymes A/S:

A leader in enzyme production, Novozymes focuses on innovative solutions that improve brewing efficiency and meet sustainability goals.Südzucker AG:

Südzucker is significant in the brewing enzymes market, providing high-quality enzymes designed for various application processes in brewing.DuPont de Nemours, Inc.:

DuPont specializes in biotechnology, delivering enzyme solutions that enhance production processes and product quality in the brewing sector.We're grateful to work with incredible clients.

FAQs

What is the market size of brewing Enzymes?

The global brewing enzymes market is valued at approximately $752 million in 2023, with a projected growth rate of 5.8% CAGR, reflecting significant growth potential for the industry by 2033.

What are the key market players or companies in the brewing Enzymes industry?

Key players include major enzyme manufacturers and suppliers who contribute innovative solutions for brewing applications, enhancing product quality and efficiency across different market segments.

What are the primary factors driving the growth in the brewing enzymes industry?

Key growth drivers include increasing demand for craft beers, advancements in enzyme technologies, and the growing trend of natural ingredients in the brewing sector, facilitating process efficiency and product consistency.

Which region is the fastest Growing in the brewing enzymes?

North America represents the fastest-growing region, with market size expected to increase from $281.10 million in 2023 to $500.68 million by 2033, driven by rising craft brewery establishments and innovation.

Does ConsaInsights provide customized market report data for the brewing enzymes industry?

Yes, ConsaInsights offers tailored market reports for the brewing enzymes industry, accommodating specific customer needs for detailed insights in various segments and regional analyses.

What deliverables can I expect from this brewing enzymes market research project?

Deliverables include comprehensive reports containing market sizes, growth rates, trend analyses, and segment data across regions, ensuring clients have in-depth insights for strategic decision-making.

What are the market trends of brewing enzymes?

Current trends include a rising emphasis on sustainability, innovation in enzyme applications, and a shift towards customization in brewing processes, influencing demand across various beverage segments.