Building Information Modeling Market Report

Published Date: 22 January 2026 | Report Code: building-information-modeling

Building Information Modeling Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Building Information Modeling (BIM) market from 2023 to 2033, covering market size, growth rates, regional insights, technology trends, and leading companies, offering valuable foresight for stakeholders.

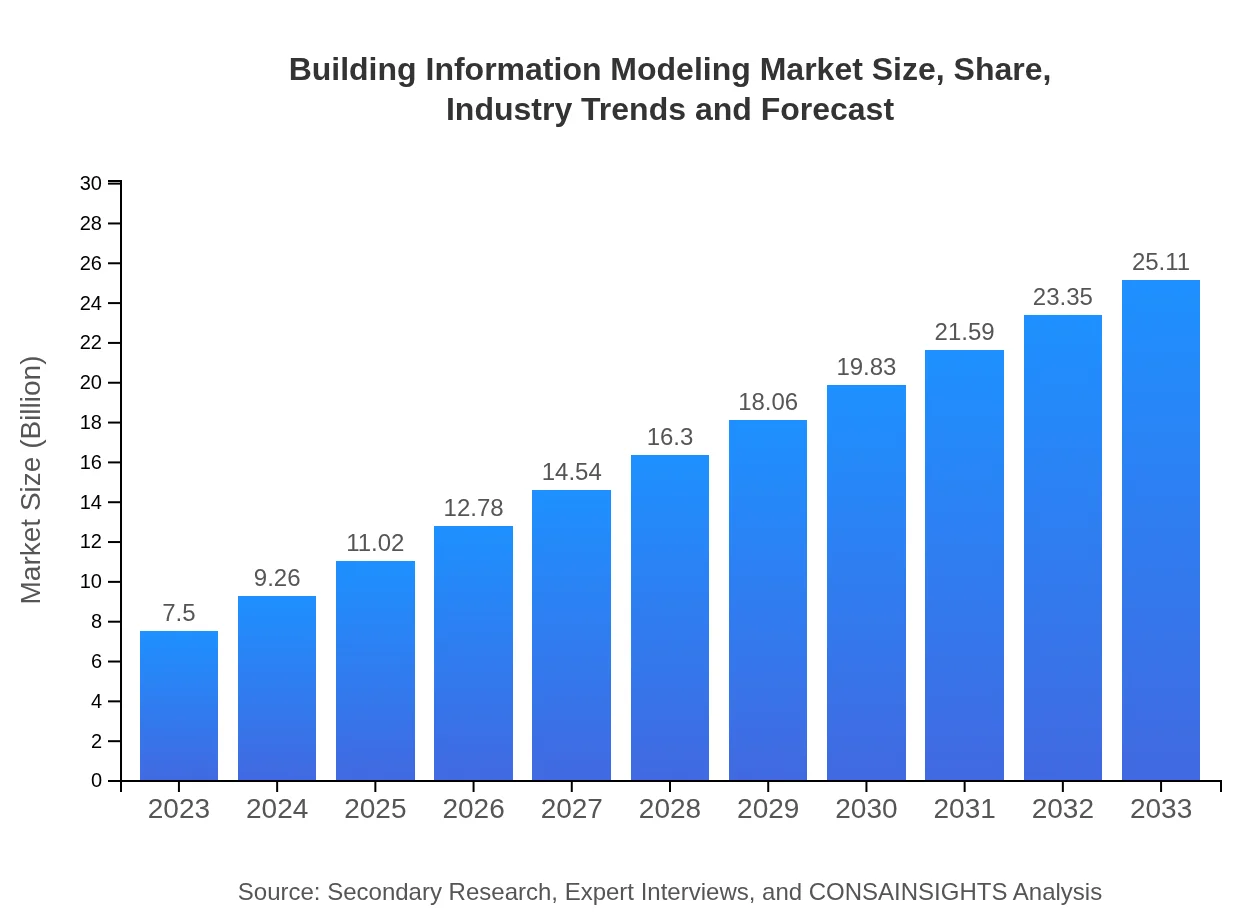

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $25.11 Billion |

| Top Companies | Autodesk , Bentley Systems, Trimble, Graphisoft, Nemetschek |

| Last Modified Date | 22 January 2026 |

Building Information Modeling Market Overview

Customize Building Information Modeling Market Report market research report

- ✔ Get in-depth analysis of Building Information Modeling market size, growth, and forecasts.

- ✔ Understand Building Information Modeling's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Building Information Modeling

What is the Market Size & CAGR of Building Information Modeling market in 2023?

Building Information Modeling Industry Analysis

Building Information Modeling Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Building Information Modeling Market Analysis Report by Region

Europe Building Information Modeling Market Report:

Europe presents a substantial BIM market size, anticipated to grow from $1.82 billion in 2023 to $6.09 billion by 2033, driven by an increasing need for digitalization in the construction sector and strong EU regulations on energy efficiency.Asia Pacific Building Information Modeling Market Report:

In the Asia Pacific region, the BIM market is expected to grow significantly, from $1.45 billion in 2023 to $4.85 billion by 2033. Key drivers include rapid urbanization, infrastructure development, and increased government investment in smart city initiatives.North America Building Information Modeling Market Report:

North America shows a robust BIM market size of $2.81 billion in 2023, expected to reach $9.39 billion by 2033. The region benefits from early adoption of technology, significant investment in infrastructure, and stringent regulatory requirements around building codes.South America Building Information Modeling Market Report:

The South American BIM market is projected to expand from $0.70 billion in 2023 to $2.35 billion in 2033. The growth is spurred by a rising focus on sustainable development and regulatory frameworks promoting modern construction practices.Middle East & Africa Building Information Modeling Market Report:

The Middle East and Africa BIM market, valued at $0.72 billion in 2023, is projected to escalate to $2.43 billion by 2033, mainly due to mega construction projects and government initiatives focused on economic diversification and infrastructure development.Tell us your focus area and get a customized research report.

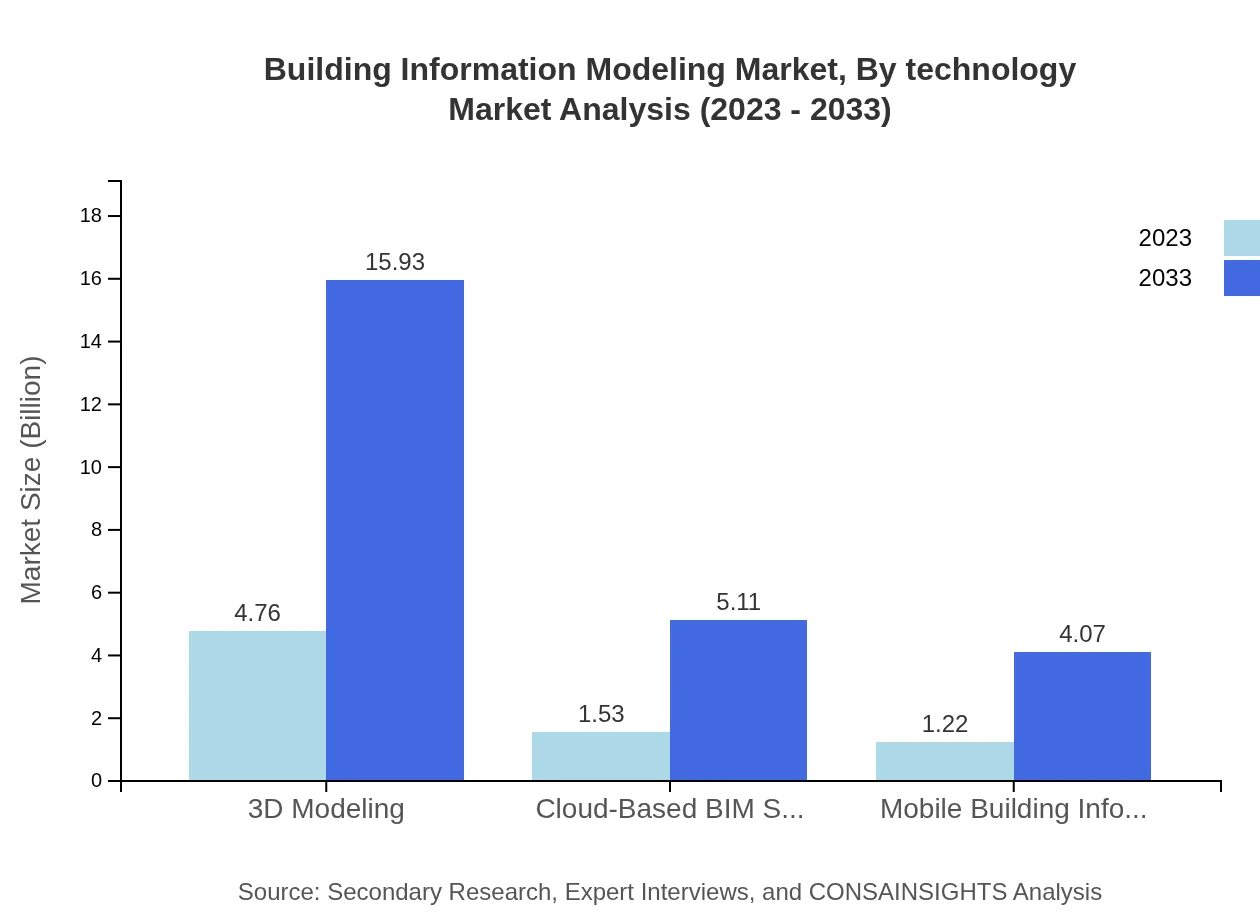

Building Information Modeling Market Analysis By Technology

BIM technologies are categorized into several key segments. As of 2023, 3D modeling dominates the market at $4.76 billion, representing 63.43% market share. Following this, cloud-based BIM solutions and mobile solutions hold significant market positions, with sizes of $1.53 billion and $1.22 billion respectively, facilitating greater accessibility and collaboration.

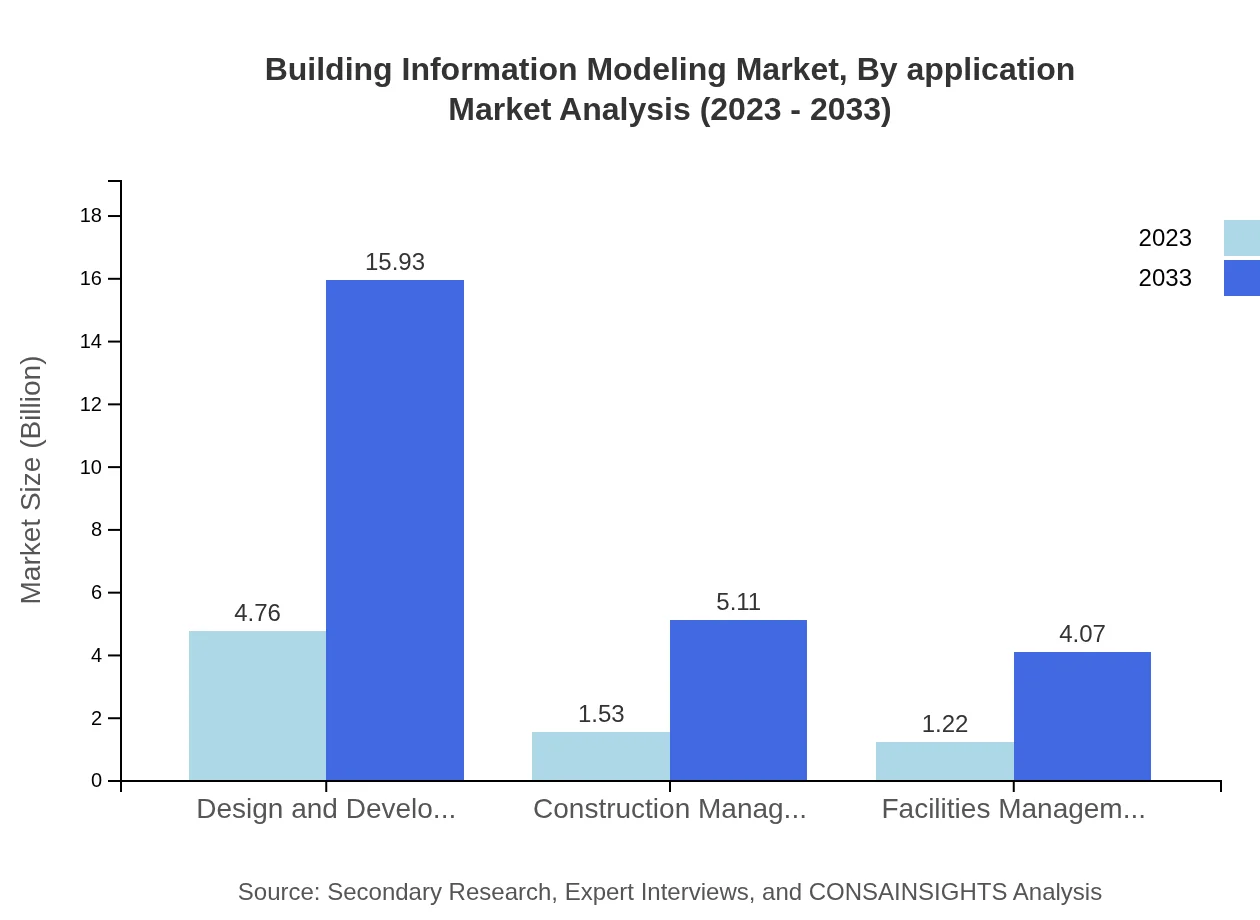

Building Information Modeling Market Analysis By Application

The BIM market application is primarily segmented into architecture, engineering, and construction. Architecture holds the largest share at 54.28% in 2023, valued at $4.07 billion, while engineering is also substantial with a $1.61 billion valuation. These segments are critical for the initial design and planning phases of construction projects.

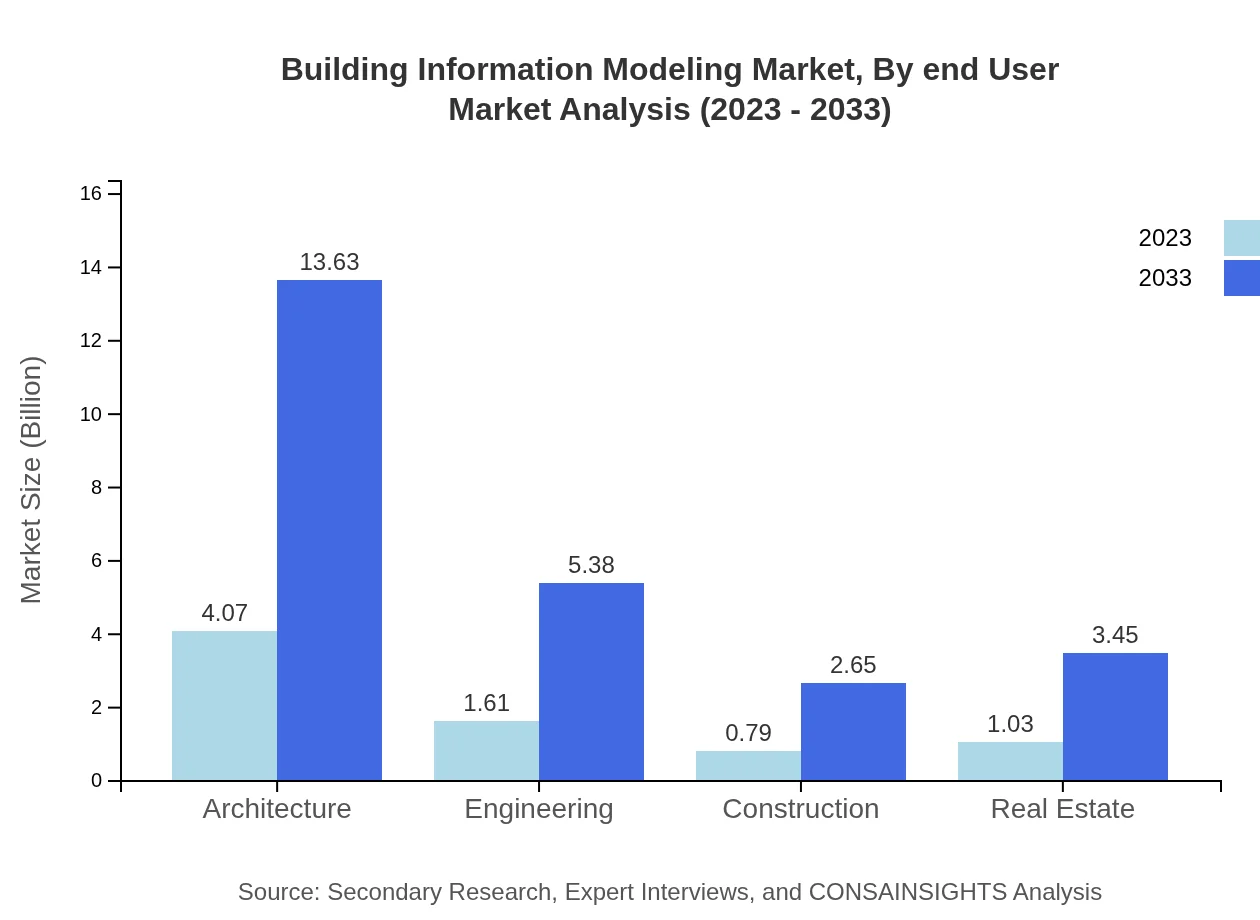

Building Information Modeling Market Analysis By End User

End-users of BIM technologies include construction companies, real estate developers, and government entities. Construction firms dominate the landscape, requiring efficient project management solutions, while real estate developers rely on BIM for enhanced visualization and project proposals.

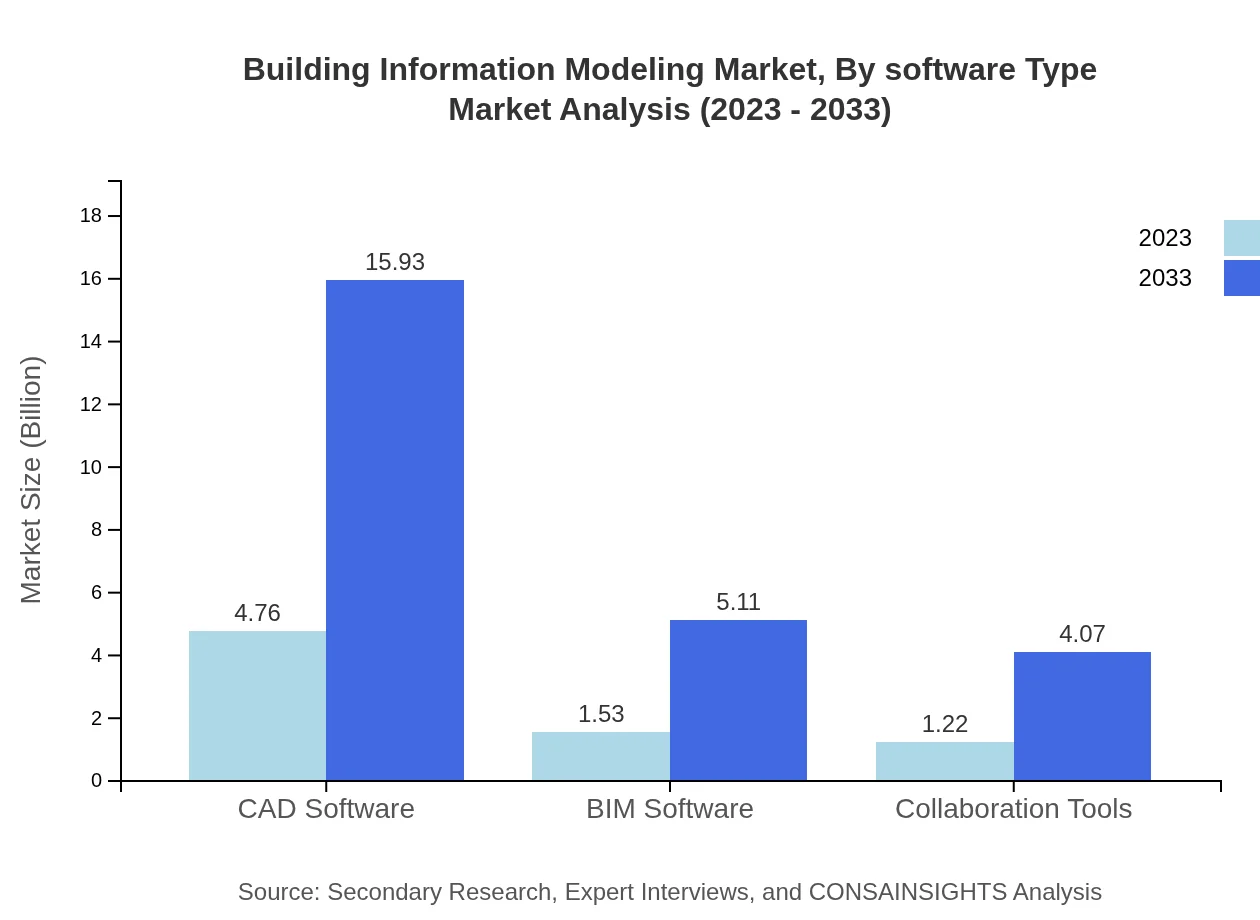

Building Information Modeling Market Analysis By Software Type

BIM software encompasses CAD software, collaboration tools, and specialized BIM software. CAD software leads the market at $4.76 billion in 2023, while collaboration tools represent $1.22 billion. The integration of these software types enhances workflow efficiency and information sharing.

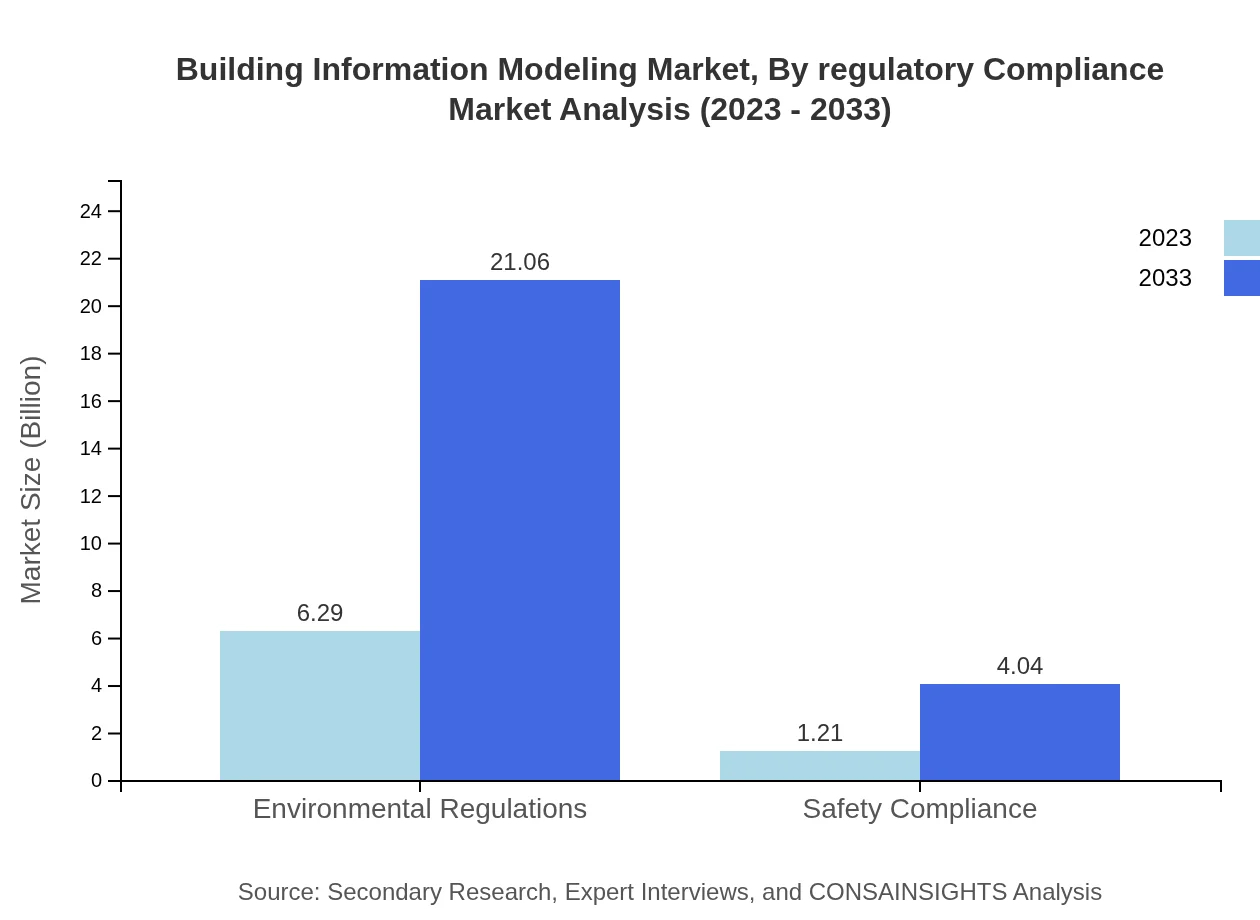

Building Information Modeling Market Analysis By Regulatory Compliance

The market is significantly influenced by environmental regulations and safety compliance standards. As of 2023, environmental regulations generate a market size of $6.29 billion, underscoring the increasing demands for sustainable construction practices, while safety compliance contributes $1.21 billion.

Building Information Modeling Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Building Information Modeling Industry

Autodesk :

A pioneer in BIM, Autodesk provides a comprehensive range of software solutions that include AutoCAD, Revit, and BIM 360, empowering professionals in design, engineering, and construction.Bentley Systems:

Bentley is known for its engineering and infrastructure solutions, offering advanced tools that enhance project delivery and management, optimizing the asset lifecycle.Trimble:

Trimble specializes in information technology and hardware solutions for construction, providing tools that integrate field and design data for better project execution.Graphisoft:

Developer of ArchiCAD, Graphisoft specializes in intuitive BIM solutions catered to architects, ensuring efficient design processes and seamless collaboration.Nemetschek:

Nemetschek offers a diverse range of design and construction management software solutions, focusing on digital collaboration and optimized workflows.We're grateful to work with incredible clients.

FAQs

What is the market size of Building Information Modeling?

The Building Information Modeling market is projected to reach approximately $7.5 billion by 2033, growing at a CAGR of 12.3% from the current valuation. This growth reflects the increasing adoption and integration of advanced modeling technologies across various segments.

What are the key market players or companies in the Building Information Modeling industry?

Key players in the Building Information Modeling market include renowned companies like Autodesk, Trimble, Bentley Systems, and Nemetschek. These organizations lead in innovation and development, influencing market trends and technological advancements in BIM.

What are the primary factors driving the growth in the Building Information Modeling industry?

Growth in the Building Information Modeling industry is primarily driven by increasing demand for collaborative project management tools, the need for enhanced project visualization, and rising investments in construction technologies. Additionally, digital transformation initiatives are pushing BIM adoption.

Which region is the fastest Growing in the Building Information Modeling market?

In the Building Information Modeling market, North America is currently the fastest-growing region, projected to expand from $2.81 billion in 2023 to $9.39 billion by 2033, led by a robust construction sector and technological innovation.

Does ConsaInsights provide customized market report data for the Building Information Modeling industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Building Information Modeling industry. This customization ensures that businesses receive the most relevant and up-to-date insights to support strategic decisions.

What deliverables can I expect from this Building Information Modeling market research project?

From the Building Information Modeling market research project, expect comprehensive reports detailing market analyses, growth projections, competitive landscapes, and segmented data across various regions and technologies. Visualization tools and executive summaries are also included.

What are the market trends of Building Information Modeling?

Current trends in the Building Information Modeling market include the rising use of cloud-based solutions, the integration of AI and machine learning, and the focus on sustainable construction practices. These trends are vital for enhancing operational efficiency and project outcomes.