Bunker Fuel Market Report

Published Date: 22 January 2026 | Report Code: bunker-fuel

Bunker Fuel Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Bunker Fuel market, including current trends, market size, and forecasts through 2033. It covers segmentation, regional insights, and key players within the industry, aimed at delivering valuable insights for stakeholders and investors.

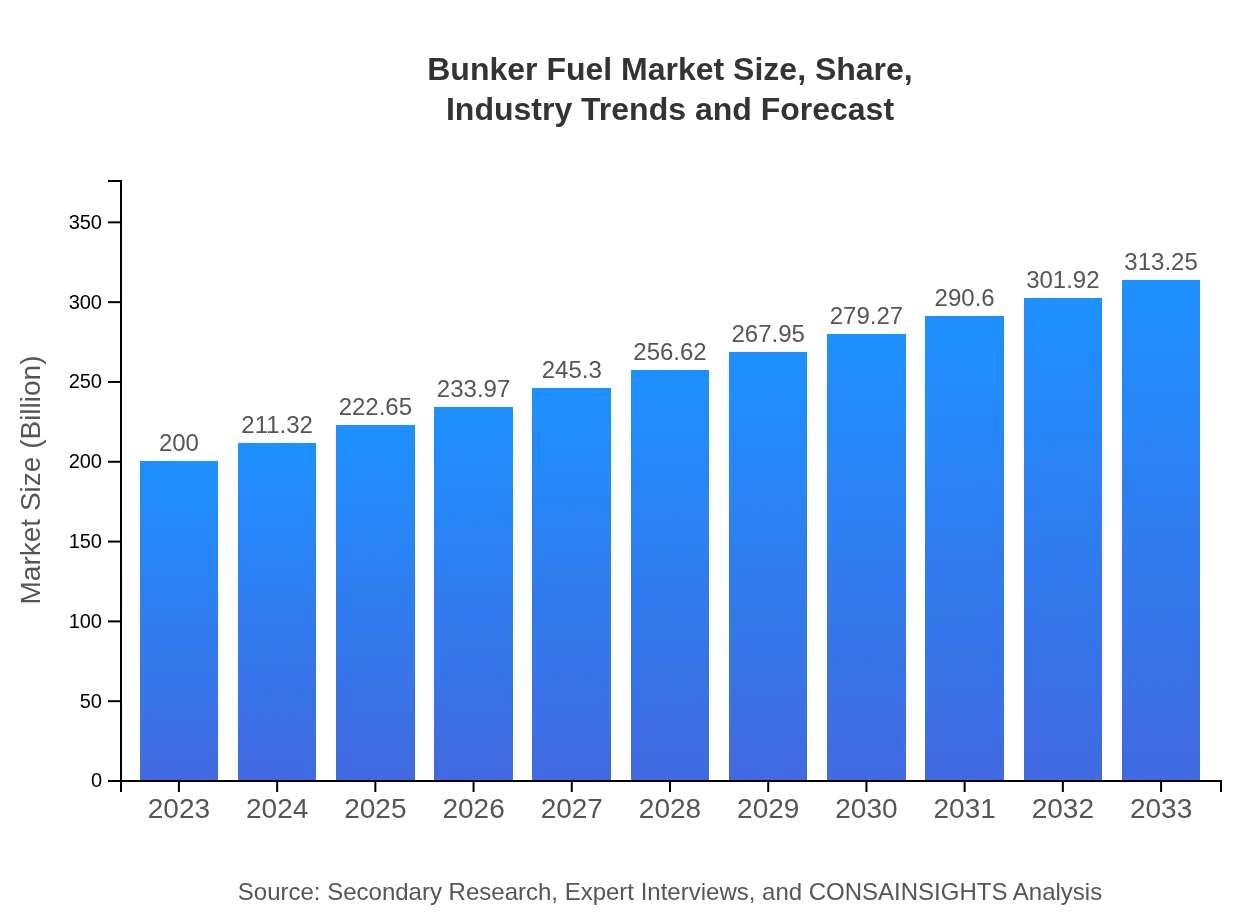

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $200.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $313.25 Billion |

| Top Companies | Bunker Holding, GAC, World Fuel Services, SEACOR Marine |

| Last Modified Date | 22 January 2026 |

Bunker Fuel Market Overview

Customize Bunker Fuel Market Report market research report

- ✔ Get in-depth analysis of Bunker Fuel market size, growth, and forecasts.

- ✔ Understand Bunker Fuel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bunker Fuel

What is the Market Size & CAGR of Bunker Fuel market in 2023?

Bunker Fuel Industry Analysis

Bunker Fuel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bunker Fuel Market Analysis Report by Region

Europe Bunker Fuel Market Report:

valued at $64.40 billion in 2023, the European Bunker Fuel market is projected to escalate to $100.87 billion by 2033. The region's focus on sustainability and stringent regulations promotes innovation, pushing towards the adoption of low sulfur fuel options and alternative fuels.Asia Pacific Bunker Fuel Market Report:

In 2023, the Asia Pacific Bunker Fuel market was valued at $36.26 billion and is projected to reach $56.79 billion by 2033, reflecting a growing demand spurred by increasing trade activities. Significant players in the region are adapting to both regulatory changes and shifting consumer preferences towards less polluting fuel types.North America Bunker Fuel Market Report:

North America’s Bunker Fuel market reached approximately $71.36 billion in 2023 and is anticipated to grow to $111.77 billion by 2033. The presence of advanced port facilities and stringent emission regulations drives the demand for cleaner fuels, leading to substantial market shifts.South America Bunker Fuel Market Report:

The South American Bunker Fuel market, valued at $17.60 billion in 2023, is expected to grow to $27.57 billion by 2033. The market is characterized by a relatively nascent regulatory environment, making it an attractive area for investment as maritime activities expand.Middle East & Africa Bunker Fuel Market Report:

The Bunker Fuel market in the Middle East and Africa was valued at $10.38 billion in 2023, with a forecast of reaching $16.26 billion by 2033. The growth can be attributed to an increase in offshore oil exploration and shipping activities in transitional waters.Tell us your focus area and get a customized research report.

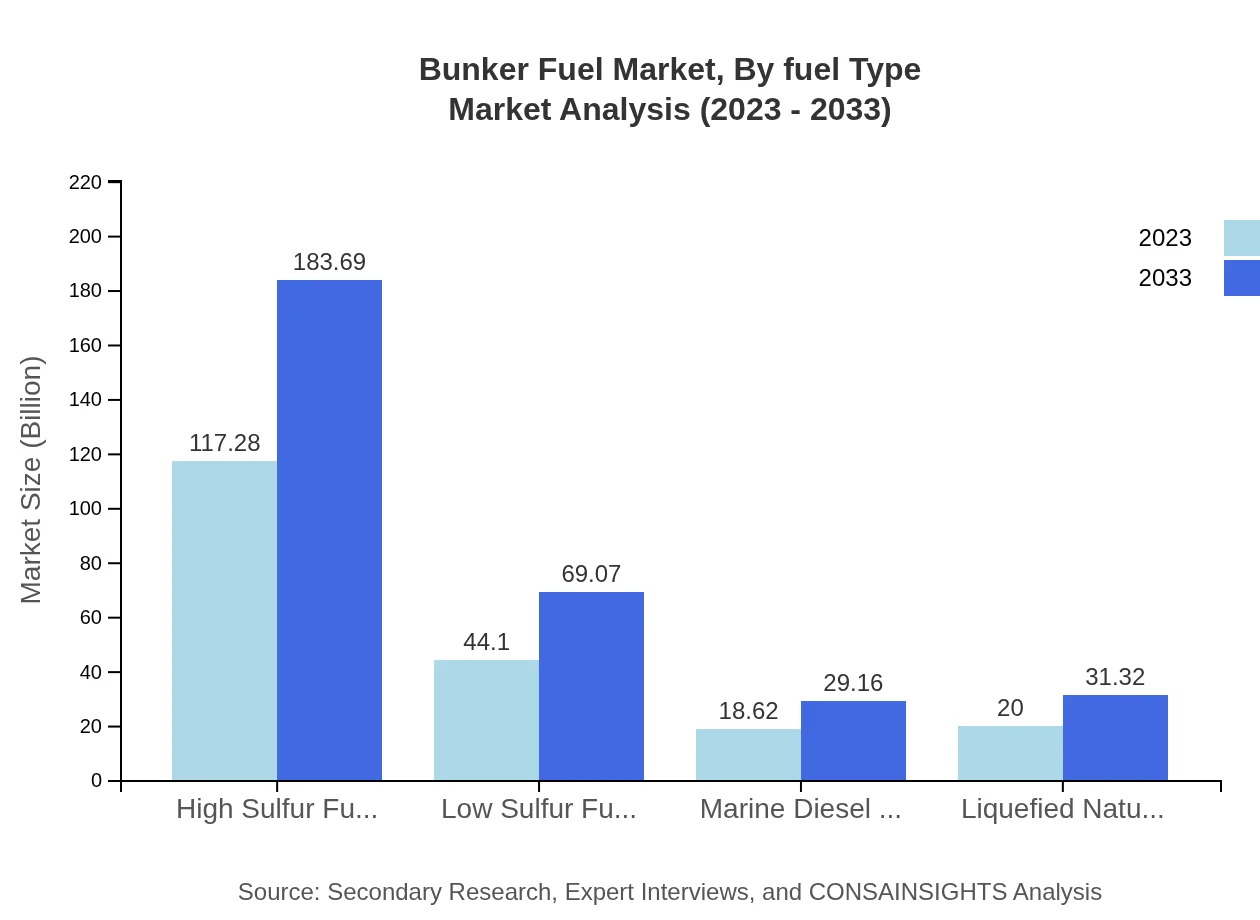

Bunker Fuel Market Analysis By Fuel Type

The largest segment by fuel type is High Sulfur Fuel Oil (HSFO), anticipated to dominate the market with a size of $117.28 billion in 2023 and grow to $183.69 billion by 2033, maintaining a 58.64% market share. Conversely, Low Sulfur Fuel Oil (LSFO) is also gaining traction, from $44.10 billion in 2023 to $69.07 billion by 2033, reflecting a growing preference for compliant fuel types.

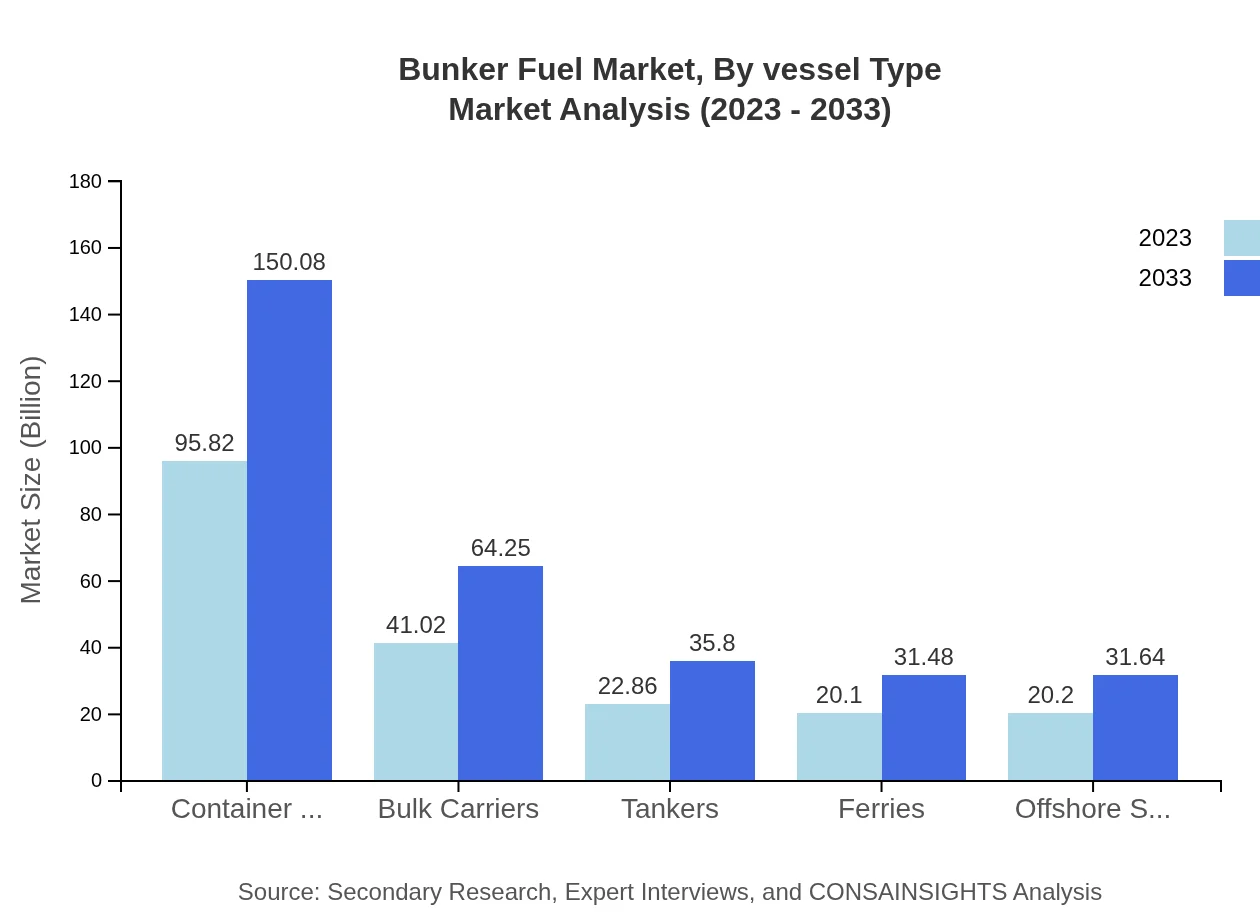

Bunker Fuel Market Analysis By Vessel Type

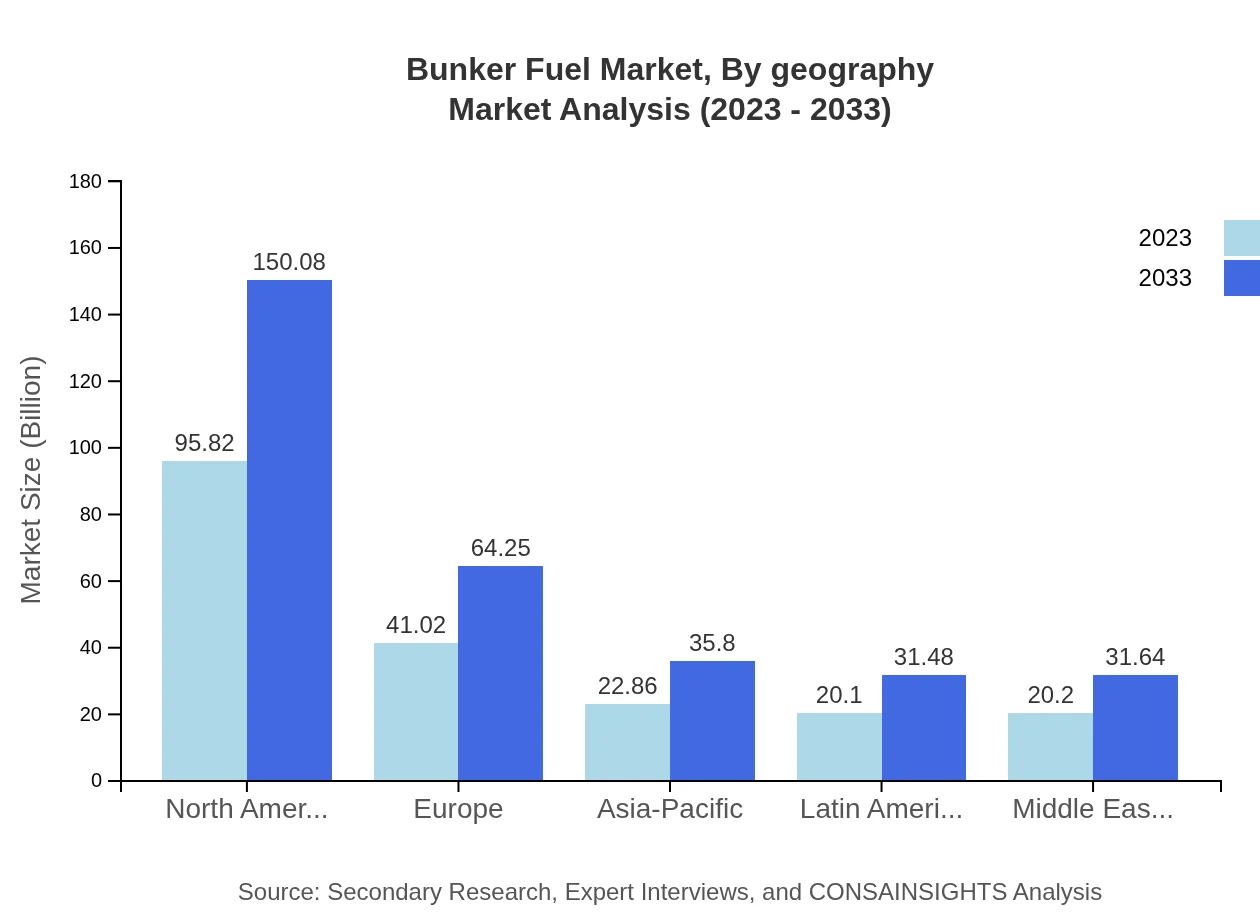

Container Ships lead Bunker Fuel consumption, carrying a market size of $95.82 billion in 2023, projected to reach $150.08 billion by 2033. This is alongside Bulk Carriers, valued at $41.02 billion in 2023 and expected to grow to $64.25 billion by 2033, making them crucial consumers in the industry.

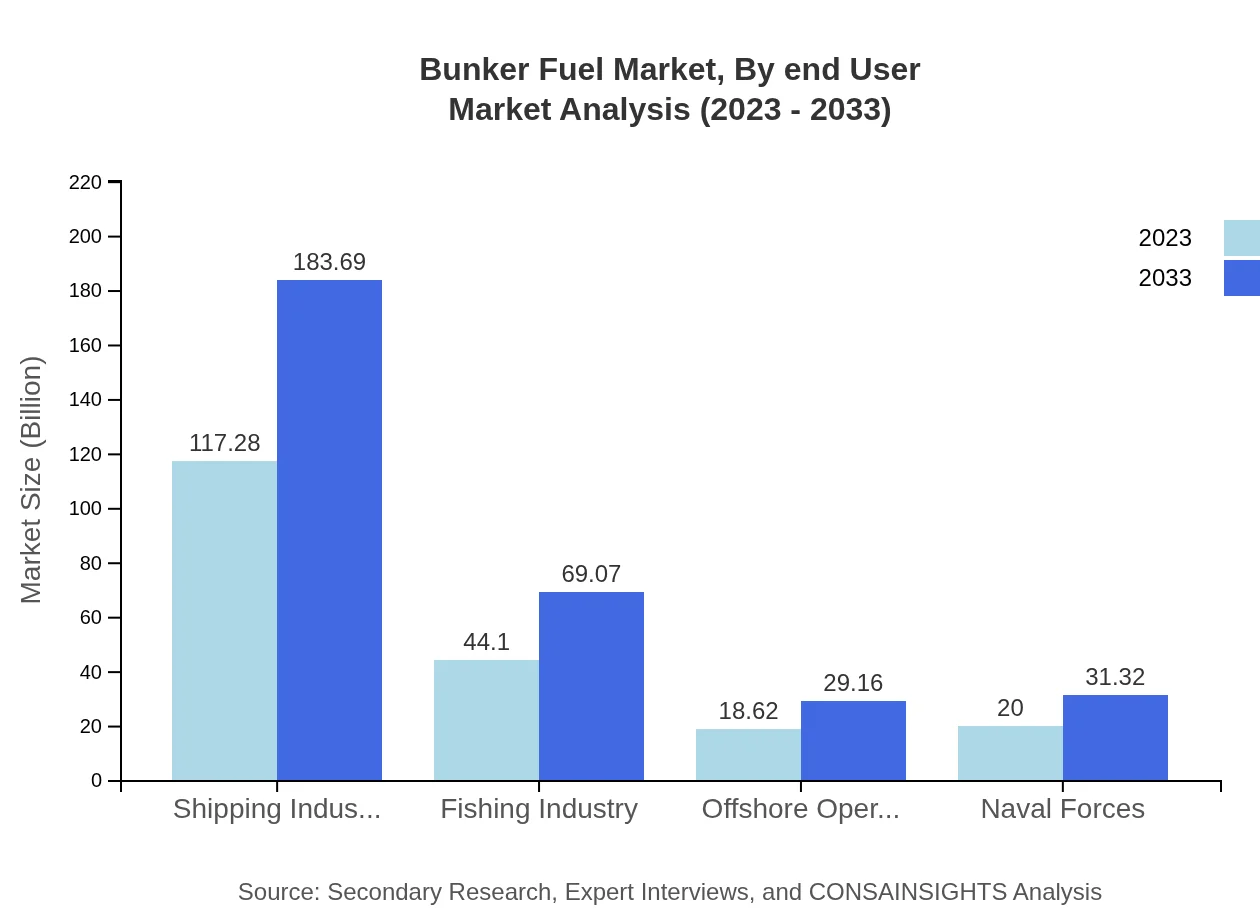

Bunker Fuel Market Analysis By End User

The shipping industry continues to be the primary consumer of Bunker Fuel, with a size of $117.28 billion in 2023, projected to grow to $183.69 billion by 2033. The fishing industry also represents a significant portion, expanding from $44.10 billion in 2023 to $69.07 billion by 2033.

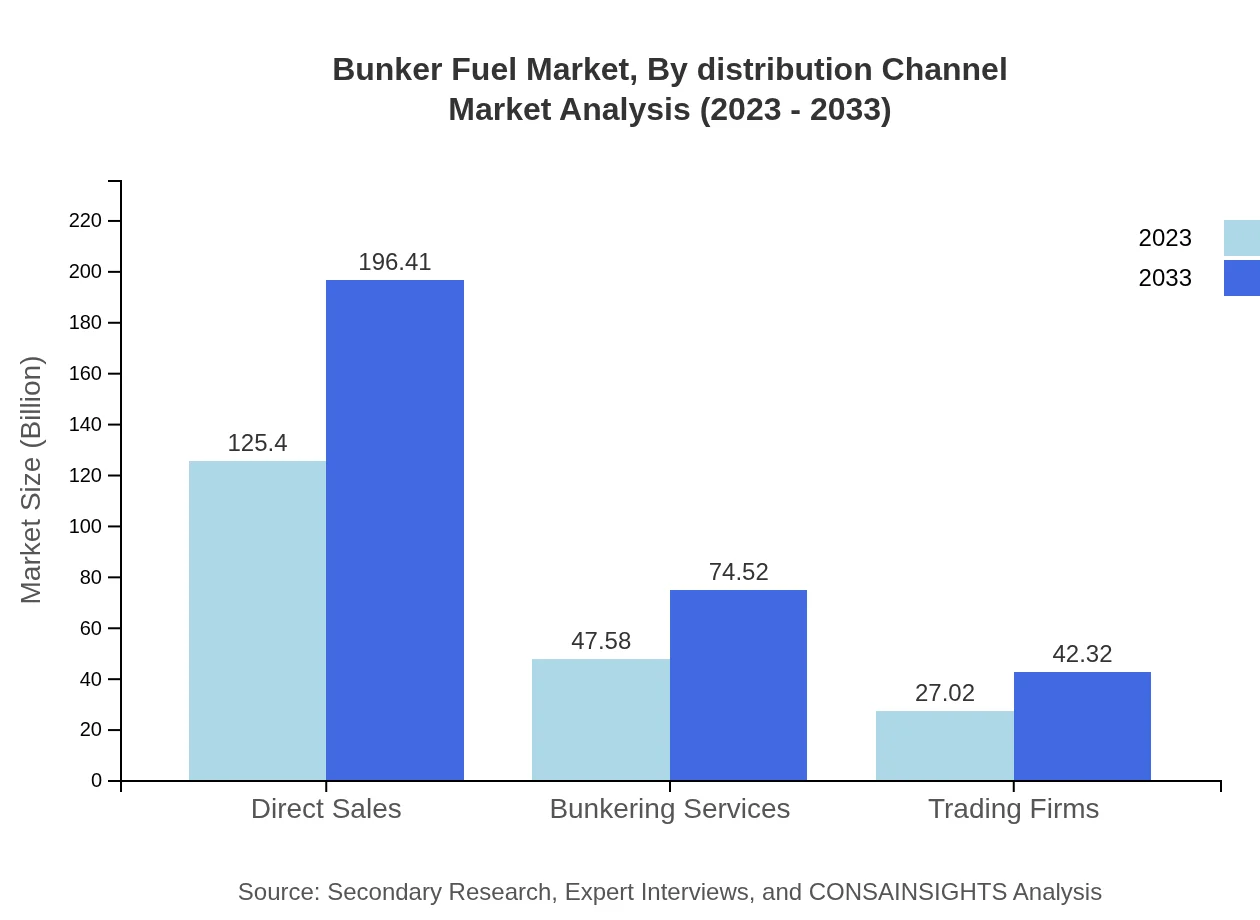

Bunker Fuel Market Analysis By Distribution Channel

Direct sales contribute significantly to the market, holding a size of $125.40 billion in 2023, anticipated to reach $196.41 billion by 2033, indicating a strong preference for consumer-direct arrangements. Bunkering services are also vital, expected to grow from $47.58 billion in 2023 to $74.52 billion by 2033.

Bunker Fuel Market Analysis By Geography

Geographically, North America leads with a size of $95.82 billion in 2023, while Europe follows closely at $41.02 billion. Each region's market dynamics differ due to local regulations, economic activity, and the presence of major shipping routes.

Bunker Fuel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bunker Fuel Industry

Bunker Holding:

A leading global supplier of Bunker Fuel, known for its comprehensive network that spans across key shipping lanes and a commitment to quality and sustainability.GAC:

An integrated logistics and shipping company that provides a wide range of bunkering services alongside fuel supply, recognized for its excellent customer service and operational efficiency.World Fuel Services:

A major player in the fuel supply business, offering Bunker Fuel and related services to marine and aviation sectors, focused on technological advancement.SEACOR Marine:

Specializes in the supply of energy and transportation logistics, contributing significantly to the Bunker Fuel sector with innovations in fuel management.We're grateful to work with incredible clients.

FAQs

What is the market size of bunker Fuel?

The global bunker fuel market is valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of 4.5% through 2033, indicating sustained demand for marine fuels across major shipping industries.

What are the key market players or companies in the bunker Fuel industry?

Key players in the bunker-fuel market include major oil companies, independent fuel suppliers, and marine service providers who dominate various segments like shipping and fishing. Their competitive strategies shape market dynamics and drive innovation.

What are the primary factors driving the growth in the bunker Fuel industry?

Growth in the bunker-fuel industry is driven by increasing global trade, a rise in shipping traffic, and regulatory advancements aimed at reducing marine emissions. Sustainable fuel alternatives and technological advancements also contribute to this expansion.

Which region is the fastest Growing in the bunker Fuel market?

North America is the fastest-growing region in the bunker-fuel market, expected to reach approximately $111.77 billion by 2033, up from $71.36 billion in 2023. This growth reflects rising shipping operations and increased fuel demand.

Does ConsaInsights provide customized market report data for the bunker Fuel industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the bunker-fuel industry, enhancing strategic decision-making and allowing businesses to adapt to market changes effectively.

What deliverables can I expect from this bunker Fuel market research project?

Clients can expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscapes, and segmentation data that provide valuable insights into trends and opportunities in the bunker-fuel market.

What are the market trends of bunker Fuel?

Current trends in the bunker-fuel market include a shift towards low sulfur fuels, increasing adoption of cleaner alternatives, technological advancements in fuel efficiency, and evolving regulatory frameworks aiming to reduce emissions in maritime operations.