Busbar Market Report

Published Date: 22 January 2026 | Report Code: busbar

Busbar Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Busbar industry, highlighting trends, forecasts, and detailed insights from 2023 to 2033. It covers market segmentation, size, leaders, and regional performance, essential for stakeholders making informed decisions.

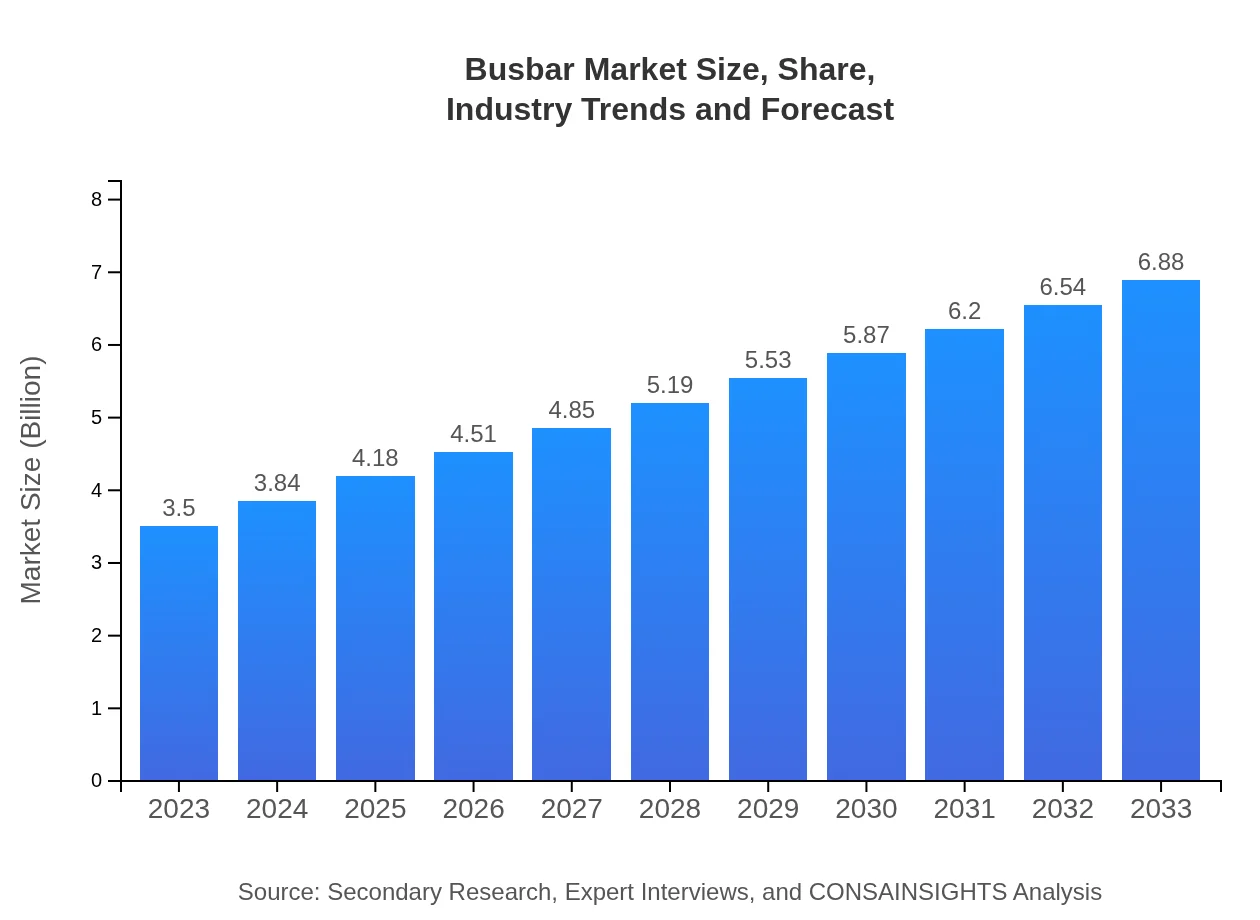

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $6.88 Billion |

| Top Companies | Schneider Electric, ABB Ltd., Siemens AG, Eaton Corporation |

| Last Modified Date | 22 January 2026 |

Busbar Market Overview

Customize Busbar Market Report market research report

- ✔ Get in-depth analysis of Busbar market size, growth, and forecasts.

- ✔ Understand Busbar's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Busbar

What is the Market Size & CAGR of Busbar market in {Year}?

Busbar Industry Analysis

Busbar Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Busbar Market Analysis Report by Region

Europe Busbar Market Report:

The European Busbar market is anticipated to rise from $0.95 billion in 2023 to $1.88 billion by 2033, indicating a CAGR of 7.1%. Europe’s focus on sustainability and upgrading electrical grids to accommodate renewable energy sources is a significant growth driver.Asia Pacific Busbar Market Report:

In the Asia Pacific region, the Busbar market is expected to see an increase from $0.70 billion in 2023 to $1.37 billion by 2033, a CAGR of 7.1%. This growth is attributed to rapid urbanization and industrialization in emerging economies like China and India, alongside increased investments in renewable energy and electricity infrastructure improvements.North America Busbar Market Report:

North America is forecasted to expand from $1.29 billion in 2023 to $2.53 billion by 2033, at a CAGR of 7.1%. High demand for advanced electrical systems, driven by an increase in data centers and energy-efficient building solutions, supports growth in this region.South America Busbar Market Report:

The South American market is projected to grow from $0.28 billion in 2023 to $0.54 billion by 2033, reflecting a CAGR of 6.9%. The region’s development efforts in energy generation and distribution, coupled with government initiatives to enhance energy accessibility, are driving this growth.Middle East & Africa Busbar Market Report:

In the Middle East and Africa, the market is set to grow from $0.28 billion in 2023 to $0.56 billion by 2033, with a CAGR of 6.9%. Investments in infrastructure and economic diversification strategies in the region's primary markets are enabling a more robust electrical distribution framework.Tell us your focus area and get a customized research report.

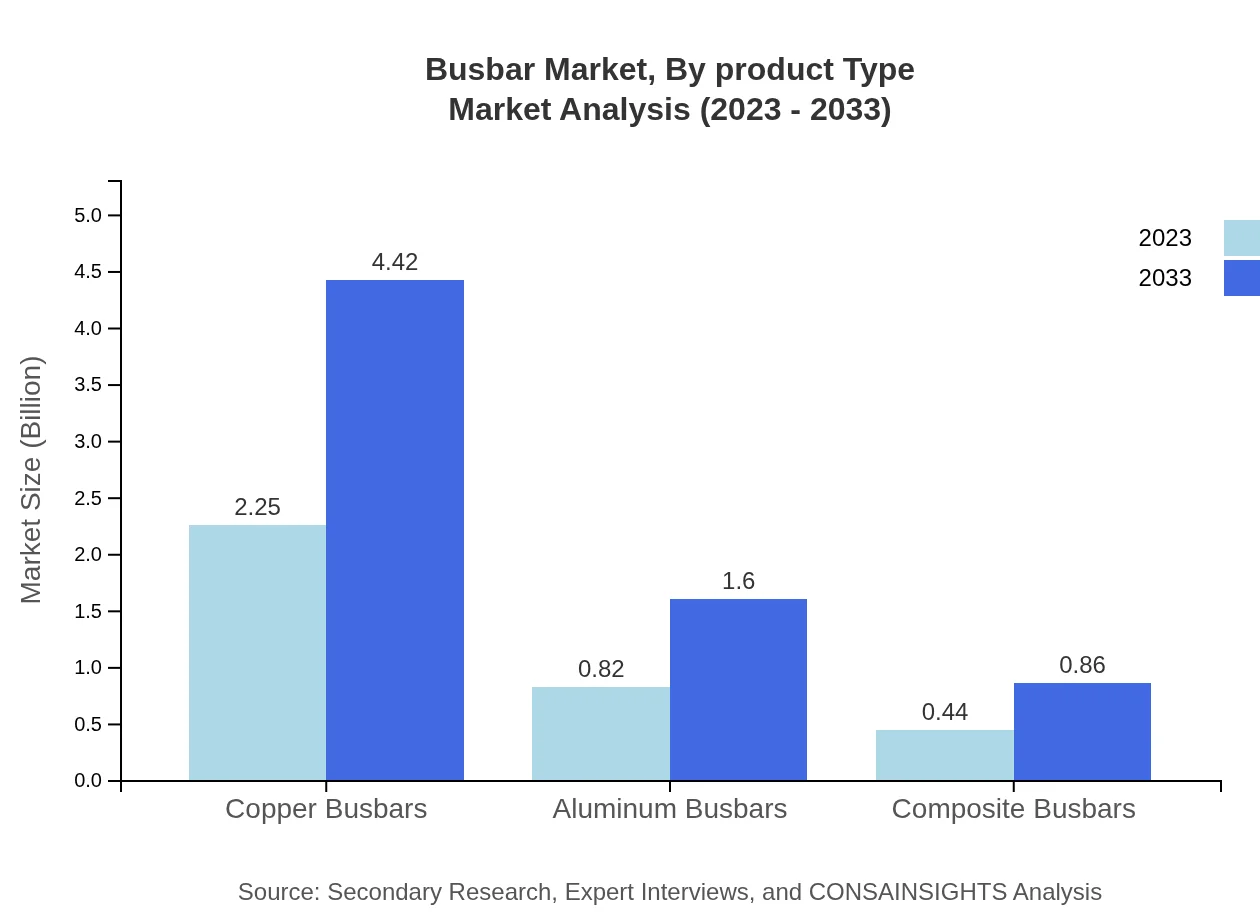

Busbar Market Analysis By Product Type

By product type, the Busbar market indicates significant performance variations. For instance, Copper Busbars accounted for $2.25 billion in 2023 and are expected to grow to $4.42 billion by 2033, maintaining a steady market share of approximately 64.19%. Aluminum Busbars also show promising growth, expanding from $0.82 billion to $1.60 billion over the same period. Composite Busbars, while smaller at $0.44 billion, are expected to reach $0.86 billion, reflecting increasing interest in lightweight and durable solutions.

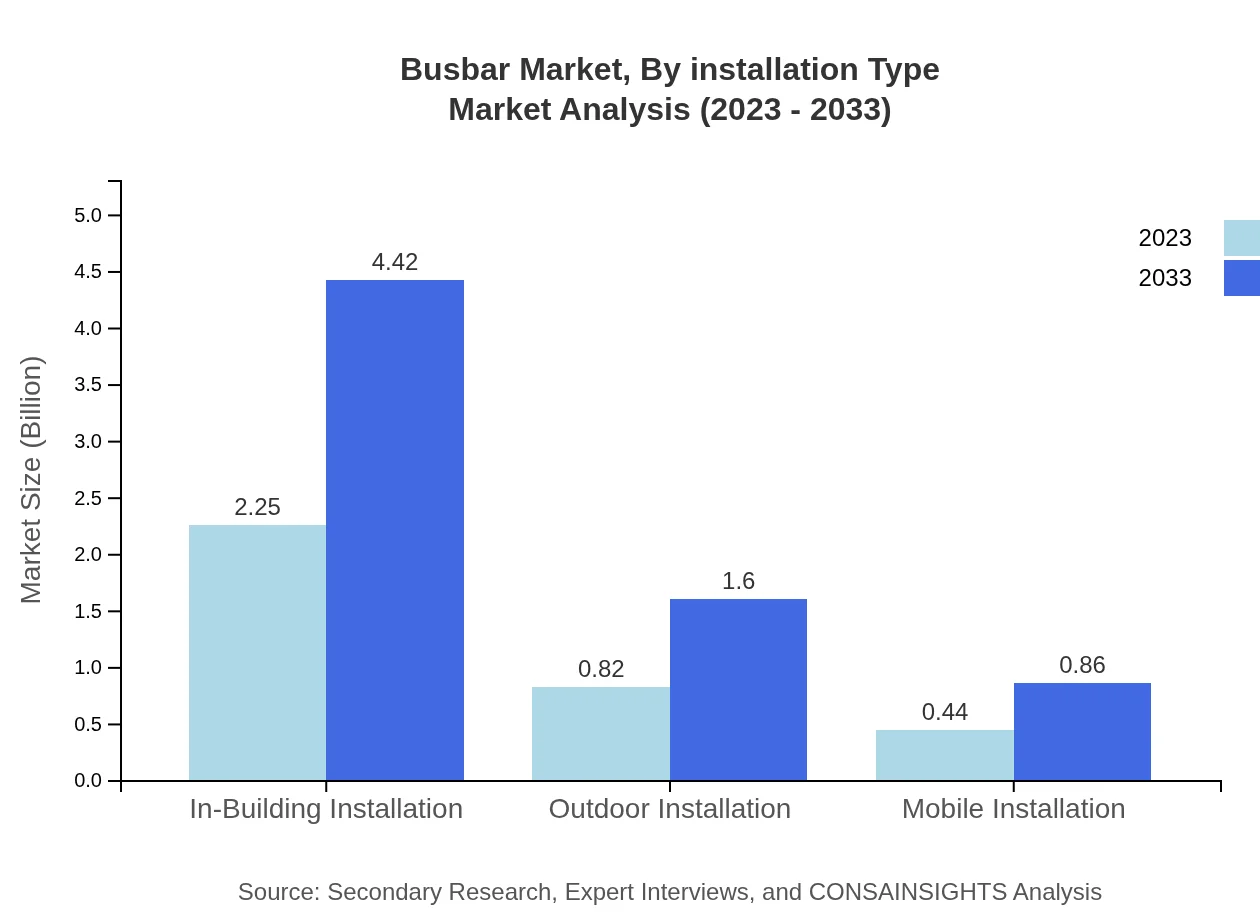

Busbar Market Analysis By Installation Type

The Busbar market is segmented into In-Building, Outdoor, and Mobile installations. In-Building installations dominate the landscape with a market size of $2.25 billion, growing to $4.42 billion by 2033, maintaining a share of 64.19%. Outdoor installations, accounting for $0.82 billion, are projected to grow to $1.60 billion, while Mobile installations, valued at $0.44 billion, are expected to reach $0.86 billion, indicating diversified application potential across sectors.

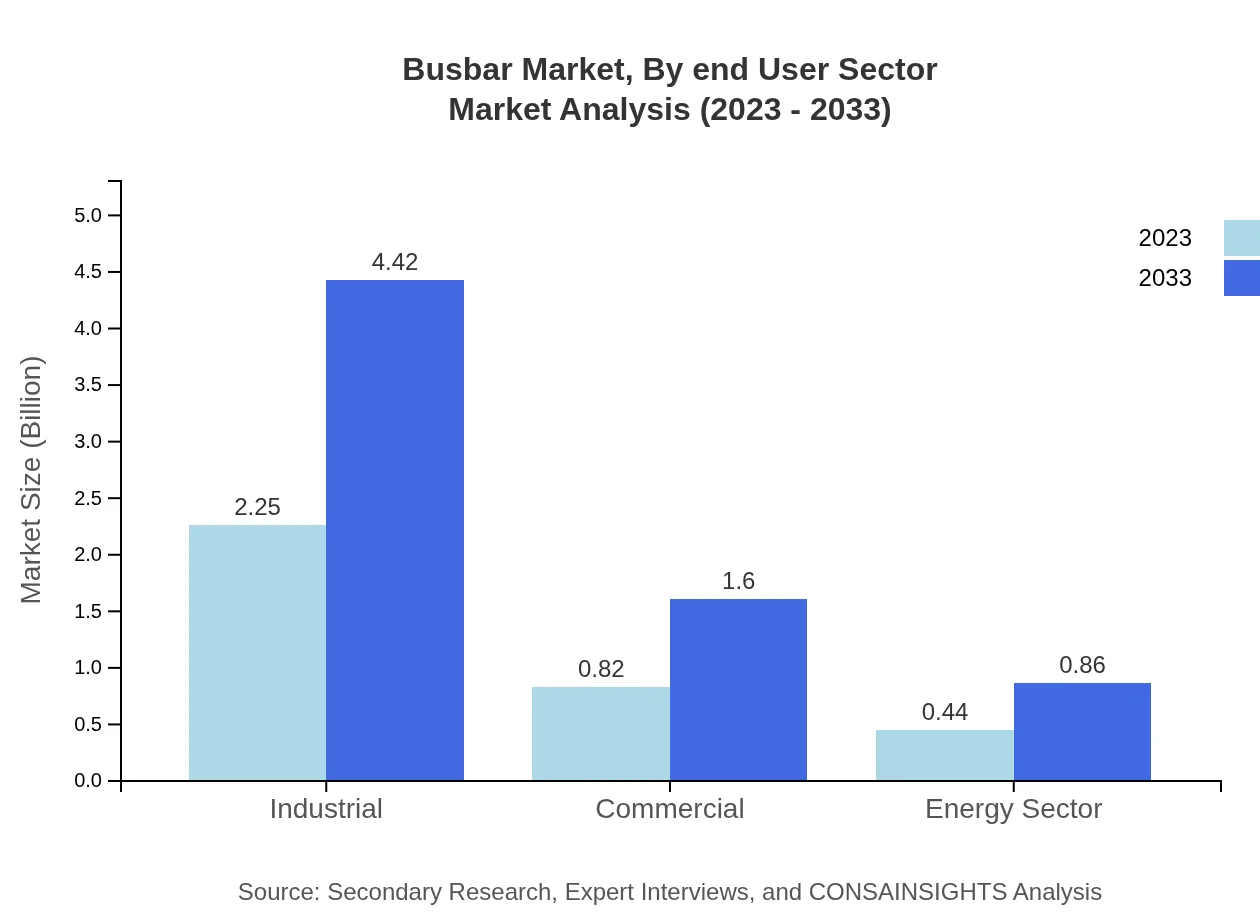

Busbar Market Analysis By End User Sector

The end-user sector segmentation highlights Industrial, Commercial, and Energy segments. The Industrial sector leads with $2.25 billion in 2023, projected to reach $4.42 billion by 2033, maintaining a substantial market share of 64.19%. Commercial sector installations, currently at $0.82 billion, are expected to grow to $1.60 billion, while the Energy sector will grow from $0.44 billion to $0.86 billion, reflecting growing reliance on stable power distribution.

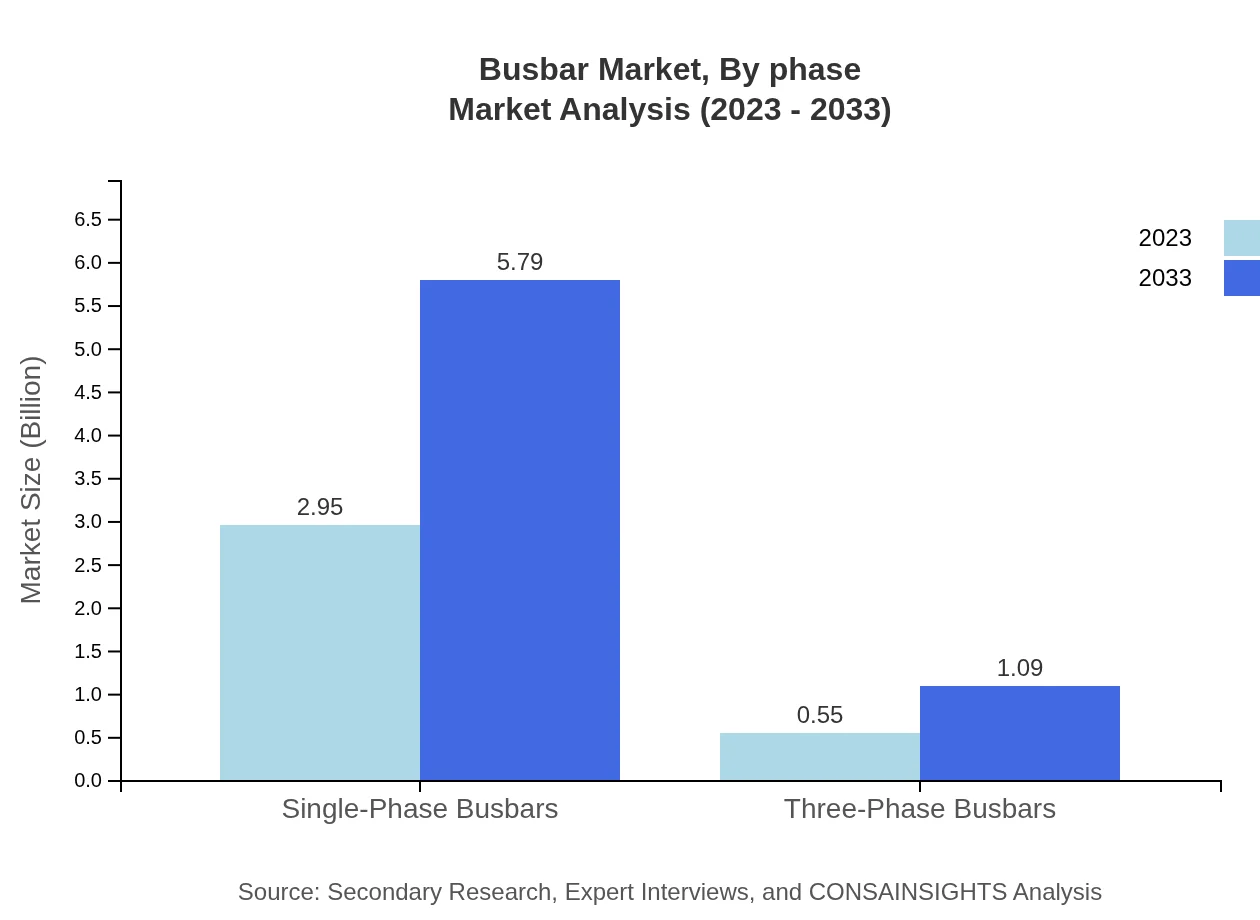

Busbar Market Analysis By Phase

The Busbar market is divided by phase into Single-Phase and Three-Phase systems. Single-Phase Busbars dominate both current size and share, valued at $2.95 billion in 2023 and projected to reach $5.79 billion by 2033, maintaining a remarkable market share of 84.22%. Meanwhile, Three-Phase Busbars show growth from $0.55 billion to $1.09 billion, indicating an evolving demand driven by advanced industrial applications.

Busbar Market Analysis By Technology

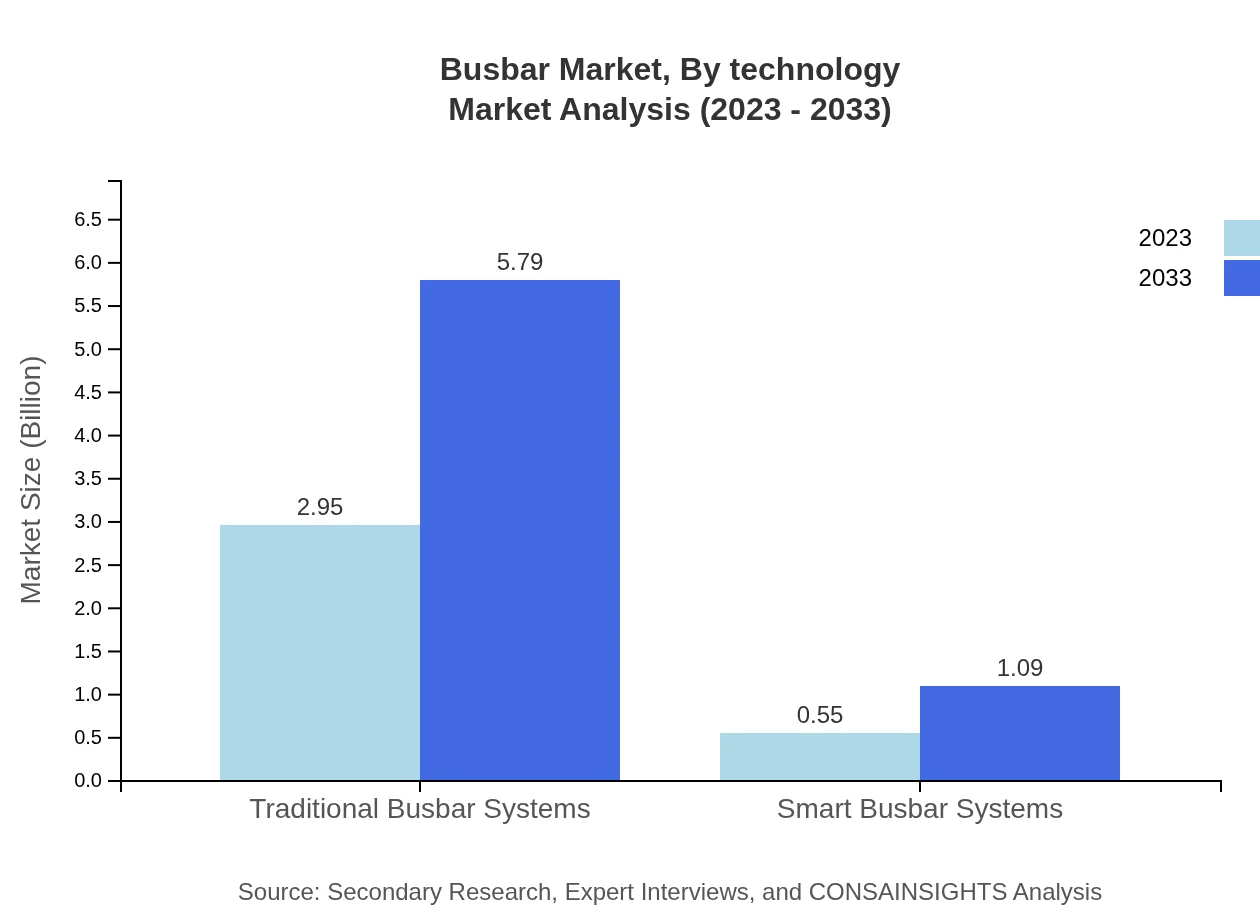

In terms of technology, the market is moving towards Smart and Traditional Busbar systems. Traditional Busbar systems currently hold a dominant market share, projected to retain their significance with $2.95 billion growing to $5.79 billion by 2033. Smart Busbar systems, while currently at a smaller size of $0.55 billion, are set to double in size by 2033, showcasing the market's shift towards automation and intelligent monitoring solutions.

Busbar Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Busbar Industry

Schneider Electric:

Schneider Electric is a multinational corporation specializing in energy management and automation solutions, providing innovative Busbar systems that enhance electrical efficiency.ABB Ltd.:

ABB leads in power and automation technologies, producing a range of busbar products that improve the reliability and efficiency of power distribution networks.Siemens AG:

Siemens AG is a prominent player in digital industries, focusing on automation and digitalization in industries, including advanced busbar systems.Eaton Corporation:

Eaton offers a broad portfolio of busbar solutions for various applications, emphasizing safety, innovation, and energy efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Busbar?

The global busbar market is projected to reach $3.5 billion by 2033, growing at a CAGR of 6.8% from its current valuation.

What are the key market players or companies in the Busbar industry?

Key players in the busbar market include Schneider Electric, Eaton Corporation, Siemens AG, and ABB Ltd., amongst others, recognized for their innovation and extensive product portfolios.

What are the primary factors driving the growth in the Busbar industry?

Growth drivers include increasing demand for reliable power distribution, urbanization, investments in infrastructure, and advancements in busbar technology enhancing operational efficiency.

Which region is the fastest Growing in the Busbar industry?

The Asia Pacific region is the fastest-growing market for busbars, expected to increase significantly from $0.70 billion in 2023 to $1.37 billion by 2033.

Does ConsaInsights provide customized market report data for the Busbar industry?

Yes, ConsaInsights offers customized market reports tailored to specific business needs and market segments within the busbar industry.

What deliverables can I expect from this Busbar market research project?

Deliverables include detailed reports, market forecasts, competitive landscape analysis, and insights into trends influencing the busbar market.

What are the market trends of Busbar?

Current trends indicate a shift towards smart busbar systems, increasing adoption of aluminum and composite materials, and a focus on sustainability within the busbar market.