Business Travel Market Report

Published Date: 01 February 2026 | Report Code: business-travel

Business Travel Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Business Travel market, focusing on market trends, segments, and regional insights from 2023 to 2033, along with data on market size and CAGR.

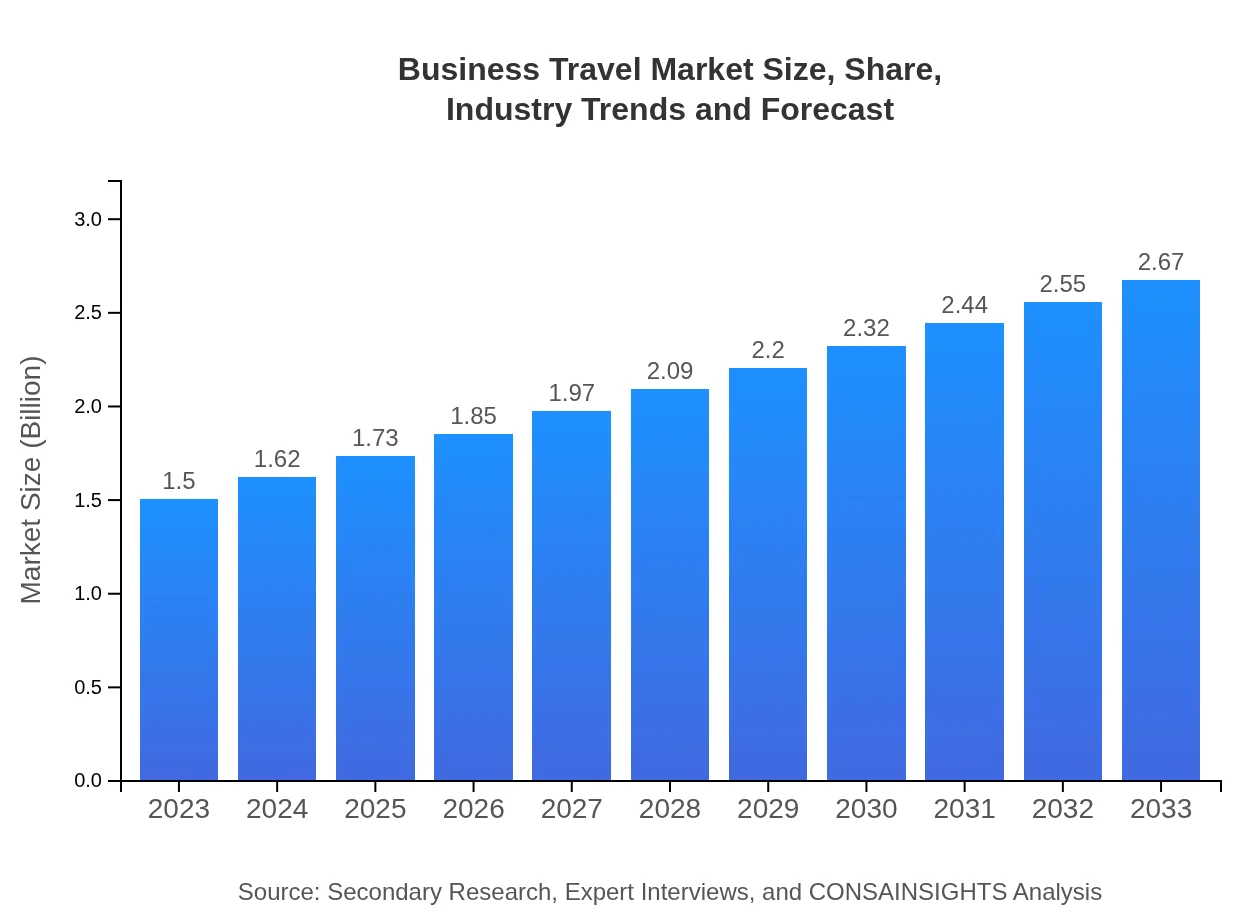

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Trillion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $2.67 Trillion |

| Top Companies | American Express Global Business Travel, Carlson Wagonlit Travel, BCD Travel, Expedia Group, Travel Leaders Group |

| Last Modified Date | 01 February 2026 |

Business Travel Market Overview

Customize Business Travel Market Report market research report

- ✔ Get in-depth analysis of Business Travel market size, growth, and forecasts.

- ✔ Understand Business Travel's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Business Travel

What is the Market Size & CAGR of Business Travel market in 2023?

Business Travel Industry Analysis

Business Travel Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Business Travel Market Analysis Report by Region

Europe Business Travel Market Report:

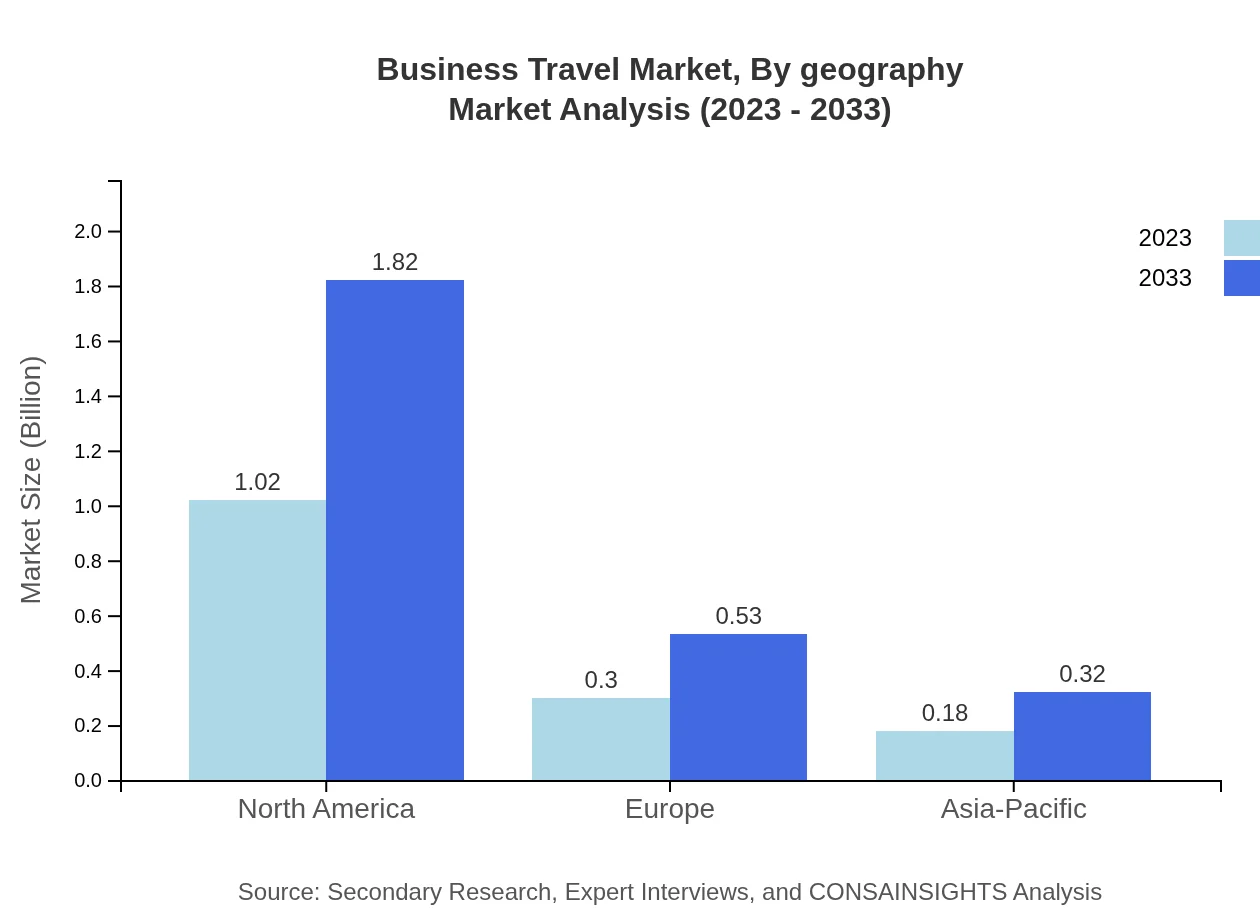

The European business travel market is projected to grow from $0.54 trillion in 2023 to $0.97 trillion by 2033, reflecting a strong demand for business-related travel amidst a recovering economy. The focus on sustainability and renewed travel policies will shape its future.Asia Pacific Business Travel Market Report:

The Asia Pacific region is experiencing rapid growth in the Business Travel market, projected to increase from $0.28 trillion in 2023 to $0.50 trillion by 2033. Countries like China and India are playing significant roles due to their expanding economies and increasing business interactions globally.North America Business Travel Market Report:

North America remains a leader in the Business Travel market, with projections growing from $0.50 trillion in 2023 to $0.90 trillion by 2033. Major corporations and a robust economy contribute to this growth, driven by increased business activities and event management.South America Business Travel Market Report:

The South America region, while currently facing challenges, is expected to have a slight decline from $0.03 trillion in 2023 to $0.06 trillion by 2033. Economic instability and political factors hinder its growth, though a rebound is anticipated as local economies recover.Middle East & Africa Business Travel Market Report:

The Middle East and Africa are projected to see growth from $0.20 trillion in 2023 to $0.36 trillion by 2033. This growth is bolstered by increasing investments in infrastructure and the region's strategic geographic position for international business.Tell us your focus area and get a customized research report.

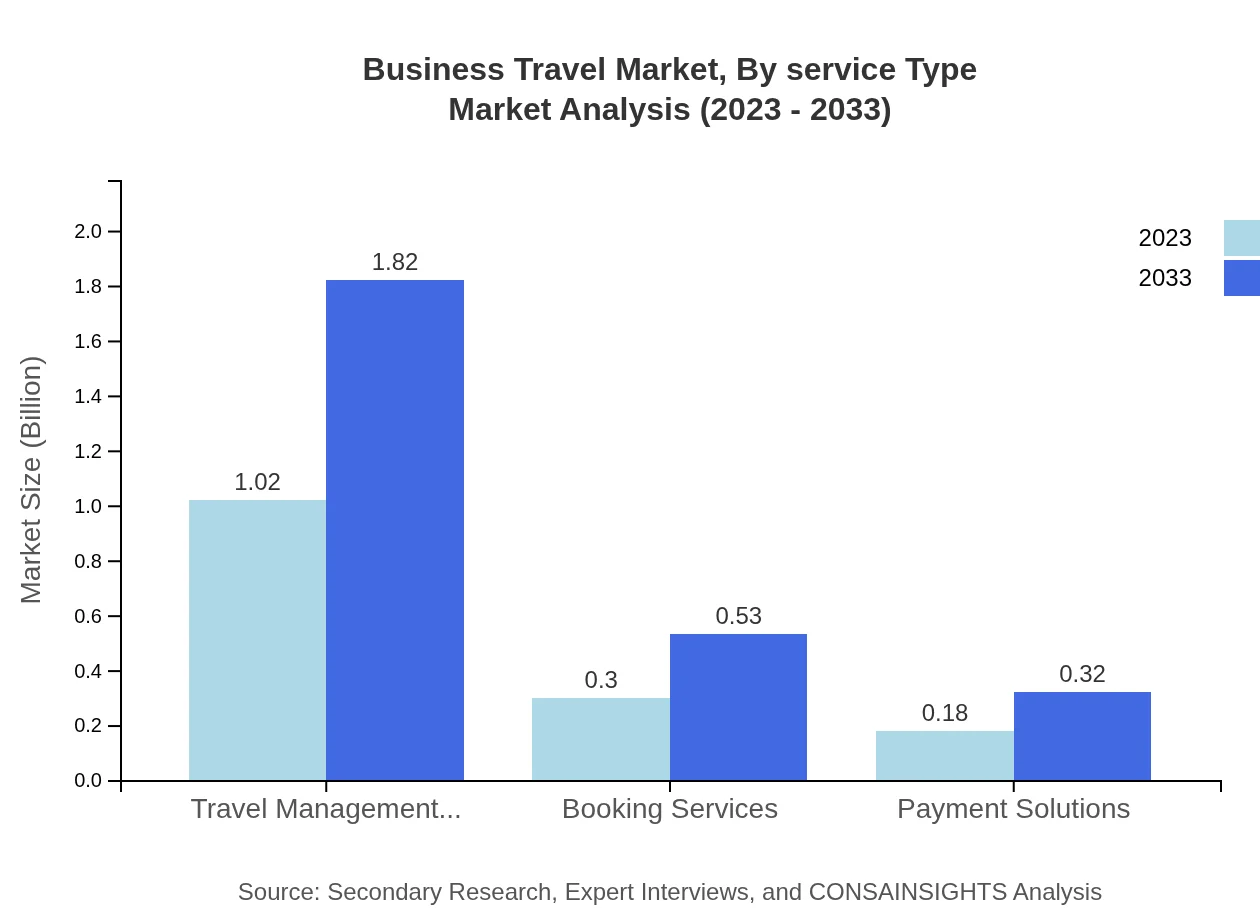

Business Travel Market Analysis By Service Type

The Business Travel market by service type is characterized by significant contributions from transportation, accommodation, and management services. Transportation is pivotal, currently valued at $1.02 trillion in 2023, expected to rise to $1.82 trillion by 2033. Accommodation services follow closely as businesses increasingly prefer value-driven hotel options. Furthermore, travel management services contribute robustly to overall growth, indicating a trend where organizations seek comprehensive travel solutions.

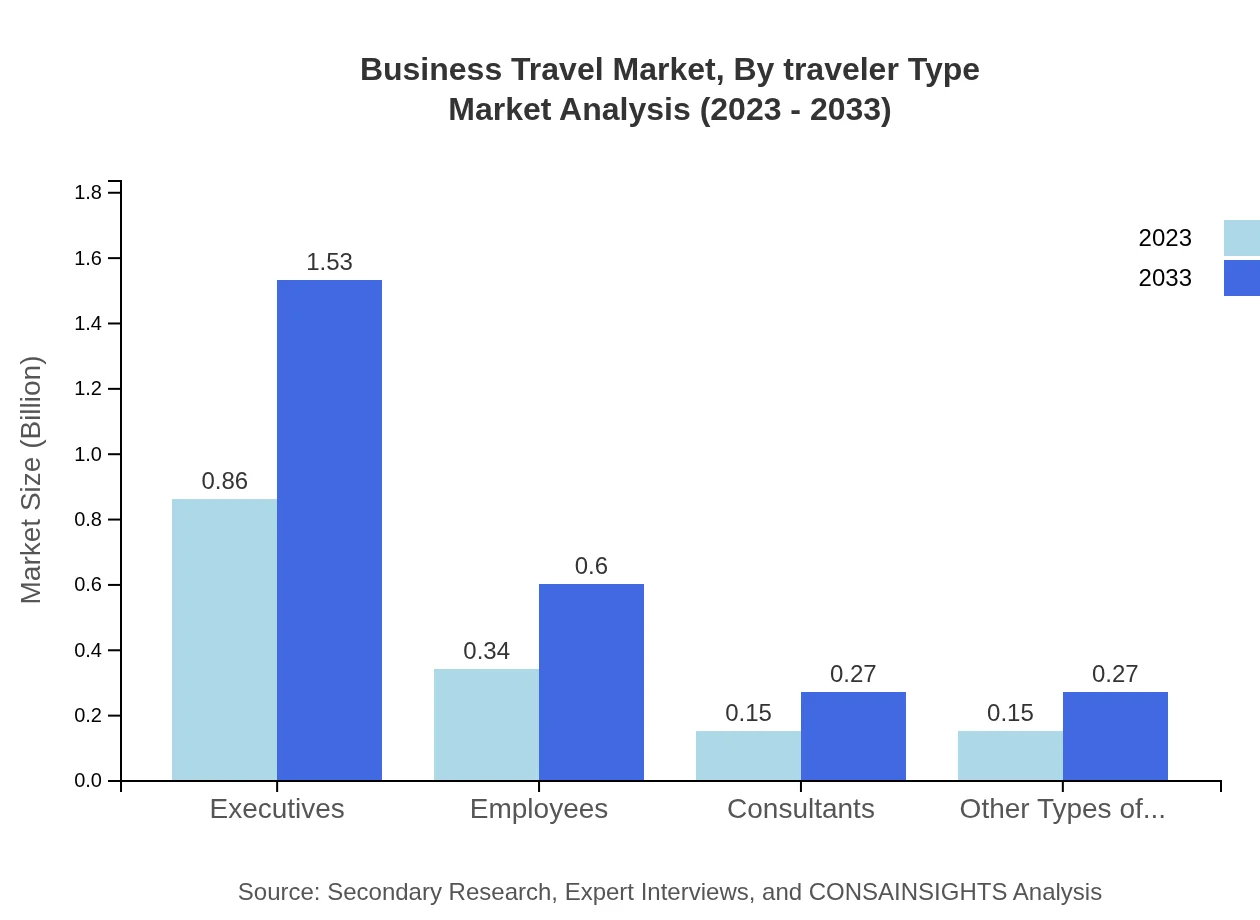

Business Travel Market Analysis By Traveler Type

Segmentation by traveler type showcases the dominance of executives, making up 57.14% of the market in 2023, valued at $0.86 trillion, with growth expected to $1.53 trillion by 2033. Employees and consultants constitute significant portions, emphasizing the need for tailored travel strategies across different corporate levels.

Business Travel Market Analysis By Geography

Geographically, North America leads the market, with a robust travel culture. Europe follows closely, reflecting its interconnected corporate environment. Asia Pacific is emerging, although facing competition from other regions. The shift towards more efficient travel solutions is influencing geographical demand dynamics.

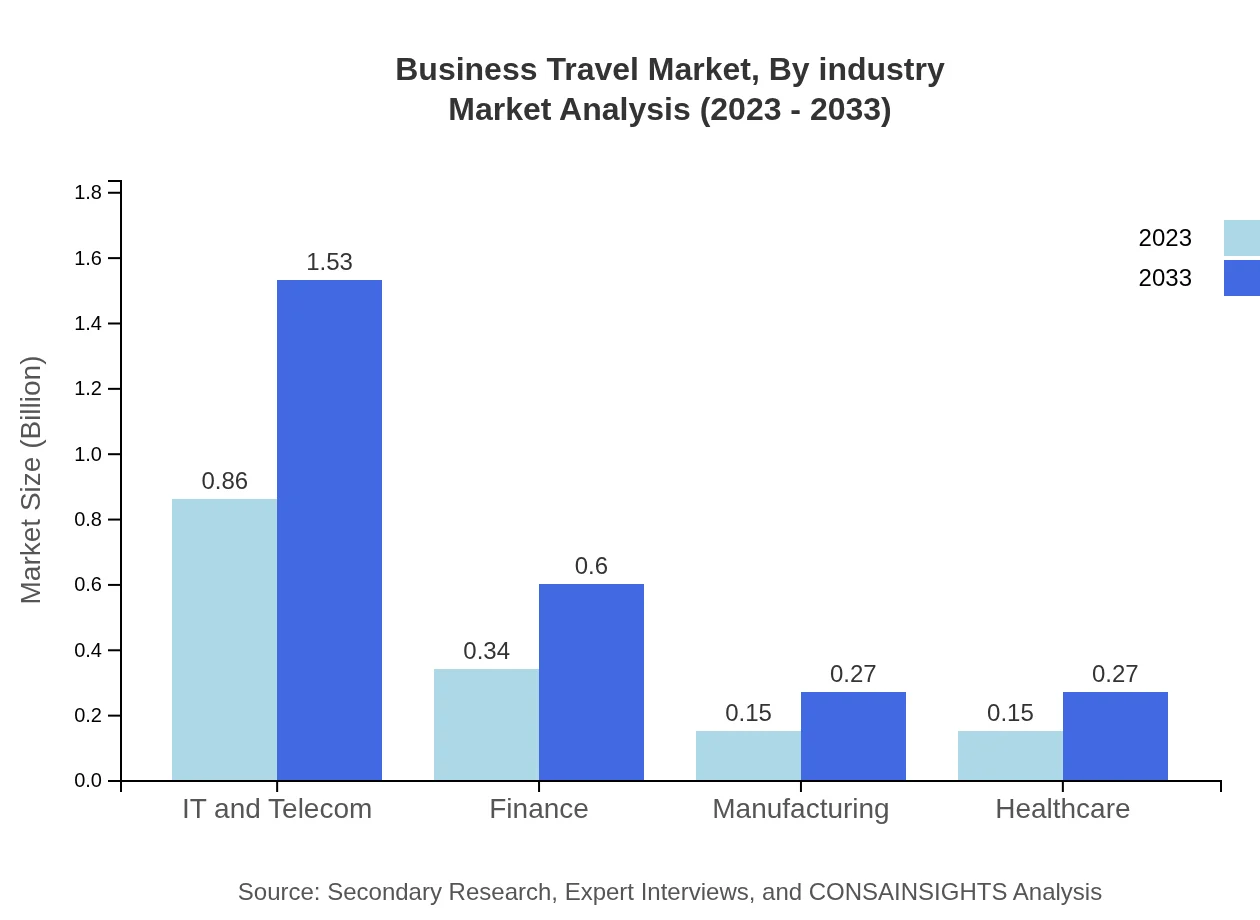

Business Travel Market Analysis By Industry

The Business Travel industry is primarily segmented into IT and Telecom, Finance, Manufacturing, and Healthcare. The IT and Telecom sector holds the largest market share, driving significant travel-related expenditures due to its global operations. Finance also plays a major role as companies expand in emerging markets, requiring more travel to forge partnerships and close business deals.

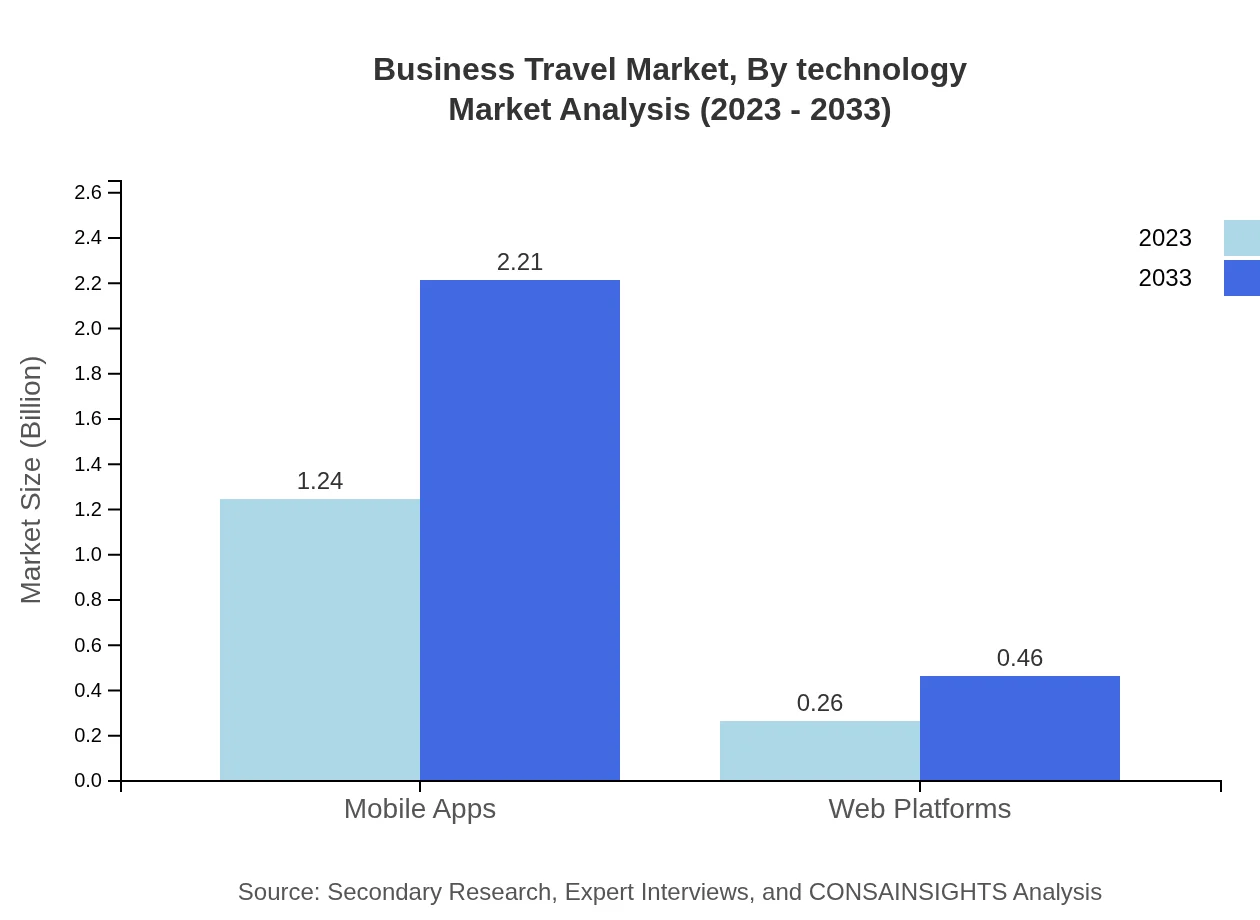

Business Travel Market Analysis By Technology

Technological advancements are transforming the Business Travel sector. Mobile applications for bookings and travel management are increasingly popular, expected to generate $1.24 trillion in 2023, growing to $2.21 trillion by 2033. Furthermore, web platforms are enhancing user experience, critical in the ongoing digital landscape.

Business Travel Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Business Travel Industry

American Express Global Business Travel:

A leader in the business travel management sector, offering comprehensive travel services, solutions, and consultations to corporate clients worldwide.Carlson Wagonlit Travel:

An international travel management company that specializes in providing a wide range of travel solutions for businesses, focusing on optimizing travel and reducing costs.BCD Travel:

A global travel management company that helps organizations to maximize performance, address complex travel challenges, and manage travel expenses effectively.Expedia Group:

A leading online travel agency providing a platform for businesses to book travel, accommodations, and related services, catering to the needs of corporate travelers.Travel Leaders Group:

A travel management company that offers diverse services to businesses, supported by a strong network of travel professionals focusing on customized travel solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of business Travel?

The business travel market is valued at approximately $1.5 trillion in 2023 and is projected to grow at a CAGR of 5.8% over the next decade, indicating a substantial opportunity for market players.

What are the key market players or companies in this business Travel industry?

Key players in the business travel sector include major airlines, hotels, travel management companies, and online booking platforms that facilitate corporate travel arrangements and enhance traveler experience.

What are the primary factors driving the growth in the business Travel industry?

Growth in the business-travel industry is fueled by increased globalization, rising corporate profits, technological advancements in booking processes, and a growing emphasis on employee travel and engagement.

Which region is the fastest Growing in the business Travel?

Among the regions, Europe exhibits rapid growth in business travel, projected to rise from $0.54 trillion in 2023 to $0.97 trillion by 2033, closely followed by North America.

Does ConsaInsights provide customized market report data for the business Travel industry?

Yes, ConsaInsights offers tailored market report data for the business travel industry, focusing on specific regions, segments, and trends to meet diverse client requirements.

What deliverables can I expect from this business Travel market research project?

Expect comprehensive reports including market size estimates, segment analyses, competitor assessments, growth forecasts, and insights into regional performance for the business travel industry.

What are the market trends of business travel?

Current trends in business travel include the adoption of advanced travel management solutions, increased focus on sustainability, and leveraging mobile technology for seamless travel experiences.