Butachlor Market Report

Published Date: 02 February 2026 | Report Code: butachlor

Butachlor Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Butachlor market for the forecast period of 2023 to 2033. It covers market size, trends, regional insights, and industry dynamics shaping the future of Butachlor.

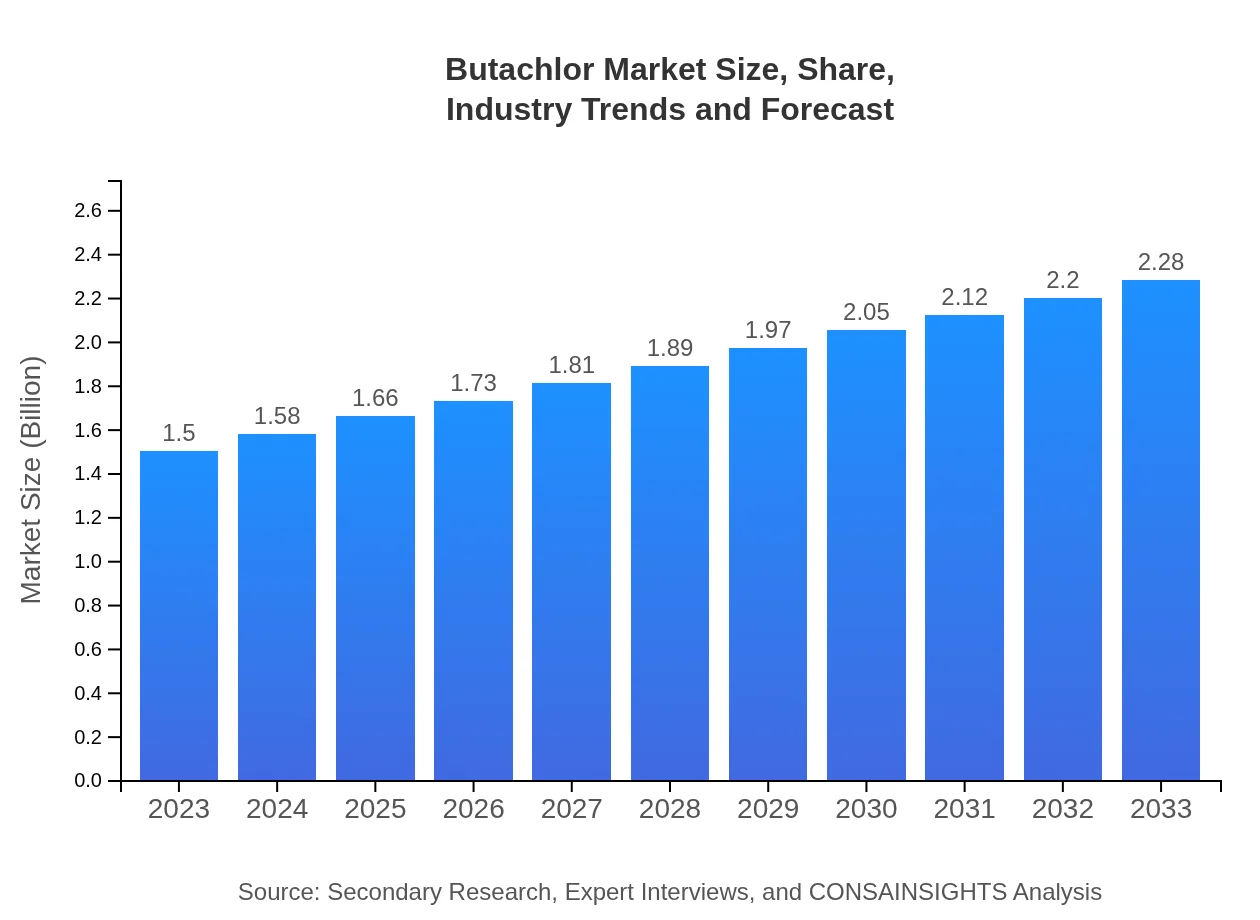

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $2.28 Billion |

| Top Companies | BASF SE, Syngenta AG, Dow AgroSciences, UPL Limited |

| Last Modified Date | 02 February 2026 |

Butachlor Market Overview

Customize Butachlor Market Report market research report

- ✔ Get in-depth analysis of Butachlor market size, growth, and forecasts.

- ✔ Understand Butachlor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Butachlor

What is the Market Size & CAGR of Butachlor market in 2023?

Butachlor Industry Analysis

Butachlor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Butachlor Market Analysis Report by Region

Europe Butachlor Market Report:

Europe's market size is forecasted to increase from $0.37 billion in 2023 to $0.56 billion by 2033, driven by sustainable practices and increasing crop demands in countries like Germany and France.Asia Pacific Butachlor Market Report:

The Asia Pacific region, expected to grow from $0.31 billion in 2023 to $0.48 billion by 2033, dominates the Butachlor market due to high agricultural activity, particularly in countries like India and China where rice cultivation is prevalent.North America Butachlor Market Report:

The North American market will see a growth from $0.57 billion in 2023 to $0.86 billion by 2033. The U.S. leads this market due to advanced agricultural practices and high adoption rates of herbicide use.South America Butachlor Market Report:

In South America, the market for Butachlor is anticipated to rise from $0.07 billion in 2023 to $0.11 billion by 2033. This growth is primarily driven by demand in Brazil and Argentina, where soybean cultivation is significant.Middle East & Africa Butachlor Market Report:

The Middle East and Africa region is expected to see its market grow from $0.18 billion in 2023 to $0.27 billion by 2033, as improving agricultural practices boost the need for effective herbicides.Tell us your focus area and get a customized research report.

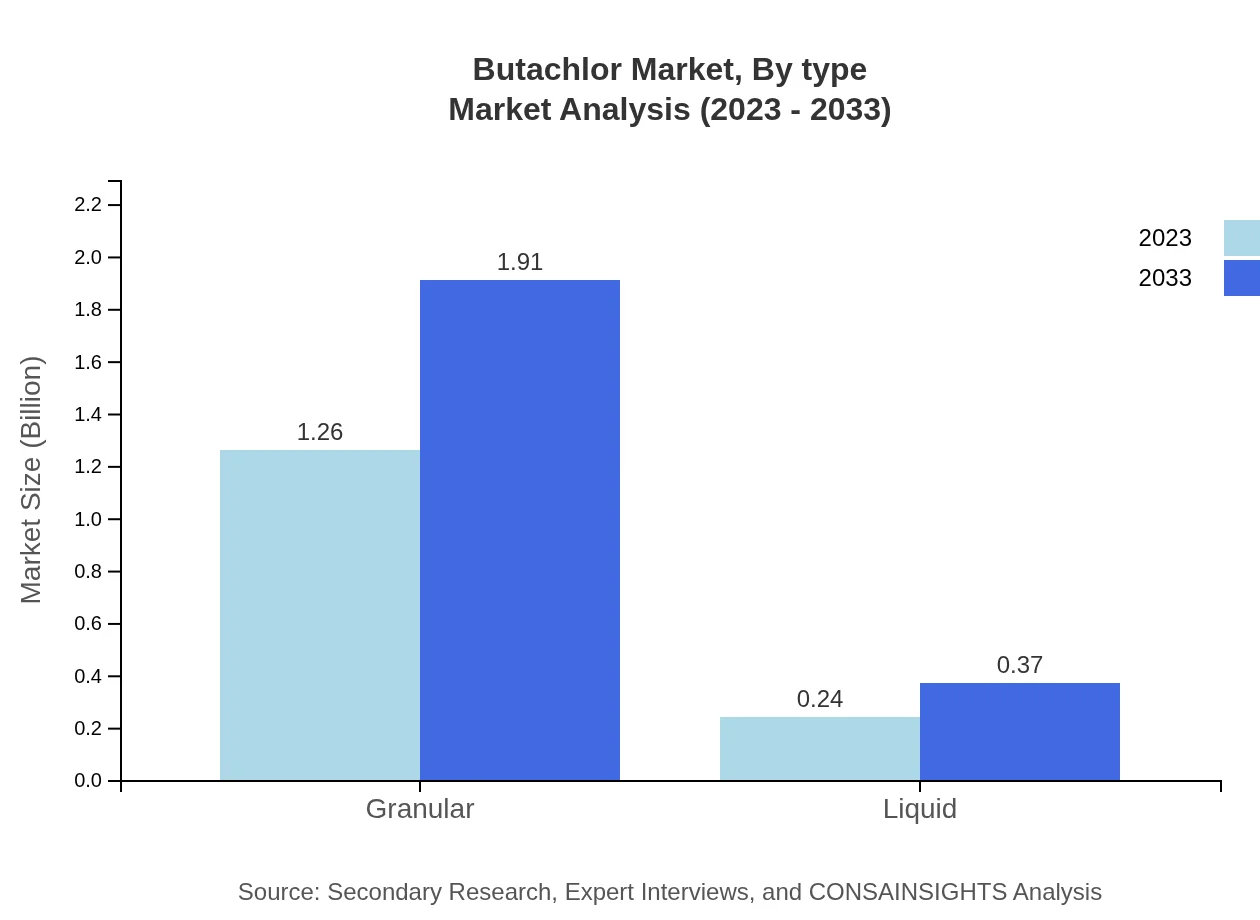

Butachlor Market Analysis By Type

The Butachlor market, segmented by type, includes granular and liquid formulations. The granular segment dominates, accounting for 83.7% market share in 2023 and projected to maintain this share by 2033. Granular formulations are favored for their ease of application and effectiveness in controlling weeds in various crops, particularly in rice and soybeans.

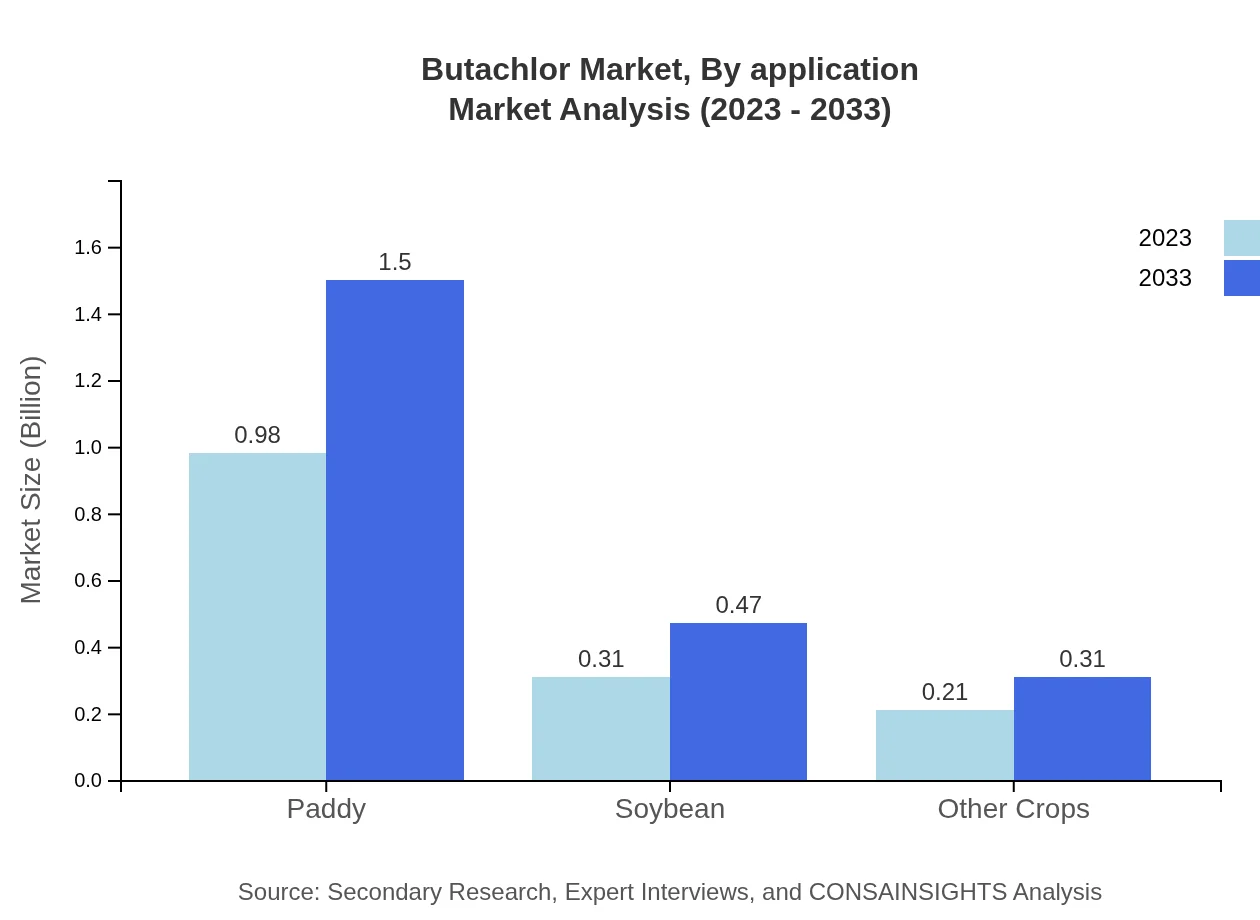

Butachlor Market Analysis By Application

In the application segment, paddy crops take the lead, constituting 65.57% of the market in 2023, with projections for growth to 1.50 billion by 2033. Other significant applications include soybean (20.73%) and other crops (13.7%), highlighting the versatility of Butachlor across different agricultural practices.

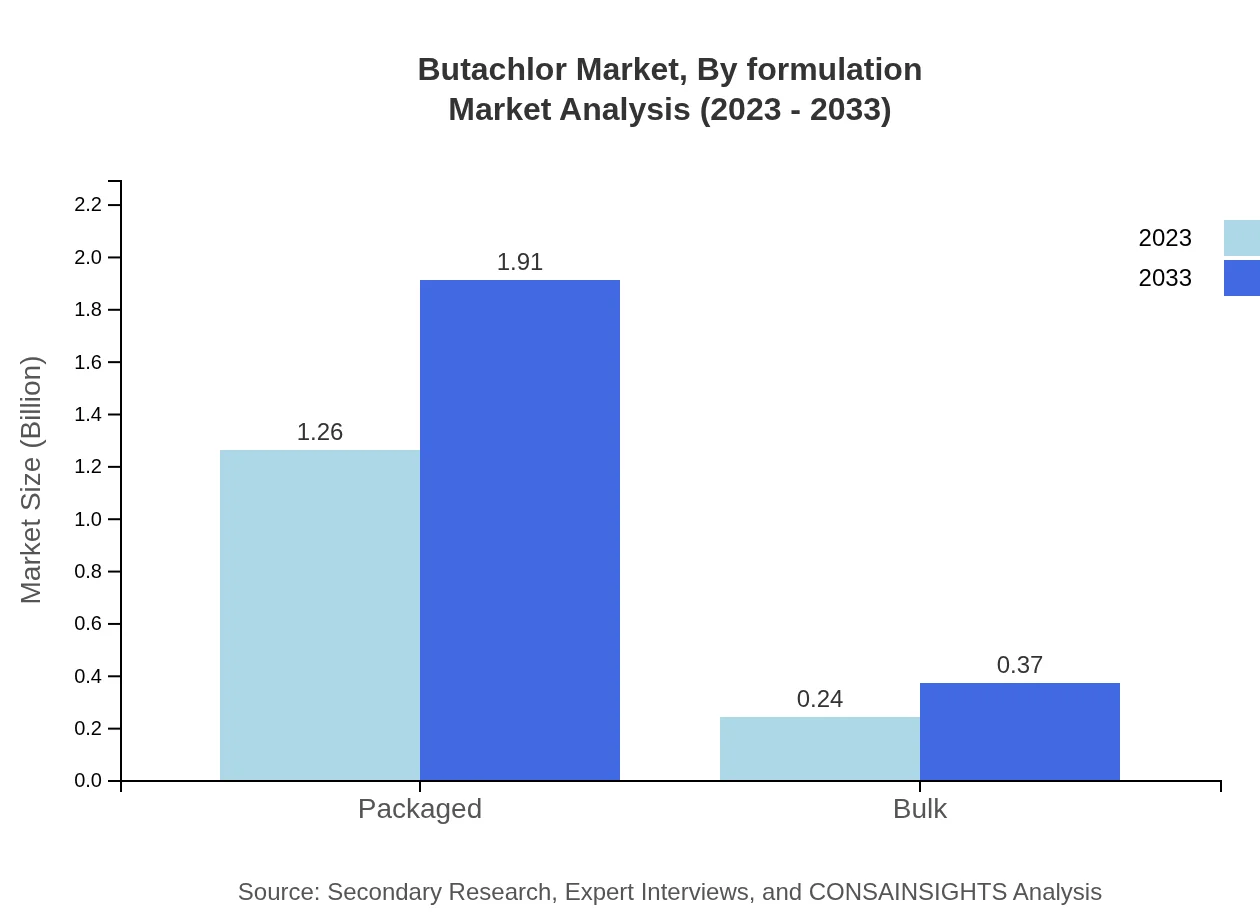

Butachlor Market Analysis By Formulation

The market by formulation primarily includes granular and liquid types, with granular formulations expected to hold 83.7% of the market share throughout the forecast period. The effectiveness and convenience of application in field conditions solidify granular formulations as the preferred choice among farmers.

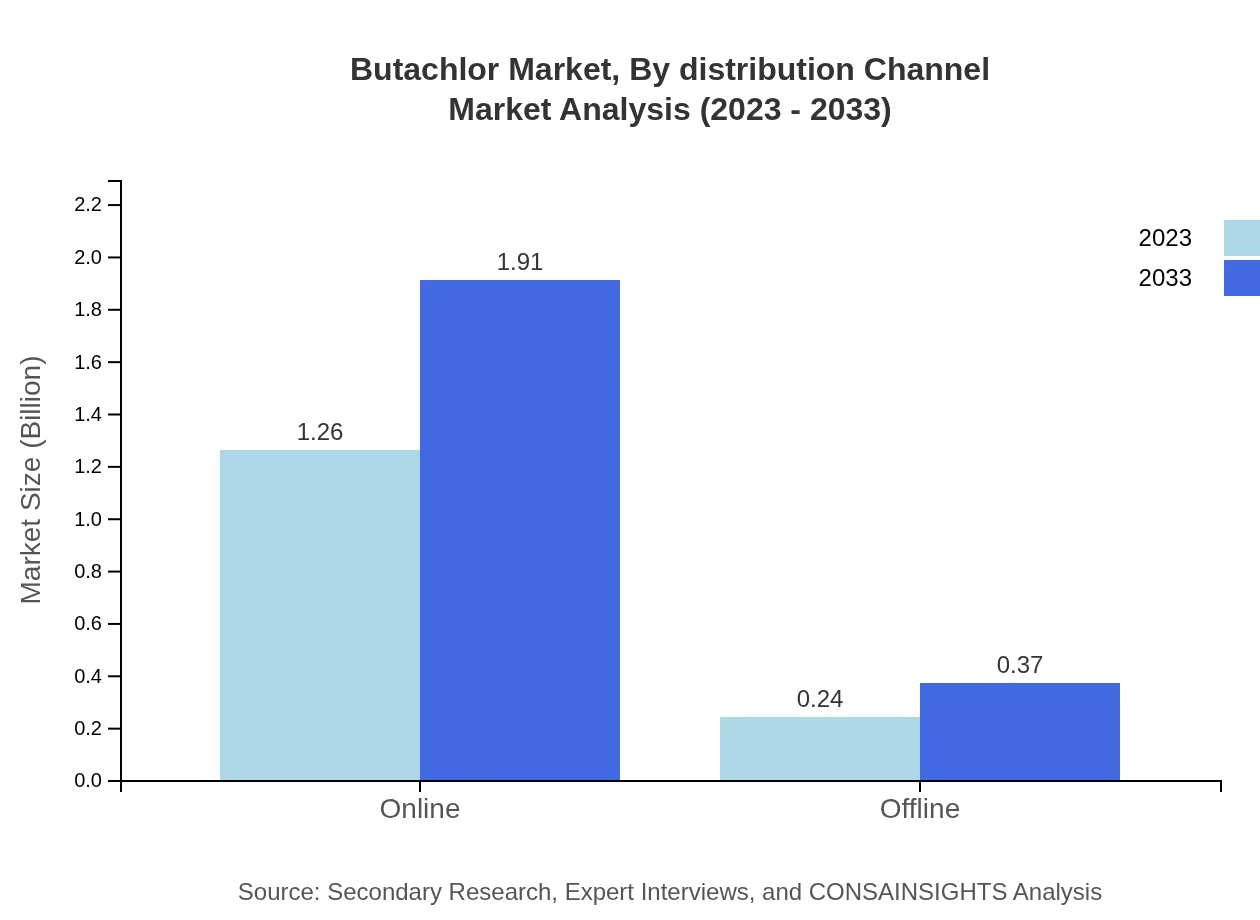

Butachlor Market Analysis By Distribution Channel

The distribution analysis shows that online channels dominate the market, accounting for 83.7% of sales in 2023, with expectations to retain this share by 2033. The convenience of online purchasing and the growing trend of digital shopping in agriculture directly contributes to the expanding online market.

Butachlor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Butachlor Industry

BASF SE:

BASF SE is a leading global player in the agricultural solutions sector, focusing on innovation and sustainability in crop protection products, including Butachlor.Syngenta AG:

Syngenta AG is renowned for its comprehensive portfolio of herbicides and insecticides, playing a crucial role in advancing agricultural productivity with products like Butachlor.Dow AgroSciences:

Dow AgroSciences, part of Dow Chemical, specializes in developing crop protection chemicals with a commitment to sustainability and regulatory compliance in the Butachlor segment.UPL Limited:

UPL Limited is an Indian multinational that focuses on agrochemicals and has made significant strides in the Butachlor market across various regions.We're grateful to work with incredible clients.

FAQs

What is the market size of Butachlor?

The global Butachlor market is projected to be valued at approximately $1.5 billion in 2023, with a compound annual growth rate (CAGR) of 4.2% expected through 2033. This growth reflects rising agricultural demands and pesticide usage globally.

What are the key market players or companies in the Butachlor industry?

Key market players in the Butachlor industry include prominent agrochemical companies like Syngenta, BASF, Bayer, and FMC Corporation. These companies lead through innovative products and extensive distribution networks, addressing diverse agricultural needs.

What are the primary factors driving the growth in the Butachlor industry?

Key drivers of Butachlor market growth include increasing agricultural productivity demands, adoption of advanced farming techniques, and rising incidences of pest infestations. Regulatory support for agricultural chemicals further enhances market growth.

Which region is the fastest Growing in the Butachlor market?

The Asia Pacific region is anticipated to be the fastest-growing market for Butachlor, expected to grow from $0.31 billion in 2023 to $0.48 billion by 2033. This growth is fueled by the increase in paddy and soybean cultivation in the region.

Does ConsaInsights provide customized market report data for the Butachlor industry?

Yes, ConsaInsights specializes in providing customized market reports tailored to specific client needs within the Butachlor industry. This includes detailed insights on market size, trends, and competitive landscapes.

What deliverables can I expect from this Butachlor market research project?

Deliverables from the Butachlor market research project include comprehensive market analysis reports, segment-specific insights, regional growth forecasts, and strategic recommendations tailored to stakeholders in the agrochemical sector.

What are the market trends of Butachlor?

Current market trends for Butachlor include increasing preference for liquid formulations, growth in online sales channels, and expansion in emerging markets. Additionally, sustainability practices are shaping the development of eco-friendly pesticide formulations.