Butter And Ghee Market Report

Published Date: 31 January 2026 | Report Code: butter-and-ghee

Butter And Ghee Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Butter and Ghee market including trends, insights, and forecasts from 2023 to 2033. It delves into market size, growth rates, regional dynamics, key players, and future trends.

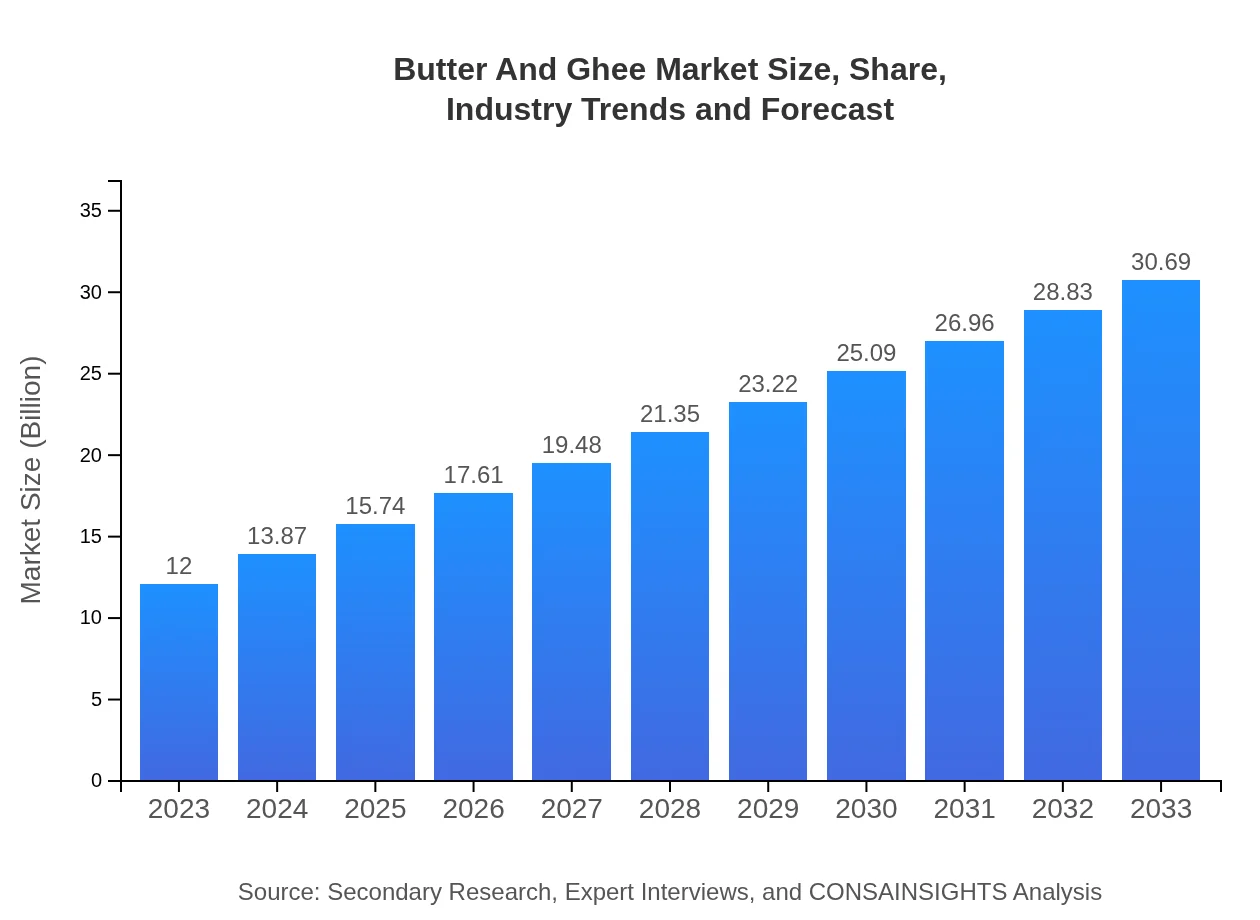

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 9.5% |

| 2033 Market Size | $30.69 Billion |

| Top Companies | Amul, Land O'Lakes, Anchor, Dairy Farmers of America (DFA), Ghee Bliss |

| Last Modified Date | 31 January 2026 |

Butter And Ghee Market Overview

Customize Butter And Ghee Market Report market research report

- ✔ Get in-depth analysis of Butter And Ghee market size, growth, and forecasts.

- ✔ Understand Butter And Ghee's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Butter And Ghee

What is the Market Size & CAGR of Butter And Ghee market in 2023?

Butter And Ghee Industry Analysis

Butter And Ghee Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Butter And Ghee Market Analysis Report by Region

Europe Butter And Ghee Market Report:

Europe's Butter and Ghee market stands at 3.87 billion USD in 2023, forecasted to grow to 9.89 billion USD by 2033. There is a growing interest in high-quality products, and many consumers are switching from margarine to butter and ghee due to health benefits. Sustainability initiatives are also influencing product sourcing.Asia Pacific Butter And Ghee Market Report:

In the Asia Pacific region, the market is valued at 2.28 billion USD in 2023, with projections reaching 5.83 billion USD by 2033. The dominance of ghee in traditional cooking across countries like India and Pakistan supports steady growth. Consumer awareness regarding health benefits is prompting a shift towards ghee over other fats, positively impacting market dynamics.North America Butter And Ghee Market Report:

In North America, the Butter and Ghee market is valued at 4.14 billion USD in 2023, projected to surge to 10.58 billion USD by 2033. The rising trend towards organic and natural foods among health-conscious consumers fuels market growth, alongside increasing demand for artisanal butter products.South America Butter And Ghee Market Report:

The South American market for Butter and Ghee is valued at 0.19 billion USD in 2023, expected to grow to 0.50 billion USD by 2033. Emerging health trends among consumers are causing a gradual increase in demand, although the market remains nascent, with significant expansion potential in Brazil and Argentina.Middle East & Africa Butter And Ghee Market Report:

The Middle East and Africa market has an initial value of 1.52 billion USD in 2023, expected to rise to 3.90 billion USD by 2033. The location's culinary traditions favor the use of ghee, thereby ensuring a steady demand. The health trend among consumers is also stirring interest in natural dairy products.Tell us your focus area and get a customized research report.

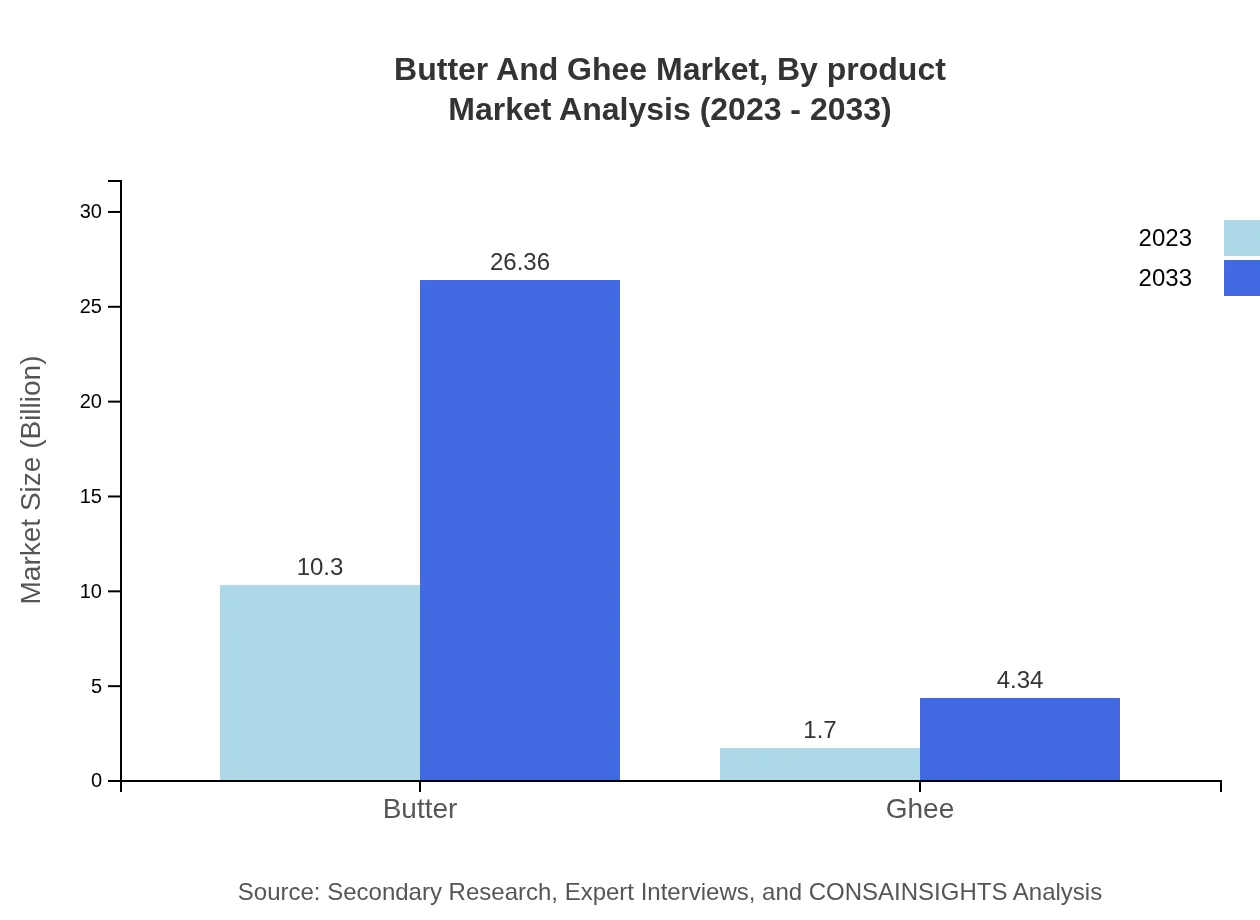

Butter And Ghee Market Analysis By Product

The product segment reflects a robust performance with Butter generating a market size of 10.30 billion USD in 2023, with projections to reach 26.36 billion USD by 2033, indicating a substantial market share of 85.87%. Ghee is expected to grow from 1.70 billion USD in 2023 to 4.34 billion USD by 2033, accounting for 14.13% of the market. The increasing acceptance of ghee for its health benefits and culinary applications drives its growth trajectory.

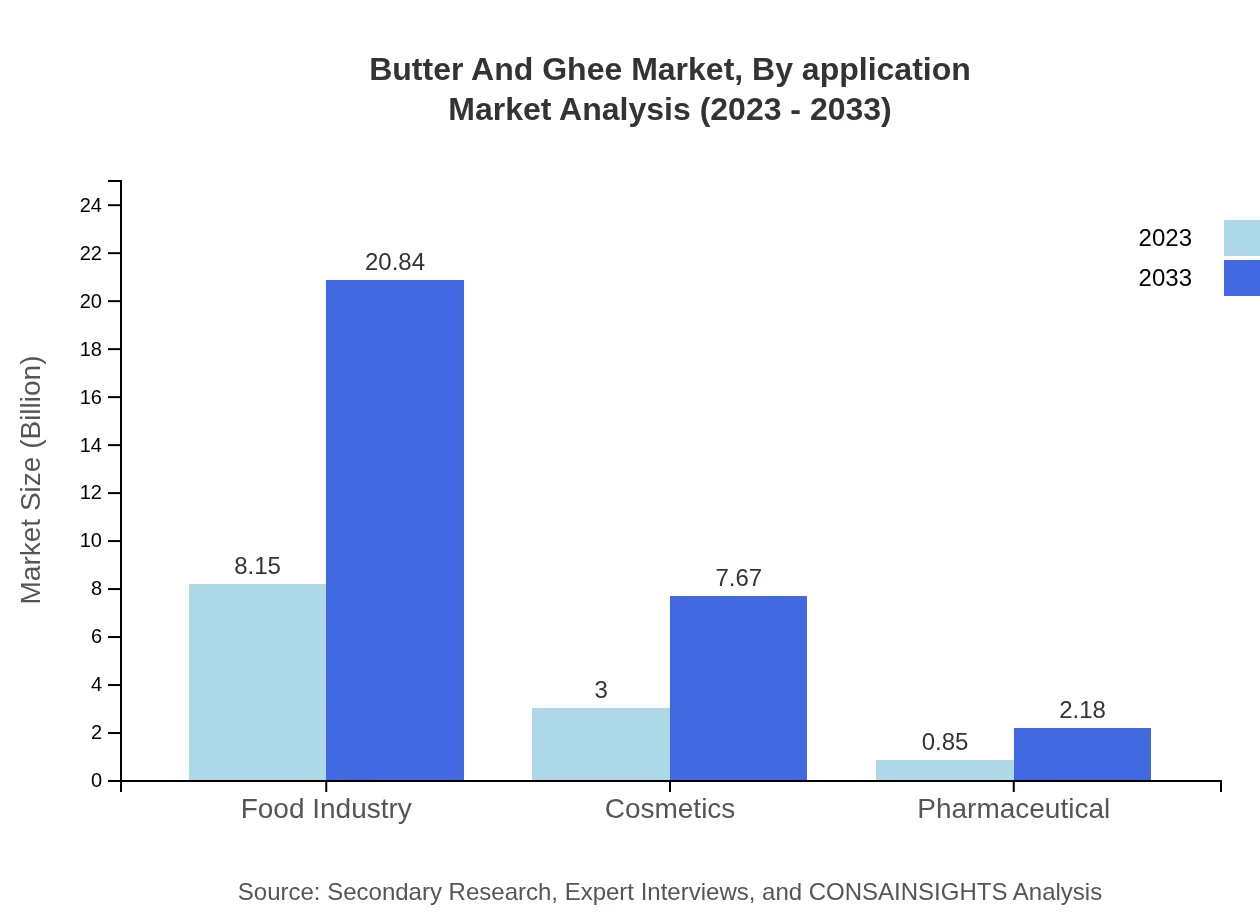

Butter And Ghee Market Analysis By Application

Application segments indicate that the food industry dominates the market with a size of 8.15 billion USD in 2023, projected to expand to 20.84 billion USD by 2033, representing 67.91% market share. Cosmetics and pharmaceuticals are also contributing, with markets of 3.00 billion USD and 0.85 billion USD respectively. The multifunctional use of butter and ghee across different segments underpins their importance.

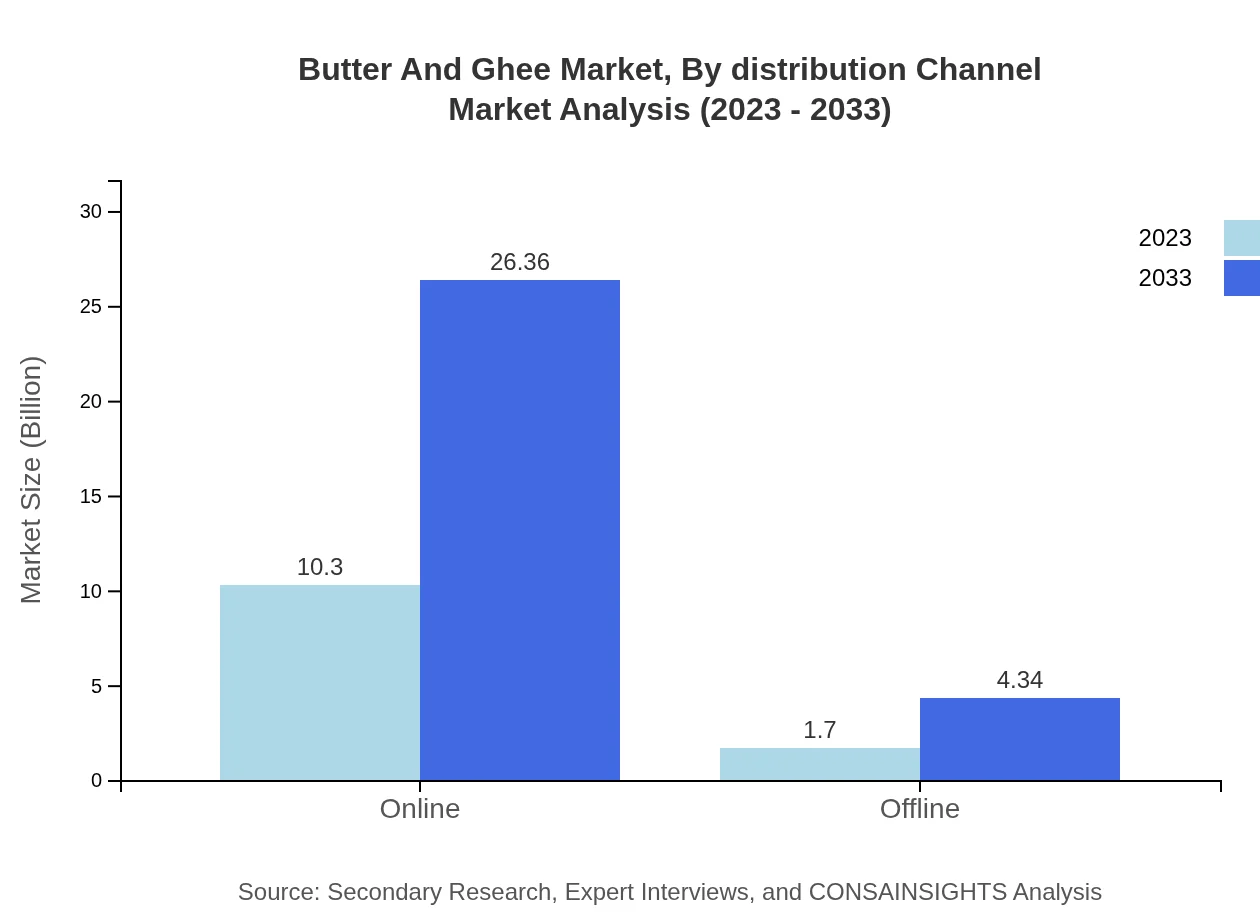

Butter And Ghee Market Analysis By Distribution Channel

Distribution channels demonstrate significant dynamics with online channels producing a size of 10.30 billion USD in 2023, expected to rise to 26.36 billion USD by 2033, capturing 85.87% of the market. Conversely, offline channels report 1.70 billion USD in 2023 with a lesser share but growing interest, indicating evolving consumer purchasing habits.

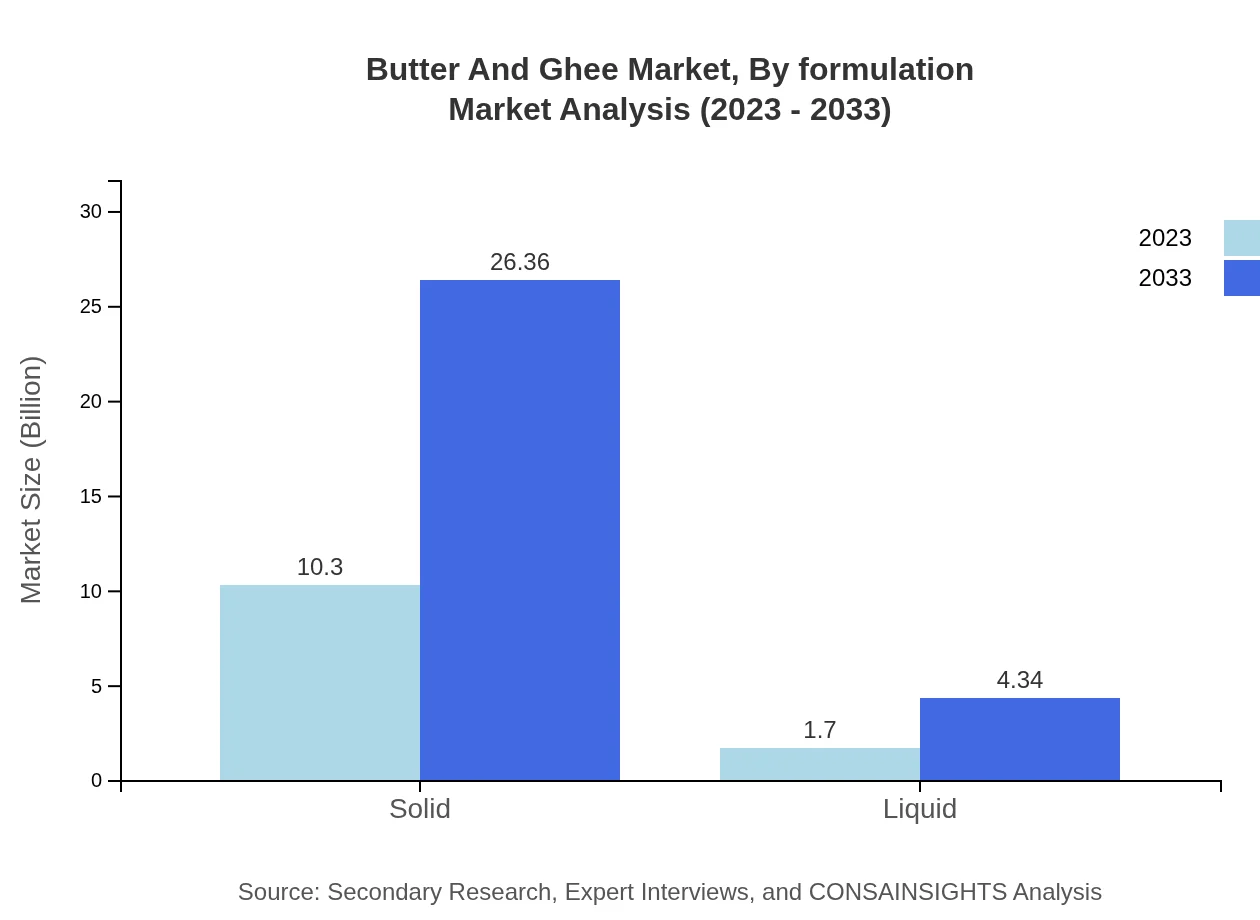

Butter And Ghee Market Analysis By Formulation

The market analysis based on formulation presents a clear divide with solid formulations commanding a size of 10.30 billion USD in 2023, projected to grow to 26.36 billion USD by 2033, maintaining an 85.87% market share. Liquid formulations, holding a market size of 1.70 billion USD in 2023, are poised to grow to 4.34 billion USD by 2033 but represent a small portion of the overall market.

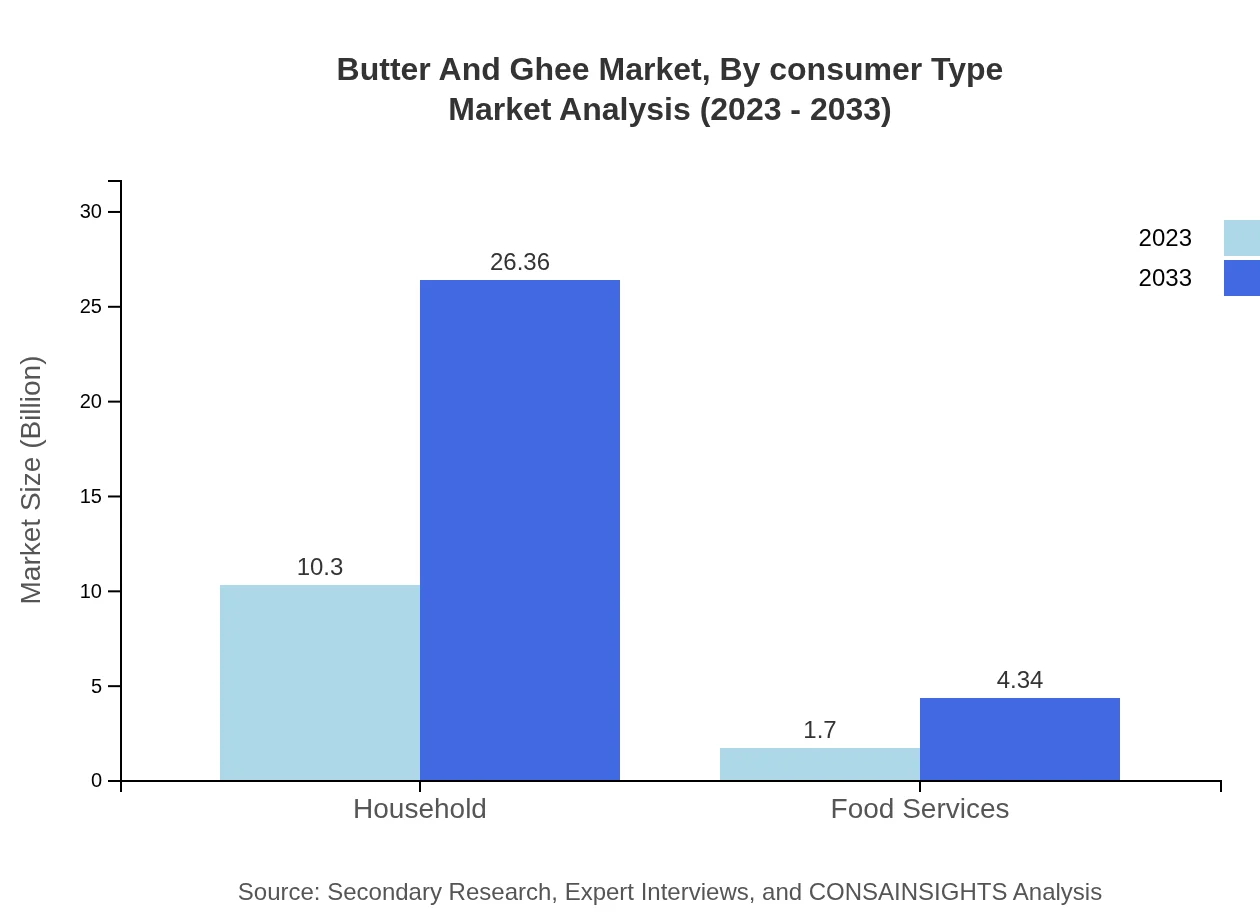

Butter And Ghee Market Analysis By Consumer Type

Consumer types reveal a strong household consumption segment with 10.30 billion USD in 2023, projected to reach 26.36 billion USD by 2033, accounting for 85.87% market share. Food services generate 1.70 billion USD in revenue in 2023, growing to 4.34 billion USD by 2033, capturing 14.13% of the market.

Butter And Ghee Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Butter And Ghee Industry

Amul:

Amul is one of India's largest dairy cooperatives, well-known for its butter and ghee products. It plays a pivotal role in the Indian dairy market and has a strong international presence.Land O'Lakes:

Land O'Lakes is a farmer-owned cooperative in the USA, specializing in dairy products including butter. They are committed to sustainable practices, quality, and innovation in product offerings.Anchor:

Anchor, a New Zealand brand, is renowned for its high-quality dairy products including butter and ghee, focusing heavily on both local and international markets.Dairy Farmers of America (DFA):

DFA is a farmer-owned cooperative and a significant player in the North American market, producing a wide range of dairy products including butter and ghee.Ghee Bliss:

Ghee Bliss is devoted to producing organic ghee products, catering to health-conscious consumers seeking high-quality, nutritious options.We're grateful to work with incredible clients.

FAQs

What is the market size of butter And Ghee?

The global butter and ghee market is projected to reach approximately $12 billion by 2033, with a compound annual growth rate (CAGR) of 9.5% from 2023 to 2033. This growth is driven by increasing consumer demand for organic dairy products.

What are the key market players or companies in this butter And Ghee industry?

Key players in the butter and ghee industry typically include major dairy companies and specialty food manufacturers. These businesses capitalize on the growing trend towards organic and health-centric products, strengthening their market presence through innovations and strategic partnerships.

What are the primary factors driving the growth in the butter And Ghee industry?

The primary growth factors for the butter and ghee industry include rising health awareness among consumers, increasing disposable incomes, and a shift towards organic and natural products. Additionally, the expansion of the food services sector plays a significant role in boosting demand.

Which region is the fastest Growing in the butter And Ghee market?

The Asia Pacific region is the fastest-growing market for butter and ghee. From 2023 to 2033, the market is expected to grow from $2.28 billion to $5.83 billion. This growth is influenced by rising population and urbanization, promoting dairy consumption.

Does ConsaInsights provide customized market report data for the butter And Ghee industry?

Yes, Consainsights offers customized market reports for the butter and ghee industry. Clients can request tailored insights based on specific needs, including market size, trends, and competitive analysis.

What deliverables can I expect from this butter And Ghee market research project?

Deliverables from a butter and ghee market research project typically include comprehensive reports detailing market size, segmented analysis, trends, competitive landscape, and forecasts, alongside actionable insights tailored to strategic business decisions.

What are the market trends of butter And Ghee?

Current market trends for butter and ghee include a growing preference for organic varieties, innovative packaging, and vegan alternatives. Additionally, the rise of online sales channels is reshaping distribution strategies, catering to the modern consumer.