Butyric Acid Market Report

Published Date: 22 January 2026 | Report Code: butyric-acid

Butyric Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Butyric Acid market, covering current trends, market size, growth forecasts from 2023 to 2033, and key players in the industry, along with insights into regional dynamics and technological advancements.

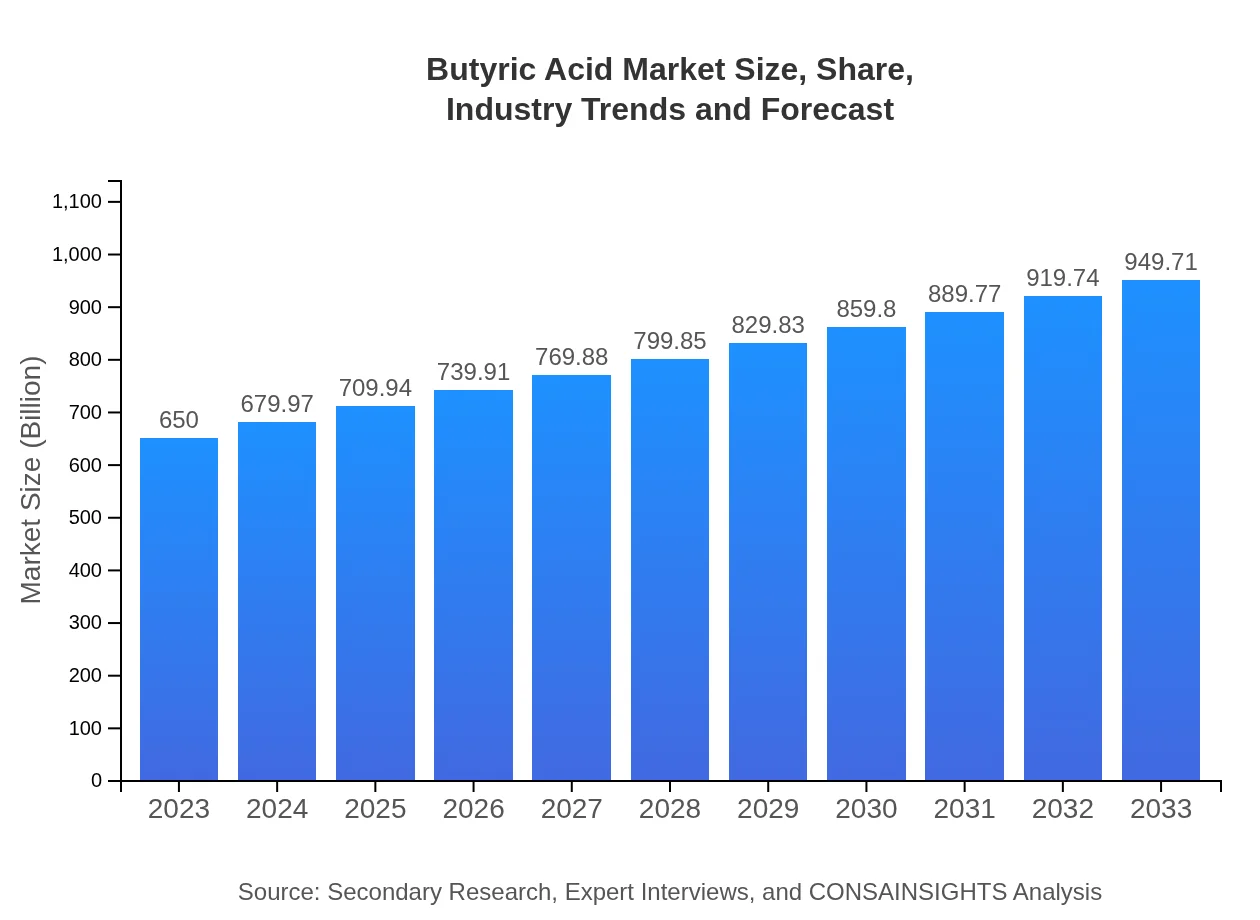

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $650.00 Million |

| CAGR (2023-2033) | 3.8% |

| 2033 Market Size | $949.71 Million |

| Top Companies | Corbion, Olon Industries, Perstorp |

| Last Modified Date | 22 January 2026 |

Butyric Acid Market Overview

Customize Butyric Acid Market Report market research report

- ✔ Get in-depth analysis of Butyric Acid market size, growth, and forecasts.

- ✔ Understand Butyric Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Butyric Acid

What is the Market Size & CAGR of Butyric Acid market in 2023?

Butyric Acid Industry Analysis

Butyric Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Butyric Acid Market Analysis Report by Region

Europe Butyric Acid Market Report:

Europe's Butyric Acid market is robust, with an estimated size of $207.74 million in 2023, expected to increase to $303.53 million by 2033. The escalating demand for functional foods and stringent health regulations support market growth.Asia Pacific Butyric Acid Market Report:

In the Asia Pacific, the Butyric Acid market accounts for $117.52 million in 2023 and is expected to reach $171.71 million by 2033. The region's growth is driven by increasing food and beverage demand, along with advancements in the healthcare sector focusing on digestive health supplements.North America Butyric Acid Market Report:

In North America, the market is valued at $242.26 million in 2023, projected to grow to $353.96 million by 2033. This growth can be attributed to heightened awareness of health benefits associated with butyric acid and a booming dietary supplement sector.South America Butyric Acid Market Report:

South America presents a unique challenge with a market size estimated at -$5.40 million in 2023, anticipated to decrease to -$7.88 million by 2033. This decline suggests a need for stronger market intervention and revitalization strategies specific to regional needs.Middle East & Africa Butyric Acid Market Report:

The Middle East and Africa are also seeing notable growth with a market size of $87.88 million in 2023, anticipated to reach $128.40 million by 2033, driven by increasing investments in healthcare and food sectors.Tell us your focus area and get a customized research report.

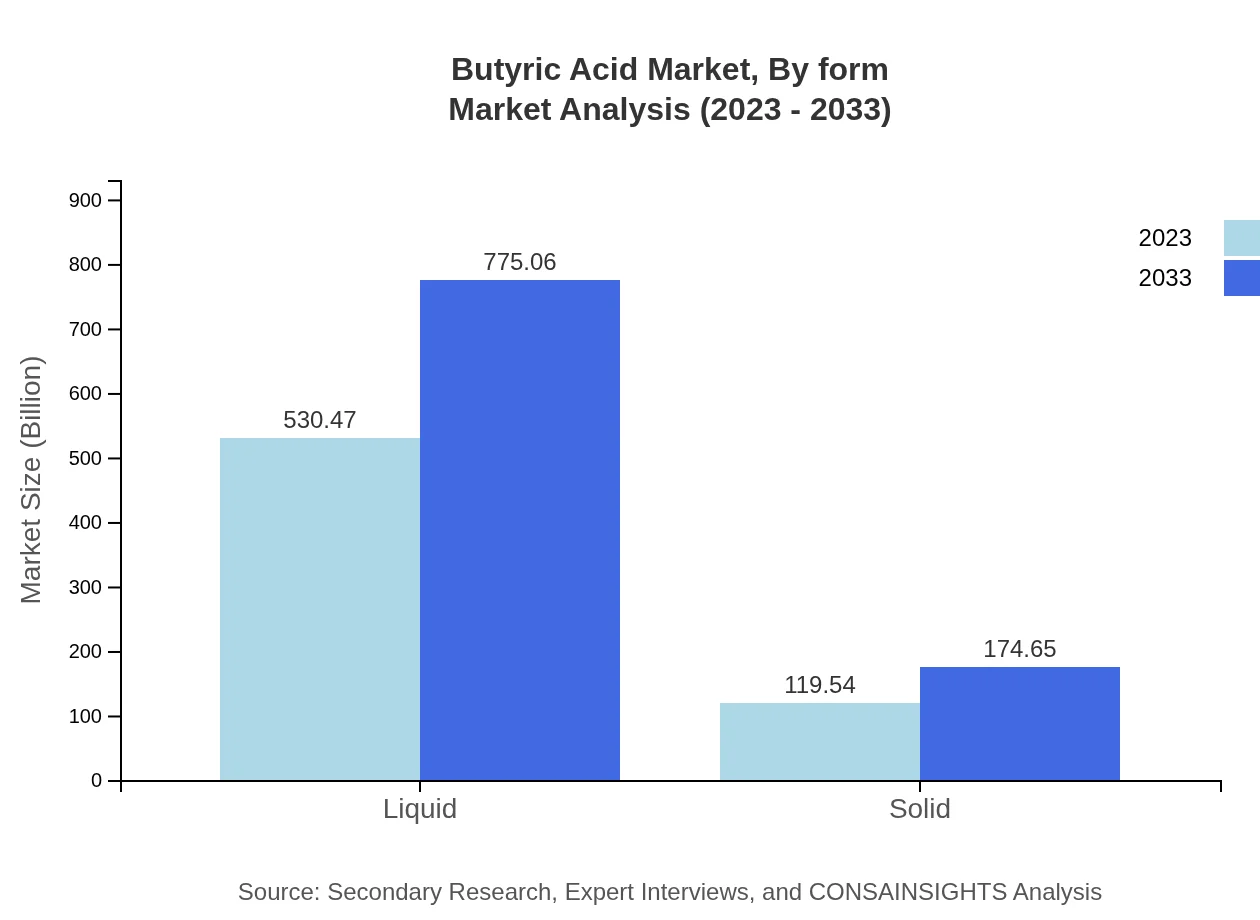

Butyric Acid Market Analysis By Form

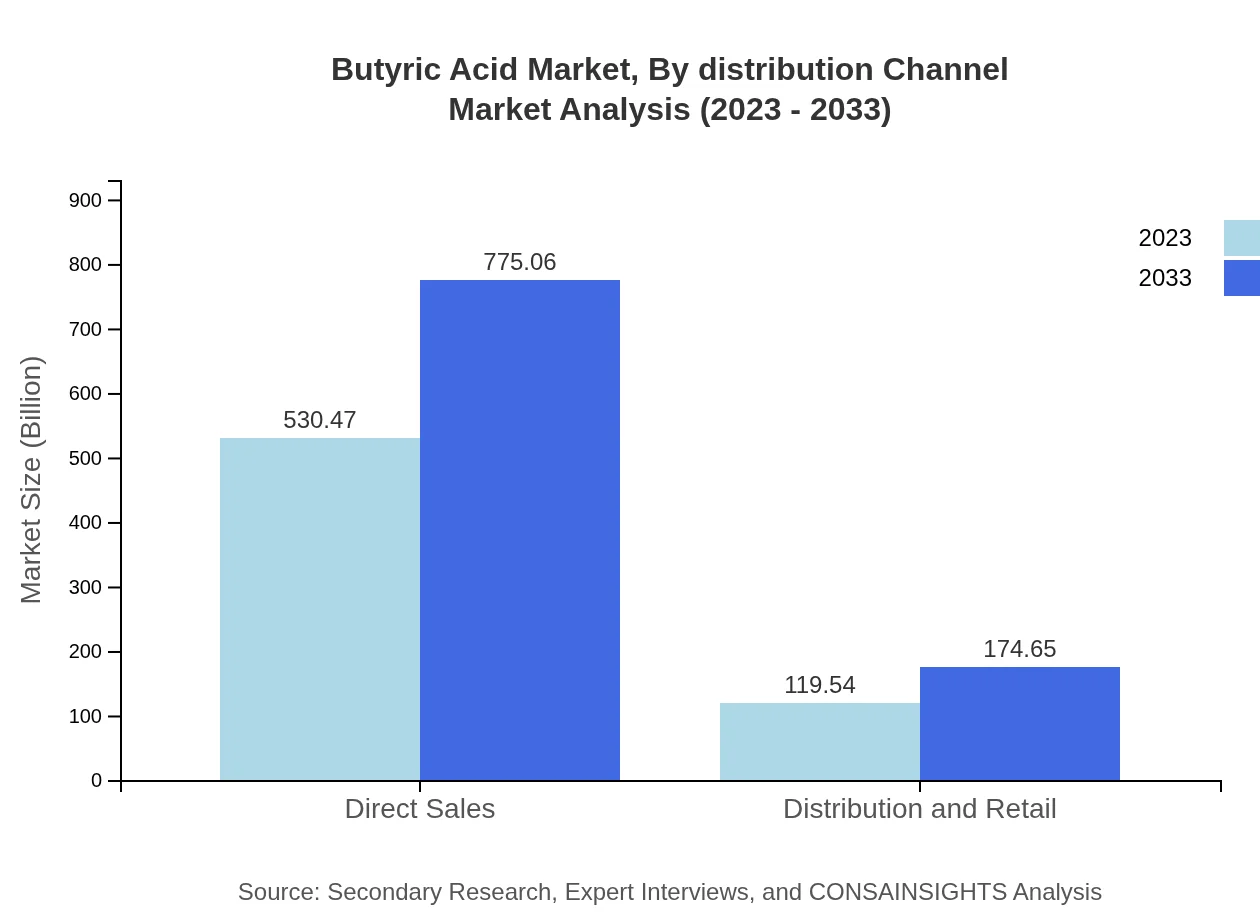

In 2023, the liquid form of Butyric Acid dominates the market, accounting for $530.47 million with an expected growth to $775.06 million by 2033, maintaining an 81.61% market share. The solid form, while smaller, has also shown growth from $119.54 million in 2023 to $174.65 million by 2033, representing 18.39% of the market share.

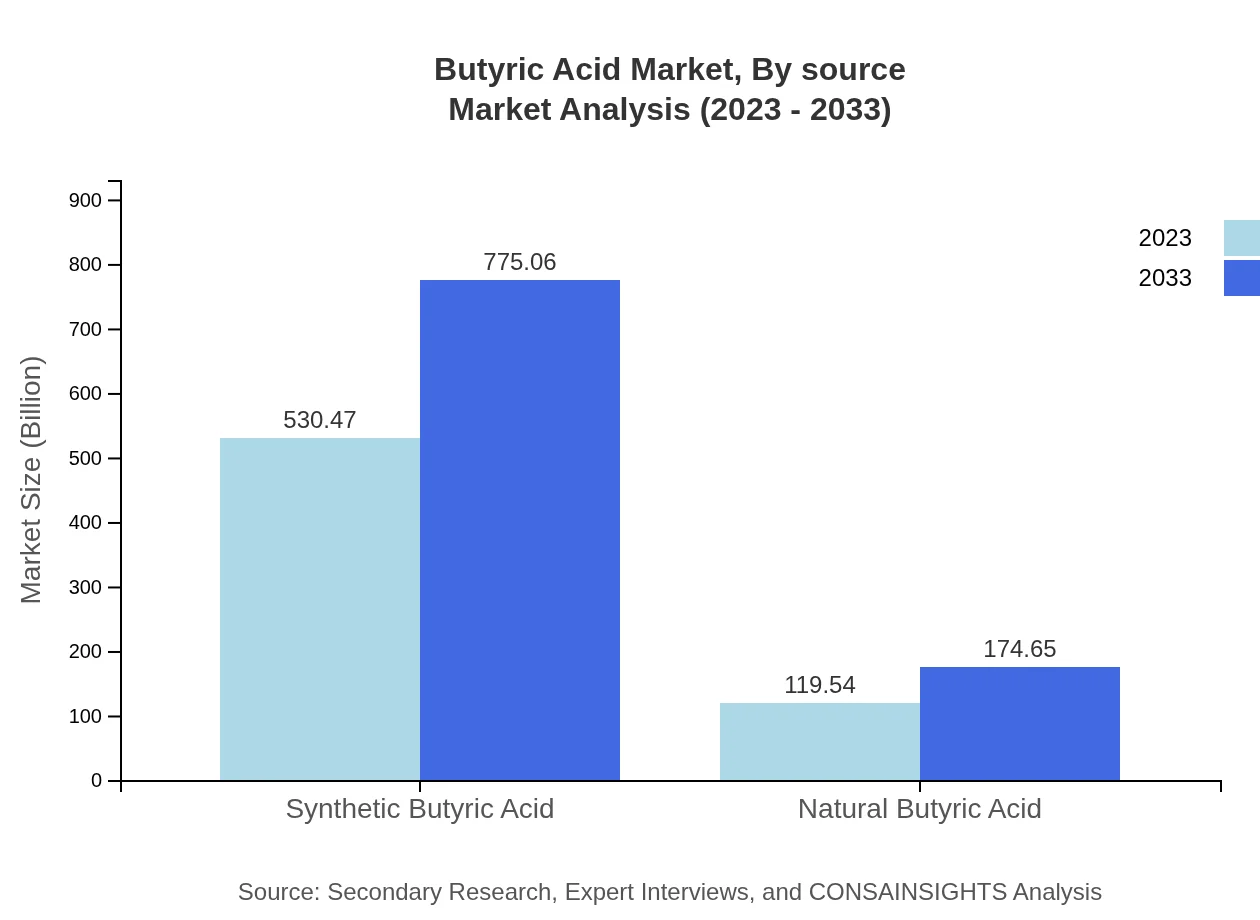

Butyric Acid Market Analysis By Source

Synthetic Butyric Acid comprises most of the market with a growth trajectory similar to that of the liquid form, while Natural Butyric Acid maintains a lesser share, providing bio-friendly options in applications, especially within the healthcare industry.

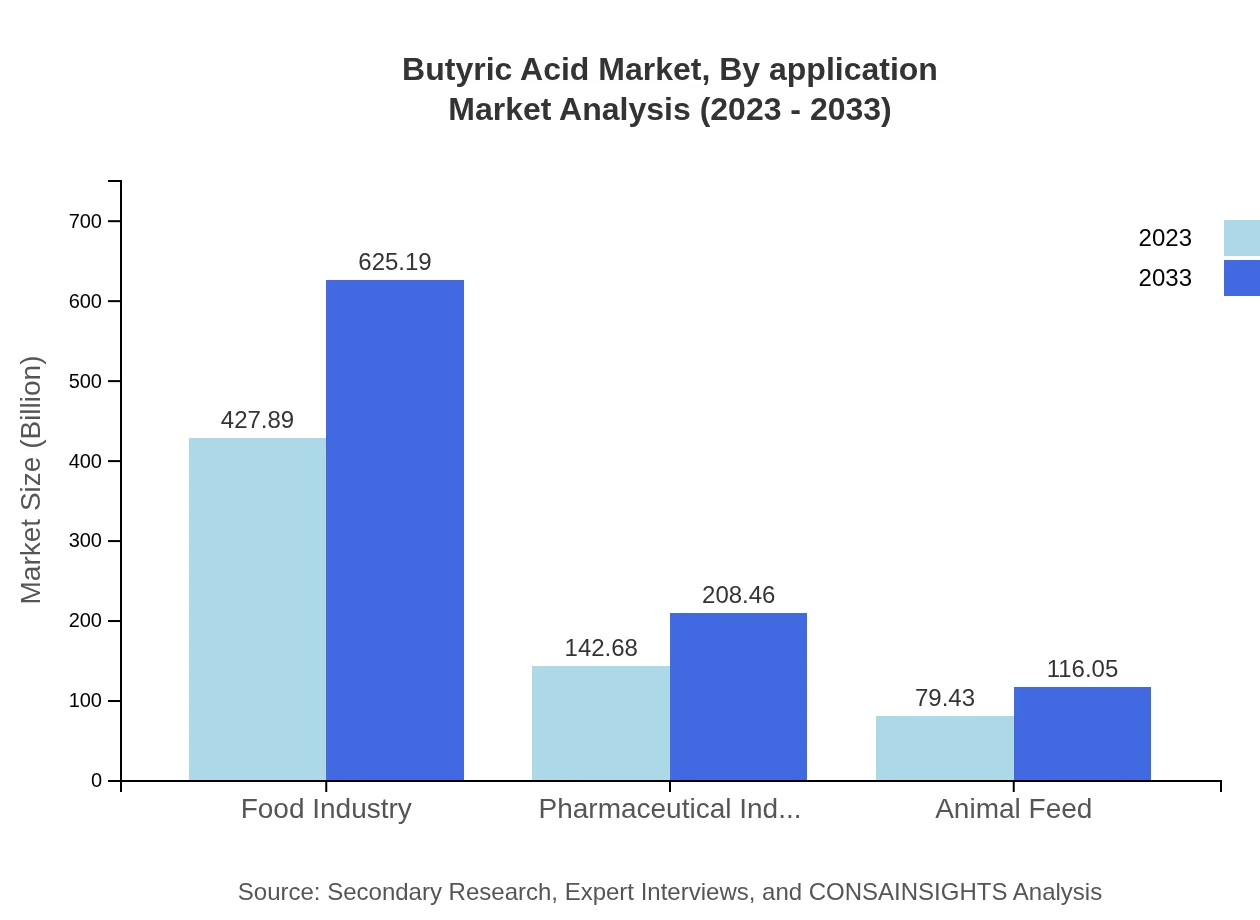

Butyric Acid Market Analysis By Application

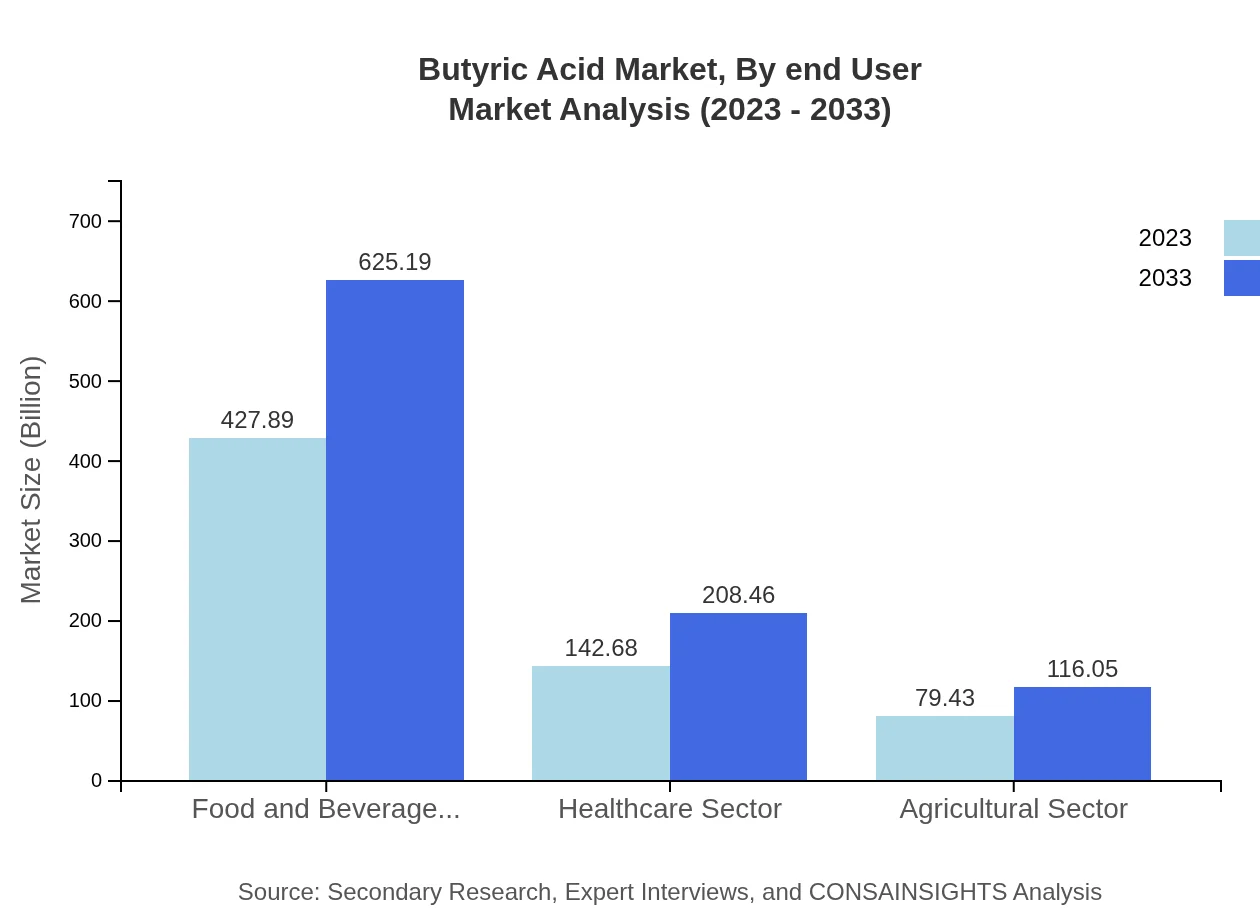

The Food and Beverage industry takes a significant portion of the market with $427.89 million in 2023, projected to grow to $625.19 million by 2033. The Healthcare sector follows with a substantial portion of $142.68 million in 2023; growth is anticipated as interest in health supplements grows.

Butyric Acid Market Analysis By End User

Key end-users for Butyric Acid include the Nutritional and Pharmaceutical industries, which together are driving significant growth through increasing awareness of the importance of gut health and digestion.

Butyric Acid Market Analysis By Distribution Channel

Direct Sales channels command a dominant market share supported by e-commerce trends, while traditional Distribution and Retail channels provide essential access to a wider consumer base.

Butyric Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Butyric Acid Industry

Corbion:

A leader in biobased ingredients, Corbion specializes in the production of sustainable food ingredients, including Butyric Acid, catering to food and beverage sectors.Olon Industries:

Olon Industries is at the forefront of synthetic chemistry and suppliers of Butyric Acid with a strong focus on quality and regulatory compliance in pharmaceuticals.Perstorp:

Perstorp is a prominent manufacturer of specialty chemicals, including Butyric Acid, providing innovative solutions tailored for various applications in agriculture and food.We're grateful to work with incredible clients.

FAQs

What is the market size of butyric acid?

The butyric acid market was valued at approximately $650 million in 2023, and it is projected to grow at a compound annual growth rate (CAGR) of 3.8% over the next decade, indicating substantial growth.

What are the key market players or companies in the butyric acid industry?

The butyric acid industry comprises key players including OXEA GmbH, BASF SE, and Perstorp Holdings AB. These companies significantly contribute to production and innovation within the butyric acid market, forming a competitive landscape.

What are the primary factors driving the growth in the butyric acid industry?

Factors driving growth in the butyric acid industry include increasing demand from the food and beverage sector and its growing application in animal feed. Additionally, a rise in health consciousness and the demand for healthcare products are key contributors.

Which region is the fastest Growing in the butyric acid market?

North America is the fastest-growing region in the butyric acid market, with an expected increase from $242.26 million in 2023 to $353.96 million by 2033, showcasing significant market activity and expansion in this area.

Does ConsaInsights provide customized market report data for the butyric acid industry?

Yes, ConsaInsights offers tailored market reports for the butyric acid industry, ensuring clients receive customized data that aligns with their specific needs and inquiries, helping to navigate market complexities effectively.

What deliverables can I expect from this butyric acid market research project?

Clients can expect comprehensive deliverables, including detailed market analysis reports, segmentation insights, competitor landscape evaluations, and growth projections for the next decade, enabling informed strategic decisions.

What are the market trends of butyric acid?

Current trends in the butyric acid market include an increasing preference for natural ingredients in food products and the rising importance of butyric acid in health supplements. Additionally, sustainability in production methods is gaining traction.