C5isr Market Report

Published Date: 03 February 2026 | Report Code: c5isr

C5isr Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the C5ISR market from 2023 to 2033, including market size, industry analysis, technological innovations, regional insights, and forecasts. It aims to offer stakeholders and decision-makers valuable insights and data to guide their strategic planning.

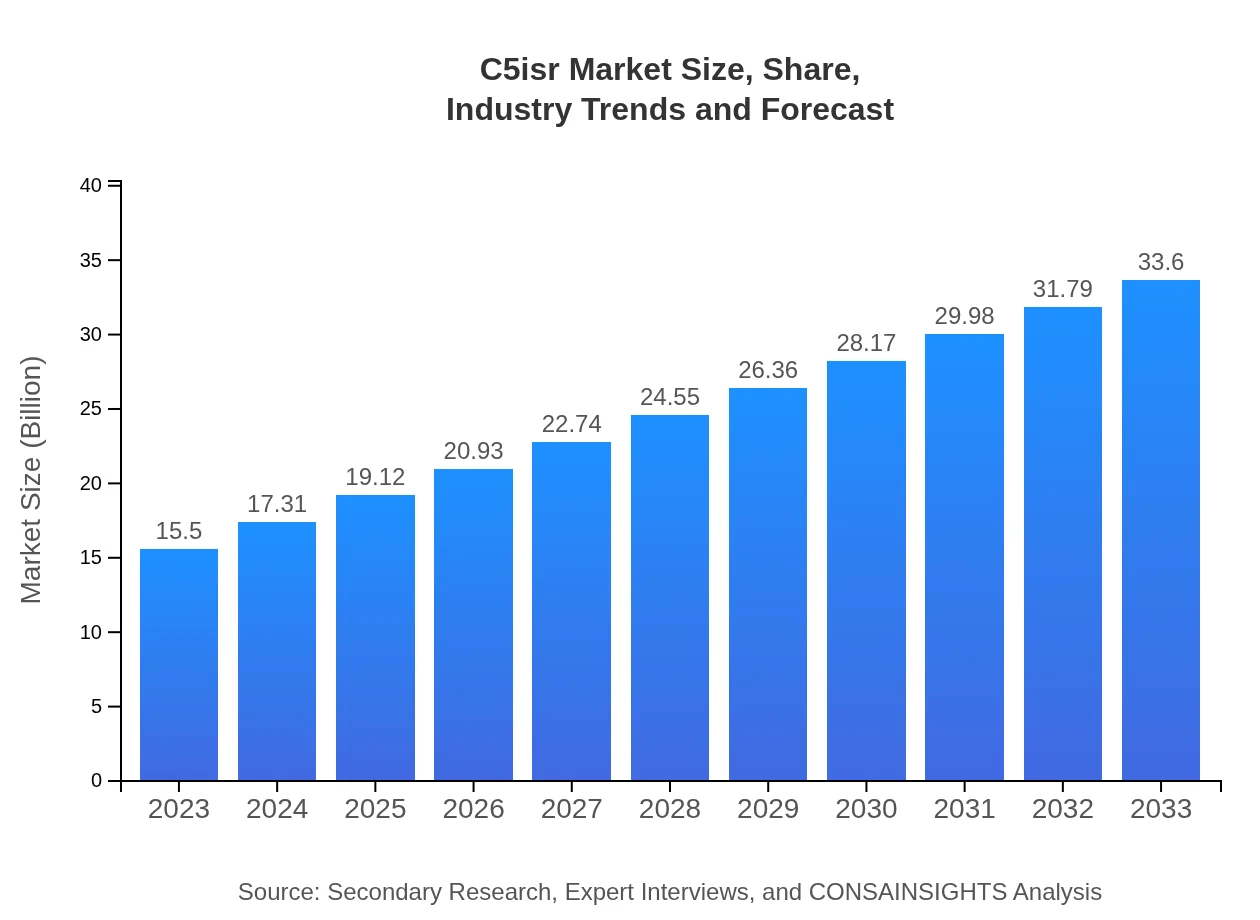

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $33.60 Billion |

| Top Companies | Lockheed Martin, Raytheon Technologies, Northrop Grumman, BAE Systems |

| Last Modified Date | 03 February 2026 |

C5isr Market Overview

Customize C5isr Market Report market research report

- ✔ Get in-depth analysis of C5isr market size, growth, and forecasts.

- ✔ Understand C5isr's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in C5isr

What is the Market Size & CAGR of C5isr market in 2023?

C5isr Industry Analysis

C5isr Market Segmentation and Scope

Tell us your focus area and get a customized research report.

C5isr Market Analysis Report by Region

Europe C5isr Market Report:

The European C5ISR market is estimated to rise from $3.85 billion in 2023 to $8.35 billion by 2033. Rising uncertainties regarding national security have led European nations to enhance their defense technologies, supporting a significant surge in C5ISR system implementation.Asia Pacific C5isr Market Report:

In the Asia-Pacific region, the C5ISR market is expected to grow from $2.98 billion in 2023 to $6.46 billion by 2033, highlighting increased investments in national defense and modernization programs. Countries like China, India, and Japan are leading defense spenders, driving the demand for advanced ISR capabilities.North America C5isr Market Report:

North America, particularly the United States, dominates the C5ISR market, projected to grow from $5.46 billion in 2023 to $11.83 billion by 2033. This growth is fueled by significant investments in defense technology, increasing collaborations among defense contractors, and burgeoning military modernization efforts in response to global threats.South America C5isr Market Report:

The South American C5ISR market is projected to grow from $1.45 billion in 2023 to $3.15 billion by 2033. Growth is primarily attributed to enhancing homeland security and increasing regulatory measures to tackle crime and terrorism, pushing for improved surveillance systems and intelligence capabilities.Middle East & Africa C5isr Market Report:

The Middle East and Africa region is projected to experience growth from $1.76 billion in 2023 to $3.82 billion by 2033. Continued conflicts and geopolitical tension necessitate a robust intelligence and surveillance framework, thereby driving investments in C5ISR capabilities.Tell us your focus area and get a customized research report.

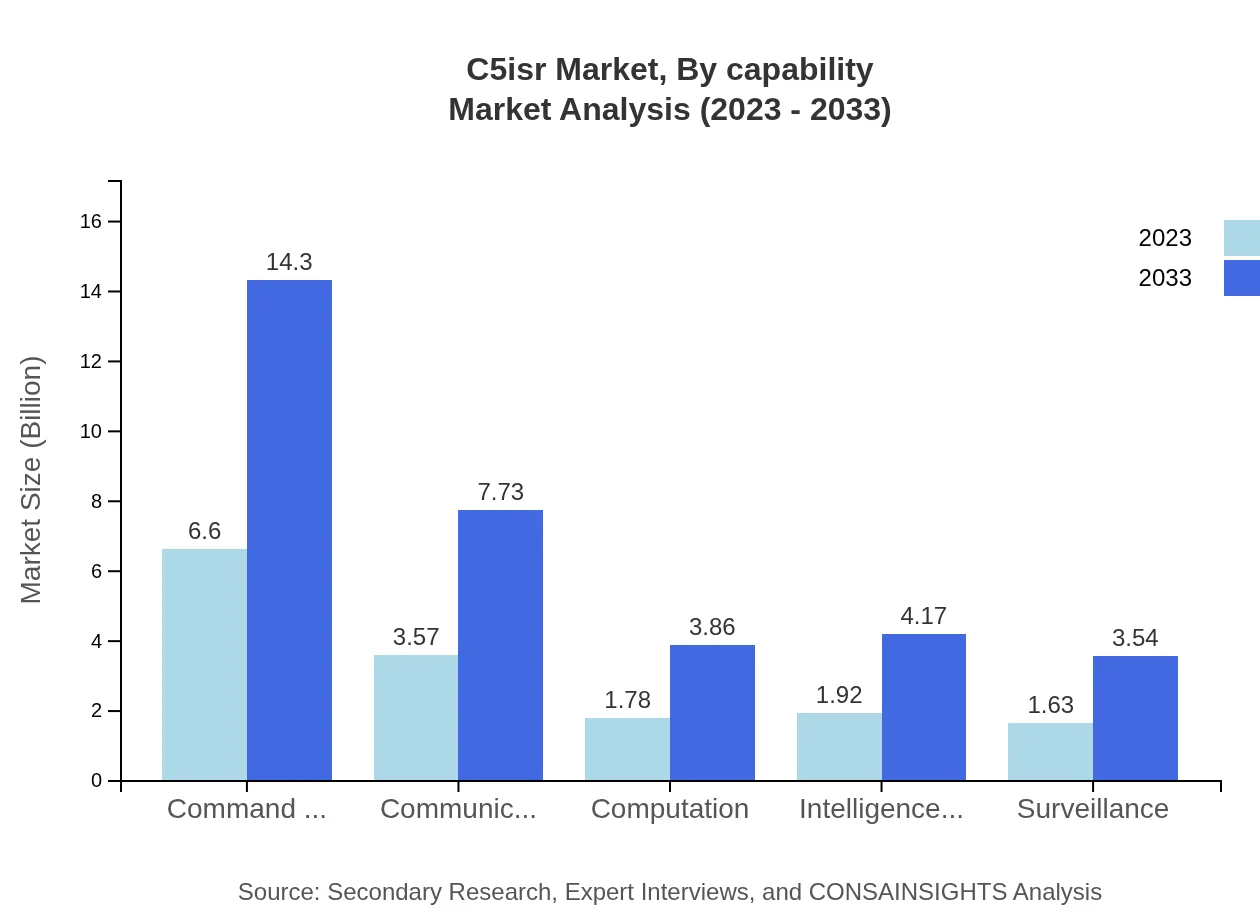

C5isr Market Analysis By Capability

The capabilities in the C5ISR market encompass vital functions like Command and Control, Communication, and Surveillance, among others. In 2023, Command and Control accounts for a significant share at $6.60 billion, maintaining its market share through 2033 with projections reaching $14.30 billion. Sensor Systems follow closely, expected to grow substantially, reflecting critical advancements in ISR technologies.

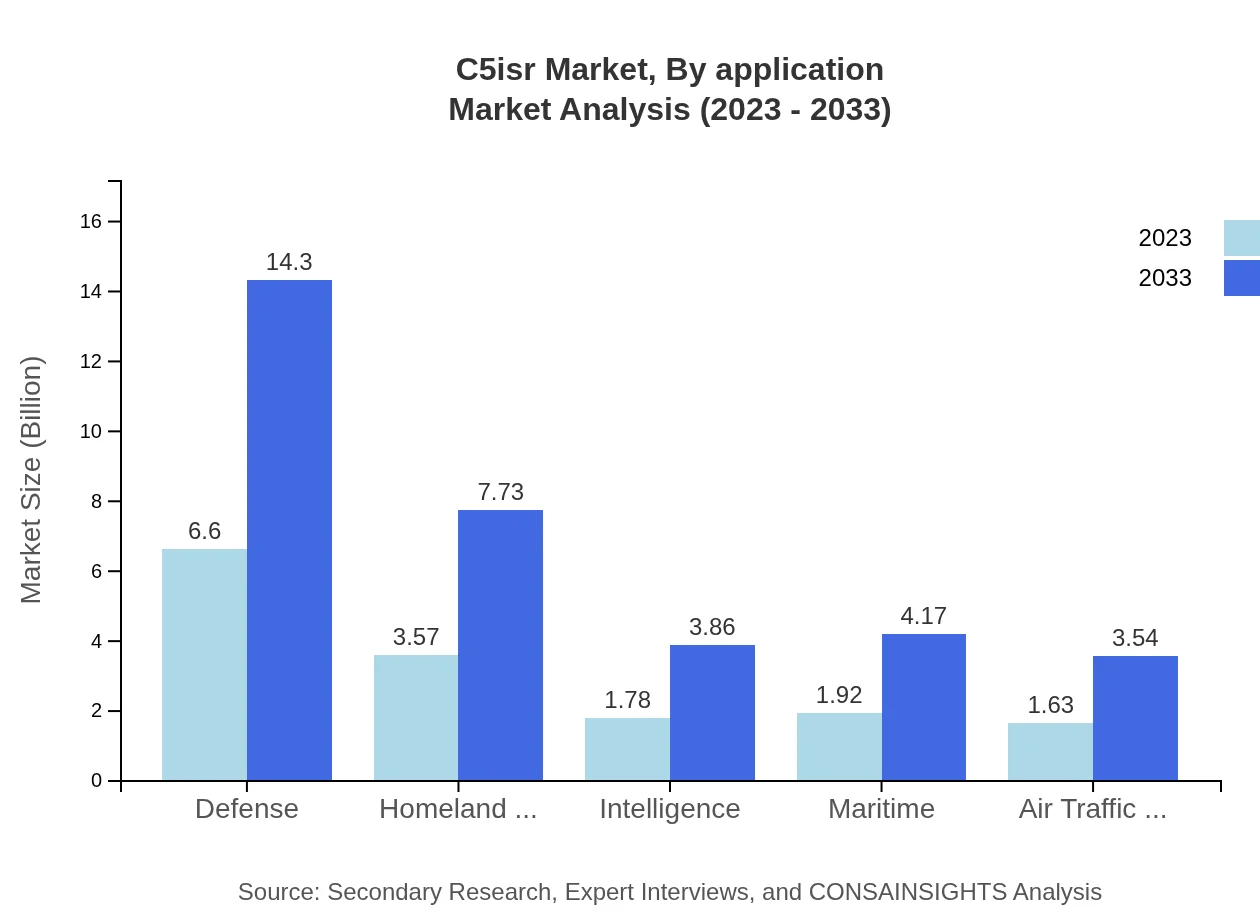

C5isr Market Analysis By Application

In terms of applications, Defense dominates the sector, projected to grow from $6.60 billion in 2023 to $14.30 billion by 2033. Homeland Security also sees robust growth, increasing from $3.57 billion to $7.73 billion, emphasizing the need for advanced surveillance systems amid rising security challenges.

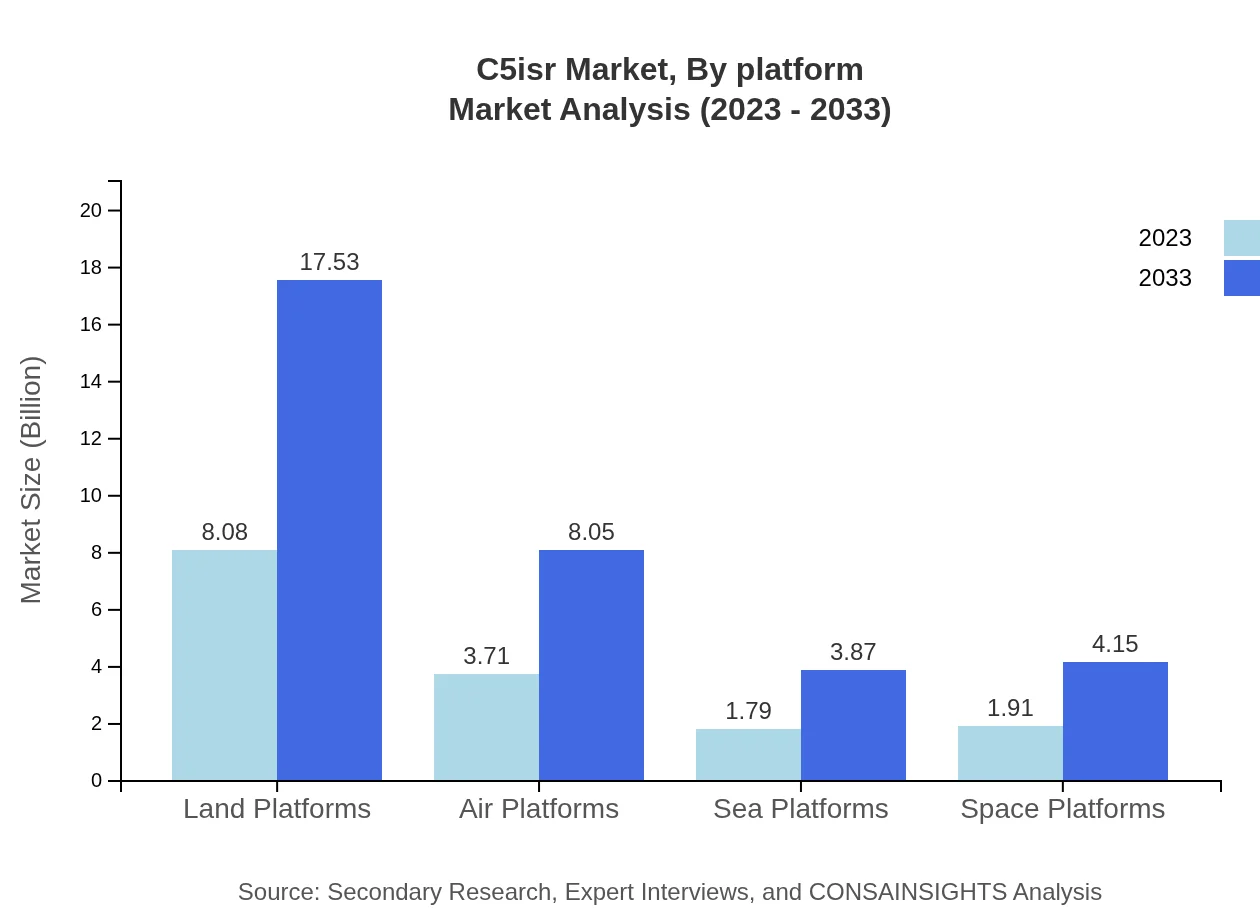

C5isr Market Analysis By Platform

Land Platforms lead the way in the C5ISR landscape, with a market size of $8.08 billion in 2023, anticipated to reach $17.53 billion by 2033, underscoring their growing importance for military operations. Air Platforms and Sea Platforms show significant growth, particularly with innovations in UAVs and naval reconnaissance systems enhancing operational effectiveness.

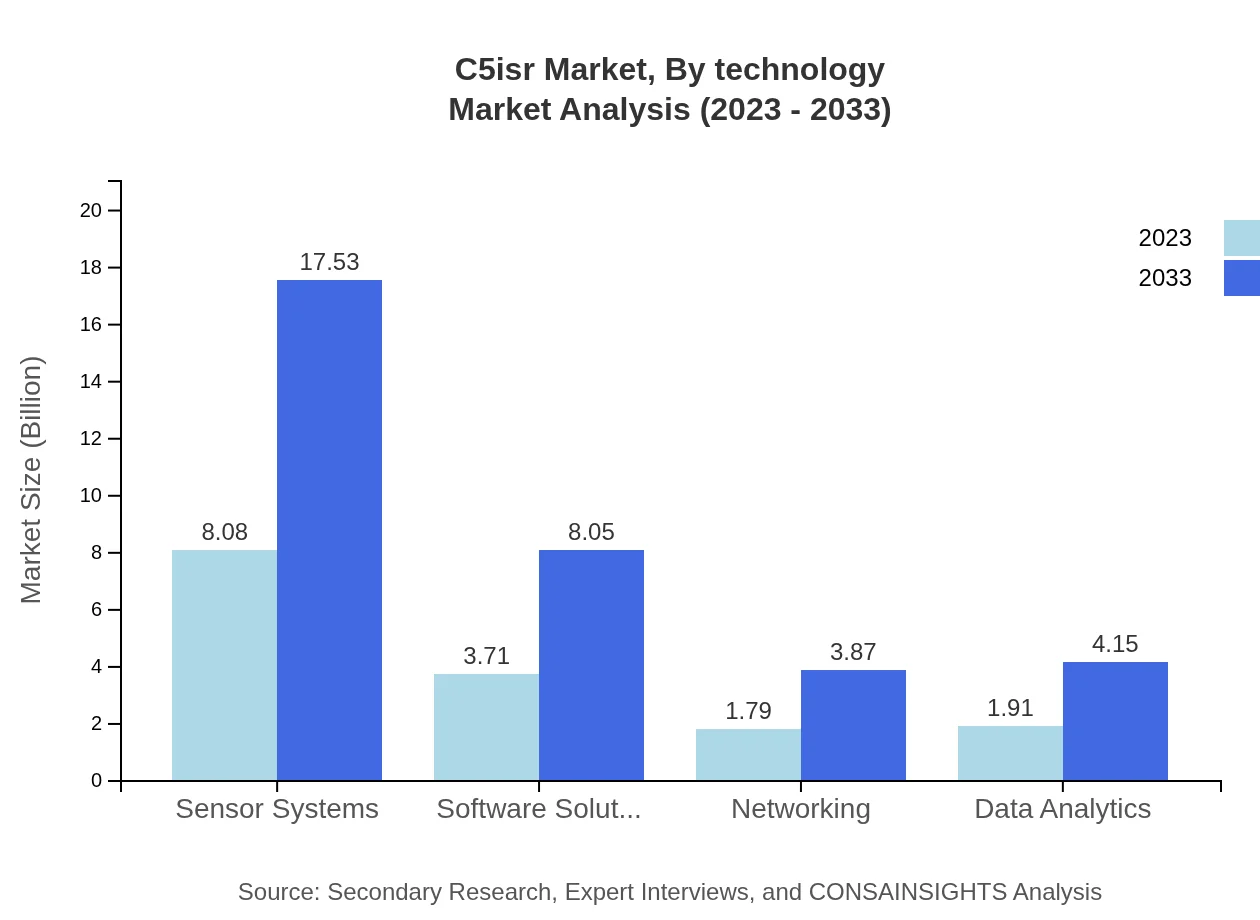

C5isr Market Analysis By Technology

Technological advancements play a pivotal role in shaping the C5ISR market. Innovations in Artificial Intelligence, cloud computing, and big data analytics are transforming operational capacities. These tech trends not only improve efficiency and decision-making but also facilitate quicker responses to emerging threats, making them integral to modern military operations.

C5isr Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in C5isr Industry

Lockheed Martin:

A leading aerospace and defense company recognized for its advanced technologies and solutions in C5ISR capabilities, playing a crucial role in military operations globally.Raytheon Technologies:

Specializes in providing integrated defense solutions, with a strong portfolio in C5ISR systems focused on enhancing situational awareness and operational efficiency.Northrop Grumman:

A major player in defense technology renowned for its innovative C5ISR solutions that support national security and military modernization efforts.BAE Systems:

Offers a broad range of products and services in defense sectors, with strategic initiatives in enhancing C5ISR technologies for better defense systems integration.We're grateful to work with incredible clients.

FAQs

What is the market size of C5ISR?

The market size of the C5ISR industry is projected to reach approximately $15.5 billion by 2033, with a compound annual growth rate (CAGR) of 7.8% from 2023 to 2033.

What are the key market players or companies in the C5ISR industry?

Key players in the C5ISR industry include major defense contractors, technology firms, and software solutions providers specializing in integrated command, control, communication, and intelligence systems.

What are the primary factors driving the growth in the C5ISR industry?

Growth in the C5ISR industry is driven by rising defense spending, increased global security threats, and advancements in technology such as AI, data analytics, and sensor systems essential for intelligent military operations.

Which region is the fastest Growing in the C5ISR?

North America is currently the fastest-growing region in the C5ISR market, projected to expand from $5.46 billion in 2023 to $11.83 billion by 2033, contributing significantly to future growth.

Does ConsaInsights provide customized market report data for the C5ISR industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and interests of clients in the C5ISR industry, ensuring relevant and actionable insights.

What deliverables can I expect from this C5ISR market research project?

Deliverables from the C5ISR market research project typically include detailed market analysis, trend reports, competitive landscape assessments, and foreseen growth projections segmented by region and application.

What are the market trends of C5ISR?

Recent trends in the C5ISR market highlight the increased adoption of cloud technologies, integration of AI for decision-making processes, and the growing importance of cybersecurity in managing defense systems.