Cabin Interior Composites Market Report

Published Date: 03 February 2026 | Report Code: cabin-interior-composites

Cabin Interior Composites Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cabin Interior Composites market, including insights on market size, trends, segmentation, regional performances, and forecasts for the period 2023-2033.

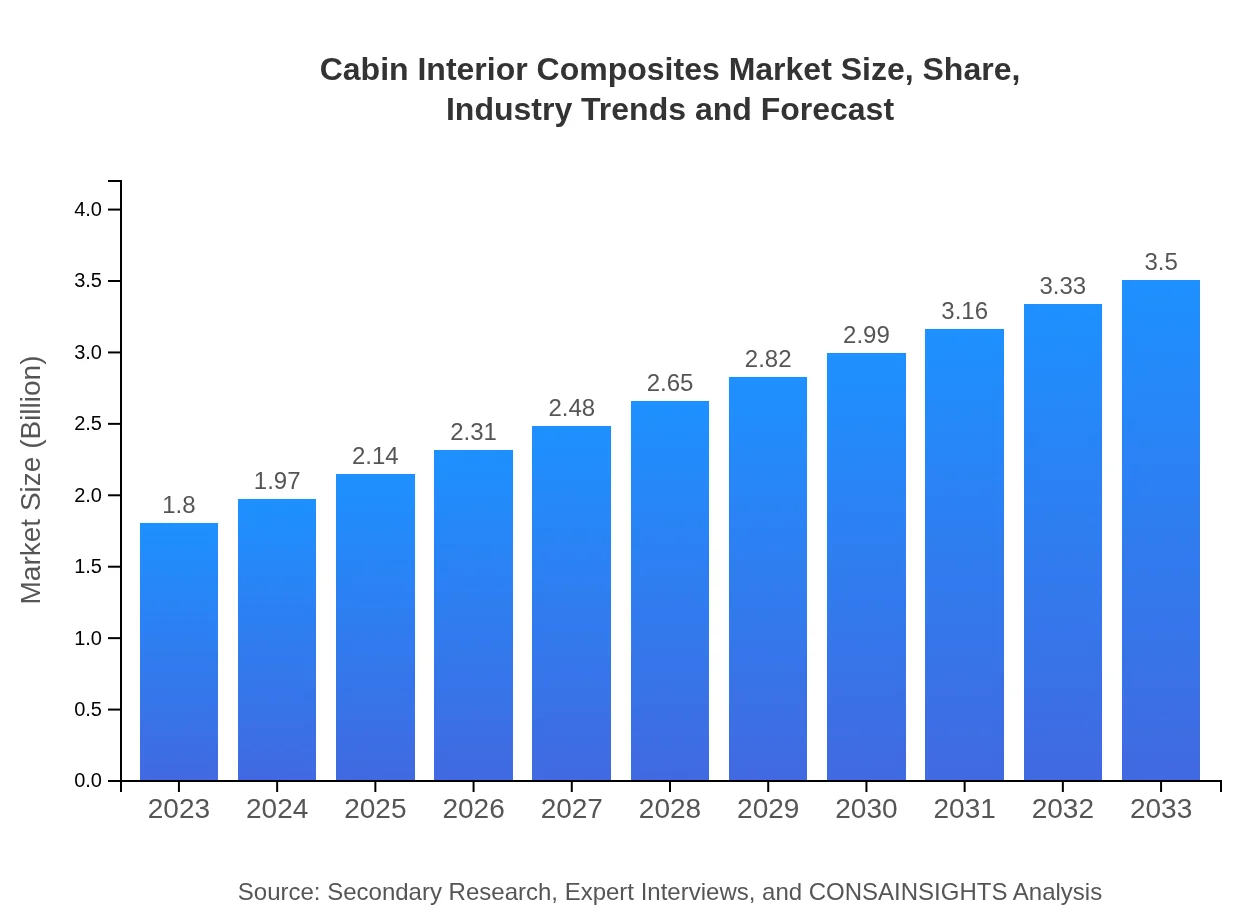

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.7% |

| 2033 Market Size | $3.50 Billion |

| Top Companies | hexcel Corporation, GKN Aerospace, Safran, Boeing |

| Last Modified Date | 03 February 2026 |

Cabin Interior Composites Market Overview

Customize Cabin Interior Composites Market Report market research report

- ✔ Get in-depth analysis of Cabin Interior Composites market size, growth, and forecasts.

- ✔ Understand Cabin Interior Composites's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cabin Interior Composites

What is the Market Size & CAGR of Cabin Interior Composites market in 2023?

Cabin Interior Composites Industry Analysis

Cabin Interior Composites Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cabin Interior Composites Market Analysis Report by Region

Europe Cabin Interior Composites Market Report:

Europe's market is projected to expand from $0.55 billion in 2023 to $1.08 billion by 2033. The region's focus on sustainability and regulatory compliance is pushing airlines to adopt advanced composite materials.Asia Pacific Cabin Interior Composites Market Report:

The Asia Pacific region is expected to witness significant growth in the Cabin Interior Composites market, projecting an increase from $0.38 billion in 2023 to $0.75 billion by 2033. The growth is driven by the expanding commercial aviation sector and rising air traffic in countries like China and India.North America Cabin Interior Composites Market Report:

North America is anticipated to dominate the market, with a size of $0.59 billion in 2023 growing to $1.15 billion in 2033. The presence of major aerospace manufacturers and a growing emphasis on innovations in materials are key factors for this growth.South America Cabin Interior Composites Market Report:

In South America, the market is projected to grow modestly from $0.04 billion in 2023 to $0.08 billion by 2033. While the growth rate may not be as high as in other regions, the focus on improving local aerospace capabilities is likely to enhance market prospects.Middle East & Africa Cabin Interior Composites Market Report:

The Middle East and Africa are expected to see growth from $0.23 billion in 2023 to $0.45 billion by 2033, driven mainly by investments in aviation infrastructure and rising air travel demand.Tell us your focus area and get a customized research report.

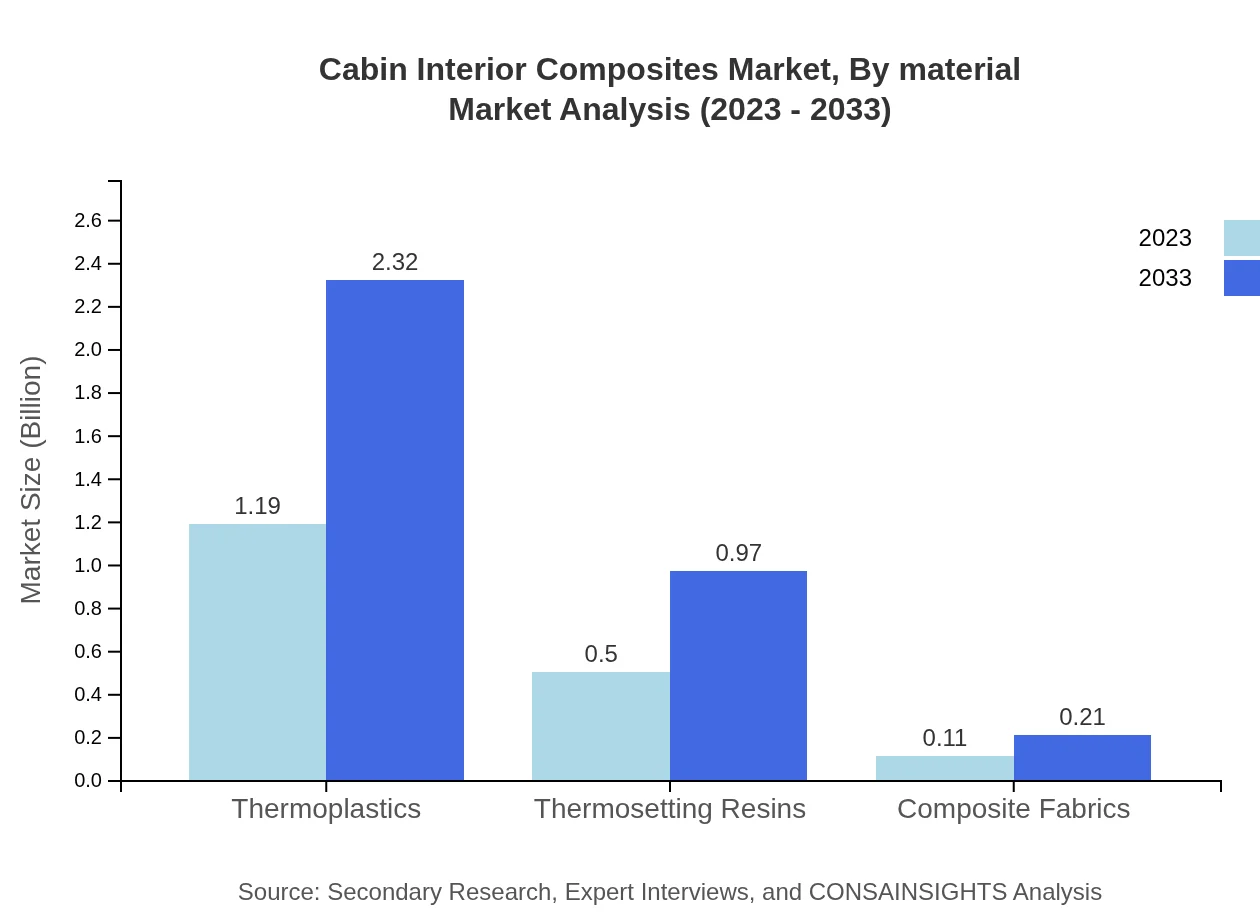

Cabin Interior Composites Market Analysis By Material

The material segment includes thermoplastics, thermosetting resins, and composite fabrics. Thermoplastics dominate the market, accounting for 66.13% and expected to grow from $1.19 billion in 2023 to $2.32 billion by 2033. Thermosetting resins and composite fabrics have significant shares as well, with a respective market size increase from $0.50 billion to $0.97 billion and $0.11 billion to $0.21 billion, highlighting their crucial roles in specific applications.

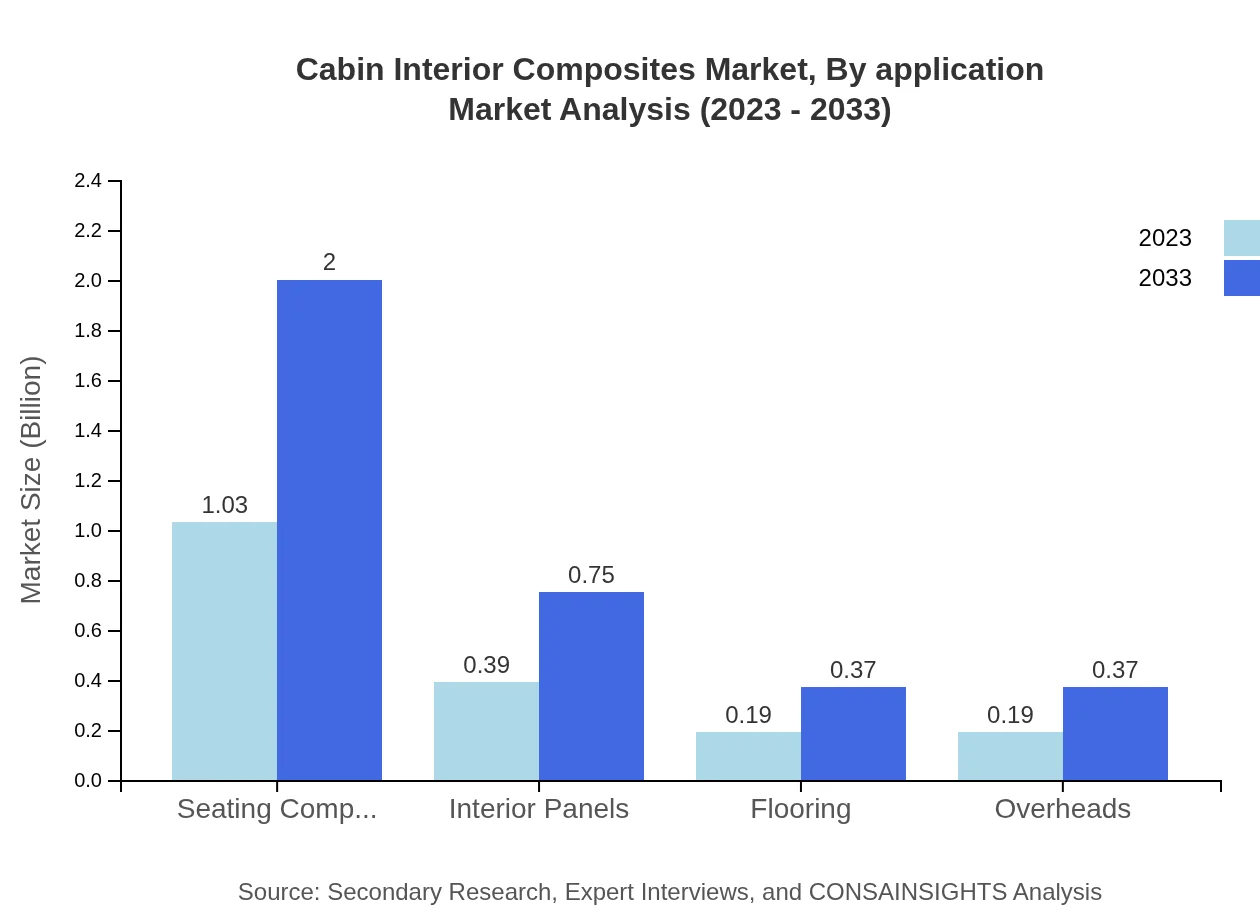

Cabin Interior Composites Market Analysis By Application

The application segment of the Cabin Interior Composites market is dominated by the commercial aerospace sector, accounting for 66.13% of the market share. Its size is projected to grow from $1.19 billion in 2023 to $2.32 billion by 2033. The general aviation sector will also see substantial growth, increasing from $0.50 billion to $0.97 billion.

Cabin Interior Composites Market Analysis By Technology

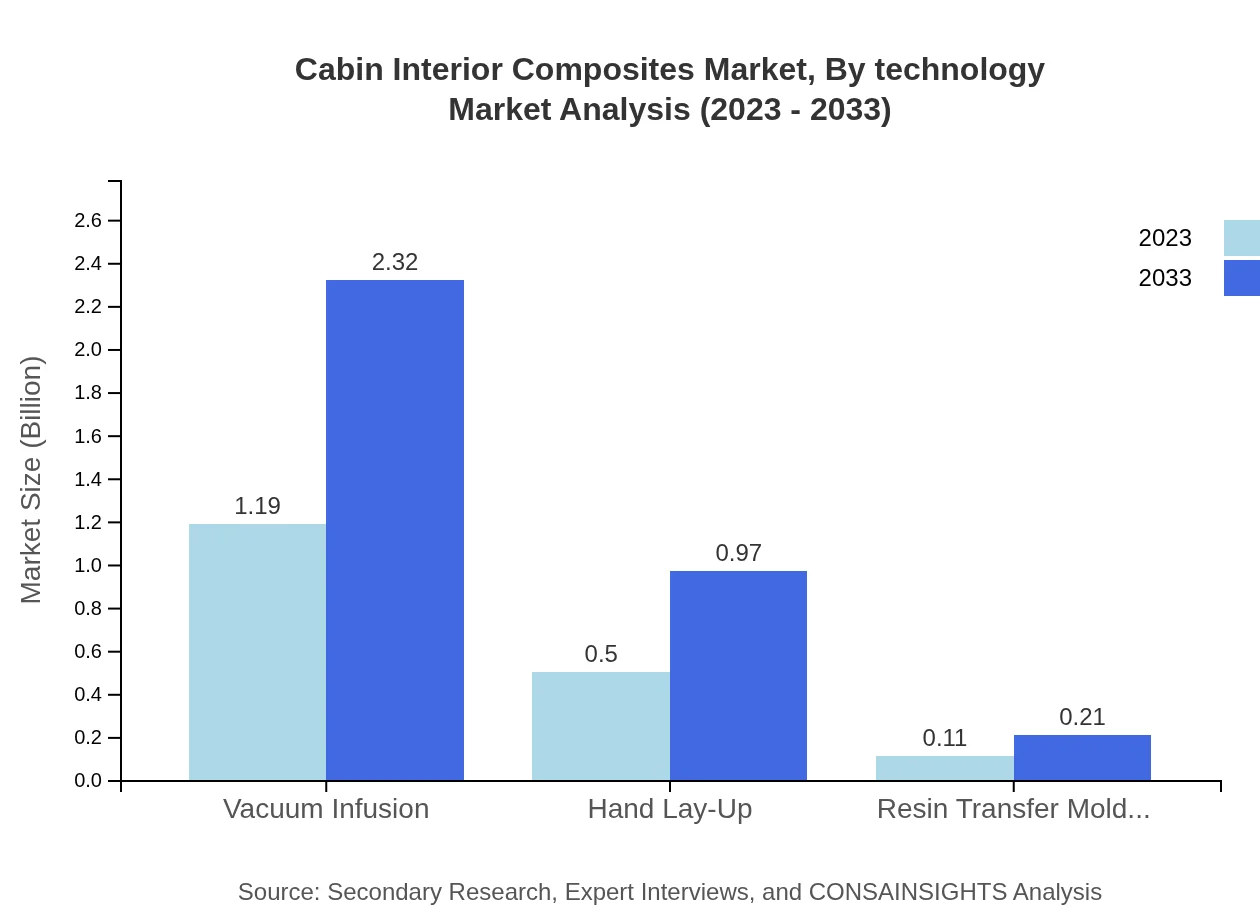

Key technologies in the market include Vacuum Infusion, Hand Lay-Up, and Resin Transfer Molding. Vacuum Infusion technology is leading with a market size of $1.19 billion in 2023 expected to grow to $2.32 billion by 2033, whereas Hand Lay-Up technology also holds a significant share with a growth trajectory from $0.50 billion to $0.97 billion.

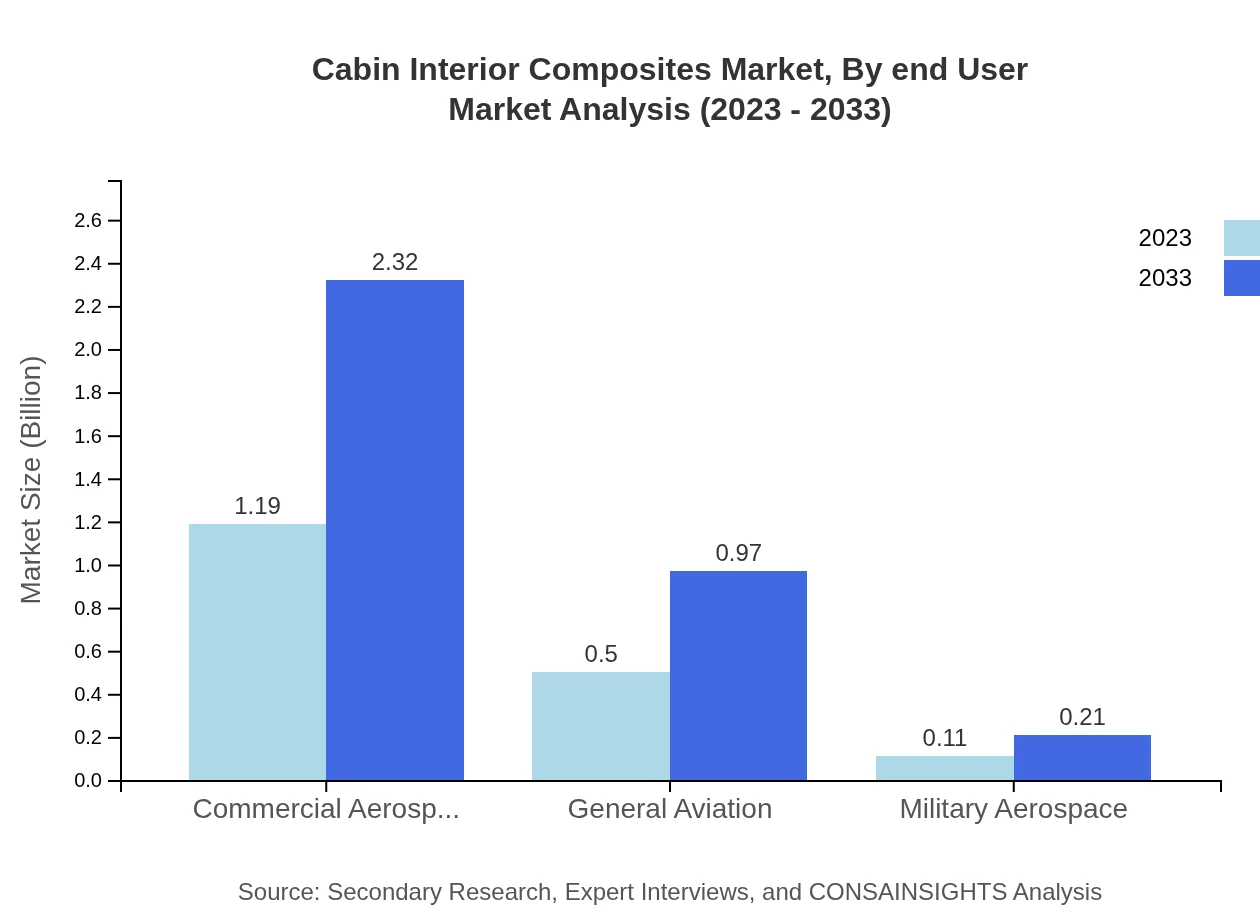

Cabin Interior Composites Market Analysis By End User

End-users in this market include commercial aerospace, general aviation, and military aerospace. The commercial aerospace sector is the largest, contributing 66.13% of the market share, while military aerospace is projected to grow from $0.11 billion in 2023 to $0.21 billion by 2033.

Cabin Interior Composites Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cabin Interior Composites Industry

hexcel Corporation:

Hexcel Corporation is a leading manufacturer of advanced composite materials, known for its innovative solutions used in various aerospace applications.GKN Aerospace:

GKN Aerospace specializes in aerospace systems and is committed to developing materials and technologies that contribute to weight reduction and aerodynamic efficiency.Safran:

Safran is a key player in the aerospace sector, providing a wide range of products and technologies, including advanced composite materials for cabin interiors.Boeing :

Boeing is one of the largest aerospace manufacturers globally and has been investing heavily in composite technologies to enhance cabin design and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of cabin Interior Composites?

The cabin interior composites market is projected to reach approximately $1.8 billion by 2033, growing at a CAGR of 6.7% from its current size. This growth reflects an increasing demand for lightweight, durable materials in aviation interiors.

What are the key market players or companies in this cabin Interior Composites industry?

Key players in the cabin interior composites industry include large aerospace companies, materials suppliers, and manufacturers specializing in composite materials. These companies focus on innovations in lightweight materials and sustainable manufacturing processes which enhance safety and performance.

What are the primary factors driving the growth in the cabin Interior Composites industry?

The growth of the cabin interior composites industry is driven by factors such as the rising demand for lightweight, fuel-efficient aircraft, enhanced passenger comfort, and regulations emphasizing safety and environmental sustainability. Innovations in composite materials further stimulate market expansion.

Which region is the fastest Growing in the cabin Interior Composites?

The fastest-growing region for cabin interior composites is Europe, with market growth from $0.55 billion in 2023 to $1.08 billion by 2033. Asia Pacific also shows significant growth from $0.38 billion in 2023 to $0.75 billion in 2033.

Does ConsaInsights provide customized market report data for the cabin Interior Composites industry?

Yes, Consainsights offers customized market report data tailored to your specific needs within the cabin interior composites industry, providing insightful and comprehensive analysis for various stakeholders.

What deliverables can I expect from this cabin Interior Composites market research project?

From the cabin interior composites market research project, expect detailed reports including market analysis, growth forecasts, regional insights, competitive landscape, and segment data ranging from commercial aerospace to military applications.

What are the market trends of cabin Interior Composites?

Current market trends in cabin interior composites include increased adoption of thermoplastics and composite fabrics, a shift towards sustainable materials, and innovations in manufacturing processes such as vacuum infusion to enhance performance and reduce waste.