Cables And Connectors Market Report

Published Date: 31 January 2026 | Report Code: cables-and-connectors

Cables And Connectors Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cables and Connectors market, detailing insights on market trends, sizes, and forecasts from 2023 to 2033. It covers regional performances, industry dynamics, and segmentation, presenting valuable information for stakeholders.

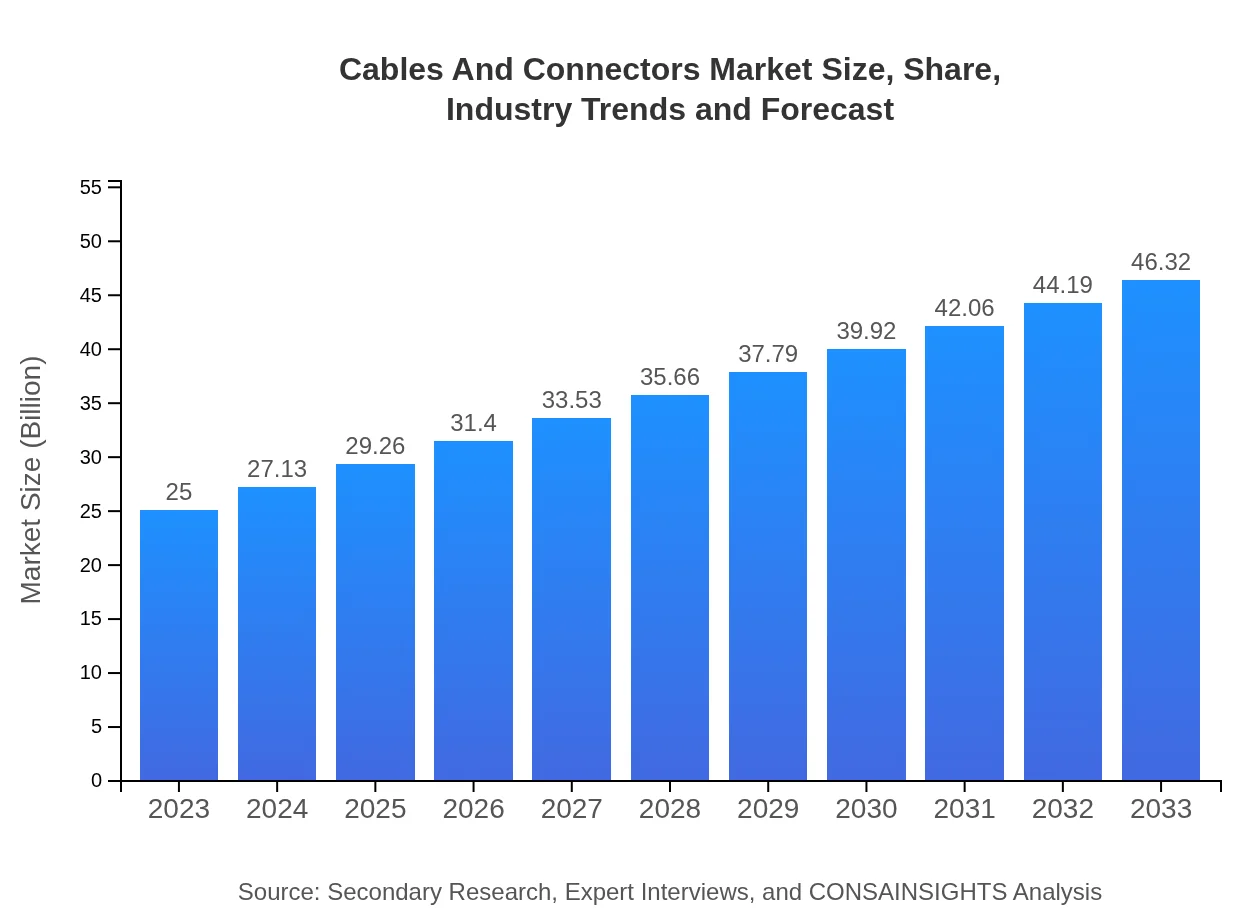

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $46.32 Billion |

| Top Companies | TE Connectivity, Amphenol Corporation, Molex, Rose Brawin Group, Belden |

| Last Modified Date | 31 January 2026 |

Cables And Connectors Market Overview

Customize Cables And Connectors Market Report market research report

- ✔ Get in-depth analysis of Cables And Connectors market size, growth, and forecasts.

- ✔ Understand Cables And Connectors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cables And Connectors

What is the Market Size & CAGR of Cables And Connectors market in 2023?

Cables And Connectors Industry Analysis

Cables And Connectors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cables And Connectors Market Analysis Report by Region

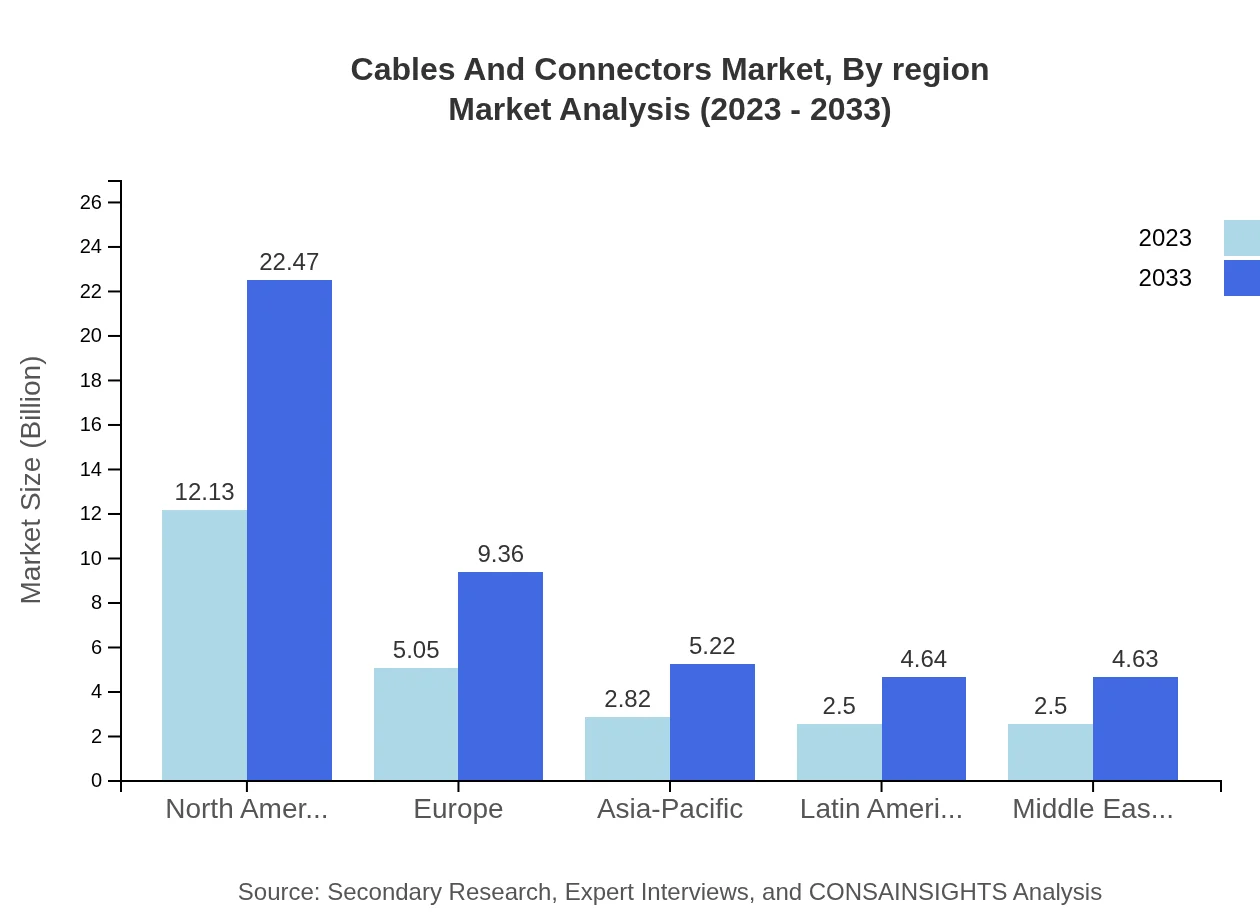

Europe Cables And Connectors Market Report:

Europe's Cables and Connectors market is growing steadily from $6.24 billion in 2023 to $11.57 billion by 2033, backed by stringent regulations promoting energy efficiency and advancements in telecommunications infrastructure. The region's focus on sustainability also drives demand for innovative products.Asia Pacific Cables And Connectors Market Report:

The Asia-Pacific region shows remarkable growth, anticipated to expand from $5.09 billion in 2023 to $9.44 billion by 2033. Factors such as rapid urbanization, increased manufacturing activities, and rising investments in telecommunications are driving this growth, alongside the growing trend of smart cities.North America Cables And Connectors Market Report:

North America remains one of the largest markets, valued at $9.57 billion in 2023 and projected to reach $17.73 billion by 2033. The region's leadership in technology innovation, along with high consumer electronics adoption and increased infrastructure development, propels market growth.South America Cables And Connectors Market Report:

South America is forecasted to grow from $1.31 billion in 2023 to $2.43 billion by 2033, driven by increasing investments in infrastructure and urbanization. The need for improved connectivity and energy efficiency in industries like healthcare and transportation is expected to boost market demand.Middle East & Africa Cables And Connectors Market Report:

The Middle East and Africa region's market is expected to grow from $2.78 billion in 2023 to $5.16 billion by 2033. Increased investment in infrastructure and energy projects in emerging economies like UAE and Saudi Arabia significantly contribute to driving this growth.Tell us your focus area and get a customized research report.

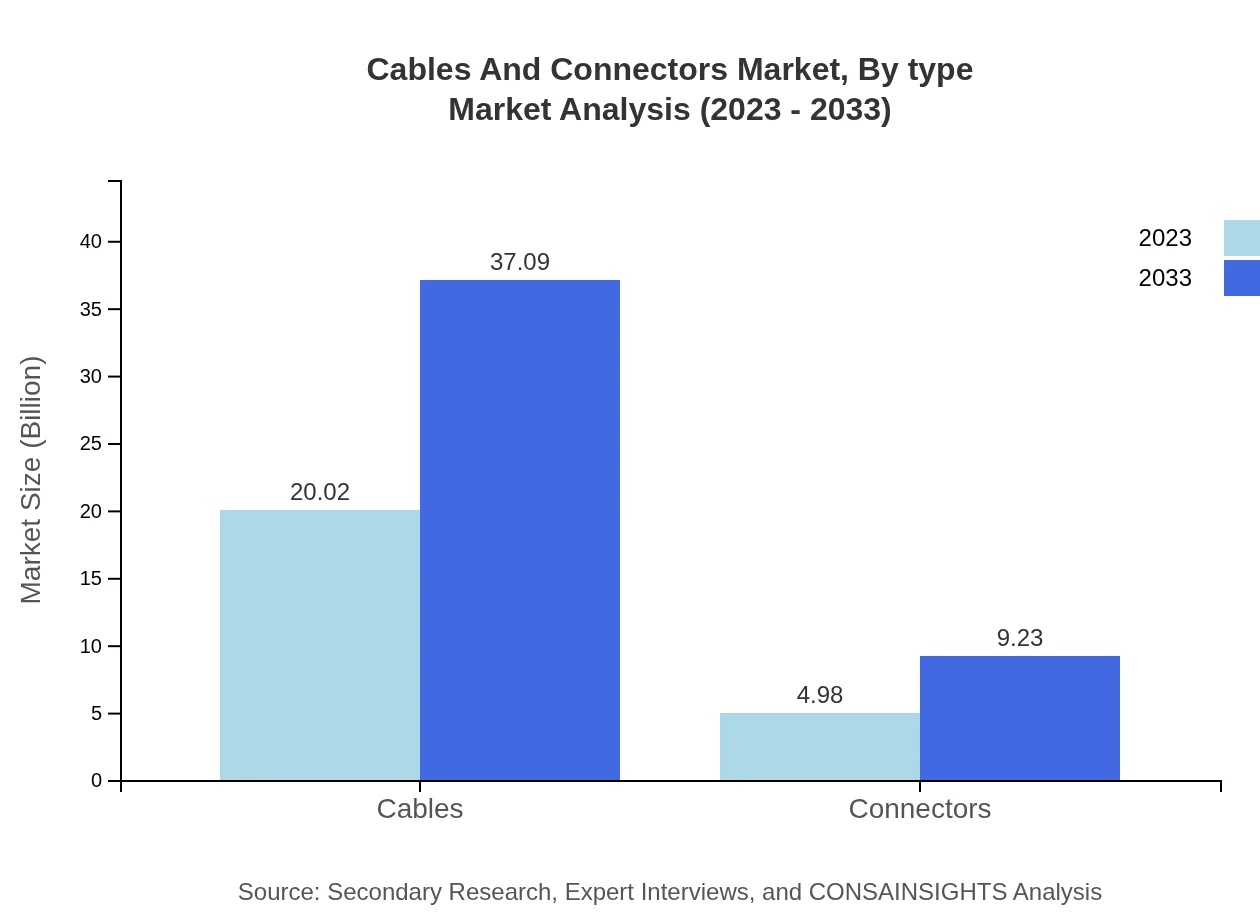

Cables And Connectors Market Analysis By Type

In 2023, cable products dominate the market, with a size of approximately $20.02 billion, projected to grow to $37.09 billion by 2033, maintaining an 80% share throughout the decade. Connectors represent a growing segment, forecasted to evolve from $4.98 billion in 2023 to $9.23 billion by 2033, capturing a 19.92% market share.

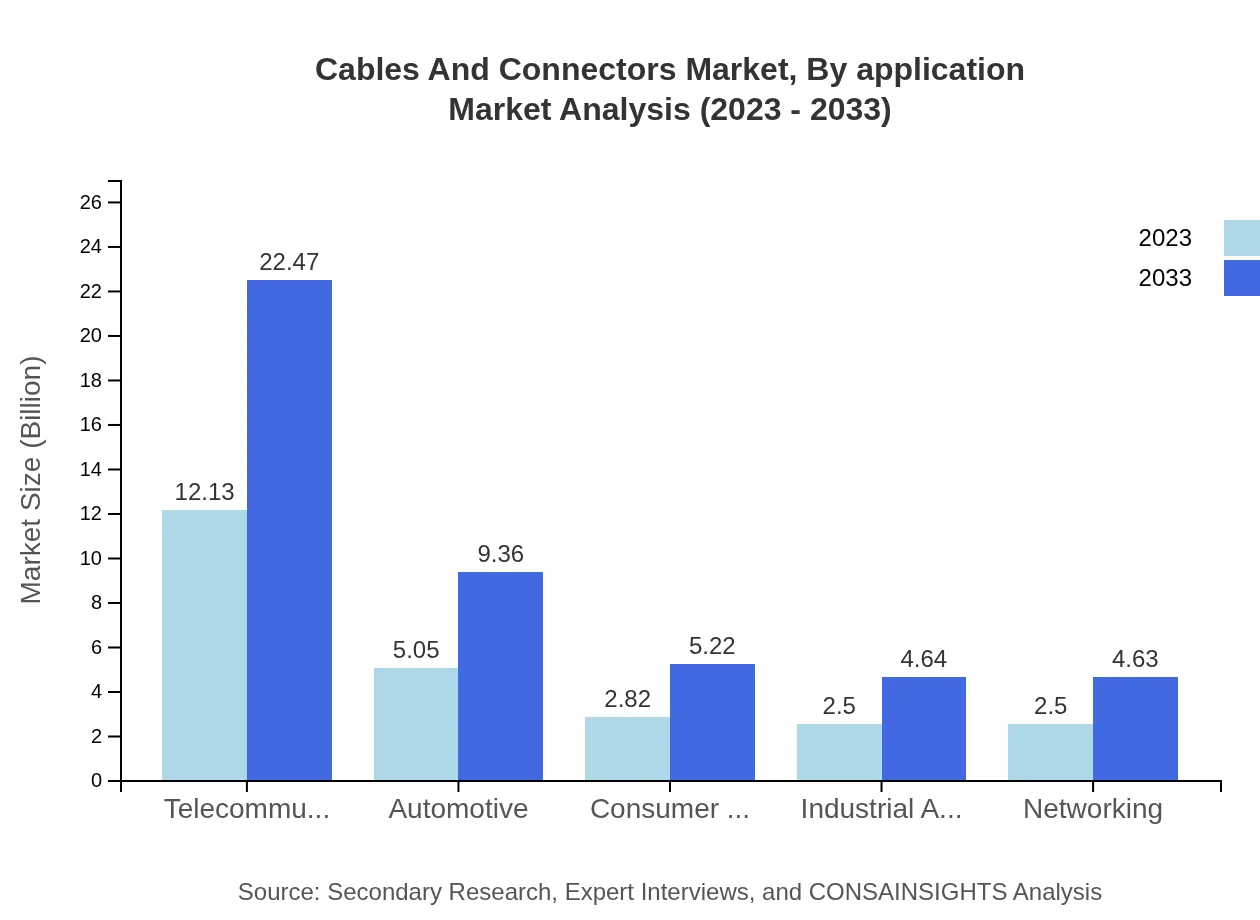

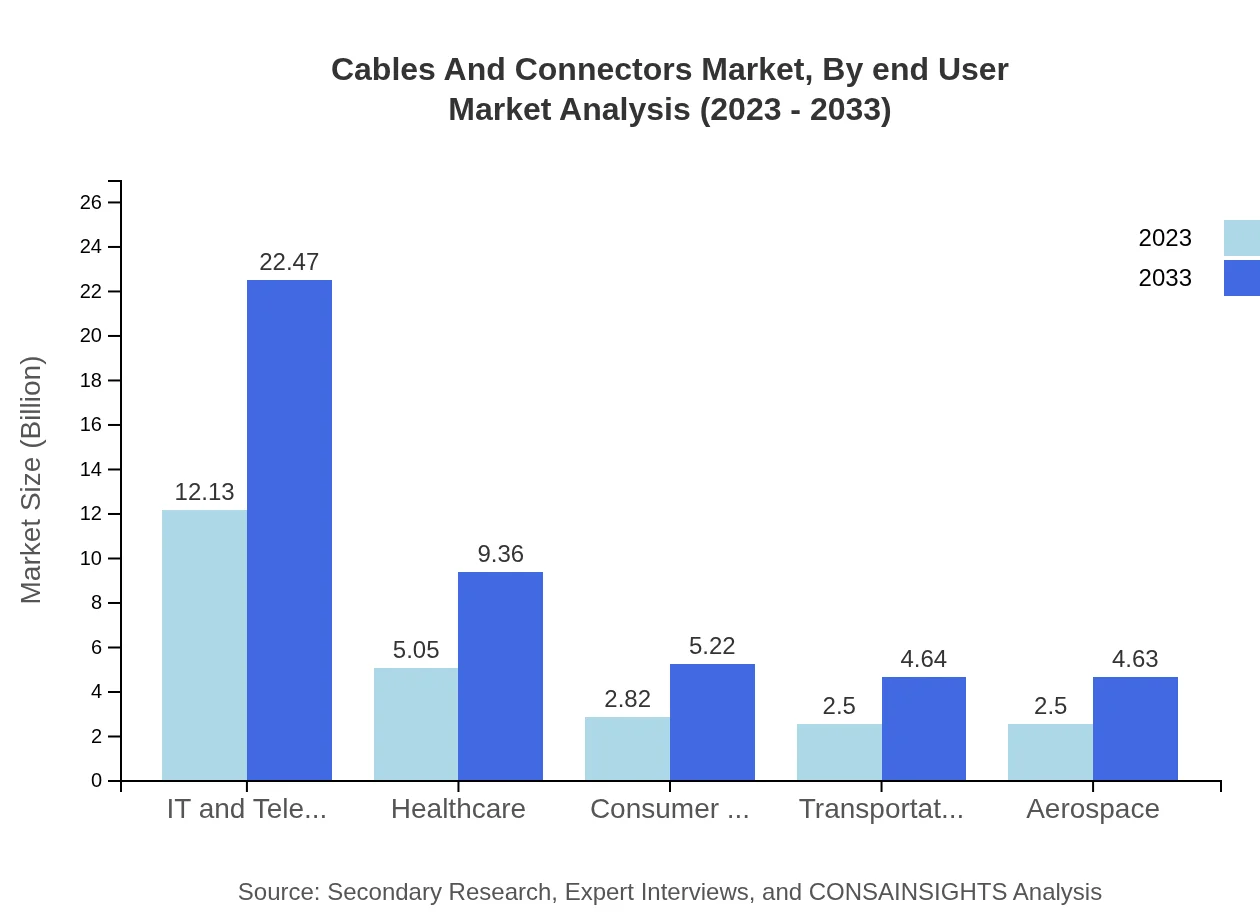

Cables And Connectors Market Analysis By Application

The IT and telecommunications sector leads the market, constituting around 48.52% share with a valuation of $12.13 billion in 2023, expected to reach $22.47 billion by 2033. Healthcare and automotive applications follow, maintaining significant shares through technological enhancements and increased demand.

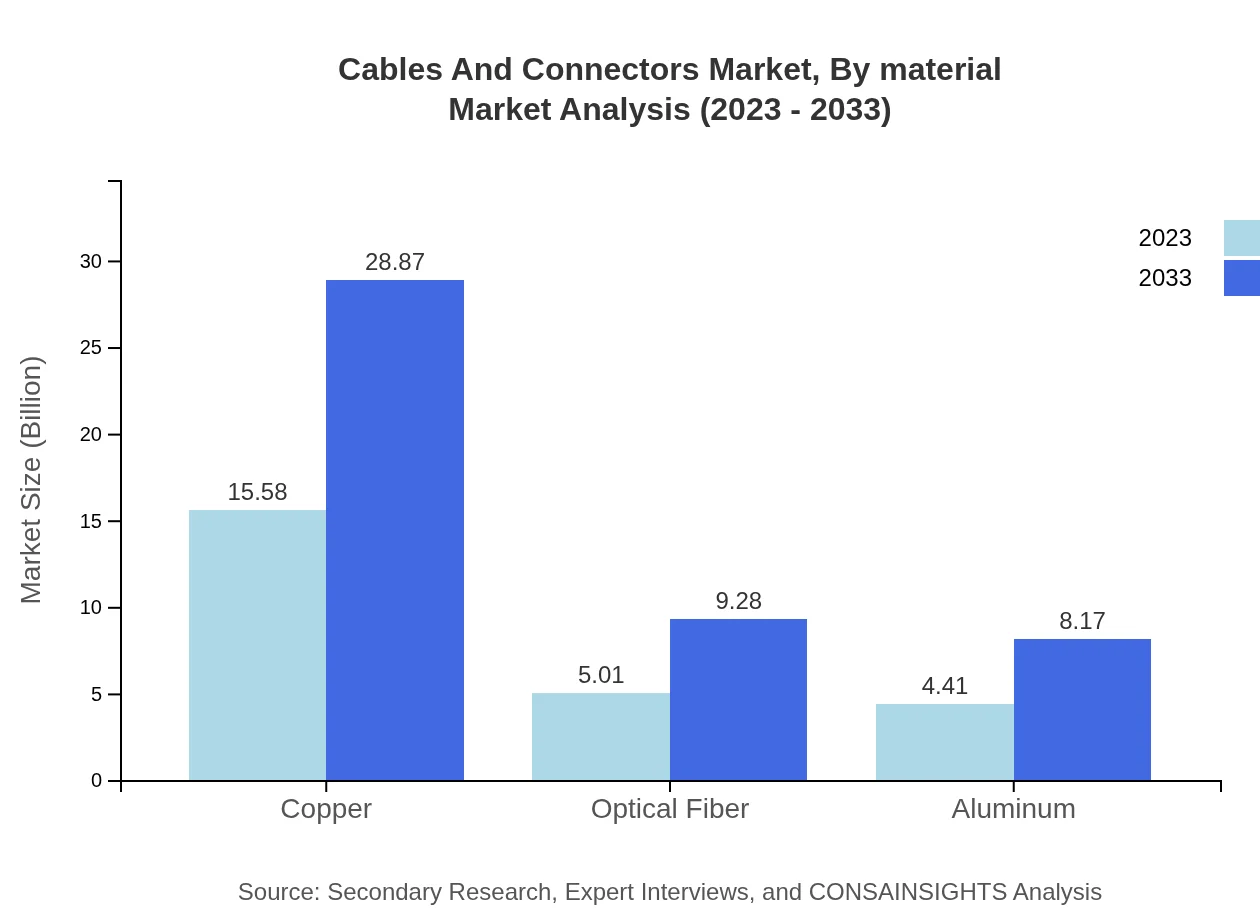

Cables And Connectors Market Analysis By Material

Copper remains the dominant material, valued at $15.58 billion in 2023 with a projected growth to $28.87 billion by 2033, securing a 62.32% market share. The demand for optical fiber is also rising, anticipated to grow from $5.01 billion in 2023 to $9.28 billion by 2033.

Cables And Connectors Market Analysis By End User

The consumer electronics sector, leveraging the growth of smart devices, is significant in the market, expected to grow from $2.82 billion in 2023 to $5.22 billion by 2033. The automotive industry gears up for advancements, while industrial applications are critical for the overall market health.

Cables And Connectors Market Analysis By Region

Regional dynamics significantly affect market performance. North America is leading, with substantial investments in infrastructure followed by Europe’s regulatory environment, encouraging innovation. The Asia-Pacific region exhibits rapid adoption of new technologies, while South America's emerging markets enhance growth potential.

Cables And Connectors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cables And Connectors Industry

TE Connectivity:

TE Connectivity is a global leader in connectivity and sensors offering a wide range of products across several industries, known for its innovative solutions in harsh environments.Amphenol Corporation:

Amphenol Corporation specializes in high-technology interconnect products. They serve various markets, including telecommunications, automotive, and military, recognized for their quality and reliability.Molex:

Molex is a leading global supplier of connectors and interconnect components, known for their pioneering innovations in automotive, consumer, and industrial markets.Rose Brawin Group:

Rose Brawin Group provides engineered connectivity solutions for multiple sectors, focusing on video and data across communications and commercial industries.Belden:

Belden offers a diversified range of networking and connectivity technologies aimed at high-performance applications, known for their high-quality cabling solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of cables And Connectors?

The cables and connectors market is currently valued at approximately $25 billion, with a projected CAGR of 6.2%. This growth reflects increasing demand across various sectors and rising technological advancements in connectivity solutions.

What are the key market players or companies in the cables And Connectors industry?

Key players in the cables and connectors industry include prominent manufacturers and innovators such as TE Connectivity, Molex, Amphenol, and 3M. These companies lead through continuous research, product innovation, and strategic partnerships.

What are the primary factors driving the growth in the cables And Connectors industry?

Growth in the cables and connectors market is primarily driven by advancements in telecommunications, increased demand for data infrastructure, and the need for efficient power distribution systems, particularly in renewable energy and electric vehicles.

Which region is the fastest Growing in the cables And Connectors market?

The Asia-Pacific region is identified as the fastest-growing market for cables and connectors, projected to rise from $5.09 billion in 2023 to $9.44 billion by 2033, reflecting a strong CAGR due to technological adoption and increasing consumer electronics.

Does ConsaInsights provide customized market report data for the cables And Connectors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs of clients in the cables-and-connectors industry, allowing for detailed insights on trends, forecasts, and competitive landscapes.

What deliverables can I expect from this cables And Connectors market research project?

From this market research project, clients can expect comprehensive reports, trend analysis, competitor profiling, segmentation data, and actionable insights tailored to support strategic decisions in the cables and connectors market.

What are the market trends of cables And Connectors?

Current trends in the cables and connectors market include a shift towards eco-friendly materials, increased use of fiber optics, and a rising focus on smart technology integration across industries, driving innovation and market competitiveness.