Cacao Beans Market Report

Published Date: 31 January 2026 | Report Code: cacao-beans

Cacao Beans Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Cacao Beans market, covering key insights and data from 2023 to 2033. It examines market size, trends, segmentation, regional dynamics, industry analysis, and forecasts to understand the evolving landscape of the Cacao Beans industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

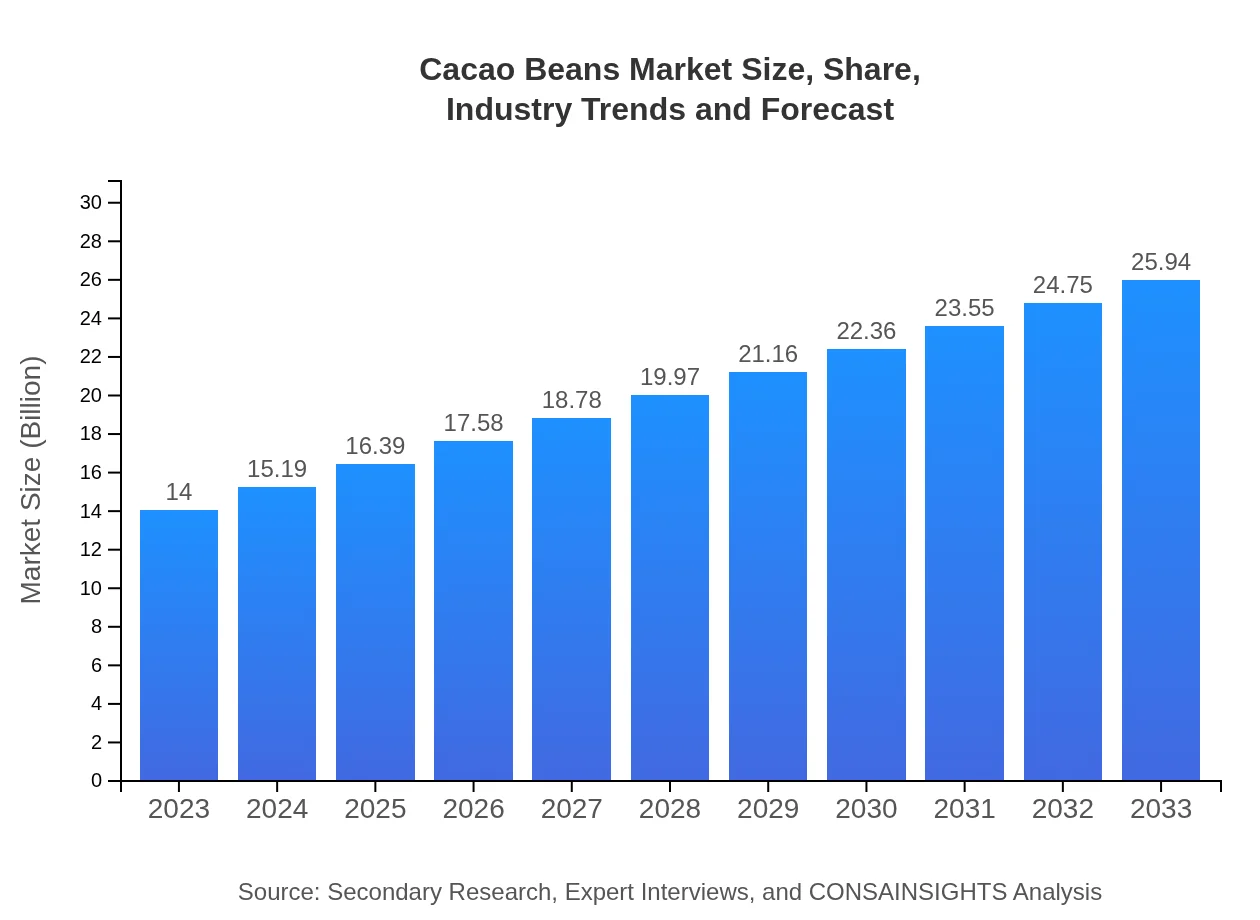

| 2023 Market Size | $14.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $25.94 Billion |

| Top Companies | Barry Callebaut, Cargill , Olam International, Cocoa Processing Company |

| Last Modified Date | 31 January 2026 |

Cacao Beans Market Overview

Customize Cacao Beans Market Report market research report

- ✔ Get in-depth analysis of Cacao Beans market size, growth, and forecasts.

- ✔ Understand Cacao Beans's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Cacao Beans

What is the Market Size & CAGR of Cacao Beans market in 2023?

Cacao Beans Industry Analysis

Cacao Beans Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Cacao Beans Market Analysis Report by Region

Europe Cacao Beans Market Report:

Europe remains one of the largest consumers of Cacao Beans, with the market size forecast to grow from USD 3.49 billion in 2023 to USD 6.46 billion in 2033. The region’s strong preference for ethically sourced and specialty products fosters a demand for fine flavor cacao, thereby driving market expansion.Asia Pacific Cacao Beans Market Report:

In the Asia Pacific region, the Cacao Beans market is projected to grow from USD 2.94 billion in 2023 to USD 5.45 billion by 2033. The increasing popularity of chocolate products and related confectionery is driving growth as countries like China and India are witnessing a surge in chocolate consumption linked to rising disposable incomes and young populations.North America Cacao Beans Market Report:

North America is a significant market for Cacao Beans, starting at USD 4.88 billion in 2023 and projected to grow to USD 9.05 billion by 2033. The region dominates in terms of high chocolate consumption rates, with a further demand surge for organic and ethically sourced cacao products driven by health trends among consumers.South America Cacao Beans Market Report:

South America, particularly countries like Ecuador and Brazil, is seeing growth with a market size of USD 1.08 billion in 2023 expected to reach USD 2.00 billion by 2033. The region's strong focus on quality and fine flavor cacao sets it apart, catering to a niche but lucrative global market segment.Middle East & Africa Cacao Beans Market Report:

In the Middle East and Africa region, the market is relatively nascent but promising, transitioning from USD 1.60 billion in 2023 to USD 2.97 billion by 2033. As economies grow, interest in premium chocolate and culinary applications of cacao is increasing, leading to higher imports of Cacao Beans.Tell us your focus area and get a customized research report.

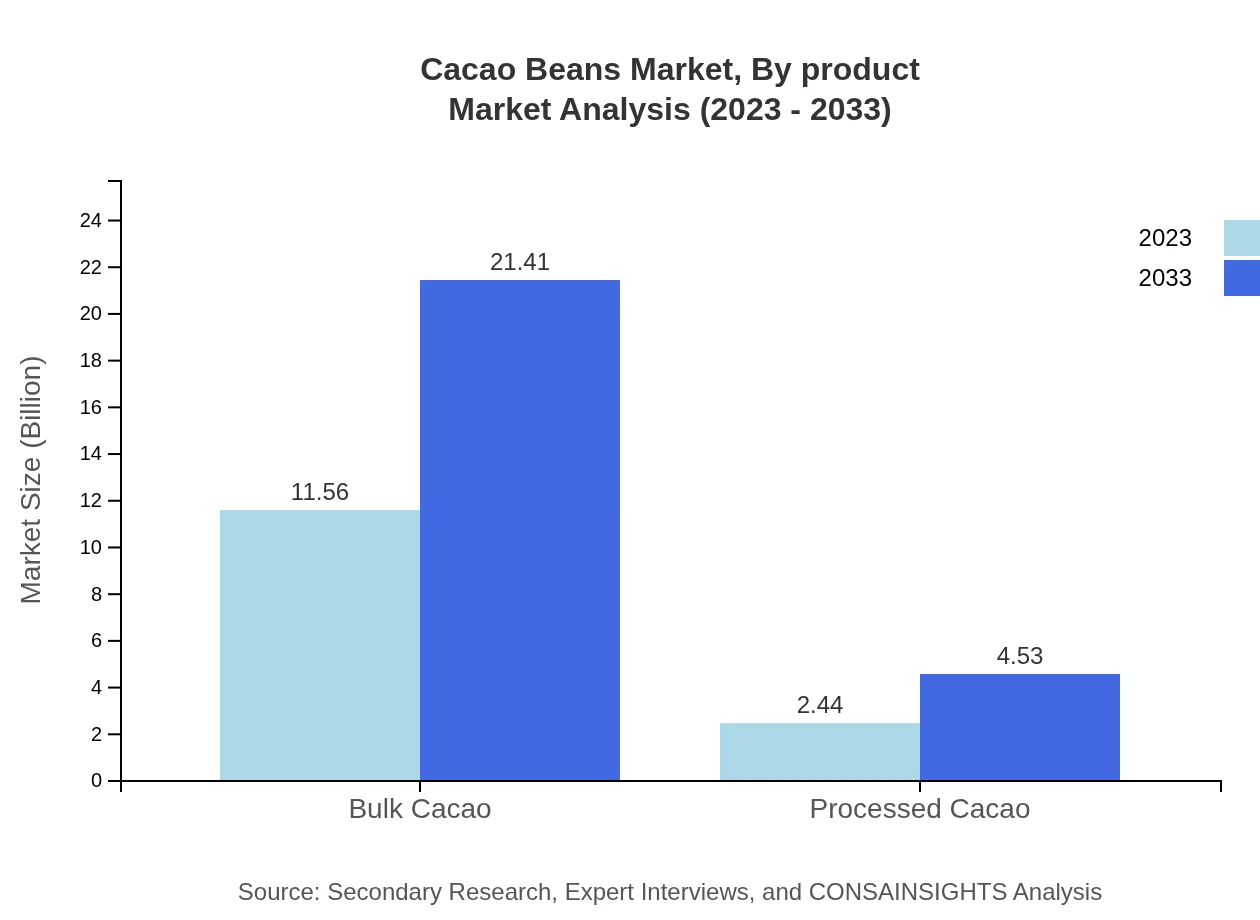

Cacao Beans Market Analysis By Product

The Cacao Beans market by product is significantly impacted by the demand for both raw and processed cacao. In 2023, the market sees strong demand for Bulk Cacao, with growth expected to reflect a market size of USD 11.56 billion by 2033, while fine flavor cacao also demands attention due to its premium positioning in the market and forecast growth to similar levels.

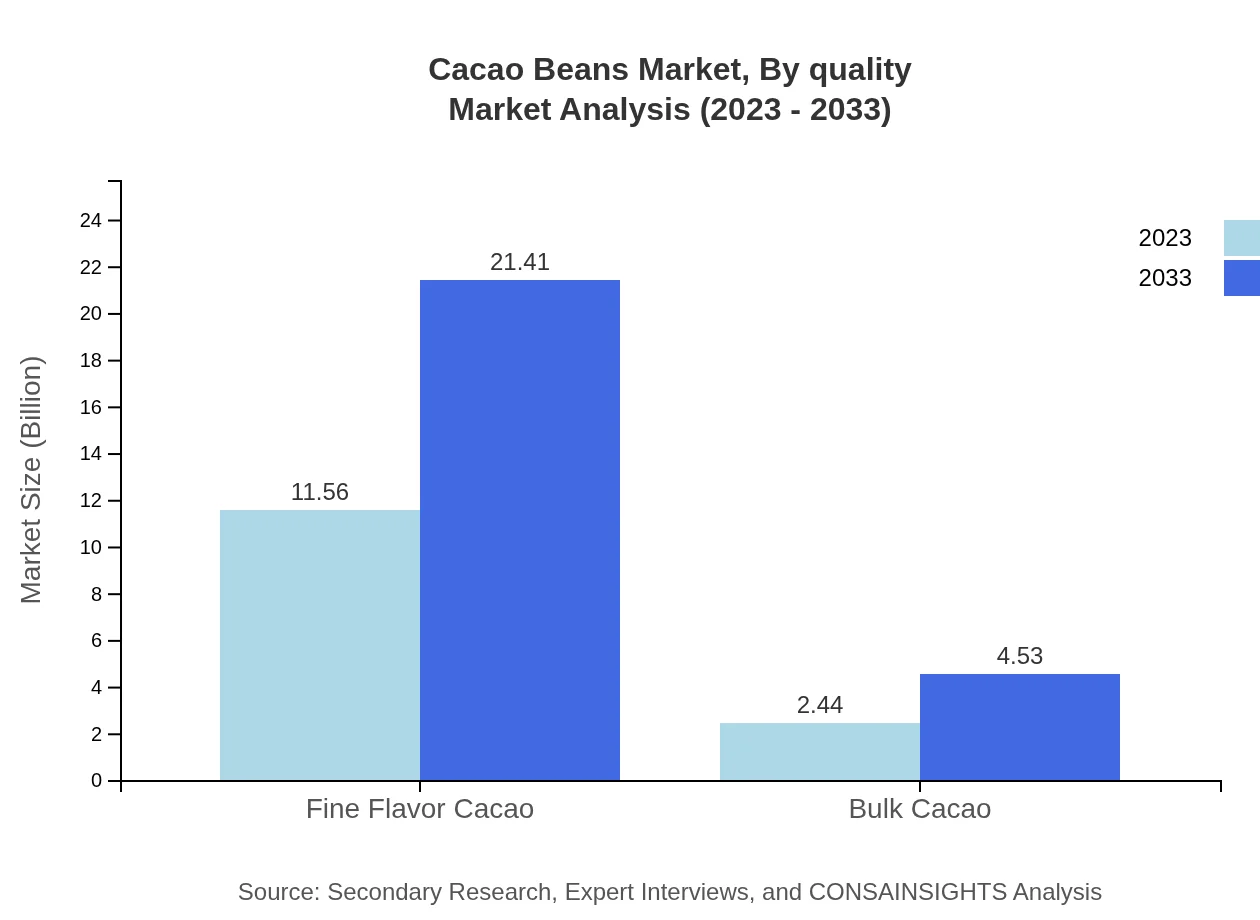

Cacao Beans Market Analysis By Quality

Quality segmentation reveals a notable preference for fine flavor cacao among high-end producers, projected to capture a considerable share of the market by 2033 as consumers gravitate towards higher quality and unique flavor profiles.

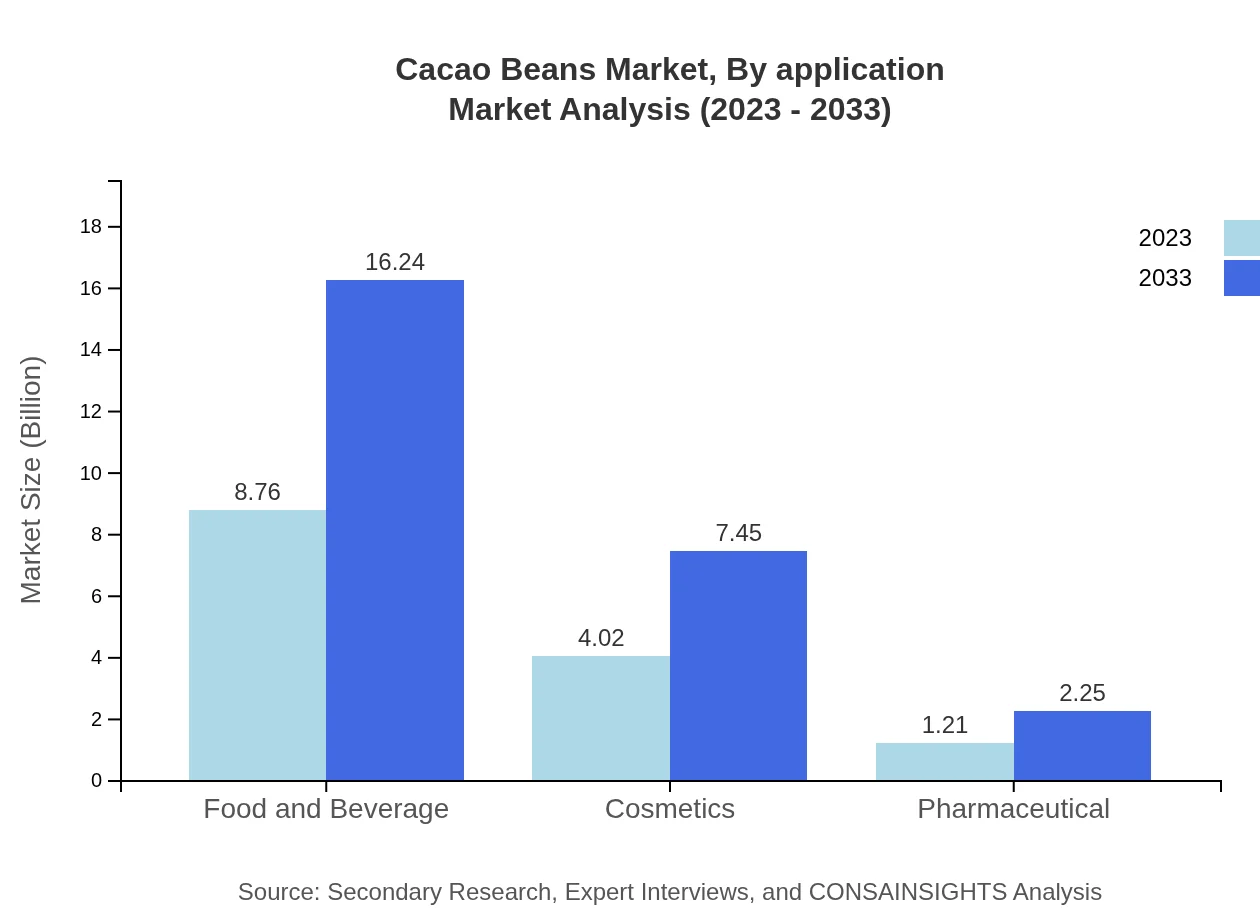

Cacao Beans Market Analysis By Application

Applications of Cacao Beans extend beyond food, penetrating cosmetics and pharmaceuticals. The food and beverage application dominates with a market size of USD 8.76 billion in 2023, reflecting a growing trend towards healthier alternatives and high cocoa content products.

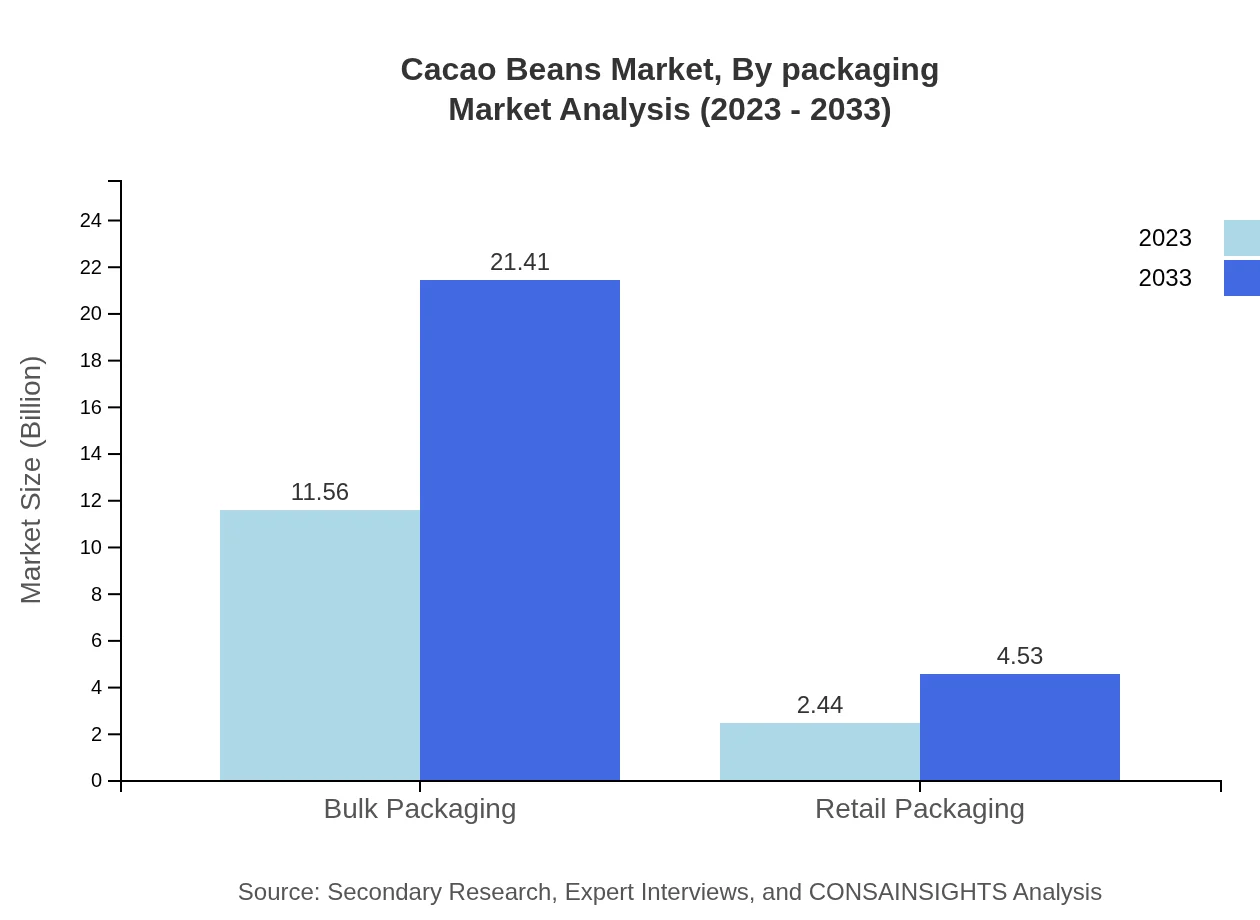

Cacao Beans Market Analysis By Packaging

The market for bulk packaging is forecasted to significantly outperform retail packaging, aligning with trends in the food service sector that favor larger quantities for consumption and manufacturing.

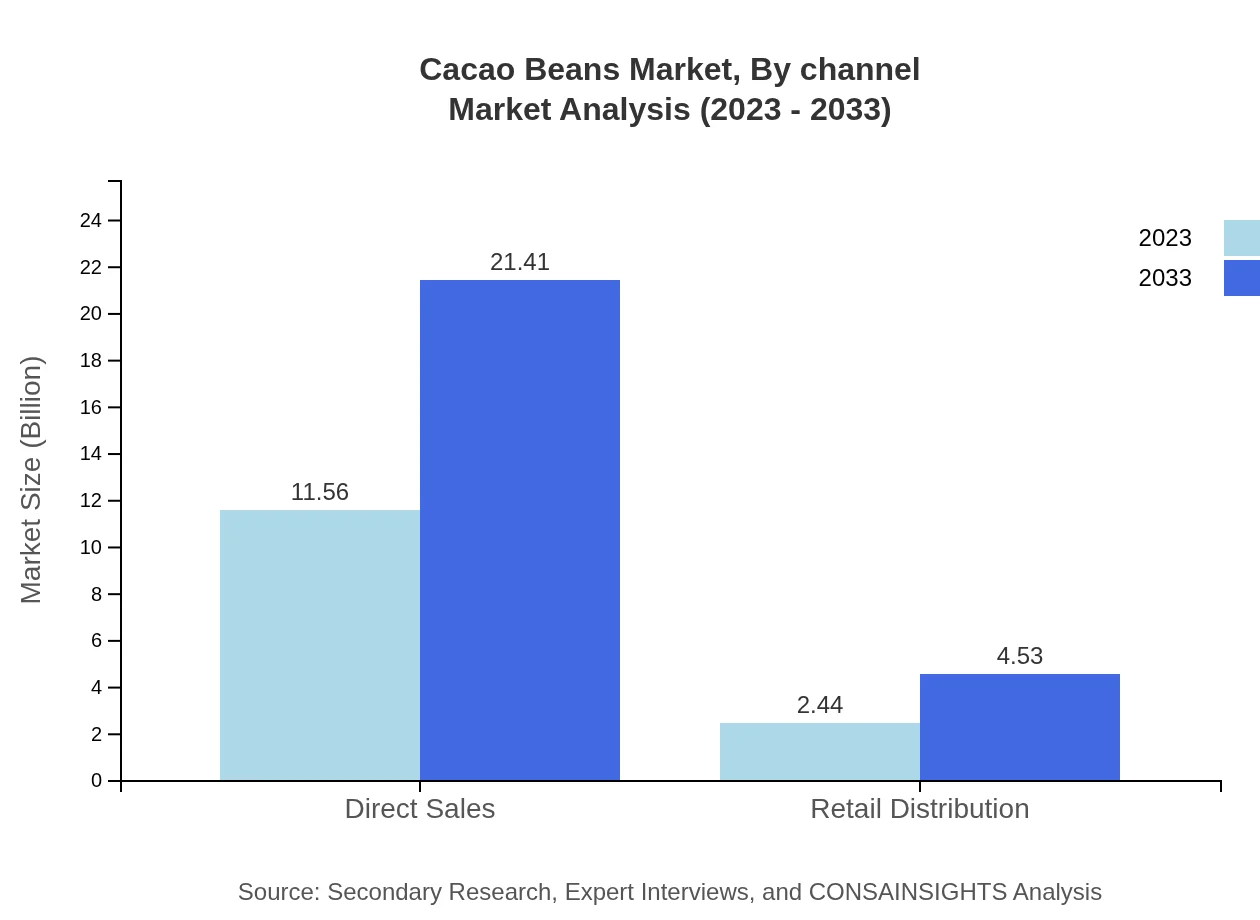

Cacao Beans Market Analysis By Channel

Direct Sales will remain the dominant channel in the Cacao Beans market, expected to retain an 82.54% share throughout the forecast period, while retail distribution continues to capture niche segments, particularly among health-oriented consumers.

Cacao Beans Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Cacao Beans Industry

Barry Callebaut:

Barry Callebaut is a global leader in cocoa and chocolate production, supplying the market with high-quality raw materials and exceptional formulations catered to industry needs.Cargill :

Cargill operates extensively in cocoa sourcing and processing, dedicated to sustainability and responsible supply chain management in the Cacao Beans industry.Olam International:

Olam International is engaged in the entire supply chain of cacao, from sourcing to processing, and is committed to improving livelihoods and environmental standards in cacao farming.Cocoa Processing Company:

Located in Ghana, this company specializes in the processing of cocoa into various chocolate products, reflecting a strong commitment to quality and community engagement.We're grateful to work with incredible clients.

FAQs

What is the market size of Cacao Beans?

The global cacao beans market is projected to reach approximately $14 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% from 2023. This growth underscores the increasing demand for cacao products across various applications.

What are the key market players or companies in the Cacao Beans industry?

The cacao beans industry features key players, including Barry Callebaut, Cargill, and Olam International. These companies lead in terms of production, processing, and distribution, significantly influencing market dynamics and trends.

What are the primary factors driving the growth in the Cacao Beans industry?

Key growth drivers for the cacao beans market include rising consumer demand for chocolate and confectionery products, increased health awareness regarding dark chocolate, and expanding applications in food, beverages, cosmetics, and pharmaceuticals.

Which region is the fastest Growing in the Cacao Beans market?

The fastest-growing region for cacao beans is expected to be Asia Pacific, with its market value projected to increase from $2.94 billion in 2023 to $5.45 billion by 2033. This growth is fueled by rising chocolate consumption and a burgeoning confectionery sector.

Does ConsaInsights provide customized market report data for the Cacao Beans industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the cacao beans industry. Clients can receive insights based on detailed analysis, regional trends, and product segments to better inform their business strategies.

What deliverables can I expect from this Cacao Beans market research project?

Deliverables from the cacao beans market research project include in-depth market analysis, comprehensive competitor profiles, growth forecasts, segment insights, and actionable recommendations to guide strategic decisions for stakeholders in the industry.

What are the market trends of Cacao Beans?

Current market trends in the cacao beans industry reveal a shift towards organic and ethically sourced cacao, a growing preference for premium chocolate products, and innovations in processing techniques that enhance flavor and quality, driving overall market growth.