Calibration Services Market Report

Published Date: 22 January 2026 | Report Code: calibration-services

Calibration Services Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Calibration Services market, covering market trends, size, regional insights, and competitive landscape from 2023 to 2033. It aims to offer key forecasts and strategic insights valuable for stakeholders.

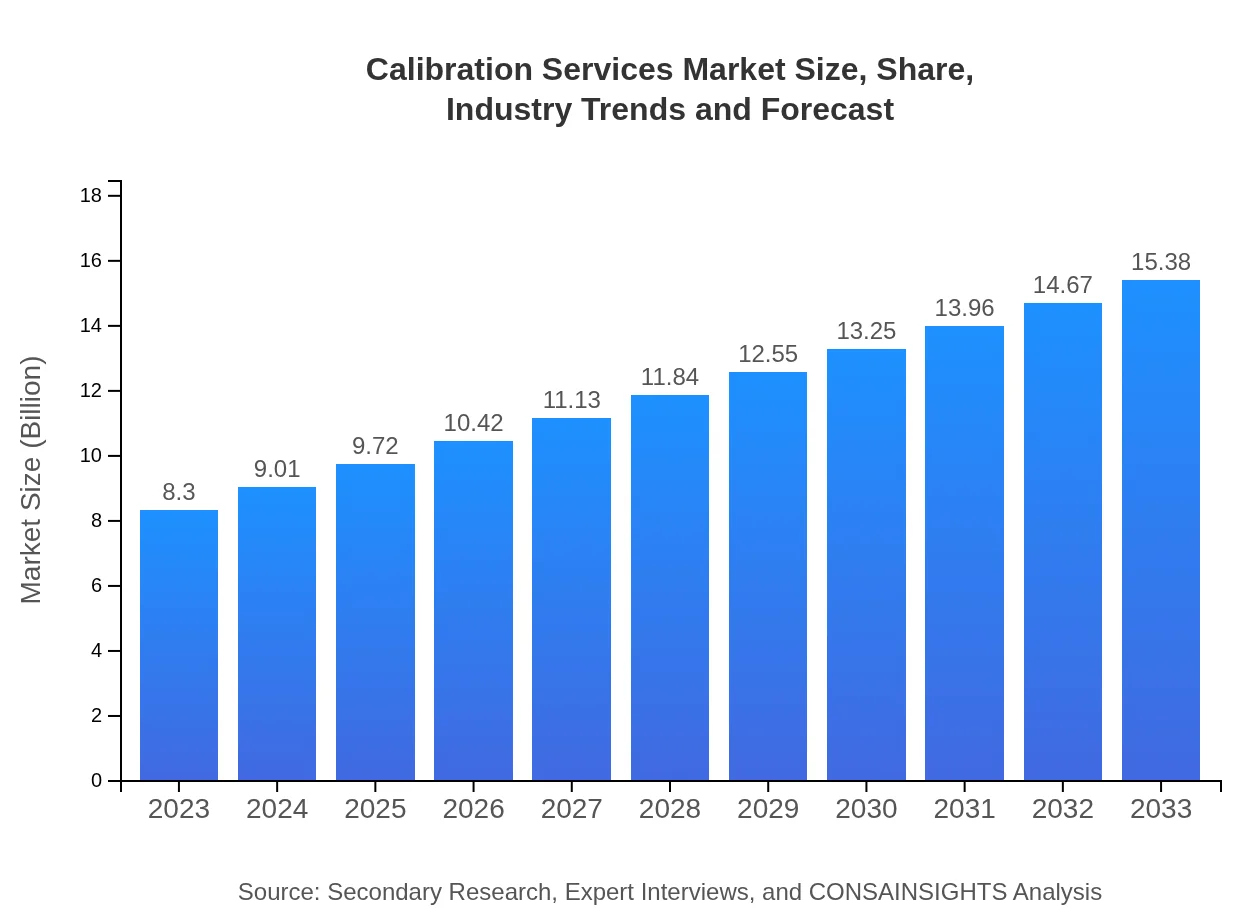

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $15.38 Billion |

| Top Companies | Fluke Corporation, Keysight Technologies, Ametek, Inc. |

| Last Modified Date | 22 January 2026 |

Calibration Services Market Overview

Customize Calibration Services Market Report market research report

- ✔ Get in-depth analysis of Calibration Services market size, growth, and forecasts.

- ✔ Understand Calibration Services's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Calibration Services

What is the Market Size & CAGR of Calibration Services market in 2023-2033?

Calibration Services Industry Analysis

Calibration Services Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Calibration Services Market Analysis Report by Region

Europe Calibration Services Market Report:

Europe's Calibration Services market size is anticipated to grow from $2.44 billion in 2023 to $4.51 billion by 2033. Stringent regulations regarding quality control in manufacturing and healthcare drive the demand for calibration services in this region.Asia Pacific Calibration Services Market Report:

The Asia Pacific region is expected to witness rapid growth, with a market size forecast to grow from $1.63 billion in 2023 to $3.01 billion in 2033. Factors contributing to this growth include increased industrialization, a booming healthcare sector, and rising quality consciousness among manufacturers.North America Calibration Services Market Report:

North America dominates the market with an estimated value of $2.99 billion in 2023, projected to reach $5.55 billion by 2033. The region's advanced infrastructure, regulatory frameworks, and a robust manufacturing base underpin its market leadership.South America Calibration Services Market Report:

In South America, the Calibration Services market is projected to grow from $0.66 billion in 2023 to $1.22 billion by 2033. The growing emphasis on industrial compliance and technological adaptation in industries such as oil and gas will bolster the demand for calibration services.Middle East & Africa Calibration Services Market Report:

The market in the Middle East and Africa is expected to rise from $0.59 billion in 2023 to $1.09 billion by 2033. This growth is supported by significant investments in infrastructure and a growing focus on energy-efficient practices.Tell us your focus area and get a customized research report.

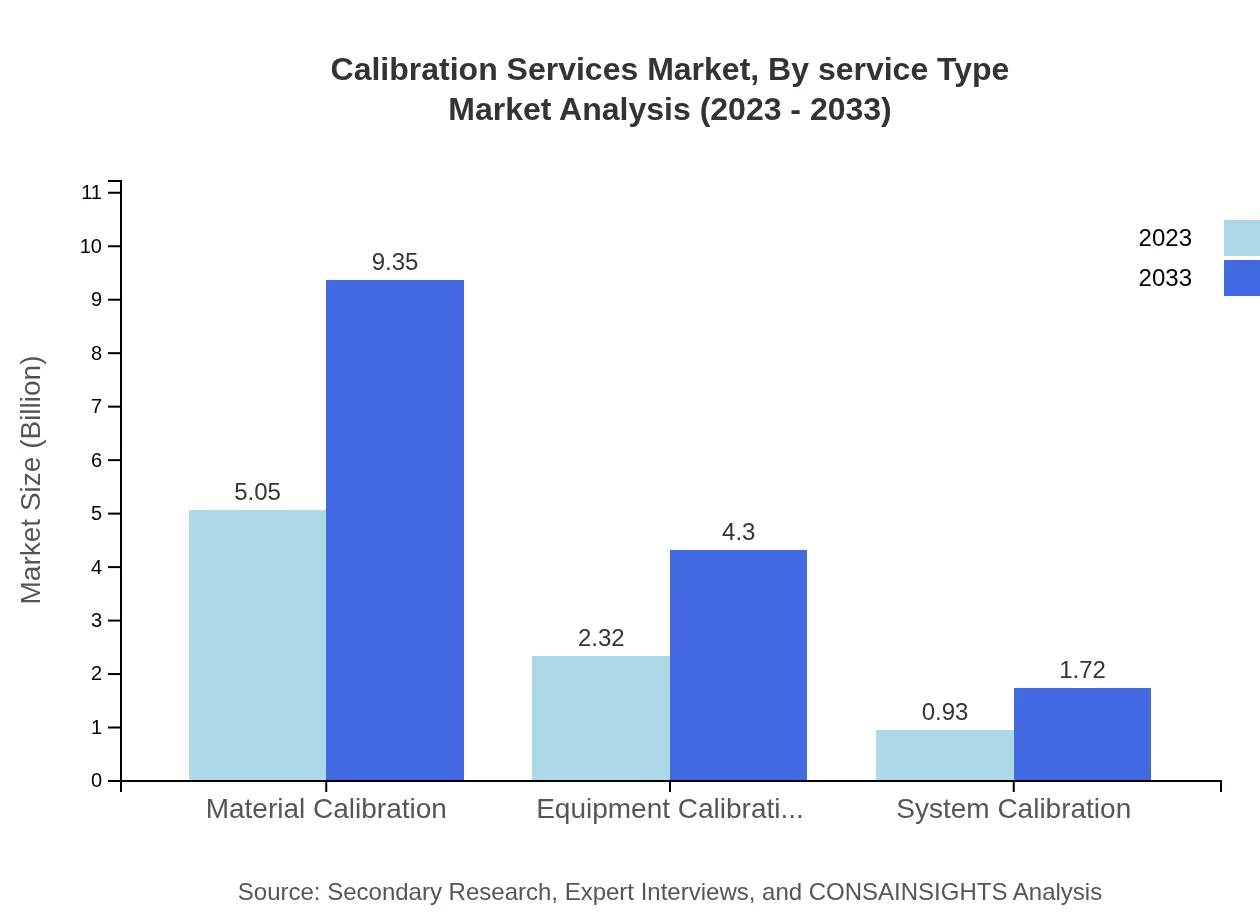

Calibration Services Market Analysis By Service Type

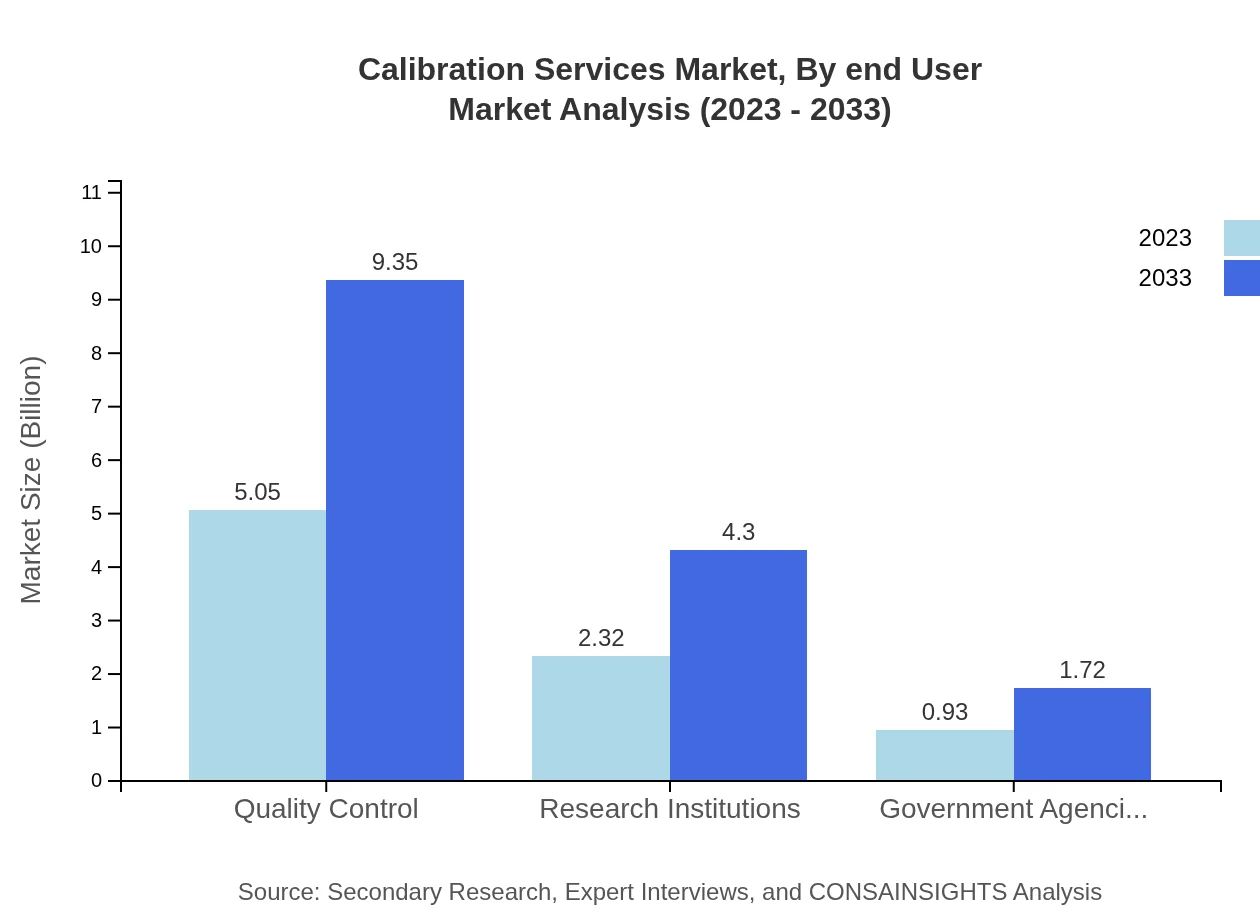

The Calibration Services Market, by service type, illustrates a robust trend towards manual and automated calibration services. In 2023, the market for manual calibration is valued at $5.05 billion, projected to grow to $9.35 billion by 2033. Automated calibration follows closely, with a 2023 valuation of $2.32 billion, growing to $4.30 billion by 2033. The trend towards automation reflects a shift in industry preference towards efficiency, cost reduction, and enhanced accuracy.

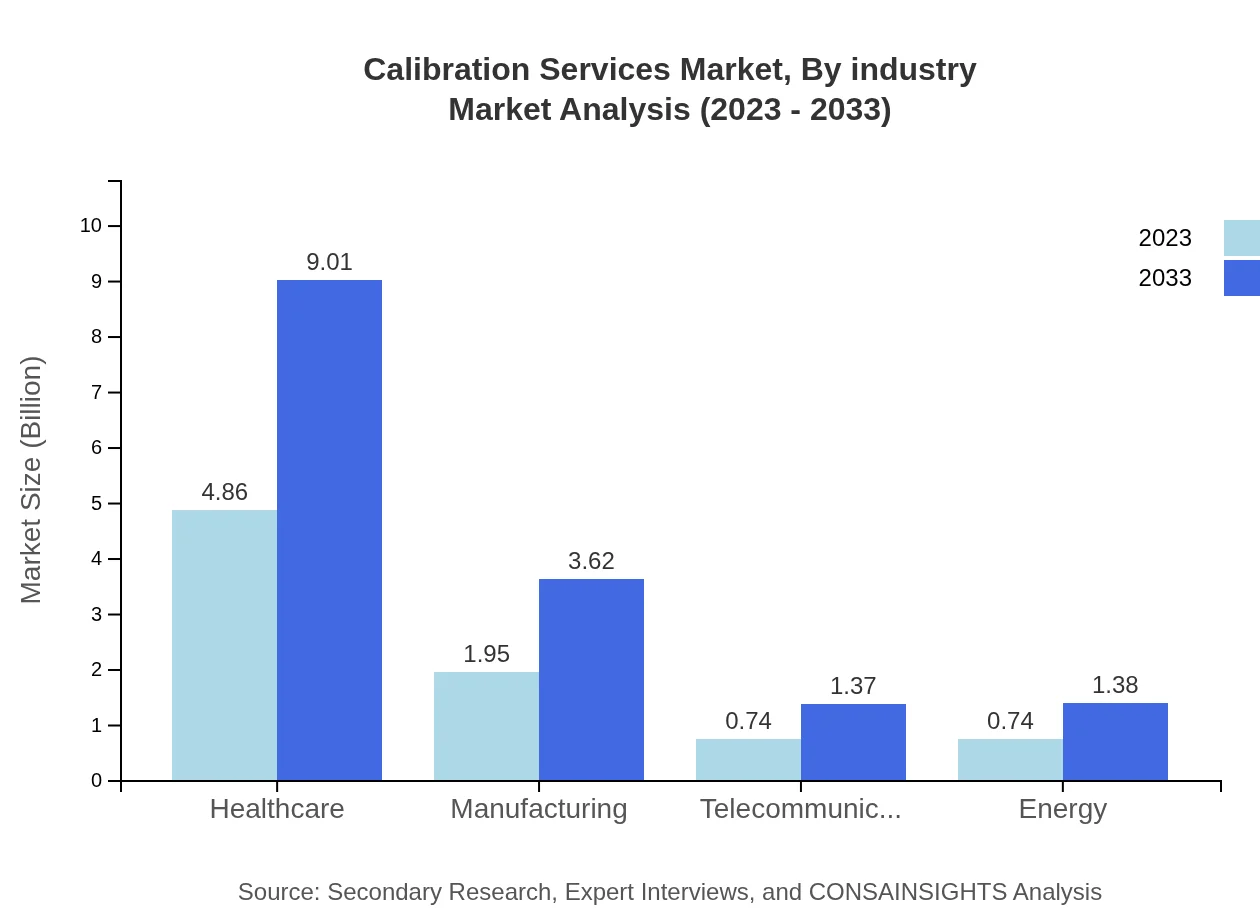

Calibration Services Market Analysis By Industry

The industry segmentation of the Calibration Services market indicates significant revenue generation from healthcare, manufacturing, and energy industries. The healthcare sector represents the largest share, valued at $4.86 billion in 2023, growing to $9.01 billion by 2033, driven by the demand for precise diagnostic instruments. The manufacturing sector, valued at $1.95 billion in 2023, is estimated to reach $3.62 billion by 2033 as manufacturers focus on quality assurance. Furthermore, sectors such as telecommunications and energy are emerging as key contributors to market growth.

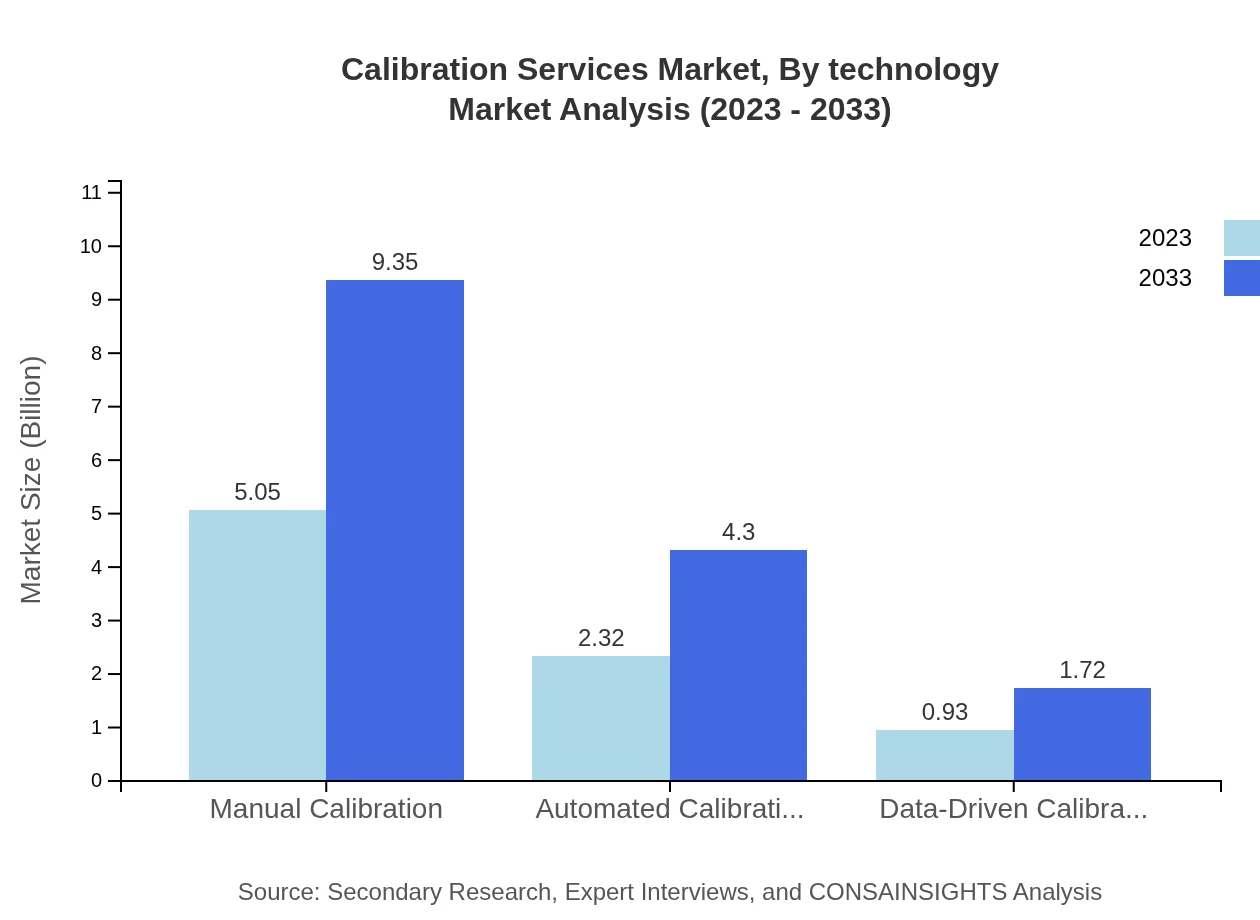

Calibration Services Market Analysis By Technology

The technology segment of the Calibration Services market reveals a growing prominence of data-driven calibration methods. The data-driven calibration market is set to expand from $0.93 billion in 2023 to $1.72 billion by 2033, showcasing a notable CAGR. This indicates an industry-wide shift towards leveraging data analytics and IoT connected devices for enhanced calibration accuracy and efficiency.

Calibration Services Market Analysis By End User

Analysis by end-user highlights the healthcare sector's pivotal role in the growth of the Calibration Services market. With a projected market size of $4.86 billion in 2023 that is expected to rise to $9.01 billion by 2033, it accounts for approximately 58.6% of the market share. This is followed by manufacturing and telecommunications sectors, which are projected to grow as industries increasingly recognize the importance of precision and reliability.

Calibration Services Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Calibration Services Industry

Fluke Corporation:

A leading provider of calibration instruments and services, Fluke Corporation is known for its high-quality equipment, which caters to various industries including healthcare and manufacturing.Keysight Technologies:

Specializing in electronic test and measurement instruments, Keysight offers comprehensive calibration services, providing accurate and reliable solutions tailored for electronic and telecommunications applications.Ametek, Inc.:

Ametek delivers a range of analytical instruments and calibration services, focusing on industries demanding high precision, such as aerospace and automotive.We're grateful to work with incredible clients.

FAQs

What is the market size of calibration Services?

The global calibration services market is valued at approximately $8.3 billion in 2023, with a forecasted CAGR of 6.2%. This growth reflects the increasing demand for precision and compliance in various industries.

What are the key market players or companies in the calibration Services industry?

The calibration services market features key players such as Fluke Calibration, Micro Precision Calibration, and Trescal, among others. These companies are recognized for their commitment to quality and customer service in various calibration sectors.

What are the primary factors driving the growth in the calibration Services industry?

Key growth drivers for calibration services include stringent quality regulations, advancements in technology leading to improved accuracy, and an increasing focus on maintaining compliance and standards across various industries.

Which region is the fastest Growing in the calibration Services market?

North America is the fastest-growing region in the calibration services market, projected to grow from $2.99 billion in 2023 to $5.55 billion by 2033. Europe's market is also expanding significantly, highlighting substantial regional opportunities.

Does ConsaInsights provide customized market report data for the calibration Services industry?

Yes, ConsaInsights specializes in delivering tailored market reports that provide in-depth analysis on the calibration services industry. Customized data allows clients to address specific market needs and strategic insights.

What deliverables can I expect from this calibration Services market research project?

Deliverables from the calibration services market research project typically include comprehensive market analysis reports, trend evaluations, competitor assessments, and detailed segment insights to facilitate strategic decision-making.

What are the market trends of calibration Services?

Current trends in the calibration services market include the growing adoption of automated calibration technologies, increased outsourcing of calibration services, and a stronger emphasis on data-driven decision-making and digital transformation in calibration practices.