Camel Meat Market Report

Published Date: 31 January 2026 | Report Code: camel-meat

Camel Meat Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Camel Meat market, covering insights into market size, trends, technological advancements, and forecasts from 2023 to 2033. The focus includes various regional analyses and market segmentation to understand different dynamics influencing the industry.

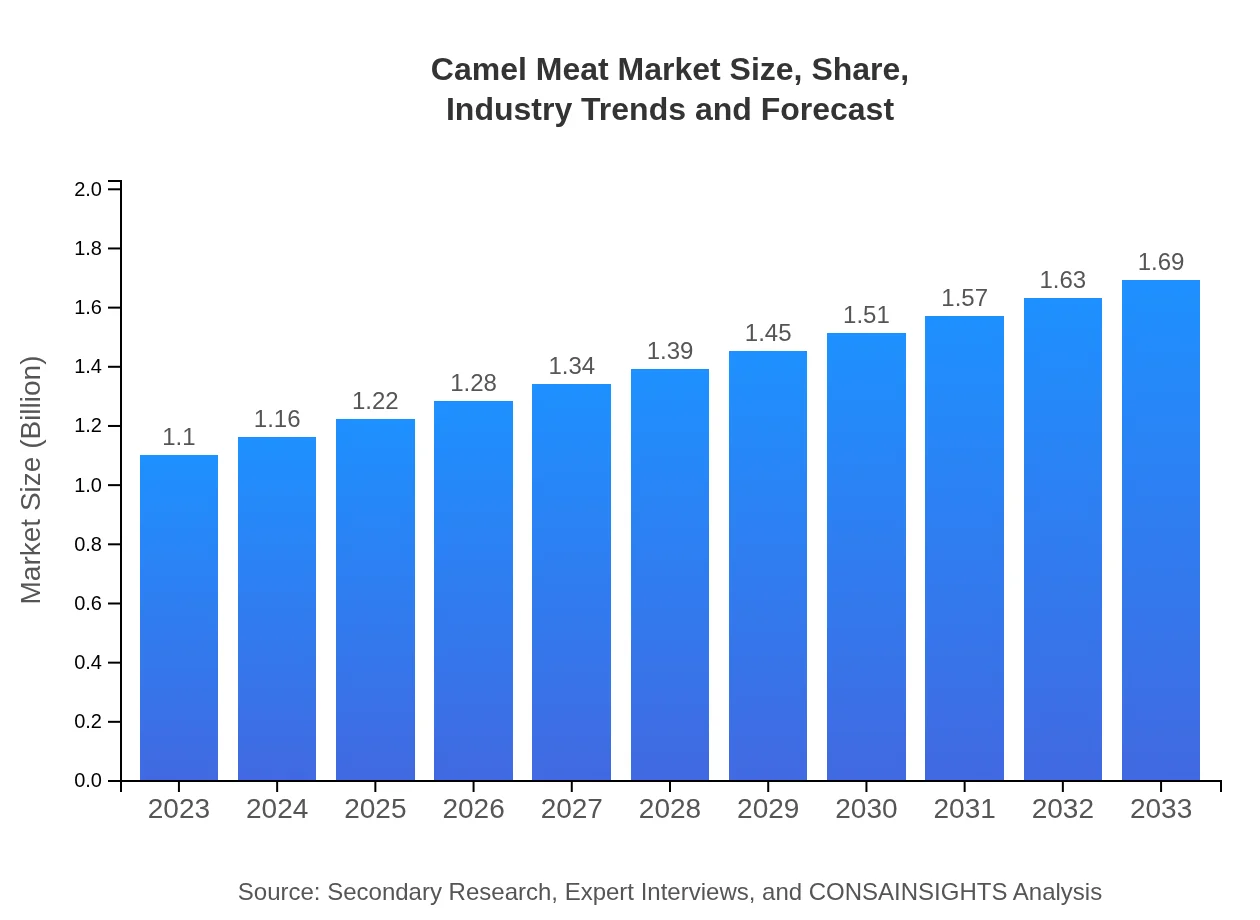

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.10 Billion |

| CAGR (2023-2033) | 4.3% |

| 2033 Market Size | $1.69 Billion |

| Top Companies | Camelicious, Al-Nakhla, Sharma Brothers Camel Farm |

| Last Modified Date | 31 January 2026 |

Camel Meat Market Overview

Customize Camel Meat Market Report market research report

- ✔ Get in-depth analysis of Camel Meat market size, growth, and forecasts.

- ✔ Understand Camel Meat's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Camel Meat

What is the Market Size & CAGR of Camel Meat market in 2033?

Camel Meat Industry Analysis

Camel Meat Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Camel Meat Market Analysis Report by Region

Europe Camel Meat Market Report:

Europe's Camel Meat market is valued at $0.36 billion in 2023 with a forecasted rise to $0.56 billion by 2033. Countries like the UK and Germany are seeing a rise in camel meat products in health-conscious communities, emphasizing sustainability.Asia Pacific Camel Meat Market Report:

In the Asia Pacific region, the Camel Meat market was valued at $0.21 billion in 2023 and is projected to reach $0.32 billion by 2033. Key countries like India and Mongolia show increasing consumption due to their existing culinary traditions. Community health initiatives are also promoting camel meat as a protein source.North America Camel Meat Market Report:

In North America, the Camel Meat market is estimated to be $0.40 billion in 2023, growing to $0.61 billion by 2033. Increased interest in alternative proteins and ethnic foods drives demand, with camel meat appearing in gourmet and specialty restaurants.South America Camel Meat Market Report:

The South American market for Camel Meat, although smaller, showed a valuation of $0.09 billion in 2023, anticipating growth to $0.13 billion by 2033. Brazil and Argentina are exploring camel meat within their expanding protein sectors, creating niche markets.Middle East & Africa Camel Meat Market Report:

The Middle East and Africa hold the largest share of the Camel Meat market, valued at $0.05 billion in 2023 and expected to reach $0.08 billion by 2033, where it is a traditional delicacy with established consumption patterns.Tell us your focus area and get a customized research report.

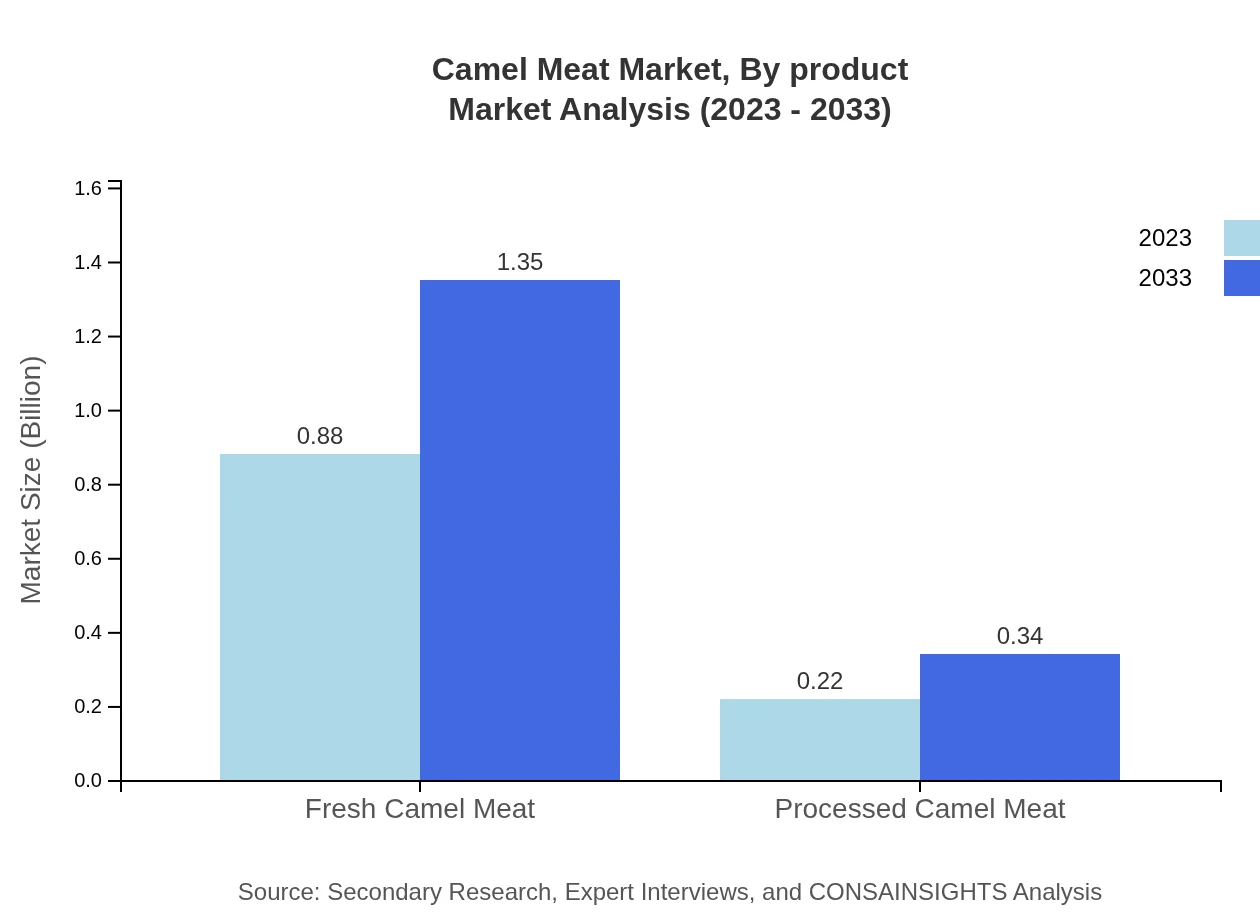

Camel Meat Market Analysis By Product

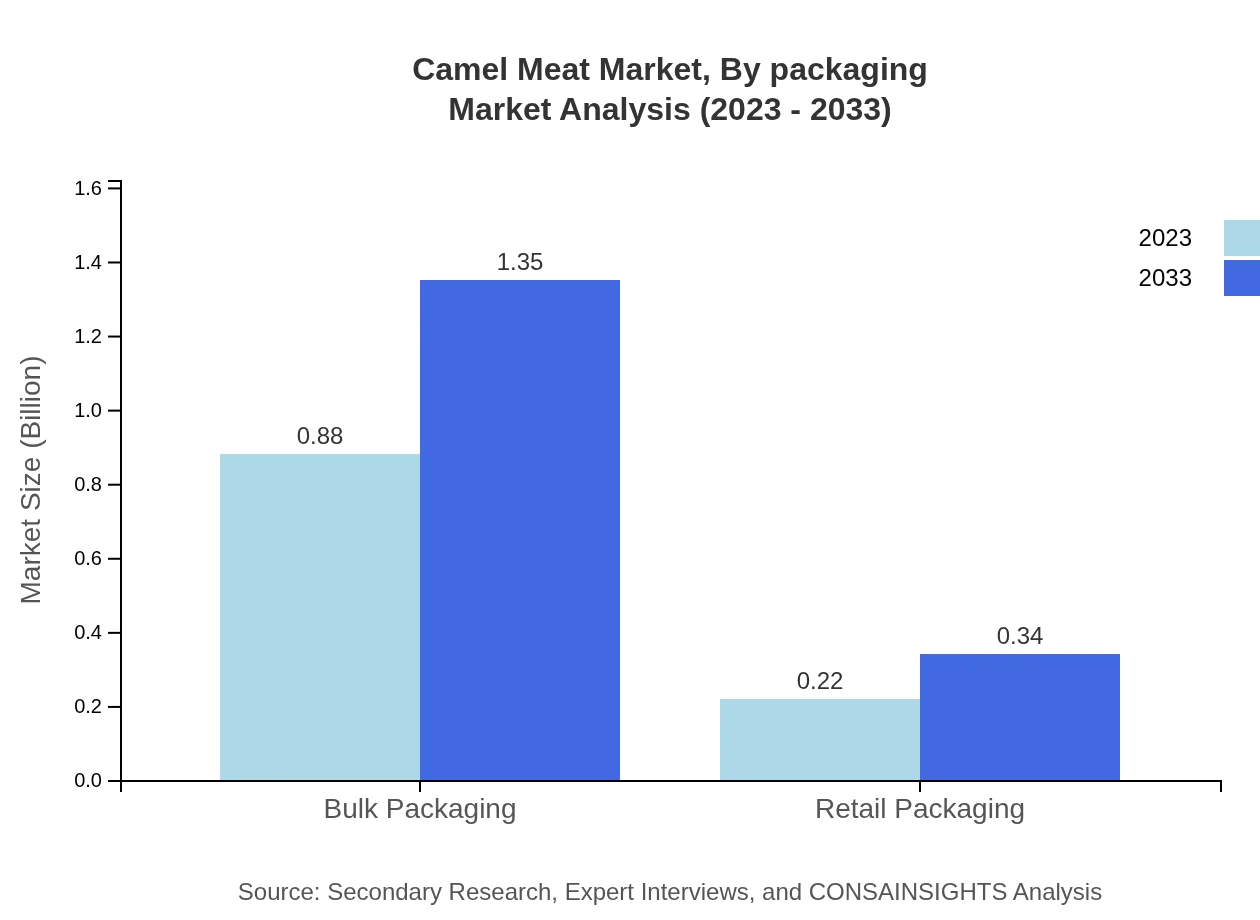

The market is primarily divided into fresh and processed products. Fresh camel meat holds a significant market share, with revenues projected to increase from $0.88 billion in 2023 to $1.35 billion in 2033. Processed camel meat is also witnessing growth from $0.22 billion to approximately $0.34 billion due to demand for convenience and ready-to-eat meals.

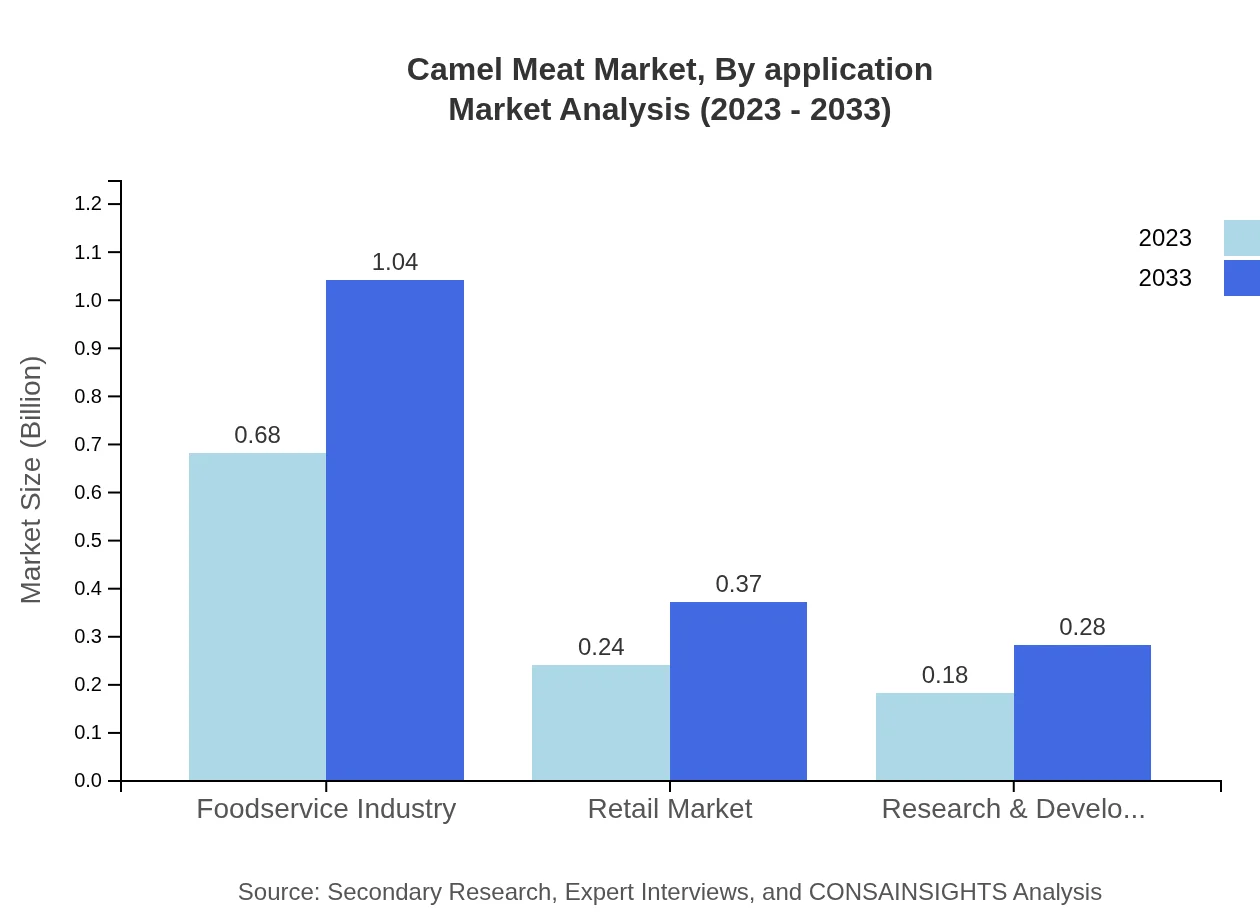

Camel Meat Market Analysis By Application

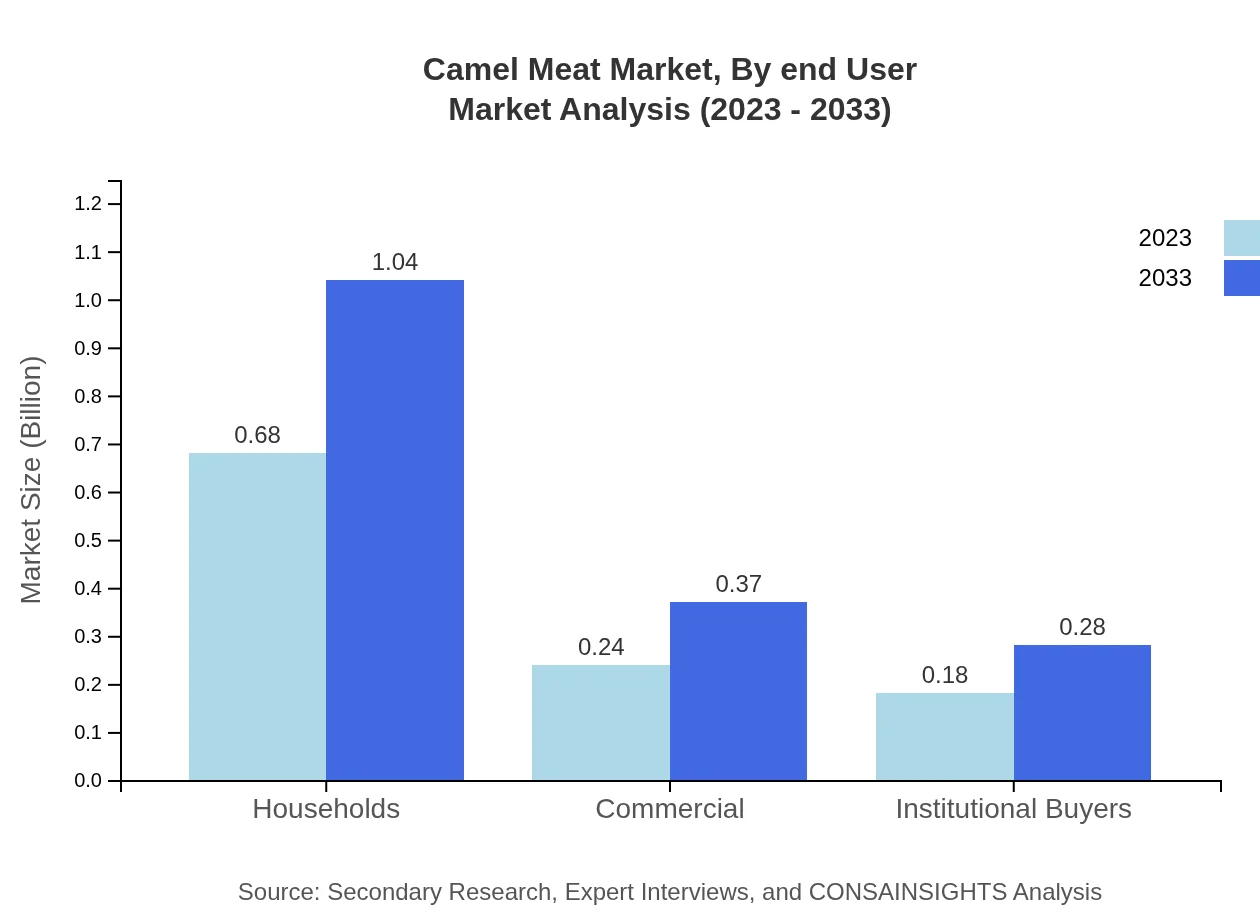

Camel meat is utilized in various applications, with significant contributions from households, the foodservice industry, and retail markets. The household market segment is projected to grow from $0.68 billion to $1.04 billion, reflecting the increased acceptance of camel meat in everyday cooking.

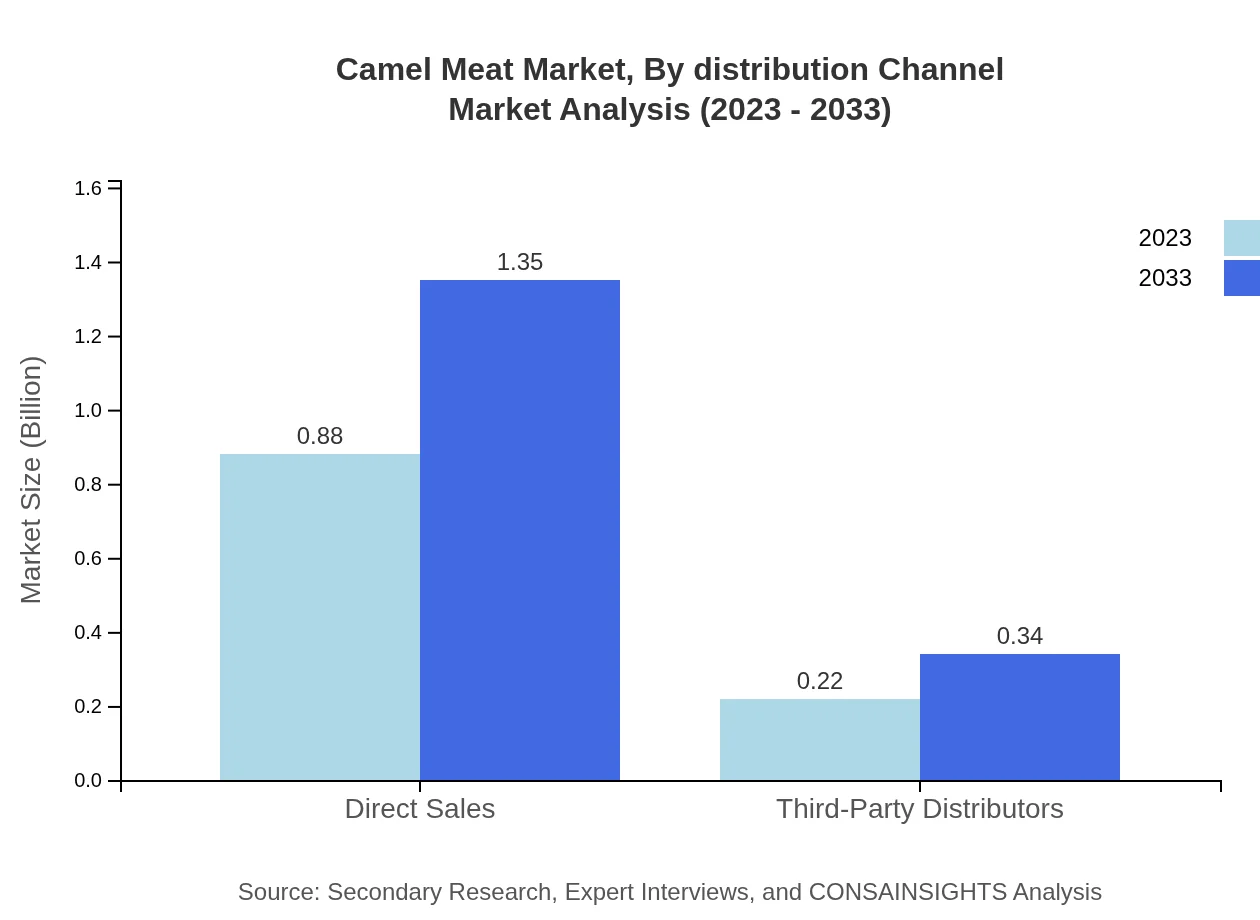

Camel Meat Market Analysis By Distribution Channel

Distribution channels include retail packaging, bulk sales, direct sales, and third-party distribution. Direct sales dominate the market, expected to rise from $0.88 billion to $1.35 billion, supported by e-commerce growth and specialty stores focusing on exotic meats.

Camel Meat Market Analysis By End User

This segment reveals diverse end-users from households to institutional buyers. Institutional buyers, including restaurants and catering services, are projected to increase their share from $0.18 billion to $0.28 billion, driven by rising trends for novel protein sources.

Camel Meat Market Analysis By Packaging

In terms of packaging, bulk packaging represents the largest market segment, valued at $0.88 billion in 2023 and expected to reach $1.35 billion by 2033. Retail packaging is also significant, set to increase from $0.22 billion to $0.34 billion as consumer awareness grows.

Camel Meat Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Camel Meat Industry

Camelicious:

As a premier supplier in the UAE, Camelicious offers a wide range of camel meat products, focusing on quality and sustainability, contributing significantly to enhancing camel farming in the region.Al-Nakhla:

Al-Nakhla specializes in camel meat processing and distribution across the Middle East and Europe, gaining recognition for its high-quality products and innovative processing methods.Sharma Brothers Camel Farm:

Known for breeding camels in South Asia, Sharma Brothers is committed to promoting camel meat as a nutritious alternative protein source, expanding its market presence.We're grateful to work with incredible clients.

FAQs

What is the market size of camel Meat?

The global camel meat market is valued at approximately $1.1 billion as of 2023, with a projected compound annual growth rate (CAGR) of 4.3%. This growth reflects rising consumer interest in diverse protein sources and increased awareness of camel meat's nutritional benefits.

What are the key market players or companies in this camel Meat industry?

Key players in the camel meat industry include established meat processors, distributors, and suppliers like Al Ain Camel Company, Camelicious, and Dubai Camel Milk, which lead the market in terms of innovation, quality assurance, and brand recognition.

What are the primary factors driving the growth in the camel meat industry?

Growth in the camel meat industry is driven by increasing demand for high-protein, low-fat meat alternatives, rising health consciousness, the cultural significance of camel meat in certain regions, and initiatives promoting sustainable livestock farming practices.

Which region is the fastest Growing in the camel meat market?

The fastest-growing region in the camel meat market is North America, projected to grow from $0.4 billion in 2023 to $0.61 billion by 2033. This growth is attributed to increased consumer awareness and demand for alternative meat sources.

Does ConsaInsights provide customized market report data for the camel meat industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the camel meat industry, providing insights into market trends, competitive landscape, regional analysis, and detailed segmentation that supports informed decision-making.

What deliverables can I expect from this camel meat market research project?

Deliverables from the camel meat market research project typically include comprehensive market analysis reports, segmentation data, growth forecasts, competitive analysis, and strategic insights that inform product development and marketing strategies.

What are the market trends of camel meat?

Current trends in the camel meat market include a shift towards sustainable and organic farming, growing popularity of processed camel meat products, innovative packaging solutions, and increased availability in retail and foodservice sectors driven by changing consumer preferences.