Camel Milk Market Report

Published Date: 31 January 2026 | Report Code: camel-milk

Camel Milk Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Camel Milk market, including current trends, regional insights, market size, and forecasts for the period 2023 to 2033. Detailed insights on segmentation by products, applications, and key market players are also provided.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

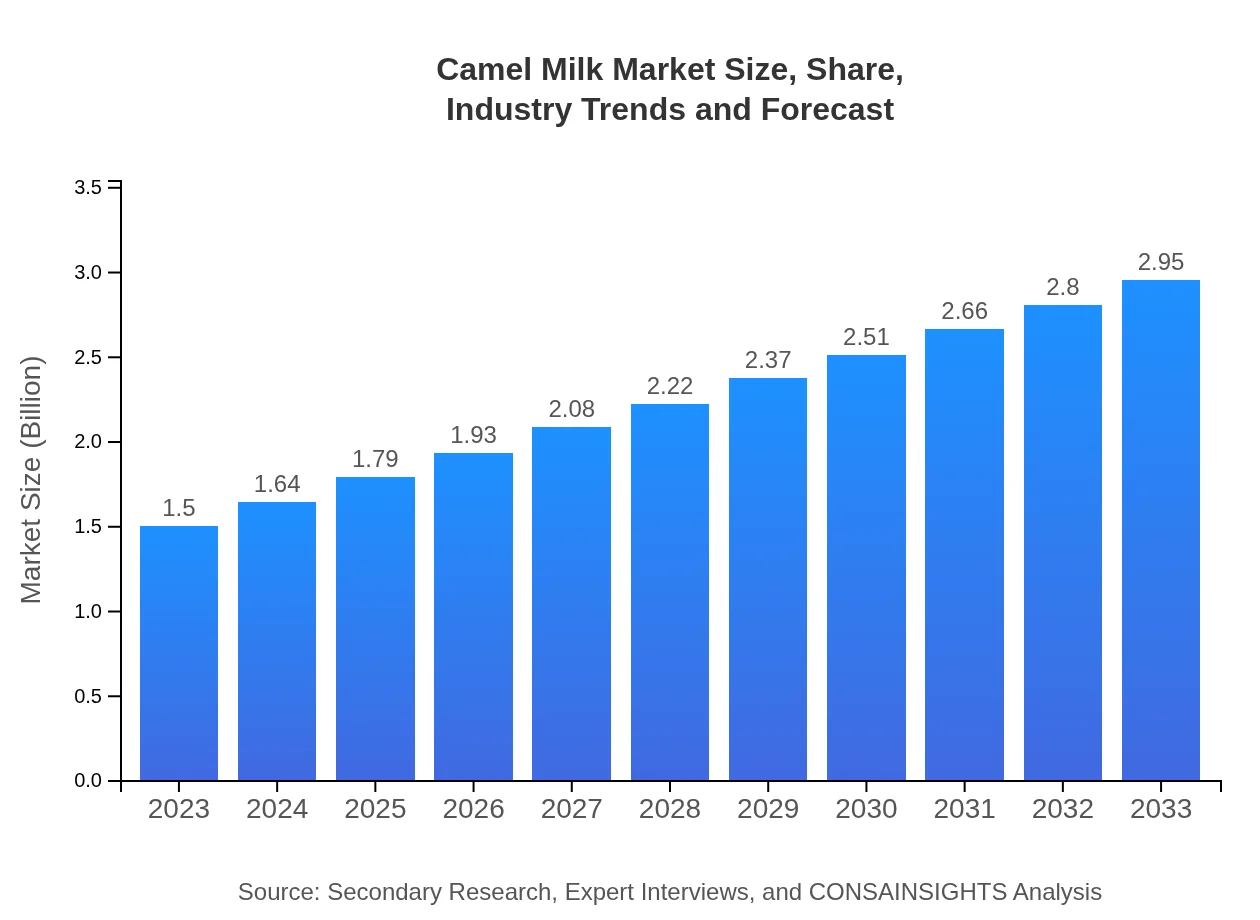

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Al Ain Dairy, Camelicious, Desert Farms, Camel Milk Victoria, Aussie Camel Milk |

| Last Modified Date | 31 January 2026 |

Camel Milk Market Overview

Customize Camel Milk Market Report market research report

- ✔ Get in-depth analysis of Camel Milk market size, growth, and forecasts.

- ✔ Understand Camel Milk's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Camel Milk

What is the Market Size & CAGR of Camel Milk market in 2023?

Camel Milk Industry Analysis

Camel Milk Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Camel Milk Market Analysis Report by Region

Europe Camel Milk Market Report:

In Europe, the Camel Milk market is expected to grow from USD 0.53 billion in 2023 to USD 1.04 billion by 2033. Growth drivers include the rising trend of health and wellness diets, increasing demand from food manufacturers for unique dairy ingredients, and expanding retail channels.Asia Pacific Camel Milk Market Report:

In 2023, the Camel Milk market in Asia Pacific is valued at USD 0.27 billion and is projected to grow to USD 0.52 billion by 2033. Growth is driven by rising health awareness and increasing disposable incomes, leading to higher demand for premium dairy alternatives. Factors like cultural acceptance and traditional consumption patterns further augment market potential.North America Camel Milk Market Report:

North America is anticipated to see the Camel Milk market grow from USD 0.50 billion in 2023 to USD 0.97 billion by 2033. The surge is linked to heightened awareness of health benefits and growing demand for alternative dairy products among consumers seeking lactose-free options.South America Camel Milk Market Report:

The Camel Milk market in South America is estimated at USD 0.12 billion in 2023, with expectations to reach USD 0.24 billion by 2033. The region has witnessed slow growth, primarily due to limited local supply and knowledge of camel milk benefits. However, increasing interest in health foods is set to create new opportunities.Middle East & Africa Camel Milk Market Report:

The Camel Milk market in the Middle East and Africa is projected to rise from USD 0.09 billion in 2023 to USD 0.18 billion by 2033. This increase is largely attributed to the traditional use of camel milk in many Middle Eastern cultures, and growing exports to other regions seeking healthier dairy alternatives.Tell us your focus area and get a customized research report.

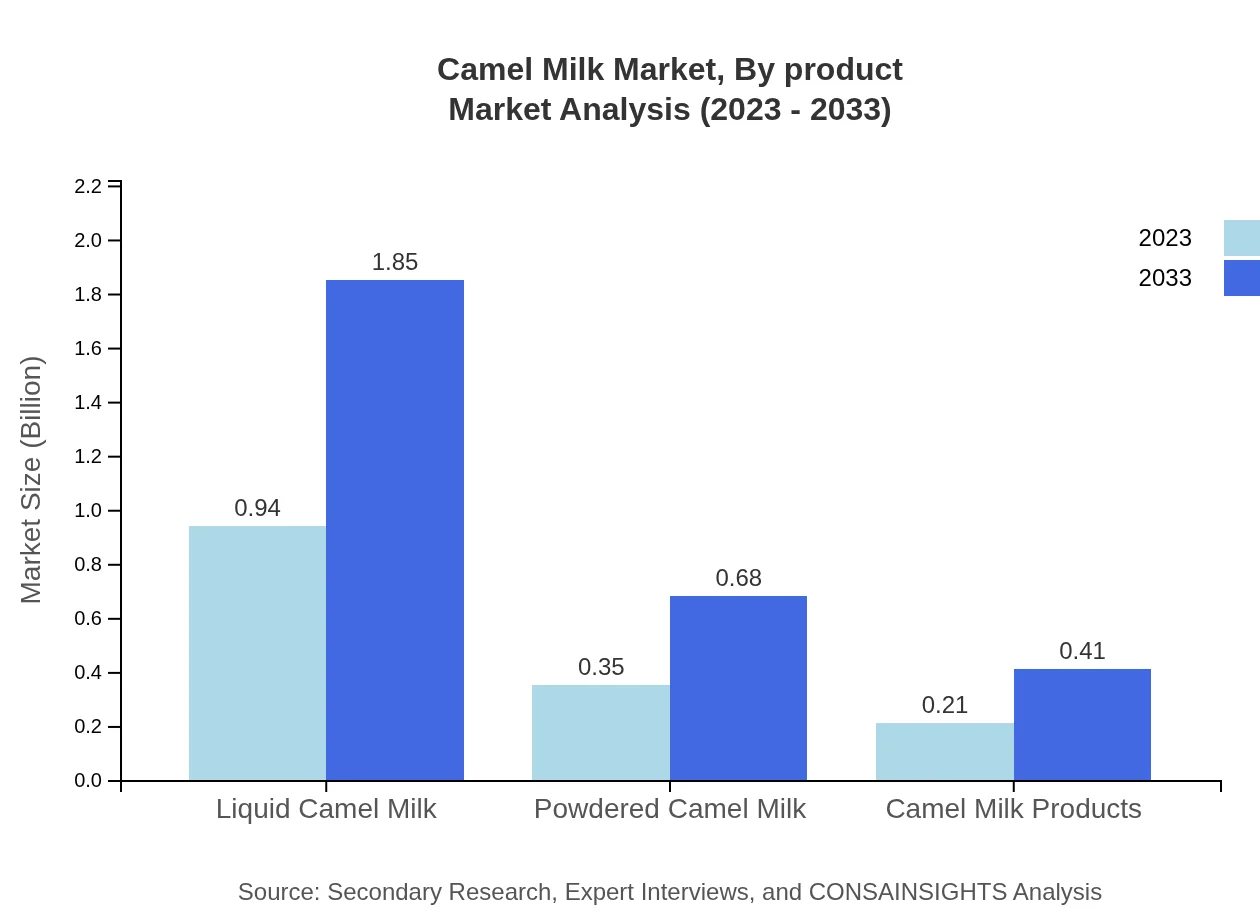

Camel Milk Market Analysis By Product

Liquid Camel Milk is the dominant segment, with a market size of USD 0.94 billion in 2023, growing to USD 1.85 billion by 2033. It accounts for 62.91% of the market share. Powdered Camel Milk is growing significantly with a market size of USD 0.35 billion in 2023, expected to reach USD 0.68 billion by 2033, capturing a share of 23.06%. Camel Milk Products, including cheese and yogurt, comprise a smaller segment calculated at USD 0.21 billion in 2023, growing to USD 0.41 billion by 2033, representing 14.03% of the market share.

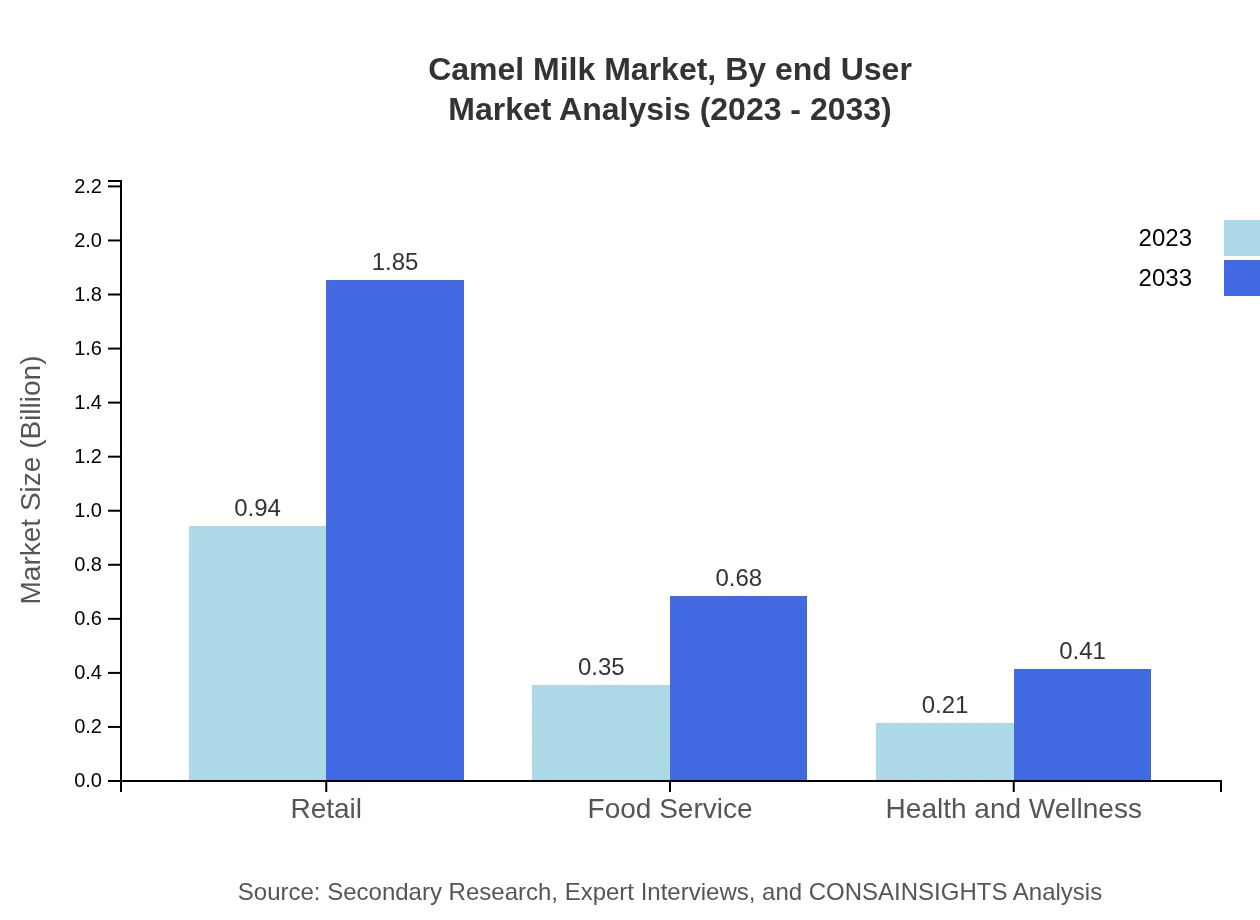

Camel Milk Market Analysis By End User

The market distribution across end-users shows a dominant retail segment at USD 0.94 billion in 2023, leading to a projected USD 1.85 billion by 2033 (62.91% share). The food service channel, including restaurants and cafes, is also notable, beginning at USD 0.35 billion and growing to USD 0.68 billion (23.06%). Other segments include health and wellness applications at USD 0.21 billion (14.03%).

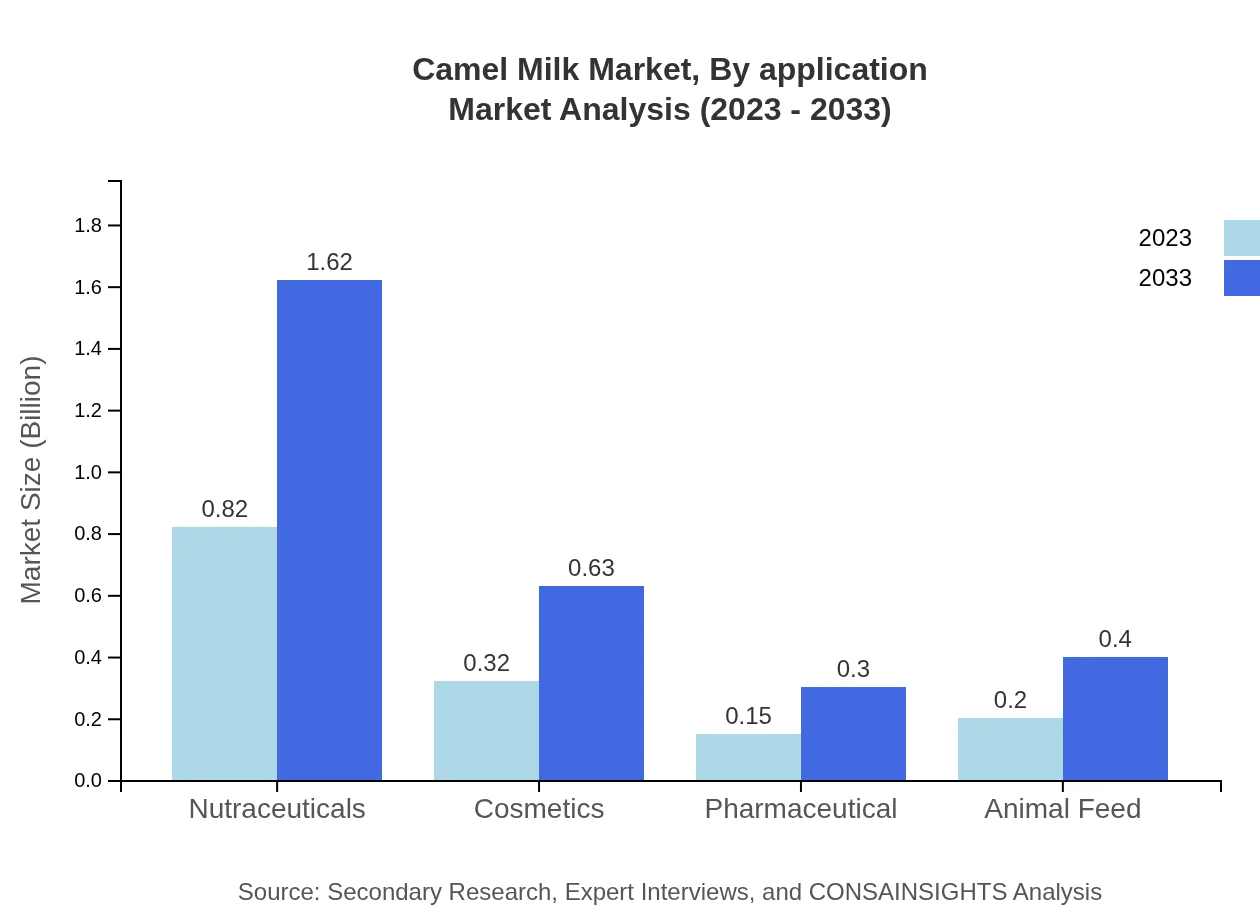

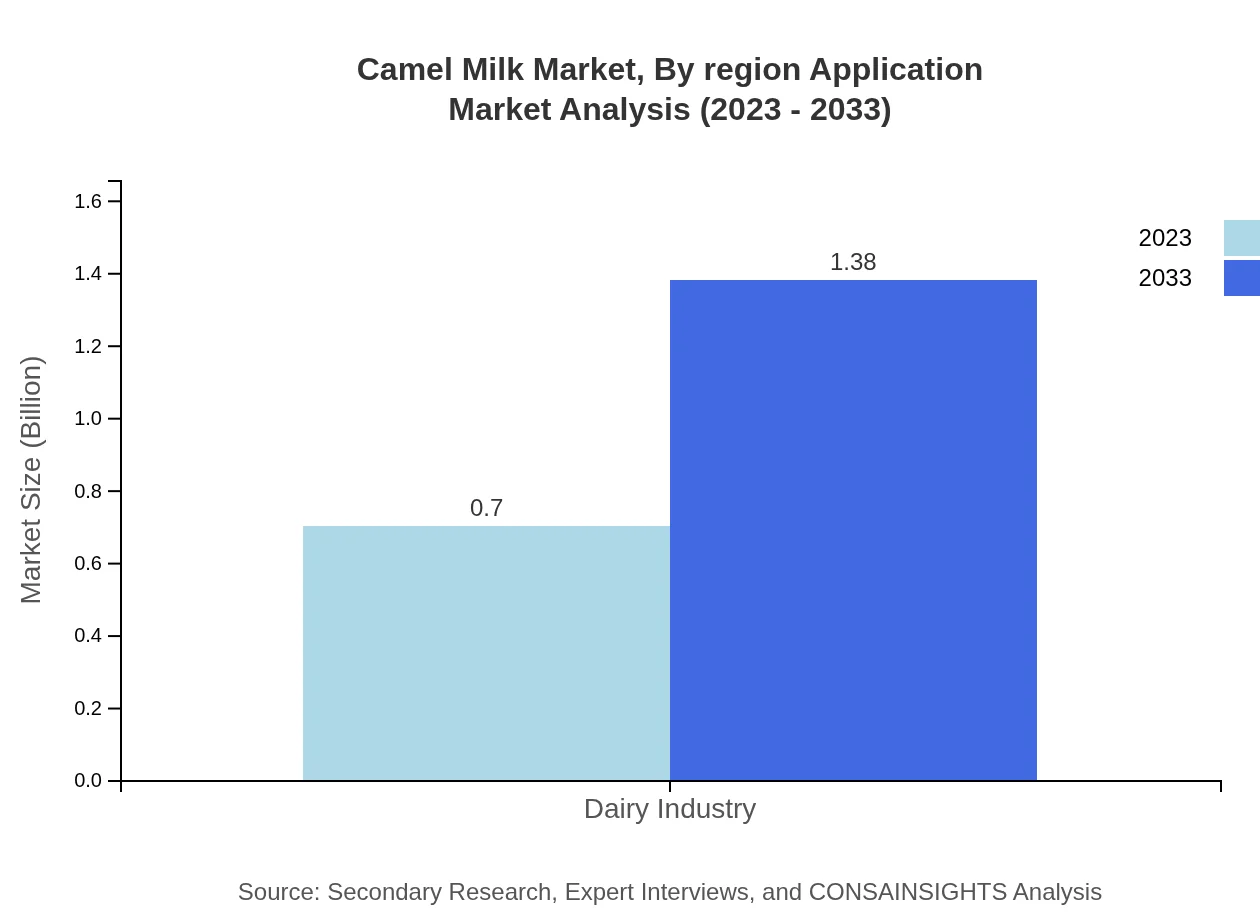

Camel Milk Market Analysis By Application

The nutraceuticals segment dominates the market, with a size of USD 0.82 billion in 2023, reaching USD 1.62 billion by 2033 (54.95% share). The dairy industry follows with USD 0.70 billion in 2023 and viewed to expand to USD 1.38 billion by 2033, contributing 46.97% to the overall market. Other applications include cosmetics at USD 0.32 billion (21.26%), pharmaceuticals at USD 0.15 billion (10.20%), and animal feed at USD 0.20 billion (13.59%).

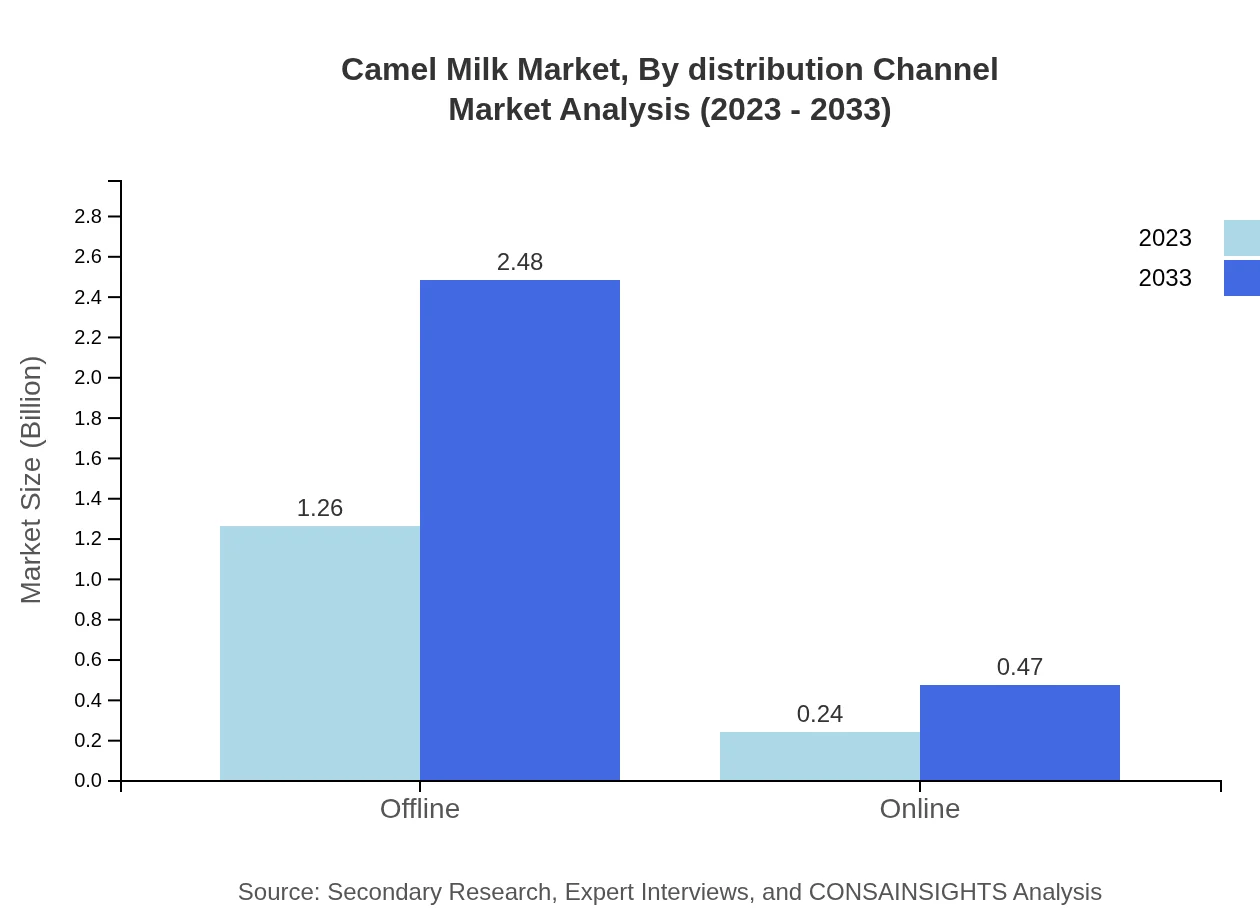

Camel Milk Market Analysis By Distribution Channel

The Camel Milk market is witnessing significant growth in offline retail, valued at USD 1.26 billion in 2023 and projected to reach USD 2.48 billion by 2033, representing 84.17% share. Online sales are growing as well, starting at USD 0.24 billion, anticipated to reach USD 0.47 billion (15.83%). This indicates a shift in consumer purchasing methods, particularly among younger demographics.

Camel Milk Market Analysis By Region Application

Each region's product applications strengthen the Camel Milk market, with variations in consumer preferences noted. For instance, the Middle East primarily emphasizes traditional beverages, while Europe sees a rise in interest for health and wellness applications. Asia Pacific reflects a blend of both traditional uses and growing demand for premium health products.

Camel Milk Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Camel Milk Industry

Al Ain Dairy:

Based in the UAE, Al Ain Dairy is a leading manufacturer and exporter of camel milk products, focusing on health and nutrition.Camelicious:

Camelicious is known for its innovative camel milk products, including flavored milk and cheese, exported to various countries.Desert Farms:

Desert Farms specializes in high-quality camel milk products and focuses on organic and natural food trends enhancing its brand appeal.Camel Milk Victoria:

An Australia-based supplier, Camel Milk Victoria provides various camel milk products, catering to domestic and international markets.Aussie Camel Milk:

Aussie Camel Milk operates sustainably and offers high-quality camel milk products while focusing on unique health benefits associated with camel milk use.We're grateful to work with incredible clients.

FAQs

What is the market size of camel Milk?

The camel milk market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.8% through 2033.

What are the key market players or companies in the camel Milk industry?

Key players in the camel milk industry include Camelicious, Al Ain Farms, and Desert Farms, which are known for their diverse product offerings and regional dominance in camel milk production.

What are the primary factors driving the growth in the camel milk industry?

The growth in the camel milk industry is driven by rising demand for dairy alternatives, health benefits attributed to camel milk, and increasing awareness among consumers about its nutritional superiority over other dairy products.

Which region is the fastest Growing in the camel milk market?

The fastest-growing regions for camel milk are Europe and Asia Pacific, with Europe projected to grow from $0.53 billion in 2023 to $1.04 billion by 2033, and Asia Pacific from $0.27 billion to $0.52 billion in the same period.

Does ConsaInsights provide customized market report data for the camel milk industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and inquiries in the camel milk sector, ensuring detailed insights and strategic recommendations.

What deliverables can I expect from this camel milk market research project?

Expect comprehensive deliverables including market size analysis, growth projections, trend identification, competitive landscape overview, and detailed insights segmented by geography and product categories.

What are the market trends of camel milk?

Current trends include increasing consumer adoption of camel milk in health and wellness products, growth in online sales, and a rising focus on sustainable and organic production practices.